Zscaler Q4 2024 Earnings Analysis

Dive into $ZS Zscaler’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$647.9M rev (+23.4% YoY, +26.4% LQ) beat est by 2.2%

↘️GM* (80.4%, -0.4 PPs YoY)🟡

↗️Operating Margin* (21.7%, +2.0 PPs YoY)

↗️FCF Margin (22.1%, +2.9 PPs YoY)

↗️Net Margin (-1.2%, +4.2 PPs YoY)

↗️EPS* $0.78 beat est by 13.0%

*non-GAAP

Key Metrics

↗️DBNR 115% (114% LQ)

↗️RPO $4.62B (+27.7% YoY)🟢

➡️Billings $743M (+18.3% YoY)🟡

Customers

↗️3,291 >$100k+ customers (+16.7% YoY, +126)

↗️620 $1M+ customers (+24.7% YoY, +35)

Operating expenses

↘️S&M*/Revenue 36.7% (-3.4 PPs YoY)

↗️R&D*/Revenue 16.2% (+1.4 PPs YoY)

↘️G&A*/Revenue 5.9% (-0.3 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $80M (-29.7% YoY)

↗️CAC* Payback Period 45.1 Months (+17.8 YoY)🟡

↘️R&D* Index (RDI) 1.63 (-0.82 YoY)🟡

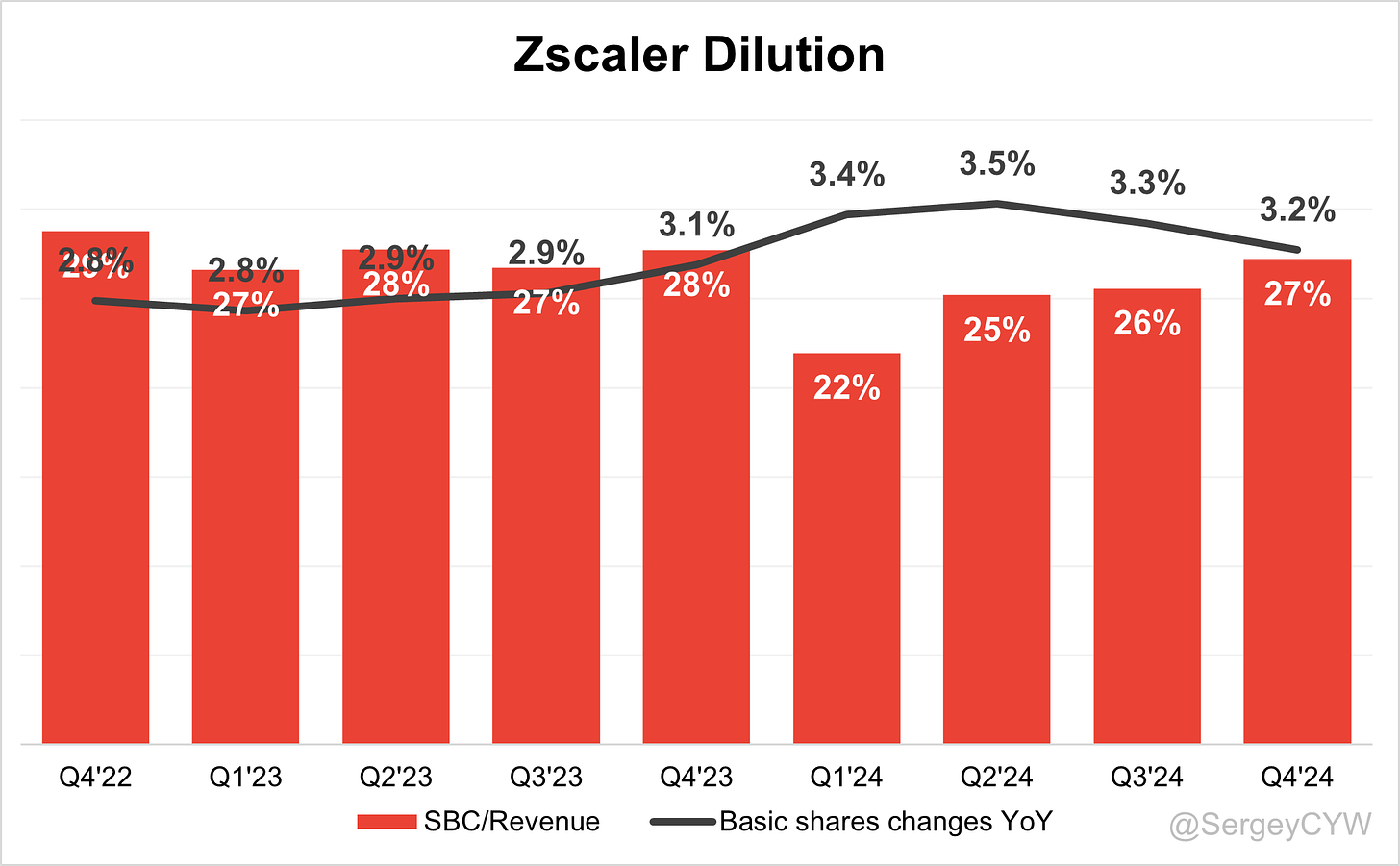

Dilution

↗️SBC/rev 27%, +1.7 PPs QoQ

↘️Basic shares up 3.2% YoY, -0.2 PPs QoQ

↗️Diluted shares up 2.1% YoY, +0.4 PPs QoQ

Guidance

➡️Q1'25 $665.0 - $667.0M guide (+20.4% YoY) in line with est

↗️$2,640.0 - $2,654.0M FY guide (+22.1% YoY) raised by 0.4% beat est by 0.5%

Key points from Zscaler’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Zscaler reported Q2 FY25 revenue of $648 million, a 23% YoY increase, exceeding guidance. Billings grew 18% YoY to $743 million, while ARR surpassed $2.7 billion, up 23% YoY. Management expects ARR to exceed $3 billion by year-end.

Operating profit grew 36% YoY, with the operating margin expanding 200 basis points to 22%. Free cash flow margin hit 22%, a record high. 620 customers now generate over $1 million in ARR, a 25% YoY increase. Net retention rate improved to 115%, driven by upsells and platform expansion.

For Q3 FY25, revenue is projected between $665 million and $667 million, reflecting 20-21% YoY growth. Full-year billings guidance is $3.153 billion to $3.168 billion, a 20-21% YoY increase. Free cash flow margin is expected to be 24.5-25%, reinforcing investment in platform expansion and go-to-market strategies.

AI and GenAI Security

AI-driven security adoption is rising, fueling demand for Zscaler’s AI-powered cybersecurity solutions. ZDX CoPilot, an AI-driven IT monitoring tool, saw bookings rise 45% YoY, reaching nearly $50 million.

LLM Proxy, a new AI security feature, prevents unauthorized data leakage, detects prompt injections, and secures AI models like Microsoft 365 Copilot and ChatGPT. AI-powered data protection solutions grew 40% YoY in ACV, reflecting strong enterprise demand.

