Sea Limited Q1 2025 Earnings Analysis

Dive into $SE Sea Limited’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↘️$4,841.0M rev (+29.6% YoY, +36.9% LQ) missed est by -1.7%🔴

↗️GM (46.2%, +4.6 PPs YoY)

↗️Operating Margin (9.4%, +7.5 PPs YoY)

↗️Operating Cash Flow Margin (15.6%, +3.8 PPs YoY)

↗️Net Margin (8.5%, +9.1 PPs YoY)

↗️EPS $0.65 beat est by 3.2%

Revenue By Type

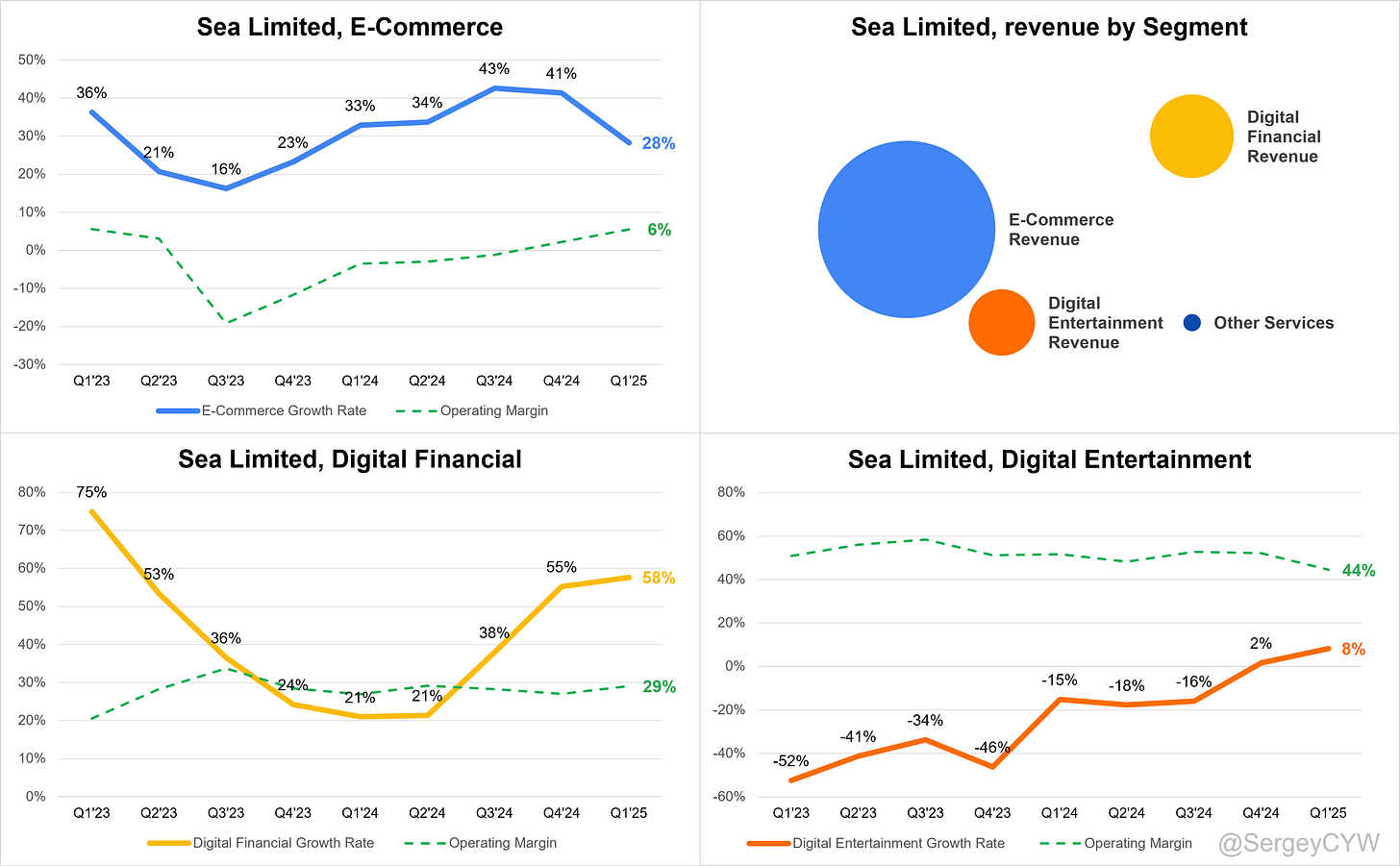

E-Commerce Revenue

➡️$3,524.1M rev (+28.3% YoY, 74.0% of Rev) 🟡

↗️Operating Margin (5.5%, +9.1 PPs YoY)

