My Stock Portfolio Review, February 2025

Portfolio Performance Overview and Key Stock Highlights

Hello, Investor,

Each month, I provide a transparent update on my portfolio performance, covering the latest news on core stock positions and analyzing recent developments across each holding.

For more frequent updates, follow me on X/Twitter and Threads, for visual infographics on Instagram and on SavvyTrader for portfolio changes.

Portfolio Review

Holdings:

Monthly Allocations:

* green (added), orange (trimmed)

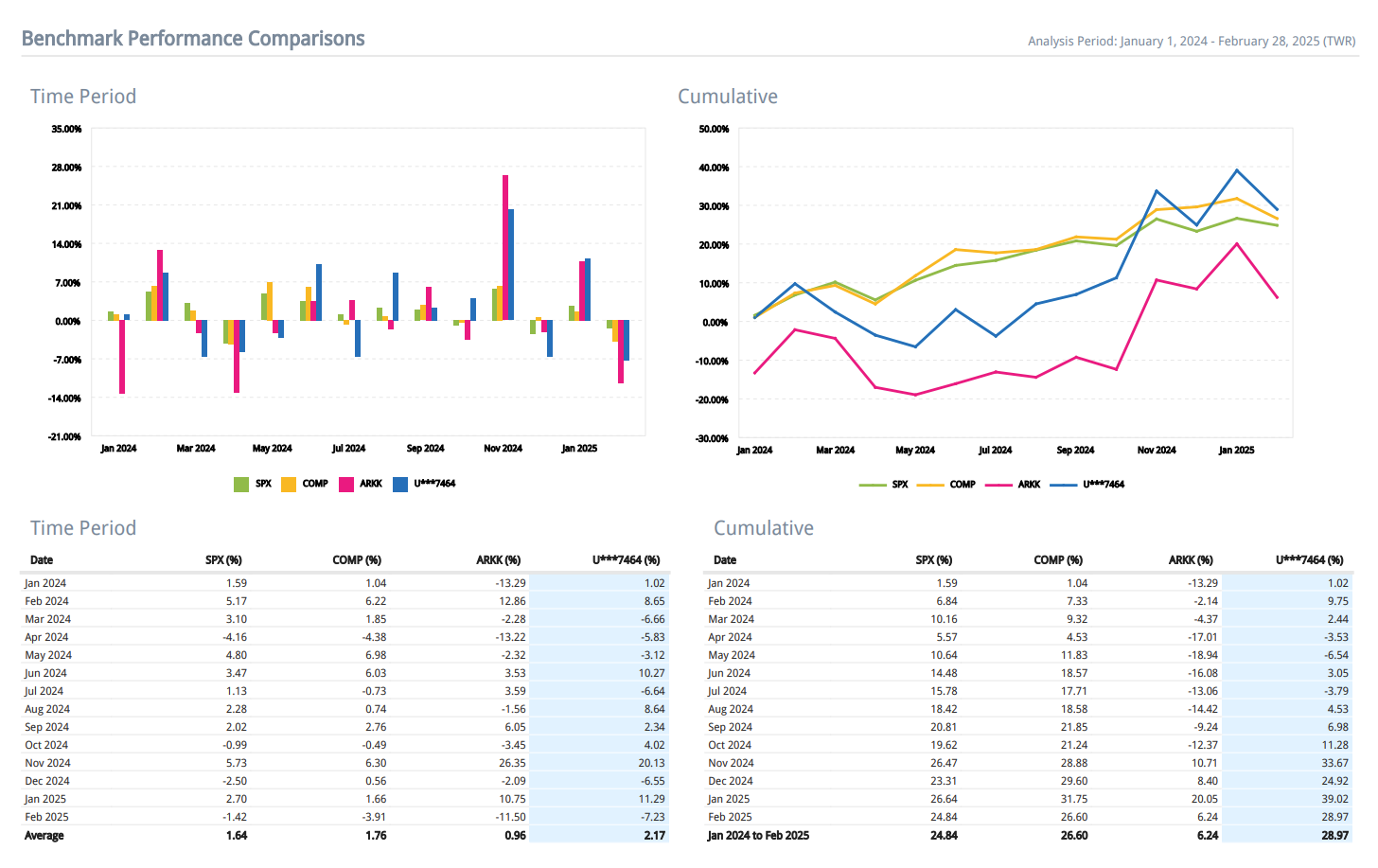

Performance (TWR):

Historical performance (TWR):

2020: +110.2%(since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

2024: +24.9%

Cumulative: +112.9%

A recap of my Portfolio in 2025

January:

⬇️ Trim TSLA

⬆️Add DDOG TTD SHOP MNDY GTLB

February:

❌ TSLA

⬇️ Trim NOW NET

⬆️Add AXON

✅New DUOL

Key reasons for changes in my investment portfolio:

The main reason for these changes was the sale of $TSLA, as I was concerned about the significant decline in European sales based on December data, as well as the progress of autonomous driving technology, including Wayve’s autonomous drive in London and Google’s Waymo expansion. Europe is a key market for Tesla, and while part of the sales decline was due to the Model Y refresh, other models also showed a significant drop in sales.

I opened a starter position in $DUOL after the stock dropped despite a strong earnings report. Valuation multiples have come down slightly but still remain near historical highs. The company continues to deliver high revenue growth, with record DAU and paid subscriber additions. I also like that Duolingo invests more in R&D than in S&M. While ChatGPT-based models raise concerns about the company's future growth trajectory, Duolingo maintains a strong competitive position.