Phil Tee, appointed as EVP of AI Innovations, will lead Agentic AI developments, enhancing vulnerability detection, risk assessment, and predictive cybersecurity.

Zero Trust Expansion

Zero Trust Exchange continues to replace firewalls, VPNs, and SD-WANs, securing users, workloads, IoT, OT devices, and cloud environments. Zero Trust Cloud enables secure workload communication without lateral movement, while Zero Trust Branch eliminates legacy firewalls and SD-WANs.

ZPA adoption is accelerating as enterprises replace VPNs and NAC solutions. Large enterprises are deploying multiple Zero Trust solutions, driving significant upsell momentum.

The $1 million+ ARR customer base grew 25% YoY to 620, with a Global 2000 financial services firm increasing spending by 65% after a seven-figure upsell deal.

Zero Trust Everywhere

130+ enterprises have adopted Zero Trust Everywhere, with a goal to triple adoption in 18 months. 57% of Zero Trust Branch customers are new logos, reflecting market expansion.

A Fortune 50 energy company secured 25,000 employees in a seven-figure deal, adopting Zero Trust Access, Cloud, and Branch solutions. A Global 2000 manufacturing firm replaced legacy firewalls and network appliances in a seven-figure deal.

ZDX Growth

ZDX CoPilot, a key AI-driven solution, recorded a 45% YoY increase in bookings, reaching nearly $50 million. Enterprises are using ZDX for IT performance monitoring, automated troubleshooting, and security analytics.

A Fortune 500 healthcare company expanded ZDX to 100,000 users, increasing its annual spend by 350%. Enterprises continue to invest in AI-powered analytics and IT automation.

ZPA Adoption

ZPA is gaining traction as enterprises eliminate VPNs, firewalls, and NAC solutions. A Fortune 50 company deployed ZPA for 25,000 employees in a multi-million-dollar deal.

Regulatory requirements and rising cybersecurity threats are driving demand for ZPA, which ensures secure access without exposing applications to the public internet.

Large Customer Wins

Fortune 50 energy, financial, and manufacturing companies expanded their Zero Trust adoption with seven-figure deals. A Global 2000 financial services firm tripled spending on AI-powered data protection.

A communications equipment provider replaced SD-WAN with Zero Trust Branch, eliminating network security vulnerabilities. Enterprises are investing in multi-product deployments to streamline security operations.

