Veeva Systems Q3 2024 Earnings Analysis

Dive into $VEEV Veeva’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$699.2M rev (+13.4% YoY, +14.6% LQ) beat est by 1.6%

↗️GM* (77.3%, +2.0 PPs YoY)🟢

↗️Operating Margin* (43.5%, +5.4 PPs YoY)🟢

↘️Net Margin* (26.6%, -8.9 PPs YoY)🟡

↗️EPS* $1.75 beat est by 10.8%🟢

*non-GAAP

Key Metrics

↗️Billings $482M (+13.7% YoY)🟢

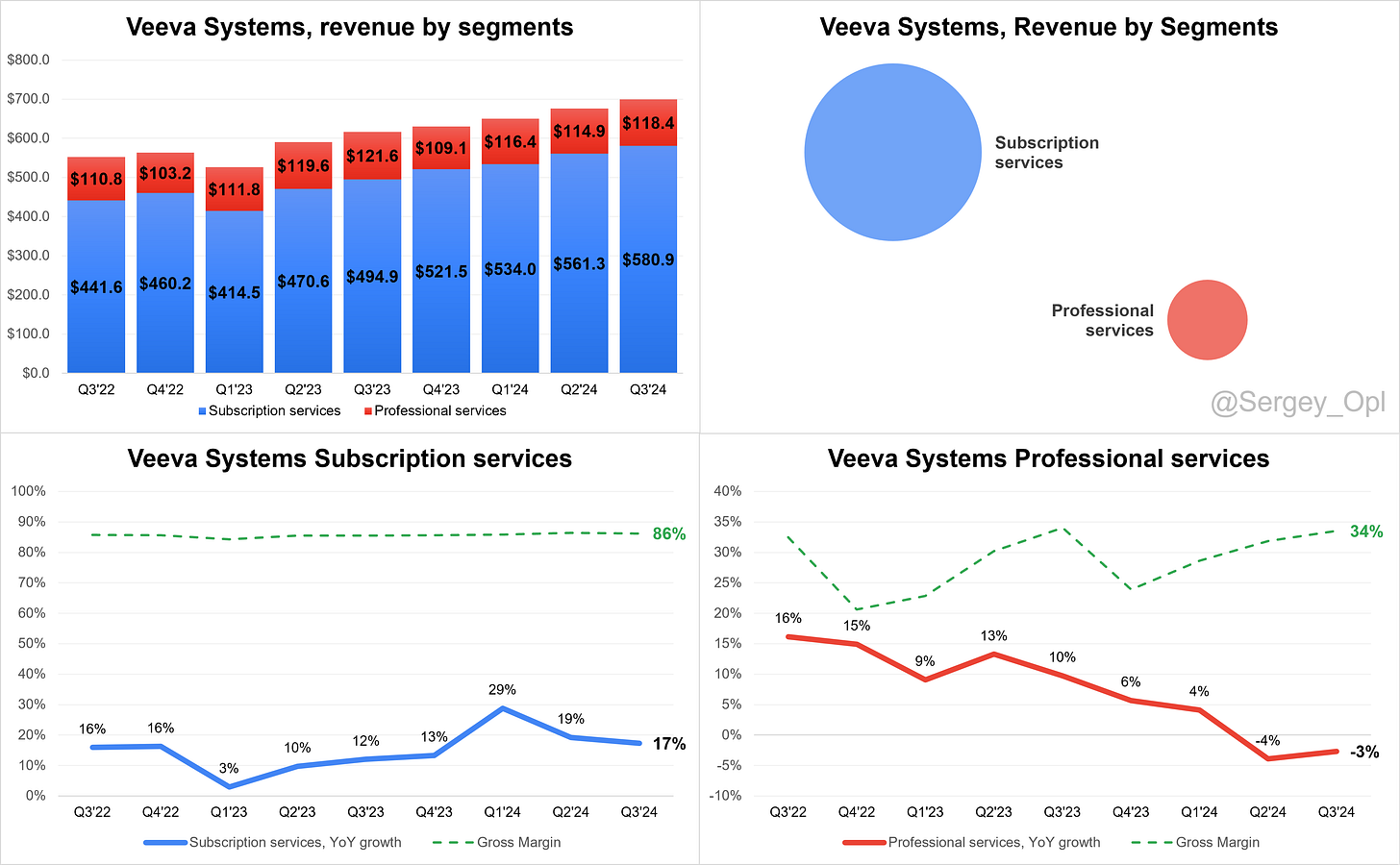

Revenue By Segments

Subscription services

↗️$580.9M Subscription services rev (+17.4% YoY)

