Zscaler Q2 2024 Earnings Analysis

Dive into $ZS Zscaler’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$592.9M rev (+30.3% YoY, +32.1% LQ) beat est by 4.4%

↗️GM* (81.1%, +0.5 PPs YoY)

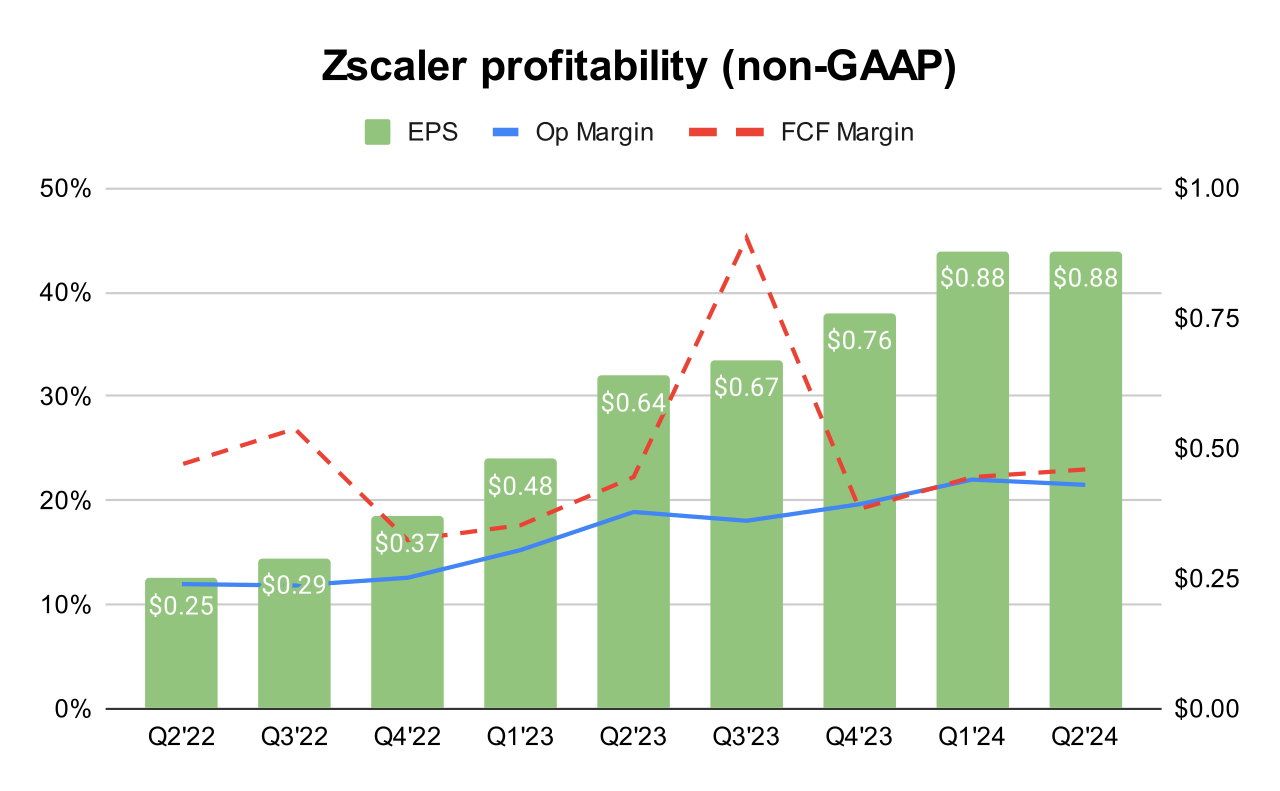

↗️Operating Margin* (21.5%, +2.6 PPs YoY)

↗️FCF Margin (23.0%, +0.7 PPs YoY)

↗️EPS* $0.88 beat est by 27.5%🟢

*non-GAAP

Key Metrics

↘️DBNR 115% (116% LQ)

➡️RPO $4.42B (+26.0% YoY)🟡

➡️Billings $911M (+27.0% YoY)🟡

Customers

↗️3,100 >$100k+ customers (+19.0% YoY, +178)

➡️567 $1M+ customers (+26.0% YoY, +44)

➡️60 $5M+ customers (+40.0% YoY, +10)

Operating expenses

↘️S&M*/Revenue 39.4% (-2.9 PPs YoY)

↗️R&D*/Revenue 14.3% (+0.7 PPs YoY)

↗️G&A*/Revenue 6.1% (+0.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $159M (+9.7% YoY)

↘️CAC* Payback Period 20.1 Months (27.7 LQ)

Dilution

↗️SBC/rev 25%, +3.2 PPs QoQ

↗️Basic shares up 3.5% YoY, +0.1 PPs QoQ

↘️Diluted shares up 2.0% YoY, -0.7 PPs QoQ

Guidance

↗️Q3'24 $604.0 - $606.0M guide (+21.8% YoY) beat est by 0.4%

➡️$2,600.0 - $2,620.0M FY guide (+20.4% YoY) in line with est

Key points from Zscaler’s Second Quarter 2024 Earnings Call:

Strong Financial Performance:

Revenue Growth 30% year-over-year in Q4, reaching $593 million. The full-year revenue grew by 34%. Billings Growth 27% year-over-year in Q4, with quarterly bookings exceeding $1 billion.

GenAI Security:

This new offering was launched earlier in the fiscal year to help customers harness the productivity benefits of generative AI technologies while ensuring robust data security. The GenAI Security solution enables visibility, access control, and enforcement of data protection policies to prevent sensitive data leaks.

AI Analytics:

Zscaler has integrated AI-driven analytics into its platform, contributing to new and upsell business growth. The analytics solutions, including unified vulnerability management and risk insights, have gained strong traction among customers. The AI analytics contributed nearly 3 points to the new and upsell business growth in Q4 and two points for the entire fiscal 2024, despite some products being available only part of the year.