I increased my position in $AXON after a strong earnings report. The stock declined following the termination of the Flock Safety partnership, but management has shifted focus to FUSUS-based ALPR alternatives after the recent acquisition of FUSUS. Following this pullback, the valuation became more reasonable, whereas I had previously trimmed my position due to the elevated valuation multiples.

I reduced my position in $NOW after a fairly weak Q4. The company provided a weak forecast below expectations for both the next quarter and the full year. According to management, the cautious outlook reflects uncertainty in AI monetization timing and election-driven delays in U.S. federal IT spending. I expect demand to recover in the next quarter, but I will closely monitor execution and whether management’s promises are backed by actual performance.

I slightly reduced my position in $NET since it had grown significantly in my portfolio and remains my largest holding.

Commentary on my holdings:

Cloudflare NET

The company reported its fourth quarter of 2024 results.

Thoughts on Cloudflare Earnings Report $NET:

🟢 Positive

Revenue: $459.9M, up 26.9% YoY and 28.2% QoQ, beating estimates by 1.8%

Billings: $548M, up 31.8% YoY

Operating Margin: 14.6%, up 3.6 PPs YoY

Net Margin: -2.8%, improved by 4.9 PPs YoY

EPS: $0.19, beat estimates by 5.6%

Dollar-Based Net Retention (DBNR): 111%, up 1 PP QoQ

RPO: $1.69B, up 35.5% YoY

Large Customers: 3,497, up 26.9% YoY

Enterprise Growth: $20M, five-year deal with a Fortune 100 tech company, multiple $10M+ contracts in AI, retail, and finance

Sales Productivity: Fifth consecutive quarter of double-digit YoY growth, 84% YoY increase in Enterprise AE hiring

🟡 Neutral

Gross Margin: 77.6%, down 1.3 PPs YoY

FCF Margin: 10.4%, down 0.6 PPs YoY

CAC Payback Period: 20.4 months, increased by 2.2 months YoY

R&D Index (RDI): 1.60, down 0.11 YoY

Stock-Based Compensation (SBC): 21% of revenue, up 0.1 PPs QoQ

Headcount: 4,263, up 15.8% YoY, added 103 employees in Q4

FY 2025 Revenue Guidance: $2.09B-$2.094B, in line with expectations

🔴 Negative

Q1 2025 Revenue Guidance: $468M-$469M, up 23.7% YoY, but missed estimates by -1.2%

SBC impact: Basic shares up 2.2% YoY, diluted shares up 1.6% YoY

Customer Acquisition Costs: Rising due to entrenched legacy vendor relationships in Zero Trust

Regulatory Compliance: Need for regional certifications in Europe and Asia to match U.S. FedRAMP High certification

Market Reaction to Earnings Release: The stock price up +12% following the earnings release.

It was a strong quarterly report for Cloudflare. The forecast for the next quarter suggests revenue growth stabilization, while billings growth has accelerated, and RPO growth is significantly higher than revenue growth. The addition of new total and large customers reached a record high. Retention (NDR) showed a trend reversal in Q4, increasing to 111% from 110% in the previous quarter.

Cloudflare Launches One-Click Content Credentials

Cloudflare NET introduced a one-click solution for content creators and publishers to preserve the digital history of images, ensuring transparency in their creation, edits, and provenance. Content Credentials, built on C2PA standards, is supported by Adobe’s Content Authenticity Initiative (CAI).

Addressing AI-Generated Manipulations: With AI-generated images becoming more common, verifying authenticity is critical. Cloudflare Images now allows users to securely preserve metadata, enabling verification of an image’s origin and modifications through Adobe’s Content Authenticity Inspect tool.

Industry Support and Integration: CEO Matthew Prince highlighted trust and authenticity as essential for the Internet’s future. Andy Parsons of Adobe noted the importance of this implementation in strengthening digital content integrity.

Driving Content Authenticity at Scale: By integrating Content Credentials globally, Cloudflare is accelerating the adoption of content authenticity standards, enhancing trust in digital media across the Internet.

Cloudflare Expands Security Certifications

Cloudflare NET is pursuing FedRAMP High authorization in the U.S. and IRAP PROTECTED assessment in Australia, following its ENS certification in Spain. These certifications enhance Cloudflare’s ability to secure critical government infrastructure and sensitive data globally.

Strengthening U.S. Federal Security: Cloudflare is working toward FedRAMP High, the highest security level for U.S. federal cloud services. This authorization will enable federal agencies to protect sensitive unclassified data using Cloudflare’s technology.

Expanding Presence in Australia and Spain: The company is advancing IRAP assessment in Australia and has secured ENS certification in Spain. These approvals confirm compliance with national security standards, allowing government agencies to modernize cybersecurity with Cloudflare’s solutions.

Crowdstrike CRWD

CRWD launches Charlotte AI Detection Triage, an AI-powered SOC automation tool with 98%+ accuracy, streamlining threat detection and response.

Key Benefits:

Eliminates 40+ hours of manual triage work weekly

Automates SOC workflows, boosting efficiency

Filters false positives, prioritizes real threats

Ensures full human oversight with built-in guardrails

Trained on Falcon Complete MDR data, Charlotte AI enhances threat detection speed and accuracy using CrowdStrike’s proprietary cybersecurity advantage.

