Hello, Investor,

Each month, I provide a transparent update on my portfolio performance, covering the latest news on core stock positions and analyzing recent developments across each holding.

For more frequent updates, follow me on X/Twitter and Threads, for visual infographics on Instagram and on SavvyTrader for portfolio changes.

Portfolio Review

Holdings:

Monthly Allocations:

* green (added), orange (trimmed)

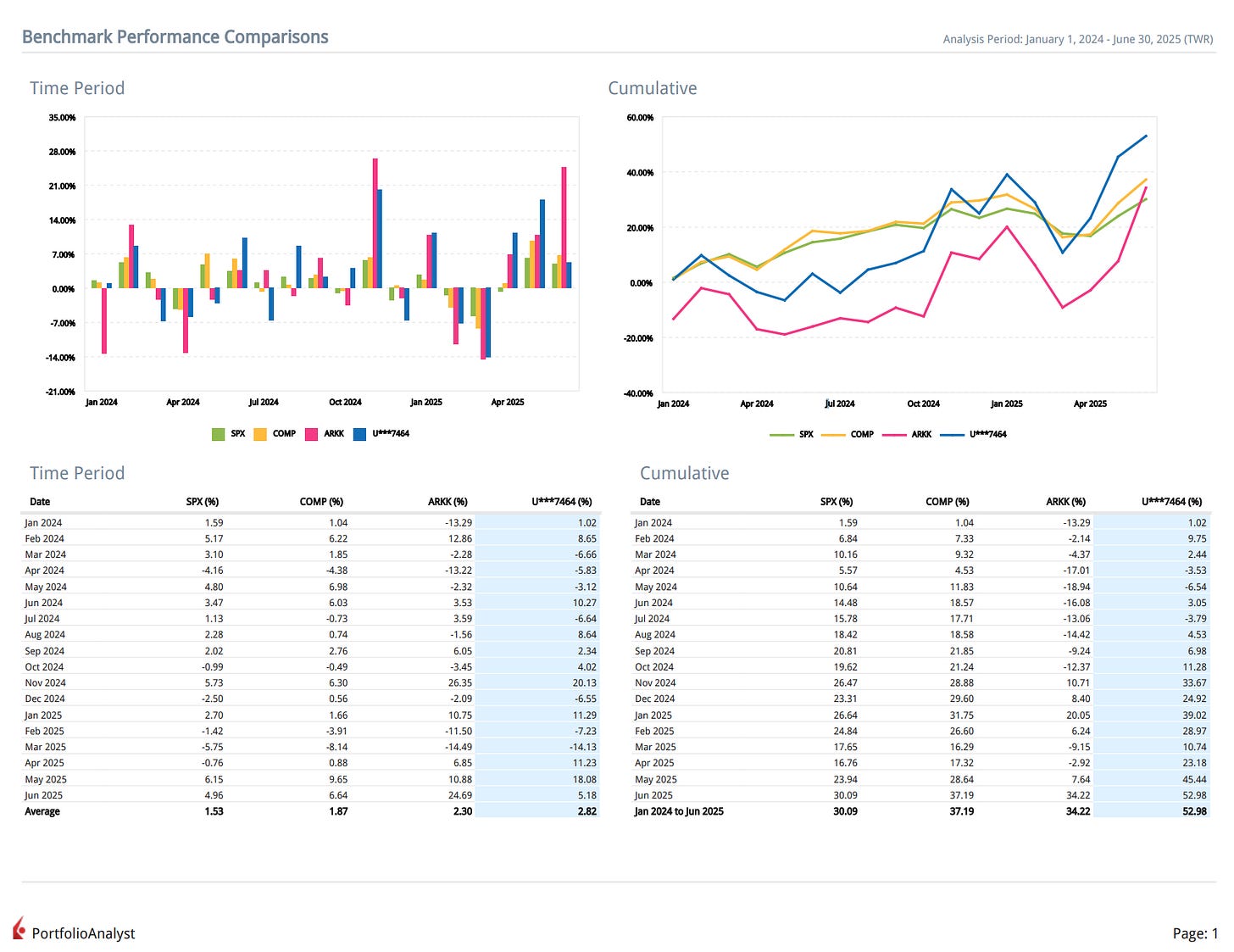

Performance (TWR):

Historical performance (TWR):

2020: +110.2% (since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

2024: +24.9%

Cumulative: +152.6%

A recap of my Portfolio in 2025

January:

⬇️ Trim TSLA

⬆️ Add DDOG TTD SHOP MNDY GTLB

February:

❌ TSLA

⬇️ Trim NOW NET

⬆️ Add AXON

✅ New DUOL

April:

⬇️ Trim CRWD AXON

⬆️ Add ZS TTD IOT DUOL

June:

⬇️ Trim ZS AXON GTLB

⬆️ Add DUOL MNDY IOT MDB DDOG

Key reasons for changes in my investment portfolio:

⬇️ZS is up 30% over the past month, which led me to trim the position slightly.

