Financial Results:

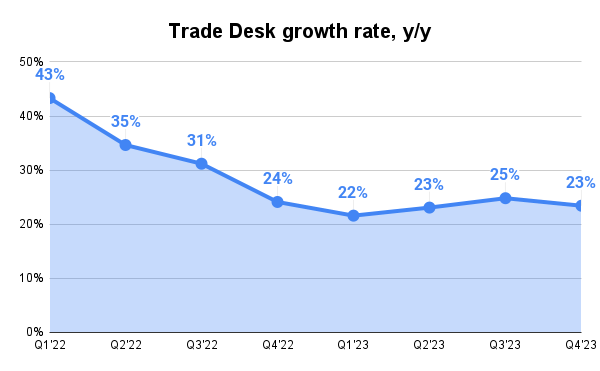

⬆️$606M rev (+23.4% YoY, +24.8% LQ) beat est by 4.1%

↘️Adj EBITDA Margin (46.9%, -3.0%pp YoY)

↘️FCF Margin 10.6%, -14.4%pp YoY)

⬆️Net Margin 16.0%, +1.6%pp YoY)🟢

↘️EPS* $0.41 missed est by -4.7%

*non-GAAP

➡️Customer Retention >95% (>95% LQ)

↘️S&M*/Revenue 17.3% (18.5% LQ)

↘️R&D*/Revenue 12.0% (15.0% LQ)

↘️G&A*/Revenue 11.3% (12.8% LQ)

↘️SBC/rev 20%, -8.3%pp QoQ)

↘️Dilution at 0.0% YoY, -0.3%pp QoQ)🟢

⬆️Q1'24 $478.0M guide (+24.8% YoY) beat est by 5.8%

Key points from The Trade Desk's Fourth Quarter 2023 Earnings Call:

Record Performance:

TTD achieved almost $10 billion in total spend on its platform in 2023, with Q4 revenue surpassing $600 million for the first time, indicating a strong finish to the year.

Growth and Profitability:

Despite uncertain market conditions, TTD reported a 23% revenue growth for 2023, outpacing the broader digital advertising market. The company also highlighted significant profitability, with over $770 million in adjusted EBITDA and $543 million in free cash flow.

Connected TV (CTV) and Retail Media Growth:

CTV remains the fastest-growing channel for TTD, with ad-supported streaming identified as a critical strategy for TV providers. Retail media also emerged as a significant growth area, with advertisers leveraging first-party data for more precise campaign activities.

Global Expansion and Diverse Growth Drivers:

TTD's international business grew faster than its U.S. operations, driven by CTV and retail media growth across different regions.

UID2 Adoption and Performance:

TTD sees rapid adoption and performance improvements for advertisers using UID2, contributing to a new identity currency for the open internet.

Kokai Platform Launch:

Kokai represents The Trade Desk's largest platform overhaul in its history, designed to enhance the way advertisers understand and score the relevance of every ad impression across all channels. It introduces an audience-first approach, leveraging advanced AI-driven tools to improve the effectiveness of advertising campaigns.

AI (Artificial Intelligence):

The Trade Desk has been embedding AI into its platform since 2016, enhancing its ability to make better choices among the millions of ad impression opportunities available every second. AI optimizations are distributed across the Kokai platform, enabling more efficient ad purchase processes and improved targeting.

Share Buyback:

The company announced a new share repurchase program authorization of up to $700 million, which includes $53 million remaining from the existing authorization.

Future Growth:

CEO Jeff Green expressed high confidence in the company's growth prospects for 2024 and beyond, citing a unique market position, ongoing strength in connected TV (CTV), and innovations in retail data and AI as key drivers.

Political Spending:

With 2024 being a U.S. election year, TTD anticipates gaining more share in the political advertising segment.

Management comments on the earnings call.

Product Innovations, Kokai

"This relentless focus on profitability and growth allows us to keep investing in innovation, ensuring we are always bringing the best possible value to our clients, whether it's our game-changing Kokai launch or new approaches to identity and authentication for the open internet." - Jeffrey Green

"Kokai represents a completely new way to understand and score the relevance of every ad impression across all channels. It allows advertisers to use an audience first approach to their campaigns." - Jeffrey Green

Competitors landscape

"In general, the current shifts will help companies with authenticated users and traffic, which also sit next to large amount of advertiser demand. These macro changes hurt those, especially content owners and publishers who don't have authentication." - Jeffrey Green

Customers

"HP started with their first-party data that consumers had consented to provide after making a purchase. That data was then matched with UID2s on our platform. As a result, HP segmented its audience into specific groups, allowing better targeting and measurement of specific product campaigns with more accuracy." - Jeffrey Green

"We're seeing significant performance improvements for advertisers who are using UID2 and this is accelerating adoption." - Jeffrey Green

Future Growth

"I've never felt more confident heading into a new year. I believe we are uniquely positioned to grow and gain market share, not only in 2024 but well into the future." - Jeffrey Green

"We're on the buy side. We also represent the majority of Fortune 500 brands. We also invested in UID2 many years ago. We invested in AI many years ago. And our business is increasingly built around CTV, audio, and environments that are almost always authenticated." - Jeffrey Green

Macro Environment:

"For nearly all of 2023, there was uncertainty, particularly around economic growth rates and recessionary fears. In that environment, CMOs become much more reliant on their CFOs, and CFOs needed to make sure that every dollar spent was in service of growth. Which means CMOs had to focus more than ever on where they could achieve efficacy and deliver strong and provable return on ad spent. That pressure came at the same time that many CTV content owners around the world were seeing how much more valuable ad viewing subscriptions were to them than the higher priced ad free subscribers." - Jeffrey Green

Political Spending:

"2024 stands to be a major year for political spending here in the United States. Since 2016, The Trade Desk has been a vital platform for leading political advertisers. This year, we expect to gain more share in this segment." - Jeffrey Green

Thoughts on Trade Desk ER $TTD :

🟢 Pros:

+ Customer retention remains above 95% for 9 consecutive years. 👍

+ Revenue rose by 23.4% YoY, and next quarter's guidance indicates an acceleration in revenue growth.

+ The company is increasing margins and profitability.

+ Beat Q4 revenue guidance by 4.5%.

🟡 Neutral:

+- SBC/rev is 20%; dilution stands at 0.0% YoY.

+- FCF margin decreased to 10.6% from 37.3% in the last quarter but is still healthy.