Financial Results:

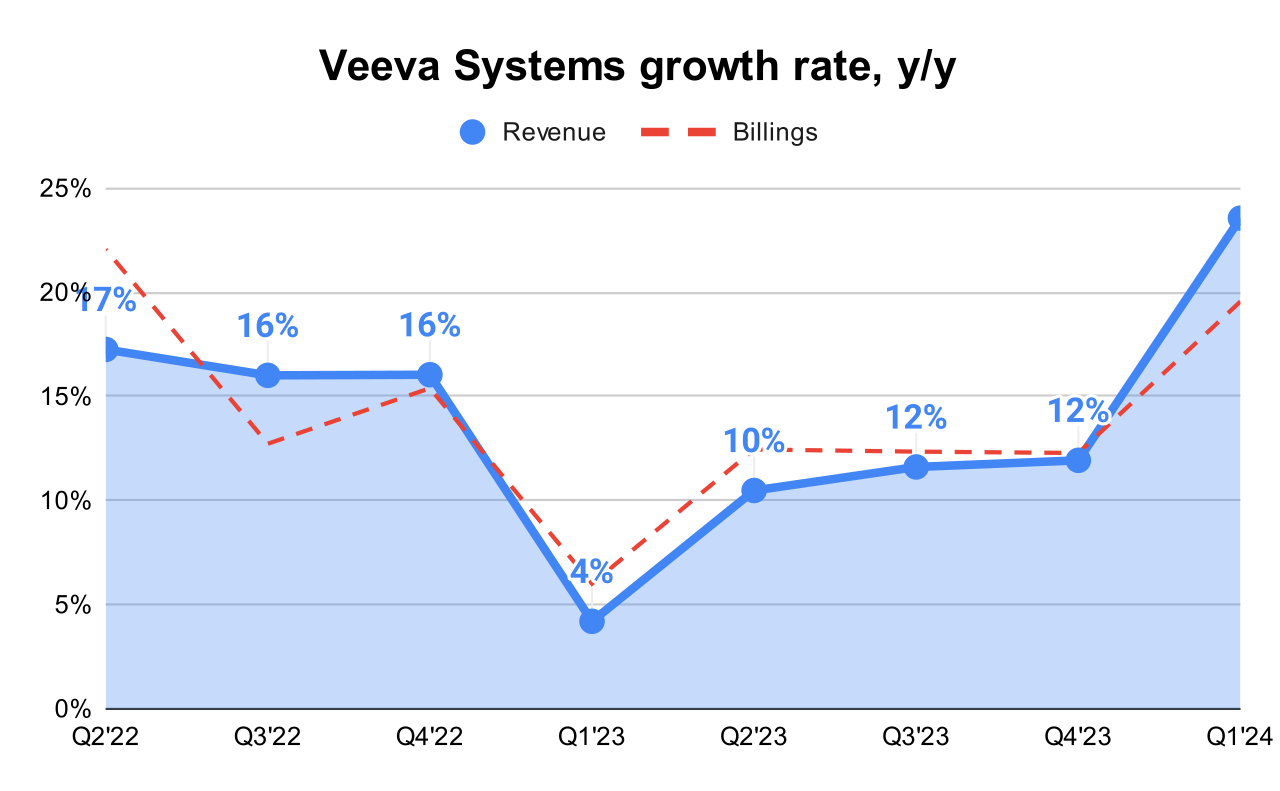

↗️$650.3M rev (+23.6% YoY, +11.9% LQ) beat est by 1.3%

↗️GM* (75.6%, +4.4%pp YoY)🟢

↗️Operating Margin* (40.1%, +10.3%pp YoY)🟢

↗️Net Margin* (38.0%, +9.9%pp YoY)🟢

↗️EPS* $1.50 beat est by 4.9%🟢

*non-GAAP

Key Metrics

➡️Billings $630M (+20.0% YoY)🟡

Revenue By Segments

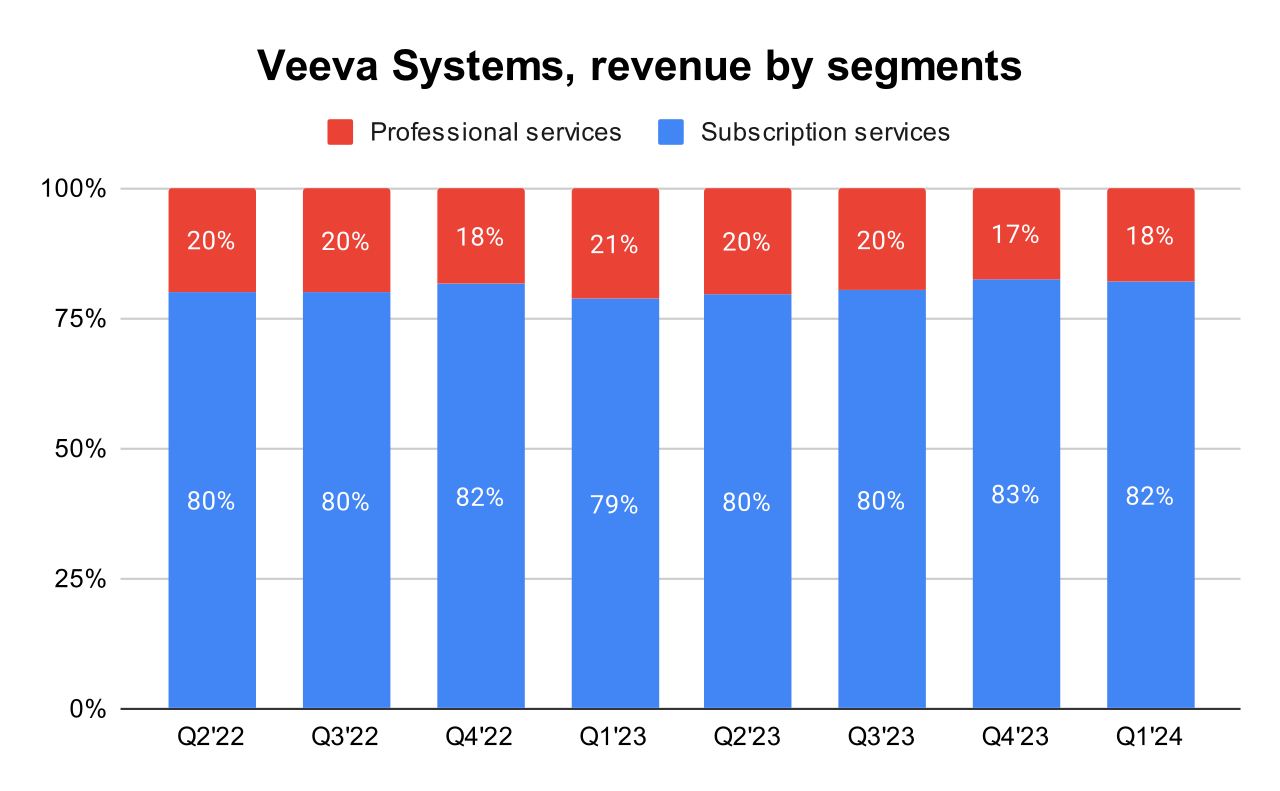

Subscription services

↗️$534.0M Subscription services rev (+28.8% YoY)🟢

↗️GM* (85.4%, +1.0%pp YoY)

Professional services

➡️$116.4M Professional services rev (+4.1% YoY)🟡

↘️GM* (17.7%, -5.1%pp YoY)

Operating expenses

↘️S&M*/Revenue 10.9% (11.4% LQ)

↘️R&D*/Revenue 18.6% (19.1% LQ)

↘️G&A*/Revenue 6.0% (6.6% LQ)

↘️Net New ARR $49.8M ($106.3 LQ)

↘️CAC* Payback Period 14.5 Months (19.7 LQ)

Dilution

↘️SBC/rev 15%, -0.9%pp QoQ

↘️Basic shares up 1.0% YoY, -1.9%pp QoQ🟢

↘️Diluted shares up 1.2% YoY, -0.1%pp QoQ

Guidance

↘️Q2'24 $666.0 - $669.0M guide (+13.1% YoY) missed est by -1.2%🔴

↘️$2,700.0 - $2,710.0M FY guide (+14.4% YoY) lowered by -1.1% missed est by -0.9%🔴

Key points from Veeva Systems First Quarter 2024 Earnings Call:

Revenue:

Veeva reported a strong start to the year with Q1 revenue of $650 million and non-GAAP operating income of $261 million, both above their guidance.

