Veeva Systems Q1 2025 Earnings Analysis

Dive into $VEEV Veeva’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

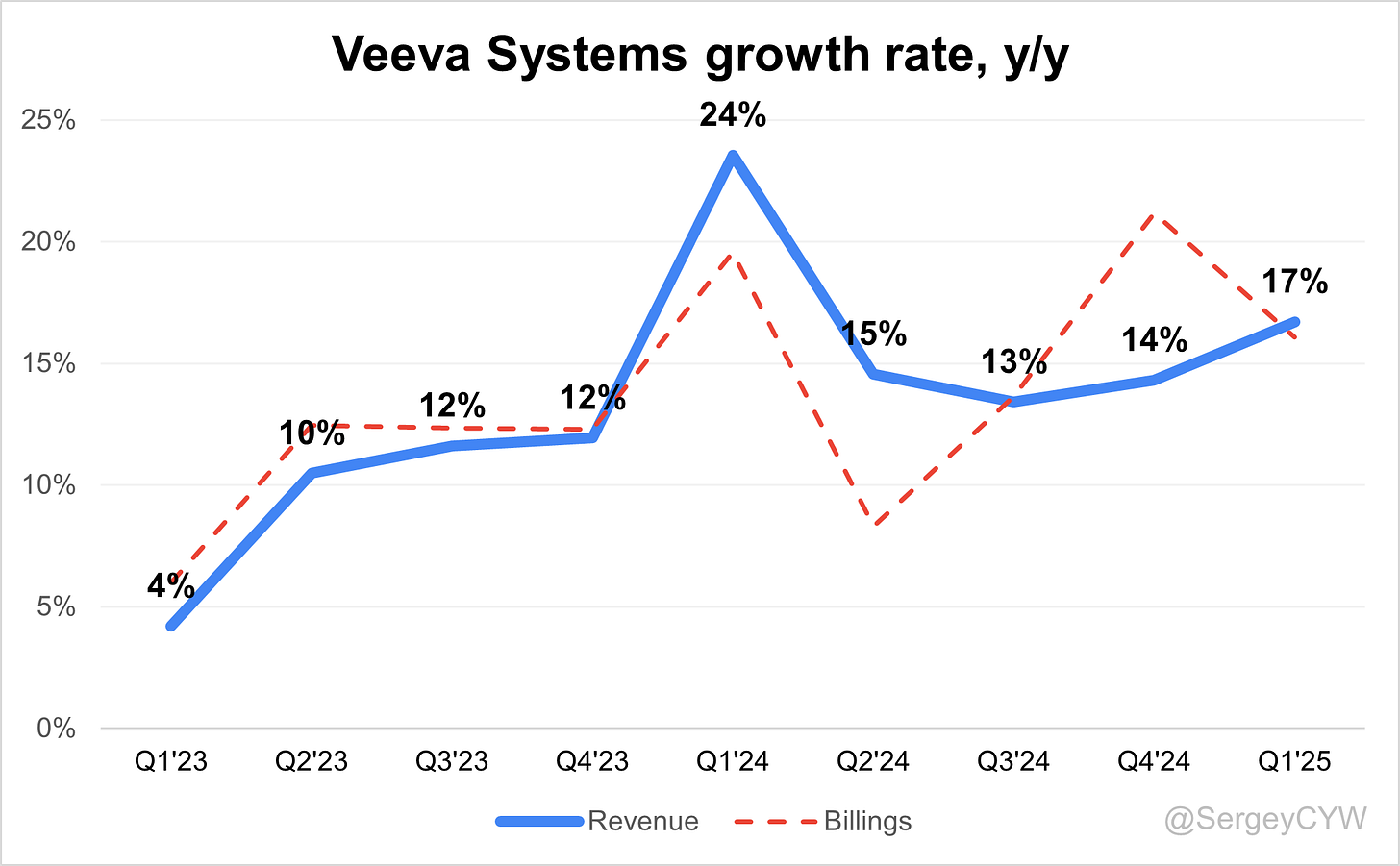

↗️$759.0M rev (+16.7% YoY, +5.3% QoQ) beat est by 4.3%

↗️GM* (79.2%, +3.5 PPs YoY)🟢

↘️Operating Margin* (30.8%, -9.3 PPs YoY)🟡

↘️FCF Margin (114.8%, -1.3 PPs YoY)🟡

↗️Net Margin (30.1%, +7.4 PPs YoY)

