The Trade Desk Q4 2024 Earnings Analysis

Dive into $TTD Trade Desk’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↘️$741M rev (+22.3% YoY, +27.4% LQ) missed est by -2.1%🔴

↘️GM* (82.9%, -1.5 PPs YoY)🟡

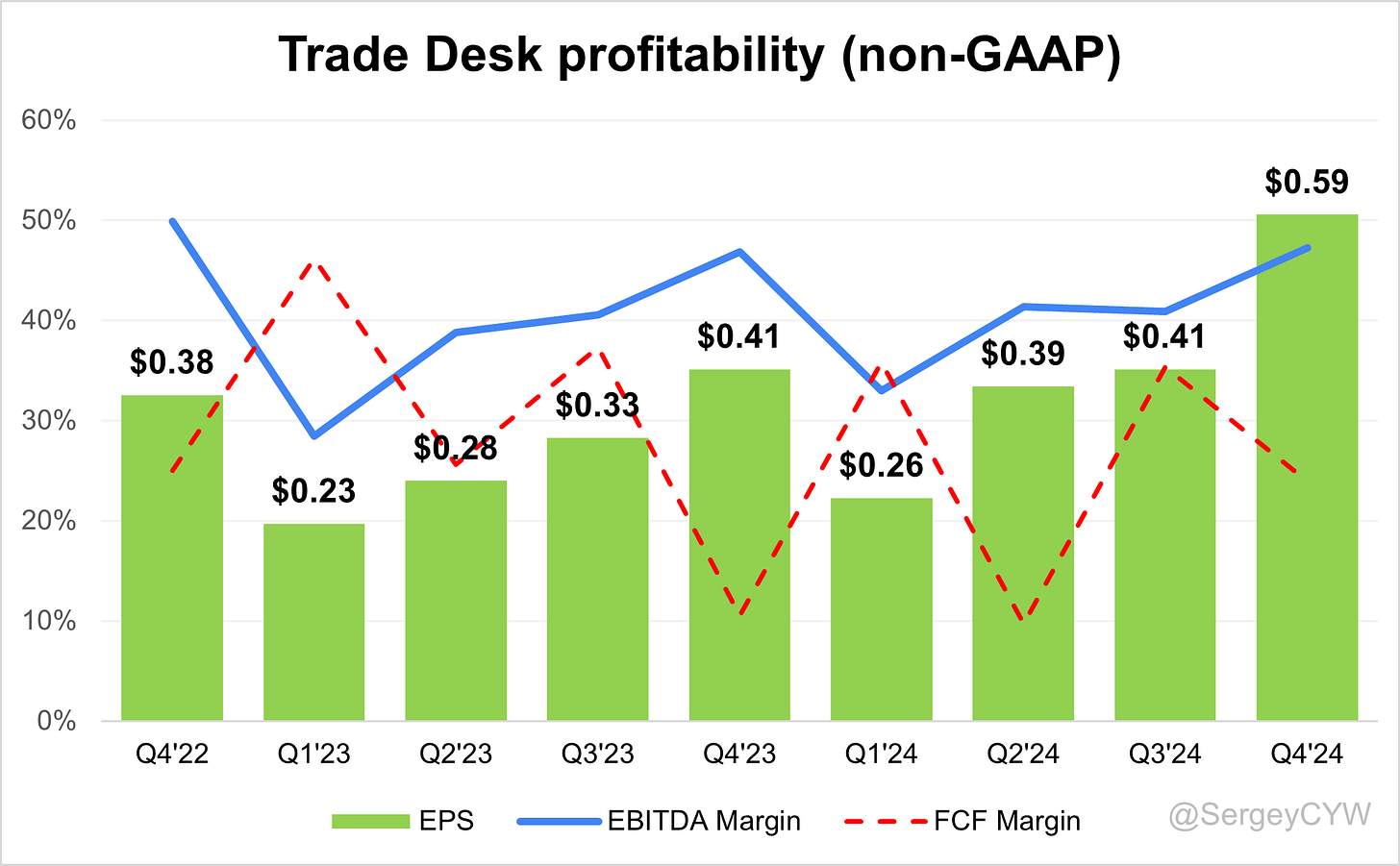

↗️Adj EBITDA Margin (47.2%, +0.4 PPs YoY)

