Tesla Q1 2025 Earnings Analysis

Dive into $TSLA Tesla’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

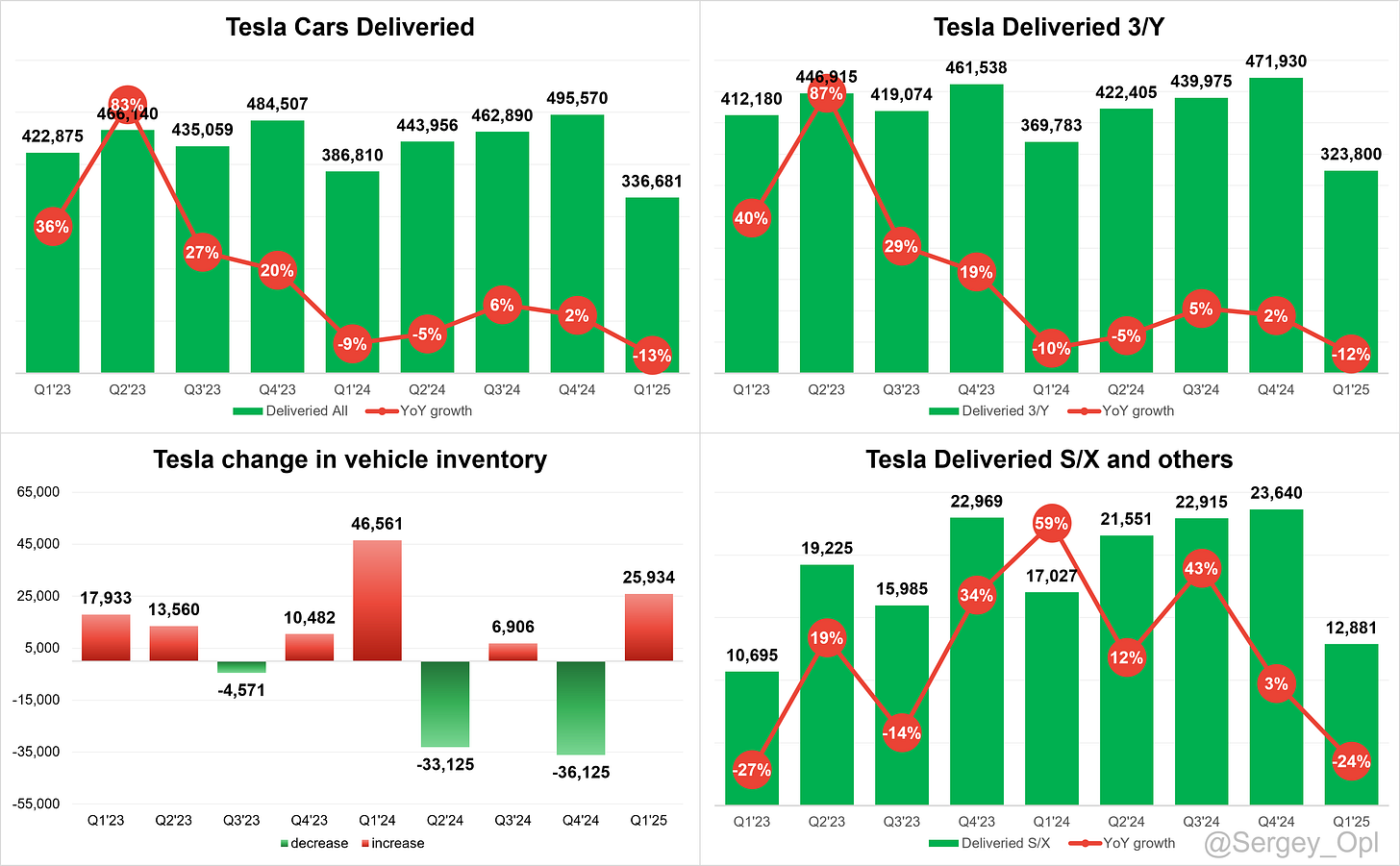

Demand

↘️Cars Delivered (336,681, -13.0% YoY) missed est by -13.8%🔴

↘️S/X and others Delivered (12,881, -24.3% YoY)

↘️3/Y Delivered (323,800, -12.4% YoY)