↗️GM* (86.2%, +0.7 PPs YoY)

Professional services

↘️$118.4M Professional services rev (-2.7% YoY)🟡

↘️GM* (33.5%, -0.6 PPs YoY)

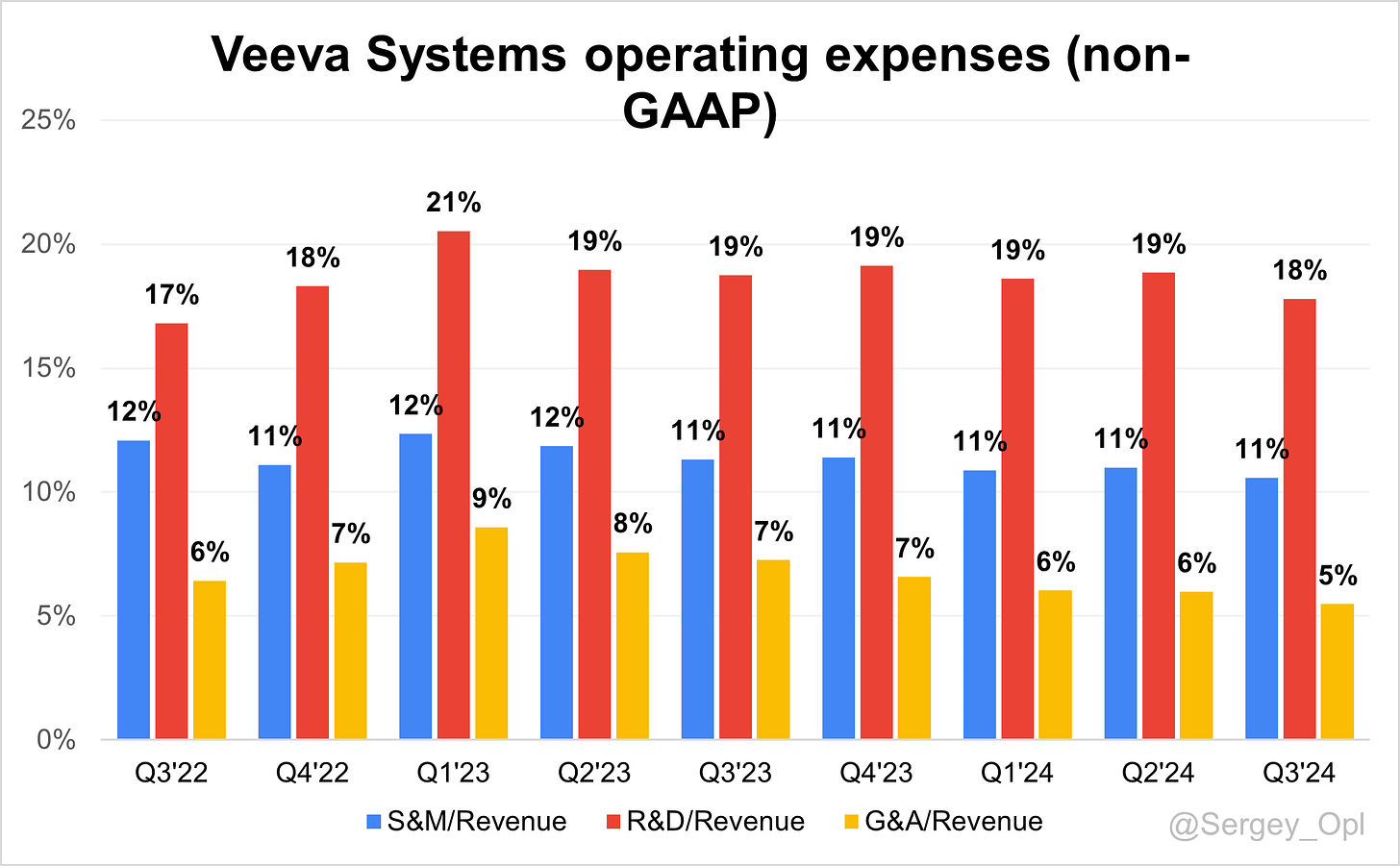

Operating expenses

↘️S&M*/Revenue 10.6% (-0.7 PPs YoY)

