Veeva Systems Q4 2024 Earnings Analysis

Dive into $VEEV Veeva’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

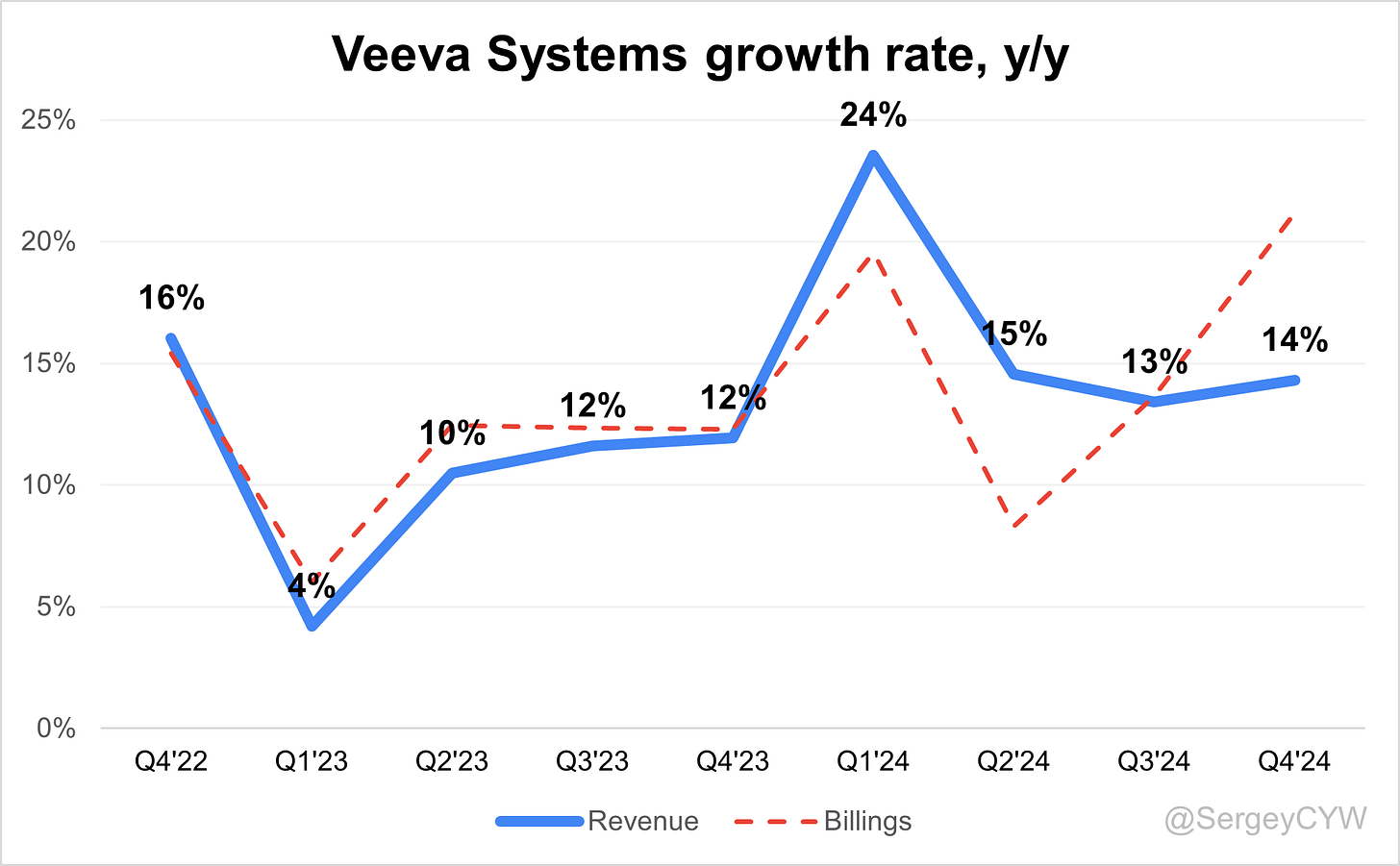

↗️$720.9M rev (+14.3% YoY, +13.4% LQ) beat est by 3.2%

↗️GM* (77.1%, +2.1 PPs YoY)