CrowdStrike Expands Falcon Cloud Security to Oracle Cloud Infrastructure.

Cloud intrusions jumped 75% last year, exposing security gaps. Falcon Cloud Security, a comprehensive CNAPP, delivers advanced detection and response (CDR) to secure applications, data, identities, and AI models across all major cloud providers.

CrowdStrike and Oracle integrate Falcon Cloud Security with OCI, providing businesses a unified cloud protection solution to reduce complexity and risk.

CrowdStrike Falcon Exposure Management Achieves FedRAMP Authorization.

CrowdStrike announced FedRAMP Moderate authorization for Falcon Exposure Management, making it available to government entities through GovCloud. The platform enables agencies to proactively reduce risk while integrating seamlessly with other FedRAMP-authorized modules within the CrowdStrike Falcon cybersecurity platform.

Falcon Exposure Management provides real-time visibility across endpoints, networks, and cloud environments, using AI-driven vulnerability prioritization to automate responses and reduce critical vulnerabilities by 98%.

CrowdStrike Expands Identity Protection to Microsoft Entra ID

CrowdStrike launched Falcon Identity Protection for Microsoft Entra ID, delivering real-time prevention, detection, and response to identity-based attacks across hybrid environments. The solution extends inline prevention to cloud-based Entra ID, securing cloud identity providers, Active Directory, and SaaS applications.

CrowdStrike’s 2025 Global Threat Report Highlights Escalating Cyber Threats

China’s cyber operations surged 150%, with targeted attacks on key industries rising up to 300%. AI-driven deception fueled a 442% spike in voice phishing, while 79% of initial intrusions were malware-free, exploiting stolen credentials and identity gaps.

Breakout times hit record lows, averaging 48 minutes, with the fastest at 51 seconds. Cloud intrusions rose 26% YoY, and valid account abuse made up 35% of cloud breaches. 52% of vulnerabilities were tied to initial access, emphasizing the need for proactive security.

CrowdStrike was recognized as a Leader in The Forrester Wave: MDR Services, Q1 2025, ranking highest in Strategy and earning top scores for Detection Surface, Threat Hunting, and Investigation.

Falcon Complete Next-Gen MDR enhances security efficiency with AI automation, cutting 40+ hours of manual work per week while improving decision accuracy to 98%. Charlotte AI Detection Triage strengthens detection across endpoints, identity, and cloud.

Forrester highlights CrowdStrike’s ability to detect adversaries early. Recognized as Customers’ Choice in Gartner Peer Insights 2024, Company of the Year by Frost & Sullivan, and Overall Leader in KuppingerCole’s 2024 MDR report, CrowdStrike delivers the fastest detection—up to 11x faster than competitors.

Monday MNDY

The company reported its fourth quarter of 2024 results.

Thoughts on Monday Earnings Report $MNDY:

🟢 Positive

Revenue: $268M (+32.3% YoY, +32.7% QoQ), exceeding estimates by 2.6%

Net Income: $57.3M in Q4, up from $33.7M in Q4 2023

Net Dollar Retention (NDR): 112% overall, 115% for $50K+ ARR, 116% for $100K+ ARR

Large Customers: $50K+ ARR customers +39.5% YoY (3,201), $100K+ ARR customers +44.9% YoY (1,207)

EPS: $1.08, beating estimates by 36.7%

Operating Margin: 15.0% (+4.6 PPs YoY)

Net New ARR: $68M (+26.9% YoY)

CRM Accounts: 27,756 (+12.2% QoQ)

Monday Dev Accounts: 3,433 (+9.0% QoQ)

Hiring: 2,508 employees (+35.3% YoY, +203 QoQ)

Q1 2025 Revenue Guidance: $274M - $276M (+26.8% YoY), beating estimates by 0.6%

AI Monetization Not Yet Reflected: AI revenue not included in 2025 guidance, representing a potential but unrealized upside.

🟡 Neutral

Gross Margin: 89.2% (-0.5 PPs YoY)

Free Cash Flow Margin: 27.1% (-0.2 PPs YoY)

Q4 Customer Growth: 245,000 total customers (+8.8% YoY, +19,769 added)

R&D Investment: 17.9% of revenue (+1.5 PPs YoY)

Q1 2025 Guidance: $1.208B - $1.221B (+24.9% YoY), in line with estimates

SBC/Revenue: 11%, down 2.6 PPs QoQ

Customer Acquisition Cost (CAC) Payback Period: 25.8 months (+0.5 YoY)

🔴 Negative

Sales & Marketing Spend: 47.7% of revenue (-6.6 PPs YoY), but still high

Stock Dilution: Basic shares up 3.7% YoY, diluted shares up 2.6% YoY

FX Headwinds: Expected to impact 2025 revenue by 100-200 basis points

Market Reaction to Earnings Release: The stock price up +23% following the earnings release.

It was a strong quarter for Monday. Although the forecast for the next quarter suggests a slight slowdown, revenue growth remains high. Management also mentioned that AI revenue is not included in the 2025 guidance, representing a potential but unrealized upside. Billings growth has accelerated and is outpacing revenue growth, while net new ARR increased by +27%. Retention (DBNR) improved across all customer cohorts, partly due to subscription price increases. The addition of new customers in the $50K+ and $100K+ segments reached a record high. While the growth of new CRM accounts was not as strong, the new Monday Service segment is expanding rapidly.