↘️R&D*/Revenue 17.8% (-1.0 PPs YoY)

↘️G&A*/Revenue 5.5% (-1.8 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $78,292M (-19.4% YoY)

↗️CAC* Payback Period 12.5 Months (+1.8 YoY)🟡

↗️R&D* Index (RDI) 0.70 (+0.03 YoY)🟢

Dilution

↗️SBC/rev 17%, +0.8 PPs QoQ

↘️Basic shares up 0.8% YoY, -0.1 PPs QoQ🟢

↘️Diluted shares up 0.7% YoY, -0.1 PPs QoQ🟢

Guidance

↘️Q4'24 $696.0 - $699.0M guide (+10.6% YoY) missed est by -0.6%🔴

↗️$2,722.0 - $2,725.0M FY guide (+15.2% YoY) lowered by -0.9% beat est by 0.1%🔴

Key points from Veeva Systems Third Quarter 2024 Earnings Call:

Financial Performance

Veeva Systems exceeded fiscal Q3 2025 guidance with total revenue of $699 million and non-GAAP operating income of $304 million, reflecting disciplined cost management and operational efficiency. The company’s operating margin reached a record 43.5%, the highest in its history, driven by a combination of revenue upside and expense discipline.

Approximately half of the margin beat came from higher-than-expected revenue, with 25% attributed to expense timing shifts into later quarters and 25% from ongoing cost control. Subscription revenue grew 15% year-over-year, aligning with long-term growth goals.

Product Innovations

Veeva focused on expanding its product portfolio in core life sciences and horizontal business applications. Key advancements included Vault platform enhancements, Development Cloud functionality, and the integration of generative AI solutions.

The MLR Bot, an AI tool for streamlining commercial content approval, accelerates workflows by identifying critical content elements while maintaining compliance. The CRM Bot links customer systems with generative AI models, enhancing automation.

Vault CRM

Vault CRM remains central to Veeva’s growth, securing its fourth Top 20 biopharma commitment in Q3. The platform integrates sales, medical, marketing, and service functions, offering life sciences companies a unified, continuously innovating solution.

Smaller biotech firms can migrate to Vault CRM within 4-6 weeks, while larger enterprises may take up to two years. Veeva has invested heavily in migration tools, minimizing disruption and ensuring smoother transitions.

Despite challenges in scaling large organizations, Veeva’s reliable solutions and proven performance continue to build customer trust. More commitments are expected in the coming quarters as Vault CRM’s maturity strengthens its market position.

Generative AI

Veeva introduced two generative AI solutions: CRM Bot and MLR Bot. CRM Bot integrates with customers' language models, adding value at no extra cost. MLR Bot, hosted by Veeva, incurs compute costs but is offset through pricing.

These AI-driven innovations automate routine tasks and improve decision-making while ensuring gross margins remain unaffected. The pricing model accounts for operational costs, sustaining profitability.

Service Center

The Service Center module adds tools for managing patient services and healthcare engagement within the Vault CRM ecosystem. Integrated with Campaign Manager and other applications, it streamlines operations and improves efficiency.

Service Center adoption is particularly strong among smaller and midsized companies, while larger enterprises are incorporating it gradually. Customer feedback highlights its operational benefits, but enterprise-level integration timelines remain a challenge.

Professional Services

Professional services revenue stabilized in Q3, contributing to Veeva’s revenue growth. Faster-than-expected project progress led to higher billings, recovering from subcontractor-related revenue challenges earlier in the year.

Services play a critical role in enabling smooth migrations to Vault CRM and other solutions. Veeva’s disciplined project management mitigates risks from schedule variability, ensuring consistent customer satisfaction.

