Zscaler: Zero Trust Leader Driving the Future of Cloud Security

Deep Dive into $ZS: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Zscaler: Company overview

About Zscaler

Zscaler, Inc. is a leading cloud security company headquartered in San Jose, California. Founded in 2007 by Jay Chaudhry and K. Kailash, Zscaler provides cloud-based cybersecurity solutions designed to protect enterprise networks and data. The company serves over 8,600 organizations globally, including 40% of Fortune 500 companies, and operates across industries such as financial services, healthcare, technology, and public sector. In fiscal year 2024, Zscaler reported $2.17 billion in revenue, with total assets of $4.70 billion.

Company Mission

Zscaler's mission is to transform enterprise security through a cloud-native zero trust architecture. The company aims to eliminate legacy network security models by delivering scalable solutions that ensure secure access for users, applications, and devices. Its platform processes 500 billion daily transactions and provides 99.9999% uptime, reflecting its commitment to innovation and reliability.

Sector

Zscaler operates within the network security and cloud computing sector, focusing on zero trust security models to address modern cybersecurity challenges. Its solutions include Zscaler Zero Trust Exchange, Zscaler Internet Access (ZIA), and Zscaler Private Access (ZPA). The company has positioned itself as a pioneer in secure digital transformation, catering to industries such as healthcare, financial services, automotive, and government.

Competitive Advantage

Zscaler’s competitive advantage lies in its proprietary Zero Trust Exchange platform, which integrates AI-powered analytics to prevent cyber threats effectively. It is recognized as a leader in the zero trust security space, with a strong foothold in the growing secure access service edge (SASE) market. The company continuously expands its capabilities through acquisitions of innovative startups like Avalor ($310 million) and Airgap Network. Its ability to process massive volumes of data securely gives it an edge over competitors like Palo Alto Networks and Cisco Systems.

Total Addressable Market (TAM)

Zscaler's Total Addressable Market (TAM) is currently estimated at $96 billion, as of its most recent update during the company's 2024 Investor Day. This represents significant growth from its previously reported TAM of $72 billion, driven by expanding product offerings and increasing adoption of cloud-native cybersecurity solutions across sectors like user protection, workload protection, and IoT/OT security.

CAGR for Zscaler's TAM is forecasted to grow at a robust rate of approximately 14% annually, aligning with broader industry trends in cybersecurity spending. Gartner projects continued growth in enterprise security budgets, particularly as organizations adopt zero trust architectures and AI-enhanced cybersecurity tools to combat rising threats. This positions Zscaler to capture a growing share of the expanding market.

Valuation

$ZS Zscaler is trading at a Forward EV/Sales multiple of 10.4, which is significantly below the median of 15.4. The company’s current multiple is near its historical lows, comparable to the levels seen in 2020 and January 2023.

$ZS Zscaler trades at a Forward P/E of 63.4, with revenue growth of +23.4% YoY in the last quarter.

The EPS growth forecast for 2026 is 19.4%, with a P/E of 66.48 and a PEG ratio of 3.4.

The EPS growth forecast for 2027 is 21.6%, with a P/E of 55.6 and a PEG ratio of 2.6.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