↗️EPS* $1.97 beat est by 13.2%🟢

*non-GAAP

Key Metrics

➡️Billings $731M (+16.1% YoY)🟡

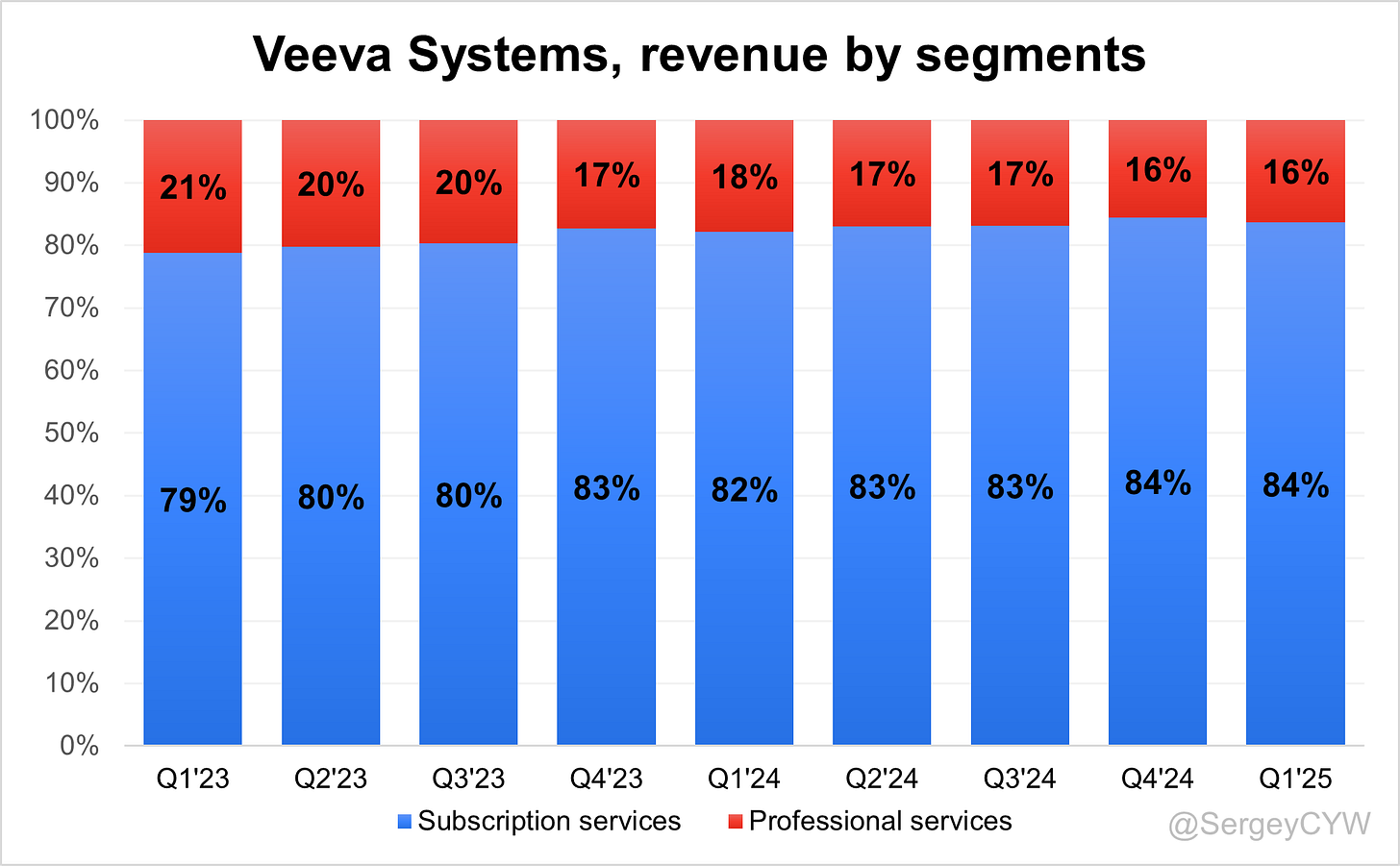

Revenue By Segments

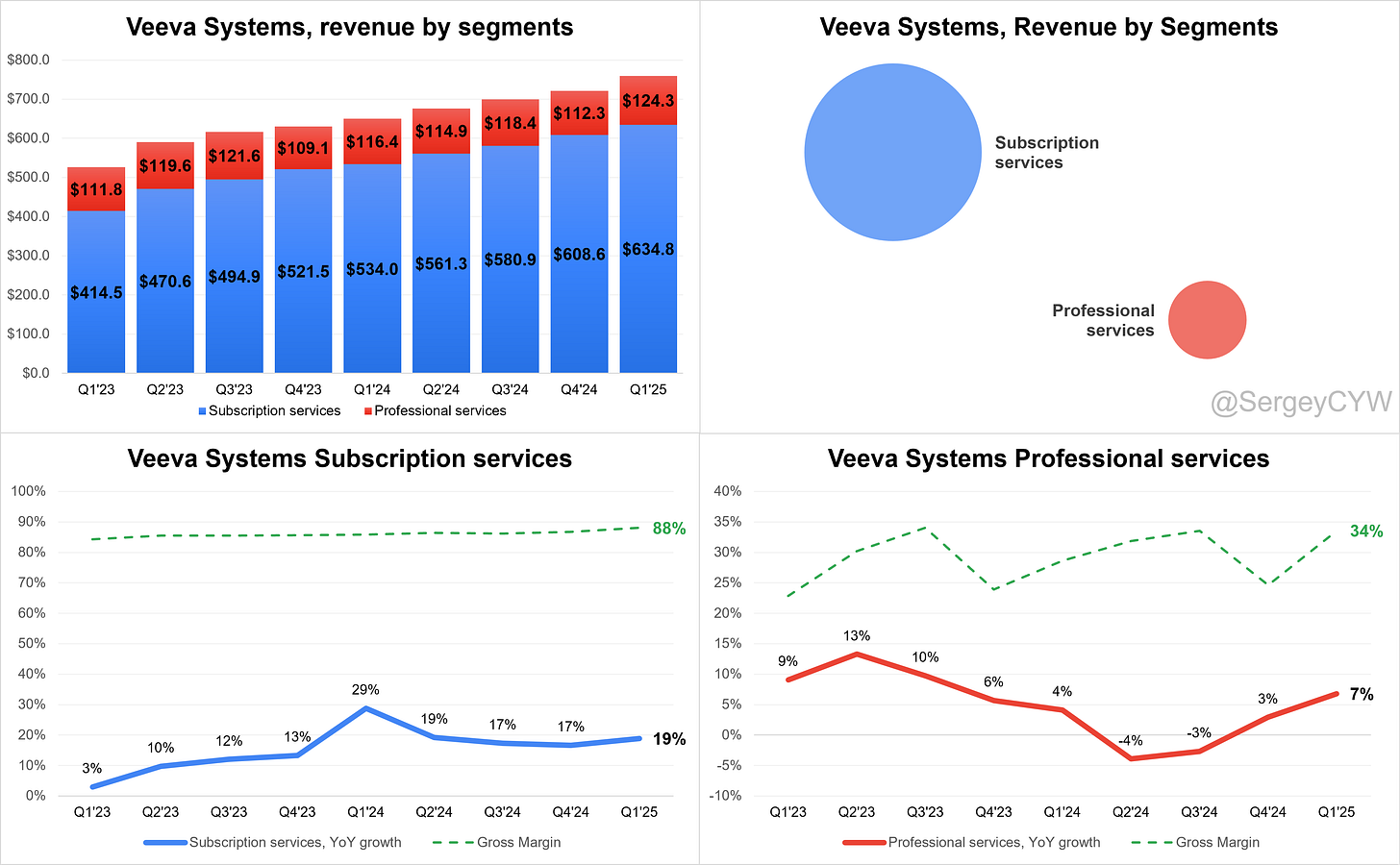

Subscription services

↗️$634.8M Subscription services rev (+18.9% YoY)🟢

↗️GM* (88.1%, +2.2 PPs YoY)

Professional services

➡️$124.3M Professional services rev (+6.8% YoY)🟡

↗️GM* (33.6%, +4.9 PPs YoY)

Operating expenses

↘️S&M*/Revenue 9.7% (-1.2 PPs YoY)

↘️R&D*/Revenue 17.9% (-0.7 PPs YoY)

↘️G&A*/Revenue 5.5% (-0.6 PPs YoY)