As for AXON, I reduced my position due to its high valuation—multiples are currently at historical highs.

⬆️I increased IOT after the market’s negative reaction to a strong quarterly report. Q1 is typically a seasonally weak quarter for the company, but compared to the same period last year, they added significantly more new customers and net new ARR.

⬆️DUOL and MNDY haven’t seen much growth over the past month, making their valuation multiples more attractive for increasing my position.

⬆️MNDY delivered an outstanding Q1 report, with strong new customer additions and improved retention.

The new Monday Service line is showing high growth, and the expansion in CRM and Dev accounts has been very strong.

DUOL also reported a strong quarter with record additions of new DAUs and MAUs.

⬇️Cut GTLB position. GitLab reported a weak Q1, even considering that the first quarter is typically seasonally soft for the company. The revenue beat was the lowest in its history. New customer additions were significantly lower compared to Q1 last year, and the retention rate declined quarter-over-quarter.

On the positive side, RPO and Billings grew faster than revenue, but in my view, customer growth remains the top priority. Revenue growth is slowing down meaningfully — especially concerning when GitHub is growing revenue at around +40% YoY with a much larger base. I’ve decided to keep a small position for now, but I was disappointed by the quarterly results.

⬆️DDOG reported a solid quarterly result, and considering the expected acceleration in revenue growth, the current valuation looks attractive. I’ve decided to slightly increase my position.

⬆️MDB also delivered a strong quarterly report, with particularly impressive new customer additions — the highest in the past two years. Retention improved, and both RPO and Billings grew faster than revenue. I decided to increase my position in MDB after reducing my exposure to GTLB.

Commentary on my holdings:

Cloudflare NET

Cloudflare Managed Security Services in Latin America

Cloudflare and TD SYNNEX have expanded their partnership to deliver managed security services across Latin America. The collaboration enables MSSPs to deploy Cloudflare’s full Zero Trust, SASE, and network security stack through a single platform.

Cloudflare blocked 30 billion daily threats in Latin America in Q1 2025, a 27% increase from the prior quarter.

Customers using Cloudflare's full suite save up to 50% compared to multi-vendor stacks.

64 cities in Latin America and the Caribbean now host Cloudflare infrastructure.

A Forrester study found Cloudflare delivers 238% ROI over three years.

New Global Privacy Certifications

Cloudflare is among the first companies certified under Global CBPR and Global PRP, covering privacy compliance across 39 jurisdictions.

Certifications created by governments including US, Japan, Australia, Mexico, and Singapore.

Standards support safe cross-border data movement and align with 50 data protection requirements.

Reinforces Cloudflare’s position as a global privacy-first infrastructure provider.

$1.75B Convertible Note Offering to Accelerate Growth

Cloudflare priced $1.75 billion in Convertible Senior Notes due 2030 to fund general corporate initiatives and pay $248 million for capped call transactions, reducing potential dilution. The initial conversion price is $247.67/share, a 45% premium over the prior close. Capped call strike is $469.73/share, a 175% premium. Estimated net proceeds: $1.72 billion.

Launch of Log Explorer: Native Observability Without Third-Party Tools

Cloudflare released Log Explorer, now generally available after previewing with over 500 customers. This solution enables full-stack, in-dashboard visibility, giving businesses real-time log access across performance and security. Replaces expensive SIEM pipelines and streamlines security ops. Users can now search HTTP, Zero Trust, and security event logs natively—simplifying operations and cutting storage costs.

TIME100 Recognition: Defending U.S. Elections from Cyber Threats

Cloudflare was named a TIME100 Most Influential Company (2025) for its cybersecurity role in protecting the 2024 U.S. elections. Through the Athenian Project, it safeguarded election infrastructure in over 25 U.S. states, blocking ~1 million threats daily at no cost. The company supported presidential campaigns and local governments, ensuring digital integrity during the election cycle.

Massive Global Network and Market Reach

Cloudflare powers ~20% of global web traffic, processing 247 billion threats daily across millions of customers, including 36% of the Fortune 500. The platform serves everything from APIs to AI workloads, and from SMBs to governments. Cloudflare’s rapid innovation has pushed its TAM from $181B in 2025 to $231B by 2028, expanding into observability, Zero Trust, AI networking, and developer platforms.