↘️Operating Margin* (43.8%, -0.1 PPs YoY)🟡

↗️FCF Margin (23.9%, +13.3 PPs YoY)

↗️Net Margin (40.0%, +5.9 PPs YoY)

↗️EPS* $0.59 beat est by 5.4%🟢

*non-GAAP

➡️Customer Retention 95% (95% LQ)

Operating expenses

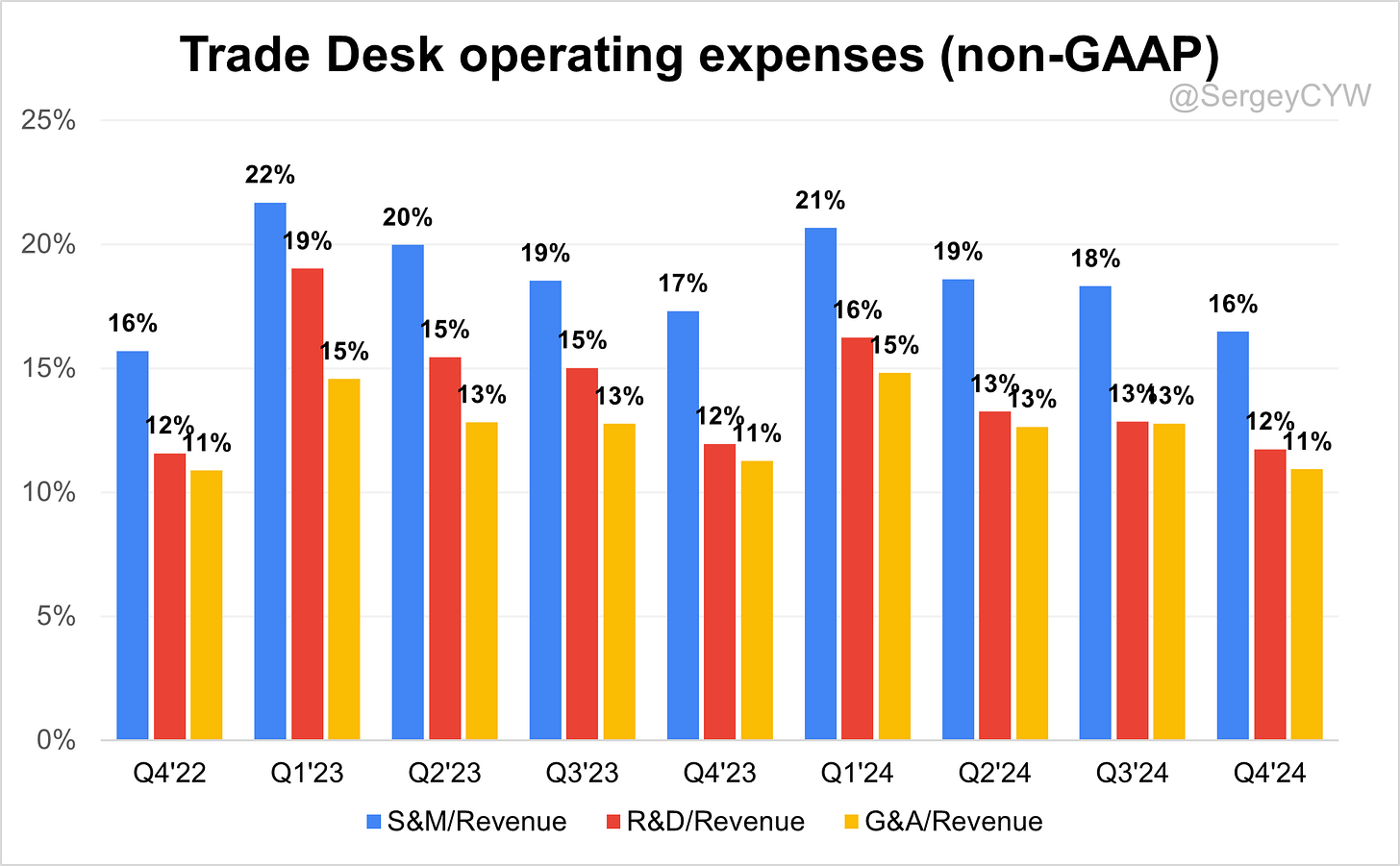

↘️S&M*/Revenue 16.5% (-0.8 PPs YoY)