Digital Financial Revenue

➡️$787.1M rev (+57.6% YoY, 14.8% of Rev) 🟢

↗️Operating Margin (29.0%, +2.1 PPs YoY)

Digital Entertainment Revenue

➡️$495.6M rev (+8.2% YoY, 10.5% of Rev) 🟡

↘️Operating Margin (44.4%, -7.2 PPs YoY)

Other Services

➡️$34.2M rev (+17.5% YoY, 0.7% of Rev) 🟡

↗️Operating Margin (-32.2%, +15.3 PPs YoY)

Key Metrics

↗️Online Games Bookings $775M (+51.3% YoY)

➡️GMV $28,600M (+21.2% YoY)🟡

➡️E-Commerce Orders $3,100M (+3.3% YoY)🟡

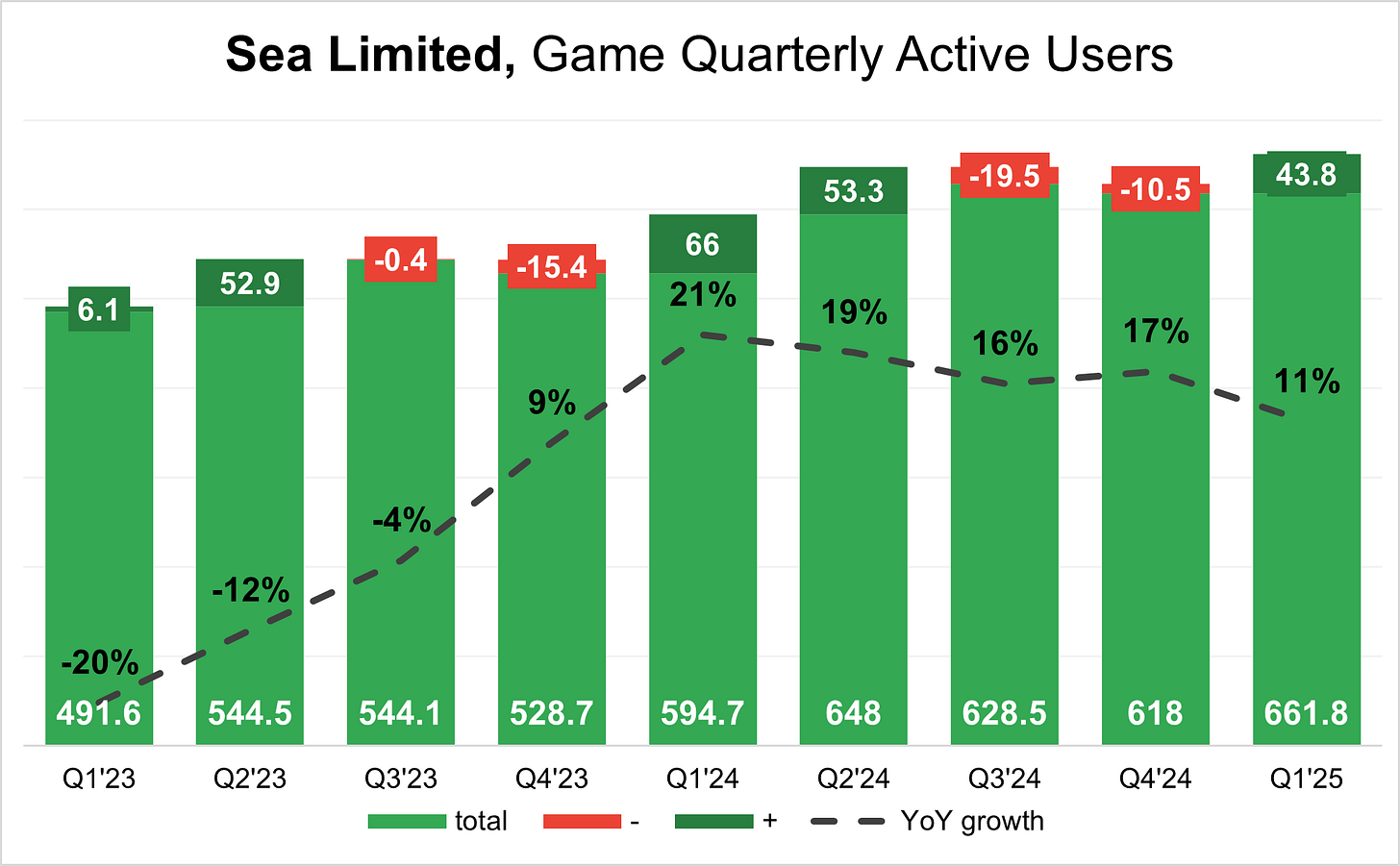

Users

➡️662 QAUs (+11.3% YoY, +44)

↗️65 QPUs (+32.1% YoY, +14)

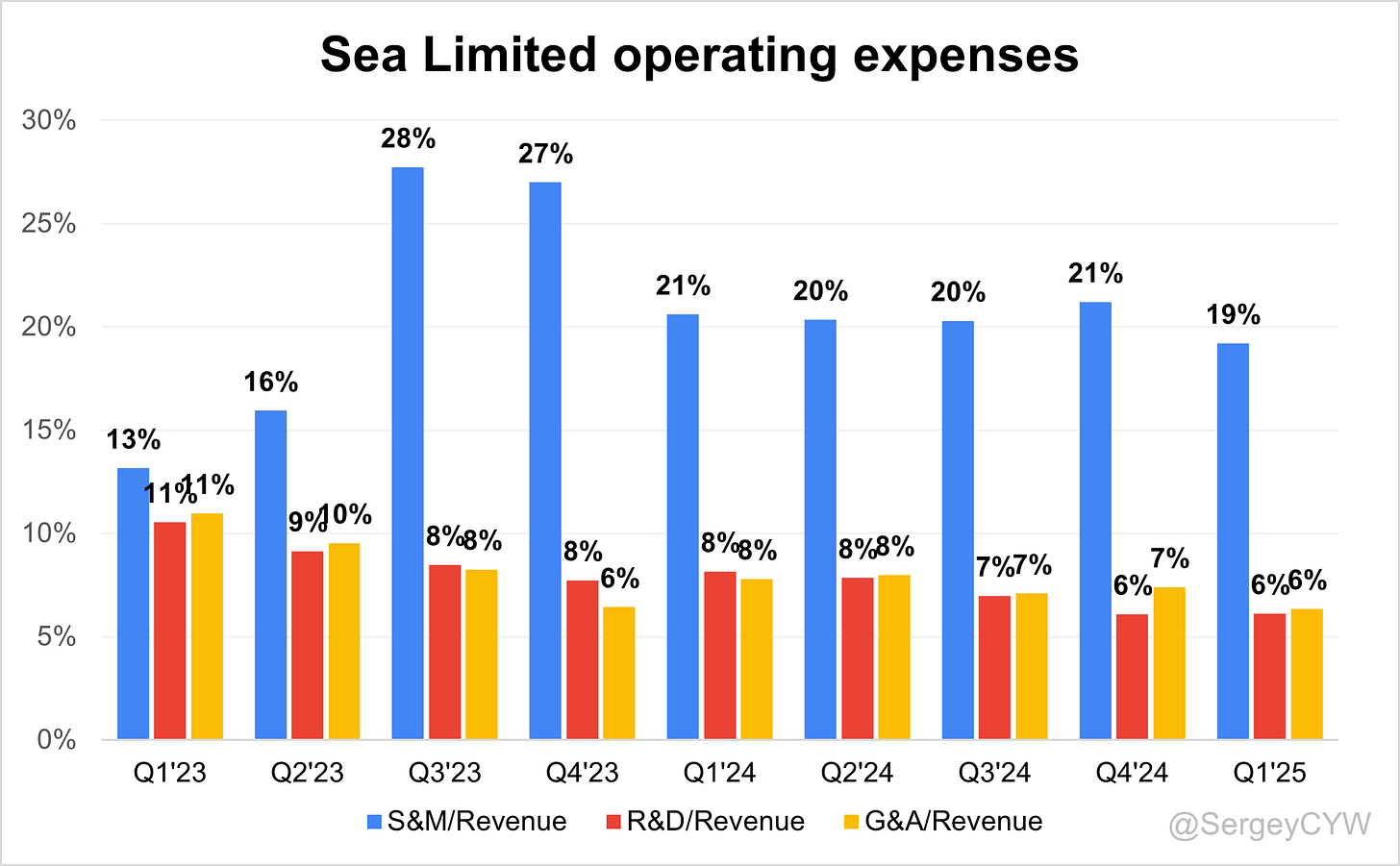

Operating expenses

↘️S&M/Revenue 19.2% (-1.4 PPs YoY)

