The Trade Desk: Leading the $1 Trillion Digital Ad Transformation

Deep Dive into $TTD: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

The Trade Desk: Company overview

About The Trade Desk

The Trade Desk, is an American multinational technology company founded in 2009 by Jeff Green and David Pickles. Headquartered in Ventura, California, the company provides real-time programmatic marketing automation to personalize digital content delivery. As the largest independent demand-side platform (DSP), TTD competes with Google's DoubleClick and Facebook Ads. It went public on September 21, 2016, debuting at $18.00 and closing at $30.10 on IPO day. Revenue grew from $308 million in 2017 to $2.44 billion in 2024, with $393 million in net income. TTD employs approximately 3,522 people across 25 offices worldwide.

Company Mission

TTD’s mission is to transform how advertising is bought and sold by giving brands and agencies tools to reach audiences with precision. It focuses on innovation, transparency, collaboration, and accountability to drive performance and maintain leadership in digital advertising. The mission fuels the development of tools that deliver relevant and measurable ad experiences.

Sector

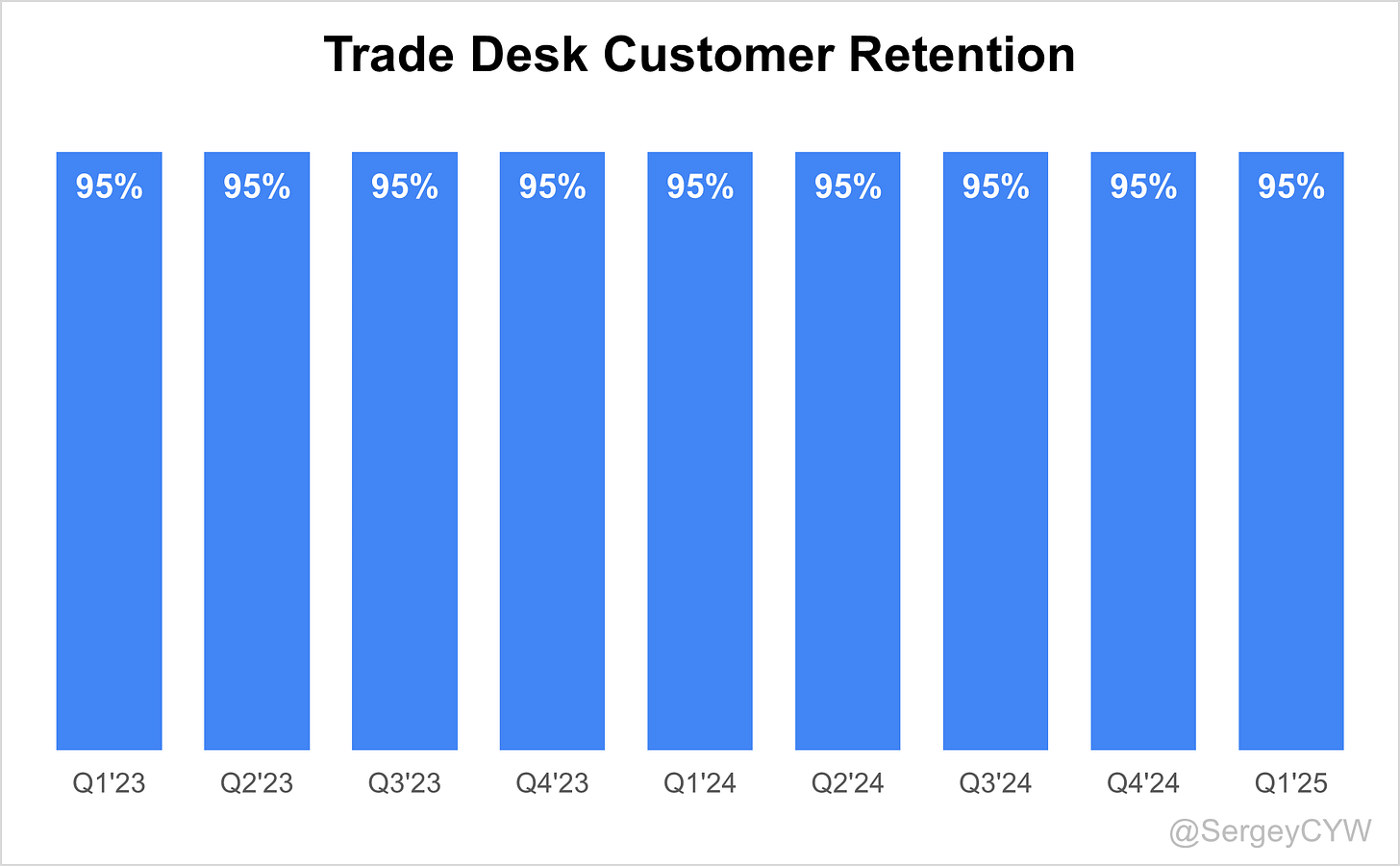

TTD operates in the digital advertising technology space, specializing in programmatic advertising. Its cloud-based platform allows advertisers to plan, manage, and optimize campaigns across devices and channels using real-time data. Programmatic decisions are made in milliseconds, driven by identity, context, and device data. TTD is known for its omni-channel approach and sustained 95% customer retention rate for 27 consecutive quarters as of 2020.

Competitive Advantage