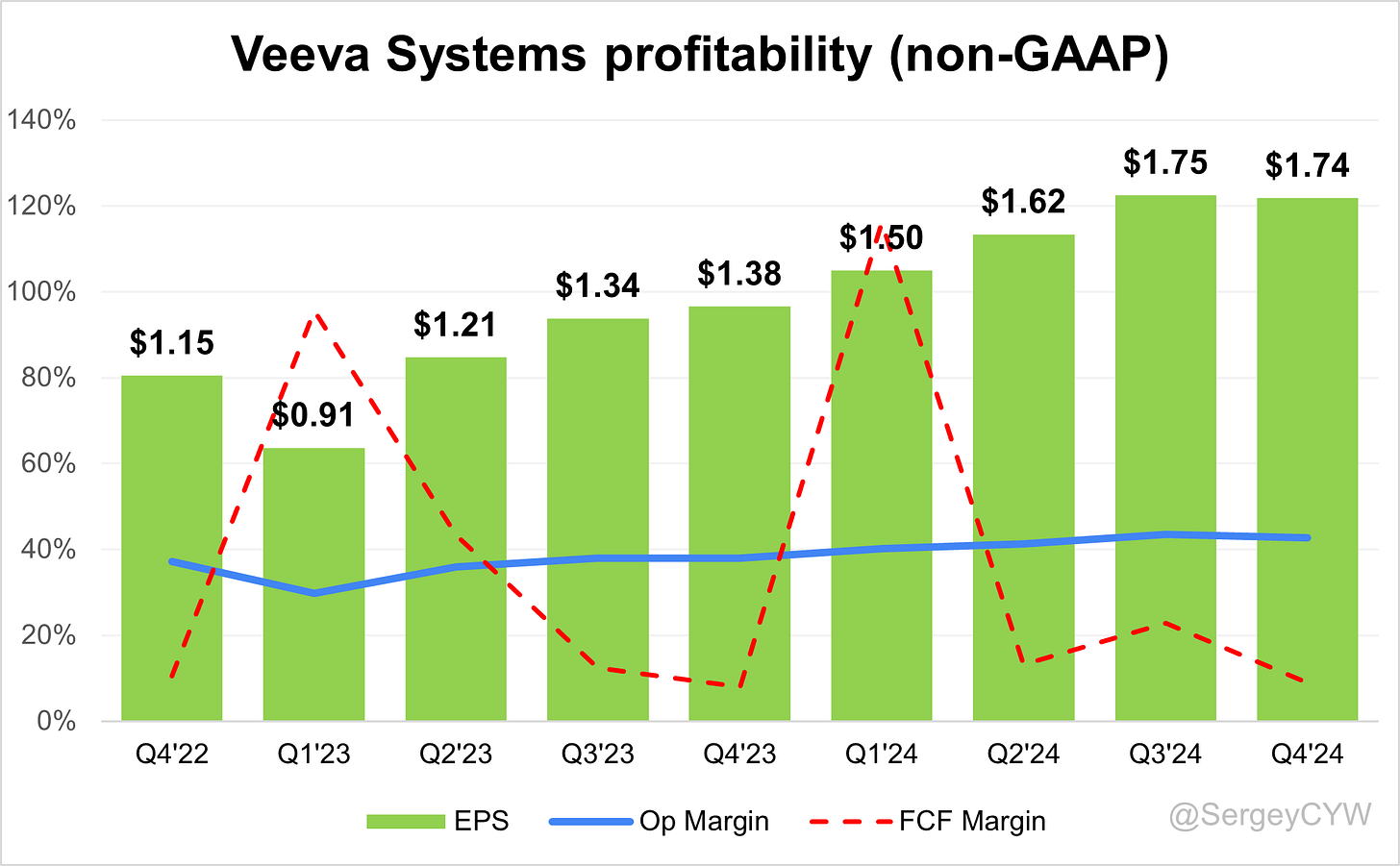

↗️Operating Margin* (42.7%, +4.8 PPs YoY)

↗️FCF Margin (9.0%, +1.1 PPs YoY)

↗️Net Margin (27.1%, +5.7 PPs YoY)

