Tesla Q3 2024 Earnings Analysis

Dive into $TSLA Tesla’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

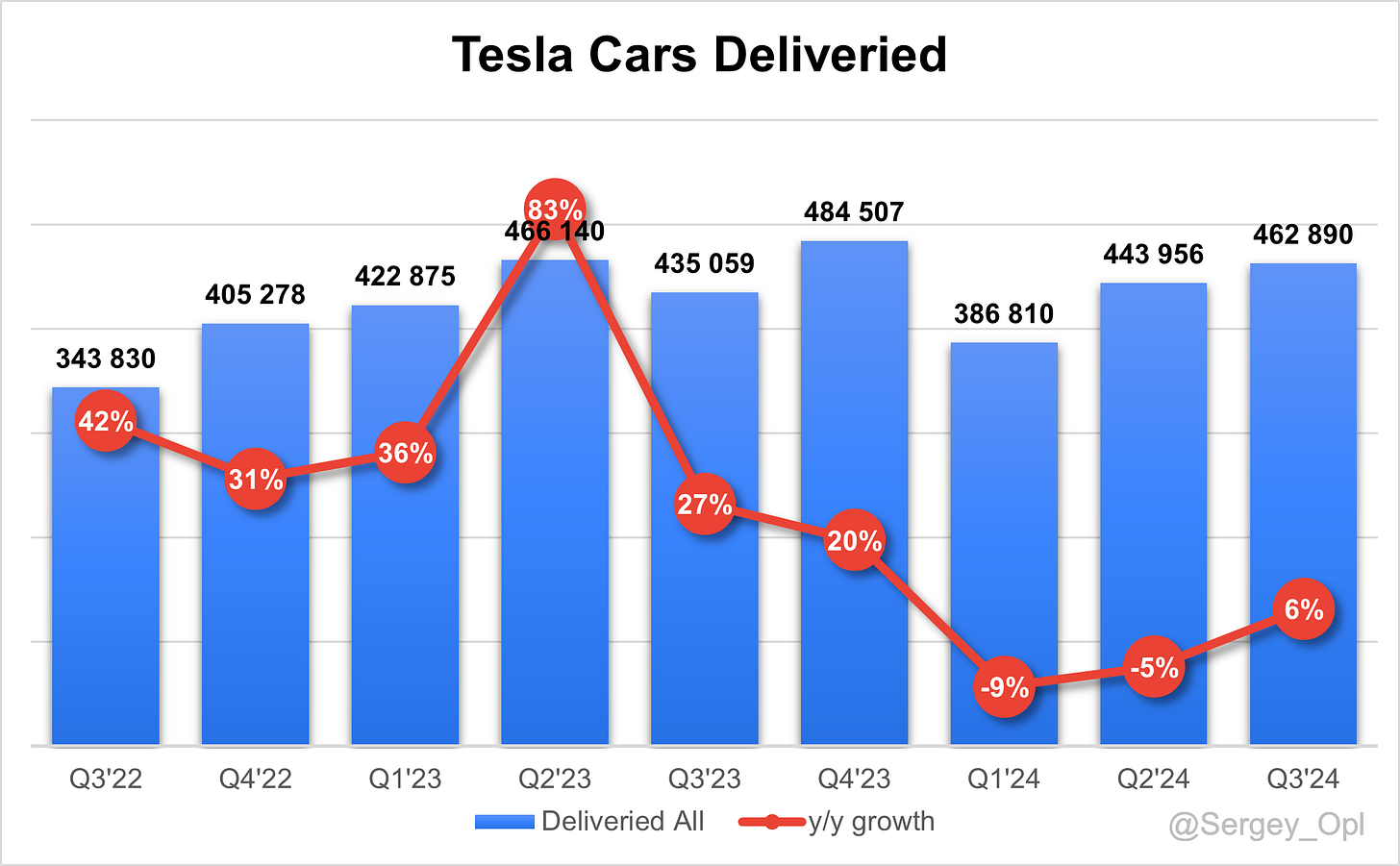

Demand

↗️Cars Delivered (462 890, +6,4% YoY) beat est by 5,7%

↗️S/X and others Delivered (22 915, +43,4% YoY)

↗️3/Y Delivered (439 975, +5,0% YoY)

