Zscaler Q1 2025 Earnings Analysis

Dive into $ZS Zscaler’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$678.0M rev (+22.6% YoY, +23.4% LQ) beat est by 1.8%

↘️GM* (80.3%, -1.1 PPs YoY)🟡

↘️Operating Margin* (21.6%, -0.4 PPs YoY)🟡

↘️FCF Margin (17.6%, -4.6 PPs YoY)🟡

↘️Net Margin (-0.6%, -4.1 PPs YoY)🟡

↗️EPS* $0.84 beat est by 10.5%

*non-GAAP

Key Metrics

↘️DBNR 114% (115% LQ)

↗️RPO $4.98B (+30.2% YoY)🟢

↗️Billings $785M (+24.9% YoY)🟢

Customers

➡️3,363 >$100k+ customers (+15.1% YoY, +72)

➡️643 $1M+ customers (+22.9% YoY, +23)

Regional Breakdown

↗️United States $343.0M rev (+22.9% YoY, 51% of Rev)

↘️EMEA $203.0M rev (+18.9% YoY, 30% of Rev)

↗️APAC $107.4M rev (+28.2% YoY, 16% of Rev)

↗️Other $24.7M rev (+26.0% YoY, 4% of Rev)

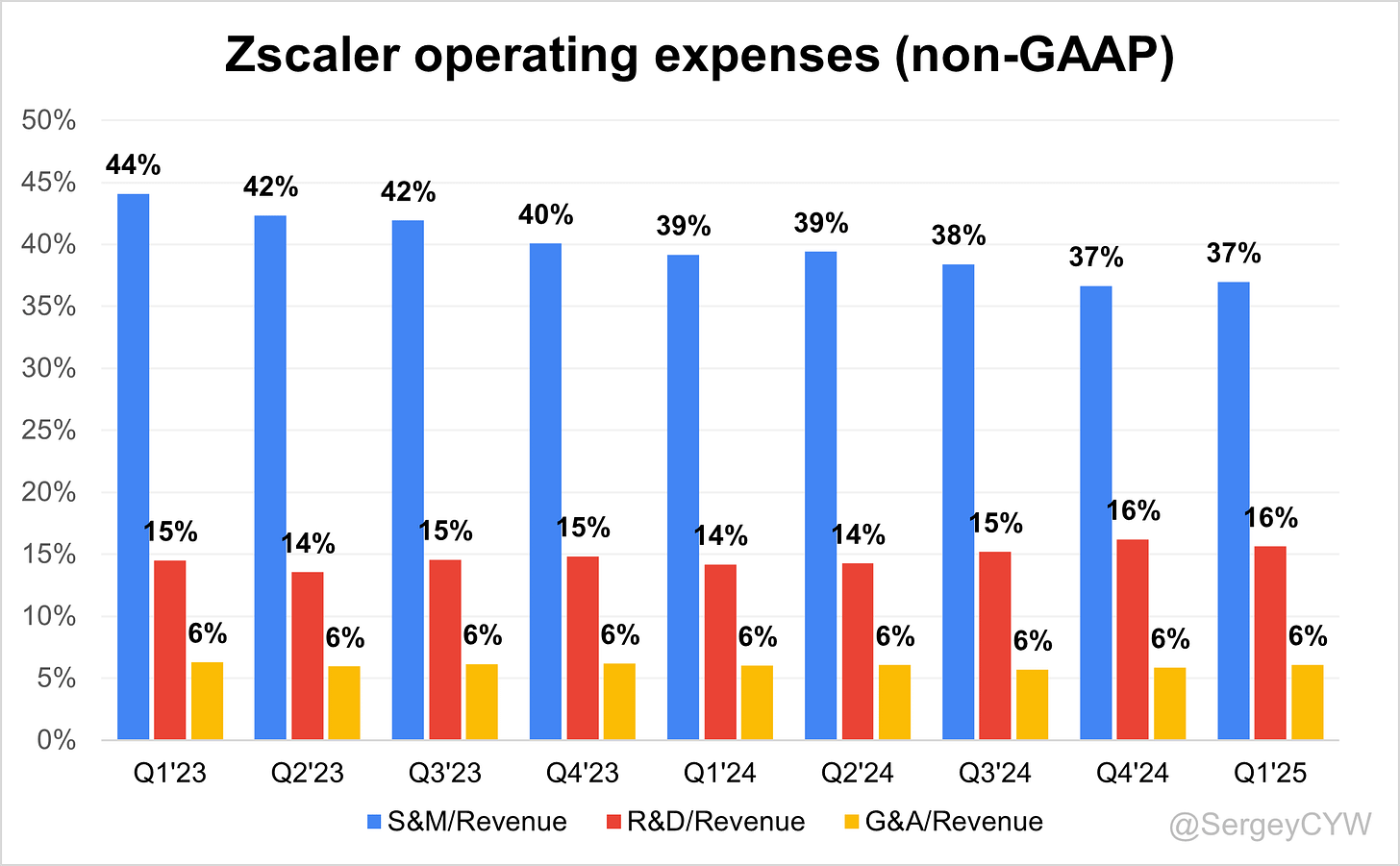

Operating expenses

↘️S&M*/Revenue 37.0% (-2.2 PPs YoY)

↗️R&D*/Revenue 15.6% (+1.4 PPs YoY)

↗️G&A*/Revenue 6.1% (+0.1 PPs YoY)