↗️EPS* $1.74 beat est by 10.8%

*non-GAAP

Key Metrics

↗️Billings $1,255M (+21.2% YoY)🟢

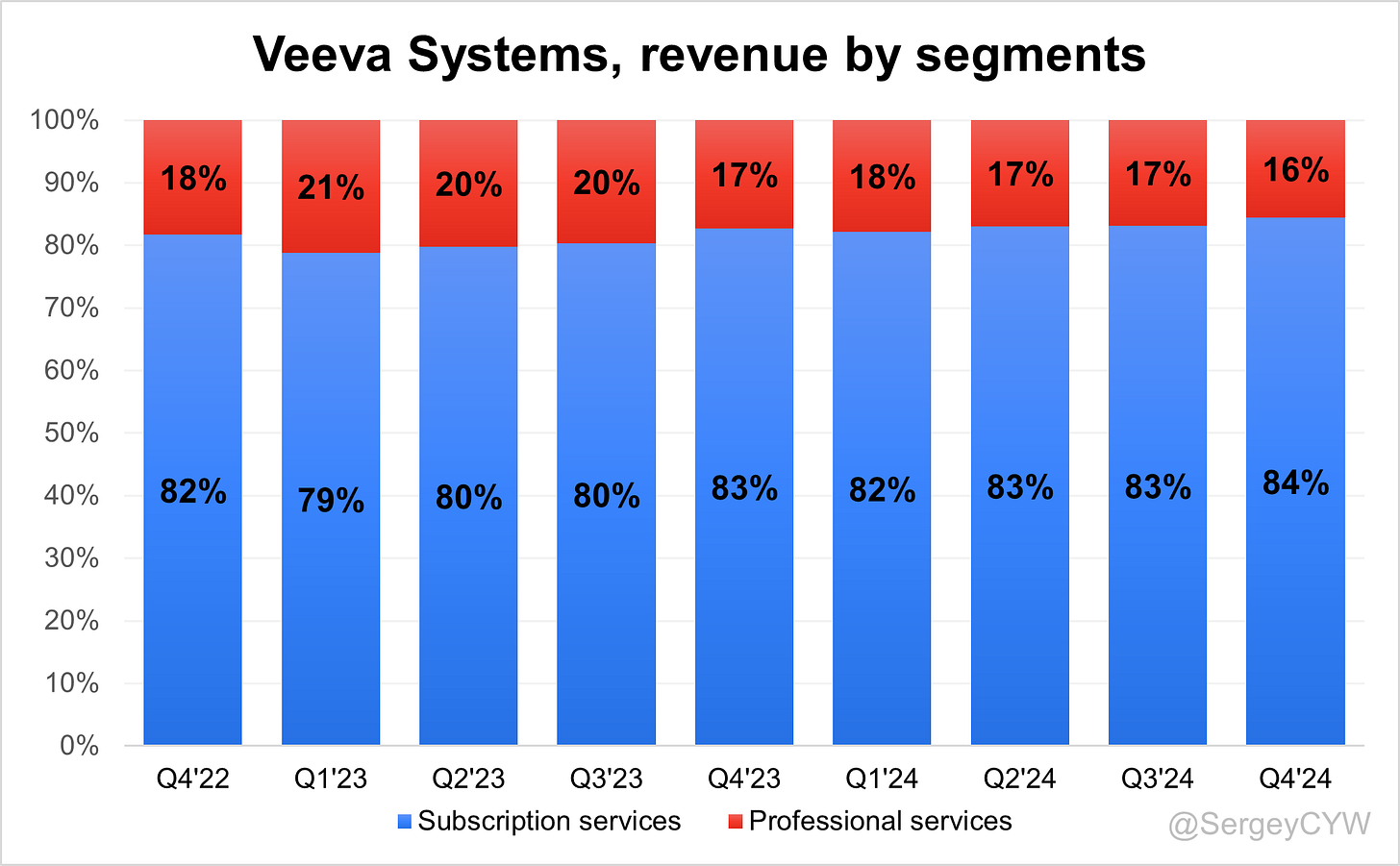

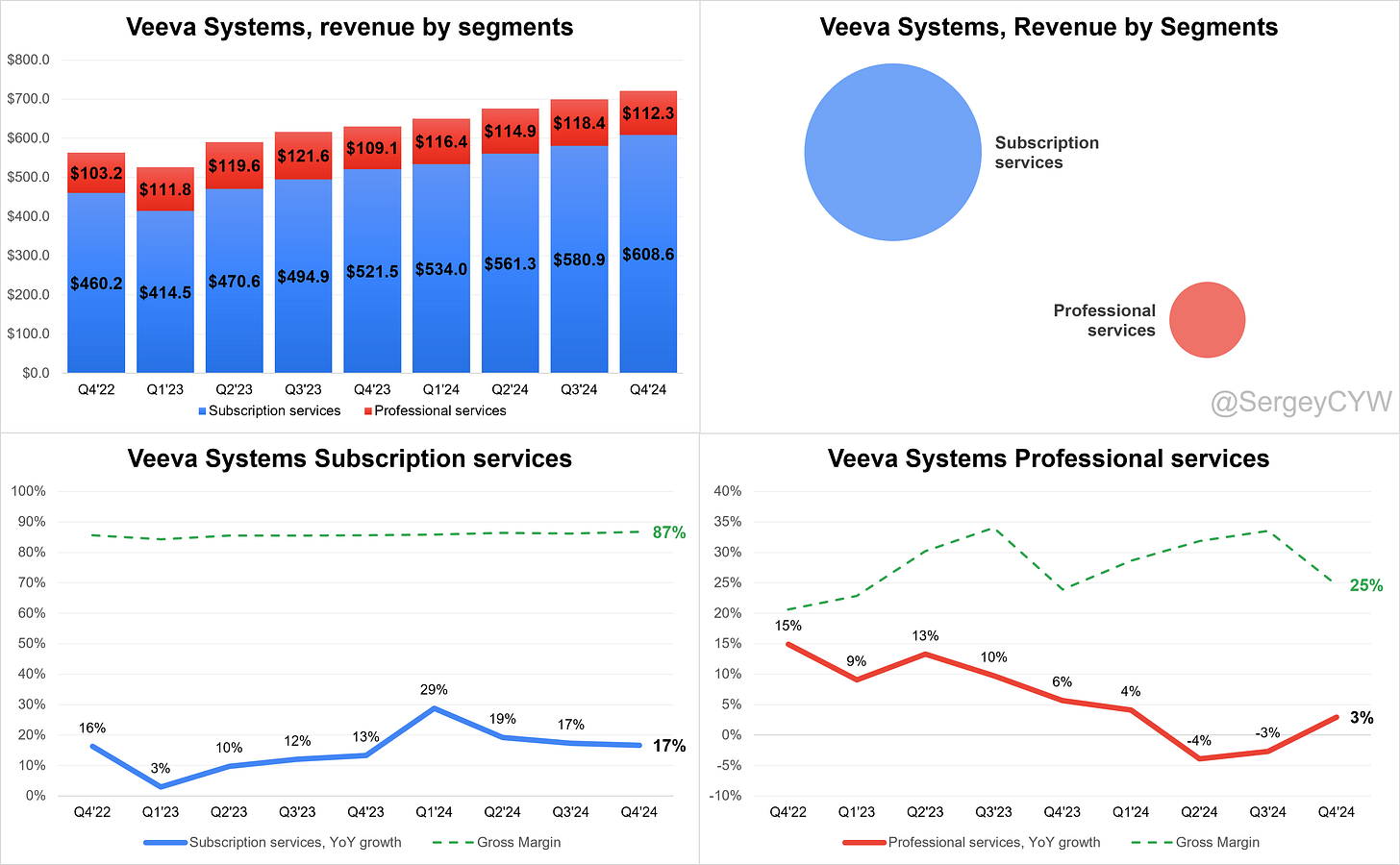

Revenue By Segments

Subscription services

↗️$608.6M Subscription services rev (+16.7% YoY)

↗️GM* (86.7%, +1.0 PPs YoY)

Professional services

➡️$112.3M Professional services rev (+2.9% YoY)🟡

↗️GM* (24.7%, +0.7 PPs YoY)

Operating expenses

↘️S&M*/Revenue 10.3% (-1.1 PPs YoY)

↘️R&D*/Revenue 18.6% (-0.5 PPs YoY)

↘️G&A*/Revenue 5.5% (-1.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $110,908M (+4.3% YoY)

↘️CAC* Payback Period 13.2 Months (-6.4 YoY)🟢

↗️R&D* Index (RDI) 0.74 (+0.06 YoY)🟢

Dilution

↘️SBC/rev 16%, -0.9 PPs QoQ

↗️Basic shares up 0.8% YoY, +0.1 PPs QoQ🟢

↗️Diluted shares up 1.0% YoY, +0.2 PPs QoQ🟢

Guidance

↗️Q1'25 $726.0 - $729.0M guide (+11.9% YoY) beat est by 0.5%

↘️$3,040.0 - $3,055.0M FY guide (+11.0% YoY) missed est by -0.4%🔴

Key points from Veeva Systems Fourth Quarter 2024 Earnings Call:

Financial Performance

Veeva Systems delivered strong Q4 and full-year fiscal 2025 results, exceeding guidance. Q4 revenue was $721M, and full-year revenue reached $2.75B. Non-GAAP operating income was $308M in Q4 and $1.15B for the year.