Monday has announced its AI Vision for 2025, focusing on three core pillars: AI Blocks, Product Power-ups, and Digital Workforce. This strategy aims to enhance workflows, democratize AI adoption, and help businesses scale efficiently.

AI Blocks enable customizable AI actions within workflows, allowing users to automate tasks like data categorization and pattern recognition.

Product Power-ups integrate AI across monday.com’s suite, improving resource management, CRM automation, and real-time service ticket resolution.

Digital Workforce introduces AI-powered agents to analyze risks, resolve issues, and assist with onboarding, with the first agent, monday Expert, launching in March.

Monday Launches AI-First Service Platform. Monday service exits beta, now available to all customers as an AI-driven Enterprise Service Management (ESM) platform designed to streamline service operations across IT, business, and service teams.

Key Features:

AI-Powered Ticket Resolution – Automates ticket handling using historical data for faster issue resolution.

Smart Ticket Routing – AI tags and prioritizes tickets based on type, urgency, and sentiment.

Real-Time Insights – Dashboards track service performance, detect trends, and prevent escalations.

Connected Operations – Centralized platform links ticketing, projects, teams, and business processes.

No-Code Customization – Intuitive platform eliminates costly implementations and training.

Customizable Customer Portal – Enables self-service, ticket tracking, and direct communication.

MercadoLibre MELI

The company reported its fourth quarter of 2024 results.

Thoughts on MercadoLibre Earnings Report $MELI:

🟢 Positive

Revenue: $6,059M (+37.4% YoY, +35.3% LQ) beat estimates by 2.4%

Operating Margin: 13.5% (+5.9 PPs YoY)

Net Margin: 10.5% (+6.8 PPs YoY)

Free Cash Flow Margin: 43.2% (+3.5 PPs YoY)

EPS: $12.60, beating estimates by 66.2%

Commerce Revenue: $3,554M (+44.4% YoY, +105.9% FX-Neutral)

GMV: $14,549M (+8.2% YoY, +79.5% FX-Neutral)

Successful Items Sold: 525M (+27.1% YoY)

Unique Marketplace Buyers: 67M (+23.7% YoY)

Credit Portfolio Growth: $6,573M (+74.0% YoY)

NPL Improvement: 15-90 days: 7.4% (-0.4 PPs QoQ), >90 days: 17.5% (-0.4 PPs QoQ)

Regional Performance: Brazil: $3,136M (+37.7% YoY), Mexico: $1,347M (+43.0% YoY)

Dilution Control: Basic shares up 0.9% YoY, Diluted shares down 0.6% YoY

🟡 Neutral

Gross Margin: 45.4% (-1.1 PPs YoY)

Fintech Revenue: $2,505M (+28.6% YoY, +83.5% FX-Neutral)

Fintech TPV: $58,914M (+32.5% YoY, +49.2% FX-Neutral)

Fintech Monthly Active Users: 61M (+33.6% YoY)

NIMAL: 27.6% (+3.4 PPs QoQ)

Operating Expenses: S&M + Provision for doubtful accounts/revenue at 19.2% (+0.4 PPs YoY)

Argentina Revenue Growth Lag: $1,307M (+31.0% YoY) vs. stronger growth in other regions

🔴 Negative

Fintech Take Rate: 4.3% (-0.1 PPs YoY)

FX Headwinds: Argentina’s currency depreciation impacted financial results despite local sales growth

Market Reaction to Earnings Release: The stock price up +12% following the earnings release.

It was a strong quarter for MercadoLibre, with accelerated revenue growth.

In the Commerce segment, revenue growth slightly slowed, and GMV growth also decelerated. However, the number of Unique Marketplace Buyers added reached a record high, and new Successful Items Sold also hit a record this quarter. The Commerce segment is facing pressure from FX headwinds, particularly Argentina’s currency depreciation. Additionally, consumers are increasingly purchasing lower-priced items, which, in my view, makes the Marketplace more integrated into everyday life and a stickier product for users. The Commerce Take Rate is increasing.

In the Fintech segment, revenue growth accelerated, and the number of new Fintech Monthly Active Users reached a record high.

The Credit Portfolio grew, while the percentage of Credits with high delinquency (NPL >90) and Credits with low delinquency (NPL >15) declined, which is an important development for the company.

Snowflake SNOW

The company reported its fourth quarter of 2024 results.

Thoughts on Snowflake Earnings Report $SNOW:

🟢 Positive

Revenue beat expectations with $987M (+27.4% YoY, +28.3% QoQ), exceeding estimates by 3.6%.

Product revenue reached $943M (+27.8% YoY), maintaining strong growth.

Operating margin improved to 9.4% (+0.2 PPs YoY), reflecting operational efficiency.

Free cash flow margin increased to 42.1% (+0.2 PPs YoY), ensuring strong liquidity.

EPS of $0.30 beat estimates by 76.5%, showing profitability improvement.

Enterprise customers expanded to 11,159 (+18.2% YoY, +541 added), reinforcing growth momentum.

Large contracts ($1M+ customers) grew to 580 (+26.6% YoY, +38 added), marking the highest addition in the last two years and showcasing strong customer retention and expansion.

S&M expense declined to 33.3% of revenue (-2.4 PPs YoY), improving cost efficiency.