Crowdstrike CRWD

The company reported its first quarter of 2025 results.

Thoughts on Crowdstrike Earnings Report $CRWD:

🟢 Positive

Total ARR reached $4.44B, up +21.6% YoY, with $194M net new ARR

Subscription revenue grew +20.5% YoY to $1,051M, with high gross margin 80%

Free cash flow was $279.4M or 25.3% of revenue

EPS (non-GAAP) beat by +12.3%, coming in at $0.73

Billings rose +22.4% YoY to $1,146M

RPO increased +44.7% YoY to $6.80B

Charlotte AI, Next-Gen SIEM, and Falcon Cloud Security drove large 7–8 figure expansions

Falcon Flex total value reached $3.2B, up 6x YoY, with 820+ accounts

MSSP channel scaled to 15% of deal value, aiding SMB and midmarket growth

Share buyback of $1B authorized, indicating confidence in cash flow and valuation

GuidePoint Security became the 5th $1B+ partner

Gross retention rate remained flat at high level 97%

🟡 Neutral

Gross margin (non-GAAP) at 77.7%, down -0.6 PPs YoY

Operating margin (non-GAAP) at 18.2%, down -3.3 PPs YoY

Professional services revenue rose +7.8% YoY to $53M, but margin fell to 31%

Net new ARR declined -8.5% YoY, but trend is healthy (-31% YoY in Q3 2024 and -21% in Q4 2024)

Revenue of $1,103M missed estimates by -0.1%

Customer module adoption flat at 48% for 6+ modules, 32% for 7+

CAC payback increased to 26.7 months from 17.7 YoY

Diluted share count down -0.7% YoY, offsetting dilution pressures

🔴 Negative

Net margin (non-GAAP) declined to -10.0%, down -14.6 PPs YoY

Free cash flow margin dropped -9.7 PPs YoY, despite healthy absolute cash generation

Q2 revenue guidance of $1.145B–$1.152B came in -1.0% below consensus

R&D Index fell to 1.09, down -0.59 YoY

U.S. revenue growth slowed to +17.8% YoY, below international rates

CCP program and July 2023 outage created $61M cash impact and $11M in revenue headwind per quarter through Q4 FY26

Market Reaction to Earnings Release: The stock price down -6.6% following the earnings release.

CrowdStrike was named the innovation and growth leader in the 2025 Frost Radar for Cloud and Application Runtime Security, earning the top Innovation Index score. It’s the only CNAPP offering unified, real-time protection across cloud, identity, and endpoint.

Frost & Sullivan highlighted its leadership in Cloud Detection and Response (CDR), driven by runtime activity correlation, AI-based threat detection, and real-time visibility.

Falcon Cloud Security provides full lifecycle coverage with both agent-based and agentless capabilities across hybrid and multi-cloud environments.

CrowdStrike and Microsoft Launch Unified Threat Actor Mapping, created a shared system to align cyber threat actor names across platforms, reducing confusion and improving cross-vendor attribution.

Over 80 adversary aliases reconciled, including Volt Typhoon = VANGUARD PANDA

AI Lifecycle Protection with NVIDIA: CrowdStrike is integrating Falcon Cloud Security with NVIDIA's NIM microservices and NeMo Safety, securing 100,000+ LLMs across hybrid and multi-cloud environments. This end-to-end integration covers build, runtime, and posture management, enabling enterprises to scale AI applications with real-time security. Capabilities include AI-SPM, Model Scanning, and Shadow AI detection, plus runtime behavior monitoring and integration into NeMo Safety workflows. The collaboration extends protection from code to cloud.