Development Cloud

Development Cloud remains a growth driver, with increasing adoption of clinical, quality, and regulatory solutions. Recent additions like Safety Signal and Safety Workbench enhance functionality and address key industry needs.

Strategic partnerships with top pharmaceutical companies, including Boehringer Ingelheim’s One Medicine program, showcase Development Cloud’s ability to integrate legacy systems and drive automation. Adoption is accelerating as customers recognize its value in creating unified ecosystems.

Customers

Veeva deepened its relationships with Top 20 biopharma companies, securing new commitments and expanding existing ones. Smaller biotech firms adopt Veeva’s platforms quickly due to simple implementations, while larger enterprises are more deliberate.

The partnership with Boehringer Ingelheim, a long-term Veeva customer, exemplifies trust in the company’s solutions. Boehringer praised Veeva’s consistency and reliability, which led to their adoption of Vault CRM for modernizing operations.

Partnerships

The partnership with Walgreens enhances Veeva’s Compass and Data Cloud offerings. Leveraging diverse data sources, the company provides accurate targeting and measurement tools that create significant value for commercial operations.

Regulatory and Macro Environment

Customers have adjusted to the stabilized macroeconomic environment, focusing on mission-critical projects planned well in advance. Potential regulatory changes, such as restrictions on direct-to-consumer advertising, are seen as long-term risks with limited immediate impact.

Future Outlook

Veeva expects 15% subscription revenue growth in FY2025, consistent with long-term targets. Margin improvements from Vault CRM migrations will unfold gradually, with full benefits anticipated by 2030.

Better visibility into FY2026 stems from multi-year agreements and a stable macro environment. Investments in horizontal applications and continued customer success will support sustained growth.

Management comments on the earnings call.

Product Innovations

Peter Gassner, Chief Executive Officer

"Our product innovation strategy prioritizes customer-centric solutions like the MLR Bot and CRM Bot, leveraging generative AI to automate routine tasks, accelerate decision-making, and enhance operational efficiency. These advancements reinforce our commitment to driving deeper enterprise relationships and higher attach rates across our portfolio."

Vault CRM

Peter Gassner, Chief Executive Officer

"Vault CRM’s ability to unify sales, medical, marketing, and service functions creates a unique competitive advantage for our customers. The platform’s continuous innovation ensures long-term value, while our investment in migration tools minimizes disruption and accelerates adoption for companies of all sizes."

Professional Services

Brian Van Wagoner, Chief Financial Officer

"Our professional services teams are pivotal in enabling smooth migrations and delivering high-quality outcomes for customers. Faster-than-expected project progress in Q3 underscores the team’s execution capabilities and demonstrates the critical role of professional services in supporting customer success."

Generative AI

Peter Gassner, Chief Executive Officer

"Our generative AI solutions, CRM Bot and MLR Bot, integrate seamlessly into our platforms, driving efficiency while maintaining cost neutrality for our customers. By embedding AI capabilities, we ensure automation and decision-making enhancements without materially impacting gross margins."

Customers

Paul Shawa, Executive Vice President, Strategy

"Our relationships with Top 20 biopharma companies continue to deepen, as evidenced by commitments like Boehringer Ingelheim’s adoption of Vault CRM. These partnerships are built on trust and our consistent ability to deliver reliable, innovative solutions."

International Growth

Peter Gassner, Chief Executive Officer

"The growing adoption of our products internationally, coupled with strategic partnerships, reflects our ability to meet diverse customer needs in different regions. We remain focused on delivering solutions that support global operational efficiencies."

Challenges

Paul Shawa, Executive Vice President, Strategy

"Large-scale migrations, especially for enterprise customers, require careful planning and extended timelines. However, our investments in migration tooling and proven execution capabilities position us to overcome these challenges and deliver consistent customer value."

Future Outlook

Brian Van Wagoner, Chief Financial Officer

"We expect subscription revenue to grow approximately 15% year-over-year in fiscal 2025, aligned with our long-term growth targets. As Vault CRM adoption scales, margin improvements will unfold gradually, with full benefits anticipated by 2030. Our disciplined investments ensure we remain well-positioned for sustained growth."