Quarterly Performance Highlights

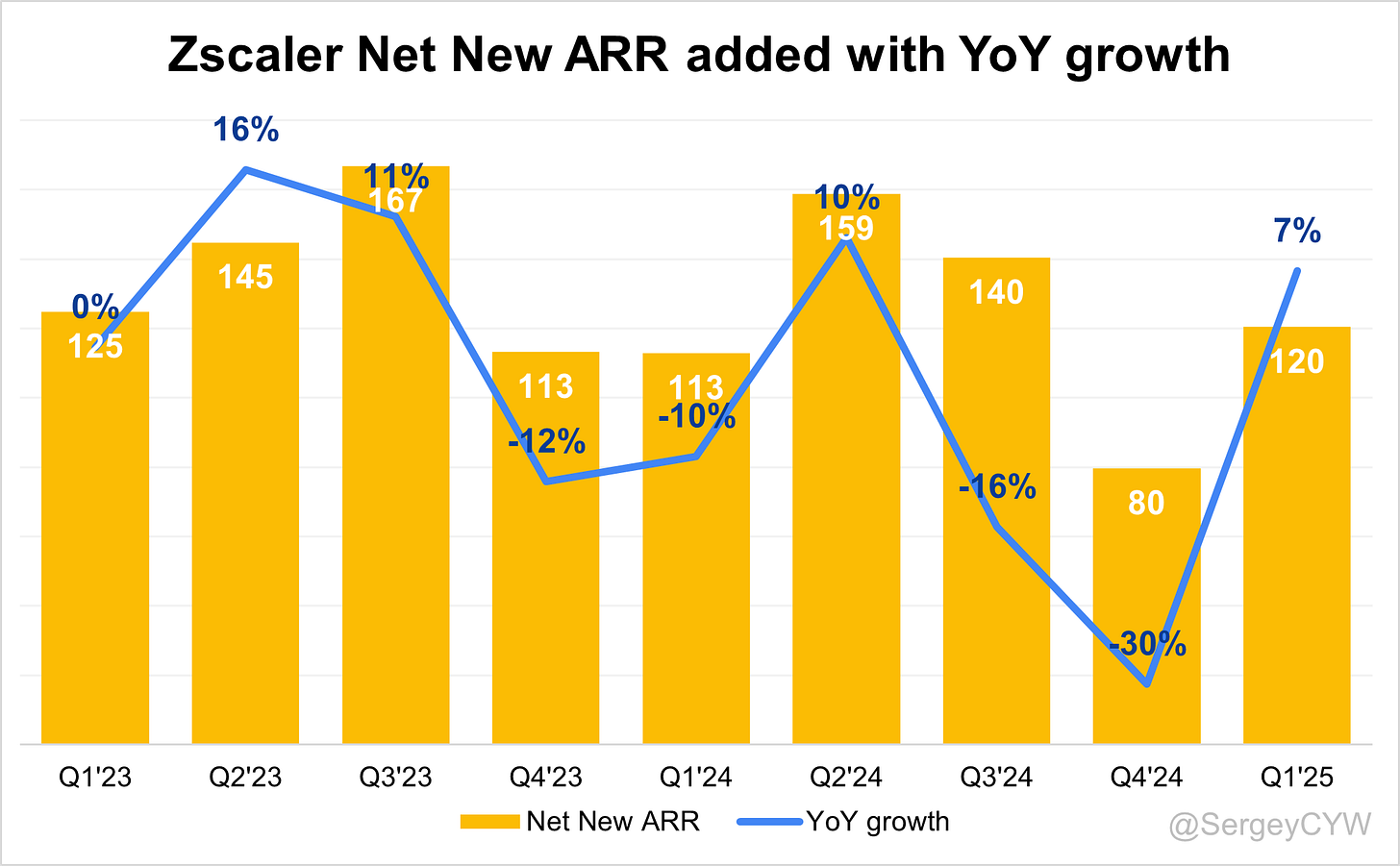

↗️Net New ARR $120M (+6.7% YoY)

