Zscaler Q3 2024 Earnings Analysis

Dive into $ZS Zscaler’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$628.0M rev (+26.4% YoY, +30.3% LQ) beat est by 3.6%

↘️GM* (80.6%, -0.2 PPs YoY)🟡

↗️Operating Margin* (21.4%, +3.3 PPs YoY)

↗️FCF Margin (46.5%, +1.2 PPs YoY)🟢

↗️EPS* $0.77 beat est by 22.2%

*non-GAAP

Key Metrics

↘️DBNR 114% (115% LQ)

➡️RPO $4.41B (+26.4% YoY)🟡

➡️Billings $517M (+13.2% YoY)🟡

Customers

➡️3,165 >$100k+ customers (+16.9% YoY, +65)🔴

➡️585 $1M+ customers (+25.0% YoY, +18)

➡️65 $5M+ customers (+5)

Operating expenses

↘️S&M*/Revenue 38.4% (-3.5 PPs YoY)

↗️R&D*/Revenue 15.2% (+0.6 PPs YoY)

↘️G&A*/Revenue 5.7% (-0.5 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $140M (-15.8% YoY)

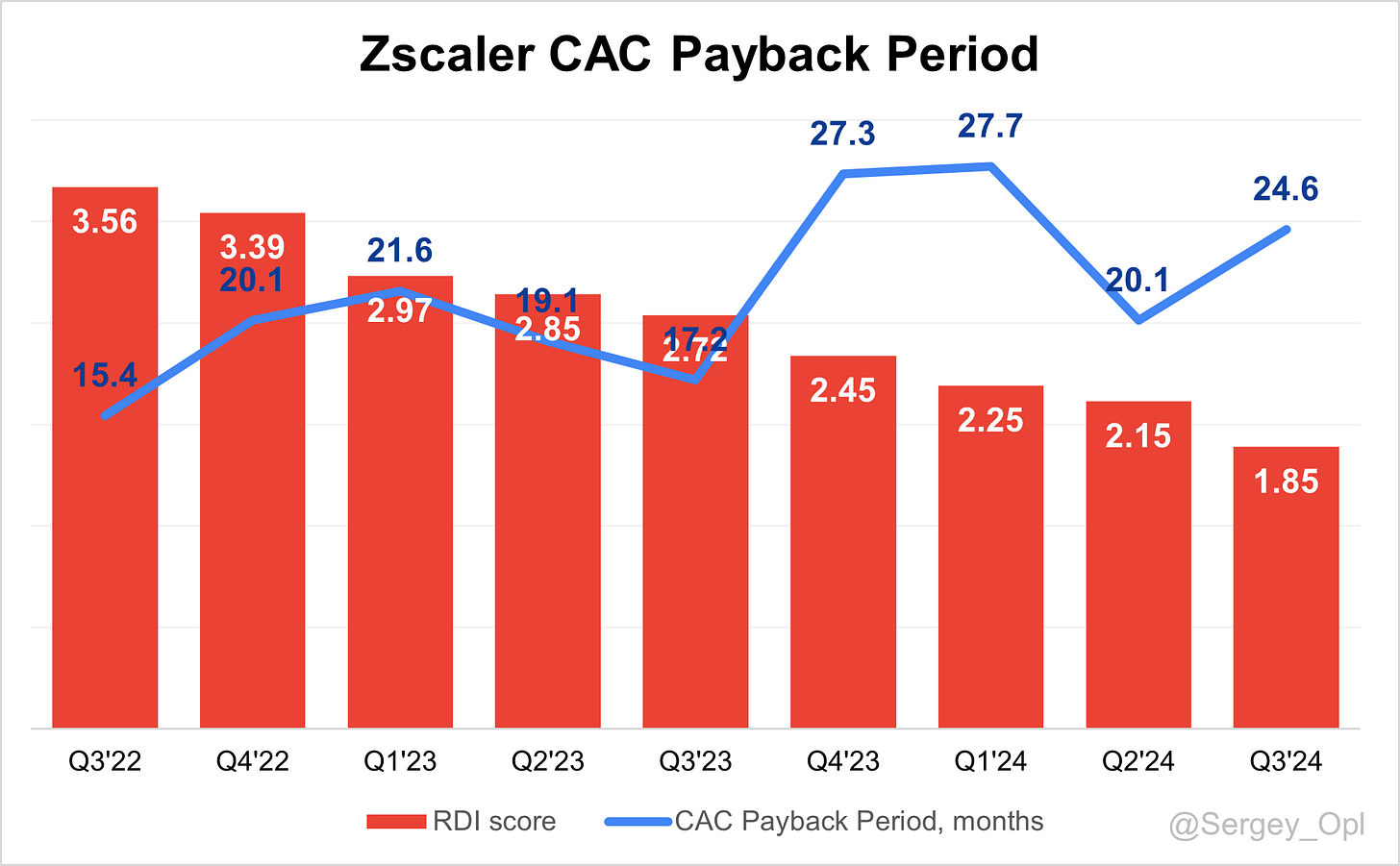

↗️CAC* Payback Period 24.6 Months (+7.4 YoY)🟡

↘️R&D* Index (RDI) 1.85 (-0.86 YoY)🟡

Dilution

↗️SBC/rev 26%, +0.4 PPs QoQ

↘️Basic shares up 3.3% YoY, -0.1 PPs QoQ

↘️Diluted shares up 1.8% YoY, -0.3 PPs QoQ

Guidance

➡️Q4'24 $633.0 - $635.0M guide (+20.8% YoY) in line with est

↗️$2,623.0 - $2,643.0M FY guide (+21.5% YoY) raised by 0.9% beat est by 0.9%

Key points from Zscaler’s Third Quarter 2024 Earnings Call:

Financial Performance

Zscaler reported exceptional Q1 2025 results, with revenue of $628 million, representing a 26% year-over-year increase. Billings grew 13% year-over-year to $517 million, supported by a 20% increase in unscheduled billings. Operating profit rose 50% year-over-year, with an operating margin of 21%, a new quarterly record.

Gross margin held steady at 80.6%, and free cash flow margin surged to 46%, showcasing operational efficiency. Remaining performance obligations (RPO) grew 26% to $4.41 billion, with 49% classified as current.

