Snowflake, Salesforce Earnings & Uipath Q3 2025 Snapshot

$SNOW, $CRM, $PATH Earnings analysis with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Table of Contents

Detailed Earnings Analysis:

Snowflake SNOW 0.00%↑ , Salesforce CRM 0.00%↑ .

Earnings Snapshot:

Uipath PATH 0.00%↑ .

Snowflake

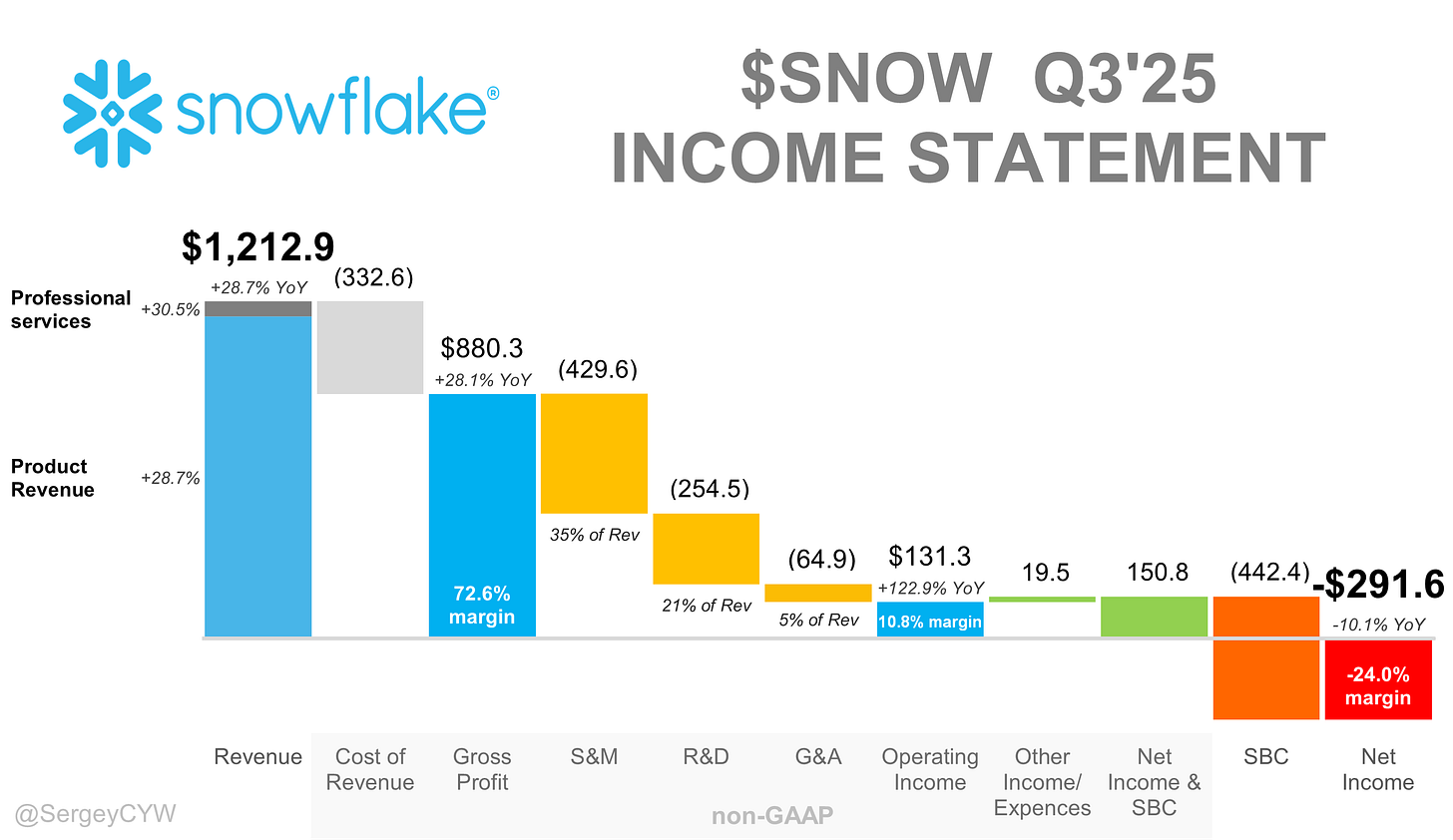

Financial Results:

↗️$1,213M rev (+28.7% YoY, +5.9% QoQ) beat est by 2.8%

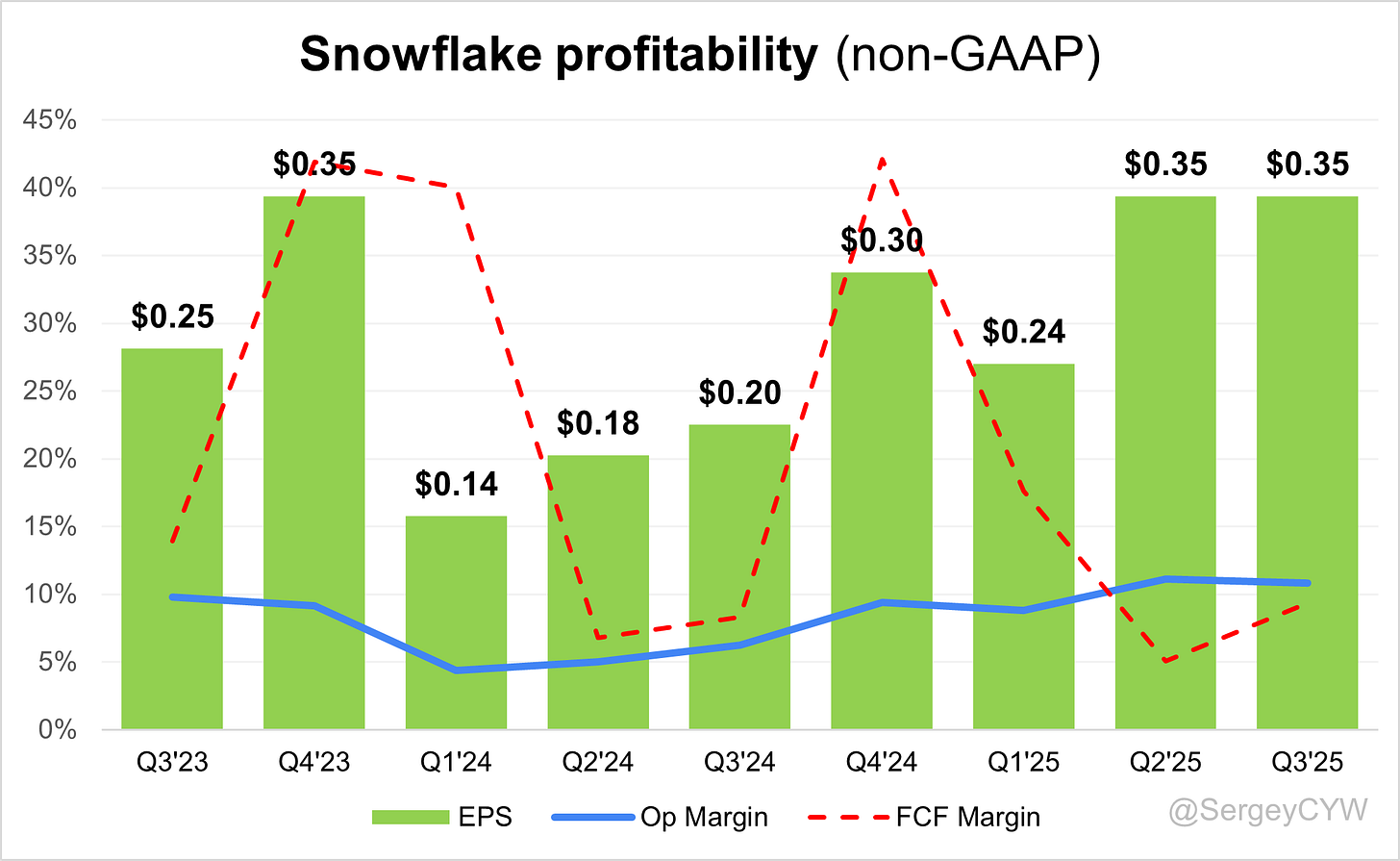

↘️GM* (72.6%, -0.4 PPs YoY)🟡

↗️Operating Margin* (10.8%, +4.6 PPs YoY)

↗️FCF Margin (9.4%, +1.1 PPs YoY)

↗️Net Margin (-24.0%, +10.4 PPs YoY)

↗️EPS* $0.35 beat est by 16.7%🟢

*non-GAAP

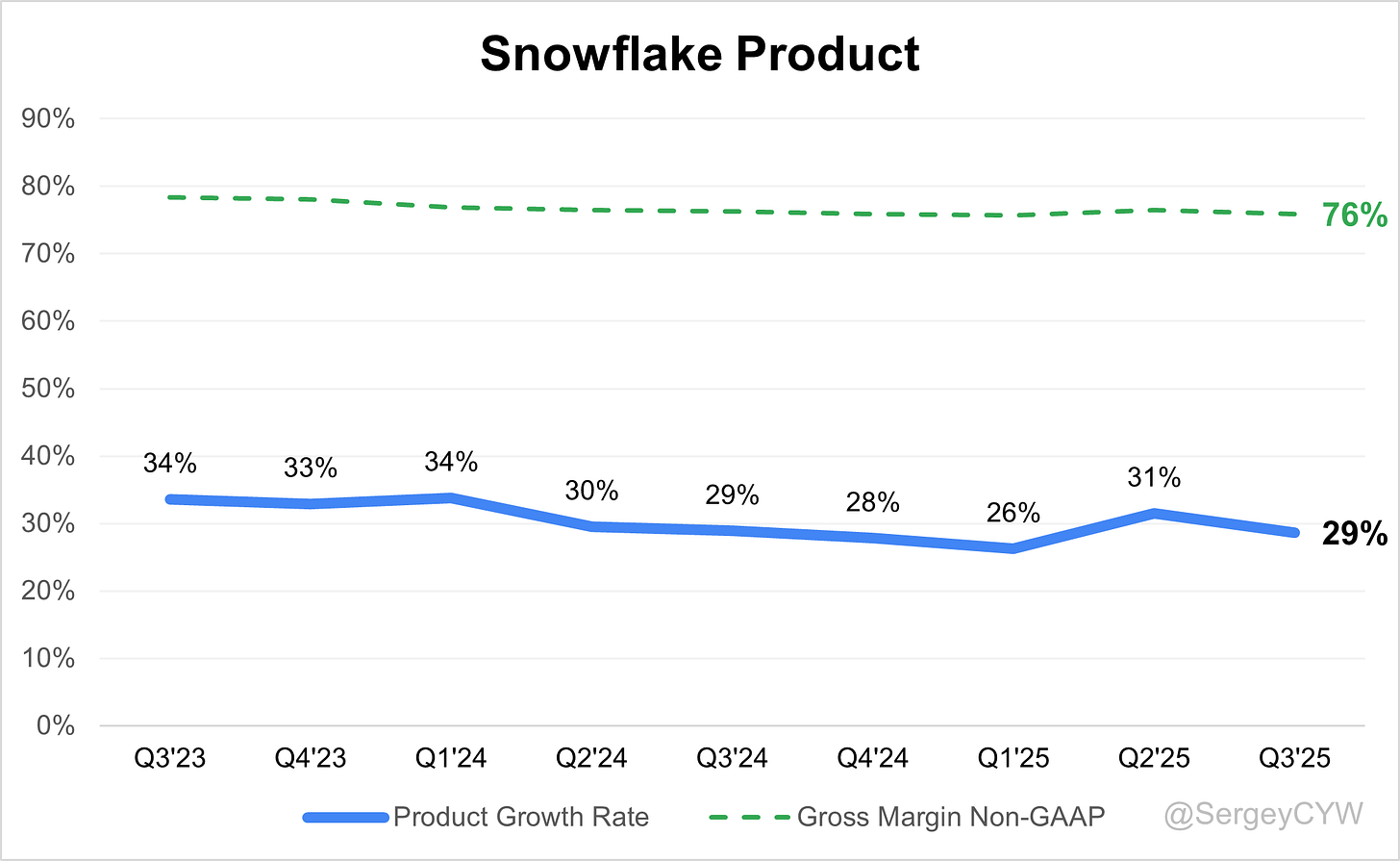

Product

➡️Product Revenue $1,158M (+28.7% YoY)🟡

↘️GM* (75.9%, -0.4 PPs YoY)