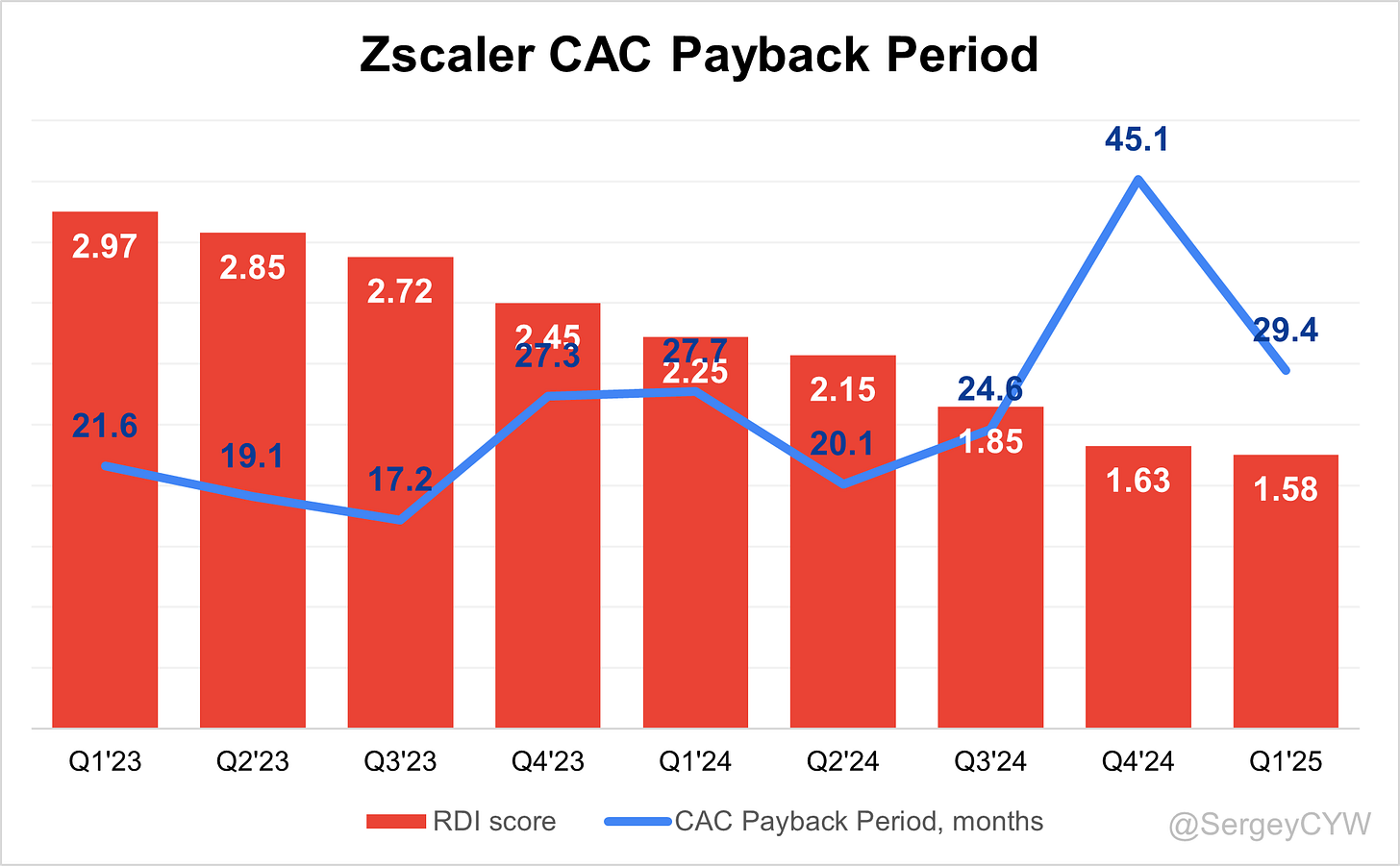

↗️CAC* Payback Period 29.4 Months (+1.7 YoY)🟡

↘️R&D* Index (RDI) 1.58 (-0.68 YoY)🟡

Dilution

↘️SBC/rev 25%, -2.5 PPs QoQ

↘️Basic shares up 3.1% YoY, -0.1 PPs QoQ

↗️Diluted shares up 2.3% YoY, +0.2 PPs QoQ

Guidance

➡️Q2'25 $705.0 - $707.0M guide (+19.1% YoY) in line with est

↗️$2,659.0 - $2,661.0M FY guide (+22.7% YoY) raised by 0.3% beat est by 0.4%

Key points from Zscaler’s First Quarter 2025 Earnings Call:

Financial Performance

Zscaler exceeded expectations in Q3 FY25. Revenue reached $678 million, up 23% YoY and 5% QoQ. Annual Recurring Revenue (ARR) hit $2.9 billion, maintaining 23% YoY growth for the third consecutive quarter and is on track to surpass $3 billion in Q4.

Total billings climbed to $785 million, up 25% YoY, driven by strong growth in unscheduled billings. Free Cash Flow margin was 18%, with full-year guidance raised to 25.5%–26%. Operating margin held steady at 22% YoY. Dollar-Based Net Retention Rate stood at 114%, with management cautioning that larger upfront bundles may compress this metric.

Platform Growth

The platform now protects over 50 million users, handles 100 trillion transactions annually, blocks 60 billion threats, and enforces 5 trillion policies. It ingests 20 petabytes of telemetry data per day, creating strong network effects and AI advantages.