Quarterly Performance Highlights

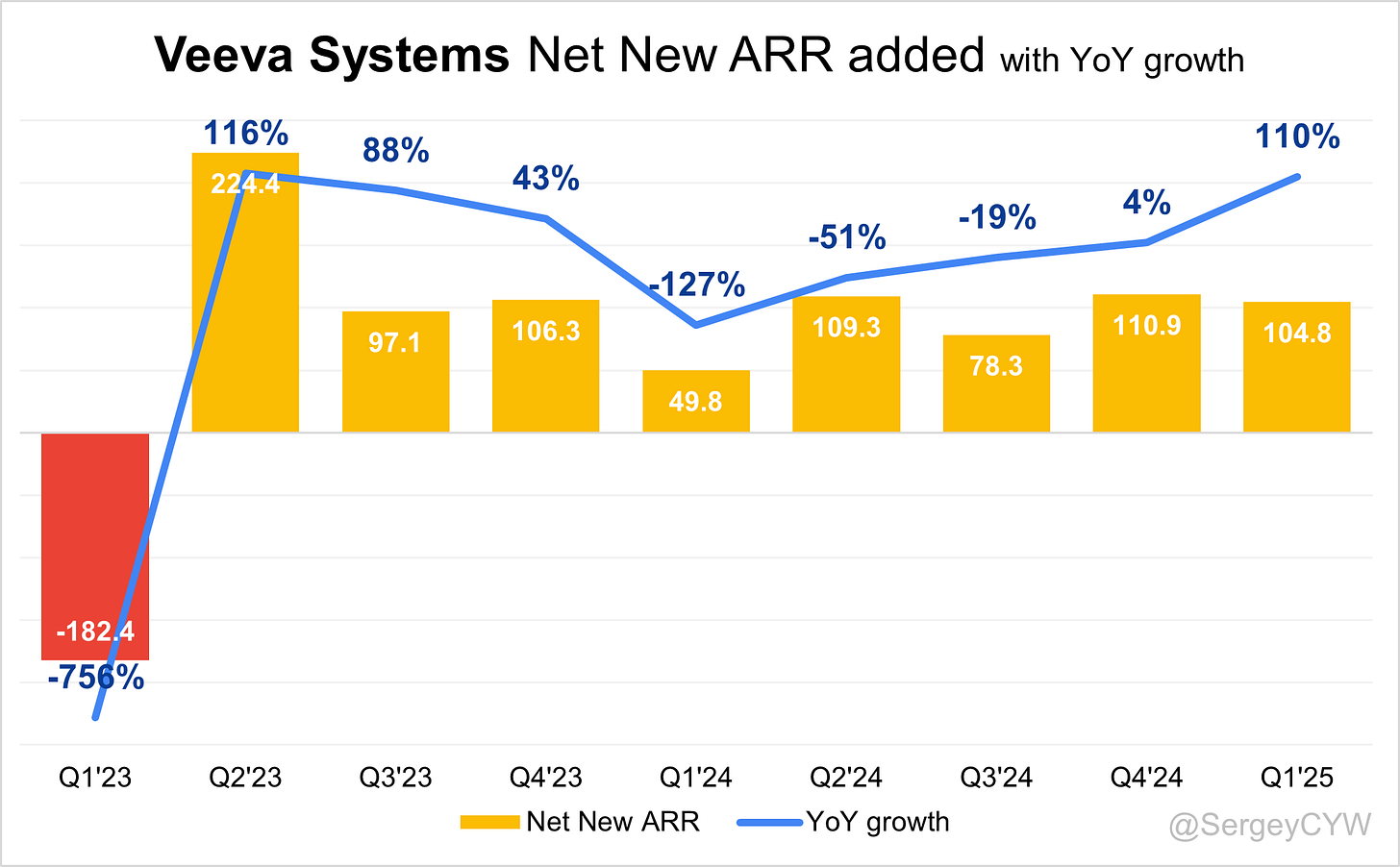

↗️Net New ARR $104,764M (+110.3% YoY)

↘️CAC* Payback Period 7.4 Months (-7.1 YoY)🟢

↘️R&D* Index (RDI) 0.89 (-0.40 YoY)🟡

Dilution

↘️SBC/rev 15%, -1.2 PPs QoQ

↗️Basic shares up 0.8% YoY, +0.0 PPs QoQ🟢

↗️Diluted shares up 1.1% YoY, +0.1 PPs QoQ

Guidance

↗️Q2'25 $766.0 - $769.0M guide (+13.5% YoY) beat est by 2.2%

↗️$3,090.0 - $3,100.0M FY guide (+12.7% YoY) raised by 1.5% beat est by 1.5%

Key points from Veeva’s First Quarter 2025 Earnings Call:

Financial Performance

Veeva reported Q1 FY2026 revenue of $759 million, exceeding internal guidance. Non-GAAP operating margin was strong, supported by usage-based Crossix revenue and accelerated services delivery. The company modestly raised its full-year billings outlook, citing FX tailwinds and Q1 outperformance.

Veeva achieved its $3 billion annual revenue run rate target for CY2025 ahead of schedule. Crossix, growing at 30%+ year-over-year, contributed significantly to both quarterly upside and long-term trajectory.

Vault CRM

Vault CRM has become Veeva’s core commercial platform. Over 80 customers are now live, with a path to reach ~200 by FY2027. Growth includes both new customers and migrations from legacy Veeva CRM.

Four Top 20 pharma firms have publicly committed to Vault CRM. One is rolling out the platform to ~20,000 users globally by year-end. Vault CRM's appeal centers on platform superiority, AI integration, and sales-marketing-medical unification.

Recent innovations—Campaign Manager and Service Center—enable an integrated go-to-market suite, gaining early traction in the small and mid-sized pharma segment.

Large customers are methodical in migration, with most expected to decide between 2025–2026, before legacy support risks increase in 2027.

Clinical Products

Veeva’s clinical suite is a high-growth area. eTMF is deployed by 19 of the Top 20 global pharma, approaching full penetration. Veeva sees this as a path to industry standardization.

EDC has been adopted by 9 of the Top 20, though implementations are in early ramp stages. Veeva positions EDC as part of a unified clinical platform, leveraging integration with CTMS and Site Connect to differentiate.

Long sales cycles and clinical inertia among large sponsors remain challenges.