FY 2026 operating margin guidance was raised to 42%+, the highest in company history, driven by efficiency improvements. Subscription revenue growth is projected at 13% YoY, a slight decline from 15% in FY 2025, due to a tougher YoY comparison in Crossix.

Vault CRM

20 new customers adopted Vault CRM in Q4, the highest quarterly growth to date. Most were U.S. biotech firms selecting it as their first CRM. Large pharma firms are progressing toward migration decisions, with multiple top 20 pharma commitments expected in 2025.

Veeva invested in automated data migration tools to accelerate transitions. Customers must complete migrations before 2027 to avoid complex implementation risks. The company remains confident in winning most top 20 pharma migrations, offering AI integration, compliance features, and end-to-end pharma-specific solutions.

Clinical Products

Veeva's Clinical suite adoption continues to grow, with 9 of the top 20 pharma firms now using EDC and 17 using CTMS. A top 20 pharma fully committed to Veeva’s Clinical platform in Q4, reinforcing its competitive advantage in speed, efficiency, and compliance.

High-growth areas like RTSM and eCOA represent multi-billion-dollar opportunities, each similar in size to EDC. Faster implementation cycles are increasing confidence in full-suite adoption, replacing fragmented systems.

Service Center & Professional Services

Veeva maintains a lean services team and leverages flexible utilization rates to meet demand without over-hiring. Strategic partnerships with Accenture and consulting firms ensure large-scale migrations run smoothly.

Veeva's automation investments in data migration reduce manual effort and accelerate transitions. The biggest challenge remains enterprise hesitancy in change management, but automated tools and expertise are driving steady progress.

Development Cloud

Enterprise adoption of Development Cloud is increasing, with top pharma firms consolidating clinical operations and data management within Veeva’s platform. Faster implementation cycles reduce delays in large-scale deployments.

A top 20 pharma committed to the full suite in Q4, signaling broader industry standardization. ROI from integrated clinical workflows is accelerating adoption among enterprise customers.

Data Cloud

Veeva's Data Cloud is emerging as a key growth driver, led by Compass Patient and Compass Prescriber solutions. Large-scale enterprise licensing agreements (ELAs) are expected within 12-18 months.

Veeva launched Pulse, securing a 7-figure deal from a top 20 pharma before full availability. Pulse enables privacy-safe physician engagement data, improving segmentation and targeting for pharma sales teams.

Generative AI

AI investments are expanding across Clinical, CRM, and Data Cloud. Key AI-powered innovations include:

CRM Bot for voice-controlled CRM enhancements

MLR Bot for AI-assisted regulatory review

TMF Bot for document classification

Direct Data API for seamless AI and data science integrations

AI is now a stable foundation, allowing deeper integration into pharma-specific workflows. AI adoption is accelerating, with customers prioritizing compliance and efficiency over experimentation.

Customers & Market Expansion

Veeva continues to gain traction across large pharma and biotech customers, reinforcing its position as the industry standard for life sciences technology.

A top 20 pharma fully committed to Veeva’s Clinical platform, marking a major strategic win. Unlike prior implementations, where pharma firms deployed individual products in phases, this signals a shift toward enterprise-wide adoption of integrated platforms.

Veeva is expanding into mid-sized and emerging biotech firms, which accounted for most new CRM wins in Q4. Large pharma firms are consolidating their tech stacks with Veeva, increasing its strategic importance.

Customer Success

Faster implementation cycles help large and small customers transition efficiently. AI-driven workflow automation is reducing deployment time, making Vault CRM, Clinical, and Data Cloud migrations more seamless.

A top 20 pharma’s full Clinical platform adoption showcases Veeva’s ability to streamline large-scale clinical operations. Pulse’s rapid adoption, with a 7-figure deal secured before launch, signals strong demand for AI-driven data solutions.

