Financial Results:

↗️$553.2M rev (+32.1% YoY, +35.4% LQ) beat est by 3.2%

↗️GM* (81.4%, +1.3%pp YoY)

↗️Operating Margin* (22.0%, +6.8%pp YoY)🟢

↗️FCF Margin (22.3%, +4.6%pp YoY)

↗️EPS* $0.88 beat est by 33.3%🟢

*non-GAAP

Key Metrics

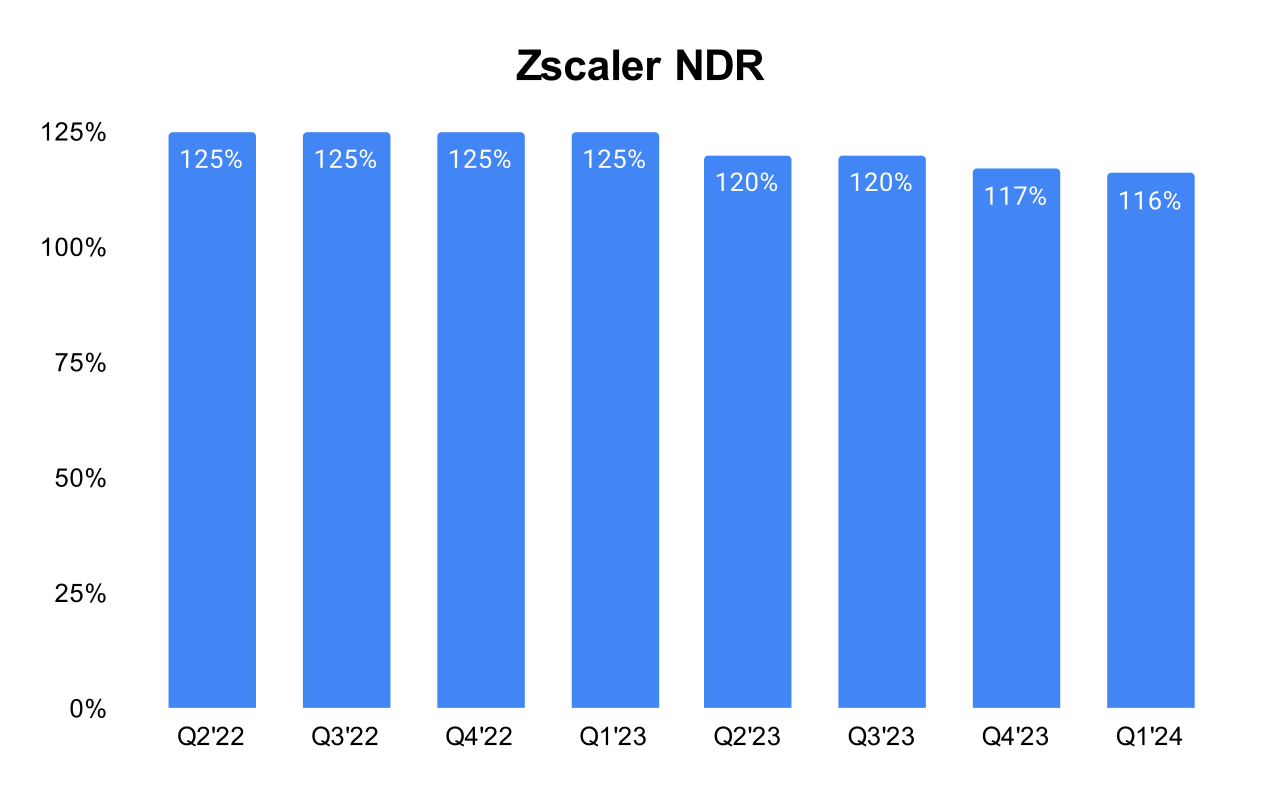

↘️DBNR 116% (117% LQ)

➡️RPO $3.82B (+26.0% YoY)🟡

➡️Billings $628M (+30.0% YoY)🟡

Customers

➡️2,922 >$100k+ customers (+20.0% YoY, +102)

