Veeva Systems Q2 2024 Earnings Analysis

Dive into $VEEV Veeva’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$676.2M rev (+14.6% YoY, +23.6% LQ) beat est by 1.2%

↗️GM* (77.2%, +2.9 PPs YoY)🟢

↗️Operating Margin* (41.4%, +5.5 PPs YoY)🟢

↗️Net Margin* (39.5%, +6.0 PPs YoY)🟢

↗️EPS* $1.62 beat est by 6.6%🟢

*non-GAAP

Key Metrics

➡️Billings $603M (+8.0% YoY)🟡

Revenue By Segments

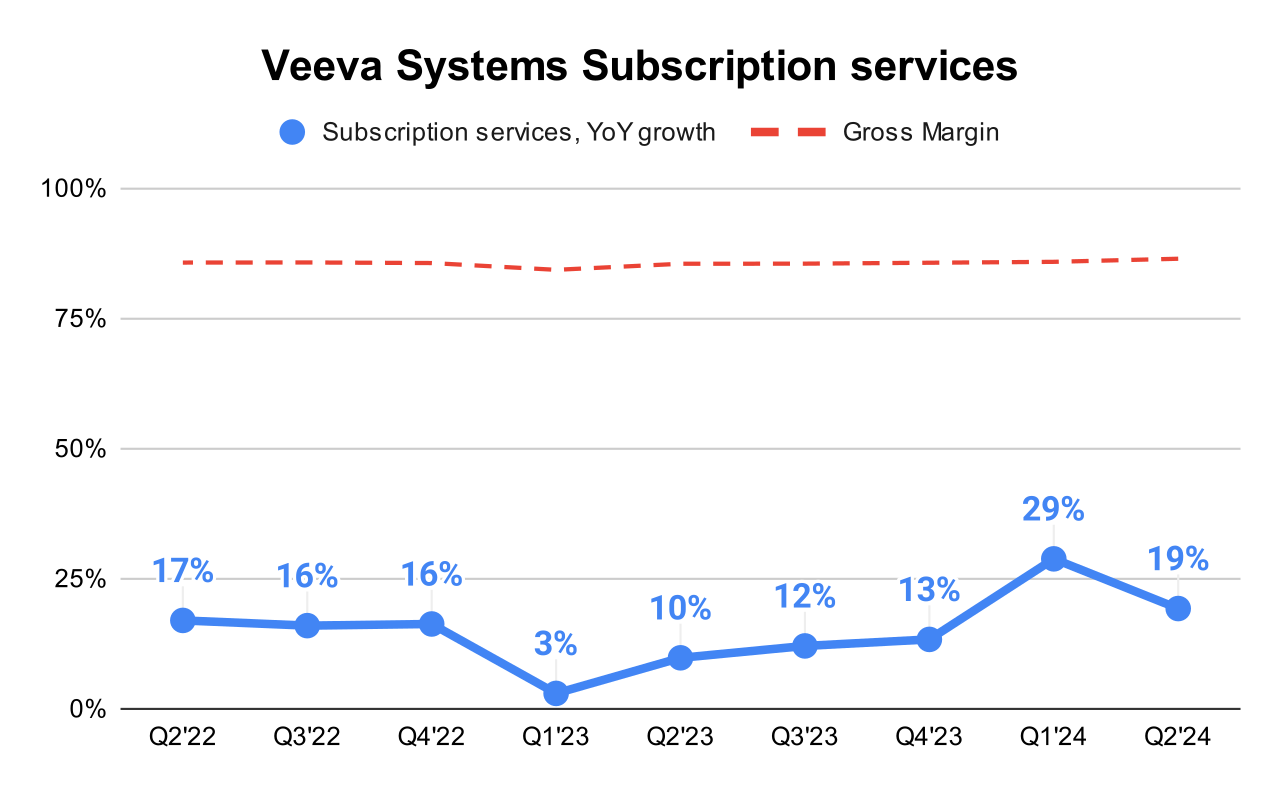

Subscription services

↗️$561.3M Subscription services rev (+19.3% YoY)

↗️GM* (86.5%, +1.0% PPs YoY)