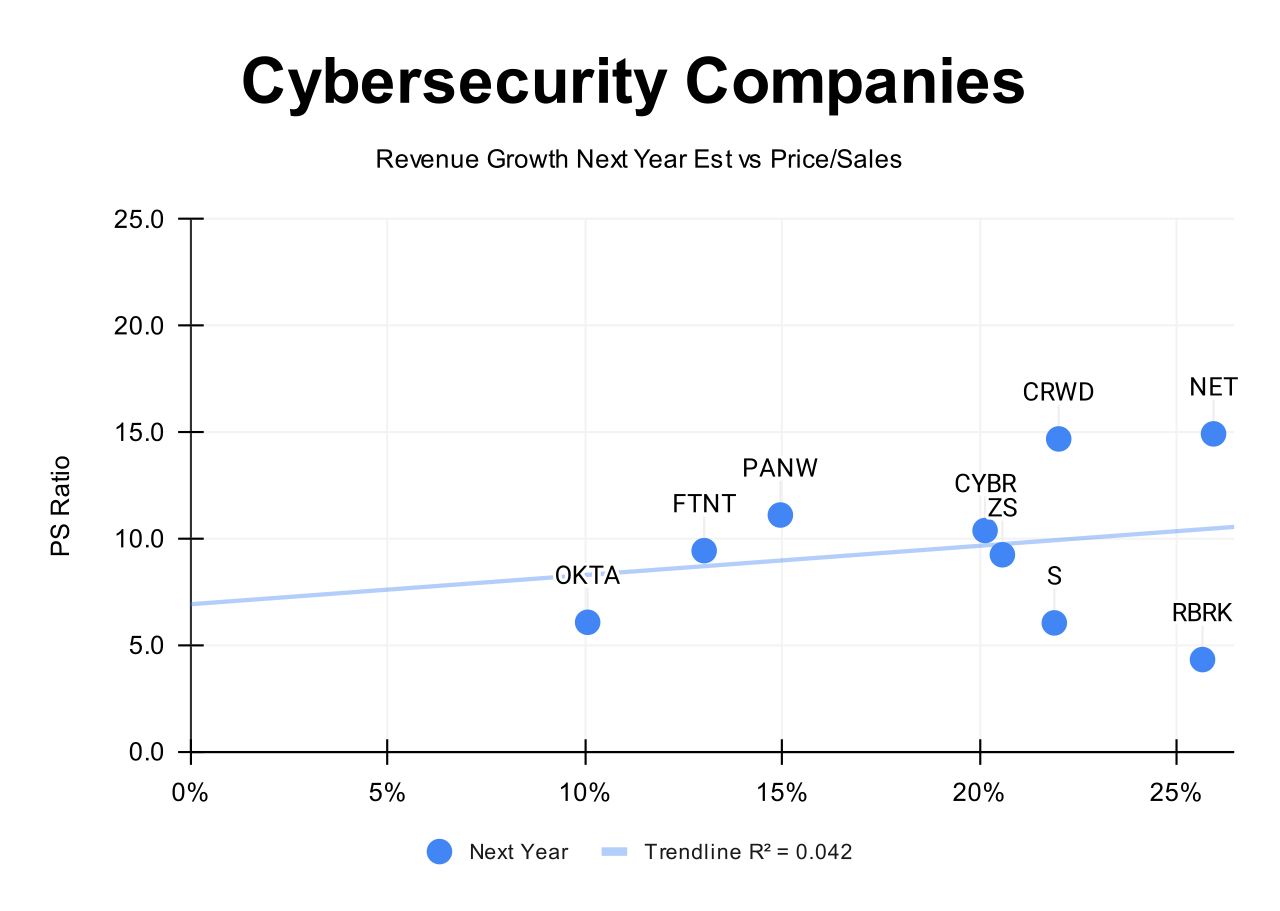

Analysts' revenue growth forecast for $ZS in 2026 is +20.6%. Considering this forecast, the valuation based on the PS multiple appears fair when compared to other companies in the cybersecurity sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Zscaler has established a competitive advantage in cybersecurity, particularly in zero-trust solutions. Its economic moat is defined by economies of scale, network effects, brand strength, intellectual property, and switching costs.

Economies of Scale

Zscaler benefits significantly from economies of scale due to its cloud-native Zero Trust Exchange platform, which processes over 500 billion daily transactions. This scale enables the company to spread fixed costs, such as R&D and infrastructure, across a growing customer base, reducing per-unit costs. The platform's ability to handle exponential growth in security transactions reinforces its scalability and cost efficiency. Strength Level: Strong, as its cloud-based architecture and global presence allow Zscaler to maintain operational efficiency while expanding.

Network Effect

The network effect is a critical moat for Zscaler. As more customers use its platform, the system collects and analyzes increasing amounts of threat intelligence, improving its ability to detect and mitigate cyber risks. This enhanced security attracts additional customers, creating a self-reinforcing cycle. With 8,600+ customers and 47+ million users, Zscaler’s network effect strengthens its competitive position. Strength Level: Strong, as the growing user base directly enhances the platform's value.

Brand

Zscaler has established itself as a trusted leader in cloud security, particularly in zero trust architecture. Its reputation is bolstered by partnerships with 40% of Fortune 500 companies and recognition as a pioneer in Secure Access Service Edge (SASE) solutions. The brand's association with innovation and reliability fosters customer loyalty and attracts new clients. Strength Level: Moderate, as the brand is strong but still faces competition from well-established cybersecurity firms like Palo Alto Networks and Cisco.

Intellectual Property

Zscaler holds a portfolio of 334 patents globally, with more than 95% active, covering proprietary technologies that underpin its Zero Trust Exchange platform. These patents create barriers for competitors seeking to replicate its solutions. However, the cybersecurity industry evolves rapidly, requiring continuous innovation to stay ahead. Strength Level: Moderate, as patents provide protection but are not insurmountable in this fast-paced sector.