Zscaler continues to win multi-product deals. A Fortune 500 tech customer expanded ARR by 40% to $19 million under the new Z-Flex model, which enables modular adoption. Platform complexity is rising, but execution is supported by dedicated takeoff teams for newer products.

ZPA Expansion

ZPA remains central to Zscaler’s Zero Trust user strategy. A Fortune 50 automotive firm increased its ARR by 50%+ to over $10 million by expanding ZPA and adding endpoint DLP and privileged access.

ZPA is increasingly sold as part of the integrated Zero Trust Everywhere offering. Adoption is strong in compliance-sensitive industries, and integration with workload and branch protection positions ZPA as more than a VPN replacement.

ZDX Momentum

ZDX bookings grew 70% YoY to $75 million. Key driver: ZDX CoPilot, an AI assistant embedded in the Advanced Plus package. A major U.S. healthcare provider deployed ZDX across 140,000 users in a 7-figure deal, citing CoPilot’s value in accelerating incident resolution.

ZDX is evolving from a monitoring tool to a core ITOps component. Zscaler prioritizes go-to-market speed over gross margin in this phase, with future optimization expected as the product scales.

Zero Trust Everywhere

Customer adoption of full Zero Trust coverage—users, cloud workloads, and branches—rose 60% QoQ, reaching 210+ customers, up from 130. The company targets 390+ by FY26.