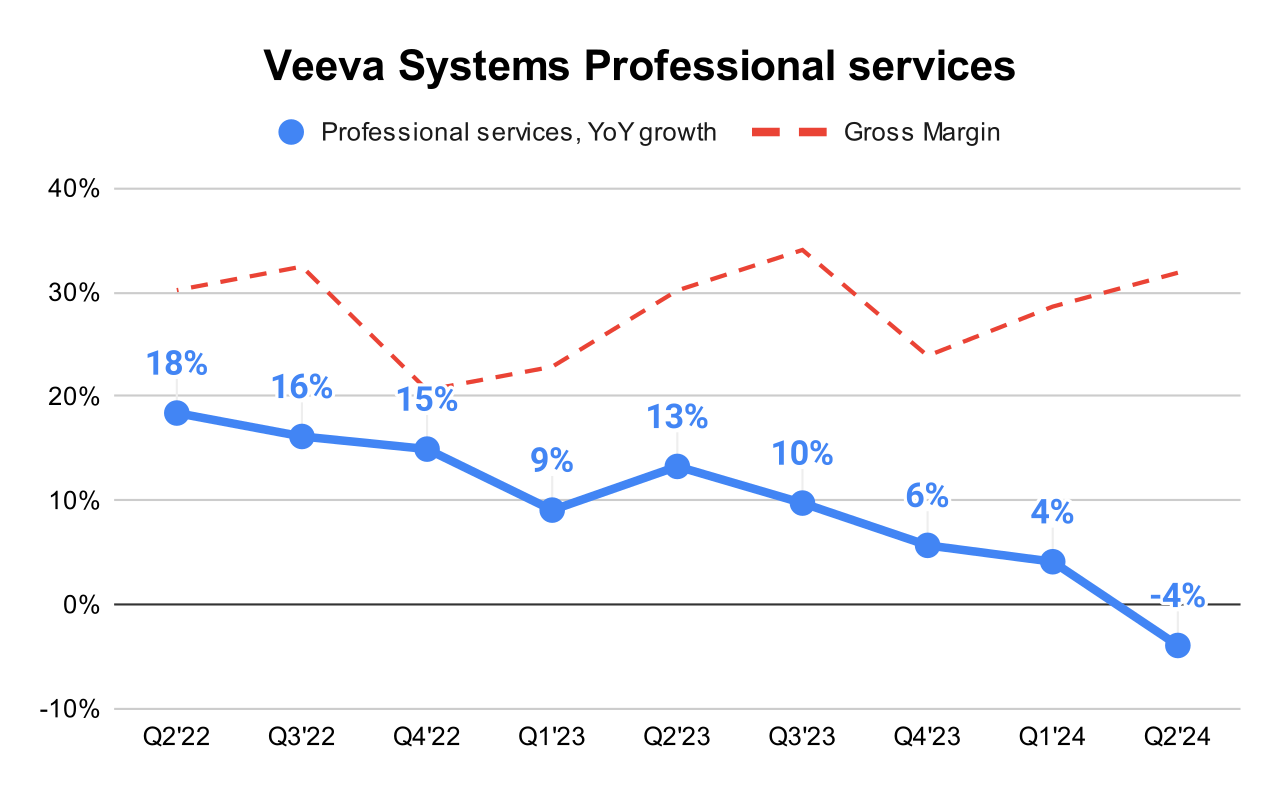

Professional services

↘️$114.9M Professional services rev (-3.9% YoY)🟡

↗️GM* (31.9%, +1.7% PPs YoY)