R&D and Commercial Cloud Developments:

There was continued adoption in all areas of the Development Cloud, including significant wins with three top 20 biopharma companies. In the Commercial segment, significant progress was noted in Vault CRM and early momentum for Compass in Data Cloud.

Commercial Cloud Vision with Vault CRM:

Veeva is making significant progress in its Commercial Cloud Vision, particularly with the integration and development of Vault CRM. This product aims to unify sales, marketing, and medical operations under a single platform, which is a shift from traditional segregated systems.

Data Cloud and Compass:

Early momentum for the Compass product in the Data Cloud was highlighted. Compass is designed to improve how companies access and utilize data, offering more precise and timely data to support decision-making processes.

Vault CRM for Medical Device Clients and Small Biotechs:

The expansion of Vault CRM to new segments such as medical device clients and small biotech firms was discussed. This expansion not only broadens the product’s market but also tailors Veeva's powerful tools to the specific needs of these sectors, demonstrating flexibility and responsiveness to diverse customer needs.

Vault Basics:

This new offering targets smaller, emerging biotech companies, providing them with essential management tools without the need for extensive customization or implementation costs. Vault Basics is designed to help small companies scale by offering standardized, industry-leading processes and systems at a lower entry cost.

Innovations in CRM and Data Management:

Significant enhancements in CRM functionalities, including new AI strategies and the integration of sales, marketing, and medical data, were noted. These innovations aim to streamline operations and provide more cohesive and actionable insights across various business functions.

Customer Engagement and Strategy:

Veeva reported significant adoption of their Development Cloud by three top 20 biopharma companies, indicating strong customer engagement and trust in Veeva's products.

Challenges and Macroeconomic Environment:

Veeva noted disruptions in large enterprises as they re-evaluate their strategies to incorporate AI technologies. This has introduced competing priorities, impacting timelines and focus areas.

The broader challenging economic conditions continue to affect customer spending and decision-making processes, contributing to delays in deal closures and project implementations.

Full Year Revenue Guidance Cut:

Veeva reduced its full-year revenue guidance from $2.74 billion to $2.71 billion. This reduction reflects the ongoing macroeconomic challenges and the specific impact of AI-related disruptions within large enterprises.

A significant factor in the revenue guidance adjustment is attributed to the timing of deals, particularly in the R&D sector. Over 50% of the reduction is related to deal timing in enterprise businesses, indicating that these are not lost deals but postponed to future financial periods.

Management comments on the earnings call.

Product Innovations:

Peter Gassner, CEO: "In Commercial, we're making great progress on our Commercial Cloud Vision with Vault CRM and in Data Cloud early momentum for Compass is strong. We have a clear and compelling product strategy and are building a very durable company with a long runway of growth."

Customers:

Paul Shawah, EVP, Commercial Strategy: "Summit was a really great event, a great success and I would say pretty, as we brought together over 2,000 people from across the industry in a wide variety of areas sales, marketing, operations, IT. We had about 100 customers presenting across all those areas from 50 different companies. So pretty broad-based covering everything from Crossix, Compass and what we're doing in CRM commercial content."

Macro Environment and Challenges:

Peter Gassner, CEO: "As I shared in our prepared remarks, we've reduced our full year revenue guidance by about $30 million from $2.74 billion to $2.71 billion as the macro environment remains challenging. Despite macro headwinds, we continue to execute well and deliver customer success."

Guidance Cut:

Tim Cabral, Interim CFO: "Yes. Hey, Joe. Tim here. Thanks for the question. As it relates to the reduction in the subscription on the R&D side, a little over 50% is related to the deal timing and the enterprise business. And the remainder is related to the SMB that we discussed. Overall, if you include services there, Joe, it's more of a 60% to enterprise, roughly 60% to the enterprise business."

Future Outlook:

Peter Gassner, CEO: "We are navigating these challenges by focusing on our core strengths and continuing to innovate in ways that matter most to our customers. We believe that our strategic investments in R&D and commercial products position us well for long-term growth despite the short-term economic pressures."