Switching Costs

Switching costs are one of Zscaler’s strongest moats. Enterprises deeply integrate Zscaler’s solutions into their IT infrastructure, making transitions to competitors costly and disruptive. Switching often requires retraining staff, reconfiguring systems, and risking temporary vulnerabilities during migration. Zscaler’s customer retention rate of 95% highlights how switching costs deter churn. Strength Level: Very Strong, as the complexity and risks of switching ensure high customer stickiness.

Revenue growth

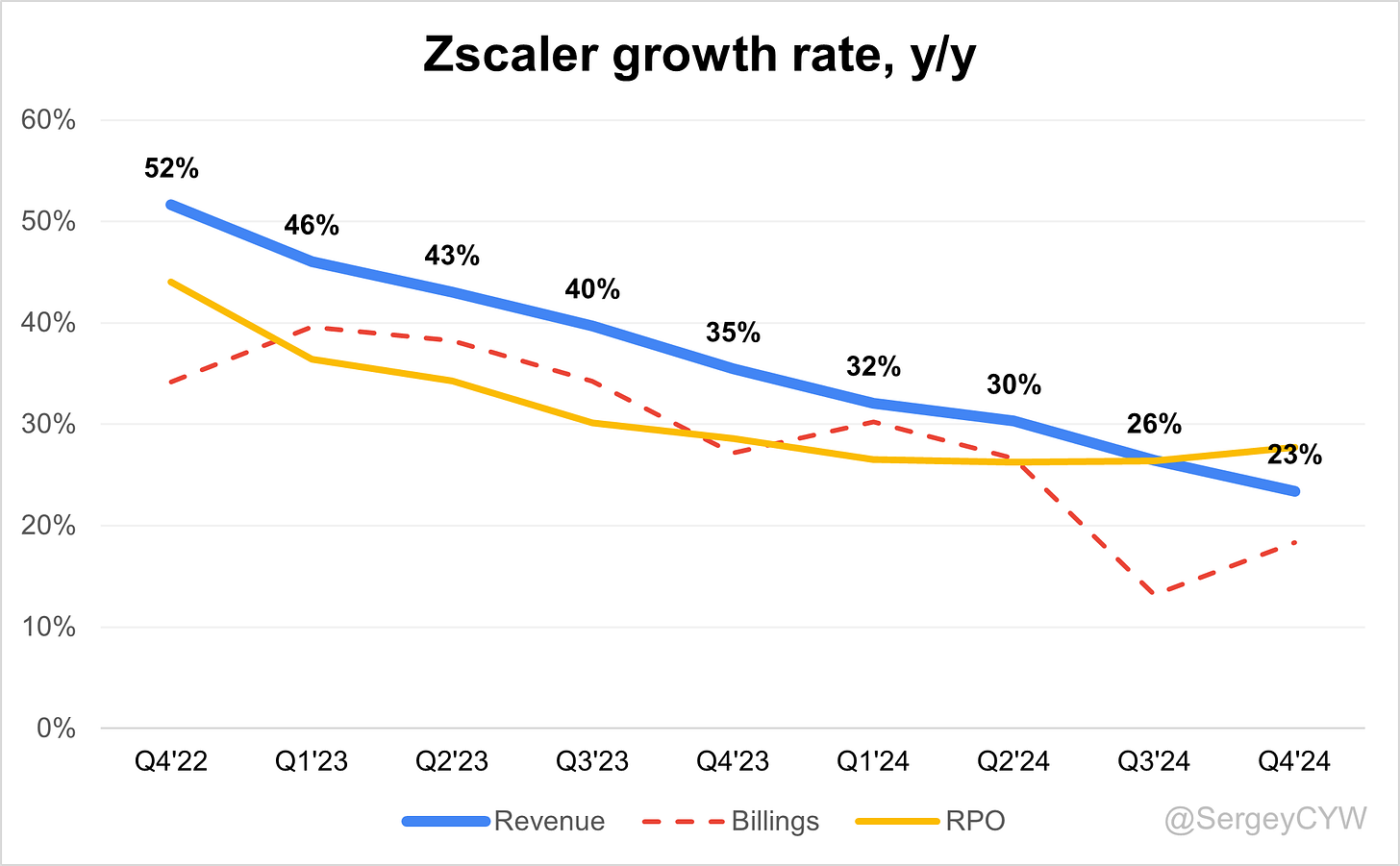

$ZS's revenue growth continues to decelerate, with the most recent quarter showing +23.4% YoY. Based on guidance for the next quarter, if the company exceeds its forecast by 2.0%, as it did in Q4, growth would reach +23.0%, indicating stabilization in revenue growth.

RPO growth accelerated to +27.4% YoY in Q4, outpacing revenue growth. Billings grew +18.3% YoY, slower than revenue, but the growth rate improved compared to Q3.