↘️R&D*/Revenue 11.7% (-0.2 PPs YoY)

↘️G&A*/Revenue 10.9% (-0.3 PPs YoY)

Dilution

↘️SBC/rev 17%, -3.0 PPs QoQ

↗️Basic shares up 0.9% YoY, +0.5 PPs QoQ🟢

↗️Diluted shares up 1.4% YoY, +1.3 PPs QoQ

Guidance

↘️Q1'25 $575.0M guide (+17.1% YoY) missed est by -1.6%🔴

Key points from The Trade Desk’s Fourth Quarter 2024 Earnings Call:

Financial Performance

The Trade Desk posted $2.4 billion in revenue in 2024, a 26% YoY increase, with total ad spend exceeding $12 billion. Q4 revenue reached $741 million (+22% YoY) but missed expectations, ending a 33-quarter streak of hitting guidance. The company remained profitable, generating over $1 billion in adjusted EBITDA and $600 million in free cash flow. The balance sheet remains strong with $1.9 billion in cash and zero debt.

For Q1 2025, revenue guidance is $575 million (+17% YoY) with $145 million in adjusted EBITDA. A $1 billion share repurchase program was announced to offset dilution and strengthen shareholder value.

Product Innovations

The company is advancing AI-driven targeting, forecasting, and measurement. Leadership is prioritizing scalability and operational efficiency with nearly 100 agile development teams, ensuring a faster product release cycle.

CTV Growth

CTV remains the largest and fastest-growing channel, accounting for a high-40s percentage of ad spend. Partnerships with Disney, Netflix, Paramount, and Vizio support programmatic CTV expansion.

With CTV ad spending still a fraction of linear TV, The Trade Desk is positioned to capture market share as brands shift budgets to digital. AI-driven auction mechanics and audience targeting will enhance efficiency.

The Ventura Operating System simplifies CTV ad supply chains for streaming services and advertisers. Early results show improved efficiency and higher revenue for streaming partners.

Kokai Adoption

Kokai, the company’s AI-powered platform, will be mandatory for all clients in 2025, replacing Solimar. Advertisers using Kokai report better audience segmentation and forecasting.

Slower-than-expected adoption in Q4 impacted short-term revenue but was a strategic move to ensure robust AI integration. Management expects long-term benefits in performance and client value.

UID2 and OpenPath Expansion

Unified ID 2.0 (UID2) adoption continues to grow as a privacy-first, cookieless identity solution, particularly in CTV and digital audio. Spotify, SiriusXM, Pandora, and iHeartMedia have integrated UID2, allowing data-driven campaign execution in logged-in environments.

OpenPath is entering a high-growth phase in 2025, removing intermediaries and improving CPMs for publishers. Disney and Vizio have already reported higher revenue from direct programmatic integration.

Sincera Acquisition

The acquisition of Sincera, a metadata company, will improve supply chain transparency, price discovery, and inventory quality. The integration strengthens the company’s commitment to an efficient ad ecosystem.

Global Expansion

International revenue is growing faster than North America for the eighth consecutive quarter, though the U.S. still accounts for 88% of total spend. Europe, Latin America, and Asia-Pacific remain key focus areas.

Retail Media Growth

Retail media is a high-growth driver, with brands increasing data-driven ad spending. The platform integrates retail data from global partners, enabling real-time conversion tracking.

Boiron, a homeopathic products leader, saw 267% ROAS using Kroger retail data. High-end skincare brand Sulwhasoo improved conversion rates by 380% and cut acquisition costs by 80% using UID2 and Kokai.

Large Customer Wins

Fortune 500 brands expanded Joint Business Plans (JVPs), which grew 50% faster than the rest of the business. Major agency partnerships were secured, reinforcing commitment to both agencies and direct brand relationships.

Vizio integrated OpenPath, leading to a 39% revenue increase and an 8x improvement in fill rate, proving the value of direct programmatic integration.

Earnings Miss and Execution Challenges

For the first time in 33 quarters, revenue expectations were missed due to execution missteps, not external macro factors.

Key factors:

Kokai rollout delays slowed platform adoption and revenue growth.

Operational inefficiencies created confusion in execution.

Short-term trade-offs were made for long-term AI and supply chain investments.

Despite this, management remains confident in long-term growth, with structural changes in place to improve execution.