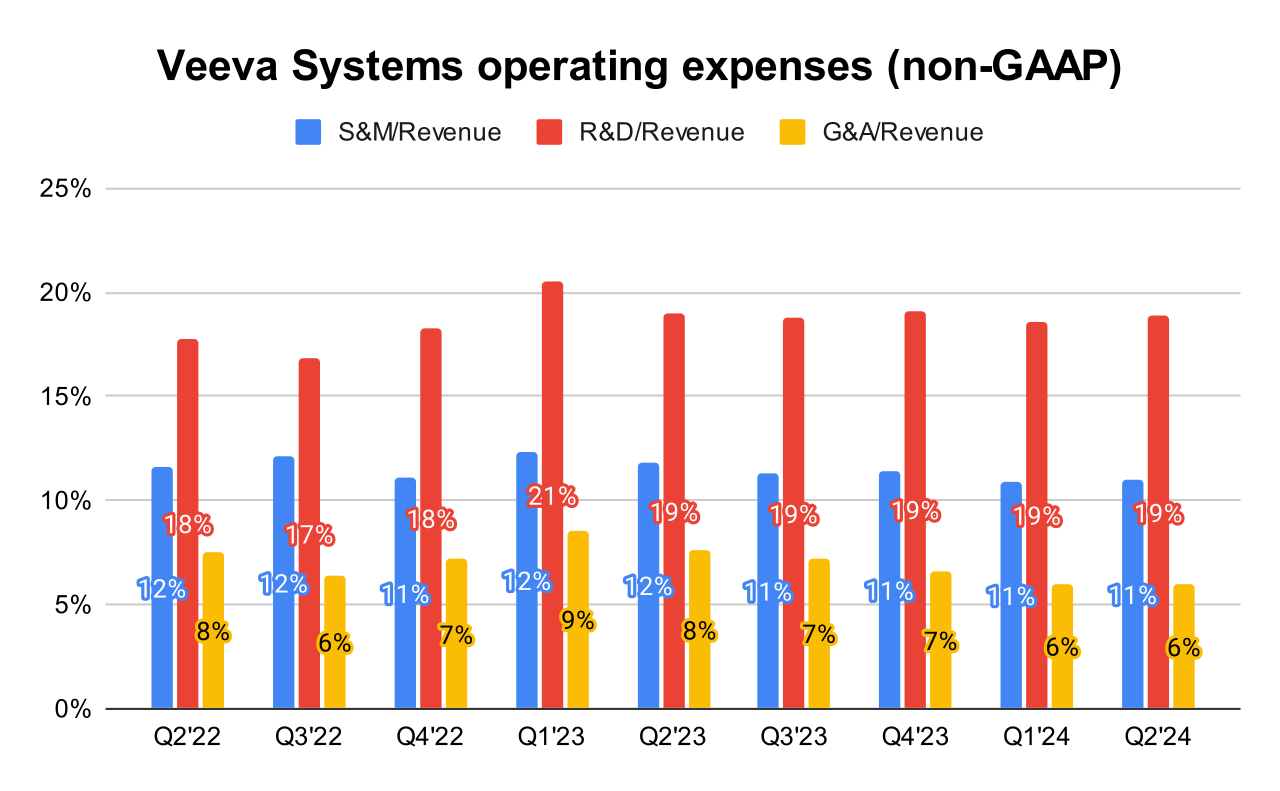

Operating expenses

↘️S&M*/Revenue 11.0% (-0.9 PPs YoY)

↘️R&D*/Revenue 18.8% (-0.1 PPs YoY)

↘️G&A*/Revenue 6.0% (-1.6 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $109,288M (-51.3% YoY)

↘️CAC* Payback Period 10.9 Months (14.5 LQ)

Dilution

↗️SBC/rev 16%, +1.3 PPs QoQ

↘️Basic shares up 0.8% YoY, -0.2 PPs QoQ🟢

↘️Diluted shares up 0.8% YoY, -0.4 PPs QoQ🟢

Guidance

➡️Q3'24 $682.0 - $685.0M guide (+10.9% YoY) in line with est

↗️$2,730.0 - $2,750.0M FY guide (+15.9% YoY) raised by 1.5% beat est by 1.1%

Key points from Veeva Systems Second Quarter 2024 Earnings Call:

Performance Highlights:

Veeva reported strong quarterly results, with total revenue of $676 million and non-GAAP operating income of $280 million.

Product innovations

Vault CRM Enhancements:

Veeva has launched significant enhancements in Vault CRM, which include better content integration and built-in opportunity management features. These upgrades are aimed at distancing Vault CRM from traditional CRM solutions by integrating more functionality directly into the platform.