↘️Cars Produced (362,615, -16.3% YoY)

↘️S/X and others Produced (17,161, -18.3% YoY)

↘️3/Y Produced (345,454, -16.2% YoY)

↗️Global vehicle inventory 22 days of supply, +10 QoQ

Financial Results

↘️$19,335M rev (-9.2% YoY, +2.1% LQ) missed est by -4.9%🔴

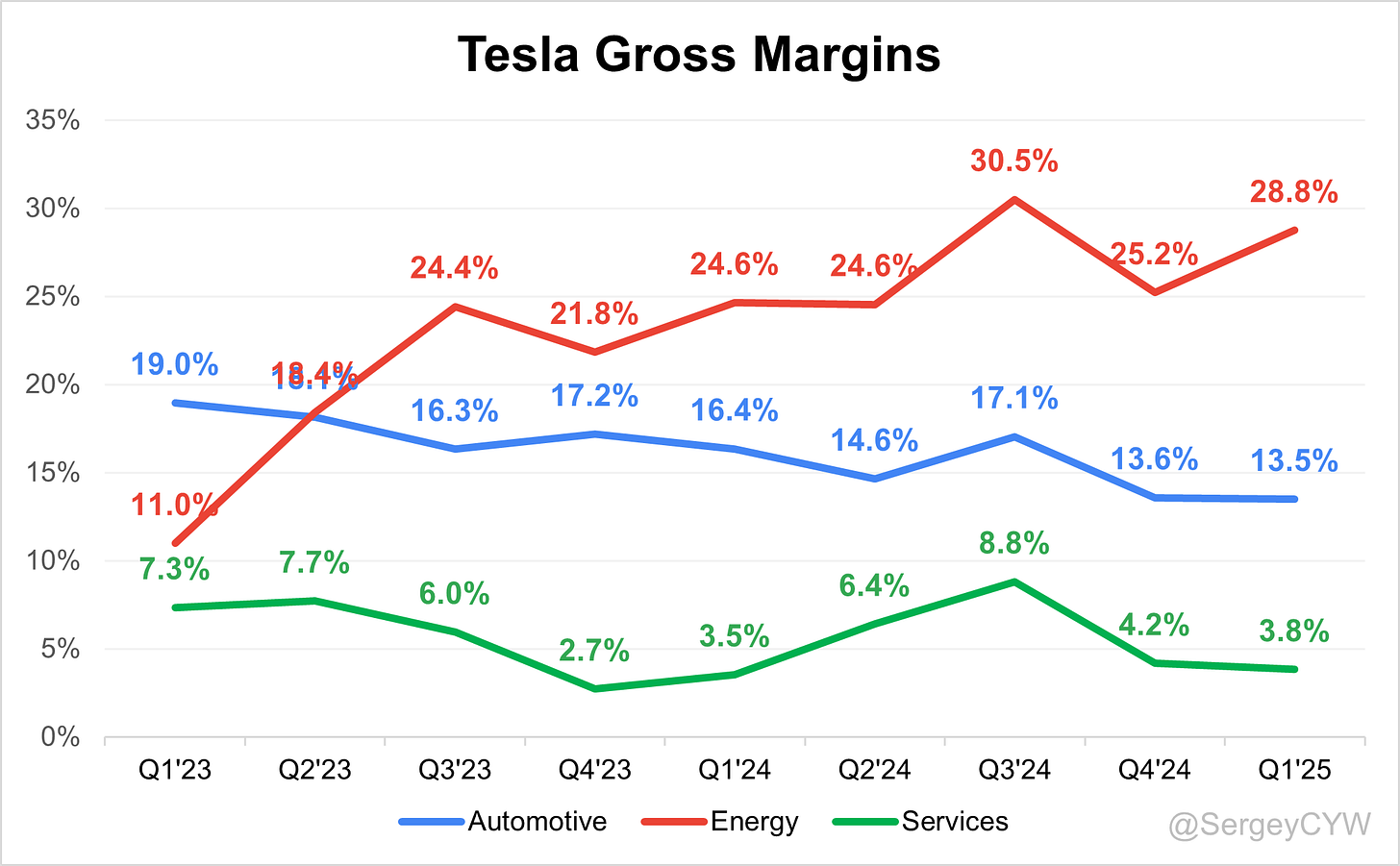

↘️GM (16.3%, -1.0 PPs YoY)🟡

↘️Adjusted EBITDA Margin (14.6%, -1.3 PPs YoY)🟡

↘️Operating Margin (2.1%, -3.4 PPs YoY)🟡

↗️FCF Margin (3.4%, +15.3 PPs YoY)