Zero Trust Branch is gaining traction. 59% of buyers were new logos. A new plug-and-play branch appliance eliminates the need for SD-WAN, NAC, and firewalls. One enterprise expanded from a 100-branch pilot to 1,000 branches based on operational simplicity and cost efficiency.

Zero Trust Cloud also gained ground with a 7-figure ACV deal in financial services, securing all internal workload traffic and replacing firewalls and VPNs.

Data Security Growth

Data Security ARR exceeded $350 million and is growing faster than the overall company. Key modules include inline DLP, endpoint DLP, SaaS Security, isolation, and DSPM.

A Fortune 100 food & beverage firm (new logo) purchased a 7-figure package including ZPA and multiple DLP modules. A Fortune 50 auto customer now uses 6 of 8 data modules and raised ARR by 50%+ to over $10 million.

Demand for Zscaler’s GenAI security module is accelerating. It governs tools like Copilot and ChatGPT by inspecting prompts and responses, with growing adoption across manufacturing and non-regulated sectors.

Risk360 and AI Operations

Agentic Operations—spanning SecOps and ITOps—delivered 120%+ ACV growth YoY. Modules like Risk360, UVM, ITDR, and CHASM leverage the Avalor-acquired data fabric for real-time correlation.

A U.S. healthcare provider deployed UVM across 400,000 assets, achieving asset visibility in 2 hours, compared to the traditional 6-month cycle.

The Red Canary acquisition will add MDR capabilities and an agentic AI engine to strengthen Zscaler’s SecOps position and accelerate its move into the full SOC stack.

Innovation Pipeline

Zscaler continues to prioritize AI-driven product launches. Key innovations include:

Unified Branch Appliance combining routing and segmentation

LLM Proxy securing private AI models from injection and leakage

Expansion of ZDX and SecOps Copilots for intelligent automation

Initial focus is on adoption, with margin optimization expected post-scale.

Red Canary Acquisition

Zscaler will acquire Red Canary for $675 million in cash plus equity, closing by August 2025. The deal is expected to be margin-neutral in FY26.

Red Canary adds a mature MDR platform, skilled detection engineers, and an in-production agentic AI engine. Zscaler expects to retain ~50% of Red Canary’s $140 million ARR, targeting strategic enterprise accounts.

Enterprise Adoption

Zscaler now has 642 customers with $1 million+ ARR and 3,363 with $100K+ ARR. Unscheduled billings grew in the high 20% YoY, and new logo ACV rose over 40% YoY.

Z-Flex contributed $65 million+ in TCV, and more deals now span 4–5 years, versus the historical 3-year standard.

Customer Highlights

Fortune 500 Tech: Increased ARR 40% to $19M, adding threat hunting, segmentation, and data modules.

Fortune 50 Auto: Expanded by 50%+ to over $10M, with endpoint DLP, PRA, and 6/8 data modules.

U.S. Healthcare: Bought ZDX for 140,000 users in a 7-figure deal; also deployed UVM for 400,000 assets.

Fortune 100 F&B: New logo, 7-figure ZPA and data security deal, driven by GenAI risk management.

Financial Institution: Secured all internal workload traffic via Zero Trust Cloud in a 7-figure land deal.

Government Expansion

Zscaler is deployed in 14 of 15 U.S. Cabinet agencies. Q3 results were in line, with no material Q4 uplift expected. Budget pressures favor Zscaler’s ability to eliminate firewall and VPN costs.

Leadership Change

Kevin Rubin will succeed Remo Canessa as CFO post-FY25. Rubin brings deep experience in data analytics, aligning with Zscaler’s AI-first growth strategy. He sees Zscaler as a leader in AI-powered security transformation.

Market Conditions

Macro conditions remain tight, with large deal scrutiny. However, Zscaler noted no April/May slowdown, bucking peer trends. Security remains a priority, especially for Zero Trust and GenAI-related initiatives.