Service Center and Services

Service Center, Veeva’s customer service application within Vault CRM, is gaining adoption among early-stage and mid-market clients. It enables integrated post-sale support, complementing CRM and Campaign Manager.

Professional services revenue benefited from timing gains in Q1, expected to normalize over Q2–Q4. Services revenue is more susceptible to macro shifts, particularly among emerging biotechs, though no softening has been observed.

Alignment between Vault CRM migrations and services delivery is driving implementation success and customer satisfaction.

Development Cloud

Development Cloud, spanning Quality, Regulatory, Clinical, and Safety, is guided to grow 19% YoY in FY2026. Customers increasingly adopt multiple modules across the platform, reinforcing cross-sell velocity.

Innovation focuses on workflow unification and data consistency, enabling customers to reduce manual duplication, enhance audit trails, and accelerate regulatory cycles.

Success depends on Veeva’s ability to drive standardization across siloed environments, especially in large global organizations.

Data Cloud

Veeva’s Data Cloud continues to expand. Crossix grew 30%+ YoY, driven by usage-based pricing and broader adoption in digital media optimization and HCP campaign performance.

Compass now supports ~4,000 brands, with recent growth in patient analytics. Q1 saw ~10 new brand adoptions, expanding its commercial footprint.

Veeva’s direct data sourcing model—via pharmacy, health system, and claims relationships—offers structural advantages over syndicated data.

Challenges include long sales cycles and entrenched competitors, particularly in Compass’s National and Prescriber segments.

Horizontal CRM

Veeva is building Horizontal CRM for large enterprises, operating through a dedicated team separate from the life sciences business. Product-market fit is in development, with the first customer expected by year-end FY2026.

Veeva aims to deliver CRM with speed, usability, and customer-centric alignment, positioning against large incumbents like Salesforce. SMB markets such as HubSpot are not targeted.

Management is exploring M&A to support this effort, emphasizing disciplined capital allocation and long-term synergy potential.

Product Innovation

Veeva is advancing its modular expansion strategy. Key product launches include Campaign Manager, Service Center, and AI-powered CRM agents.

Crossix now offers full-suite audience segmentation and optimization for both consumers and HCPs. Compass continues to build scale in patient behavior analytics, reinforcing its value as a commercial insight platform.

In R&D, adoption of eTMF, EDC, and Vault Safety is driving integrated platform expansion.

AI Strategy

AI innovation is centralized in Veeva.ai, a dedicated platform team building embedded intelligence within core apps.

Early use cases include:

CRM Agent for pre-call planning and data entry

MLR Agent for automated regulatory review

Safety Agent for case creation from unstructured data

Veeva estimates its AI capabilities could drive 15% industry efficiency gains by 2030. Pricing will be designed for broad adoption, though details are not yet finalized. Customer interest is high, especially following live demos at the Commercial Summit.

Customer Sentiment

Customer feedback is overwhelmingly positive. At the Commercial Summit (~2,000 attendees), executives expressed alignment with Veeva’s product vision and execution.

Top priorities include connected platforms, data integration, and operational ROI. Vault CRM and Veeva AI were major points of interest, with clients looking to scale usage and adopt next-gen capabilities.

Competitive Outlook

Veeva differentiates through its industry-specific architecture and integration of software and data, giving it an edge over horizontal CRM providers like Salesforce.

New verticals such as Horizontal CRM and AI introduce competition, but Veeva is pursuing a measured, high-value approach.

Customers who prefer highly customized tools are less aligned with Veeva’s standardized, scalable model.

Strategic Partnerships

Veeva is investing in its partner ecosystem to support AI and data-driven solutions. The rollout of a Direct Data API facilitates secure integration with external LLM providers and data platforms.

No material new partnerships were announced in the quarter, but M&A remains active, especially in areas related to data infrastructure and horizontal applications.