↘️Net Margin (2.1%, -3.2 PPs YoY)🟡

↘️EPS $0.27 missed est by -35.7%

Revenue By Segments

Automotive

↘️$13,967M Total automotive Revenue (-19.6% YoY, 72.2% of total Revenue)

↘️Automotive GM excl. regulatory credits (13.5%, -2.9 PPs YoY)🟡

Energy generation and storage

↗️$2,730M Energy generation and storage Revenue (+67.0% YoY, 14.1% of total Revenue)

↗️Energy GM (28.8%, +4.1 PPs YoY)

Services

↗️$2,638M Services and other Revenue (+15.3% YoY, 13.6% of total Revenue)

↗️Services GM (3.8%, +0.3 PPs YoY)

↗️10,400 MWh Storage deployed (+156.6% YoY)

➡️7,131 Supercharger stations (+14.1% YoY)

↗️1,492 CAPEX (+21.0% YoY)

Operating expenses

↗️S&M+G&A/Revenue 6.5% (+0.0 PPs YoY)

↗️R&D/Revenue 7.3% (+1.9 PPs YoY)

Dilution

↗️SBC/rev 21%, +2.1 PPs QoQ

↘️Basic shares up 1.0% YoY, -0.0 PPs QoQ

↗️Diluted shares up 1.1% YoY, +0.3 PPs QoQ

Key points from Tesla’s First Quarter 2025 Earnings Call:

Financial Performance

Tesla reported a decline in automotive revenue and gross margin due to factory retooling and macroeconomic headwinds. The Energy Storage division achieved record gross profit, driven by strong Megapack demand. Operating expenses rose sequentially, led by R&D investments in FSD, Optimus, and Cybercab. SG&A declined, reflecting tighter vertical integration.

CapEx for 2025 is projected to exceed $10B, allocated to AI infrastructure, battery production, and next-gen vehicle lines. Other income dropped $472M QoQ, largely from a Bitcoin mark-to-market loss and FX remeasurement.

Automotive

A synchronized global Model Y platform refresh resulted in temporary production downtime across all gigafactories. The transition to a new version was completed within the quarter, with prior output levels restored in eight weeks.

Legacy Model Y inventory sold out in major markets, including the U.S. and China. Tesla continues to focus on monthly payment affordability to maintain demand in price-sensitive environments. Despite delivery volume softness, Model Y remained California’s top-selling car in Q1.

Key margin pressure came from lower fixed-cost absorption and performance in the used car and insurance segments.

Energy Storage

Tesla’s Energy Storage segment delivered record gross profit in Q1 2025. Utility-scale Megapack orders exceeded gigawatt-class deployments, enabling more efficient grid operation through time-shifted energy.

New Megapack capacity launched in China, supporting international markets and mitigating U.S.-China tariff exposure. Powerwall 3 received strong reception, but remains supply constrained.

Profitability depends on successful LFP supply localization. U.S. production is being ramped but will initially meet only a portion of demand.

Battery Production

Tesla holds the lowest cost per kilowatt-hour in North America for its in-house cells. Vertical integration includes lithium refining in South Texas and cathode production in Austin.

Anode production is under development, with advanced designs in focus. Battery supply is stable for vehicles but remains a limiting factor for some energy deployments, especially where imports are tariff-sensitive.

Cybercab

Cybercab production is on track, with pilot builds expected by end of Q2 2025. The vehicle will be the first to use Tesla’s Unboxed Manufacturing Process, built entirely within Giga Texas using existing space.

The system allows for faster production with a 5-second cycle time, supported by AI-driven subassembly automation. Launch is scheduled for 2026, with no new building construction required.

Model Y Refresh

All Tesla gigafactories updated the Model Y platform simultaneously—an auto industry first. The refresh included improvements to design, drivability, and AI capability.

Despite downtime, production recovered to previous levels in eight weeks. Demand remained high across markets.