Deferred revenue is growing faster than both billings and revenue, at +25.1% YoY.

The key question for Zscaler is whether it can successfully stabilize revenue growth, or if the slowdown will continue—and at what pace. It appears that a turning point in growth stabilization may occur next quarter, which would be a critical milestone in reversing the revenue deceleration trend.

Segments and Main Products

Zscaler organizes its solutions into three core segments: Zscaler for Users, Zscaler for Workloads, and Zscaler for IoT/OT. All offerings are powered by the Zero Trust Exchange platform, delivering end-to-end cloud-native security.

Zscaler Private Access (ZPA) enables zero trust network access to private applications without exposing them to the internet. It replaces legacy VPNs, eliminates lateral movement, and uses AI-powered application segmentation to enforce least-privileged access. Recent product updates include B2B application access and support for VoIP and server-to-client applications.

Zscaler Digital Experience (ZDX) provides deep visibility into application performance, device health, and network conditions. Offered in Standard, Advanced, and Advanced Plus tiers, ZDX enables IT teams to identify and resolve performance issues proactively across applications, networks, and devices.

Zero Trust Segmentation protects branches, factories, and cloud environments without traditional firewalls. Each location operates as a secure isolated “island” connected directly to Zscaler’s platform. This architecture prevents ransomware propagation and can reduce infrastructure costs by up to 50%.

Risk360 delivers automated cyber risk quantification using real-time data from Zscaler environments, external sources, and internal research. It provides a complete view of an organization’s security posture, assessing risks across attack surface exposure, potential compromise, lateral movement, and data loss. Features include AI-driven maturity assessments, financial risk exposure estimates, and compliance-aligned board-level reporting mapped to MITRE ATT&CK and NIST CSF frameworks.

Zscaler Platform Bundles are offered through subscription-based pricing, including the Essentials Platform and the broader Zscaler Platform. Customers can extend capabilities with advanced modules such as Deception Advanced, Risk360 Advanced, and Unified Vulnerability Management, offering tailored protections for enterprise needs.

Zero Trust Everywhere extends Zscaler’s zero trust framework across the entire enterprise architecture, covering branches, campuses, factories, and cloud workloads. It integrates device segmentation, workload protection, and AI-powered analytics to block ransomware and lateral movement, while reducing the complexity and cost of traditional security infrastructure.

Main Products Performance in the Last Quarter

Zscaler Platform

The Zscaler platform delivered strong results in Q2 FY25, with revenue growing 23% YoY to $648 million and ARR reaching over $2.7 billion. The platform continues to benefit from broad-based adoption across large enterprises. Notably, $1 million+ ARR customers grew 25% YoY, and 620 customers now fall into that high-value segment. Net Retention Rate (NRR) improved to 115%, supported by both upsell and multi-product adoption.

Platform adoption is being driven by its Zero Trust architecture, vendor consolidation, and the desire to eliminate legacy tech like firewalls, VPNs, and SD-WANs. GSIs (Global System Integrators) played a crucial role in expanding customer reach and deal size, actively closing multiple 7-figure deals.

Challenges remain in deal scrutiny and macro pressure, especially on large transactions, but execution improvements and sales productivity gains are helping offset these headwinds.

ZPA (Zscaler Private Access)

ZPA continues to be a foundational product in broader platform deals. It is increasingly bundled with ZIA and ZDX in both land and expansion deals. In Q2, a Fortune-50 energy company adopted ZPA along with other Zero Trust products in a 7-figure deal, securing 25,000 users.

ZPA is part of the strategic shift from point products to platform adoption. It's commonly used to replace legacy VPNs, enabling Zero Trust access across hybrid workforces. Expansion into federal and international government accounts also included ZPA deployments.

ZDX (Zscaler Digital Experience)

ZDX has entered a new growth phase fueled by AI integration. Bookings for ZDX Advanced Plus, which includes ZDX Copilot powered by Gemini, grew over 45% to nearly $50 million. Zscaler is now enhancing this product with Agentic AI to deliver automated root cause analysis and faster remediation.

ZDX is helping drive higher deal sizes, especially in large enterprises looking to consolidate performance monitoring and security. The product’s continued evolution with AI is increasing its strategic value, making it a core upsell lever within the platform.

Risk360 and AI Analytics

AI-powered analytics is a fast-emerging growth vector. Risk360, Unified Vulnerability Management, and Business Insights are all built on Zscaler’s data fabric architecture. ACV from AI analytics nearly doubled YoY, highlighting early traction.

Zscaler is using its access to over 5 billion daily logs to feed these analytics products. New leadership, including Phil Tee as EVP of AI Innovations, will accelerate the development of Agentic AI and further expand this segment.