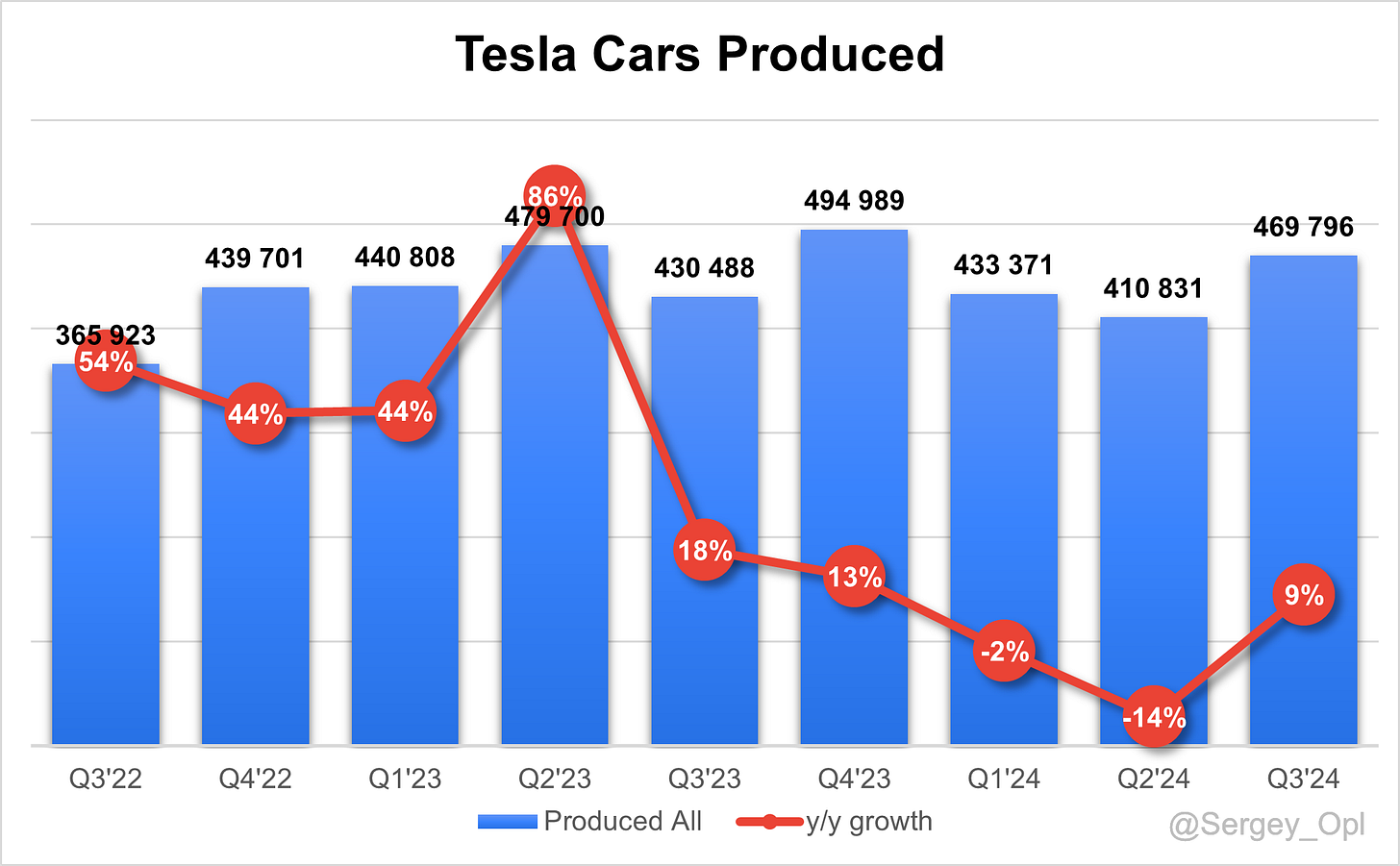

↗️Cars Produced (469 796, +9,1% YoY)

↗️S/X and others Produced (26 128, +90,9% YoY)

↗️3/Y Produced (443 668, +6,4% YoY)