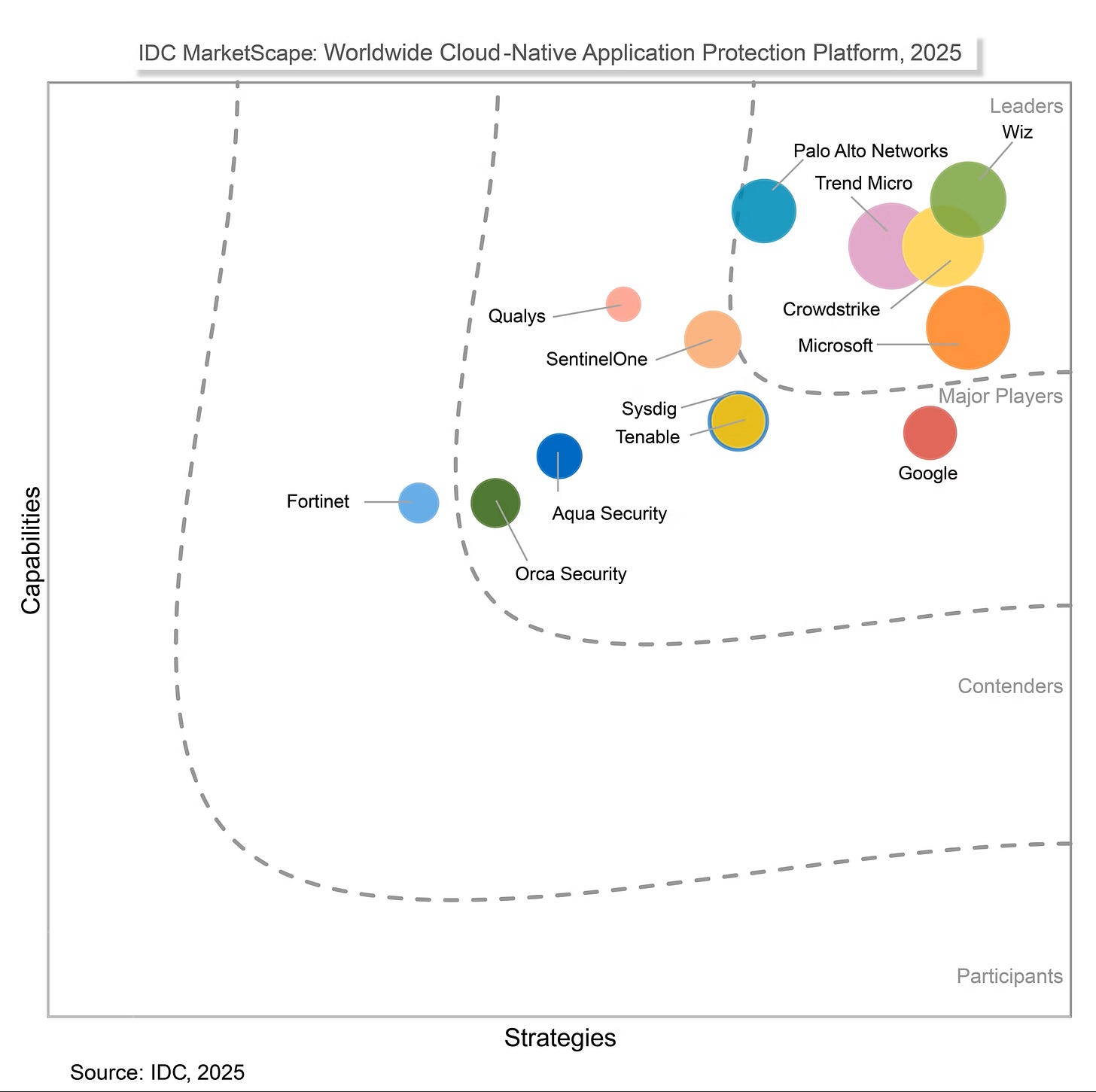

Recognition as CNAPP Leader by IDC: CrowdStrike has been named a Leader in the IDC MarketScape: Worldwide Cloud-Native Application Protection Platform (CNAPP) 2025. The Falcon Cloud Security platform is the only CNAPP delivering real-time protection across cloud, identity, and endpoint, with AI-driven risk prioritization, code-to-cloud visibility, and cloud workload protection. IDC highlighted Falcon’s shift-left capabilities, unified dashboard, and maturity/assessment model for benchmarking cloud security posture.

Court Win on Software Outage Lawsuit: A U.S. District Court dismissed a class action against CrowdStrike tied to the July 2024 airline outage, ruling that the Airline Deregulation Act preempts claims against non-airline software providers. The court confirmed federal protection extends to third parties supporting airline services.

Monday MNDY

Monday has appointed Harris Beber as Chief Marketing Officer, effective July 3, 2025. He will lead global marketing strategy across brand, performance, demand generation, and communications.

Beber previously led global marketing at Google Workspace, driving AI adoption across its product suite. As CMO at Waze, he integrated marketing under Google’s Geo division. At Vimeo, he helped take the company public, tripled the user base, and drove 400% revenue growth.

Datadog DDOG

Datadog is scaling observability, automation, and security for the AI-native era. New releases across observability, log management, applied AI, and developer workflows empower organizations to deploy, monitor, and secure intelligent systems at scale.

AI Observability and Monitoring

Datadog introduced AI Agent Monitoring, LLM Experiments, and AI Agents Console to provide end-to-end visibility, rigorous testing, and governance across custom and third-party AI agents. Agent decision paths are mapped in real time, enabling teams to detect latency spikes, incorrect tool usage, and infinite loops. LLM Experiments validate prompt, model, and application changes using production data. The AI Agents Console measures usage, impact, and ROI while monitoring permissions, behavior, and compliance risk.