Zero Trust Everywhere

Zero Trust Everywhere is now the company’s flagship initiative. As of Q2, over 130 enterprises have adopted it. Management is targeting a 3x increase in adoption over the next 18 months. The offering spans Zero Trust for users, cloud, and branches.

Key wins include a Global-2000 manufacturing customer deploying Zero Trust Branch across its sites in a 7-figure deal and a large communications equipment company phasing out SD-WAN using the same. 57% of Zero Trust Branch customers in Q2 were new logos, signaling its potential as an acquisition driver.

Adoption is being fueled by the hardware refresh cycle and a push to eliminate firewalls and legacy appliances in branch locations. A recent CXO survey at Zscaler’s summit revealed 96% are ready to embrace Zero Trust Branch.

Product Innovations and AI Expansion

Zscaler is leaning heavily into AI across its portfolio. Core developments include:

ZDX Copilot and Agentic AI for autonomous troubleshooting and performance optimization.

LLM Proxy to secure both public and private GenAI usage.

AI-driven DLP and classification to secure data in motion and at rest.

DSPM, endpoint data protection, and cloud-based DLP integrated under one policy engine.

The company is also embedding AI into Zero-day detection, image classification, IoT/OT discovery, and automated app segmentation. AI is enhancing both detection and remediation, while also becoming a product growth lever through differentiated pricing and new SKU creation.

Management expects AI to be the next secular tailwind, calling it “the internet moment of AI”, with far-reaching impact across cybersecurity and IT.

Market Leader

Zscaler has been recognized as a Leader in Security Service Edge (SSE) for the third consecutive year in the 2024 Gartner Magic Quadrant.

The report highlights how SSE unifies Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), and Zero Trust Network Access (ZTNA) into a cloud-delivered platform that helps reduce risk and accelerate secure digital transformation.

Customers

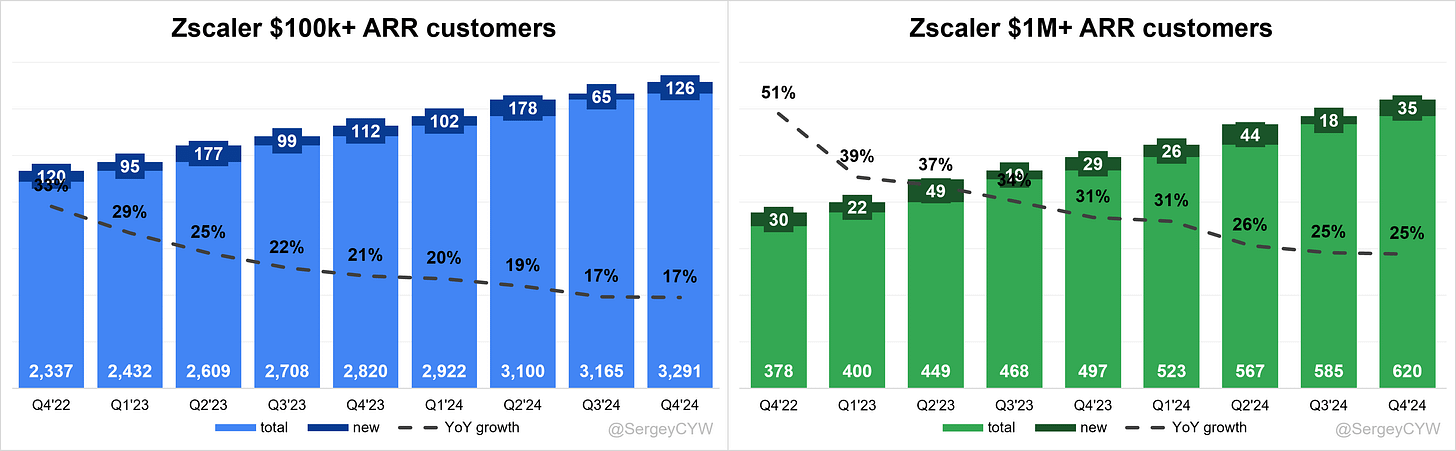

$ZS Zscaler added 126 customers with ARR over $100K, which is fewer than the same period last year, representing +17% YoY growth.

The company also added 35 customers with ARR over $1M, reflecting +25% YoY growth—a record high for Q4 in the company's history.

Customer Success Stories

A Global-2000 manufacturing company significantly expanded its partnership with Zscaler through a 7-figure deal by adopting Zero Trust Branch, building on prior commitments to ZIA and ZPA. The customer is now using Zscaler to secure all manufacturing sites while eliminating firewalls, NACs, routers, and switches. Zscaler is actively working with the customer to further upsell Zero Trust Cloud, driving toward full platform adoption.