↘️R&D/Revenue 6.1% (-2.0 PPs YoY)

↘️G&A/Revenue 6.3% (-1.4 PPs YoY)

Dilution

↗️SBC/rev 4%, +0.2 PPs QoQ

↗️Basic shares up 3.4% YoY, +1.5 PPs QoQ

↗️Diluted shares up 11.2% YoY, +4.0 PPs QoQ🔴

Key points from Sea Limited’s First Quarter 2025 Earnings Call:

Financial Performance

Sea Limited reported strong Q1 2025 results with GAAP revenue of $4.84B, up 30% YoY. Adjusted EBITDA more than doubled to $947M from $401M last year, driven by improved unit economics and operating efficiency. Net income reached $411M, reversing a $23M net loss in Q1 2024. Non-operating income rose to $89M, compared to a $18M loss a year ago. All business segments contributed positively to free cash flow.

Shopee Growth

Shopee posted a record quarter with GMV of $28.6B (+22% YoY) and 3.1B orders (+20% YoY). Marketplace GAAP revenue rose 29% YoY to $3.1B. Core marketplace revenue, including ads and transaction fees, increased 39% YoY to $2.4B. Logistics-related value-added services revenue grew modestly by 4% YoY to $800M.

Shopee achieved a major turnaround in profitability, reporting $264M in adjusted EBITDA, compared to a $22M loss a year earlier. Ad revenue surged 50% YoY, supported by a 22% increase in ad-buying sellers and 28% growth in average spend. Logistics cost per order declined 6% in Asia and 21% in Brazil. Monthly active buyers rose 15%+ YoY.

Shopee deployed AI tools including Shopee AI Assistant and GMV Max to automate seller operations and optimize ad targeting. Video commerce expanded through Shopee Live and short-form content, contributing roughly 20% of order volume in Southeast Asia. A strategic partnership with YouTube enabled 4M+ embedded product-linked videos, further supporting traffic and conversion.

The Shopee VIP program in Indonesia surpassed 1M paid members by March. VIP users spent 4x more and purchased 3x more frequently than non-members. Shopee also launched same-day delivery in São Paulo and improved logistics speed in Brazil by 2–3 days YoY, maintaining EBITDA profitability in the region.

VAS take rate was marginally impacted due to higher shipping subsidies, though core monetization improved. Management continues to monitor FX volatility and the competitive impact of TikTok Shop’s launch in Brazil.

Monee Scale

Monee generated $787M in GAAP revenue (+58% YoY) and $241M in adjusted EBITDA (+62% YoY). The total loan book expanded 75%+ YoY to $5.8B, including $4.9B on-book and $900M off-book. Over 4M first-time borrowers were added in Q1, bringing total loan users to 28M+, up 50% YoY.

The fintech business expanded into cash loans, QR-based lending, and high-ticket verticals such as smartphone and motorbike financing. The Shopee Pay app exceeded 30M downloads in Indonesia, supporting off-platform adoption. In Malaysia, 10%+ of the loan book now originates off Shopee.

Portfolio quality remained stable with a 90+ day NPL ratio of 1.1%. Average loan tenure was 3–6 months, enabling real-time credit risk adjustment. Management noted margin compression risk from product and regional mix shifts, though absolute EBITDA is expected to continue rising.

Brazil showed strong loan growth, supported by Shopee penetration and high interest margins. Open Finance integration helped improve underwriting precision. Brazil offers mid-tier EBITDA margins, balancing risk and return.

Garena

Garena reported $775M in bookings, up 51% YoY, and $458M in adjusted EBITDA, up 57% YoY. Free Fire’s average DAU returned to near-pandemic highs following the Naruto Shippuden collaboration, which generated 300M+ video impressions and was Garena’s highest-rated event.