Outlook

Q4 FY25 guidance:

Revenue: $705M–$707M (+19% YoY)

Gross Margin: ~80%

Operating Profit: $152M–$154M

EPS: $0.79–$0.80

Full-year FY25:

Revenue: $2.659B–$2.661B (+23% YoY)

Billings: $3.184B–$3.189B (+21%–22% YoY)

Operating Profit: $573M–$575M

Free Cash Flow Margin: 25.5%–26%

From FY26, Zscaler will transition to ARR-based guidance, reflecting the shift toward long-term platform commitments. Management reaffirmed the growth path to $5 billion in ARR.

Management comments on the earnings call.

Product Innovations

Jay Chaudhry, Chairman and Chief Executive Officer

"We are constantly expanding our core Zero Trust Exchange by integrating new functionality to solve more and more of our customers' security concerns."

Jay Chaudhry, Chairman and Chief Executive Officer

"With the increasing adoption of GenAI and SaaS applications, data security is now becoming important to all industries… We are expanding the functionality of our Zero Trust Exchange with an LLM proxy to analyze prompt queries to detect and prevent prompt injections and other malicious activities."

Jay Chaudhry, Chairman and Chief Executive Officer

"Leveraging our scale, we are building new security operational solutions, Copilots, and Agentic AI solutions that will be showcased at our upcoming Zenith Live conferences."

Zscaler Platform

Jay Chaudhry, Chairman and Chief Executive Officer

"Our strong Q3 results demonstrate growing demand for our platform and continued improvement in our sales productivity… We are proud of achieving these strong top-line results at scale while delivering strong profitability."

Jay Chaudhry, Chairman and Chief Executive Officer

"Zscaler’s Zero Trust Exchange platform sits in line for enterprise communications. Every time we secure a user from a new attack, we apply that protection for all users of our platform, creating a flywheel for improving security."

Jay Chaudhry, Chairman and Chief Executive Officer

"The millions of users, workloads, and IoT/OT devices on our platform result in over 500 billion transactions, generating over 20 petabytes of high-fidelity data per day."

ZPA

Jay Chaudhry, Chairman and Chief Executive Officer

"With Zero Trust, we connect only the authorized party to the authorized application. While legacy vendors are attempting to cobble together disjointed point products and calling it a platform, we are expanding our Zero Trust Exchange."

ZDX

Jay Chaudhry, Chairman and Chief Executive Officer

"ZDX CoPilot helps lower the mean time to resolution of service tickets, and its capabilities are becoming a key differentiator for us."

Remo Canessa, Chief Financial Officer

"Since the launch of ZDX CoPilot a year ago, bookings for ZDX Advanced Plus grew over 70% year over year to nearly $75 million."

Zero Trust Everywhere

Jay Chaudhry, Chairman and Chief Executive Officer

"We are seeing tremendous success as more customers are becoming Zero Trust Everywhere enterprises by embracing Zero Trust for users, branches, and cloud."

Jay Chaudhry, Chairman and Chief Executive Officer

"Last quarter, we shared our goal to triple the number of Zero Trust Everywhere customers from over 130 to over 390 by the end of fiscal 2026. I'm pleased to share that we ended Q3 with over 210, which is over 60% quarter-over-quarter growth."

Risk360

Jay Chaudhry, Chairman and Chief Executive Officer

"Our SecOps solution, built on the data fabric technology we acquired last year, is gaining traction, and it drove over 120% year-over-year growth in SecOps ACV."

Jay Chaudhry, Chairman and Chief Executive Officer

"The customer told me that UVM gave them an accurate asset inventory within two hours, which is a dramatic reduction from the six months it would have taken them otherwise."

Competitors

Jay Chaudhry, Chairman and Chief Executive Officer

"While legacy vendors are attempting to cobble together disjointed point products and calling it a platform, we are expanding our Zero Trust Exchange."

Jay Chaudhry, Chairman and Chief Executive Officer

"Customers dislike ELAs. They know that ELAs often become shelfware. So we really don't like to push ELA."

Customers

Jay Chaudhry, Chairman and Chief Executive Officer

"Three customers told me this week alone that they're becoming third-time customers for Zscaler. That’s relationships. That’s what they’re proud of."

Jay Chaudhry, Chairman and Chief Executive Officer

"Oftentimes customers are saying, ‘I want to open a new branch office in two days rather than two months.’ Zscaler can make it happen."