Key Metrics

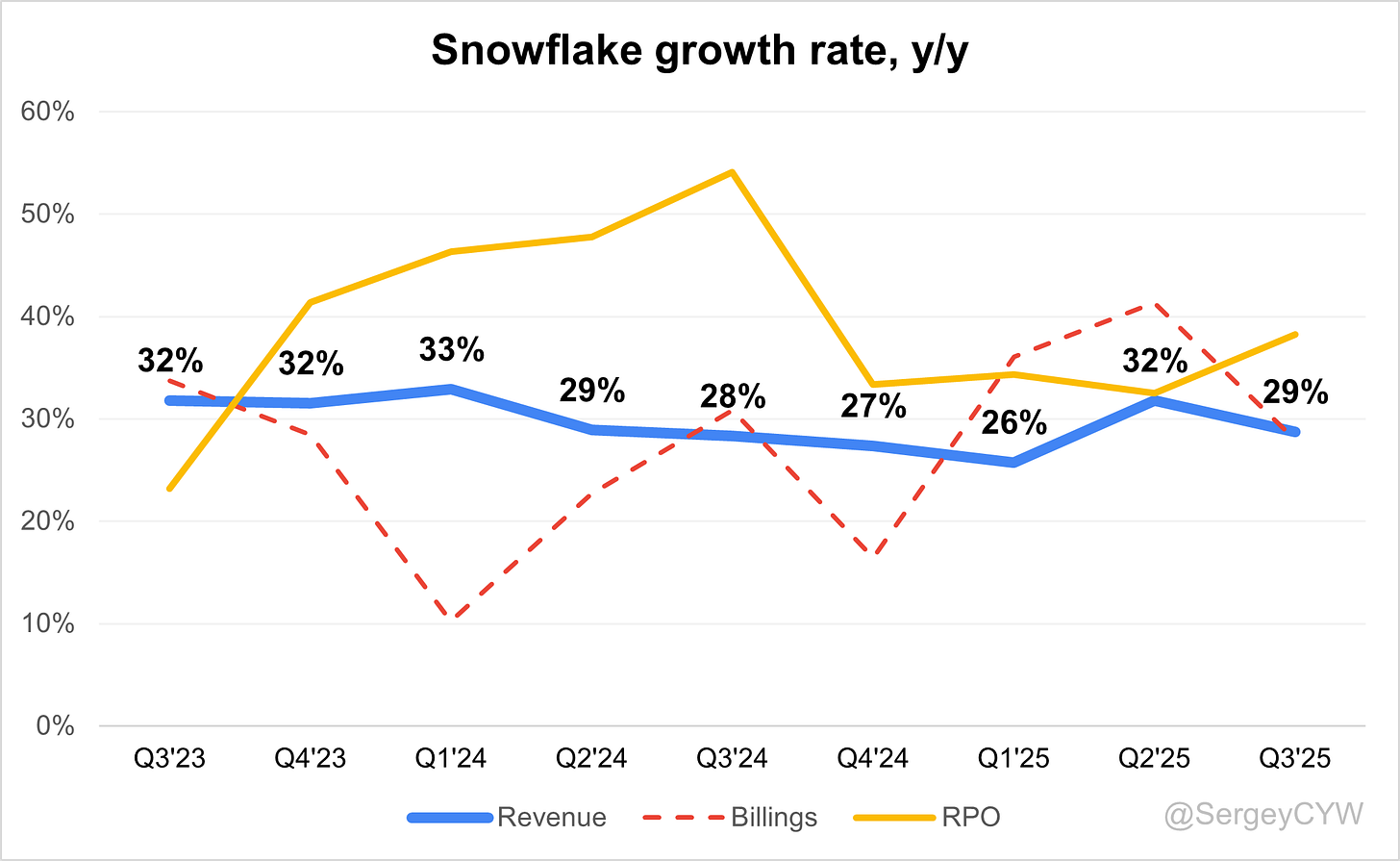

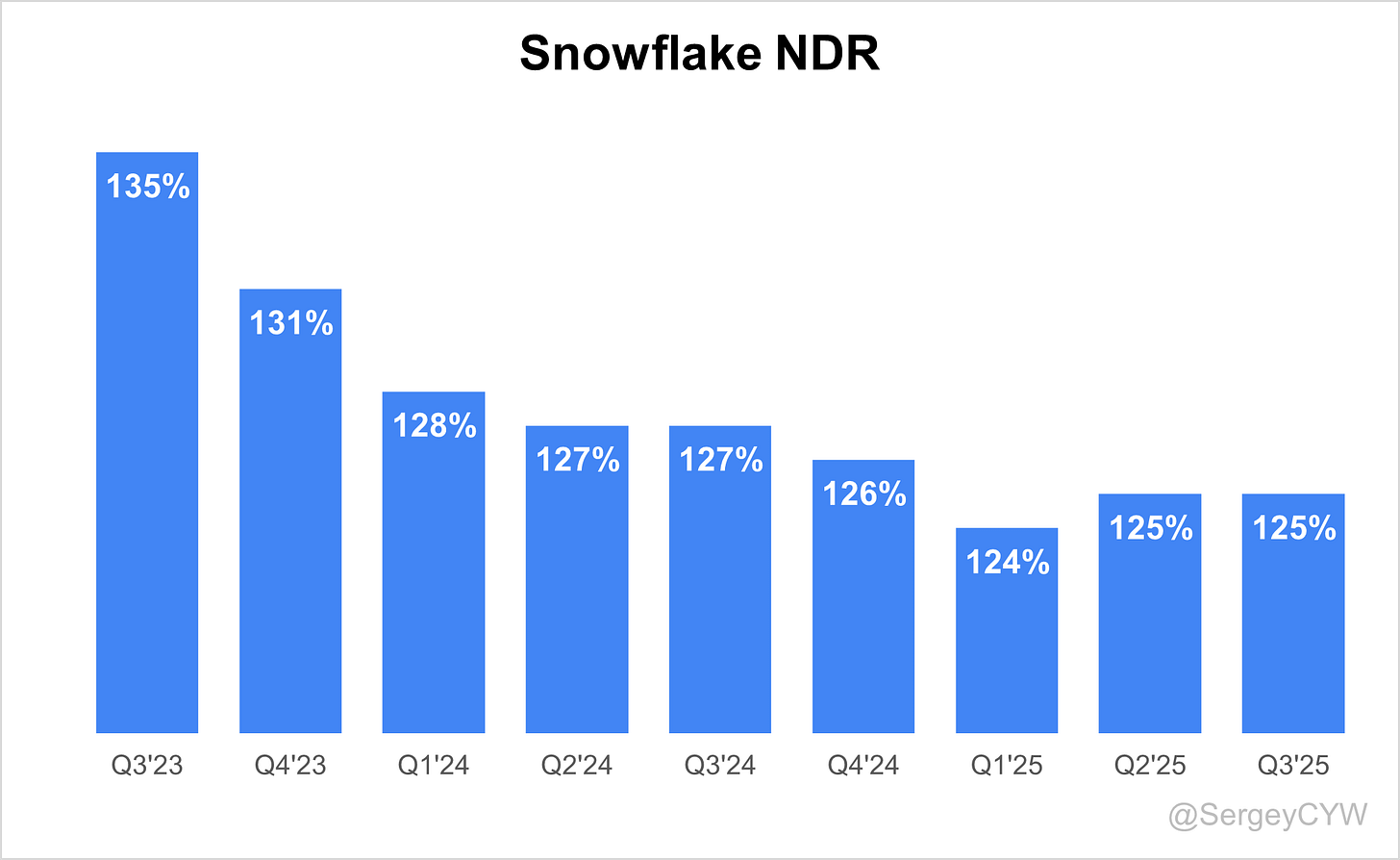

➡️NDR 125% (-2 PPs YoY, - PPs QoQ)

↗️RPO $7.88B (+38.3% YoY)🟢

↗️сRPO $3.78B (+32.7% YoY)🟢

➡️Billings $1,367M (+28.0% YoY)🟡

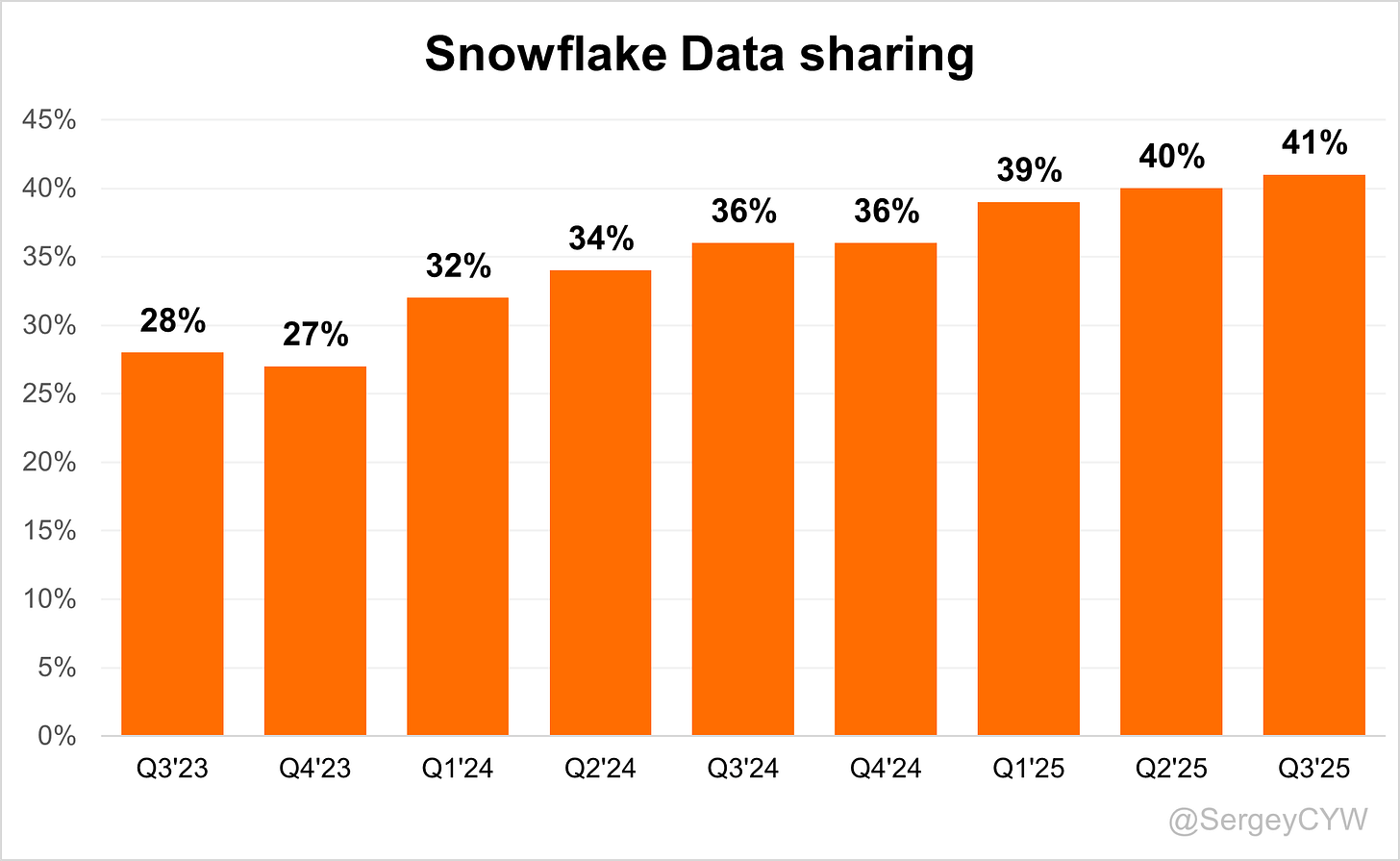

↗️Data sharing 41.0% (+1.0 PPs QoQ)

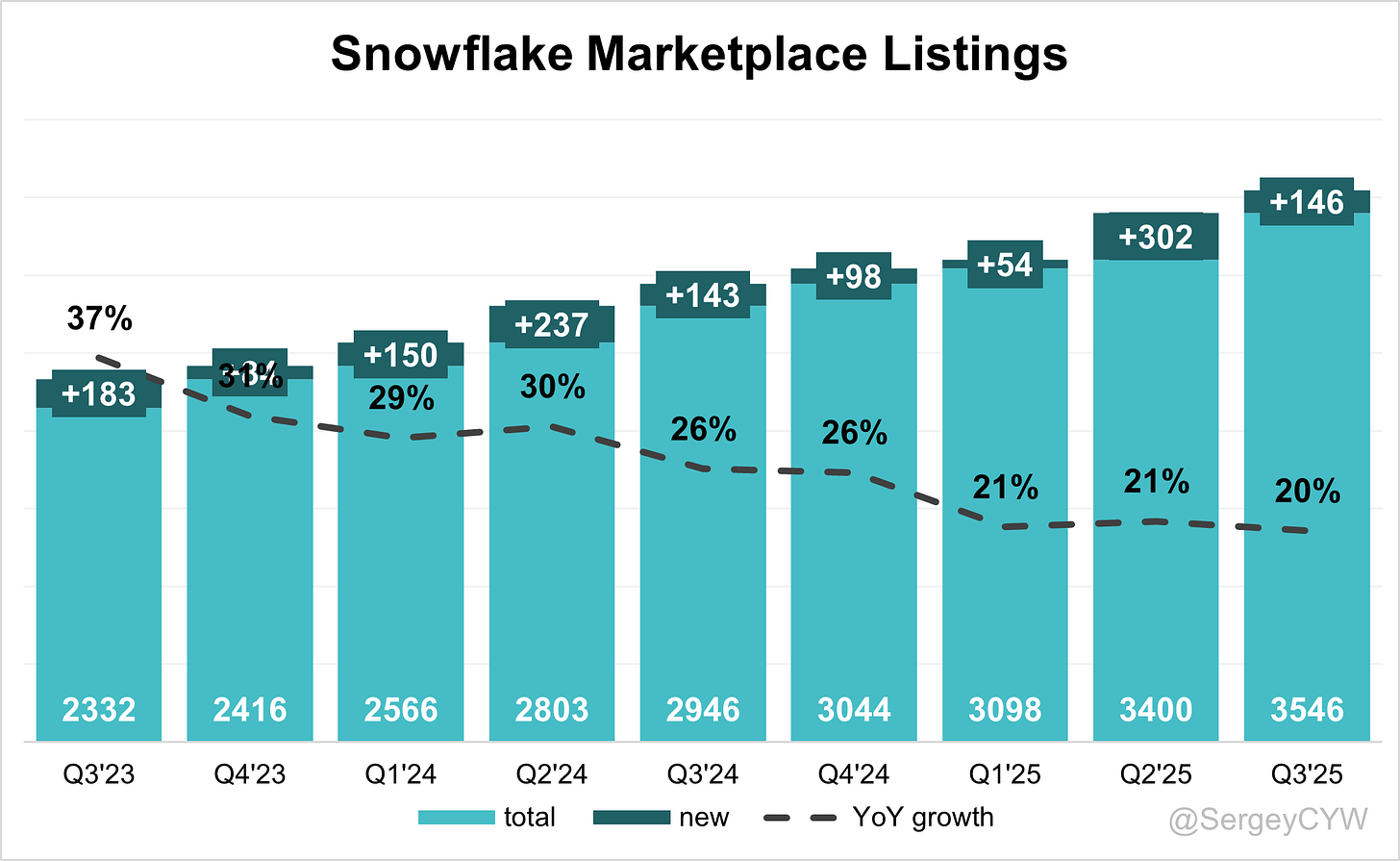

➡️3,546 Marketplace Listings (+20.4% YoY, +146)