↗️Global vehicle inventory 19 days of supply, +1 QoQ

Financial Results

↘️$25 182M rev (+7,8% YoY, +2,3% LQ) missed est by -0,6%🔴

↗️GM (19,8%, +2,0 PPs YoY)

↗️Adjusted EBITDA Margin (18,5%, +2,4 PPs YoY)

↗️Operating Margin (10,8%, +3,2 PPs YoY)

↗️FCF Margin (10,9%, +7,3 PPs YoY)

↗️Net Margin (8,6%, +0,7 PPs YoY)

↗️EPS $0,72 beat est by 24,1%

Revenue By Segments

Automotive

➡️$20 016M Total automotive Revenue (+2,0% YoY, 79,5% of total Revenue)

↗️Automotive GM excl. regulatory credits (17,1%, +0,7 PPs YoY)

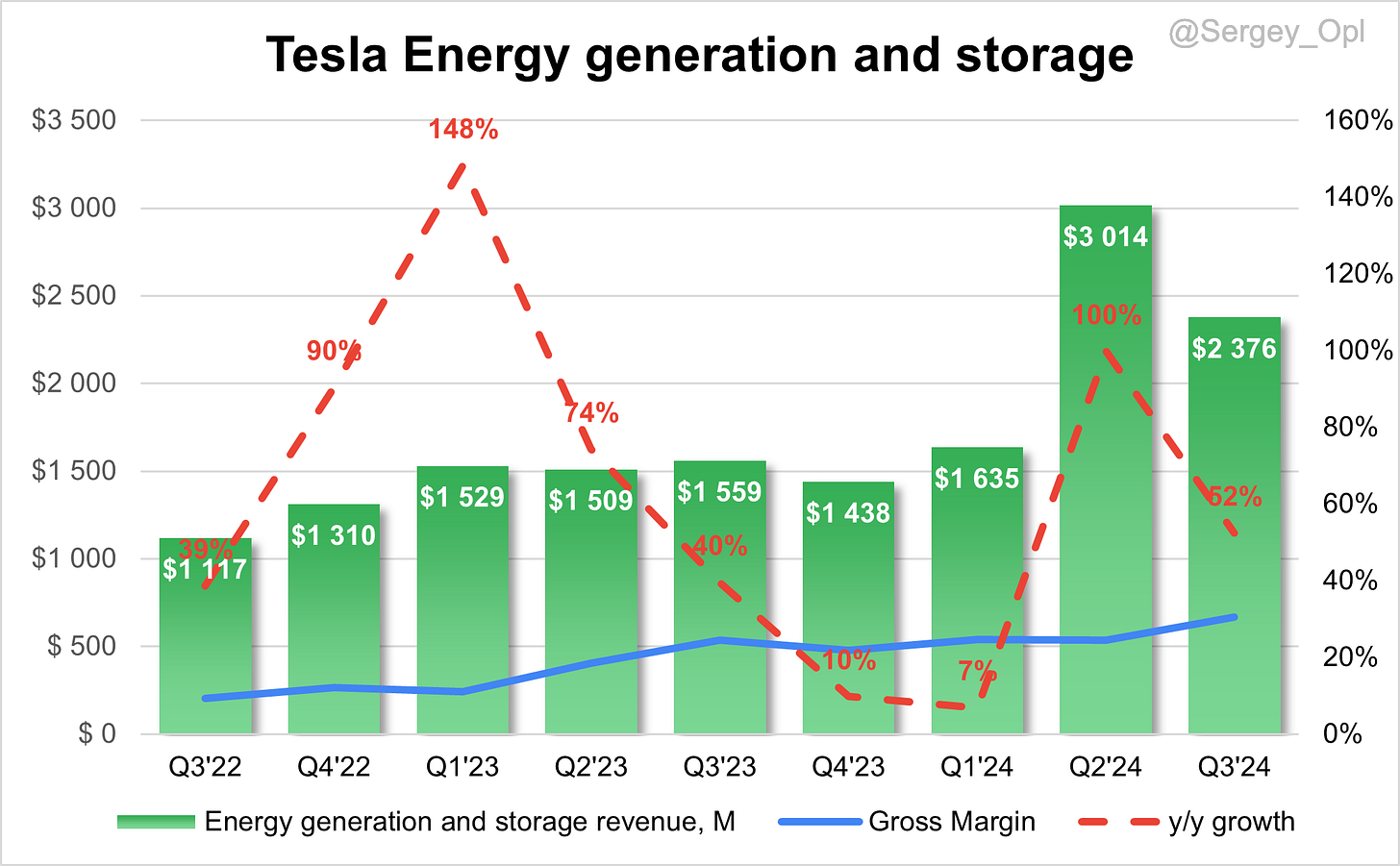

Energy generation and storage

↗️$2 376M Energy generation and storage Revenue (+52,4% YoY, 9,4% of total Revenue)