A Global-2000 retail enterprise adopted three additional data protection modules in Q1 FY25 and rolled them out to all users in Q2, expanding from three to six modules. The move nearly tripled the customer's annual spend and reflected a strong appetite for operational simplicity and unified policy enforcement across Zscaler’s data protection platform.

A Global-2000 financial services customer executed a 7-figure upsell deal to secure 100,000 users with expanded data protection. The deal increased annual spend by 65%, further validating Zscaler’s cross-sell motion and policy unification advantage across multiple protection vectors.

Several enterprises, including a Global-2000 hospitality company, technology provider, and manufacturing organization, adopted Zscaler’s data protection to safeguard against data leakage to public GenAI apps like ChatGPT and Microsoft Copilot. AI-related risks are directly fueling demand for Zscaler’s DLP solutions, which operate across endpoints, SaaS, cloud, and more.

Bookings for ZDX Advanced Plus, which includes AI-powered ZDX Copilot, grew 45%+ to nearly $50 million, reflecting customer willingness to pay a premium for faster resolution and AI-automated troubleshooting.

Large Customer Wins

A Fortune-50 energy company became a new logo in Q2 FY25, deploying Zscaler’s full Zero Trust platform, including ZIA, ZPA, Zero Trust Branch, and Zero Trust Cloud. The customer secured 25,000 users in a 7-figure deal and replaced firewalls, SD-WAN, VPNs, and legacy gateways. The land included both user and cloud components, signaling trust in the platform’s full-stack capability from day one.

A national government in the APJ region signed an 8-figure TCV agreement to secure its entire government workforce with Zscaler for users. The win demonstrates the platform's suitability for high-assurance environments and is considered a landmark expansion into international public sector accounts.

A Fortune-500 healthcare customer, already generating over $1 million in ARR, partnered with a GSI to expand its ZIA, ZPA, and data protection footprint across 100,000 users. The transaction, valued in the 7-figure range, lifted annual spend by over 350%, highlighting the effectiveness of joint go-to-market efforts with system integrators.

A Global-2000 insurance provider selected Zscaler as a new logo via Cognizant in a 7-figure deal covering 23,000 employees. The deal reflects both platform relevance and increased channel leverage, particularly with GSIs embedding Zscaler into security transformation engagements.

A large communications equipment vendor replaced its existing SD-WAN with Zscaler’s Zero Trust Branch, further validating the company's strategic narrative around firewall and SD-WAN displacement.

Overall, the company added 57% of Zero Trust Branch customers as net new logos during the quarter, demonstrating both land motion strength and expanding enterprise appetite for branch-level transformation.