TTD’s advantages include transparency, AI-driven targeting, and a business model that aligns with client interests. It does not own ad inventory, avoiding conflicts of interest. Customers retain ownership of their data. The platform integrates over 1,200 machine learning models, achieving 92% AI-powered targeting accuracy. TTD’s Unified ID 2.0, with 200 million+ authenticated users in 2023, provides a privacy-forward alternative to third-party cookies.

Total Addressable Market (TAM)

The Trade Desk operates within a global advertising market nearing $1 trillion in TAM, with specific estimates placing its opportunity at over $935 billion. The company focuses on digital channels, the fastest-growing segment within that market.

The global digital advertising market is projected to reach $786.22 billion by 2026, driven by accelerating budget shifts from traditional to digital media. Core growth areas include Connected TV (CTV), retail media, and international expansion, all aligned with TTD’s platform strategy.

The overall digital advertising market is expected to grow at a 12% CAGR. Within it, CTV advertising, a key focus for TTD, is forecast to grow at a 21.2% CAGR, reaching $31.47 billion by 2027. The AI in advertising market—critical to TTD’s tech-driven advantage—is projected to expand at a 32.5% CAGR, hitting $107.3 billion by 2028.

Valuation

$TTD The Trade Desk is currently trading at a forward EV/Sales multiple of 12.3, which is below its median of 14.5. As of January 2023, it is also near the lows seen between 2019 and 2024.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$TTD The Trade Desk is a GAAP net income profitable company. The Trade Desk trades at a forward P/E of 42.5, with revenue growth in the last quarter of 25.5% YoY. This forward P/E ratio is 1.6 times the anticipated revenue growth rate.

The EPS growth forecast for 2026 is 19.3%, with a P/E of 43.1 and a PEG ratio of 2.2.

The EPS growth forecast for 2027 is 23.5%, with a P/E of 36.1 and a PEG ratio of 1.5.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