Strategic Partnerships

Global System Integrators (GSIs) play a growing role in Zscaler’s enterprise expansion. Cognizant helped secure a seven-figure deal with a global insurance company. GSIs are embedding Zscaler into digital transformation initiatives, increasing customer adoption.

Government Expansion

A national government in APJ awarded Zscaler an eight-figure contract, deploying Zero Trust security across its workforce. U.S. federal adoption continues, with Zscaler in 14 of 15 cabinet-level agencies.

Agencies seek cost-saving security solutions, eliminating redundant tools like VPNs, NACs, and firewalls. Government contracts remain lumpy, but Zscaler sees long-term opportunities in digital transformation projects.

Challenges

Large deals face increasing scrutiny as enterprises evaluate cost efficiency. Government contracts have long sales cycles, creating revenue timing variability.

Zscaler’s business value assessments help enterprises quantify cost savings and security improvements, strengthening deal conversions.

Future Outlook

ARR is expected to surpass $3 billion by year-end, driven by Zero Trust adoption, AI-powered security, and stronger go-to-market execution.

Expanding GSI partnerships and federal adoption will fuel growth. AI-driven analytics and security innovations will drive long-term value. Zscaler remains on track for sustained high-margin SaaS growth.

Management comments on the earnings call.

Product Innovations

Jay Chaudhry, Chairman and CEO

"Our Zero Trust Exchange goes far beyond traditional security models, enabling enterprises to eliminate firewalls, VPNs, and legacy network segmentation. With Zero Trust Cloud and Zero Trust Branch, we are redefining how organizations secure their users, workloads, and infrastructure."

"We are introducing new AI-powered solutions, Zero Trust Everywhere, and data protection enhancements that make our platform even more indispensable. Customers are increasingly choosing us for full-scale security transformation rather than piecemeal solutions."

AI and GenAI Security

Jay Chaudhry, Chairman and CEO

"AI is transforming cybersecurity at an unprecedented pace. We are leveraging AI to automate data classification, prevent zero-day vulnerabilities, and enhance threat intelligence. Our AI-driven risk analysis and GenAI-powered security solutions allow enterprises to protect sensitive data while maintaining efficiency."

"With the rapid adoption of GenAI in enterprises, organizations are facing new security risks. We have introduced an LLM Proxy to safeguard against data loss and unauthorized AI interactions. Our AI-driven approach ensures that companies can embrace AI without compromising security."

Remo Canessa, Chief Financial Officer

"We continue to invest aggressively in AI-driven security innovations. The demand for AI-powered data protection and automation is accelerating, and we are well-positioned to capitalize on this shift."

Zero Trust Platform

Jay Chaudhry, Chairman and CEO

"Our Zero Trust Platform is eliminating lateral movement threats, dramatically reducing attack surfaces, and providing enterprises with a comprehensive, cloud-native security solution. We are redefining network security by making firewalls and VPNs obsolete."

"We are seeing strong enterprise demand for our Zero Trust architecture, with organizations moving away from perimeter-based security in favor of our platform. Customers recognize that true Zero Trust is not about network segmentation but about ensuring that users, workloads, and devices never have implicit trust."

Competitors

Jay Chaudhry, Chairman and CEO

"SASE is not Zero Trust. Many vendors continue to push SD-WAN-based security, which fails to stop lateral movement attacks. Our Zero Trust architecture eliminates the vulnerabilities created by traditional network security models."

"Enterprises are looking to escape the hardware refresh cycle and legacy appliance-based security. While some vendors still rely on firewalls and VPNs, we provide a cloud-first, Zero Trust alternative that eliminates the need for outdated security stacks."

Customers

Jay Chaudhry, Chairman and CEO

"Our enterprise customers are increasingly embracing Zero Trust Everywhere, securing users, workloads, and branches without relying on legacy infrastructure. We surpassed 130 enterprises adopting this model, and we expect to triple that number in the next 18 months."

"Our success in large customer wins speaks for itself. A Fortune 50 energy company, a global 2,000 financial services firm, and a manufacturing giant all expanded their commitments with us, adopting multiple pillars of our security platform."

Remo Canessa, Chief Financial Officer

"Our net retention rate improved to 115%, reflecting strong customer expansion. Upsells accounted for 65% of new ACV, demonstrating the value customers see in our platform and the ability to drive long-term revenue growth."

Strategic Partnerships

Jay Chaudhry, Chairman and CEO

"We are seeing a significant shift in Global System Integrators (GSIs) embedding our platform into their security transformation practices. Several GSIs now consider us a top strategic partner alongside Microsoft and Salesforce."

"In Q2, GSIs played a crucial role in securing several large enterprise deals. For example, we partnered with Cognizant to close a seven-figure deal with a global insurance company. These partnerships are helping us scale and reach more large enterprises globally."