Macro Environment

While core performance remains solid, Veeva acknowledged uncertainty around:

U.S. drug pricing reforms

Trade and tariff risks

Capital market conditions affecting biotech funding

Management reports no material impact on deal flow, renewals, or project execution. The subscription model and mission-critical product suite provide stability, even in volatile markets.

Outlook

FY2026 guidance is reaffirmed, with billings raised modestly on Crossix outperformance and FX impact.

Vault CRM migrations are expected to accelerate in 2025–2026, with large enterprise decisions front-loading before 2027. Expansion of Campaign Manager, Service Center, and Data Cloud will unlock incremental value.

AI monetization and Horizontal CRM are future growth levers, with real impact expected post-FY2026. Veeva is positioned to lead across both vertical and emerging horizontal markets.

Management comments on the earnings call.

Product Innovations

Peter Gassner, Chief Executive Officer

“We are innovating in a lot of different ways. So new companies want to get started [on Vault CRM], and other customers want to migrate.”

“We're not building a generic AI. We're building a medical, legal, regulatory approval agent, a CRM agent for pre-call planning, a safety agent that can transcribe pretext into a safety case. These AI applications work because they're deeply embedded in our core apps.”

Paul Shawah, Executive Vice President, Strategy

“Since we made the move to Vault CRM, we've been able to innovate in totally different ways. That includes bringing sales, marketing, and service together in a single customer database that hasn’t been done in life sciences.”

Vault CRM

Paul Shawah, Executive Vice President, Strategy

“Today, we're at about over 80 customers live, and we're on track to be about 200 customers live on Vault CRM one year from now.”

“In the quarter, we added 28 Vault CRM customers total, and about half of those were migrations. The other half were net new customers.”

“We're executing this transition in a customer-friendly way. We're not forcing anyone to move. Most large companies will make decisions in 2025 or 2026.”

Clinical Products

Peter Gassner, Chief Executive Officer

“We’re really excited about eTMF. We have 19 of the top 20 pharma customers and a pretty good path to get all 20. That’s just amazing, and we view that as an honor.”

“In EDC, we have nine of the top 20 using the product. Some are early, multi-year ramp deals. I believe over time we’ll get there, because of the structural advantage in integrating clinical operations and data management.”

AI Strategy

Peter Gassner, Chief Executive Officer

“I think Veeva can help increase life sciences efficiency by 15% by 2030 with deep AI. That’s a huge number and a step change for the industry.”

“It’s very clear to me: the magic happens when deep core applications and AI work together. This is a new computing paradigm, and it doesn’t replace core systems—it complements them.”

“I want Veeva to be known as the company that did AI right. Where we bring in $1 and customers get $4 of value.”

Paul Shawah, Executive Vice President, Strategy

“One of our first AI agents will be in core CRM. We believe we can significantly boost field team productivity with better pre-call planning and post-call automation.”

Horizontal CRM

Peter Gassner, Chief Executive Officer

“We’re pretty excited about that new market. We’re focusing first on horizontal CRM, but we still need to define the exact product area and customer segment.”

“It’s a whole new Veeva out there. Different team, different operating model, but we bring the same values: product excellence, speed, and customer success.”

“I think the space is in need of innovation. People got used to thinking there’s nothing new in CRM—but there actually is.”

“We’re more expert in large enterprises than in the SMB area. So I think you’ll see us target there, not the HubSpot space.”

Competitors

Peter Gassner, Chief Executive Officer

“Some companies want more of a custom-type product. That’s not our approach, but we expect to win and retain the vast majority of our customers.”

Paul Shawah, Executive Vice President, Strategy

“Our differentiation is around standardization, embedded intelligence, and bringing multiple commercial functions—sales, marketing, service—into a single, life sciences-specific platform. That’s not something generic CRM vendors do well.”

Customers

Peter Gassner, Chief Executive Officer

“I had more than 50 one-on-one conversations at the Commercial Summit. The customer feeling is good. That’s because we’re executing, we’re bringing value, and our people are performing.”