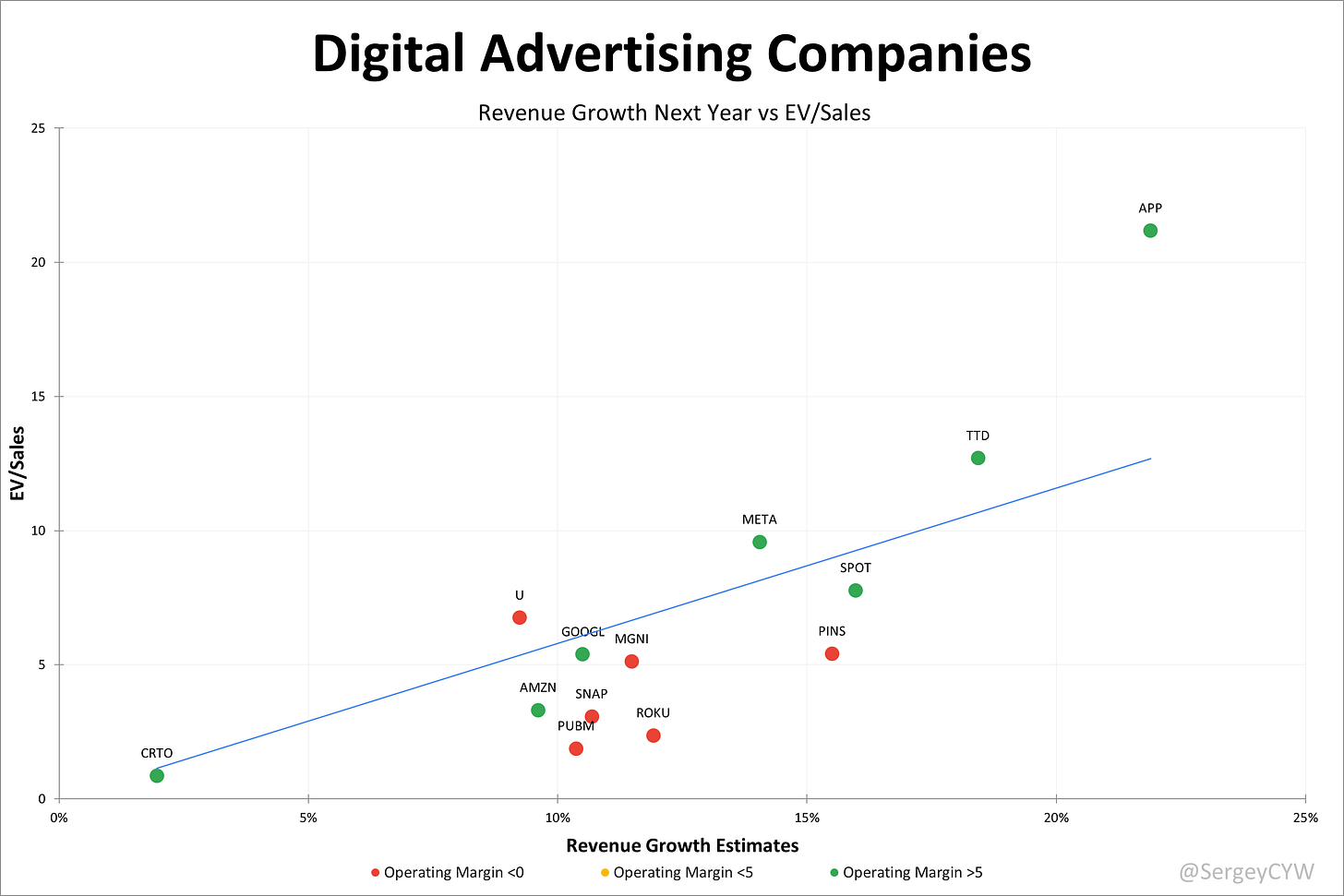

Valuation comparison

Analysts forecast $TTD's revenue growth at +18.0% for 2025 and +18.8% for 2026. Based on these projections, The Trade Desk appears fairly valued on an EV/Sales basis relative to other digital advertising companies.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

The Trade Desk demonstrates strong economies of scale through its massive platform operations and data processing capabilities. In Q1 2025, the company generated $616 million in revenue, representing a 25% year-over-year increase. The platform processes billions of advertising transactions daily, with two-thirds of clients now using its core Kokai platform, where the bulk of spend flows through. This scale enables The Trade Desk to spread its technology infrastructure costs across a vast customer base while continuously improving its algorithms through increased data volume. The company's 95% customer retention rate demonstrates how scale creates value for clients through better targeting capabilities and operational efficiency. The recent launch of Deal Desk addresses inefficiencies where approximately 90% of Deal IDs fail to scale effectively, showcasing how the company leverages its scale to solve industry-wide problems.