Hyper-local content campaigns such as Ramadan donation missions in Indonesia and temple blessing events in Taiwan boosted engagement. Garena maintained its position as the #1 global mobile game by DAU and downloads, according to Sensor Tower.

Delta Force Mobile launched in April and surpassed 10M downloads. Pre-registration began for Free City, an open-world game developed in-house. These launches mark a strategic effort to diversify beyond Free Fire.

Management guided conservatively due to campaign seasonality and acknowledged the Naruto event's impact would not recur quarterly. Focus remains on sustaining engagement and scaling new IP.

AI Integration

AI is being deployed across the organization to enhance ad targeting, search, customer service automation, and fraud detection. Shopee introduced AIGC tools to generate product listings and videos. All AI investments are tied to measurable KPIs including CTR, conversion rate, and cost efficiency.

International Expansion

Brazil remains Sea’s most promising growth market. Shopee scaled same-day delivery, seller onboarding, and credit solutions. In fintech, loan growth accelerated with higher penetration and improved risk management. Garena continues expanding across Latin America, MENA, and South Asia.

Risk Factors

Sea’s local-first model mitigates global trade risks, though FX volatility remains a concern in key markets. Credit quality is stable but may fluctuate with macro shifts. Competitive pressure from TikTok in Brazil is being closely observed.

Outlook

Management reaffirmed 20% GMV growth for Shopee, double-digit bookings growth for Garena, and ongoing loan book expansion for Monee. Shopee targets 2–3% long-term EBITDA margin over GMV, with upside potential. All business units are now cash-generating. Focus is on sustaining profitable growth through AI deployment, user expansion, and diversified funding sources.

Management comments on the earnings call.

Product Innovations

Chris Feng, President

“We introduced Shopee AI Assistant to help sellers handle routine customer queries, making their daily operations on Shopee more effortless.”

Chris Feng, President

“Our upgraded ad tech product called GMV Max has made it easier for sellers to launch campaigns, reach the right audience and maximize their returns.”

Chris Feng, President

“We are also investing quite a lot on improving our internal productivity... we're using AI to help our internal listing team to filter the product in our marketplace a lot more efficiently.”

Chris Feng, President

“For any AI investment, we always have a very clear ROI measurement. Whether it’s in ads, product recommendations, or content creation, we look at click-through rate, conversion, and cost savings.”

E-Commerce (Shopee)

Chris Feng, President

“In the first quarter, our average monthly active buyers on Shopee grew by over 15% year on year.”

Chris Feng, President

“Shopee has delivered a record high GMV and gross order volume in the first quarter. We sustained market leadership with improved profitability across both Asia and Brazil.”

Chris Feng, President

“Our logistics cost per order dropped 6% in Asia and 21% in Brazil year on year, while improving delivery speed and expanding network coverage.”

Chris Feng, President

“Our Shopee VIP membership program in Indonesia reached over 1 million subscribers by March. These members purchase more than three times as frequently and spend more than four times as much as regular buyers.”

Chris Feng, President

“Ad revenue grew by more than 50% year on year in the first quarter, supported by better marketing efficiency and higher adoption of Shopee Live Ads.”

Digital Financial Services (Monee)

Forrest Li, Chairman and Chief Executive Officer

“Today, Money is already one of the largest unsecured consumer lending businesses in Southeast Asia, and I believe we are only at the start of realizing its full potential.”

Chris Feng, President

“In the first quarter, we added over four million first-time borrowers, and we see new user cohorts continuing to generate positive profit over time as we scale.”

Chris Feng, President

“Our overall portfolio quality remains healthy, with our ninety day NPL ratio staying relatively stable at 1.1%.”

Chris Feng, President

“Off-Shopee usage of S Pay Later has grown meaningfully. In Malaysia, it now accounts for over 10% of our total loan book.”

Chris Feng, President

“In Indonesia, the Shopee Pay standalone app has surpassed 30 million downloads. It integrates S Pay Later functionality to support everyday payments beyond Shopee.”

Tony Hou, Chief Financial Officer

“We would prefer to diversify our source of funding. Rather than using all our own cash, we want to build up a more sustainable model by collaborating with financial institutions and exploring structured products like ABS.”

