Financial Results:

↗️$491M rev (28.2% YoY, +23.4% LQ) beat est by 2.2%

↗️Adj EBITDA Margin (33.0%, +4.5%pp YoY)

↘️Net Margin* (26.7%, -3.1%pp YoY)

↘️FCF Margin (35.8%, -10.3%pp YoY)

↗️EPS* $0.26 beat est by 23.8%

*non-GAAP

➡️Customer Retention 95% (95% LQ)

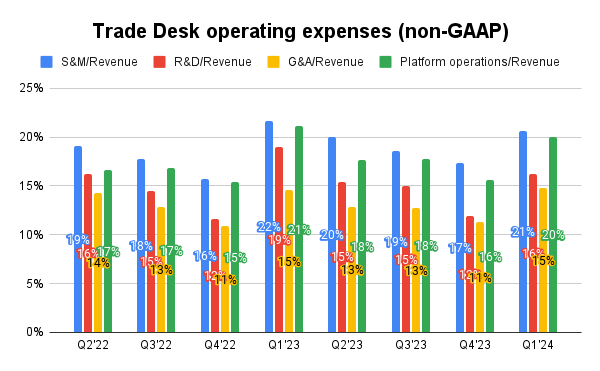

Operating expenses

↗️Platform operations*/Revenue 20.0% (15.6% LQ)

↗️S&M*/Revenue 20.7% (17.3% LQ)

↗️R&D*/Revenue 16.2% (12.0% LQ)

↗️G&A*/Revenue 14.8% (11.3% LQ)

Dilution

↗️SBC/rev 23%, +2.0%pp QoQ

↘️Basic shares down -0.2% YoY, -0.3%pp QoQ🟢

↘️Diluted shares down -0.3% YoY, -0.2%pp QoQ🟢

Guidance

↗️Q2'24 $575.0M guide (+23.9% YoY) beat est by 1.5%

Key points from Trade Desk’s First Quarter 2024 Earnings Call:

Revenue Growth and Financial Performance:

Revenue for Q1 2024 grew by 28% year-over-year, amounting to $491 million.

The growth was driven primarily by increased activity in Connected TV (CTV) and retail media.

Strong performance was attributed to scalability and increased utilization of the company's platform, including innovations like Kokai and UID2 deployment.

UID2 Integration and Identity Management:

The Trade Desk has integrated UID2 (Unified ID 2.0) across their platform. This technology serves as a new identity framework for the internet, allowing for better audience targeting and tracking without relying on traditional cookies. UID2 has become a standard for improving ad targeting accuracy and privacy compliance.

Kokai Platform Enhancements:

The Trade Desk's advanced AI-driven platform, Kokai, has received significant enhancements. Kokai includes features that leverage artificial intelligence for improved forecasting, budget optimization, and relevance scoring. This platform also supports audience-based buying, allowing advertisers to apply their data more effectively to target potential customers across the open internet.

Retail and CTV Data Integration:

The Trade Desk has emphasized the integration of retail data, particularly in Connected TV (CTV) advertising. By incorporating first-party data from retailers and advertisers, the platform can provide more precise targeting, leading to higher conversion rates and more efficient ad spend.

Partnerships with Major Broadcasters and Platforms:

The Trade Desk has formed strategic partnerships with major CTV providers like Disney, NBCU, and Roku. These partnerships often involve direct integrations (e.g., Disney's real-time ad exchange) that allow for programmatic buying and better inventory access. These collaborations have enabled advertisers to access premium CTV content programmatically, enhancing the availability and quality of CTV advertising.

OpenPath Technology:

The Trade Desk has developed and implemented OpenPath to streamline the digital advertising supply chain. This technology connects advertisers directly to publishers' inventories without intermediaries, enhancing transparency and efficiency in ad buying processes.

Market Positioning and Industry Trends:

TTD is positioning itself as a leader in providing programmatic advertising solutions that outperform traditional and walled garden approaches.

The CEO, Jeff Green, emphasized the transition of advertising spend towards the open internet, away from walled gardens like Google and Meta, citing better transparency and effectiveness.

Political Spending:

TTD anticipates significant growth in advertising spending tied to the upcoming U.S. election cycle. This political season is expected to generate substantial advertising revenue due to increased campaign activity and the need for targeted digital advertising solutions.

Global Expansion:

TTD is experiencing robust growth internationally, with international revenue growth outpacing that of North America for five consecutive quarters. The company is actively executing its growth playbook outside North America, focusing on expanding its presence and scaling operations in key international markets.

Management comments on the earnings call.

Customers:

Jeff Green: "More than 90% of the Ad Age Top 200, the largest 200 advertisers in the world, have run advertising campaigns on our platform over the last 12 months."

UID2:

Jeff Green: "UID2 has become ubiquitous across the premium parts of the open Internet, and along with greater first-party data deployment and advances in emerging data markets, especially retail data, we are building the new identity and authentication fabric of the Internet."

Kokai Platform:

Jeff Green : "I believe our revenue growth acceleration in the first quarter speaks to the innovation and value that we're delivering to our clients with Kokai."

"We are integrating directly with the Disney real-time ad exchange, which includes Hulu and Disney+ via our OpenPath technology. For the first time ever, NBCU will make the Olympics available programmatically to advertisers and is doing so with The Trade Desk."

"We are quickly approaching some of the biggest UX and product rollouts of Kokai that nearly all of our customers will begin to use and see benefits from over the next few quarters, including a game-changing AI-fueled forecasting tool."

CTV:

Jeff Green: "Even with its considerable size, CTV continues to be our fastest-growing channel... And the innovations in our Kokai platform will help our clients take advantage of this revaluation and fully leverage data-driven buying to fuel their own business growth."

Market Positioning:

Jeff Green: "But I'm so proud of our team for now having outpaced the digital advertising industry for a couple of years straight."

Global Expansion:

Laura Schenkein: "We saw strong consistent year-over-year growth across all of our regions in Q1, with international growth outpacing North America for the fifth quarter in a row."

Future Growth:

Jeff Green: "I've never been more optimistic about the future of the open Internet, and our ability to gain more than our fair share of the nearly $1 trillion advertising TAM."

Thoughts on Trade Desk ER $TTD :

🟢 Pros:

+ Customer retention remains above 95% for 9 consecutive years.

+ Revenue growth rate accelerating to 28.2% YoY

+ The company is increasing margins and profitability, EBITDA Margin +4.5pp YoY

+ Beat Q1 revenue guidance by 2.7%.

+ Strong FCF margin at 35%

+ Basic shares down 0.2% YoY

+ The company is actively pursuing Global Expansion, international revenue growth outpacing that of North America

+ This political season is expected to generate substantial advertising revenue

+ The Trade Desk has formed strategic partnerships with CTV providers: Disney, NBCU, and Roku

+ AI-driven platform, Kokai, has received significant enhancements

🟡 Neutral:

+- SBC/rev is 23%