Network Effect

The Trade Desk benefits from very strong network effects that create a self-reinforcing competitive advantage. As more advertisers join the platform, it becomes more attractive to publishers seeking access to demand, which in turn attracts more advertisers. This dynamic is particularly powerful in programmatic advertising where liquidity and inventory access are critical. The company's position as an independent demand-side platform connecting to the entire open internet creates network value that compounds as the digital advertising ecosystem grows. The platform's ability to aggregate demand from thousands of advertisers makes it an essential partner for publishers, while the vast inventory access attracts more advertisers. This network effect is further strengthened by The Trade Desk's focus on Connected TV (CTV), where it has established partnerships with major players like Disney and Comcast, creating additional network value.

Brand Strength

The Trade Desk has built a strong brand within the digital advertising industry, particularly among agencies and large advertisers. The company is recognized as the global leader in advertising technology and has established itself as the primary independent alternative to walled garden platforms like Google and Meta. CEO Jeff Green's industry prominence and the company's consistent advocacy for transparency and the open internet have strengthened its brand positioning. The brand benefits from The Trade Desk's reputation for innovation, demonstrated through products like Kokai with AI tools and the recent Deal Desk launch. However, the brand strength is primarily concentrated within the B2B advertising technology space rather than having broad consumer recognition, which limits its overall brand moat compared to consumer-facing technology companies.

Intellectual Property

The Trade Desk possesses moderate intellectual property advantages through its proprietary technology and algorithms. The company holds multiple patents related to contextual navigation frameworks, optimization data systems, and targeted communications indexing. Its core intellectual property lies in sophisticated AI and machine learning algorithms that optimize ad buying and real-time bidding processes. The Kokai platform represents significant proprietary technology that processes vast amounts of data to improve campaign performance and lower advertisers' cost per acquisition. The company's Unified ID 2.0 (UID2) initiative for cookieless tracking represents valuable intellectual property for the post-cookie advertising landscape. However, the fast-moving nature of ad technology means that intellectual property advantages can be temporary, requiring continuous innovation to maintain competitive positioning.

Switching Costs

The Trade Desk has created very strong switching costs for its clients through deep platform integration and operational dependencies. Agencies and advertisers face significant administrative efficiency benefits from The Trade Desk's consolidated billing system, which includes third-party ad tech charges in a single invoice. The platform integration with client workflows, training investments, and potential service disruption risks make switching costly and complex. The reliability of campaign management for large-scale operations creates substantial switching costs, as agencies managing significant advertising budgets cannot afford platform disruptions. The company's premium pricing model is sustained by these switching costs, as clients value the operational efficiency and performance consistency over cost savings from alternatives. The recent reorganization and platform upgrades have further enhanced client stickiness by improving campaign performance and user experience.

The Trade Desk holds a strong competitive moat built on economies of scale, a very strong network effect, and high switching costs. Its $616M Q1 2025 revenue and 95% retention rate reflect operational scale and customer loyalty. As the leading independent DSP, it benefits from a self-reinforcing ecosystem across the open internet, especially in CTV. The Kokai platform and UID2 strengthen its IP position, though rapid tech shifts demand constant innovation. Deep platform integration and mission-critical performance create substantial frictionfor clients to switch.

Revenue growth

$TTD's revenue growth accelerated from +22% YoY in Q4 2024 to +25.5% in Q1 2025. Management issued strong guidance for the next quarter, and if the company beats its forecast by 7.1% again, Q2 growth would reach 25%, indicating stabilization in revenue growth.

Segments and Main Products

Core Demand-Side Platform

The Trade Desk operates as a global demand-side platform (DSP) that enables advertisers and agencies to purchase digital advertising programmatically across multiple channels. The company generated $616 million in revenue during Q1 2025, representing a 25% year-over-year increase. The platform maintains a 95% customer retention rate and serves as the primary technology infrastructure for data-driven advertising campaigns.

Kokai Platform

Kokai serves as The Trade Desk's core technology platform, with two-thirds of clients now using it and the bulk of advertising spend flowing through its infrastructure. The platform incorporates AI tools to improve campaign performance and lower advertisers' cost per acquisition. Kokai represents a significant upgrade from previous systems and enables sophisticated targeting capabilities across the open internet.