Customers

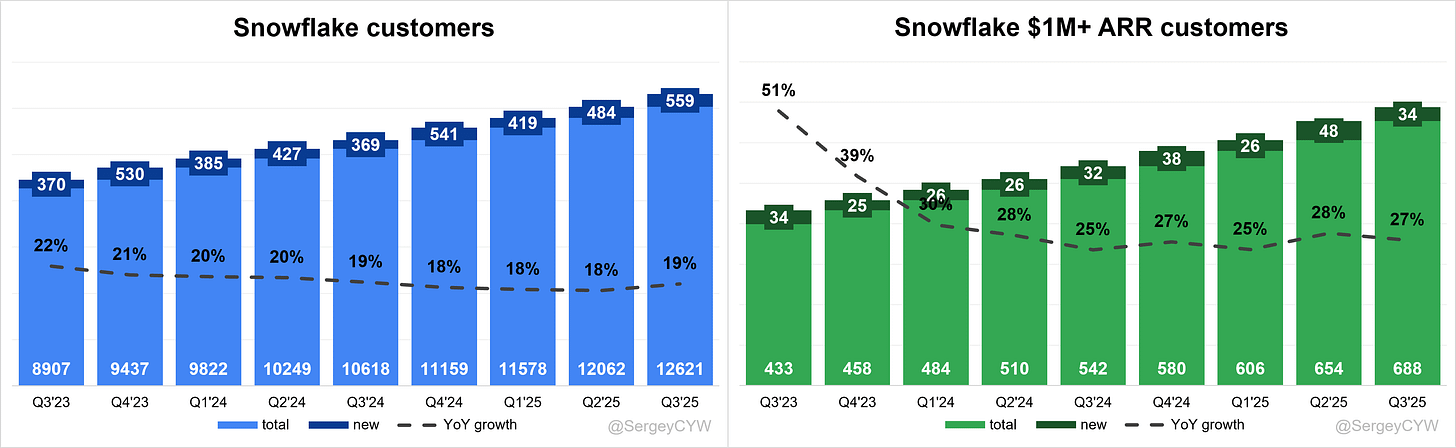

↗️12,621 customers (+18.9% YoY, +559)

➡️688 $1M+ customers (+26.9% YoY, +34)

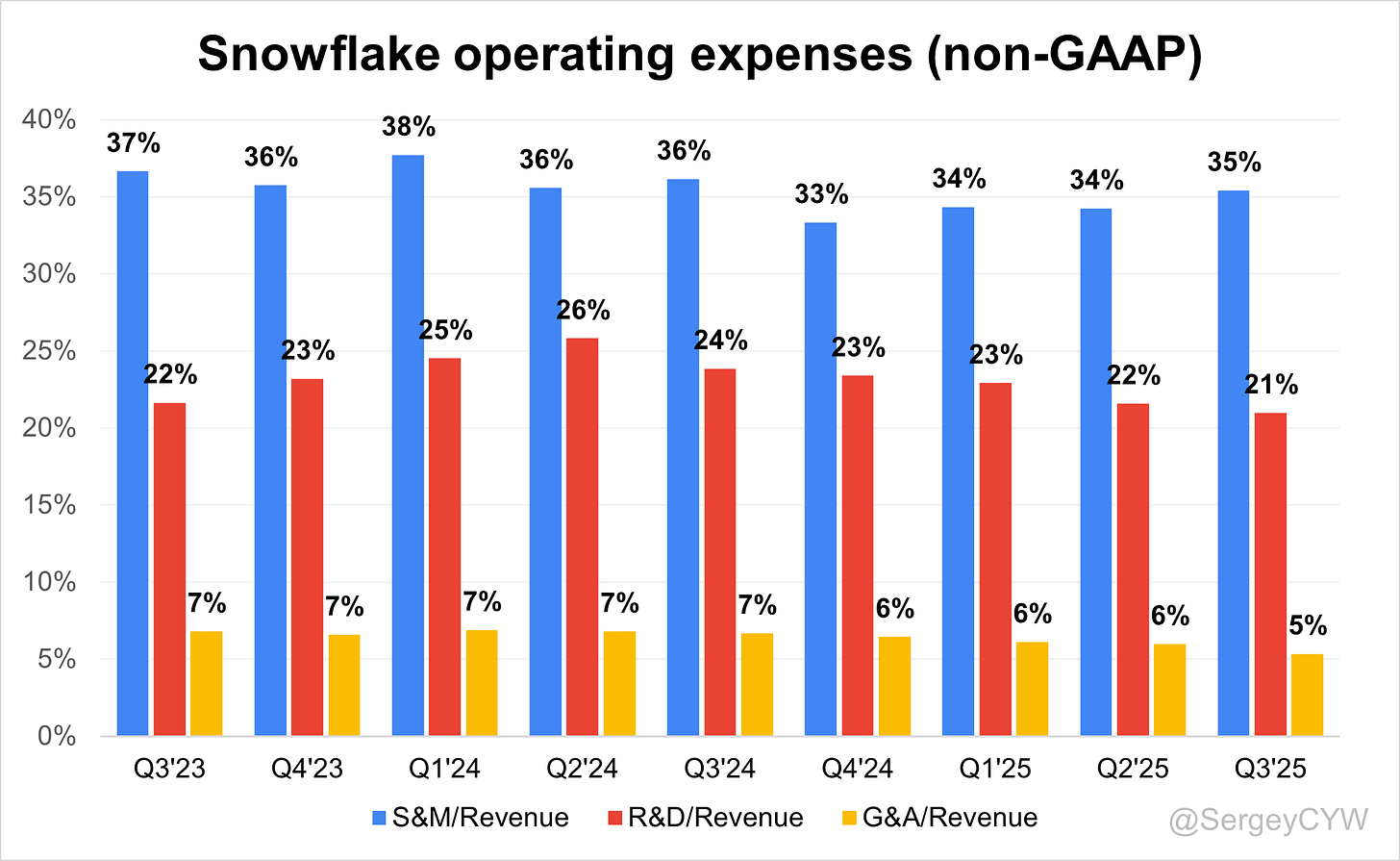

Operating expenses

↘️S&M*/Revenue 35.4% (-0.7 PPs YoY)

↘️R&D*/Revenue 21.0% (-2.9 PPs YoY)

↘️G&A*/Revenue 5.4% (-1.3 PPs YoY)

Quarterly Performance Highlights

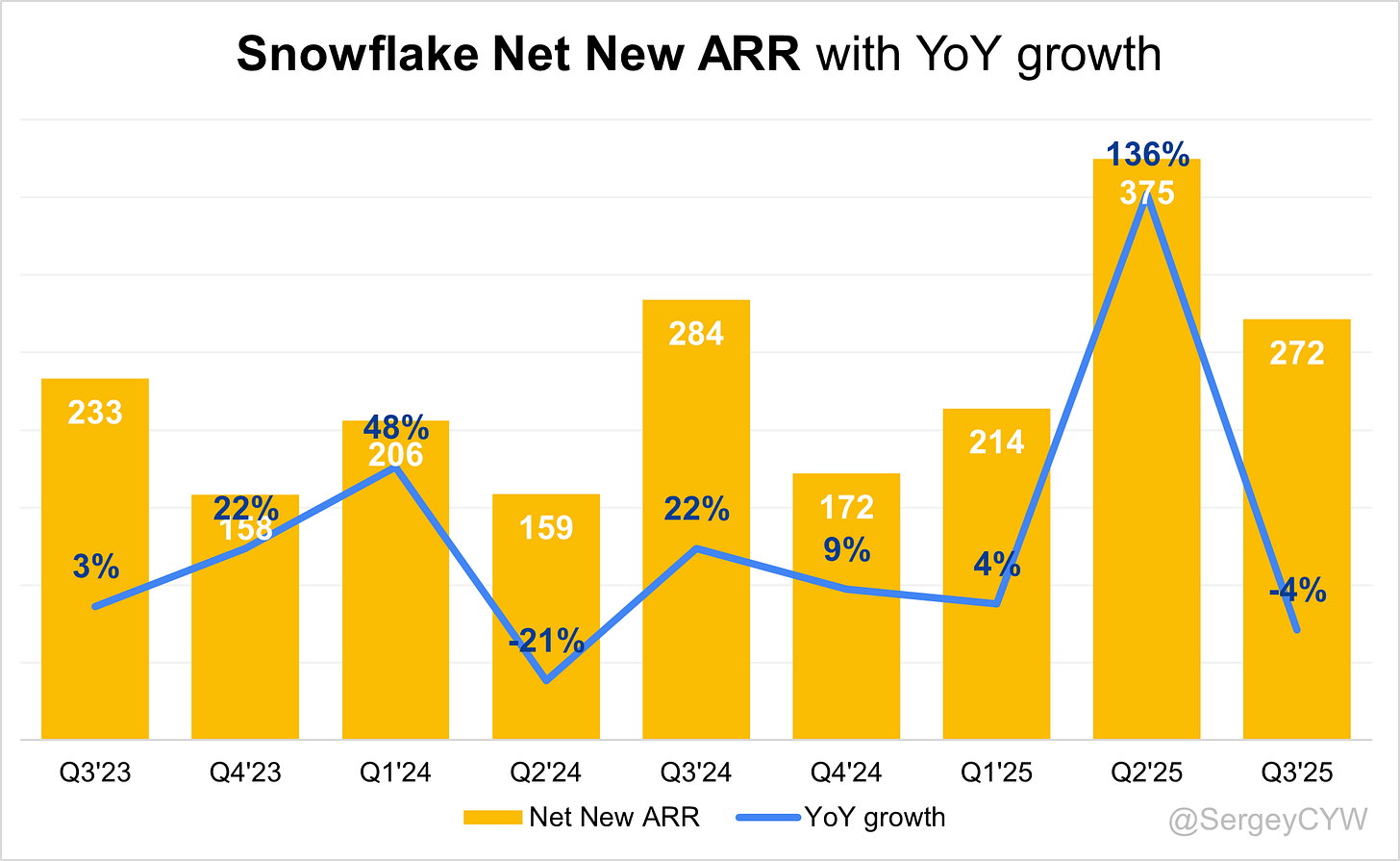

↘️Net New ARR $272M (-4.4% YoY)