➡️523 $1M+ customers (+31.0% YoY, +26)

↗️50 $5M+ customers (+43.0% YoY)

Operating expenses

↘️S&M*/Revenue 39.2% (40.1% LQ)

↘️R&D*/Revenue 14.2% (14.8% LQ)

↘️G&A*/Revenue 6.0% (6.2% LQ)

↘️Net New ARR $113M ($113 LQ)

↗️CAC* Payback Period 27.5 Months (27.3 LQ)

Dilution

↘️SBC/rev 22%, -5.8%pp QoQ

↗️Basic shares up 3.4% YoY, +0.3%pp QoQ

↘️Diluted shares up 2.7% YoY, -0.2%pp QoQ

Guidance

➡️Q2'24$565.0 - $567.0M guide (+24.4% YoY) in line with est

↗️$2,140.0 - $2,142.0M FY guide (+32.4% YoY) raised by 0.9% beat est by 1.0%

Key points from Zscaler's First Quarter 2024 Earnings Call:

Financial Performance:

Zscaler reported a strong financial quarter, with revenue growing by 32% year-over-year to $553 million, and billings growing by 30%. The company also reported its first quarter of GAAP profitability on a net income basis.

Customer Engagement and Growth:

Zscaler reported significant growth in its customer base, with 523 customers now exceeding $1 million in annual recurring revenue (ARR), a 31% increase year-over-year.

The company has successfully expanded its footprint in existing accounts, evidenced by several multi-million dollar upsell deals. These deals often involve multiple product pillars, indicating a deeper integration of Zscaler's solutions into customer operations.

Zscaler’s emphasis on developing relationships at the CXO level has been crucial.

Product Innovations and Enhancements:

AI-powered ZDX Co-pilot: This new feature within ZDX aims to simplify and automate the detection and resolution of performance issues.

Data Security Posture Management (DSPM): Introduced as part of the data protection initiatives, DSPM helps discover, classify, and protect sensitive data in public clouds, strengthening Zscaler’s cloud security offerings.

GenAI App Security: This new product provides deep visibility and granular controls for GenAI applications, ensuring that data protection policies are enforced and sensitive data is safeguarded.

Zscaler Private Access (ZPA):

ZPA has been a key component in driving the adoption of Zscaler's Zero Trust solutions. It allows secure remote access to internal applications without the need for a traditional VPN, thus minimizing the attack surface.

Recent vulnerabilities in VPN solutions have heightened interest in ZPA, as it provides a more secure and modern alternative to VPNs, especially highlighted by increased deployments following high-profile VPN vulnerabilities.

Zscaler Digital Experience (ZDX):

ZDX continues to evolve with the integration of AI capabilities, enhancing its ability to monitor and improve the digital experiences of enterprise users across geographically dispersed locations.

Cloud Security Enhancements:

Zscaler’s ongoing commitment to cloud security is evident in its continuous updates and feature additions aimed at enhancing security in cloud environments. This includes the aforementioned DSPM and the broader application of AI in security protocols.

Acquisitions: The integration of acquired technologies and innovations, such as those from the recent acquisitions of Avalor and Airgap Networks, further enhance Zscaler’s cloud security capabilities, particularly in data management and secure branch access.

Risk360:

Zscaler’s Risk360 is an AI-driven solution that provides organizations with a comprehensive risk score, highlighting factors contributing to their security risk and offering actionable recommendations for mitigation.

Sales Leadership and Team Expansion:

Zscaler has appointed Mike Rich as the Chief Revenue Officer.

The company has accelerated the hiring of quota-carrying representatives, especially focusing on increasing this pace following a structured leadership establishment.

Go-to-Market Strategy Adjustments:

Zscaler is shifting its sales approach from opportunity-centric to account-centric. This strategy focuses on deepening relationships with key accounts rather than just expanding the number of opportunities.