AI Security Enhancements

Datadog expanded its security platform to protect AI workloads from development to runtime. Code Security detects vulnerabilities in custom and open-source code using AI-powered remediation. LLM Observability performs toxicity and behavior checks. Cloud Security detects misconfigurations and unauthorized access while meeting frameworks like NIST AI. Sensitive Data Scanner prevents PII leaks during training. Bits AI Security Analyst autonomously triages alerts, investigates threats, and delivers resolutions with context.

Applied AI for Engineering, DevOps, and Security

Datadog launched Bits AI SRE, Bits AI Dev Agent, and Bits AI Security Analyst to automate investigations and fixes across incidents, code, and security. These agents operate on shared task systems and are powered by Datadog’s telemetry data. Additional tools like Proactive App Recommendations and APM Investigator identify high-impact fixes, bottlenecks, and patterns to reduce latency and resource use.

Internal Developer Portal (IDP)

Datadog unveiled the first IDP powered by live observability data. The portal enables fast, standards-compliant software delivery through live service mapping, dependency tracking, and ownership context. Developers use Self-Service Actions and Scorecards to meet internal requirements, while Engineering Reports provide insights into delivery performance, reliability, and compliance.

Log Management Innovation

New capabilities include Archive Search, Flex Frozen, and CloudPrem. Archive Search enables querying from cold storage without re-indexing. Flex Frozen offers 7+ years of in-platform log retention for audit-heavy environments. CloudPrem allows on-premise deployment to meet data residency laws while retaining Datadog’s UI and workflows.

Snowflake SNOW

Snowflake Intelligence & Data Science Agent

Announced at Snowflake Summit 2025, Snowflake Intelligence (public preview soon) allows business users to analyze structured and unstructured data via natural language, eliminating technical overhead. Data Science Agent (private preview soon) automates ML workflows for data scientists, improving speed and productivity.

Key Highlights:

Over 5,200 enterprises including BlackRock, WHOOP, and Penske Logistics are already using Snowflake’s AI solutions.

Snowflake Intelligence runs within the existing Snowflake environment, inheriting all security, masking, and governance policies.

Integration with Box, Google Drive, Salesforce, Workday, Zendesk, and more via Snowflake Openflow.

Powered by Cortex Agents, using LLMs from Anthropic and OpenAI.

Cortex AISQL & SnowConvert AI: Modern Analytics for AI Era

Cortex AISQL (public preview) integrates generative AI into SQL queries, enabling analysis of multi-modal data with up to 60% cost savings. SnowConvert AI accelerates migration from legacy platforms with AI-powered automation.

Benefits:

SQL for text, images, and audio analysis.

Used by companies like Hex, TS Imagine, and Sigma.

Improves performance by 30–70%.

Enables analysts to perform AI tasks without engineering support.

Agentic AI on Snowflake Marketplace

Cortex Knowledge Extensions (GA soon) provide access to content from USA TODAY, Stack Overflow, and others to enrich AI apps. Enterprises can now license high-quality content and build agentic workflows securely.

Updates:

Semantic Models sharing (private preview) allows consistent, trusted AI outputs across organizations.

Agentic Native Apps enable plug-and-play deployment of AI agents within Snowflake.

Compute Innovations: Faster, Smarter Warehousing

Standard Warehouse – Gen2 delivers 2.1x faster analytics. Adaptive Compute (private preview) auto-scales resources, reducing manual effort and cost.

Enhancements:

Reduced operational overhead.

AI-powered governance tools like Copilot for Horizon Catalog.

Immutable Snapshots for ransomware recovery (public preview).

Snowflake Openflow: Unified Data Ingestion for AI

Openflow (GA) simplifies data integration with hundreds of connectors, powered by Apache NiFi. Supports real-time, batch, and streaming data movement for AI workflows.

Key Capabilities:

Ingests from Box, Oracle, Salesforce, and others.

Delivers high-throughput streaming with Snowpipe Streaming.

Supports Apache Iceberg for open lakehouse architectures.

Snowflake Acquires Crunchy Data for Enterprise Postgres

Snowflake to integrate Crunchy Data’s enterprise-grade Postgres, enabling secure and compliant Postgres-based AI apps on the AI Data Cloud.

Impact:

Postgres used by 49% of developers.

Supports FedRAMP environments.

Complements Unistore to unify transactional and analytical workloads.