↗️Energy GM (30,5%, +6,1 PPs YoY)🟢

Services

↗️$2 790M Services and other Revenue (+28,8% YoY, 11,1% of total Revenue)

↗️Services GM (8,8%, +2,9 PPs YoY)🟢

↗️6 900 MWh Storage deployed (+73,4% YoY)

➡️6 706 Supercharger stations (+19,9% YoY)

↗️3 513 CAPEX (+19,2% YoY)

Operating expenses

↘️S&M+G&A/Revenue 4,7% (-0,7 PPs YoY)

↘️R&D/Revenue 4,1% (-0,8 PPs YoY)

Dilution

↗️SBC/rev 19%, +4,7 PPs QoQ

↗️Basic shares up 0,7% YoY, +0,1 PPs QoQ🟢

↗️Diluted shares up 0,1% YoY, +0,1 PPs QoQ🟢

Key points from Tesla’s Third Quarter 2024 Earnings Call:

Financial Performance

Tesla generated record operating cash flow of $6.3 billion in Q3 2024, with automotive revenues growing both quarter-over-quarter and year-over-year, despite a reduction in Average Selling Prices (ASPs) due to financing incentives. Record vehicle deliveries were achieved, even as global EV order volumes experienced a year-over-year decline.

Automotive

Tesla reached a new milestone with record deliveries in Q3 2024, underscoring its ability to scale production amid broader industry declines in order volumes. During the quarter, Tesla produced its 7 millionth vehicle. The company’s approach to inventory management focuses on reducing logistical costs by localizing deliveries, minimizing freight expenses, and maintaining flexibility to adapt to varying market demand. This strategy allows Tesla to manage costs associated with excess inventory while continuing to scale production.

Automotive margins improved quarter-over-quarter, benefiting from increased production and deliveries, reduced freight costs, and favorable commodity pricing. However, sustaining these margins into Q4 may prove challenging due to broader economic conditions. Tesla also achieved its lowest cost per vehicle in Q3, with initiatives in place to further reduce costs moving forward.

4680 battery Production

Tesla continues to produce the 4680 battery internally while also buying a large number of cells from external suppliers.

The Tesla team has made significant strides in optimizing the 4680 production process, aiming to lower costs per kilowatt-hour. The battery is not yet the most competitive but is close to achieving that milestone.

Energy Storage Business

Tesla’s energy division exhibited strong growth, with a 30% margin in Q3. The Lathrop Megapack factory reached an annual run rate of 40 GWh, while a new Shanghai factory is set to begin with 20 GWh in Q1 2025. Tesla’s long-term goal is to scale its energy storage business to terawatt-hour levels, playing a crucial role in the transition to a sustainable energy future.

Autonomy and FSD Developments

The company reported $326 million in revenue from Full Self-Driving (FSD) feature releases in Q3. FSD has shown significant improvement, with Version 12.5 delivering a 100x improvement in miles between interventions compared to the beginning of the year. Tesla anticipates further advancements with Version 13, targeting unsupervised FSD capability by Q2 2025.

Cybertruck and Manufacturing Efficiency

Tesla remains on track to begin volume production of the Cybertruck by 2026. CEO Elon Musk highlighted plans to produce 2-4 million units annually across multiple factories. The Cybertruck represents a major shift in Tesla’s manufacturing approach, with a radical redesign of production processes aimed at significantly enhancing factory efficiency and reducing cycle times well beyond industry norms.

CapEx and AI Investments

Capital expenditures in Q3 totaled $3.5 billion, as Tesla continues to invest heavily in AI infrastructure. The company is deploying 50,000 GPUs in Texas to bolster its AI capabilities, particularly in the areas of FSD and robotics.