International Growth

Jay Chaudhry, Chairman and CEO

"Our international expansion is gaining momentum, particularly in APJ and EMEA. Enterprises outside the U.S. are increasingly recognizing the need for a cloud-first Zero Trust security model."

"Zero Trust Branch and data protection solutions are gaining traction internationally, helping us drive new customer acquisitions while increasing spend from existing clients."

Federal & Government Expansion

Jay Chaudhry, Chairman and CEO

"The federal sector presents a significant growth opportunity. We have landed in nearly all cabinet-level U.S. government agencies, and our platform is well-positioned to help agencies achieve better security while reducing costs."

"Our eight-figure contract with an APJ national government is a testament to the increasing global demand for Zero Trust security. We expect to see continued momentum in government deals, as agencies look to eliminate legacy firewalls, VPNs, and outdated security stacks."

Remo Canessa, Chief Financial Officer

"We are not baking in a strong federal ramp-up in the second half of the fiscal year, given the timing uncertainties of government deals. However, our presence in the U.S. federal market remains strong, and we see significant long-term opportunities."

Challenges

Jay Chaudhry, Chairman and CEO

"While the macroeconomic environment remains tight, cybersecurity budgets remain resilient. Organizations are scrutinizing large deals more carefully, but when we demonstrate security transformation and cost reduction, we see strong customer engagement."

"We continue to refine our business value assessments, ensuring that CFOs and CIOs see the cost savings and operational benefits of migrating to our platform. The stronger the business case, the larger the platform adoption."

Remo Canessa, Chief Financial Officer

"While scheduled billings growth is improving, we are seeing ongoing deal scrutiny. That said, our pipeline remains robust, and our guidance reflects confidence in our ability to execute in the second half of the fiscal year."

Future Outlook

Jay Chaudhry, Chairman and CEO

"With strong demand for our platform and growing innovation, we expect to achieve $3 billion or more in ARR by the end of the fiscal year. Our focus remains on driving Zero Trust adoption, expanding AI-powered security solutions, and increasing sales productivity."

"We are just scratching the surface of the enterprise security transformation. Organizations across industries are looking to eliminate legacy security infrastructure, and we are well-positioned to lead this market shift."

Remo Canessa, Chief Financial Officer

"We have raised our guidance and remain confident in our ability to execute. Our investments in go-to-market execution, product innovation, and AI security will drive long-term revenue growth and profitability."

Thoughts on Zscaler Earnings Report $ZS:

🟢 Positive

Revenue reached $648M, up +23% YoY, exceeding estimates by 2.2%.

ARR surpassed $2.7B, up +23% YoY, with a $3B+ target by year-end.

Operating margin improved +2.0 PPs YoY to 21.7%.

Free cash flow margin hit a record 22.1%, up +2.9 PPs YoY.

EPS of $0.78, beating estimates by 13%.

DBNR improved to 115% (from 114% last quarter).

RPO increased +27.7% YoY to $4.62B.

$1M+ ARR customers grew +24.7% YoY to 620.

ZDX CoPilot bookings rose +45% YoY, reaching $50M.

AI-powered data protection ACV grew +40% YoY.

Large enterprise deals expanded, including seven-figure contracts with Fortune 50 energy and financial firms.

Federal growth: Eight-figure contract secured with an APJ national government.

Raised full-year guidance by 0.4%, now forecasting $2.64B - $2.65B revenue (+22.1% YoY).

🟡 Neutral

Billings growth accelerated to +18.3% YoY from +13.2% last quarter but is still growing slower than revenue.

Zero Trust Branch adoption rising, but hardware refresh cycle timing remains uncertain.

Guidance for Q1’25 revenue of $665M - $667M (+20.4% YoY) meets expectations, but growth is moderating.

S&M/revenue fell -3.4 PPs YoY but remains high at 36.7%.

R&D/revenue up +1.4 PPs YoY to 16.2%, supporting innovation but impacting margins.

G&A/revenue slightly down -0.3 PPs YoY to 5.9%, reflecting stable cost management.

🔴 Negative

Net new ARR fell -29.7% YoY to $80M, signaling slowing customer expansion.

Customer acquisition cost (CAC) payback period increased +17.8 months YoY to 45.1 months.

R&D Index (RDI) declined -0.82 YoY, suggesting slower efficiency improvements.

Stock-based compensation (SBC) climbed to 27% of revenue, up +1.7 PPs QoQ.

Basic shares up +3.2% YoY, leading to potential dilution concerns.

Federal contracts remain lumpy, impacting short-term revenue predictability.

Large deal scrutiny increasing, causing longer sales cycles and delays in decision-making.