🟡 Neutral

Net revenue retention rate (NDR) declined to 126% (-1 PPs QoQ), still solid but showing slight deceleration.

Billings reached $1.59B (+16.4% YoY), significantly lagging revenue growth.

RPO grew to $6.90B (+33.3% YoY) but growth has slowed considerably. Since Snowflake operates on a consumption-based model, management attributes this to large customers consuming capacity faster than expected and opting for on-demand purchases instead of early renewals.

Marketplace listings grew to 3,044 (+26.0% YoY, +98 added QoQ), though momentum slowed.

Headcount growth slowed to just +14 employees QoQ, optimizing workforce expansion.

cRPO at $3.31B (+28.0% YoY), reflecting a healthy backlog but slightly lower than total RPO growth.

Stock-based compensation (SBC) as a % of revenue increased to 46% (+5 PPs QoQ), impacting share dilution.

Guidance missed estimates: Q1’25 revenue guidance of $955M–$960M (+21.3% YoY) was 0.3% below expectations, but FY guidance was strong.

🔴 Negative

Gross margin dropped to 72.6% (-1.8 PPs YoY), with product gross margin at 75.8% (-2.2 PPs YoY), pressured by AI infrastructure costs.

Net margin declined sharply to -33.0% (-11.1 PPs YoY), reflecting increased expenses.

Diluted shares outstanding rose 1.9% YoY (+1.8 PPs QoQ), causing further dilution.

Customer acquisition cost (CAC) payback period increased to 32.6 months (+5.4 YoY), making customer profitability take longer.

R&D Index (RDI) fell to 1.26 (-0.52 YoY), suggesting reduced efficiency in innovation spending.

Market Reaction to Earnings Release: The stock price up +9% following the earnings release.

It was a solid quarter for Snowflake, though revenue growth slightly slowed. I expect a stronger-than-expected beat on next quarter’s forecast, with a potential slight slowdown or stabilization in revenue growth.

Billings and RPO growth slowed significantly, but since Snowflake operates on a consumption-based model, management attributes this to large customers consuming capacity faster than expected and opting for on-demand purchases instead of early renewals, making the RPO slowdown less concerning.

DBNR declined slightly to 126%, but the company calculates this metric using a two-year timeframe, making it a lagging indicator. Net new ARR growth remained strong at +9%. The addition of new customers was the highest in the past two years.

However, new Marketplace Listings declined compared to the previous quarter. To counter this, Snowflake is expanding AI-driven capabilities, improving data discoverability, and refining revenue-sharing models. Marketplace activity is expected to reaccelerate in H2 FY 2026 as AI applications scale.

Snowflake Expands AI Partnership with Microsoft

Snowflake integrates OpenAI models into Cortex AI via Azure OpenAI Service, enabling enterprises to build AI-powered apps with real-time reasoning across audio, video, and text in a secure AI Data Cloud.

With 59% of enterprises citing security as a challenge, Snowflake ensures built-in governance, access controls, and monitoring, allowing cross-cloud AI inference without complex integrations.

Cortex Agents for Microsoft 365 Copilot and Teams will enable natural language interactions with structured and unstructured data. General availability: June 2025.

Snowflake is launching a 30,000-square-foot Silicon Valley AI Hub in Menlo Park, opening Summer 2025, to foster AI collaboration among developers, startups, and business leaders.

The company is investing $200 million in next-gen AI startups through the Snowflake Startup Accelerator. AWS will provide $1 million in free Snowflake credits over four years to support AI-driven applications.

Shopify SHOP

The company reported its fourth quarter of 2024 results.

Thoughts on Shopify Earnings Report $SHOP:

🟢 Positive

Revenue: $2.8B in Q4, +31% YoY, exceeding estimates by 3.2%

Operating Income: Surpassed $1B, a 4× increase from its previous peak

Net Margin: 46.0%, up 15.3 PPs YoY

Free Cash Flow Margin: 21.7%, up 0.9 PPs YoY

Shop Pay GMV: $27B, up 50% YoY, now 41% of total GPV

B2B GMV Growth: +40% YoY, marking six straight quarters of 100%+ growth

International GMV: Grew 33% YoY, outpacing North America, led by Europe (+37% YoY)

Enterprise Adoption: Signed Reebok, Champion, Hunter Douglas, Westwing, Karl Lagerfeld, FC Barcelona, Real Madrid, and LA Lakers

Gross Payments Volume (GPV): $59.5B, up 32% YoY, representing 63% of GMV

Operating Margin: 20.8%, up 2.3 PPs YoY

Shop App GMV Growth: +84% YoY, reinforcing its role in mobile commerce

🟡 Neutral

Gross Margin Decline: 48.1%, down 1.7 PPs YoY, impacted by higher payments penetration

Subscription Solutions Revenue: $666M, +26.9% YoY, maintaining a strong 79.9% Gross Margin, but expected to normalize in 2025

Merchant Solutions Gross Margin: 38.2%, reflecting an ongoing mix shift

Q1 2025 Guidance: $2.32B–$2.34B, +25.2% YoY, slightly beating estimates (+0.8%)

R&D, S&M, and G&A Expenses Lower: Operating efficiency improved, but investments in AI and international expansion will continue

Attach Rate: 2.98%, up 13 BPs YoY, but needs further merchant adoption for sustained growth