The company is actively working with GSI (Global System Integrators) partners to expand market opportunities.

FedRAMP and Government Sector Engagement:

Zscaler emphasized its commitment to the federal market, noting that it is serving 12 of the 15 U.S. cabinet-level agencies.

The company also mentioned a significant contract win with a Department of Defense branch, highlighting a seven-figure Annual Contract Value (ACV) deal, which underscores Zscaler’s growing penetration in the government sector.

Market Opportunity:

Zscaler sees a significant expansion in its total addressable market (TAM) due to its ongoing product innovations and recent acquisitions. The company highlighted that these developments have increased their market opportunity by several billion dollars.

This expansion is fueled by entering new markets such as vulnerability management, security operations, and branch security, each representing substantial growth areas.

The introduction of products like Zero Trust Network Segmentation and innovations in AI and data protection further broaden Zscaler's reach and relevance in the cybersecurity market.

Future Outlook:

Zscaler is optimistic about its growth trajectory, driven by its innovative product offerings and expanded market opportunities. The company has set a target to scale its business to $5 billion in ARR, reflecting confidence in its sales strategies and market demand.

Management comments on the earnings call.

Product Innovations

Jay Chaudhry, CEO: "We introduced the industry's first AI-powered Co-pilot for ZDX, our digital experience monitoring solution. This helps simplify and automate detection and resolution of performance issues."

Future Outlook

Jay Chaudhry, CEO: "We are on a mission to take our platform everywhere so customers can benefit from better security, simplified IT operations and improved user productivity... I believe the next three decades will be defined by Zero Trust architecture."

Customers

Jay Chaudhry, CEO: "After experiencing a catastrophic cyberattack last year, a large financial services new logo customer purchased our ZIA data protection and ZDX pillars for 25,000 users in a seven-figure ACV multi-year deal."

Jay Chaudhry, CEO: "After making an initial purchase last year, a Global 100 Financial Services customer significantly expanded the purchase of Zscaler for users in a seven-figure ACV deal for over 64,000 users. Despite having years of relationship with the legacy firewall security vendor, they chose Zscaler."

Market Opportunity

Jay Chaudhry, CEO: "We talked about our $72 billion market opportunity in the past. Our recent acquisitions and other innovations increase our market opportunity by several billion dollars as they extend our platform into new adjacent markets including vulnerability management, security operations, and branch security."

FedRAMP

Jay Chaudhry, CEO: "In the federal vertical, we are proud to be serving 12 of the 15 cabinet-level agencies, and we continue to pursue new and upsell business opportunities across the federal market to help them adopt Zero Trust architecture as mandated by the President's executive order."

Future Outlook

Remo Canessa, CFO: "Our Q3 results exceeded our guidance on growth and profitability, even with ongoing customer scrutiny of large deals, the changes in our sales organization, and higher than expected sales attrition in the quarter."

Thoughts on Zscaler ER $ZS:

🟢Pros:

+ Revenue rose by +32% YoY.

+ DBNR at 116%, a slight decrease from last quarter.

+ Strong customer growth with $1M+ ARR added: +26.

+ Strong customer growth with $5M+ ARR 43% YoY.

+ Company increasing margins and profitability.

+ Beat Q4 revenue guidance by 3.2%.

+ Raised FY guidance by 1%.

+ Billings growth accelerated to 30% YoY from 27% in the last quarter.

+ Zscaler sees a significant expansion in its TAM

+ Zscaler sees significant expansion in its TAM.

+ Introduced new products, Data Security Posture Management and GenAI App Security, which will contribute to future revenue growth.

+ Zscaler's acquisition of Avalor and Airgap Networks further enhances the company's cloud security capabilities.

🟡Neutral:

+- SBC/rev at 22%, Basic shares up 3.4% YoY.

+- Weak Net New ARR added: (+113, -10% YoY).

+- Q2 guide: +2.5% QoQ, revenue growth is still slowing down.

+- RPO and billings are growing slower than revenue.