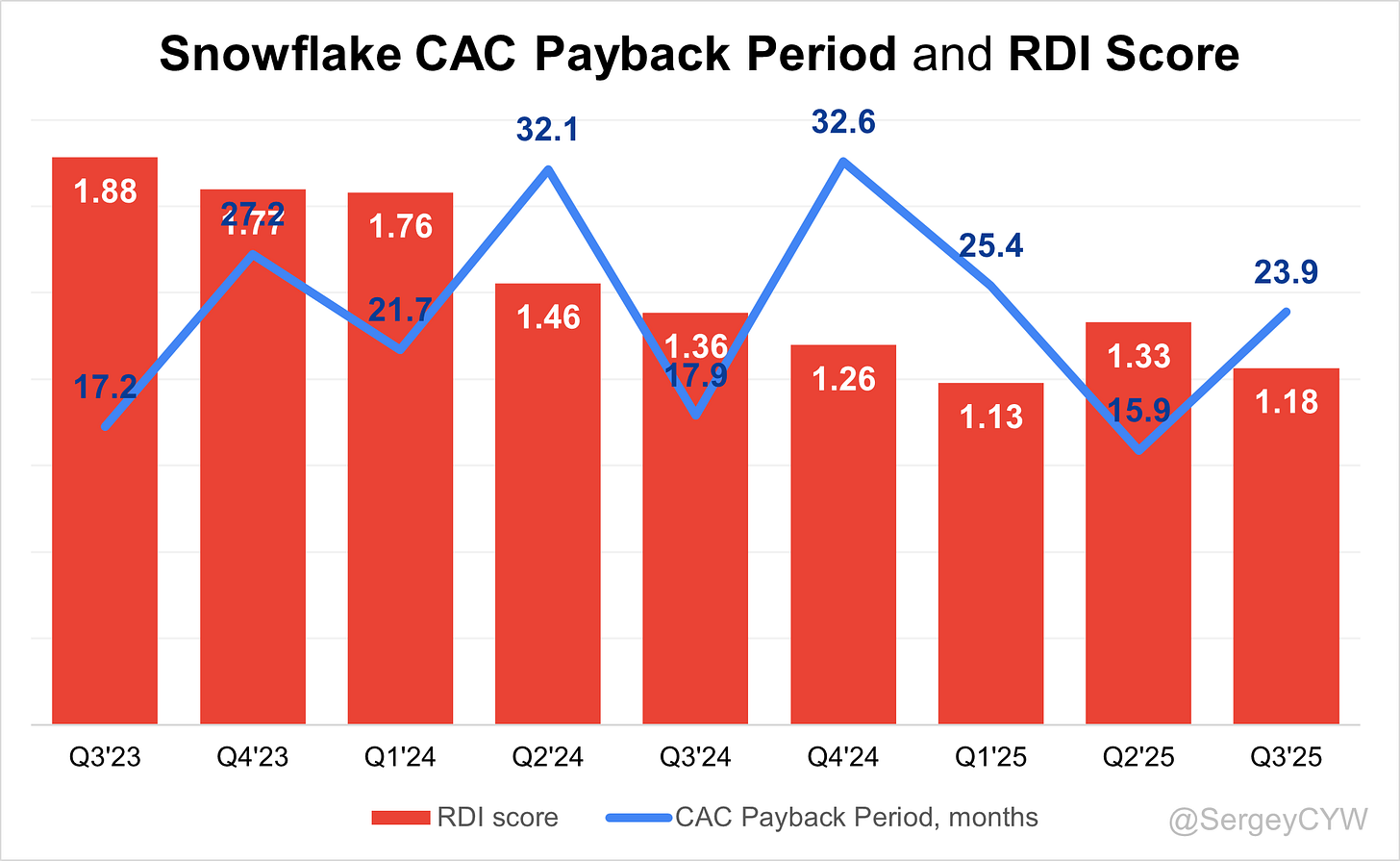

↗️CAC* Payback Period 23.9 Months (+6.0 YoY)🟡

↘️R&D* Index (RDI) 1.18 (-0.18 YoY)🟡

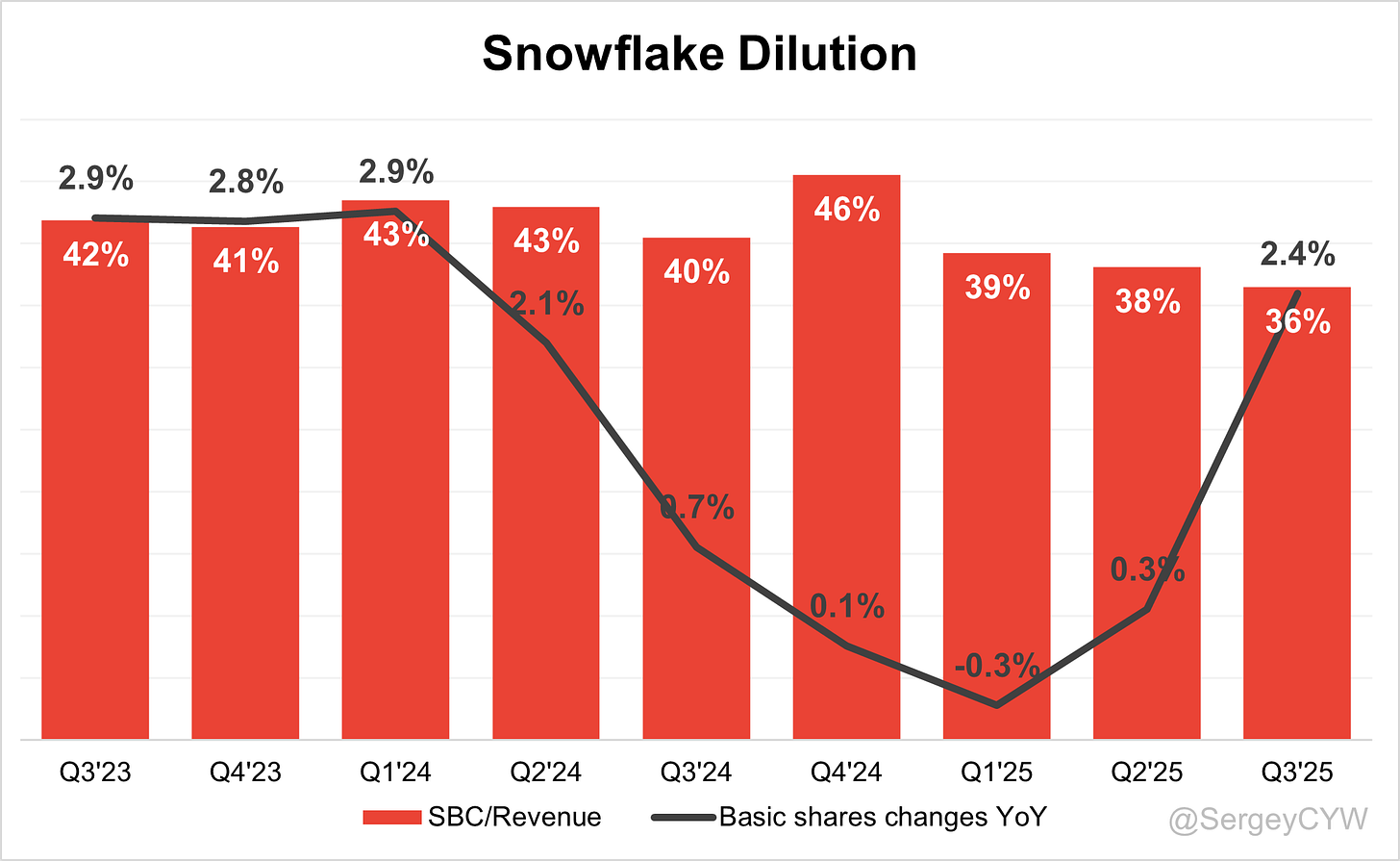

Dilution

↘️SBC/rev 36%, -1.6 PPs QoQ

↗️Basic shares up 2.4% YoY, +2.0 PPs QoQ

↘️Diluted shares up 3.1% YoY, -0.5 PPs QoQ

Headcount

↗️9,023 Total Headcount (+15.3% YoY, +254 added)

Guidance

↗️Q4’25 $1,195.0 - $1,200.0M guide (+26.9% YoY) beat est by 1.8%

↗️$4,446.0M FY guide (+28.4% YoY) raised by 1.2% beat est by 1.2%

Key points from Snowflake Third Quarter 2025 Earnings Call:

Financial Performance

Snowflake reported 29% YoY product revenue growth to $1.16B in Q3 and raised its full-year forecast to $4.446B, implying 28% annual growth. Remaining Performance Obligations rose 37% YoY to $7.88B, showing stronger multi-year commitments. Gross margin reached 75.9%, while operating margin expanded 450 bps YoY to 11%, reflecting improved efficiency despite earlier sales and marketing investments. Free cash flow margin stood at 11%. The company ended the quarter with $4.4B in liquidity after repurchasing $233M in stock. A brief $1–2M revenue impact came from a hyperscaler outage, but consumption trends stayed aligned with internal expectations.

Brian Robins, Chief Financial Officer: “The quarter pretty much played out as expected, and the annual guide is the most meaningful signal of the underlying demand we are seeing.”

Brian Robins, Chief Financial Officer: “Our view of the business improved over the last 90 days, which gave us confidence to raise our full-year outlook.”

Cortex AI

Cortex AI drove Snowflake’s AI revenue run rate to $100M, achieved one quarter early. It functions as an enterprise gateway for foundation models, SQL-based AI, and agentic workflows. Integrations with Google’s Gemini and Anthropic’s models make it model-agnostic and flexible. Cortex supports the full data lifecycle from ingestion to deployment and is gaining traction across financial, tech, and digital sectors. The main operational focus is sustaining low-latency performance and managing cost as model complexity grows.

Sridhar Ramaswamy, Chief Executive Officer: “This momentum has enabled us to reach the $100M AI run rate ahead of schedule, a direct sign of real enterprise production usage.”

Sridhar Ramaswamy, Chief Executive Officer: “AI is becoming a powerful pull into Snowflake, influencing half of all bookings this quarter.”

Snowflake Intelligence

Snowflake Intelligence became the fastest-adopted product in company history, with 1,200 active customers and 7,300 accounts using AI weekly. It converts natural-language queries into real-time insights and broadens access to enterprise data. TS Imagine built an AI agent equating to 8.5 FTEs of automated output, while Fanatics unified data for 100M+ fans to power its advertising network. AI influenced 50% of bookings and appeared in 28% of deployments. Execution complexity remains a constraint as enterprise readiness and governance maturity vary.

Sridhar Ramaswamy, Chief Executive Officer: “Snowflake Intelligence is giving every business user instant access to the data they need, and adoption is spreading faster than any product we’ve launched.”

Sridhar Ramaswamy, Chief Executive Officer: “When executives see it in action, the reaction is immediate—they want it deployed inside their companies.”

Apache Iceberg

Support for Apache Iceberg expands Snowflake’s reach into open data ecosystems, letting enterprises maintain hybrid or multi-engine environments with Snowflake governance and performance. Iceberg reduces migration friction and positions Snowflake as a neutral orchestration layer. The challenge lies in persuading customers running heavy analytical workloads on open formats to consolidate compute in Snowflake rather than rely on external engines.

Sridhar Ramaswamy, Chief Executive Officer: “Interoperability and openness are now essential, and Iceberg gives customers flexibility without sacrificing governance.”

Snowpark

Snowpark adoption grew as enterprises scaled data engineering and machine-learning workloads. Management cited it as a major contributor to Q3 consumption growth. AI-powered coding agents now accelerate Snowpark development and reduce build times. The product underpins Dynamic Tables and Cortex AI. Migration from legacy Python or Spark pipelines remains a hurdle, prompting Snowflake’s acquisitions of Datometry and Telemetry technologies to ease transitions and cut costs.

Sridhar Ramaswamy, Chief Executive Officer: “Investments in migration tooling are unlocking Snowpark adoption and shortening time-to-value for engineering teams.”

Dynamic Tables

Dynamic Tables automate incremental data refresh, supporting real-time analytics and AI workflows. Adoption is rising as organizations modernize engineering stacks. Faster refresh cycles improve consumption predictability and consolidate workloads within Snowflake. The key friction is operational migration, requiring pipeline rearchitecture to exploit automation. Integration with OpenFlow and Snowpark aims to streamline this process.

Sridhar Ramaswamy, Chief Executive Officer: “Dynamic, fresh data is now foundational for AI use cases, and customers are rapidly modernizing pipelines to support it.”

Product Innovation

Snowflake released 370 GA features YTD, up 35% YoY. Notable additions include OpenFlow for unified data ingestion, Unistore HTAP expansion, Snowflake Postgres from the Crunchy Data acquisition, and Select Star integration for richer cataloging. The company continues converging data, ML, and application layers to simplify enterprise AI deployment.

Sridhar Ramaswamy, Chief Executive Officer: “We maintained a rapid pace of innovation with AI front and center across our 370 new capabilities this year.”

AI Adoption

AI drove a significant shift in spending behavior. Roughly 50% of bookings and 28% of use cases involved AI. Enterprises are linking AI and Snowflake budgets, viewing the platform as core infrastructure for data-driven operations. Usage is now production-grade rather than experimental.

Sridhar Ramaswamy, Chief Executive Officer: “AI is strengthening customer relationships and expanding the value we deliver across the entire data lifecycle.”

Marketplace and Data Sharing

Snowflake’s Marketplace exceeded $2B in AWS sales this year. The company is evolving data sharing from static datasets to shareable AI agents built on Snowflake Intelligence. Zero-Copy agreements with SAP, Salesforce, Workday, and ServiceNow support collaboration under Snowflake governance.

Sridhar Ramaswamy, Chief Executive Officer: “Our disaster recovery capabilities transferred more than 300 mission-critical workloads during the cloud outage, reinforcing our reliability.”

Sridhar Ramaswamy, Chief Executive Officer: “We’ve surpassed $2 billion in AWS Marketplace sales, highlighting extraordinary demand.”

Go-to-Market

The quarter saw 615 new customers and four nine-figure deals. AI-driven demos and customized proofs-of-concept now anchor Snowflake’s sales strategy. Internal AI agents improve rep efficiency and accelerate POC delivery.

Brian Robins, Chief Financial Officer: “We signed a record number of nine-figure deals, reflecting strong enterprise commitment to our platform.”

Sridhar Ramaswamy, Chief Executive Officer: “AI enables us to demonstrate the art of the possible with highly tailored, outcome-oriented demos.”

Partnerships

Partnership activity accelerated. SAP integration enables direct ERP analytics. Workday, UiPath, Palantir, and Splunk expand operational reach. A $200M Anthropic partnership deepens model availability and GTM collaboration. Integration with Gemini, and Accenture training 5,000 specialists, signals strong institutional alignment.

Sridhar Ramaswamy, Chief Executive Officer: “Our partnerships—from SAP to Anthropic—are unlocking new levels of performance and accessibility for customers.”

Sridhar Ramaswamy, Chief Executive Officer: “Winning 14 AWS Partner Awards underscores the momentum in our cloud ecosystem.”