FC Barcelona and other major brands adopted Shopify POS, but offline retail still in early scaling phase

EPS: $0.44, in line with estimates, showing no significant earnings outperformance

Higher Diluted Share Count: Up 0.6% YoY, reflecting stock-based compensation (SBC) impact

🔴 Negative

MRR Growth Slowing: $178B, up +19.5% YoY, impacted by transition to three-month trials, which will delay short-term revenue recognition into Q1 & Q2 2025

Competition in Payments: While Shop Pay continues to grow, competitors Apple Pay & Google Pay remain threats

Regulatory & Trade Risks: De minimis exemptions and tariffs could impact cross-border merchants, but Shopify is addressing this through duty collection integrations

No Major Pricing Adjustments in 2025, limiting subscription revenue acceleration after last year’s price increases

Market Reaction to Earnings Release: The stock price declined by -8% following the earnings release.

It was a solid quarter for Shopify, with the company delivering its strongest revenue growth since late 2021. However, Shopify only beat its guidance by 0.8%, the smallest beat over the past year.

GMV and GPV growth accelerated, and the Attach Rate increased compared to last year. In my view, the decline in stock price was driven by elevated valuation multiples leading up to the earnings report and overly high market expectations.

Datadog DDOG

The company reported its fourth quarter of 2024 results.

Thoughts on Datadog Earnings Report $DDOG:

🟢 Positive

Revenue grew +25.1% YoY to $737.7M, beating estimates by +3.7%.

EPS reached $0.60, exceeding forecasts by +39.5%.

Billings increased +25.7% YoY to $908M, signaling strong contract momentum.

Net New ARR rose +13.4% YoY to $191M, reflecting solid customer expansion.

DBNR improved to 119%, up from 115% last quarter, showing strong upsell potential.

Large customer growth: $100K+ customers up +13.2% to 3,610, $1M+ customers up +16.7% to 462.

FlexLogs & Cloud SIEM saw increased adoption, securing seven-figure enterprise deals in financial, oil & gas, and healthcare sectors.

Multi-cloud monitoring growth, with expanded integrations in AWS, Azure, GCP, and OCI.

Customer acquisition costs increased, with CAC payback period rising to 12.0 months (+1.1 YoY), but one of the better in class.

🟡 Neutral

Gross Margin declined -1.7 PPs YoY to 81.7%, but remained stable sequentially.

Operating Margin fell -4.0 PPs YoY to 24.3%, reflecting higher investments in R&D and sales expansion.

Free Cash Flow Margin dropped -1.5 PPs YoY to 32.7%, still maintaining strong profitability.

Platform adoption expanding: 50% of customers now use 4+ products, 26% use 6+, and 12% use 8+.

S&M expenses rose to 23.5% of revenue (+1.1 PPs YoY) as Datadog scaled its sales force and expanded global reach.

R&D spending increased to 28.7% of revenue (+1.0 PPs YoY), aligning with continued product innovation.

RPO grew +23.4% YoY to $2.27B, with mid-30s% normalized growth.

Diluted shares increased +2.3% YoY, impacting EPS growth.

🔴 Negative

Full-year 2025 revenue guidance of $3.175B - $3.195B (+18.7% YoY) missed estimates by -1.7%.

Cloud migration slowing due to AI infrastructure capacity constraints, impacting observability demand growth.

Enterprise cost optimizations resulted in some volume discounts at renewal, particularly in log management and security.

Net Margin declined -3.0 PPs YoY to 6.2%, reflecting higher expenses relative to revenue growth.

Market Reaction to Earnings Release: The stock price declined by -11% following the earnings release.

It was a strong quarter for Datadog, with the forecast indicating a slight acceleration in revenue growth.

Similar to Snowflake, RPO growth is not as critical since Datadog operates on a consumption-based model. However, management noted that normalized RPO growth is in the mid-30s% range, which is significantly higher than revenue growth.

Retention (DBNR) improved to approximately 118-119%, while gross margin increased, reversing a three-quarter decline trend.

The company is focused on attracting larger customers, so I pay close attention to product adoption metrics. However, this quarter, the only notable increase was in the percentage of customers using 4+ products, which rose to 50%. This is the only aspect of the report that I see as somewhat questionable.

I attribute the decline in stock price to Datadog’s conservative full-year guidance, which the company will likely exceed significantly.

The Trade Desk TTD

The company reported its fourth quarter of 2024 results.

Thoughts on The Trade Desk Earnings Report $TTD:

🟢 Positive

Revenue: $2.4B in 2024 (+26% YoY). If the company beats its forecast by 1.4%, median beat for last year, next quarter’s growth is projected to be +19%.

Profitability: Adjusted EBITDA of $1B and free cash flow of $600M.

Margins: Net margin 40.0% (+5.9 PPs YoY), FCF margin 23.9% (+13.3 PPs YoY), Adj EBITDA margin 47.2% (+0.4 PPs YoY).

EPS: $0.59, beating estimates by 5.4%.

Customer Retention: 95%, unchanged.

Retail Media Success: Boiron saw 267% ROAS, Sulwhasoo increased conversions by 380% while cutting acquisition costs by 80%.

OpenPath Expansion: Vizio integrated OpenPath, increasing revenue by 39% and improving fill rates 8x.

Operational Efficiency: S&M, R&D, and G&A expenses as a percentage of revenue declined YoY.