Affordable Model

Tesla confirmed a June 2025 launch for its new low-cost model, built on existing production lines. The design leverages current platforms, focusing on cost efficiency and affordability.

No new factory is required, aligning with Tesla’s goal of expanding addressable market share through higher factory utilization.

FSD and Autonomy

Fully autonomous rides will launch in Austin by June 2025, using current Model Y vehicles. Tesla targets broader deployment by late 2025, with millions of autonomous cars expected by mid-2026.

Tesla’s perception stack now uses direct photon-counting, enabling reliable operation in sun glare, fog, and low-light. Audio input supports emergency detection.

Intervention rates are now one every 10,000 miles in QA fleets. Simulation and long-tail validation are the final barriers to full rollout.

Customer feedback has improved, with FSD proving useful for disabled and elderly users. The $99/month subscription offers a supervised experience for early adopters.

Optimus

Tesla aims to deploy thousands of Optimus humanoid robots by end of 2025, scaling to 1 million units/year by 2029. The robots will first support internal manufacturing tasks.

Optimus uses Tesla’s in-house AI inference chip, reducing hardware costs. Most components are custom-built, and the rare-earth magnet supply chain remains a constraint due to new Chinese export controls.

Tesla is negotiating licenses and exploring alternatives to mitigate delays.

Product Innovation

Tesla’s Unboxed Manufacturing System revolutionizes vehicle production by assembling large subcomponents in parallel. The system targets a 5-second cycle time, significantly faster than Tesla's current fastest line at 33 seconds/car.

Crash tests confirm safety equivalence to conventional structures. Tesla sees this system as its biggest manufacturing breakthrough since the assembly line.

CapEx

Tesla's 2025 CapEx will exceed $10B, allocated to AI infrastructure, Cybercab tools, battery scaling, and Unboxed manufacturing.

Tariff-driven import costs on industrial equipment sourced from China remain a headwind, despite internal optimization efforts.

Tariff Exposure

Tesla benefits from high regional content—85%+ USMCA compliance in the U.S., 95%+ local sourcing in Shanghai, and strong European coverage (battery exempted).

Tariffs on LFP imports from China threaten energy margins. Tesla is building U.S. cell capacity but acknowledged it will take time to match scale.

Future Outlook

Tesla expects autonomous ride monetization by mid-2026, with scaling driven by robotaxis, Optimus, and Cybercab.

The low-cost model will support near-term volume growth. Long-term strategy remains centered on AI-driven automation and sustainable energy, with a vision for delivering “sustainable abundance for all.”

Tesla’s vertical integration, AI-first design, and manufacturing innovations position it to lead amid macro and regulatory uncertainties.

Management comments on the earnings call.

Automotive

Elon Musk, Chief Executive Officer

"We changed production of the world’s best-selling car—the Model Y—at the same time in factories all across the world. This is not a small feat."

Elon Musk, Chief Executive Officer

"This is not one of those times we’re on the ragged edge of death. Not even close. There are some challenges, but I remain extremely optimistic about the future of the company."

Energy Storage

Vaibhav Taneja, Chief Financial Officer

"We also hit record gross profit for the energy storage business in the quarter."

Vaibhav Taneja, Chief Financial Officer

"The importance of this business is profound, especially in this environment, because in order for grids to work properly with AI and other demands, you need more stability. This is by far the simplest and best solution we are aware of."

Battery Production

Elon Musk, Chief Executive Officer

"We have built a lithium refinery in South Texas—it’s the biggest lithium refinery outside of China. We’ve got the cathode refinery in Austin next to our gigafactory."

Drew Baglino, Senior Vice President, Powertrain and Energy Engineering

"We are in a good position. Our in-house cells are currently the lowest cost per kilowatt-hour in North America."

Elon Musk, Chief Executive Officer

"There’s no other car company that is building lithium refineries and cathode refineries. We're ridiculously vertically integrated."

Cybercab

Lars Moravy, Vice President of Vehicle Engineering

"The Cybercab product will begin production next year. We have our first big builds coming at the end of this quarter, and the large-scale installation of equipment will begin in Giga Texas."

Elon Musk, Chief Executive Officer

"This really is a profound reimagining of how to make cars in the first place. No cars are made like this anywhere in the world."