“One of the top 20 pharma customers confirmed they’ll be fully live on Vault CRM globally by year-end. That’s 20,000 users across countries. That’s real enterprise adoption.”

“When I showed the demo of Veeva AI, you could just see the light bulbs go on. Field teams want help planning the call and avoiding manual data entry. That’s the excitement—real use cases.”

Strategic Partnerships

Peter Gassner, Chief Executive Officer

“We’ve developed a partner program and launched our Direct Data API. That gives partners controlled access to data in a secure and responsible way, aligned with our AI strategy.”

“We keep a wide aperture on M&A. If we can find something synergistic—especially in horizontal applications—we’d look closely. We’ve had no failed acquisitions to date, and we’ll stay disciplined.”

Challenges and Macro

Peter Gassner, Chief Executive Officer

“There’s more uncertainty today than ninety days ago. Customers are talking about FDA vacancy concerns, the potential impact of executive orders on drug pricing, and acquisition planning.”

“We haven’t seen any material change in our pipeline or results. But if uncertainty persists, it won’t help patients or innovation in the industry.”

Brian Van Wagener, Chief Financial Officer

“Our business is largely subscription-based, in mission-critical areas, with long-term contracts. That insulates us to some degree from macro pressures.”

“If things were to deteriorate, services and small biotech funding would be the most vulnerable. But so far, deals are progressing, contracts are renewing, and we’re executing on plan.”

Future Outlook

Peter Gassner, Chief Executive Officer

“We’ve achieved our $3 billion annual run rate goal ahead of schedule. That’s a great milestone for the company and reflects broad execution.”

Brian Van Wagener, Chief Financial Officer

“Our guidance assumes current conditions persist. The Q1 beat was driven by Crossix usage and services timing. We’ve adjusted the billings outlook to reflect that.”

“Crossix is a 30%+ growth business. It’s lumpy quarter to quarter, but we believe it will be a significant long-term contributor to growth.”

Thoughts on Veeva Earnings Report $VEEV:

🟢 Positive

Revenue rose to $759.0M, up +16.7% YoY, beating estimates by 4.3%

EPS (non-GAAP) reached $1.97, exceeding estimates by 13.2%

Subscription revenue grew to $634.8M, up +18.9% YoY, with a gross margin of 88.1%

Net margin increased to 30.1%, up +7.4 percentage points YoY

Gross margin (non-GAAP) improved to 79.2%, up +3.5 PPs YoY

Net new ARR hit $104.8M, up +110.3% YoY

Crossix grew 30%+ YoY, supporting Q1 revenue beat and guidance raise

Vault CRM surpassed 80 customers, on track for ~200 by FY2027

Guidance raised: FY26 revenue now $3.09–$3.10B, up +12.7% YoY, above consensus by 1.5%

CAC payback improved to 7.4 months, down 7.1 months YoY

🟡 Neutral

Billings at $731M, up +16.1% YoY, in line with expectations

Professional services revenue reached $124.3M, up +6.8% YoY; expected to normalize after early recognition

Development Cloud guided to grow +19% YoY, with stable cross-sell performance

Service Center gaining traction in mid-market, still in early adoption

Compass added ~10 brands in Q1; progress steady but long cycle remains

S&M/R&D/G&A as % of revenue all declined slightly YoY, showing disciplined spend

Diluted share count rose +1.1% YoY, minimal impact

Free cash flow margin dipped to 114.8%, down -1.3 PPs YoY

🔴 Negative

Operating margin (non-GAAP) declined to 30.8%, down -9.3 PPs YoY

R&D Index fell to 0.89, down -0.40 YoY

Stock-based comp at 15% of revenue, remains elevated despite -1.2 PPs QoQ improvement

EDC ramp slow, only 9 of Top 20 pharma live, implementations remain early stage

Macro risks persist: U.S. drug pricing, tariffs, and biotech funding pressure noted, though not yet materializing in pipeline impact

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.