Digital Entertainment (Garena)

Forrest Li, Chairman and Chief Executive Officer

“Garena had a stellar start to 2025, with its best quarter since 2021. Bookings grew 51% and adjusted EBITDA grew 57% year on year.”

Forrest Li, Chairman and Chief Executive Officer

“The Naruto campaign was a resounding success... it stands out as the highest rated collaboration Free Fire has ever done.”

Forrest Li, Chairman and Chief Executive Officer

“Free Fire’s average DAU in the first quarter was close to its peak during the pandemic, reinforcing its position as the world’s largest mobile game by average DAU and downloads.”

Forrest Li, Chairman and Chief Executive Officer

“In April, we published Delta Force Mobile... Since launch, the game has seen good traction with over 10 million downloads.”

Competitors

Chris Feng, President

“The overall competitive landscape in ASEAN and Brazil remains relatively stable. We did not observe any major strategic shifts by competitors in Q1.”

Chris Feng, President

“We’re closely monitoring the TikTok Shop launch in Brazil. While live streaming is still in early stages there, we have the experience and technology to capture demand if the trend scales.”

International Growth

Chris Feng, President

“In Brazil, we’ve shortened our delivery time by 2 to 3 days year on year and launched same-day delivery in São Paulo.”

Chris Feng, President

“Brazil continues to grow faster than market average. We’re serving more underserved segments, diversifying into higher ticket size products, and improving logistics while maintaining cost advantage.”

Chris Feng, President

“We also started procurement services for some sellers in Brazil, and feedback has been very positive.”

Challenges

Chris Feng, President

“The only thing that might impact our numbers in a meaningful way is foreign exchange volatility. In some markets, FX rates can fluctuate quite a lot.”

Chris Feng, President

“We’re seeing a country and product mix shift in Monee that may cause some fluctuations in percentage margins, although absolute EBITDA should keep growing.”

Future Outlook

Forrest Li, Chairman and Chief Executive Officer

“All three of our businesses have shown strong growth and improving profitability. We remain committed to executing well and driving greater efficiency.”

Chris Feng, President

“We remain confident of achieving our full year GMV growth guidance of 20% with improving profitability.”

Forrest Li, Chairman and Chief Executive Officer

“We are confident that we can grow Money in a way that is resilient to credit cycles and profitable into the long term.”

Tony Hou, Chief Financial Officer

“With stronger visibility over the full year, we may return to the market with more detailed updates on Garena’s performance outlook.”

Thoughts on Sea Limited Earnings Report $SE:

🟢 Positive

Adjusted EBITDA rose to $947M, more than 2x YoY

Net income reached $411M, reversing a $23M loss in Q1 2024

EPS of $0.65, beating estimates by 3.2%

Digital Financial Services revenue grew +57.6% YoY to $787.1M with a 29.0% operating margin

Online games bookings increased +51.3% YoY to $775M

Shopee adjusted EBITDA reached $264M, up from a $22M loss

Free Fire DAUs returned to near-pandemic peak, with 300M+ views on Naruto campaign content

R&D/Revenue dropped 2.0pp YoY to 6.1%, improving cost leverage

S&M/Revenue and G&A/Revenue both fell 1.4pp YoY, reflecting better operating efficiency

🟡 Neutral

Total revenue of $4.84B, up +29.6% YoY, but missed estimates by -1.7%

E-Commerce revenue rose +28.3% YoY to $3.52B, with a 5.5% operating margin

Shopee orders reached 3.1B, growing +3.3% YoY, lagging GMV growth

Digital Entertainment revenue was $495.6M, up +8.2% YoY, with a strong 44.4% margin, but down -7.2pp YoY

Shopee GMV grew +21.2% YoY to $28.6B, supporting top-line resilience

Shopee VIP membership passed 1M paid users, aiding engagement

Basic shares rose +3.4% YoY, contributing to mild dilution

🔴 Negative

Diluted shares increased +11.2% YoY, creating meaningful shareholder dilution

VAS take rate affected by higher shipping subsidies

Digital Entertainment margin declined -7.2pp YoY, despite revenue growth

Stock-based compensation rose to 4% of revenue, up 0.2pp QoQ

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

Your earnings write ups are so fast, thank you for sharing!

Question - how did you calculate FCF? They did not break out Cash Flow from Investing activities (to subtract out capex)