Customers

Snowflake’s Global 2000 base reached 776, averaging $2.3M in trailing 12-month spend. AI engagement scaled to 7,300 weekly active users and 1,200 Snowflake Intelligence deployments.

Sridhar Ramaswamy, Chief Executive Officer: “We added a record 615 customers, and net revenue retention stayed at a very healthy 125%.”

Customer Success Stories

TS Imagine automated the equivalent of 8.5 FTEs. Fanatics unified billions of data points for 100M+ fans. AstraZeneca enabled real-time ERP analytics. USA Bobsled & Skeleton optimized Olympic performance workflows. EVgo modernized ingestion pipelines. ServiceNow and PayPal advanced analytics automation.

Sridhar Ramaswamy, Chief Executive Officer: “Customers across industries are using agentic AI to drive tangible business outcomes at scale.”

Large Customer Wins

Snowflake secured four nine-figure transactions, all expansions within existing enterprises. Morgan Stanley named Snowflake its Strategic Partner of the Year. AI influenced roughly 50% of bookings.

Sridhar Ramaswamy, Chief Executive Officer: “The level of commitment from our largest customers reflects confidence in Snowflake as the foundation of their AI strategy.”

Competition

Competitors relying on raw foundation models or MCP frameworks struggle with scale and governance. Snowflake’s integrated model offers reliability, governance, and cost efficiency.

Sridhar Ramaswamy, Chief Executive Officer: “Companies realize quickly that homegrown agentic systems fail at scale; our platform solves the operational complexity for them.”

Challenges

Migration timing causes volatility, and Q2 benefited from exceptional events not expected to recur. Variability across 12,000+ customers complicates forecasting. Expanding into new workloads increases execution demands.

Brian Robins, Chief Financial Officer: “Quarterly variability is inherent in a consumption model, and migrations do not follow calendar pacing.”

Sridhar Ramaswamy, Chief Executive Officer: “Accelerating migrations remains a priority as we deploy more automation and AI-driven tooling.”

Future Outlook

Management expects durable high growth, supported by AI adoption, product expansion, and partner scaling. FY26 margin targets remain unchanged. FY27 guidance depends on post-holiday consumption, but RPO acceleration and record bookings signal strong demand.

Sridhar Ramaswamy, Chief Executive Officer: “We see a long runway of growth ahead as we scale AI capabilities and deepen operational discipline.”

Brian Robins, Chief Financial Officer: “Raising guidance by $51M reflects improved customer behavior and a strengthening demand environment.”

Thoughts on Snowflake Earnings Report $SNOW:

🟢 Positive

Revenue: Q3 revenue reached $1.213B (+28.7% YoY, +5.9% QoQ), beating estimates by 2.8%.

Product revenue: $1.158B (+28.7% YoY) with 75.9% gross margin.

Operating margin: Improved to 10.8% (+4.6 pps YoY); FCF margin rose to 9.4% (+1.1 pps YoY).

EPS: $0.35, beating estimates by 16.7%.

RPO: $7.88B (+38.3% YoY); cRPO $3.78B (+32.7% YoY).

Customer growth: Total 12,621 (+18.9% YoY); 688 customers spending $1M+ annually (+26.9% YoY).

AI traction: AI influenced 50% of bookings; Snowflake Intelligence adopted by 1,200 customers; Cortex AI hit $100M run rate a quarter early.

Efficiency: S&M/Revenue 35.4%, R&D/Revenue 21.0%, G&A/Revenue 5.4% — all improved YoY.

Partnerships: Expanded with SAP, Anthropic ($200M), Google (Gemini); Accenture training 5,000 specialists; 14 AWS Partner Awards.

Marketplace: Surpassed $2B AWS sales; Data sharing reached 41% (+1 pp QoQ).

🟡 Neutral

Gross margin: Stable at 72.6% (-0.4 pp YoY).

Net revenue retention: 125%, down 2 pps YoY but steady sequentially.

Billings: $1.367B (+28% YoY), tracking with revenue growth.

Net margin: -24%, improved 10.4 pps YoY but remains negative.

Headcount: 9,023 employees (+15.3% YoY), showing steady hiring amid cost discipline.

Q4 guidance: $1.195–1.200B revenue (+26.9% YoY) — modest beat vs. consensus.

FY25 guidance: Raised to $4.446B (+28.4% YoY), up 1.2%.

🔴 Negative

Net new ARR: $272M, down 4.4% YoY, showing slower incremental growth.

CAC payback: Lengthened to 23.9 months (+6.0 YoY).

R&D Index (RDI): Declined to 1.18 (-0.18 YoY).

Share-based comp: 36% of revenue, still elevated despite slight QoQ improvement.

Migration variability: Consumption timing remains unpredictable; Q2 benefited from one-time migrations.

Execution complexity: Expanding into new workloads and AI services increases operational demands.

Salesforce

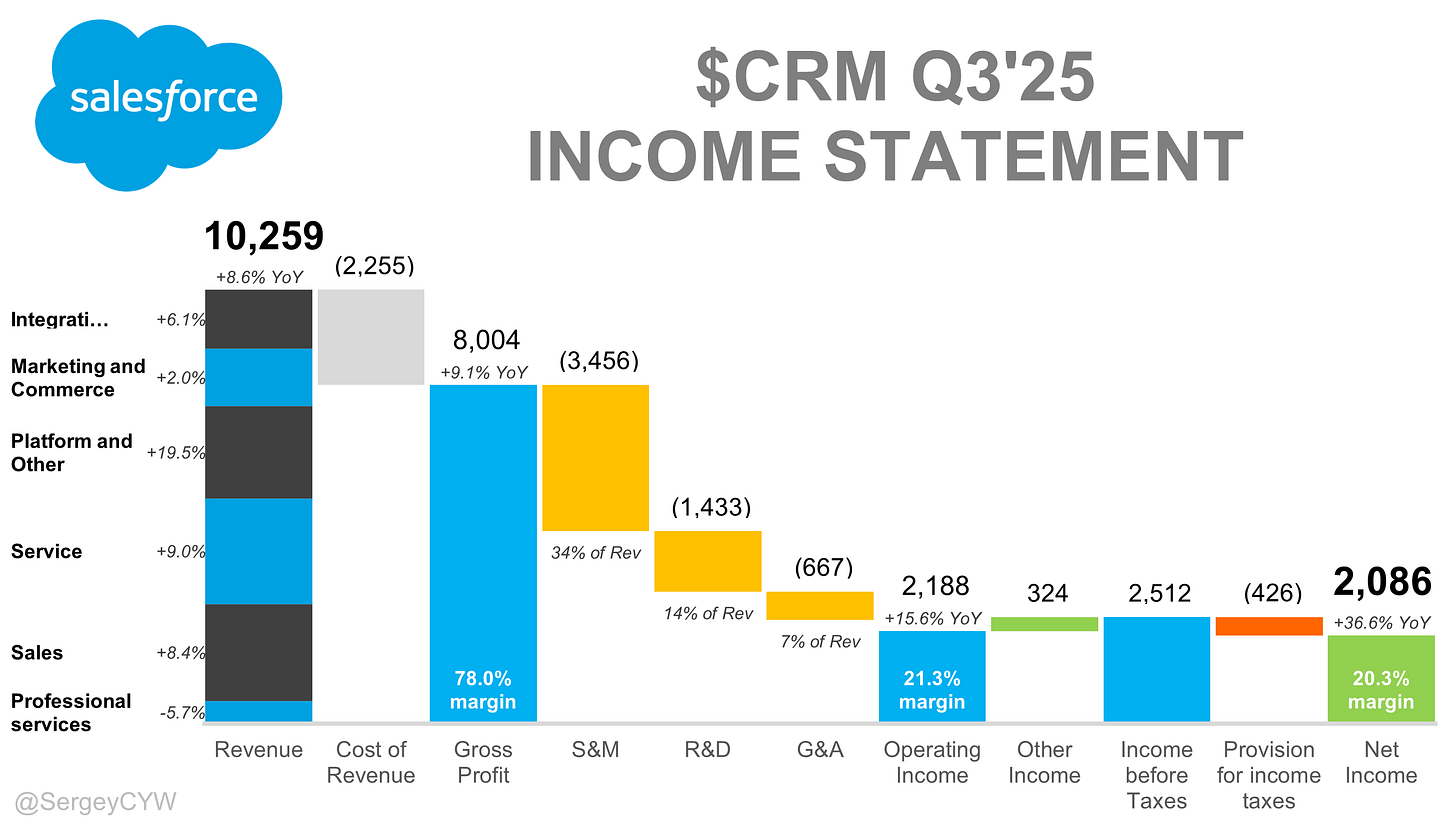

Financial Results:

↘️$10,259.0M rev (+8.6% YoY, +0.2% QoQ) missed est by -0.1%🔴

↗️GM (78.0%, +0.3 PPs YoY)

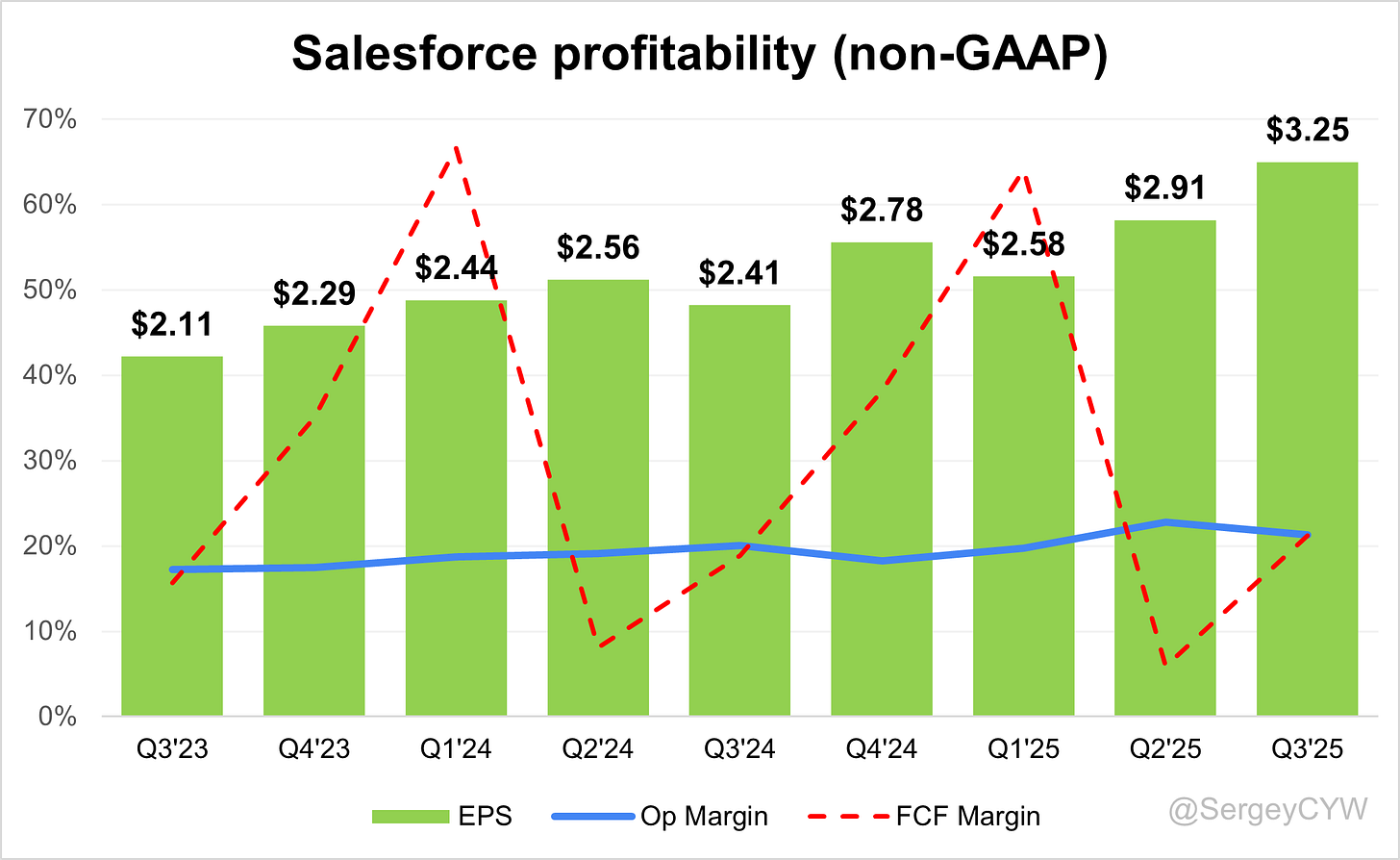

↗️Operating Margin (21.3%, +1.3 PPs YoY)

↗️FCF Margin (21.2%, +2.4 PPs YoY)