Emerging Products:

These contributed approximately 22% of new and upsell business in fiscal 2024, up from 18% the previous year. The emerging products portfolio includes Zero Trust for workloads, Zero Trust SD-WAN, and Zero Trust segmentation. These products are driving meaningful wins and are expected to grow to mid-20s in contribution in fiscal 2025.

Zero Trust for Branch and Cloud:

This solution includes Zero Trust SD-WAN and Zero Trust for workloads. It is designed to protect on-prem applications and eliminate the need for traditional firewalls at manufacturing sites, effectively making each site "like a Starbucks" in terms of security.

Unified Vulnerability Management:

Acquired through the purchase of Avedore, this solution combines enterprise security data with Zscaler's proprietary log data from daily transactions to deliver real-time actionable insights for improving overall security posture.

ZDX and ZPA:

ZDX is increasingly integrated into larger deals as part of Zscaler’s broader platform. It has been particularly useful for clients who started with ZIA (Zscaler Internet Access) and sought to expand their security solutions.

ZPA has grown significantly, accounting for over 40% of new business between it and ZIA. This growth indicates a strong adoption rate among new and existing customers.

Customer Success Stories

Fortune 500 Industrial Machinery Company:

This new logo win involves the company purchasing Zscaler for users for 100,000 users in a multi-year, seven-figure Annual Contract Value (ACV) deal. This customer had initially chosen a firewall-based SASE solution but later switched to Zscaler after realizing the previous solution allowed lateral threat movement and did not deliver true Zero Trust security.

Fortune 200 Financial Services:

In a significant upsell, this customer initially secured internet and SaaS access with Zscaler and then expanded their purchase to include ZPA (Zscaler Private Access) and ZDX (Zscaler Digital Experience) for 68,000 users. This purchase more than doubled the customer's ARR to nearly $10 million.

American Healthcare Provider:

In another new logo win, this provider purchased multiple pillars of Zscaler's platform, including ZIA (Zscaler Internet Access) transformation, Data Protection Advanced, and ZDX for 124,000 users in a multi-year, eight-figure Total Contract Value (TCV) deal. Data protection capabilities were crucial in securing this deal.

Customer Base Growth:

Zscaler ended the fiscal year with 567 customers with over $1 million in ARR each, and over 60 customers spending $5 million plus annually. This growth speaks to the strategic role Zscaler plays in digital transformation journeys for major enterprises.

Large Enterprise Focus:

The company continues to deepen relationships with Global 2000 and Fortune 500 companies, now serving 35 percent of Global 2000 companies and more than 40 percent of Fortune 500 companies.

Go-To-Market Strategy:

Zscaler reported improvements in sales organization performance, marked by lower than expected attrition and a strong hiring quarter. The company plans to continue hiring sales reps at a robust pace and expects attrition to further improve in fiscal 2025.

Competitive Outlook:

Zscaler emphasized its differentiated offering based on its robust cloud security platform, especially highlighting its resilience and reliability in the wake of recent outages experienced by competitors like Microsoft and CrowdStrike. Zscaler’s ability to deliver seamless security services without interruptions positions it favorably against both legacy providers and new entrants in the cybersecurity space.

Future Outlook:

Zscaler plans to continue investing in product innovation, particularly in emerging areas like AI analytics and Zero Trust solutions for applications, workloads, and IoT/OT devices. With an addressable market estimated at $96 billion, Zscaler is optimistic about capturing significant market share.

Management comments on the earnings call.

Product Innovations

Jay Chaudhry, CEO: "Using our GenAI Security, customers can gain visibility, apply access control and enforce data protection policies to prevent their sensitive data from leaking."

Jay Chaudhry, CEO: "Our AI analytics solution including unified vulnerability management, risk 360, business insights are seeing strong traction. AI analytics contributed nearly 3 points to new and up sub business growth in Q4."

Competitors

Jay Chaudhry, CEO: "The gap between our offering and what I call so would be competitors is growing bigger and bigger. So I have to be very bullish and comfortable with the platform and the gap we are creating with other competitors."

Customers

Jay Chaudhry, CEO: "In a new logo win, a top 10 Fortune 500 Industry Machinery Company purchased Zscaler for users for 100,000 users in a multi-year 7 figure ACV deal."

Future Outlook

Jay Chaudhry, CEO: "We enter fiscal 2025 with a stronger go to market machine, increased pace of R and D innovation, strong adoption of our emerging products and high levels of customer satisfaction with an NPS score of over 70."

Jay Chaudhry, CEO: "With our customer obsession, expanding platform and a large addressable market, I expect another strong year which will move us closer to our goal of $5,000,000,000 in ARR."

Thoughts on Zscaler ER $ZS:

🟢Pros:

+ Revenue rose by +30.3% YoY; if the company beats the forecast similarly, revenue growth will be 27.6%.

+ DBNR at 115%, a slight decrease from last quarter.

+ Strong customer growth with $1M+ ARR added: +44.

+ Strong customer growth with $5M+ ARR +10, 40% YoY.

+ Company increasing margins and profitability.

+ Beat Q2 revenue guidance by 4.6%.

+ Solid Net New ARR added: (+159, +10% YoY).

+ New products contributed approximately 22% of new and upsell business in fiscal 2024.

🟡Neutral:

+- SBC/rev at 25%, Basic shares up 3.5% YoY.

+- Billings and RPO growth at 27%, lower than revenue growth, but RPO growth stabilized at last quarter's level.

+- Q3 guidance: +2.2% QoQ, which is lower than last year's forecast of +4.2%; revenue growth is still slowing down.