Strategic Reorganization

A company-wide reorganization in December improved efficiency and clarity by:

Reorganizing client-facing teams, splitting focus between brands and agencies.

Streamlining reporting structures for clearer accountability.

Shifting to smaller agile teams, enabling weekly product releases.

Leadership Expansion

Senior leadership is expanding, including a planned COO hire to enhance operational efficiency. The company expects to double VP-level and above executives in the coming years.

Competitive Positioning

The Trade Desk remains the leading independent DSP, while competition from walled gardens intensifies.

Google’s DV360 DSP is being deprioritized, with ad spend shifting to YouTube.

Amazon’s DSP is growing but faces objectivity issues, competing with many advertisers.

Meta and Apple are focusing on closed ecosystems, while The Trade Desk leads in premium open-internet advertising.

Future Outlook

Q1 2025 revenue is expected to be $575 million (+17% YoY), with a modest increase in operating expenses due to investments in AI, infrastructure, and talent.

The company sees strong tailwinds in CTV, retail media, AI adoption, and Google’s exit from the open internet. The total addressable market exceeds $1 trillion, and The Trade Desk controls just over 1% today.

Management is focused on scaling faster and resuming revenue acceleration in 2025 and beyond.

Management comments on the earnings call.

Product Innovations

Jeff Green, Co-Founder and Chief Executive Officer

“Our platform is the most advanced data-driven decision-making system in our industry, and we are constantly iterating to enhance advertiser value. The shift back to smaller agile teams will accelerate Kokai enhancements and allow us to ship improvements at a faster pace, ensuring advertisers benefit from more efficient and effective ad buying.”

Jeff Green, Co-Founder and Chief Executive Officer

“We continue to inject AI into our platform to drive performance gains. AI is improving forecasting, audience segmentation, and supply chain optimization, helping our clients achieve better outcomes with every ad dollar they invest.”

Connected TV (CTV) Growth

Jeff Green, Co-Founder and Chief Executive Officer

“CTV remains the kingpin of the open internet, and it should be the first place where brand advertisers spend, not walled gardens. The most successful streaming companies realize that programmatic advertising is the most effective way to fund their content and drive profitability. That is why we see CTV continuing to outpace other channels in terms of growth.”

Jeff Green, Co-Founder and Chief Executive Officer

“As media leaders such as Disney and Vizio embrace OpenPath, they are proving that a more efficient supply chain translates into better yield and profitability. We expect OpenPath to reach the steep acceleration phase of its growth curve in 2025 as more major CTV players deploy it.”

Kokai Transition and AI Integration

Jeff Green, Co-Founder and Chief Executive Officer

“Kokai represents the biggest transformation of our platform in company history. AI-driven forecasting, precision targeting, and advanced deal management capabilities are making programmatic advertising more intelligent and effective. By the end of this year, 100% of our clients will be using Kokai exclusively.”

Jeff Green, Co-Founder and Chief Executive Officer

“We are optimizing our product process to ensure we ship impactful enhancements on a weekly basis. Our agile teams are releasing AI-powered features that improve efficiency and transparency, ensuring our advertisers always have access to the most advanced capabilities.”

Competitive Landscape and Market Position

Jeff Green, Co-Founder and Chief Executive Officer

“The competitive advantage of our independent, objective DSP has never been clearer. We are not competing with our clients, unlike walled gardens that leverage advertiser data for their own benefit. Advertisers increasingly recognize that objectivity matters, and every day, that importance only grows.”

Jeff Green, Co-Founder and Chief Executive Officer

“Amazon’s objectivity problem is even bigger than Google’s because they compete with nearly every Fortune 500 company. Our independence and neutrality position us as the clear choice for advertisers who want transparency and control.”

Earnings Miss and Execution Challenges

Jeff Green, Co-Founder and Chief Executive Officer

“For the first time in eight years, we missed our own expectations, and that is on us. It was not due to a smaller opportunity or increased competition but rather a series of execution missteps. We take this moment seriously, and we are making the necessary adjustments to ensure we continue our track record of delivering strong performance.”

Jeff Green, Co-Founder and Chief Executive Officer

“In Q4, we could have made decisions that prioritized short-term revenue, but we consistently chose to build for the long-term opportunity. We are recalibrating the company to scale faster because we see a bigger and faster-growing market than we originally anticipated.”