↗️Net Margin (20.3%, +4.2 PPs YoY)🟢

↗️EPS* $3.25 beat est by 14.0%

*non-GAAP

Segment Revenue

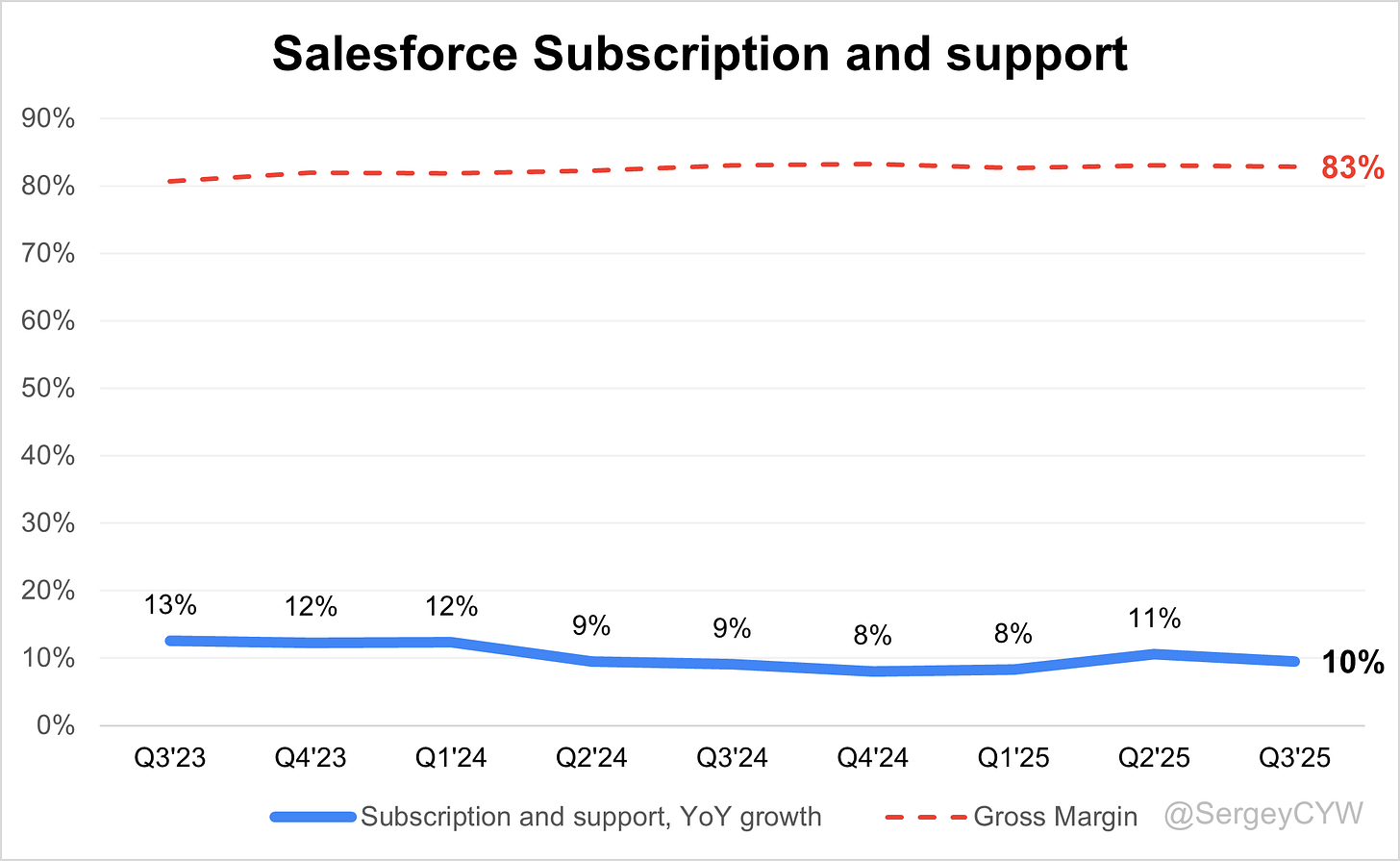

↗️Subscription and support $9,726M rev (+9.5% YoY, 82.9% Gross Margin)