Deal Desk

Deal Desk launched in June 2025 as an integrated solution within the Kokai platform designed to address programmatic deal inefficiencies. The product tackles the problem where approximately 90% of Deal IDs fail to scale effectively for advertisers. Deal Desk provides Deal Quality Scores, automation tools, and detailed inventory descriptions powered by artificial intelligence to optimize deal performance.

Connected TV (CTV) Solutions

The Trade Desk has established a strong position in Connected TV advertising, partnering with major players including Disney and Comcast. The company is developing Ventura, its own operating system for smart TVs to host advertising directly. CTV represents a key growth area as advertisers shift budgets from traditional television to streaming platforms.

OpenPath

OpenPath functions as a direct connection platform that links publishers with advertisers, bypassing traditional supply-side platforms like Magnite and Google's Ad Exchange. The product aims to create more direct relationships between buyers and sellers in the programmatic advertising ecosystem.

Unified ID 2.0 (UID2)

UID2 serves as The Trade Desk's cookieless tracking solution designed for the post-cookie advertising landscape. The technology enables identity resolution across the open internet while maintaining privacy compliance. UID2 addresses the industry's need for effective audience targeting as third-party cookies phase out.

Retail Media Solutions

The Trade Desk provides retail media network capabilities through partnerships with major retailers and retail data providers. The platform enables advertisers to leverage first-party retail data for audience targeting while accessing premium inventory across multiple retailers through a single interface. Recent partnerships include collaborations with Instacart for retail data integration.

Enterprise APIs

The company offers Enterprise APIs for clients seeking to build customized omnichannel bidding platforms. The APIs provide flexibility for organizations new to real-time bidding or those looking to enhance their competitive position in programmatic advertising.

Main Products Performance in the Last Quarter

CTV Growth

CTV remains The Trade Desk’s largest and fastest-growing channel, with video now representing a high-40s percentage of total spend. Growth is driven by supply-demand dynamics shifting in favor of advertisers. Streamers are increasing ad inventory amid consumer pressure, creating a buyer’s market. Major CTV platforms like VIZIO and another unnamed network experienced material revenue gains via OpenPath, up 39% and over 25%, respectively. More CTV publishers are integrating directly with The Trade Desk and adopting UID2, increasing monetization. However, ad supply has outpaced demand, indicating pressure on pricing power. Despite this, performance-driven buying and higher fill rates are offsetting those pressures. CTV also leads international expansion, contributing to stronger YoY growth outside North America for the ninth consecutive quarter.

Kokai Adoption

Kokai is now live across two-thirds of the client base, ahead of internal timelines. The platform accounts for the majority of ad spend, showing rapid acceleration since Q4 2024. Adoption is translating into tangible performance gains: 42% lower cost per unique reach, 24% lower cost per conversion, and 20% lower cost per acquisition. Clients are using ~30% more data elements per impression, unlocking more precise targeting. Case studies like Deutsche Telekom showed 11x lift in post-click conversions and 18x efficiency in acquisition cost, reinforcing Kokai’s impact on both upper and lower funnel outcomes. Challenges remain in transitioning clients from Solimar and completing remaining feature rollouts, including a Deal Desk for forward-market buying. Still, Kokai is positioned as the industry’s most powerful programmatic platform, combining ease of use with advanced AI and marketplace transparency.

Unified ID 2.0 (UID2)

UID2 adoption continues to grow, particularly in CTV, where most scaled publishers now support it. The company emphasized that publishers not using UID2 are under-monetizing inventory. UID2 is central to The Trade Desk’s value proposition—bringing addressability, performance, and privacy compliance to the open internet. Growing UID2 adoption strengthens the company’s differentiation from walled gardens, whose data remains siloed and unverifiable. UID2’s success is tightly linked to the growth of OpenPath and Kokai, as all three work in tandem to provide data-rich, transparent, high-performance campaigns. UID2 is not yet fully penetrated across all verticals, but traction is strong where monetization incentives are aligned.

Retail Media Solutions

Retail media remains a key growth lever, with clients increasingly linking ad spend to real-world sales. The Walmart DSP partnership continues to gain momentum. Retail data integration in Kokai is improving campaign attribution and performance, leading to more budget reallocation from walled gardens. While specific retail verticals weren't broken out, the platform continues to support complex omnichannel measurement, driving demand for more deterministic, closed-loop ROI. The commentary implies expanding partnerships but leaves out exact figures on new accounts. Retail data use in video and display is fueling growth in both branding and performance budgets.