Strategic Reorganization and Operational Efficiency

Jeff Green, Co-Founder and Chief Executive Officer

“In December, we executed the largest reorganization in company history. We streamlined client-facing teams, clarified roles and responsibilities, and ensured better alignment between our agency and brand teams. These structural improvements will help us scale more efficiently and execute at a higher level.”

Jeff Green, Co-Founder and Chief Executive Officer

“Our leadership team has spent more time in the last two months discussing internal effectiveness and operational improvements than at any other point in our history. We recognize that growing companies need recalibration, and these changes position us to capitalize on the massive opportunity ahead.”

Product Development Process Improvements

Jeff Green, Co-Founder and Chief Executive Officer

“We have shifted back to smaller, highly agile scrum teams that release updates weekly. This ensures we can move faster, improve responsiveness to customer needs, and continuously innovate at a high pace.”

Jeff Green, Co-Founder and Chief Executive Officer

“Our product process has been revised to avoid unnecessary complexity while maintaining innovation. The goal is to make decision-making easier and more intuitive for advertisers while delivering powerful new features that enhance performance.”

Leadership and Talent Expansion

Jeff Green, Co-Founder and Chief Executive Officer

“As our company grows, we need to scale our leadership to match the increasing complexity of our business. Over the next few years, we expect to double the number of senior leaders, particularly at the VP level and above.”

Jeff Green, Co-Founder and Chief Executive Officer

“We have achieved all of this growth without a Chief Operating Officer, but as we scale, there is no reason why we shouldn’t bring in a world-class COO to help drive operational efficiency.”

Future Outlook and Market Opportunity

Jeff Green, Co-Founder and Chief Executive Officer

“The total addressable market (TAM) for digital advertising exceeds $1 trillion, and we control just over 1% of it today. Our opportunity is enormous, and our focus remains on scaling our business to capture a much larger share.”

Jeff Green, Co-Founder and Chief Executive Officer

“We are obsessing about scale. The question we continuously ask is, ‘How do we take what works and make it scale faster?’ As we refine our structure and improve efficiency, I am confident that we will resume acceleration and continue our path of market leadership.”

Thoughts on The Trade Desk Earnings Report $TTD:

🟢 Positive

Revenue: $2.4B in 2024 (+26% YoY). If the company beats its forecast by 1.4%, median beat for last year, next quarter’s growth is projected to be +19%.

Profitability: Adjusted EBITDA of $1B and free cash flow of $600M.

Margins: Net margin 40.0% (+5.9 PPs YoY), FCF margin 23.9% (+13.3 PPs YoY), Adj EBITDA margin 47.2% (+0.4 PPs YoY).

EPS: $0.59, beating estimates by 5.4%.

Customer Retention: 95%, unchanged.

Retail Media Success: Boiron saw 267% ROAS, Sulwhasoo increased conversions by 380% while cutting acquisition costs by 80%.

OpenPath Expansion: Vizio integrated OpenPath, increasing revenue by 39% and improving fill rates 8x.

Operational Efficiency: S&M, R&D, and G&A expenses as a percentage of revenue declined YoY.

Shareholder Returns: $1B share repurchase program announced.

Proactivity of management – Jeff Green doesn’t just blame circumstances but takes responsibility and takes action: announcing a planned COO hire and a company-wide reorganization in December.

🟡 Neutral

Gross Margin: 82.9% (-1.5 PPs YoY).

Operating Margin: 43.8% (-0.1 PPs YoY).

Kokai Rollout Delays: Slower adoption impacted short-term revenue, but AI integration is expected to drive long-term gains.

International Growth: Outpacing North America for the 8th straight quarter, but the U.S. still accounts for 88% of total revenue.

Stock-Based Compensation (SBC): 17% of revenue, down 3.0 PPs QoQ, but still a dilution concern.

🔴 Negative

Q4 Revenue Missed Estimates: $741M (+22.3% YoY, +27.4% QoQ), -2.1% below expectations.

Q1’25 Guidance Below Estimates: $575M (+17.1% YoY), missed estimates by -1.6%.

Execution Issues: First earnings miss in 33 quarters due to operational inefficiencies, Kokai rollout delays, and long-term investment trade-offs.

Dilution: Basic shares up 0.9% YoY, diluted shares up 1.4% YoY.