Competitive Outlook

Veeva's vertical focus enables deeper industry expertise, setting it apart from Salesforce, Oracle, and Medidata. The combination of clinical operations and data management gives it a structural edge over competitors lacking full integration.

Vault CRM remains a key battleground, as customers evaluate Veeva’s end-to-end pharma CRM vs. Salesforce-based alternatives, which often require costly custom builds. Veeva's AI-driven automation makes it the fastest path to AI-powered CRM workflows.

Strategic Partnerships

Veeva's consulting and implementation partners, led by Accenture, are scaling their Veeva practices to support increasing demand. Expanding data partnerships for Compass and Pulse is driving broader adoption across large and small pharma customers.

Macro Environment & Challenges

No material impact from regulatory shifts, NIH funding changes, or drug pricing policies has been observed. Life sciences remain resilient to economic cycles due to mission-critical software and long-term contracts.

Potential tariff and supply chain risks could delay large enterprise deals, but are unlikely to impact long-term growth.

Future Outlook

Veeva is well-positioned for long-term expansion, with $6B revenue projected by 2030. Growth will be driven by AI, Data Cloud, and Clinical expansion, alongside Vault CRM migrations in top 20 pharma.

Margin expansion remains a priority, supported by operating efficiencies and disciplined execution. R&D investments—twice the size of sales and marketing spend—ensure sustained product innovation.

Consistent execution, accelerating adoption, and a strong enterprise pipeline position Veeva for another high-growth year in FY 2026.

Management comments on the earnings call.

Product Innovations

Peter Gassner, Chief Executive Officer

“Our AI-driven workflow automation is accelerating customer adoption across Clinical, CRM, and Data Cloud. The goal is to provide seamless, compliant, and highly efficient solutions that integrate directly into pharma operations, ensuring our customers can execute faster and more effectively.”

Peter Gassner, Chief Executive Officer

“Our platform is built for continuous innovation. With products like CRM Bot, MLR Bot, and Direct Data API, we are giving customers the tools to scale AI-powered processes efficiently. This isn’t about hype—it’s about delivering tangible, high-impact solutions that solve real industry challenges.”

Vault CRM

Paul Shawa, EVP, Strategy

“We are engaged in discussions with all of the top 20 pharma companies, and the momentum is clearly in our direction. Customers see a path to innovation and efficiency, and Vault CRM provides the foundation they need to achieve it.”

Peter Gassner, Chief Executive Officer

“We’re not forcing migration timelines—our customers are coming to us because they recognize that standardizing on Vault CRM is the fastest path to AI-driven commercial operations. The conversations have shifted from ‘if’ to ‘when.’”

Paul Shawa, EVP, Strategy

“Most of the top 20 pharma firms will make their CRM transition decisions by the end of 2026. They understand that waiting too long will put them in the red zone, where managing a complex migration becomes significantly more challenging.”

Clinical Products

Peter Gassner, Chief Executive Officer

“The industry is standardizing on our Clinical suite. With 17 of the top 20 pharma firms using our CTMS and 9 already on EDC, it’s clear that Veeva has become the preferred platform for clinical operations.”

Peter Gassner, Chief Executive Officer

“Our customers are looking for efficiency, not incremental change. That’s why we’re seeing large enterprises commit to full-suite adoption rather than piecemeal implementations. It’s a strategic decision to eliminate complexity and drive innovation at scale.”

Brian Van Wagner, Chief Financial Officer

“We continue to see strong enterprise commitments to our Clinical platform, and the success of our full-suite implementations is reinforcing our leadership position. We’re moving beyond individual product wins to true enterprise-wide adoption.”

Data Cloud

Peter Gassner, Chief Executive Officer

“We see Data Cloud as one of our biggest opportunities. Compass and Pulse are just the beginning—our customers want integrated, privacy-safe data solutions that deliver actionable insights. We are building a next-generation data platform that will redefine how life sciences companies operate.”

Peter Gassner, Chief Executive Officer

“Pulse signed its first 7-figure contract before the product was even fully available. That level of demand tells us that the market is ready for a fresh approach to commercial data.”

Generative AI

Peter Gassner, Chief Executive Officer

“AI in life sciences isn’t about replacing systems—it’s about enabling them. Our AI solutions are designed to work within the existing workflow, helping commercial teams, regulatory groups, and clinical operations move faster and make better decisions.”