Innovations & Product Updates

Kokai is The Trade Desk’s largest platform overhaul to date. It introduces AI-powered tools via Koa and improves navigation, usability, and outcome-based planning. Final feature rollouts this year include a new Deal Desk to modernize and operationalize upfront buying in programmatic.

OpenPath is reshaping the programmatic supply chain, increasing transparency and efficiency. Key outcomes include 4x increase in fill rate and 79% revenue uplift for Arena Group, and 8x fill rate growth and 97% revenue increase at the New York Post. While OpenPath won't be the primary supply source, it's keeping SSPs accountable via A/B performance comparisons.

Sincera, acquired in Q1, is being integrated into Kokai. It enhances metadata and supply chain visibility. A new free tool, Open Sincera, will be launched to give advertisers, agencies, and publishers full transparency into auction mechanics.

Internally, product velocity has accelerated. The company now runs 100+ scrums shipping weekly, and business and engineering teams are better aligned than in prior years. A new COO, Vivek Kundra, was hired to scale global operations, previously holding leadership roles at Salesforce and the U.S. government.

Market Leader

The Trade Desk secured the top position in The Forrester Wave: Omnichannel Demand-Side Platforms, Q3 2023, earning the highest score in the strategy category. Forrester evaluated 12 top vendors across 28 criteria and awarded The Trade Desk top marks for vision and innovation. The firm noted, “The Trade Desk leads with usability and prescient bets on CTV and Identity.”

Forrester emphasized The Trade Desk's leadership in Connected TV, calling it “the dominant DSP for CTV.” Strategic integrations with Disney and AMC enable first-party data activation via Unified ID 2.0, while its CTV quality metric enhances brand reach measurement. Clients praised the platform’s intuitive UI and transparent reporting.

In 2024, The Trade Desk was also named a leader in the Quadrant Knowledge Solutions SPARK Matrix for Ad Tech, ranking highest in both technology excellence and customer impact. The evaluation covered 20 AdTech companies, positioning The Trade Desk alongside top-tier players such as Adobe, Google, and Flashtalking.

The Trade Desk recognized as a leading vendor in 2025 Frost Radar for Demand-Side Platforms for the second consecutive time, emerging as the Innovation and Growth leader, scoring 5 out of 5 on the Innovation Index and 4.80 out of 5 on the Growth Index.

Strategic Partnerships

The Trade Desk's momentum is reinforced by expanding long-term partnerships through Joint Business Plans (JBPs). Over 40% of platform spend now runs under JBPs, which are growing 50% faster than overall spend. JBPs represent multi-quarter and multi-year revenue visibility with strategic accounts, aligning growth and product integration roadmaps. The active pipeline and in-contract JBPs are currently at all-time highs, pointing to durable revenue acceleration.

Key partners continue deepening integrations, especially across CTV and retail ecosystems. The Walmart DSP remains a key strategic channel, driving cross-retail attribution and shoppable media outcomes. Additionally, major CTV publishers are integrating through OpenPath, reducing intermediaries and achieving higher fill rates and monetization.

Internationally, local partnerships in CTV and data are supporting growth, though specifics remain undisclosed. New leadership hires, including COO Vivek Kundra, with Salesforce and federal experience, are expected to scale operational and partnership frameworks globally.

Customer Success Stories

Deutsche Telekom, operating the streaming service MagentaTV, ran multi-channel campaigns using Kokai and saw an 11x lift in post-click conversions and 18x improvement in cost per acquisition. This campaign began as a test with seed data and scaled into broader adoption, consistent with observed behavior among large clients shifting from Solimar to Kokai.

In publishing, Arena Group saw a 4x improvement in fill rate and 79% jump in programmatic revenue via OpenPath integration. The New York Post realized even greater efficiency gains, increasing fill rates 8x and revenue by 97%. VIZIO achieved a 39% increase in programmatic revenue, while a major unnamed broadcaster reported a 7x increase in fill rate and 25%+ revenue growth.