Retention

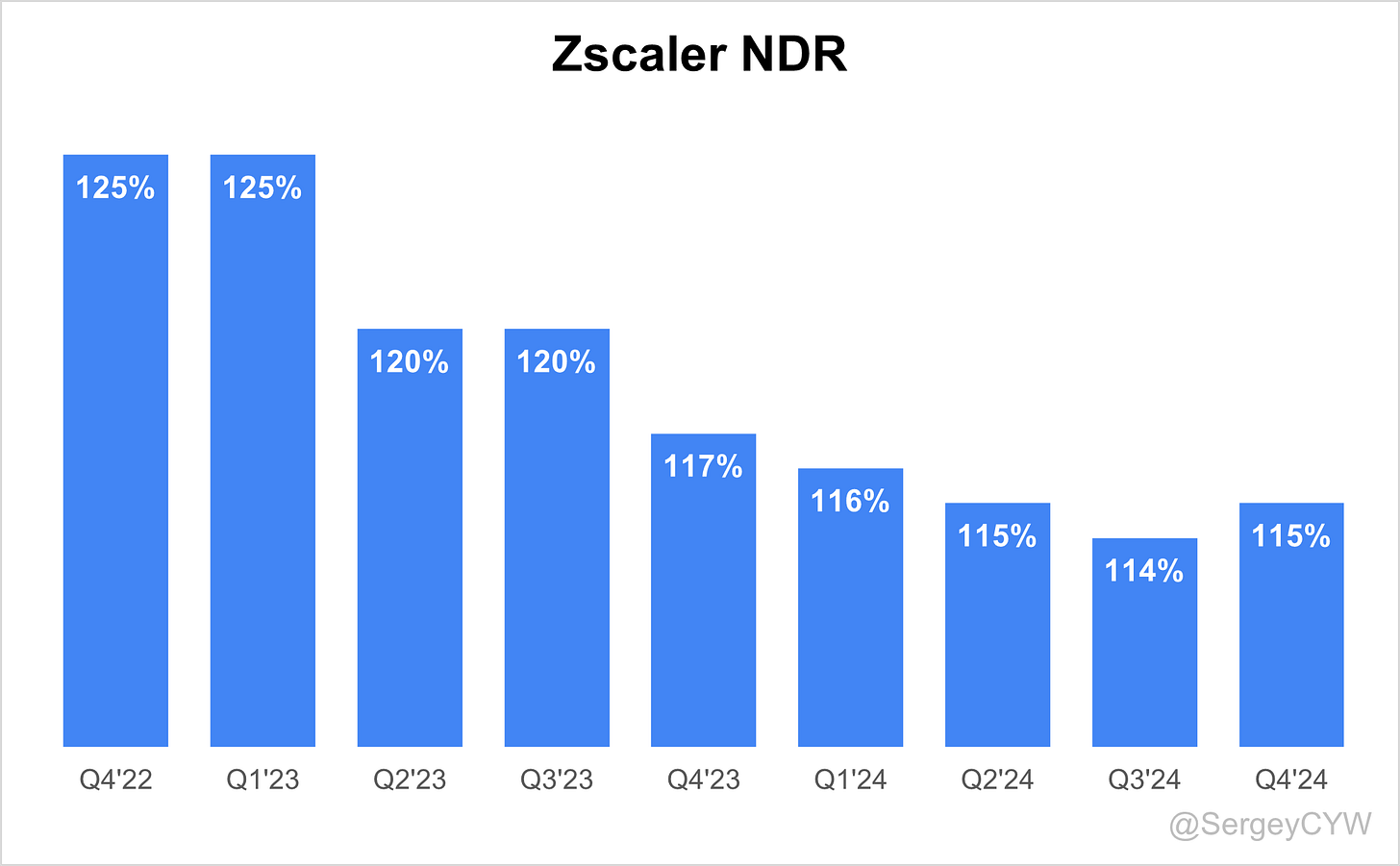

$ZS's Net Dollar Retention (NDR) rate increased to 115% in Q4 and remains at a healthy level, though it is slightly below the 117% median for the SaaS companies I monitor.