Stationary Storage Growth and Terawatt Vision

Tesla’s stationary storage business continues its expansion, with the company targeting 100 GWh of annual capacity in the near future. Tesla’s long-term vision is to reach multi-terawatt levels, aligning with global sustainability objectives.

Future Outlook

Tesla plans to roll out autonomous ride-hailing services in Texas and California by 2025, pending regulatory approval. Elon Musk forecasts vehicle sales growth of 20-30% in 2025, driven by the introduction of lower-cost EV models and advancements in autonomy. The CyberCab is expected to be a major growth driver, with production targeted at millions of units annually by 2026.

Management comments on the earnings call.

EV Market and Competitors

Elon Musk, CEO

"When you look at the electric vehicle market globally, to the best of my knowledge, no EV company is consistently profitable, not even the EV divisions of traditional automakers. Yet, here we are achieving profitability and hitting record deliveries in a highly competitive and difficult environment. This underscores the strength of our operational efficiency and long-term vision. The future of the auto industry is clearly electric and autonomous. Companies that don’t fully embrace this reality will face significant challenges, as we’ve been saying for years."

Challenges in the Automotive Industry

Elon Musk, CEO

"The broader automotive market is facing headwinds due to rising interest rates, inflation, and affordability concerns. Many consumers are holding onto their cars longer, especially in the U.S., because financing has become more expensive. Despite these challenges, our strategy remains focused on providing unmatched value through vehicle safety, performance, and integrated software features. As interest rates eventually decline, we expect this to create a positive demand environment, and we’ll be well-positioned to capture it."

Energy Business and Growth

Elon Musk, CEO

"The energy storage side of our business is growing like wildfire. Our Lathrop Megapack factory has hit an annual production run rate of 40 GWh, and we’ll be starting production at our Shanghai Megapack factory next quarter with an additional 20 GWh capacity. We expect to be shipping 100 GWh of stationary storage annually soon. Ultimately, the scale of energy storage production needs to reach multiple terawatt-hours to support a fully sustainable energy future. Our energy business has a massive runway for growth, and we are investing to meet that global demand."

Full Self-Driving (FSD) and Autonomy

Elon Musk, CEO

"Our Full Self-Driving (FSD) technology continues to improve rapidly. With Version 12.5, we’ve achieved a 100x improvement in miles between interventions compared to the beginning of the year. Looking ahead, Version 13 will bring even more advances, and we expect to reach unsupervised autonomy by mid-2025. This will unlock enormous potential for autonomous vehicles across all markets. We are well on our way to building an autonomous fleet that will change how the world moves."

Robotaxi Plans and Future Outlook

Elon Musk, CEO

"We are moving full steam ahead with our robotaxi plans. By 2026, we expect the CyberCab to reach volume production, with annual output of 2 to 4 million units. This vehicle, optimized for autonomy, will revolutionize the ride-hailing industry. While some companies are just starting to experiment with autonomous technology, we’re already producing tens of thousands of vehicles each week capable of autonomy. The future of transportation will be fully autonomous, and we’re building the infrastructure today to make that a reality. The path ahead is clear, and we are confident we’ll continue leading the way."

Thoughts on Tesla ER $TSLA:

🟢Pros:

+ Tesla cars delivered increased by 6% YoY.

+ Auto gross margin significantly increased to 17.1%.

+ Gross margin, operating margin, and net margin increased both QoQ and YoY.

+ Cybertruck is in the ramp-up phase (S/X and other models produced increased by +91% YoY).

+ Tesla generated $326 million in revenue from FSD in Q3.

+ Global vehicle inventory slightly increased to 19 days (6,906 more vehicles produced than delivered in Q3), but remains at a low level.

+ Energy generation and storage revenue increased by +62% YoY; gross margin improved by +6.1 percentage points YoY.

+ Services revenue increased by +29% YoY; gross margin improved by +2.9 percentage points YoY.

+ Free cash flow (FCF) margin is 10.9%, up by +7.3 percentage points YoY.

+ Tesla CyberCab is expected to be a major growth driver in 2026.

+ Tesla Bot Optimus could be a future growth driver for the company.

🟡Neutral:

+- Automotive revenue increased by 2% YoY.