Shareholder Returns: $1B share repurchase program announced.

Proactivity of management – Jeff Green doesn’t just blame circumstances but takes responsibility and takes action: announcing a planned COO hire and a company-wide reorganization in December.

🟡 Neutral

Gross Margin: 82.9% (-1.5 PPs YoY).

Operating Margin: 43.8% (-0.1 PPs YoY).

Kokai Rollout Delays: Slower adoption impacted short-term revenue, but AI integration is expected to drive long-term gains.

International Growth: Outpacing North America for the 8th straight quarter, but the U.S. still accounts for 88% of total revenue.

Stock-Based Compensation (SBC): 17% of revenue, down 3.0 PPs QoQ, but still a dilution concern.

🔴 Negative

Q4 Revenue Missed Estimates: $741M (+22.3% YoY, +27.4% QoQ), -2.1% below expectations.

Q1’25 Guidance Below Estimates: $575M (+17.1% YoY), missed estimates by -1.6%.

Execution Issues: First earnings miss in 33 quarters due to operational inefficiencies, Kokai rollout delays, and long-term investment trade-offs.

Dilution: Basic shares up 0.9% YoY, diluted shares up 1.4% YoY.

Market Reaction to Earnings Release: The stock price declined by -27% following the earnings release.

It was a very weak quarter for TTD. However, I liked the proactiveness of CEO Jeff Green, who announced that a company-wide reorganization had already been conducted in December, followed by strengthening the management team with Alex Kayyal joining the Board of Directors.

I have no plans to increase or decrease my position at this time, as I am giving management the opportunity to turn things around, and I believe they can.

I will closely monitor the next earnings report to assess execution improvements and determine whether management’s actions start delivering positive results.

TTD Appoints Alex Kayyal to Board of Directors. Alex Kayyal joins The Trade Desk's board, bringing expertise in cloud-based services, AI, and high-growth businesses. A longtime investor in the company, he is currently a partner at Lightspeed Venture Partners and previously served as SVP at Salesforce, overseeing global investments exceeding $5 billion.

Kayyal has invested in and advised leading tech companies across 15 countries, including monday.com, Gong, Snyk, and Miro.

ServiceNow NOW

The company reported its fourth quarter of 2024 results.

Thoughts on ServiceNow Earnings Report $NOW:

Thoughts on ServiceNow Earnings Report $NOW:

🟢 Pros:

Revenue growth stabilized at 21.3% YoY.

Renewal rate remains strong at 98%.

CAC payback period is healthy at 19 months, in line with the SaaS industry average.

AI growth: Pro Plus AI deals up +150% QoQ; over 1,000 customers using AgenTic AI.

Raptor DB adoption: Five customers with $1M+ ACV within months; 3.5x faster response times.

Stock buyback expanded by $3B, totaling $4.5B in authorized repurchases.

Expanded partnerships with AWS, Google Cloud, Microsoft, Visa, and Five9.

🔴 Cons:

Management provided weak guidance for the next quarter and full year, missing analysts' expectations. Q4 guidance projects 18.4% YoY revenue growth, a decline justified by Federal IT spending delays due to the U.S. election cycle.

Missed its own Q4 forecast by 0.4%.

🟡 Neutral:

RPO growth slowed to +23.9% YoY, but remains faster than revenue; cRPO growth dropped to +19.4% YoY, now lower than revenue growth.

Gross margin declined to 81.94%.

2025 subscription gross margin expected at 83.5%, slightly lower due to AI and data center investments.

The addition of new $1M+ ACV customers was lower than last year: +89 vs. +108 in the previous year.

Diluted shares count rose by 1.3% YoY.

SBC/rev at 15%.

Market Reaction to Earnings Release: The stock price declined by -8.4% following the earnings release.

It was a fairly weak quarter for ServiceNow. The company provided a weak forecast below expectations for both the next quarter and the full year. According to management, the cautious outlook reflects uncertainty in AI monetization timing and election-driven delays in U.S. federal IT spending.

Subscription gross margin is expected to decline to 83.5%, slightly lower due to AI and data center investments. Growth slowed due to seasonality in large contracts and uncertainty in federal spending, though AI adoption could help reaccelerate RPO.

I believe these challenges are temporary, and that delayed U.S. federal IT spending will eventually recover. I am keeping my position unchanged and will monitor the next earnings report, expecting to see confirmation that these issues are indeed temporary.

Axon AXON

The company reported its fourth quarter of 2024 results.

Thoughts on Axon Earnings Report $AXON:

🟢 Positive

Revenue: $575M (+33.1% YoY, +31.6% QoQ) beat estimates by 1.5%.

Profitability: Net margin 23.5% (+10.3 PPs YoY), FCF margin 39.2% (+12.3 PPs YoY).

EPS: $2.08 beat estimates by 48.6%.

Axon Cloud: Revenue up 40.8% YoY to $230.3M.

TASER Growth: Revenue up 37.1% YoY to $221.2M, gross margin expanded 4.2 PPs.

ARR & Future Revenue: ARR hit $1.00B (+36.7% YoY), future contracted revenue exceeded $10.1B (+41.5% YoY).

Net New ARR: $116M, up 45.0% YoY.

Strong Enterprise Growth: Largest contract in company history secured in Q4.

NRR: 123%, +1 PPs YoY.