Kokai clients on average are experiencing 42% lower cost per unique reach, with significant gains also across lower-funnel KPIs: 24% reduction in cost per conversion and 20% lower cost per acquisition. Improvements are tied to broader usage of third-party data—campaigns now utilize 30% more data elements per impression.

International Expansion

International growth outpaced North America for the ninth consecutive quarter, supported by strong CTV expansion. Geographic mix remains tilted, with 88% of spend from North America and 12% international, but momentum abroad is building. The company is executing its domestic growth playbook internationally, centered around high-quality CTV inventory, first-party data activation, and objective measurement.

Kokai rollouts are progressing globally, and early adoption is following similar patterns as seen in North America—starting with display and CTV campaigns and expanding into full-funnel adoption. No specific international partners or wins were cited, but leadership remains confident that ex-U.S. markets will be meaningful contributors to total growth in 2025 and beyond. Enhanced transparency, AI, and UID2 adoption are central to unlocking these markets.

Retention

$TTD's Customer Retention Rate has remained high for a long time, consistently above 95%.

Profitability

Over the past year, $TTD has seen changes in its margins and profitability:

· EBITDA margin rose from 32.9% to 33,7%.

· Net margin GAAP increase slightly from 26.7% to 26.8%.

· FCF margin rose from 35,8% to 37,6%.

Operating expenses

$TTD The Trade Desk's non-GAAP operating expenses have decreased, driven by reductions in S&M, R&D, and G&A spending.

Sales & Marketing (S&M) expenses declined from 22% to 20% over the past two years.

R&D expenses fell from 19% to 15% of revenue, though they remain high, supporting continued investment in innovation.

General & Administrative (G&A) expenses slightly decreased to 14%.

Balance Sheet

$TTD Balance Sheet: Total debt stands at $335M, while The Trade Desk holds $1,740M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$TTD Shareholder Dilution: The Trade Desk’s stock-based compensation (SBC) expenses declined over the past year, but rose slightly in the most recent quarter to 21% of revenue, which is in line with the SaaS company average.

Shareholder dilution remains at an acceptable level, with a modest 1.3% YoY increase in the weighted-average number of basic common shares outstanding.

The Trade Desk repurchased $386 million of Class A common stock during Q1 2025 under its authorized share repurchase program. Activity reflects management’s confidence in long-term fundamentals and a disciplined capital allocation strategy. The company maintains a strong balance sheet with $1.7 billion in cash, cash equivalents, and short-term investments, and carries no debt, allowing for continued opportunistic repurchases.

Conclusion

After an unexpectedly weak Q4 2024 for $TTD, with revenue missing estimates by -2.1% and Q1'25 guidance coming in -1.6% below expectations, the company reported its first earnings miss in 33 quarters, driven by operational inefficiencies and delays in the Kokai rollout.

However, Q1 2025 was very strong, with revenue beating guidance by a record 7.1%.

Importantly, management responded proactively. Jeff Green took full responsibility, rather than blaming external factors. The team was strengthened with Alex Kayyal joining the Board of Directors, and a company-wide reorganization in December aimed at improving operational efficiency delivered visible results—highlighting both strong leadership and a high level of skin in the game.

Following the Q4 miss, $TTD stock dropped 27%, and was down -58.1% YTD, significantly compressing valuation multiples. While the multiples have since recovered, the stock still trades below its historical averages and appears fairly valued relative to other digital advertising companies, especially considering the expected revenue growth.

The Trade Desk continues to be recognized as a category leader, as highlighted in the SPARK Matrix for Ad Tech and Forrester Wave. It has maintained a consistently high customer retention rate above 95% in recent years.

The global advertising market is approaching $1 trillion in TAM, with CTV advertising—a key focus for TTD—projected to grow at a 21.2% CAGR, reaching $31.47 billion by 2027.

International growth has outpaced North America for nine consecutive quarters, supported by strong momentum in CTV expansion.

In April 2025, I significantly increased my position after the share price drop. $TTD currently represents 4.6% of my portfolio.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.