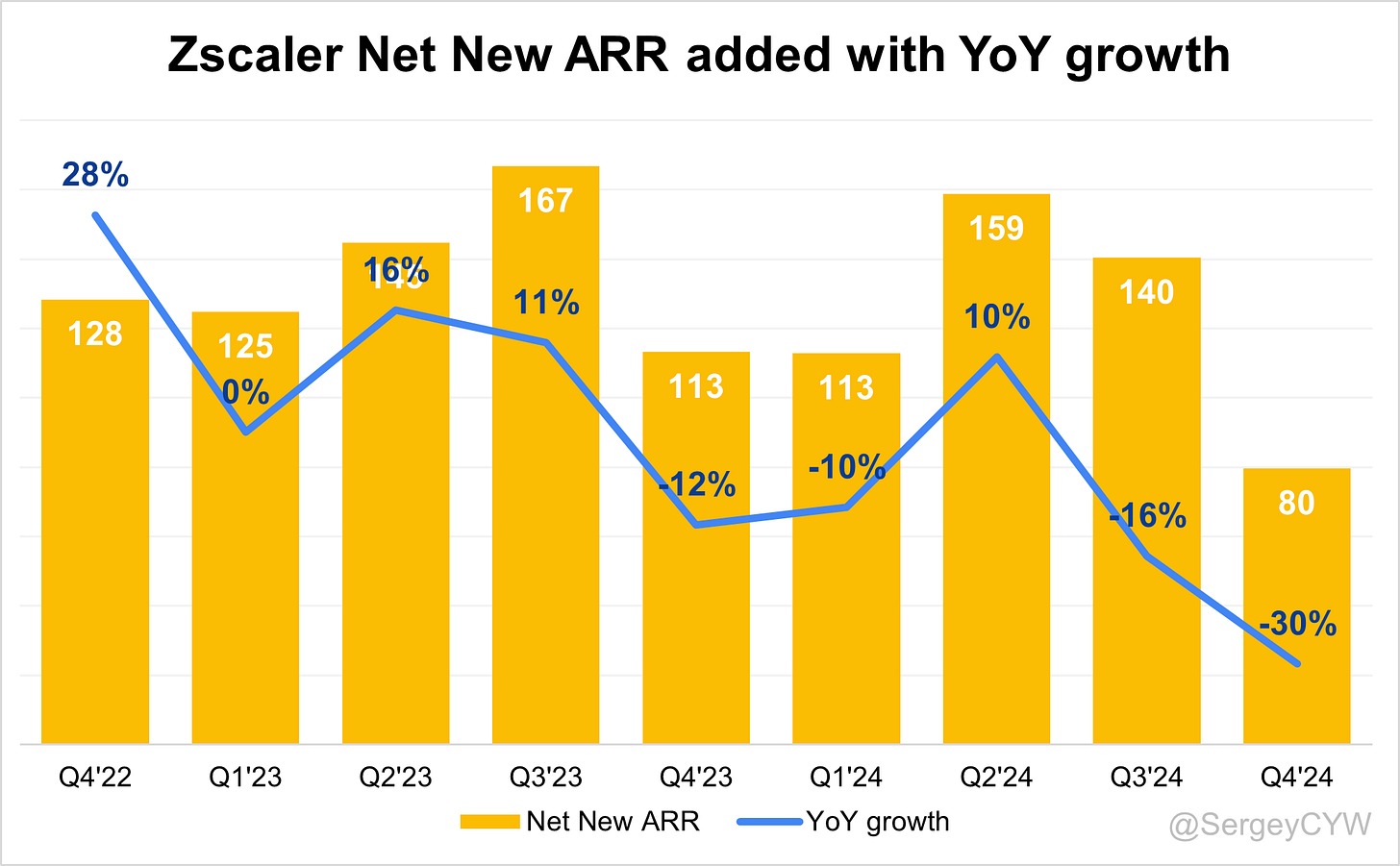

Net new ARR

Zscaler $ZS added $80M in net new ARR in Q4 2024, representing a –30% YoY decline, marking a weak quarter for net new ARR.

However, based on management's guidance for the next quarter, if the company beats its forecast at the same rate as it did this quarter, net new ARR in Q1 could grow +16% YoY, signaling a potential reversal of the negative trend seen over the past two quarters.

CAC Payback Period and RDI Score

$ZS's return on S&M spending is 45.1. The CAC Payback Period has worsened compared to the previous quarter and is above the median for SaaS companies (20.8 months among the companies I track).

The R&D Index (RDI Score) for Q4 is 1.63, which is above the median of 1.2 for the SaaS companies I monitor and significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered best-in-class, and the low industry median of 0.7 underscores the importance of efficient R&D investment.

Profitability

Over the past year, $ZS Zscaler has improved its margins:

Gross Margin slightly decreased from 80.7% to 80.4%.

Operating Margin increased from 19.6% to 21.7%.

Free Cash Flow (FCF) Margin increased from 19.2% to 22.1%.

Operating expenses

Zscaler's Non-GAAP operating expenses have gradually decreased, driven by a reduction in Sales & Marketing (S&M) spending, which declined from 47% two years ago to 37%.

R&D expenses have slightly increased and remain high at 16%, reflecting the company’s continued investment in future growth through enhancements and updates to its core Zero Trust product.

General & Administrative (G&A) expenses remain stable at 6%.

Balance Sheet

$ZS Balance Sheet: Total debt stands at $1,239M, while Zscaler holds $2,880M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$ZS Shareholder Dilution: Zscaler's stock-based compensation (SBC) expenses have increased over the past three quarters, reaching 27% of revenue in the last quarter, which is relatively high for SaaS companies.

Shareholder dilution also remains elevated, though it is gradually declining, with the weighted-average number of basic common shares outstanding increasing by 3.2% YoY.

Conclusion

Although $ZS Zscaler's Q4 was not strong, primarily due to weak net new ARR additions, the guidance for the next quarter suggests revenue growth stabilization, which could mark a turning point in the company's growth deceleration. Over the past few quarters, Zscaler has introduced major product updates and strengthened its management team to improve its go-to-market strategy.

Leading Indicators

RPO growth of +27.7% exceeded revenue growth.

Net new ARR additions declined –30% YoY.

Record number of large customers added for a Q4.

Key Indicators

Net Dollar Retention (NDR) increased 1 percentage point QoQ to 115%.

CAC Payback Period worsened significantly to 45.1 months, which is below average.

RDI Score slightly declined to 1.63, but remains above the median of other SaaS companies I track.

The forecast suggests revenue growth stabilization, supported by strong leading indicators such as the record number of new large customers, accelerating RPO growth, and improved billings growth.

The valuation appears reasonable, with the company trading at a discount relative to its Forward EV/Sales multiple.

While Zscaler is facing challenges with slowing revenue growth, management is actively taking steps to reinforce its competitive position and stabilize performance. The key moment for Zscaler will be when the revenue slowdown ends and at what level growth stabilizes—which is likely to happen next quarter.

As of now, $ZS accounts for 6.2% of my portfolio.

Seems like an interesting company!