🟡 Neutral

Guidance: FY 2025 revenue guidance of $2.55B - $2.65B (+24.7% YoY) in line with estimates.

Operating Expenses: SG&A/Revenue 39.5% (+7.7 PPs YoY), R&D/Revenue 23.4% (+4.0 PPs YoY).

CAC Payback Period: 21.1 months, up from 15.6 months last quarter (subscription revenue ~40% of Revenue).

Axon Cloud Margin: 73.7% (-0.9 PPs YoY).

TASER 10 Supply Constraints: Demand outpacing supply, requiring manufacturing expansion.

🔴 Negative

Operating Margin Decline: -2.7% (-13.6 PPs YoY).

Sensor Segment Margin Decline: Revenue up 15.3% YoY, but gross margin dropped 13.5 PPs to 32.8%.

Stock-Based Compensation (SBC): SBC/Revenue 23%, up 4.1 PPs QoQ.

Share Dilution: Basic shares up 1.7% YoY, diluted shares up 6.4% YoY (+3.6 PPs QoQ).

Regulatory Risks: Arizona legal challenges may impact headquarters expansion.

Tariffs & Trade Restrictions: DJI import restrictions create risks, despite Skydio partnership gains.

Market Reaction to Earnings Release: The stock price up by +13% following the earnings release.

It was a strong quarter for Axon, with accelerated revenue growth and faster ARR and RPO growth outpacing revenue growth. Net new ARR increased by +45% YoY, while DBNR remained high at 123%, up 1 percentage point from last year.

The stock price rose after the earnings report, but previously saw a significant decline following news of the Flock Safety partnership termination. The company had been trading at a historically high Forward EV/Sales multiple, which is why I trimmed my position in October, November, and December 2024. After the stock’s decline, the valuation has now become more reasonable.

The Flock Safety partnership termination was driven by data-sharing concerns, with Axon advocating for more transparency. In response, management has shifted focus to FUSUS-based ALPR alternatives, following the company’s recent acquisition of FUSUS.

Zscaler ZS

Zscaler introduced Asset Exposure Management, a CAASM solution designed to track, assess, and mitigate cyber risks. Built on Zscaler’s Data Fabric for Security, it consolidates data from hundreds of sources, providing a comprehensive asset inventory and security insights.

Key Benefits:

Accurate asset inventory by aggregating and deduplicating data

Identifies security gaps, such as missing EDR solutions or outdated software

Enhances data accuracy by updating CMDBs and resolving discrepancies

Automates risk mitigation through policy adjustments and remediation workflows

Scalability and Integration: Zscaler’s Zero Trust Exchange processes 500 billion security transactions daily, delivering unmatched visibility into branch, factory, and cloud environments. Integrated with Risk360 and Unified Vulnerability Management, the solution offers a complete approach to threat exposure management.

Tesla TSLA

Tesla’s Europe Sales Drop 45% in January Amid Rising EV Market

Tesla sold 9,945 cars in Europe in January, a 45% decline year-over-year, while overall EV sales rose 37%. In 2024, Tesla’s sales fell 13% across the EU, with Germany down 41%. Market share dropped to 1% from 1.8%.

Registrations fell 63% in France to 1,141 cars, the lowest since August 2022. Germany’s sales dropped to 1,277, the lowest since July 2021. In the UK, BYD outsold Tesla for the first time.

Samsara IOT

Industry Leaders Trust Samsara

Major transportation companies, including Werner Enterprises, XPO, and UniGroup, leverage Samsara for enhanced safety and fleet efficiency. Jaime Hamm, SVP at Werner, highlighted Samsara’s commitment to innovation and customer success.

Mongodb MDB

Lombard Odier and MongoDB Drive AI-Powered Modernization

Lombard Odier, a Swiss private bank, partnered with MongoDB ($MDB) to modernize its banking systems using generative AI. The collaboration streamlined system migrations, reducing technical complexity and enhancing customer experiences.

AI-Driven Efficiency: With MongoDB’s Modernization Factory, the bank migrated applications 20x faster, cutting project timelines from days to hours through AI automation.

Scalable Banking Solutions: The Portfolio Management System (PMS), Lombard Odier’s largest application, moved to MongoDB’s platform, optimizing investment decisions and powering the MyLO online banking app.

MongoDB has acquired Voyage AI, a leader in embedding and reranking models, to enhance AI-powered search and retrieval for enterprise applications.

The integration helps businesses reduce hallucinations and improve information retrieval for more accurate AI applications.

Voyage AI’s technology is trusted by Anthropic, LangChain, Harvey, and Replit. Its models rank among the top zero-shot embedding models on Hugging Face.

The acquisition enables MongoDB to offer highly precise AI retrieval integrated with operational data, making AI more reliable for mission-critical applications.

Voyage AI’s solutions remain available on voyage.ai, AWS Marketplace, and Azure Marketplace. MongoDB integrations launch later this year.

Thank you for reading!

Follow me for frequent updates on key news on X/Twitter and Threads @SergeyCYW and for visual infographics on Instagram.

For portfolio changes, follow me on SavvyTrader, where you'll find: current portfolio holdings, portfolio performance, trade alerts, and trade history.

Past recaps:

January 2025

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024

May 2024

April 2024

March 2024

Disclaimer: This portfolio summary is for informational purposes only and not investment advice. Opinions are my own; please conduct your own due diligence.