Peter Gassner, Chief Executive Officer

“We didn’t rush into AI. Instead, we waited until the technology was stable, and now we are scaling with confidence. Our customers appreciate that we focus on execution, not experimentation.”

Market Expansion

Peter Gassner, Chief Executive Officer

“Our existing customers are asking us what comes next, and we see opportunities to extend our platform beyond life sciences. The cloud application space is evolving, and we believe there is room for a next-generation approach.”

Peter Gassner, Chief Executive Officer

“Most cloud application platforms today are still on version one. We see an opportunity to introduce a version two—a platform designed for the AI-driven enterprise. We are moving with precision, ensuring that when we enter a new market, we do it with the same level of industry expertise that made us successful in life sciences.”

Customers

Paul Shawa, EVP, Strategy

“Our conversations with customers are not about ‘if’ they will transition to Veeva, but how quickly they can do it. The demand for modern, integrated solutions is accelerating, and we are delivering exactly what the market needs.”

Peter Gassner, Chief Executive Officer

“Our customers are realizing that piecing together fragmented solutions is no longer sustainable. The future belongs to fully integrated platforms, and we are leading that shift.”

Strategic Partnerships

Peter Gassner, Chief Executive Officer

“We maintain a lean services team and rely on trusted partners like Accenture to scale our implementations. This ensures that our customers get the best expertise without the inefficiencies of a bloated services organization.”

Peter Gassner, Chief Executive Officer

“Accenture has expanded its Veeva practice significantly, and we are seeing strong execution in large-scale implementations. Our partner ecosystem is critical to ensuring that our customers can transition smoothly and efficiently.”

Challenges

Paul Shawa, EVP, Strategy

“Enterprise transitions take time, and some customers are still navigating internal decision-making processes. However, the trend is clear—more companies are moving towards fully integrated solutions, and we are positioned to be their provider of choice.”

Peter Gassner, Chief Executive Officer

“The biggest risk in AI isn’t technology—it’s execution. We have been deliberate in how we roll out AI solutions, ensuring they provide real, measurable value rather than just hype.”

Future Outlook

Brian Van Wagner, Chief Financial Officer

“We’re delivering margin expansion while continuing to invest in growth. The efficiencies we are driving today will allow us to scale even more effectively in the future.”

Peter Gassner, Chief Executive Officer

“Our long-term vision is clear: We see a $6 billion revenue opportunity by 2030, with AI, Data Cloud, and Clinical driving the next wave of expansion. We are executing on that vision with discipline and precision.”

Paul Shawa, EVP, Strategy

“The industry is changing, and we are ahead of the curve. We are winning more enterprise commitments, expanding into new markets, and redefining what’s possible in life sciences technology.”

Thoughts on Veeva Systems Earnings Report $VEEV:

🟢 Positive

Revenue beat expectations by 3.2%, reaching $721M (+14.3% YoY), accelerates from +13.4% last quarter.

EPS of $1.74 (+10.8% above estimates).

Operating margin improved to 42.7% (+4.8 PPs YoY).

Subscription revenue grew 16.7% YoY to $608.6M, driving 86.7% GM (+1.0 PPs YoY).

Billings surged 21.2% YoY to $1,255M.

FCF margin increased to 9.0% (+1.1 PPs YoY).

S&M spend decreased to 10.3% of revenue (-1.1 PPs YoY), improving cost efficiency.

Vault CRM added 20 new customers in Q4, highest ever.

Top 20 pharma fully committed to Veeva Clinical platform.

Pulse secured a 7-figure deal before full launch.

AI adoption accelerating across Clinical, CRM, and Data Cloud.

🟡 Neutral

Professional services revenue grew slightly (+2.9% YoY) to $112.3M.

SBC/rev declined to 16% (-0.9 PPs QoQ), but dilution impact remains.

CAC payback period improved to 13.2 months (-6.4 YoY), indicating stronger customer acquisition efficiency.

Enterprise licensing agreements (ELAs) for Compass expected in 12-18 months.

Subscription revenue growth slowed due to tougher comps in Crossix.

🔴 Negative

FY 2026 revenue guidance of $3,040M-$3,055M (+11.0% YoY) missed estimates by -0.4%.

Large enterprise customers are taking longer to make CRM migration decisions.

Tariffs and supply chain disruptions could delay large deals.