↘️Professional services $533M rev (-5.7% YoY, -10.7% Gross Margin)🟡

Key Metrics

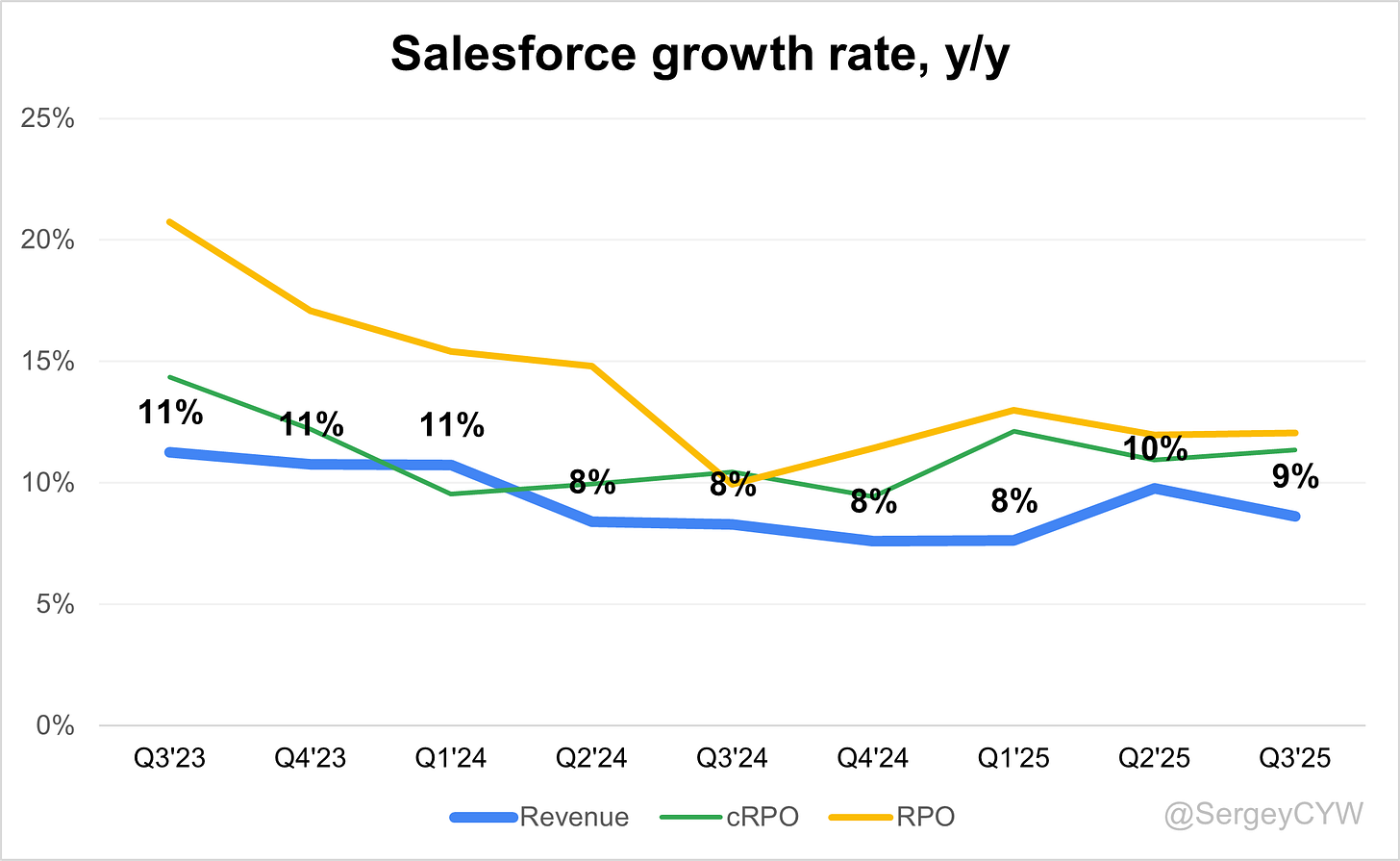

↗️RPO $59.50B (+12.1% YoY)🟢

↗️cRPO $29.40B (+11.4% YoY)🟢

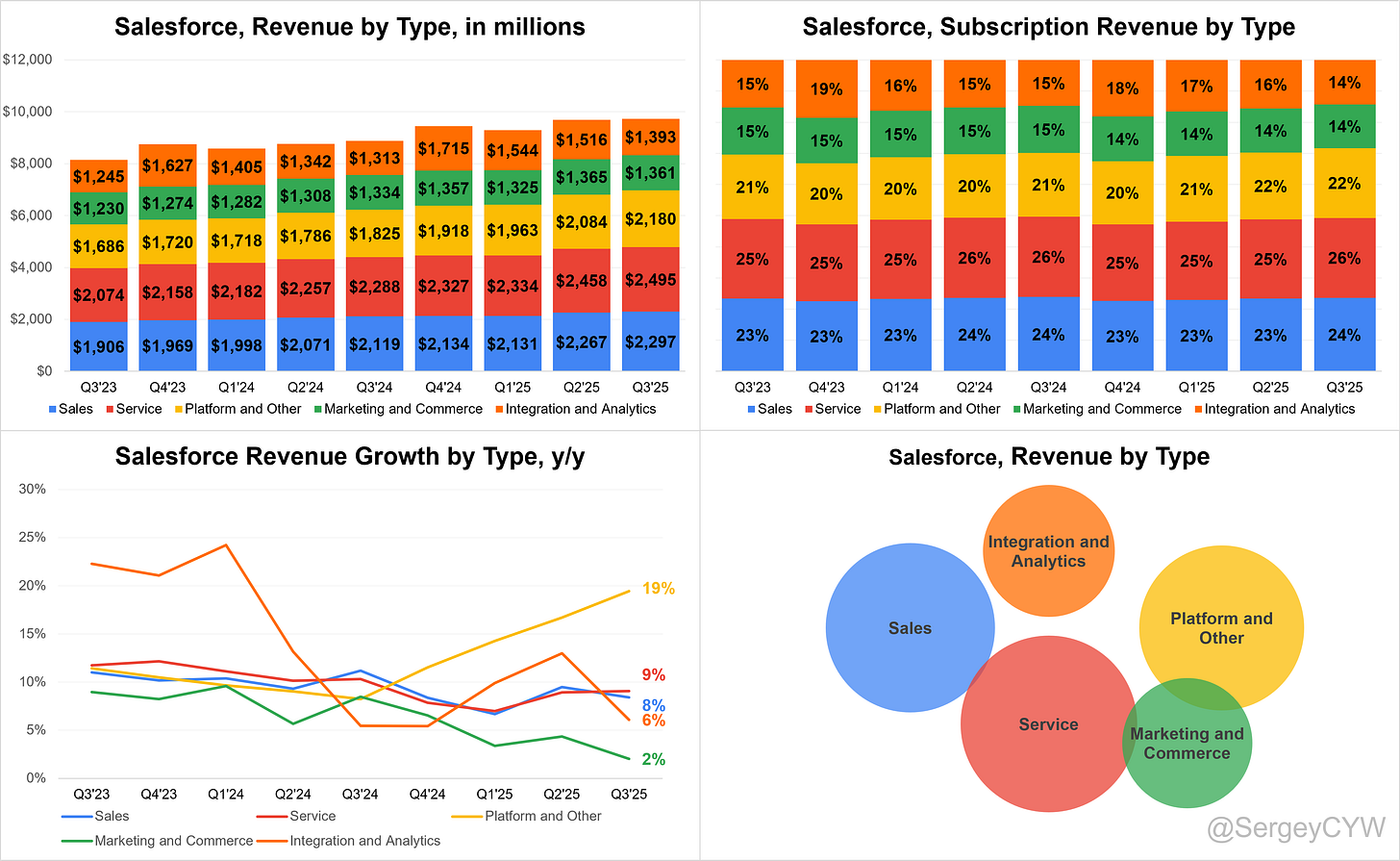

Subscription Revenue by Type

➡️Sales $2,297M rev (+8.4% YoY)🟡

↗️Service $2,495M rev (+9.0% YoY)🟢

↗️Platform and Other $2,180M rev (+19.5% YoY)🟢

➡️Marketing and Commerce $1,361M rev (+2.0% YoY)🟡

➡️Integration and Analytics $1,393M rev (+6.1% YoY)🟡

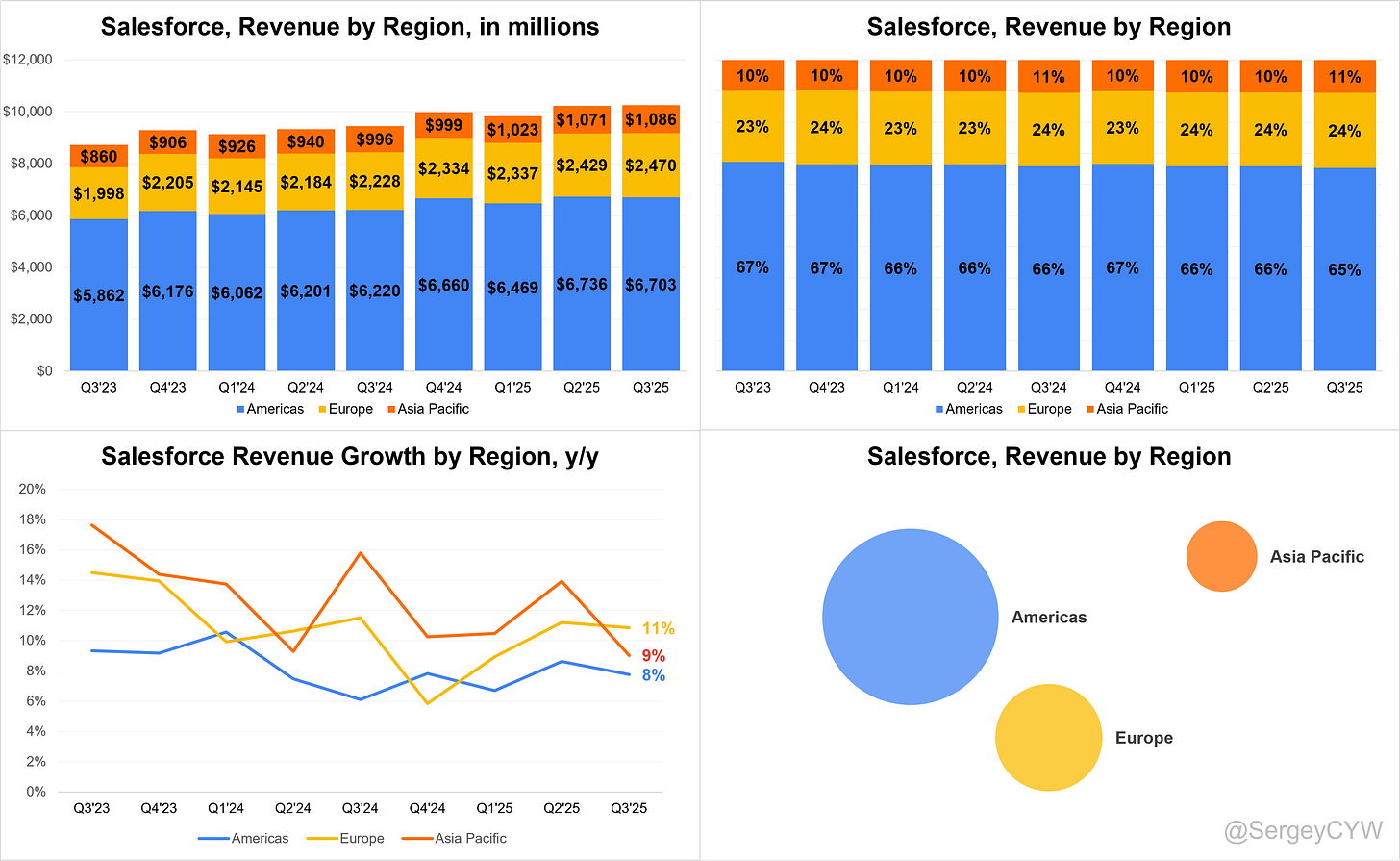

Revenue by Region

➡️Americas $6,703M rev (+7.8% YoY, 65.3% of Rev)🟡

↗️Europe $2,470M rev (+10.9% YoY, 24.1% of Rev)

↗️Asia Pacific $1,086M rev (+9.0% YoY, 10.6% of Rev)

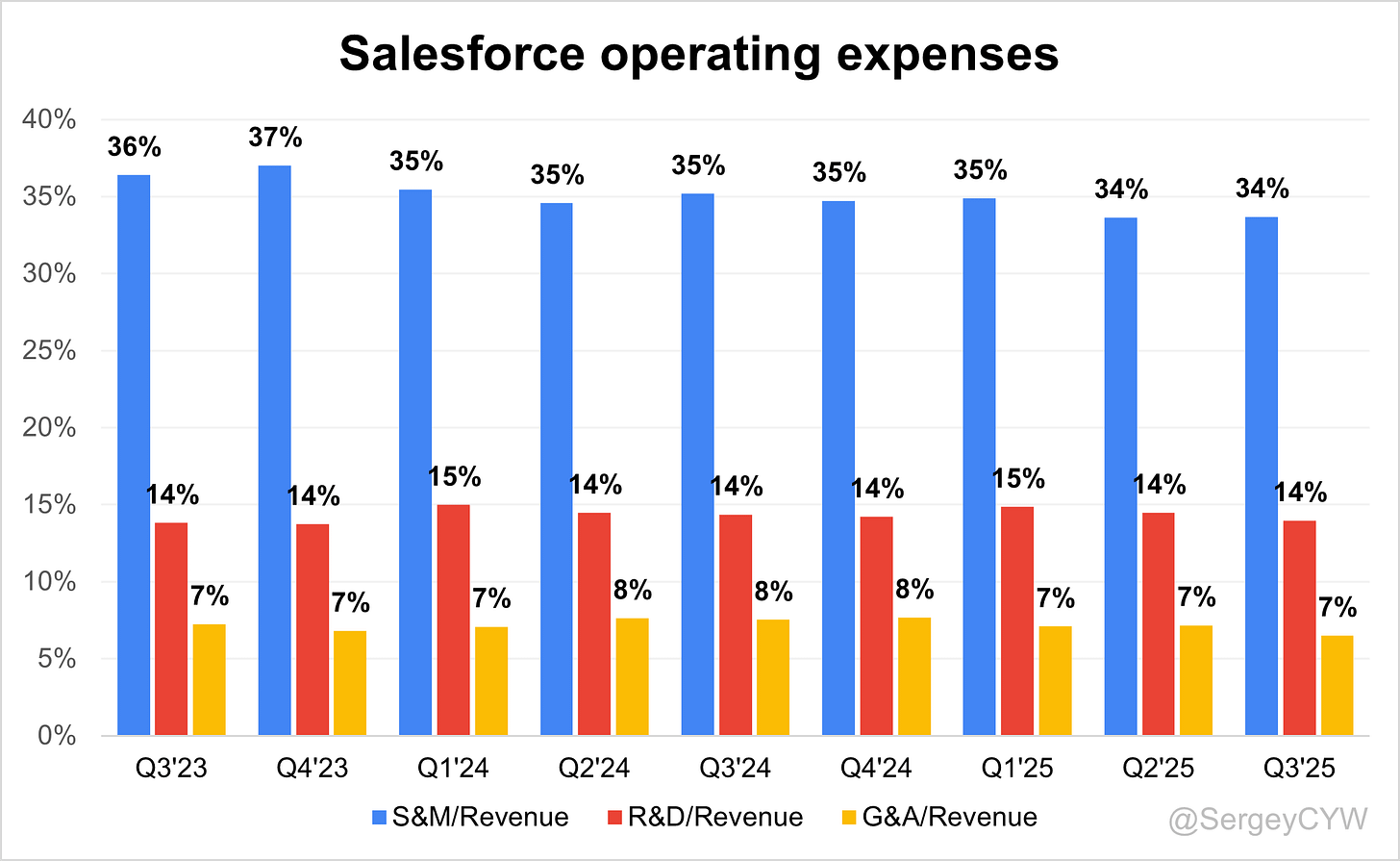

Operating expenses

↘️S&M/Revenue 33.7% (-1.5 PPs YoY)

↘️R&D/Revenue 14.0% (-0.4 PPs YoY)

↘️G&A/Revenue 6.5% (-1.0 PPs YoY)

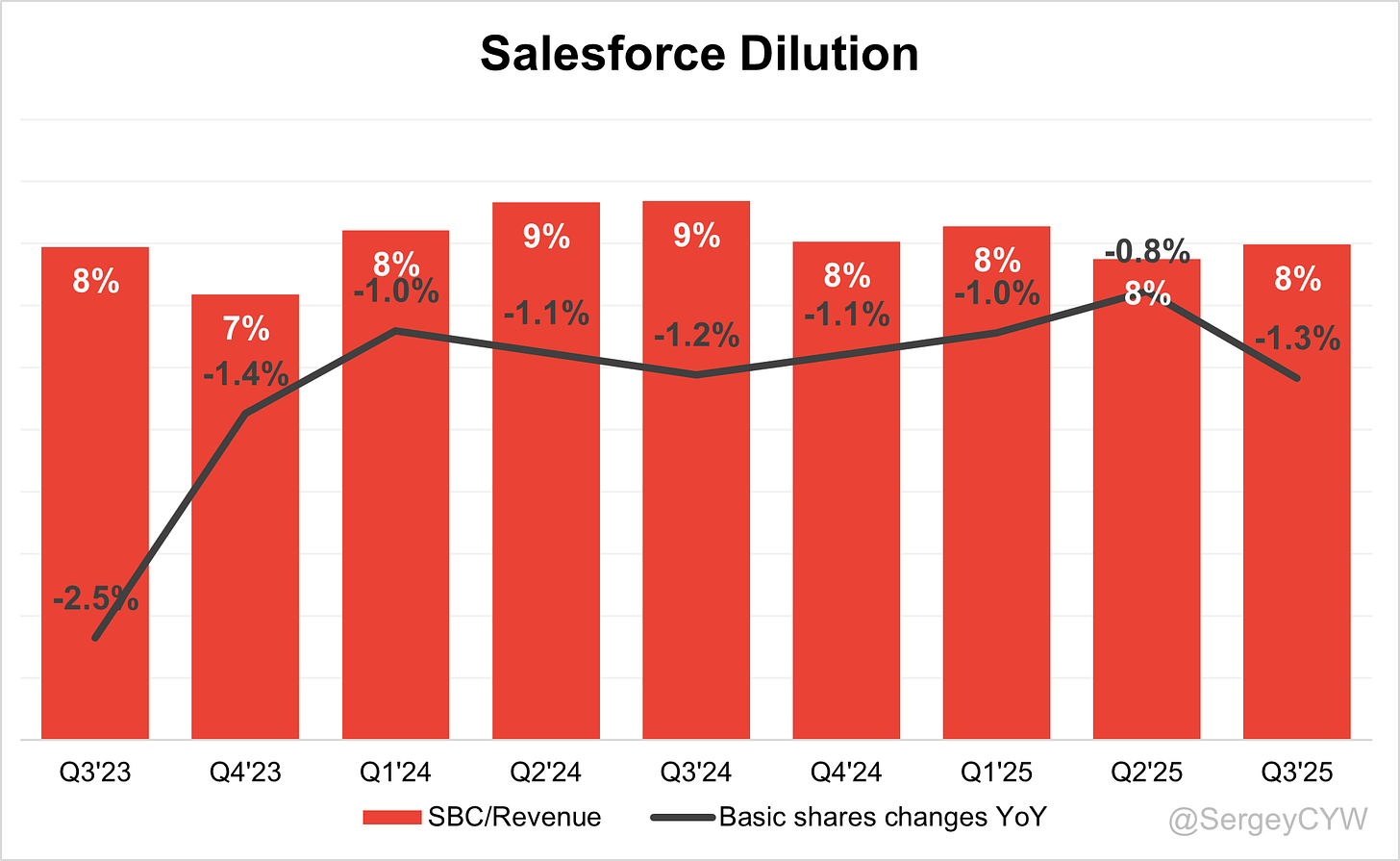

Dilution

↗️SBC/rev 8%, +0.2 PPs QoQ

↘️Basic shares down -1.3% YoY, -0.4 PPs QoQ🟢

↘️Diluted shares down -2.7% YoY, -1.5 PPs QoQ🟢

Guidance

↗️Q4’25 $11.13 - $11.23B guide (+19.0% YoY) beat est by 2.5%

↗️$41.5 - $41.6B FY guide (+9.5% YoY) raised by 0.6% beat est by 0.6%

Key points from Salesforce Third Quarter 2025 Earnings Call:

Financial performance

Revenue in Q3 FY26 reached $10.26 billion, rising 9% year over year (8% in constant currency). Subscription and support revenue increased 10% nominal (9% cc). Non-GAAP operating margin was 35.5%, with GAAP margin expanding 130 bps. Current RPO stood at $29.4 billion, up ~11%, including a $200 million FX tailwind. Total RPO neared $60 billion, up ~12%. Operating cash flow reached $2.3 billion, up 17%, and free cash flow was $2.2 billion, up 22%.

Full-year guidance calls for total revenue between $41.45–$41.55 billion, representing 9–10% nominal growth, with ~80 bps added by the Informatica acquisition. FY26 non-GAAP operating margin is guided at 34.1%, GAAP margin at 20.3%, and operating and free cash flow growth at ~13–14%. Management expects Q4 CRPO growth of ~11% nominal (~9% cc) and ~15% nominal including Informatica. Revenue re-acceleration is anticipated within 12–18 months.

Data platform

The data foundation expanded into a three-layer architecture integrating Informatica for ingestion and governance, Data 360 for harmonization and real-time profiles, and MuleSoft for orchestration. Combined, the unit is expected to generate roughly $10 billion in annualized revenue next year. The Informatica deal closed three months early, and new federation capabilities now connect Data 360 directly to IBM mainframes, enabling agentic use cases without full data replication. Major adopters include Costco, TD Bank, CVS Health, and Telecom Argentina. The platform gained from rising attach rates to Agentforce, though revenue variability in MuleSoft and Tableau, and soft demand in APAC, remain short-term challenges.

Marc Benioff, Chair and CEO

“We’re making disciplined strategic acquisitions like Informatica, which brings together harmonization, integration, and federation—Data 360 plus MuleSoft plus Informatica is giving us a powerful platform.”

AI platform

The AI platform scaled to industrial-grade throughput with a model-agnostic LLM gateway and hybrid reasoning architecture combining probabilistic and deterministic workflows. Cumulative usage surpassed 3.2 trillion tokens, with 540 billion in October, up 25% month over month. Q3 logged 200 million LLM calls, totaling 1.2 billion to date. Enhanced evaluation, auditing, and data residency tools strengthened trust for production AI. The system can dynamically swap between OpenAI, Anthropic, Gemini, and open source models for cost and performance optimization. Enterprise success includes the IRS automating 98% of manual workflows, reducing case setup from 10 days to 30 minutes, and Williams-Sonoma’s Olive agent managing ~60% of inbound conversations.

Marc Benioff, Chair and CEO

“We use all of the large language models—they’re all just commodities. We can swap them in and out. The lowest-cost one is the best one for us.”

