Demand:

⬆️Cars Delivered (484,507, +19.5% YoY) beat est by 0.3%

⬆️Cars Produced (494,989, +12.6% YoY)

↘️Global vehicle inventory 15 days of supply, -1 QoQ

Financial Results:

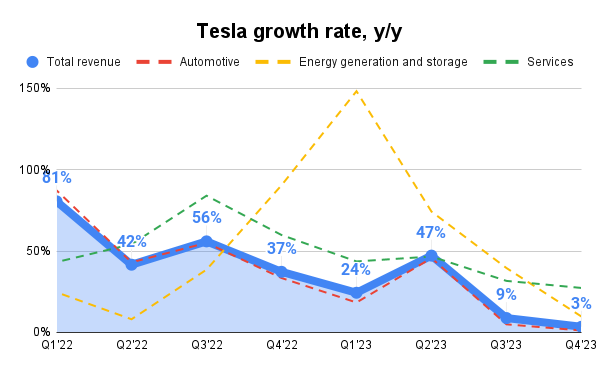

↘️$25,167M rev (+3.5% YoY, 8.8% LQ) missed est by -1.8%🔴

↘️GM (17.6%, -6.1%pp YoY)🟡

↘️Adjusted EBITDA Margin (15.7%, -6.5%pp YoY)🟡

↘️Operating Margin (8.2%, -7.8%pp YoY)🟡

⬆️FCF Margin 8.2%, +2.4%pp YoY)

⬆️Net Margin 31.5%, +16.3%pp YoY)

↘️EPS $0.71 missed est by -3.3%

Tesla's segments:

Automotive

➡️$21,563M Total automotive Revenue (+1.2% YoY, 85.7% of total Revenue)

↘️Automotive GM excl. regulatory credits (17.2%, -7.1%pp YoY)🟡

Energy generation and storage

⬆️$1,438M Energy generation and storage Revenue (+9.8% YoY, 5.7% of total Revenue)

⬆️Energy GM (21.8%, +9.7%pp YoY)

Services

⬆️$2,166M Services and other Revenue (+27.3% YoY, 8.6% of total Revenue)

↘️Services GM (2.7%, -2.9%pp YoY)🟡

↘️41 MW Solar deployed (-59.0% YoY)

⬆️3,202 MWh Storage deployed (+30.0% YoY)

⬆️5,952 Supercharger stations (+27.0% YoY)

⬆️2,306 CAPEX (+34.0% YoY)

Operating expenses

↘️S&M+G&A/Revenue 5.1% (5.4% LQ)

↘️R&D/Revenue 4.3% (5.0% LQ)

Dilution

⬆️SBC/rev 34%, +4.0%pp QoQ)

⬆️Dilution at 0.7% YoY, +0.2%pp QoQ)🟢

Key points from Tesla's Fourth Quarter 2023 Earnings Call:

1. Production and Deliveries:

Tesla achieved record production and deliveries in 2023, exceeding 1.8 million vehicles, aligning with their official guidance. The Fremont factory alone produced 560,000 cars, marking it the highest output automotive plant in North America. The Model Y became the best-selling vehicle globally, with over 1.2 million units delivered.

2. Refreshed Model 3 and next-generation car:

An updated Model 3 is now globally available.

Tesla planning to start production on next-generation low-cost vehicle in 2nd half of 2025. Tesla is also progressing on a next-generation lower-cost vehicle, planning its first manufacturing in Austin, Texas. They are waiting to start on Giga Mexico construction until their test the next-generation car production line design in Texas.

3. Cybertruck and 4680 Cells:

The Cybertruck is in the ramp-up phase, with 4680 cell production ahead of the schedule. Tesla aims to deliver significant quantities of Cybertrucks in the future.

4. Cost Reduction Efforts:

Tesla continues to focus on reducing per-unit costs through various initiatives, COGS per car are down ~3% sequentially to slightly above $36,000.

5. FSD:

Tesla released Version 12 of FSD, a complete architectural rewrite featuring end-to-end AI.

6. AI and Robotics:

Tesla could start shipping some Tesla Bot Optimus units in 2025.

7. Energy Storage Growth:

Tesla's energy storage business delivered nearly 15 gigawatt hours of batteries.

8. Financial Performance:

Tesla reported $4.4 billion in free cash flow in 2023, despite significant investments in future projects. The company ended the year with over $29 billion of cash and investments.

9. Investments and Future Projects:

Tesla plans significant investments in 2024, expecting capital expenditure to exceed $10 billion for future growth initiatives.

Management comments on the earnings call.

Next-Generation Vehicle Development:

Elon Musk emphasized the significance of the next-generation vehicle in Tesla's future growth trajectory. “We're very far along on our next-generation low-cost vehicle... a revolutionary manufacturing system significantly more advanced than any other automotive manufacturing system in the world by a significant margin," he noted.

Cybertruck Production and Demand:

Lars Moravy: "Certainly, the Cybertruck is really a proving ground for the next-gen platform and is really going to be a gating factor in unlocking the cost reductions needed for the next-gen platform."

Elon Musk: "The demand for Cybertruck is off the hook. We are now all hands on deck, focused on ramping up so we can fulfill all the demands in a reduced wait time."

4680 Ramp:

Karn Budhiraj: "To date, 4680 production is ahead of the ramp, with actually weeks of finished cell inventory." "Texas successfully switched line one from the Model Y design of the cell to the Cybertruck design of the cell, which was the 10% cell energy increase," he noted.

Musk: "We also expect to ramp up orders from our suppliers. So this is not about replacing our suppliers, it's about supplementing our suppliers."

Customer Acquisition:

Vaibhav Taneja: "Our data suggests that around 90% of our vehicle buyers in 2023 never owned a Tesla before. We are being creative in figuring out ways to bring in new customers."

Tesla Bot Optimus Development:

Elon Musk: "I see a path to creating an artificial intelligence and robotics juggernaut of truly immense capability and power." "Optimus has the potential to be the most valuable product of any kind ever, by far. It's a humanoid robot with arms and legs and represents the most sophisticated humanoid robot being developed anywhere in the world," he explained.

Full Self-Driving (FSD) Technology:

Elon Musk: "For full self-driving, we've released Version 12, which is a complete architectural rewrite. This is the first time AI is being used for object perception, path planning, and vehicle controls. We're rolling it out to all customers in the U.S. who request full self-driving."

Thoughts on Tesla ER $TSLA:

🟢Pros:

+Automotive GM excl. regulatory credits 17.2% which rose from 16.3% in last Q

+Cybertruck is in the ramp-up phase

+Next-generation low-cost vehicle start production in 2nd half of 2025

+Vehicle production capacity now is 2,350,000 which already implying 27% YoY growth

+COGS going down ~3% sequentially

+Strong FCF margin and cash and investments in Q4 increased to $29.1B

+Refreshed Model 3 is now globally available, that could boost demand

+Tesla Bot Optimus and FSD could be company growth drivers in future

🔴Cons:

-Automotive revenue increased by only 1.2% YoY

🟡Neutral:

+-Tesla is still planning to build a Mexico plant, but doesn't have a timeline yet

+-Tesla slightly missed Wall Street Q4 expectations