Jay Chaudhry, Chairman and Chief Executive Officer

"Many customers, including a Fortune 100 food and beverage company, a leading fleet management company, and a large federal customer, purchased our GenAI data security module."

Strategic Partnerships

Jay Chaudhry, Chairman and Chief Executive Officer

"The acquisition of Red Canary will allow us to expand into SAW categories of Managed Detection and Response, or MDR, and Threat Intel."

Jay Chaudhry, Chairman and Chief Executive Officer

"We are acquiring a seasoned go-to-market team that knows how to sell SOC solutions. This will act as our second specialist team working closely with our broader Zscaler sales organization."

Government Expansion

Jay Chaudhry, Chairman and Chief Executive Officer

"Federal customers want to cut costs. The biggest cost in the security space is firewall and legacy-type vendors. If I can go and take a lot of cost out of it by removing a lot of those products, it actually works in our favor."

Remo Canessa, Chief Financial Officer

"We are in 14 of the 15 Cabinet agencies. But again, right now, as Jay mentioned, we came as expected in Q3, and we're not expecting a significant Q4 in that area."

Challenges

Jay Chaudhry, Chairman and Chief Executive Officer

"Overall, the spending environment remains challenging. Macro is still tight, and we continue to see large deal scrutiny."

Jay Chaudhry, Chairman and Chief Executive Officer

"Even in cyber, the two areas that are high priority are Zero Trust Architecture and securing the use of AI. If your project involves one of these and delivers cost savings, the deal can get done."

Future Outlook

Jay Chaudhry, Chairman and Chief Executive Officer

"With a strong go-to-market machine and strong momentum in Zero Trust Everywhere and AI security, I am more excited than ever about our continued growth to $5 billion or more in ARR."

Kevin Rubin, Incoming Chief Financial Officer

"I believe with its expanding platform, Zscaler is well positioned to benefit in an increasingly AI-driven enterprise security market. With my background in data analytics, I am strongly aligned with Jay’s vision."

Remo Canessa, Chief Financial Officer

"We've talked about it — we’re going to go to ARR in fiscal ’26. I believe going to an ARR metric is the right move going forward. It gives us the opportunity to sell deeper and across more products."

Thoughts on Zscaler Earnings Report $ZS:

🟢 Positive

Revenue grew to $678M, up +22.6% YoY, beating estimates by 1.8%

EPS (non-GAAP) of $0.84, beat estimates by 10.5%

Billings rose to $785M, up +24.9% YoY

RPO reached $4.98B, up +30.2% YoY

ARR hit $2.9B, with consistent +23% YoY growth, tracking toward $3B+ in Q4

ZDX bookings up +70% YoY to $75M

SecOps ACV up +120% YoY driven by Risk360 and UVM adoption

Fortune 500 tech customer expanded ARR +40% to $19M

Fortune 50 auto customer expanded ARR +50%+ to over $10M

New logo ACV up +40% YoY

Z-Flex added over $65M in TCV

APAC revenue up +28.2% YoY

🟡 Neutral

Dollar-Based Net Retention Rate at 114%, down 1 point QoQ due to larger bundled deals

Gross Margin (non-GAAP) at 80.3%, down -1.1 pts YoY

Operating Margin (non-GAAP) at 21.6%, down -0.4 pts YoY

Customer count over $1M ARR grew to 643 (+23 YoY)

Customer count over $100K ARR reached 3,363 (+72 QoQ)

S&M expense improved to 37.0% of revenue, down 2.2 pts YoY

R&D investment rose to 15.6% of revenue, up 1.4 pts YoY

Guidance for Q2 revenue $705M–$707M, in line with expectations

Diluted shares up +2.3% YoY

CAC Payback Period increased to 29.4 months, up +1.7 months YoY

R&D Index (RDI) declined to 1.58, down -0.68 YoY

SBC as % of revenue remains high at 25%, though improved QoQ

🔴 Negative

Free Cash Flow Margin declined to 17.6%, down -4.6 pts YoY

Net Margin dropped to -0.6%, down -4.1 pts YoY

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.