Canva is using Snowflake to scale globally, boost enterprise adoption, and accelerate product innovation. With 230M+ users and $3B+ in revenue, Canva leverages Snowflake to personalize design experiences using AI-driven recommendations and accelerate product development with data-informed decisions (e.g., Canva Sheets).

Snowflake is the foundation enabling Canva’s shift from consumer tool to enterprise design platform.

Snowflake and Acxiom Redefine Enterprise Marketing With Cloud-Native, AI-Driven Infrastructure for Real-Time Personalization and Data Transparency

Snowflake and Acxiom launched a global AI-powered marketing foundation that gives brands direct access to IPG’s Interact, Real ID, and data collaboration tools within their Snowflake environments. The solution eliminates data transfers, enforces zero-copy privacy architecture, and replaces legacy “black box” agency models with client-owned systems.

Brands gain real-time personalization, AI-powered campaign optimization, and full visibility into marketing performance. Early outcomes include real-time ad spend optimization, faster media investment decisions, and cloud modernization for financial services.

Zscaler ZS

Zscaler Expands AI and Zero Trust Innovations Across Cloud and Enterprise Environments

Zscaler introduced new AI capabilities to improve threat detection, data protection, and network performance across distributed environments.

AI Data Classification: Identifies sensitive data across 200+ categories with high precision

GenAI Protection: Expands prompt visibility and policy enforcement for tools like Microsoft CoPilot

AI Segmentation: Automates user-to-app segmentation to strengthen posture and simplify workflows

AI-Powered ZDX: Enhances ISP benchmarking, outage detection, and network optimization using multi-path flow analysis

Zscaler Zero Trust Everywhere Architecture

Zscaler launched new Zero Trust solutions to protect data across branches, cloud workloads, and B2B environments.

Zero Trust Branch Appliance: Secures OT, IoT, and user traffic across sites; eliminates legacy firewalls and NAC

Zero Trust Gateway for Cloud: Cloud-native workload protection with no agents or VMs, deployable in under 10 minutes

Microsegmentation for Cloud: Host-level segmentation across AWS, Azure, and on-premise using AI-based policies

B2B Exchange: Enables secure partner collaboration without VPNs or MPLS; now available for select use cases

Zscaler priced $1.5 billion in 0.00% convertible senior notes due 2028 through a private offering under Rule 144A. An additional $225 million may be issued if the initial purchasers exercise their 13-day option in full. The deal is expected to close on July 3, 2025.

The Trade Desk TTD

The Trade Desk Unveils AI-Powered Deal Desk

The Trade Desk launched Deal Desk, a Kokai platform feature using AI to score and optimize private ad deals. Advertisers and publishers gain shared visibility through Deal Quality Scores and real-time insights. The platform automates activation, expansion, and cancellation to maintain deal health. Early adopters include Disney. Beta testing begins Q3 2025.

GitLab GTLB

The company reported its first quarter of 2025 results.

Thoughts on GitLab Earnings Report $GTLB:

🟢 Positive

Revenue of $214.5M grew +26.8% YoY, but slowing from +29.1% growth rate in Q4 2024, beating consensus by 0.9%

EPS of $0.17 exceeded expectations by 13.3%

Free Cash Flow Margin reached a record 48.5% (+26.4pp YoY)

Operating Margin rose to 12.2% (+14.4pp YoY)

RPO of $0.96B, up +40.2% YoY

Billings grew to $222M, up +35.4% YoY

Duo customer growth accelerated +35% QoQ

Ultimate tier reached 52% of ARR, with 8 of top 10 deals

GitLab 18 introduced major upgrades, including AI-powered compliance, artifact management, and knowledge graph

GitLab Dedicated gained FedRAMP Moderate Authorization, unlocking public sector momentum

Over 100 product enhancements launched in the past year

Strategic partnership with AWS expanded, including Amazon Q integration

🟡 Neutral

Gross Margin of 90.2%, down 0.5pp YoY

DBNRR at 122%, down from 123% LQ

Premium remains the most common entry point despite Ultimate growth

S&M/Revenue at 39.9%, down 4.1pp YoY

Public beta for Duo Workflow expected in summer, GA in winter

Customer adoption lag in AI workflows noted, requiring education and demos

SBC/Revenue increased to 26%, +4pp QoQ

🔴 Negative

Net New ARR of $12M, down -42.6% YoY

10,104 customers (+12.6% YoY, +211 QoQ) and 1,288 $100K+ customers (+25.7% YoY), weak new customers addition

CAC Payback Period increased to 85.5 months, up +40.5 YoY

R&D Index (RDI) dropped to 1.09, down 0.11 YoY

Diluted shares up 7.6% YoY, dilutive to long-term equity holders

Logo growth impacted by SMB churn near $5K ARR threshold

“Skinny beat” attributed to SaaS mix and back-end weighted linearity

Future expansion runway pressure from higher initial Ultimate lands

Market Reaction to Earnings Release: The stock price down -12.6% following the earnings release.