New Affordable Model

Lars Moravy, Vice President of Vehicle Engineering

"We are still planning to release new models this year. Ramp might be a little slower than we had hoped initially, but there’s nothing blocking us from starting production on time."

Vaibhav Taneja, Chief Financial Officer

"The strategy of providing the best product at a competitive price is going to be a winner. That’s why we are focused on bringing cheaper models to market soon."

Autonomy

Elon Musk, Chief Executive Officer

"Fully autonomous rides will begin in Austin in June. The Model Ys that will operate there are the same ones we build today. There’s no change."

Elon Musk, Chief Executive Officer

"I believe there will be millions of Teslas operating autonomously in the second half of next year."

Ashok Elluswamy, Director of Autopilot Software

"FSD is solving for a general solution, not a city-specific one. It’s working in China with minimal local data. This confirms we are on the right path with an AI-based approach."

Optimus

Elon Musk, Chief Executive Officer

"We expect to have thousands of Optimus robots working in Tesla factories by the end of this year."

Elon Musk, Chief Executive Officer

"I feel confident in predicting 1 million Optimus units per year by 2030, maybe even by 2029."

Tariff Impact

Vaibhav Taneja, Chief Financial Officer

"On a weighted average basis, our U.S. lineup is about 85% USMCA compliant. That gives us a bigger edge compared to other OEMs, but we’re not immune to Section 232 tariffs."

Elon Musk, Chief Executive Officer

"I continue to advocate for lower tariffs. But ultimately, the decision rests with the president."

Challenges

Vaibhav Taneja, Chief Financial Officer

"Auto margins declined sequentially due to the reduction in deliveries and lower fixed cost absorption during factory changeovers."

Elon Musk, Chief Executive Officer

"You’re going to see some unexpected bumps this year. We’ve been through many near-death experiences, but this is not one of them."

Future Outlook

Elon Musk, Chief Executive Officer

"With excellent execution, Tesla will be the most valuable company in the world by far. Possibly more valuable than the next five companies combined."

Elon Musk, Chief Executive Officer

"The future is about large-scale autonomous cars and vast numbers of useful humanoid robots. The value of a company that can deliver that at scale is staggering."

Thoughts on Tesla Earnings Report $TSLA:

🟢 Positive

Energy revenue rose to $2.73B, up +67.0% YoY, with Energy GM at 28.8%, +4.1 PPs YoY

Energy Storage deployments hit 10,400 MWh, up +156.6% YoY

Services revenue reached $2.64B, up +15.3% YoY, with Services GM at 3.8%, +0.3 PPs YoY

FSD deployment on track with launch of fully autonomous rides in Austin by June 2025

Powerwall 3 launched with strong reception

Unboxed Manufacturing aims for 5-second vehicle cycle time, 6x faster than current lines

Optimus pilot to deploy thousands of units by end of 2025

Cybercab builds begin by end of Q2 2025, production remains on schedule for 2026

🟡 Neutral

CapEx for Q1 at $1.49B, up +21.0% YoY; FY25 expected to exceed $10B

R&D/Revenue increased to 7.3%, up +1.9 PPs YoY

S&M + G&A/Revenue held flat at 6.5%

Global vehicle inventory at 22 days of supply, up +10 days QoQ

Supercharger stations grew to 7,131, up +14.1% YoY

Battery cost/kWh remains industry-low due to in-house vertical integration

🔴 Negative

Vehicle deliveries fell to 336,681, down -13.0% YoY, missing estimates by -13.8%

Model 3/Y deliveries dropped -12.4% YoY; S/X and other models down -24.3% YoY

Total production declined to 362,615, down -16.3% YoY

Automotive revenue fell to $13.97B, down -19.6% YoY

Gross margin compressed to 16.3%, down -1.0 PPs YoY

Automotive GM ex-regulatory credits dropped to 13.5%, down -2.9 PPs YoY

Operating margin declined to 2.1%, down -3.4 PPs YoY

EPS missed by -35.7%, reported at $0.27

Net margin fell to 2.1%, down -3.2 PPs YoY

Adjusted EBITDA margin decreased to 14.6%, down -1.3 PPs YoY

LFP battery imports remain tariff-sensitive; localization in progress but not yet scaled

SBC/Revenue increased to 21%, up +2.1 PPs QoQ

Basic and diluted shares increased +1.0% YoY

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.