Product Innovations

Zscaler’s focus on innovation has driven rapid adoption of AI-powered analytics, workload protection, ZDX, and Zero Trust SD-WAN. Emerging products now account for mid-20% of new and upsell business, up from 22% last year, and are growing twice as fast as core products.

The company launched ZDX CoPilot and ZDX AI Agent for automating root cause analysis and improving user performance monitoring. Workload protection and branch segmentation also contributed significantly to ARR, demonstrating traction in large enterprises.

GenAI Security

Demand for securing generative AI applications, such as Microsoft Copilot and ChatGPT, has surged. Zscaler’s GenAI Security leverages its Zero Trust Exchange platform to provide inline visibility and control of sensitive data, processing over 500 billion daily transactions to train its AI models.

A notable seven-figure deal with a Fortune 500 technology services firm highlighted Zscaler's ability to secure AI applications and integrate with Microsoft solutions, reinforcing its leadership in AI-driven security.

Zero Trust Platform

Zscaler’s Zero Trust Exchange continues to replace legacy firewalls and VPNs, reducing cost and complexity while eliminating lateral threat movement. A seven-figure deal with a Fortune 50 retail customer highlighted the platform’s ability to unify security infrastructure and deliver operational simplicity.

The platform is gaining traction in the public sector, securing contracts with 14 of the 15 U.S. cabinet-level agencies and expanding into NATO-friendly countries. Challenges remain in overcoming inertia among customers still reliant on legacy systems, but Zscaler’s focus on cost savings and advanced AI capabilities positions it for sustained adoption.