Agentforce

Agentforce continued as a key growth driver. Combined ARR with Data 360 reached $1.4 billion, up 114% year over year, while Agentforce alone hit $540 million, up 330%. Since launch, 18,500+ deals have closed, including 9,500 paid, and customers in production rose ~70% quarter over quarter. More than 50% of new bookings came from existing clients expanding usage. Agentforce is now embedded across Sales, Service, Slack, ITSM, Supply Chain, Tableau, and industry clouds. Average weekly actions rose ~140% quarter over quarter, and deterministic routing helped cut LLM costs. Major deployments included General Motors, Costco, Uber, Conagra, Engie, and Haleon.

Miguel Milano, President and Chief Revenue Officer

“There is a new secular demand trend—the agentic enterprise. Customers have gone from experimentation to frustration, and now they’re ready to scale.”

Slack

Slack became the employee-agent interface, with Slackbot integrating across Salesforce apps and Data 360 to enable real-time workflow automation. Over one million companies use Slack, and 80% of the Forbes Top 50 AI companies rely on it. General Motors deployed Slack to 96,000 employees in nine months, embedding AI into operations and service. Slack’s role as a conversational hub is expanding rapidly, with governance and reliability as scaling priorities.

Marc Benioff, Chair and CEO

“We’ve delivered a new framework deeply integrated into Slack—something new called Slackbot, the heart of our employee agent strategy.”

Data 360 growth

Data 360 ingested 32 trillion records, a 119% increase year over year, including 15 trillion through zero-copy federation, up 341%. Unstructured data ingestion grew 109%, covering manuals and documents. The platform powers real-time customer, product, and account profiles with major clients such as Dentsu, Moody’s, KPMG, Ferguson, and Zoom. Attach rates to Agentforce and Life Sciences Cloud accelerated, with the latter seeing bookings triple year over year.

Product innovations

Salesforce launched Agentforce IT Service (ITSM), expanding into enterprise service management. PenFed implemented the solution, projecting a 30% cost reduction and $2 million in annual savings. Hybrid reasoning, omnichannel management, and Slack integration strengthened service automation. Life Sciences Cloud recorded 120+ new customers and tripled bookings, reflecting share gains from Veeva.

AI adoption

Enterprises are moving from experimentation to scaled deployment. Adoption hinges on unified data, metadata, workflows, and governance, which Salesforce’s platform delivers. Built-in evaluation and residency tools provide operational integrity for regulated sectors.

Marc Benioff, Chair and CEO

“Customers in production with Agentforce have jumped 70% quarter over quarter.”

Customer wins

Broad-based adoption continues across industries. Williams-Sonoma’s Olive assistant handles most customer interactions, while General Motors integrated Salesforce across Automotive Cloud, Data 360, MuleSoft, Agentforce, and Slack. Costco deepened AI modernization with Salesforce and Google. Financial clients TD Bank and CVS Health, along with Telecom Argentina and Falabella, expanded multi-cloud deployments. In life sciences, Pfizer, Novartis, Takeda, and Haleon led growth as bookings tripled.

Marc Benioff, Chair and CEO

“Costco is driving AI and digitization across everything they do for their members, and General Motors is expanding across every Salesforce cloud.”

Government momentum

Public sector ARR climbed ~50% year over year. The IRS automated 98% of manual activities, cutting case setup to 30 minutes and saving 500,000 minutes annually. The UK police’s Bobby AI agent reduced non-emergency demand by ~20%. Government adoption now spans the Air Force, Army, Department of Agriculture, and Veterans Affairs.

Partnerships

Strategic alliances reinforced growth. Informatica handles ingestion, Data 360 manages harmonization, and MuleSoft connects APIs. New federation with IBM mainframes allows simultaneous operation between legacy systems and AI. Consulting partnerships with Accenture, Deloitte, and PwC accelerate joint deployments, while model partnerships with OpenAI, Anthropic, and Google maintain performance flexibility.

Srini Tallapragada, President and Chief Engineering and Customer Success Officer

“We are heavily invested with Accenture, Deloitte, and PwC, co-selling and running combined training for forward-deployed engineers.”

International expansion

Growth was strongest in North America and EMEA, led by France and the UK. Japan showed positive momentum, while Australia and India remained soft. CEO-level interest in agentic transformation continues to rise across global markets.

Marc Benioff, Chair and CEO

“I just got back from Japan and the UK—it’s really a global phenomenon.”

Share buybacks

Salesforce returned over $4 billion to shareholders in Q3 and plans a 50% increase in buybacks for 2H FY26. The company targets ~$15 billion in operating cash flow for the year, signaling strong financial discipline.

Challenges

Growth was moderated by Tableau’s faster cloud migration, variable on-premise timing in MuleSoft, and weaker marketing and commerce demand. APAC performance, particularly Australia and India, remained below expectations. Pricing flexibility continues to evolve, with enterprise licensing smoothing adoption.

Robin Washington, Chief Operating and Finance Officer

“We continue to see weaknesses in marketing and commerce, and Asia-Pacific was more constrained, particularly Australia and India.”

Future outlook

FY26 revenue guidance stands at $41.45–$41.55 billion, with non-GAAP margins at 34.1% and cash flow growth around 13–14%. Q4 CRPO growth is projected at ~11% organic or ~15% including Informatica. Sales capacity expanded 23%, with 15% ramped by year-end. Pipeline generation grew double digits, supporting a 12–18 month revenue re-acceleration driven by Agentforce, Slack, and the data platform.

Marc Benioff, Chair and CEO

“I’m really excited about fiscal years 2027 and 2028 because of the capacity increases we’re making now.”

Thoughts on Salesforce Earnings Report $CRM:

🟢 Positive

Revenue grew +8.6% YoY to $10.26B, with non-GAAP EPS $3.25, beating estimates by 14%.

Operating margin expanded +1.3 pps YoY to 21.3%, Net margin rose +4.2 pps YoY to 20.3%, and FCF margin improved to 21.2% (+2.4 pps).

Subscription & Support revenue increased +9.5% YoY to $9.73B, with 82.9% gross margin.

RPO reached $59.5B (+12.1% YoY), cRPO at $29.4B (+11.4% YoY), signaling strong future growth.

Platform & Other revenue surged +19.5% YoY to $2.18B, driven by Data 360 and Agentforce expansion.

Operating cash flow rose +17% YoY to $2.3B, free cash flow +22% YoY to $2.2B.

Q4 guidance raised to $11.13–$11.23B (+19% YoY), FY26 revenue now $41.45–$41.55B, up ~9–10% YoY.

Share buybacks exceeded $4B, with a 50% increase planned in 2H FY26.

Agentforce ARR hit $540M (+330% YoY); combined with Data 360, ARR reached $1.4B (+114%).

Slack adoption surpassed 1M companies, with GM scaling to 96K employees in 9 months.

Public Sector ARR grew ~50% YoY, with IRS and UK Police achieving major AI efficiency gains.

🟡 Neutral

Sales revenue grew +8.4% YoY to $2.30B; Service up +9.0% to $2.50B; Marketing & Commerce modest at +2.0% YoY ($1.36B).

Professional Services declined -5.7% YoY to $533M, reflecting delivery normalization.

Americas revenue rose +7.8% YoY, Europe +10.9%, APAC +9.0%, with the region contributing 10.6% of total revenue.

S&M spend dropped to 33.7% of revenue (-1.5 pps YoY), while R&D (14.0%) and G&A (6.5%) were slightly lower.

Stock-based compensation rose modestly to 8% of revenue (+0.2 pps QoQ).

Basic shares -1.3% YoY, diluted shares -2.7% YoY, supporting EPS accretion.

Management reaffirmed a 12–18 month path to revenue re-acceleration, driven by AI and data platform scale-up.

🔴 Negative

Revenue missed estimates by -0.1%.

Professional services margin declined -10.7 pps YoY, impacting profitability mix.

Marketing and Commerce growth (+2%) and Integration & Analytics (+6.1%) underperformed relative to core segments.

APAC softness persisted, notably in Australia and India, with management citing macro headwinds.

MuleSoft and Tableau experienced revenue timing issues due to accelerated cloud migration.

Pricing complexity and diverse consumption models remain friction points in large-scale Agentforce deals.

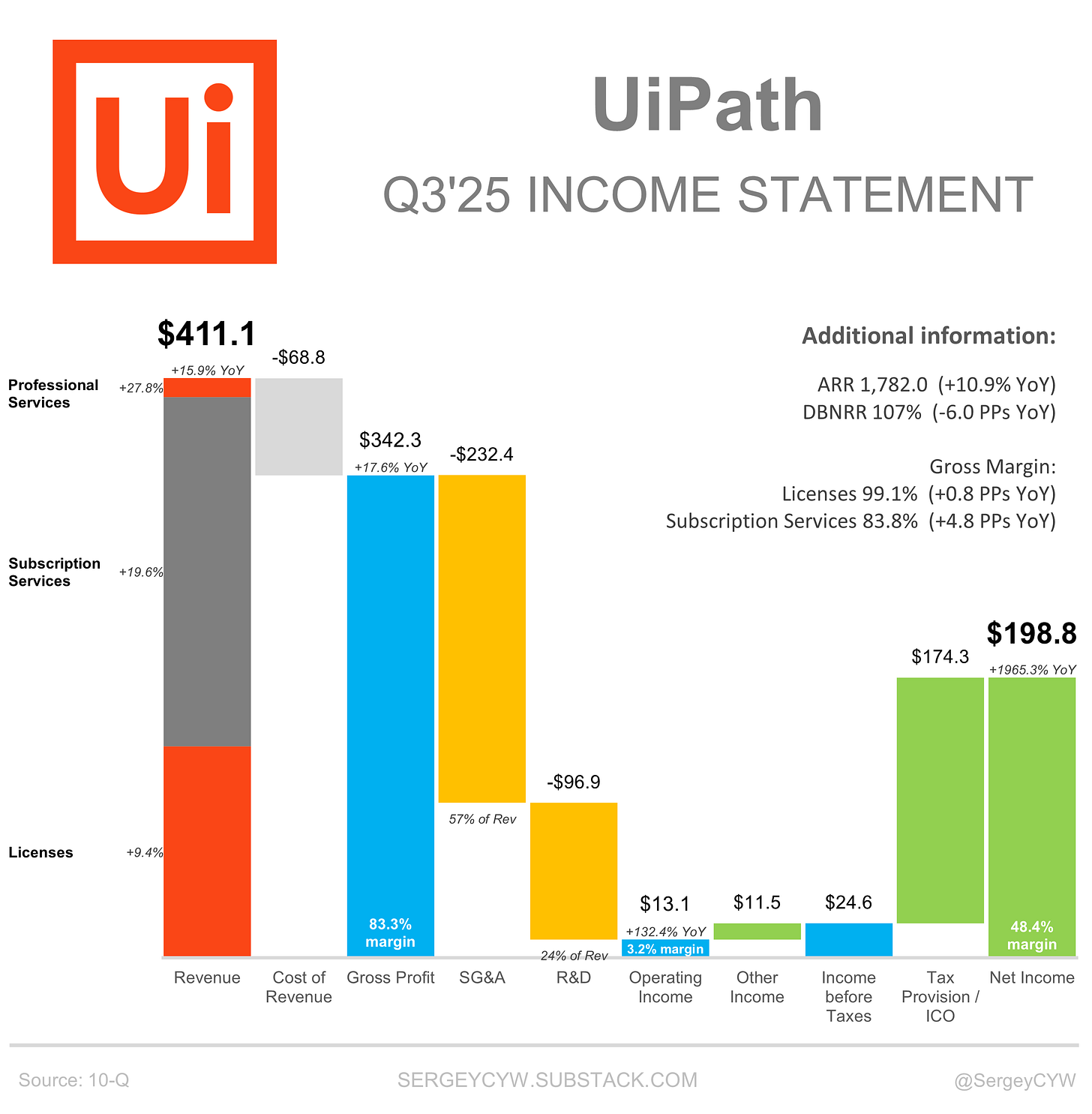

Uipath

UiPath’s Q3 FY26 showed meaningful progress across revenue, margins, and profitability. Revenue grew 16% YoY to $411M, beating estimates. Gross margin expanded to 85%, while operating margin hit 3%—a 14.5-point jump YoY. The company also reported its first GAAP-profitable third quarter, with net income soaring nearly 20x to $199M. Non-GAAP operating margin reached 21%, reflecting strong cost discipline and leverage.

Operating efficiency stood out: SG&A dropped to 57% of revenue (down 9.4 points YoY), and R&D fell to 24% (down 3.7 points). Subscription services led top-line expansion at +20% YoY, and ARR climbed 11% to $1.78B. Large customer growth continued, with 333 customers now generating $1M+ in ARR.

But with DBNRR slipping to 107% from 113% a year ago, is customer expansion starting to level off?

Beyond the numbers, UiPath is leaning into “agentic AI” — embedding intelligent automation into enterprise workflows. Adoption looks healthy: over 950 companies are building agents, and over 365K processes are orchestrated through Maestro. Strategic integrations with OpenAI, Microsoft, NVIDIA, Google, and Snowflake are widening the moat around its automation ecosystem.

Looking ahead, Q4 guidance points to revenue of $462–$467M and ARR nearing $1.85B. The company’s trajectory toward sustained profitability and expanding AI-driven automation signals a maturing business balancing growth with discipline.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.