GitLab Named Leader in DevOps Platforms by Forrester

GitLab has been recognized as a Leader in The Forrester Wave: DevOps Platforms, Q2 2025, ranking highest in project planning, CI/build automation, and pipeline security.

Core Capabilities Highlighted

Offers the most comprehensive all-in-one DevOps solution evaluated

Delivers strong out-of-the-box usability, with built-in tools and guided migrations

Integrated with Amazon Q, includes cloud development environments (CDEs), IDP, and documentation wikis

Monthly release cadence enables faster innovation cycles

Active developer community surpasses larger competitors

MongoDB MDB

The company reported its first quarter of 2025 results.

Thoughts on MongoDB Earnings Report $MDB:

🟢 Positive

Revenue grew to $549M (+21.8% YoY, +0.1% QoQ), beating estimates by 4.2%

Atlas revenue reached $395M (+26.0% YoY), representing 72% of total revenue

Net ARR expansion held strong at 119% (+1pp QoQ)

Billings increased to $510M (+23.4% YoY), RPO rose to $774M (+32.0% YoY)

Free Cash Flow margin expanded to 19.3% (+5.8pp YoY)

Operating margin improved to 15.9% (+8.6pp YoY)

EPS (non-GAAP) hit $1.00, beating estimates by 53.8%

$100K+ customers increased to 2,506 (+17.3% YoY, +110 QoQ)

Atlas customers rose to 55,800 (+17.0% YoY, +2,700 QoQ)

Net new ARR added $2M, up 106.3% YoY

R&D Index improved to 1.22 (+0.07 YoY)

Operating efficiency improved: S&M/rev down 6.4pp, G&A/rev down 2.5pp

FY26 revenue guidance raised slightly to $2.25B–$2.29B, a 0.4% increase, tracking consensus

🟡 Neutral

Q2 FY26 revenue guidance of $548M–$553M implies 15.1% YoY growth, in line with expectations

April Atlas consumption was soft due to macro volatility, but May rebounded

Self-serve channel grew strongly, but onboarding challenges persist

SBC/revenue rose slightly to 24% (+0.3pp QoQ)

CAC payback period increased to 1,135 months, distorted by seasonality

🔴 Negative

Gross margin declined to 74.0% (-0.9pp YoY) due to Atlas mix and Voyage AI integration

Direct sales customers grew only +5.6% YoY, remaining flat QoQ at 7,500

Non-Atlas revenue expected to decline high single digits YoY due to $50M license revenue headwind

Dilution impact from share count:

Basic shares up 11.1% YoY, +3.8pp QoQ

Diluted shares up 18.2% YoY, +1.3pp QoQ

Market Reaction to Earnings Release: The stock price up +14.6% following the earnings release.

MongoDB Targets FedRAMP High and IL5 to Power Sensitive U.S. Government Workloads

MongoDB is seeking FedRAMP High and IL5 authorizations for Atlas for Government, enabling secure, scalable support for critical U.S. public sector workloads in law enforcement, emergency services, finance, and healthcare.

Already FedRAMP Moderate authorized, Atlas serves 13 Cabinet-level agencies, DoD, and the Intelligence Community, including NOAA, FDA, HHS, and the State of Utah.

Key innovation: Queryable Encryption secures data in use, in transit, at rest, and in backups, with client-side decryption only.

In production, Utah saw a 25% speed boost, cut recovery time from 58 hours to 5 minutes, and reduced management complexity.

Samsara IOT

The company reported its first quarter of 2025 results.

Thoughts on Samsara Earnings Report $IOT:

🟢 Positive

Revenue reached $366.9M, up +30.7% YoY, beating estimates by 4.4%

Non-GAAP Gross Margin improved to 78.5%, up +1.6 percentage points (PPs) YoY

Non-GAAP Operating Margin rose to 13.9%, up +11.7 PPs YoY

Free Cash Flow Margin increased to 12.5%, up +5.8 PPs YoY

EPS (non-GAAP) of $0.11, beat estimates by 83.3%

Net Retention Rate (NRR) at 115% for $10K+ ARR customers

ARR ended at $1.54B, up +30.6% YoY

$100K+ customer count rose to 2,638, up +35.1% YoY

Billings reached $387M, up +27.7% YoY

Major wins: Knife River, propane distributor, vegetation management firm

International ACV mix tied record high at 18%, with Europe at highest ever contribution