ZDX (Zscaler Digital Experience)

ZDX plays a key role in Zscaler’s Zero Trust strategy, offering advanced monitoring and automation. A healthcare provider expanded its ZDX deployment to 60,000 users, doubling its annual spend to $5 million.

ZDX CoPilot and AI Agent automate IT operations and resolve performance issues, providing a clear market differentiator. Adoption challenges persist among organizations with less mature IT operations, but growing demand for efficiency supports future growth.

ZPA (Zscaler Private Access)

ZPA accounted for 40% of new and upsell business in Q1, replacing VPNs and legacy DMZ infrastructures. A Fortune 500 insurance company expanded its ZPA deployment to 70,000 users, nearly doubling its annual spend.

Another significant deal involved a global aerospace company securing 100,000 users and 5,000 workloads, demonstrating ZPA’s scalability. Resistance to replacing entrenched VPN systems remains a hurdle, but rising demand for Zero Trust segmentation is driving adoption.

Customer Base Expansion

Zscaler now serves 585 customers with $1 million+ ARR, a 25% year-over-year increase, and 65 customers spending $5 million+ annually. This growth highlights Zscaler's ability to scale within large enterprises.

The public sector remains a strong growth driver, with the company leading in federal adoption and expanding internationally into NATO-friendly regions.

Customer Success Stories

A Fortune 500 insurance company expanded its ZPA deployment from 45,000 to 70,000 users, driving significant cost savings and operational improvements. A global aerospace company adopted Zscaler’s Zero Trust Exchange to secure 100,000 users and 5,000 workloads, transitioning to a cloud-first architecture.

A healthcare provider increased ZDX deployment to 60,000 users, doubling its annual spend. A Fortune 50 retail customer replaced its legacy security setup with Zscaler’s unified platform, achieving cost reduction and improved security. A Global 2000 technology services firm leveraged Zscaler’s AI-powered data protection to secure Microsoft Copilot in a seven-figure deal.

Go-To-Market Strategy

The shift to account-centric selling has improved pipeline quality and close rates. Partnerships with Global System Integrators (GSIs) are driving large deals, particularly in workload protection and branch security. GSIs also play a key role in helping customers modernize security architectures and reduce costs.

Leadership

CFO Remo Canessa announced his retirement after eight years with Zscaler, during which the company scaled from $250 million to over $2.5 billion in ARR. Canessa will remain in his role until a successor is appointed. CEO Jay Chaudhry credited Canessa’s leadership for guiding Zscaler’s financial strategy through its rapid growth phase.

Challenges

Customer scrutiny over large deals, influenced by macroeconomic uncertainties, poses a challenge. Delays in migrating from entrenched legacy systems and confusion created by competitors’ disjointed solutions can slow adoption.

Adoption of emerging products, such as ZDX and Zero Trust SD-WAN, is slower in organizations with less advanced IT infrastructures. Federal sector growth is constrained by lengthy procurement processes, while investments in AI infrastructure are expected to raise CapEx by 3 percentage points of revenue in fiscal 2025.

Future Outlook

Zscaler projects full-year revenue between $2.623 billion and $2.643 billion, a 21%-22% year-over-year increase, and billings of $3.124 billion–$3.149 billion, a 19%-20% increase. Q2 revenue guidance stands at $633 million–$635 million, reflecting 21% year-over-year growth.

The company aims to achieve $5 billion in ARR, supported by strong demand for Zero Trust and AI-powered solutions. Free cash flow margins are expected to remain robust at 23.5%-24%, despite increased CapEx for AI infrastructure upgrades. Strategic investments and growing adoption position Zscaler for sustained leadership in cybersecurity.

Management comments on the earnings call.

Product Innovations

Jay Chaudhry, Chairman and CEO

"Our innovations in AI-powered tools like ZDX CoPilot and ZDX AI Agent are automating IT operations and driving significant value for our customers. Emerging products, now growing twice as fast as our core offerings, are helping us secure seven-figure deals and expand our footprint in large enterprises."