Veeva Site Connect:

An important release mentioned during the call was Veeva Site Connect, designed to streamline clinical trials. This tool aims to enhance the efficiency of both clinical sites and sponsors through improved document exchange and communication.

Service Center in CRM Suite:

The introduction of Service Center as part of the CRM suite was highlighted. This new tool is designed to integrate customer service and support directly into the CRM system, allowing for a more unified customer view and streamlined operations across sales and service teams.

AI Integration and Direct Data API:

Veeva continues to integrate AI into its platforms, leveraging its Direct Data API to enable customers to implement AI-driven solutions efficiently. This approach allows for innovative use cases like dynamic targeting and next-best-action models in the commercial space, and automated data anomaly detection in clinical operations.

Customers

Strong Customer Wins:

Veeva reported robust customer wins, particularly in its core CRM suite, including 14 significant new CRM deals. The company highlighted its success in winning nearly all competitive deals, indicating high customer satisfaction and preference for Veeva’s solutions over competitors.

Migration to Vault CRM:

Several customers are transitioning to Vault CRM, with Veeva supporting migrations to ensure smooth transitions and immediate operational benefits. Veeva’s emphasis on customer readiness and appropriate timing for migrations demonstrates its commitment to customer success.

Top 20 Pharma Customer Engagement:

A top 20 pharmaceutical company has standardized on Veeva for both RIM (Regulatory Information Management) and CTMS (Clinical Trial Management System), showcasing trust and reliance on Veeva’s comprehensive suite of solutions.

Use of AI and Direct Data API:

Customers are increasingly utilizing Veeva's AI capabilities and Direct Data API for various innovative applications, such as improving media campaign outcomes and optimizing clinical trial processes.

Service Center Success:

The newly launched Service Center is expected to enhance customer service capabilities directly within the CRM system. Early adoption by small to mid-sized biotech firms, which often lead to broader usage as these firms grow, indicates potential long-term success and customer satisfaction.

Challenges in Professional Services:

Veeva noted some volatility in its professional services segment, attributed to projects being delayed by customers, possibly as a discretionary cost-saving measure. Additionally, some customers chose to contract directly with third-party service providers, bypassing Veeva for certain services, which led to a decrease in service revenue.

Macroeconomic Headwinds:

The company acknowledged the presence of ongoing macroeconomic headwinds that continue to influence business operations and customer decisions. Despite these challenges, Veeva reported that it had not observed significant changes in the business environment compared to the previous quarter, suggesting a stabilization in the impact of these headwinds on their operations.

Future Outlook:

Veeva remains optimistic about its future performance, adjusting its guidance based on strong current results and better visibility into the second half of the year.

The company anticipates more customer commitments in the coming 12 months, signaling a positive outlook on business growth and expansion, especially in core areas like CRM and Vault applications.

Management comments on the earnings call.

Product Innovations

Peter Gassner, CEO: "Q2 was a strong quarter with results above our guidance. Thanks to the team, we advanced in all major areas with key product expansions and strategic customer wins. This included an important new release of Veeva Site Connect to streamline clinical trials and the first release of Service Center in the CRM Suite."

Paul Shawah, EVP Strategy: "Vault CRM, became generally available in April. It's exclusively what we're selling into the market... You certainly never know if we’re winning all of them, but it certainly feels like we're winning all of them."

Customers

Paul Shawah, EVP Strategy: "We had another very strong quarter. We -- Vault CRM, became generally available in April. It's exclusively what we're selling into the market. In the quarter, we had 14 wins... We know we're not losing any deals to competitors that we're competing in."

Challenges

Peter Gassner, CEO: "During this call, we may make forward-looking statements regarding trends, our strategies, and the anticipated performance of the business, including guidance regarding future financial results. These forward-looking statements will be based on our current views and expectations and are subject to various risks and uncertainties."

Future Outlook

Tim Cabral, Interim CFO: "We continue to build really productive conversations with those customers. We continue to move through the sales cycles with those customers. And today, we just have better visibility than we did 90 days ago, Ken which informed or was a good input to the modest increase in R&D subs revenue for the year."