Full-year revenue guidance raised to $1.547B–$1.555B, up +24.2% YoY

🟡 Neutral

Net new ARR added $78M, up +5.2% YoY

CAC Payback Period increased to 23.9 months, up +5.6 YoY

R&D Index declined to 1.81, down 0.18 YoY

Customer methodology updated to consolidate related entities; minimal metric impact

Software-only SKUs and asset tags gaining traction, still early in full deployment

SBC as % of revenue rose to 23%, up +1.9 PPs QoQ

🔴 Negative

Net Margin remained negative at -6.0%, despite improving +7.7 PPs YoY

Basic shares up +3.5% YoY; Diluted shares up +1.7% YoY, dilutive pressure persists

Sales cycles extended post-Liberation Day due to tariff-related purchasing delays

Market Reaction to Earnings Release: The stock price down -12.1% following the earnings release.

Samsara Powers Field Services with AI-Driven Operational Intelligence

Thousands of field services organizations globally have standardized on Samsara's AI-powered platform to improve safety, efficiency, and response times.

Customer Outcomes

Interstate Waste: Broadened use cases beyond dash cams to full digital transformation.

Sunrun: Lowered accident rate by 32%, improved utilization by 23%.

Uniti Fiber: Increased dispatch efficiency by 76%.

Midland Tyre: Saved thousands of hours via faster response.

Roto-Rooter & Satellites Unlimited: Enhanced safety, reduced risk exposure, and gained insurer endorsement.

AI Safety Intelligence

Samsara introduced AI Multicam with up to 4 HD cameras offering 360-degree coverage and real-time pedestrian/cyclist alerts. Weather Intelligence overlays National Weather Service data to identify environmental threats. AI Coaching Automation analyzes risk and automates coaching workflows. The Driver App now includes TikTok-style training, end-of-day reviews, and in-app rewards to boost engagement. Coach USA achieved a 92% reduction in preventable incidents leveraging these capabilities.

Connected Wearable for Field Workers

The Samsara Wearable extends protection beyond the vehicle with one-year battery life, one-click emergency alerts, and real-time GPS/audio support. It detects falls and provides proactive weather threat alerts, helping reduce injuries in high-risk or remote job sites.

Advanced Routing & Navigation

Route Planning integrates with ERP/CRM systems and reduces vehicle usage by up to 15% through optimized delivery scheduling. Commercial Navigation layers in vehicle-specific compliance for accurate, real-time routing, improving reliability and efficiency.

AI-Driven Maintenance

New upgrades include voice-to-text DVIR, real-time FMCSA alerts, and AI-deciphered fault codes that trigger automated work orders. AI Invoice Scanning digitizes vendor receipts, while Level Monitoring provides near real-time insight into fuel and tank levels—minimizing downtime and cost.

Customer Outcomes

Mohawk Industries saves $7.75M annually by tightening route performance. Rolfson Oil manages over 700 assets with Samsara’s AI-driven maintenance dashboard. Univar Solutions uses the new wearable to protect teams handling hazardous materials.

Strategic Integrations and Investments

Samsara partnered with HappyRobot to bring voice AI automation to the platform. The integration handles 20M+ annual conversations, reducing call time by 50% and operational costs by 33%. The solution is now available on the Samsara Marketplace.

NASCAR Sponsorship & Brand Expansion

As the official sponsor of NASCAR Mexico, Samsara showcases its real-time tech stack across 120,000 km/year of racing logistics. The partnership with Richard Childress Racing demonstrates the impact of predictive maintenance and intelligent routing in extreme conditions.

Recognition and Community

Samsara’s 2025 Connected Operations Awards recognized outcomes like $13M+ saved in maintenance, 97% reduction in theft, and 60%+ gains in driver retention. Its Customer Advisory Board, which includes Republic Services, Mohawk Industries, DHL, Tyson Foods, and others, plays a key role in shaping Samsara’s product direction.

Thank you for reading!

Follow me for frequent updates on key news on X/Twitter and Threads @SergeyCYW and for visual infographics on Instagram.

For portfolio changes, follow me on SavvyTrader, where you'll find: current portfolio holdings, portfolio performance, trade alerts, and trade history.

Past recaps:

May 2025

April 2025

March 2025

February 2025

January 2025

2024

Disclaimer: This portfolio summary is for informational purposes only and not investment advice. Opinions are my own; please conduct your own due diligence.

Hi there, do you calculate an intrinsic value for the stocks you own?

Why do you own Net? They are unprofitable??