Zero Trust Platform

Jay Chaudhry, Chairman and CEO

"Our Zero Trust Exchange is enabling organizations to modernize their IT environments by replacing legacy firewalls and VPNs. By reducing cost and complexity while delivering enhanced security, we continue to drive substantial customer wins across industries, including the public sector and Fortune 50 companies."

GenAI Security

Jay Chaudhry, Chairman and CEO

"The rise of generative AI applications like Microsoft Copilot has created a critical need for secure data protection. Leveraging over 500 billion daily transactions, our GenAI Security solutions ensure that sensitive data is safeguarded while enabling enterprises to adopt AI responsibly."

Competitors

Jay Chaudhry, Chairman and CEO

"Legacy vendors are struggling to match our cloud-native approach. Their disjointed solutions, often disguised as platforms, create confusion and add complexity, while we focus on unified security architectures that simplify operations and eliminate lateral threat movement."

Customers

Jay Chaudhry, Chairman and CEO

"Our ability to grow the number of $5 million-plus customers by 25% year-over-year underscores the trust enterprises place in our platform. From securing Fortune 500 insurance companies to transforming IT environments for healthcare providers, our solutions deliver measurable value and operational efficiency."

Go-To-Market Strategy

Jay Chaudhry, Chairman and CEO

"Our shift to account-centric selling is paying off with higher close rates, stronger pipelines, and deeper engagements with customers. Partnerships with Global System Integrators are further amplifying our ability to deliver value at scale and help enterprises modernize their security architectures."

International Growth

Jay Chaudhry, Chairman and CEO

"With Zero Trust becoming a priority for governments worldwide, we are leveraging our success in the U.S. federal market to expand into NATO-friendly nations and beyond. Our ability to meet stringent regulatory requirements positions us as a trusted partner in international markets."

Challenges

Jay Chaudhry, Chairman and CEO

"While enterprises recognize the need for modernization, inertia around legacy systems and lengthy procurement cycles in the public sector remain hurdles. However, our ability to demonstrate cost reductions and security enhancements helps us overcome these barriers."

Future Outlook

Jay Chaudhry, Chairman and CEO

"Our guidance reflects confidence in our pipeline and execution. With strong demand for AI-powered solutions and Zero Trust architectures, we are well-positioned to achieve $5 billion in ARR, solidifying our leadership in cybersecurity."

Thoughts on Zscaler ER $ZS:

🟢 Pros:

Revenue rose by +26.4% YoY, a decline from +30.3% last quarter. If the company exceeds its forecast in a similar fashion, revenue growth will stabilize at +25.3%, which indicates consistent performance.

DBNR (Dollar-Based Net Retention Rate) is at 114%, a strong metric, though slightly down from 115% last quarter.

The company is improving margins and profitability, with a record Free Cash Flow (FCF) margin and strong Operating Margin.

Q3 revenue guidance was beaten by +3.6%, and full-year guidance has been raised by +1%.

R&D expenses as a percentage of revenue have increased, while SG&A expenses have decreased, showing that the company is investing in product improvements.

RPO growth is at +26.4%, slightly higher than last quarter and aligned with revenue growth. Deferred revenue growth at +27.5% also exceeds revenue growth.

ZPA (Zscaler Private Access) accounted for 40% of new and upsell business, highlighting its importance in the product portfolio.

🔴 Cons:

Customer growth with $100k+ ARR added was +65, the lowest growth recorded.

Billings growth slowed significantly to +13%, which is below revenue growth.

🟡 Neutral:

Gross margin slightly decreased compared to the previous quarter.

Net New ARR added was weak at +140, representing a -16% YoY decline.

Weak growth in customers with $1M+ ARR, with +18 added, roughly the same as last year’s +19.

SBC/Revenue (Stock-Based Compensation as a percentage of revenue) remains high at 26%, with basic shares up +3.3% YoY.