Snowflake Q4 2024 Earnings Analysis

Dive into $SNOW Snowflake’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$987M rev (+27.4% YoY, +28.3% LQ) beat est by 3.6%

↘️GM* (72.6%, -1.8 PPs YoY)🟡

↗️Operating Margin* (9.4%, +0.2 PPs YoY)

↗️FCF Margin (42.1%, +0.2 PPs YoY)

↘️Net Margin (-33.0%, -11.1 PPs YoY)🟡

↗️EPS* $0.30 beat est by 76.5%

*non-GAAP

Product

↗️Product Revenue $943M (+27.8% YoY)

↘️GM* (75.8%, -2.2 PPs YoY)

Key Metrics

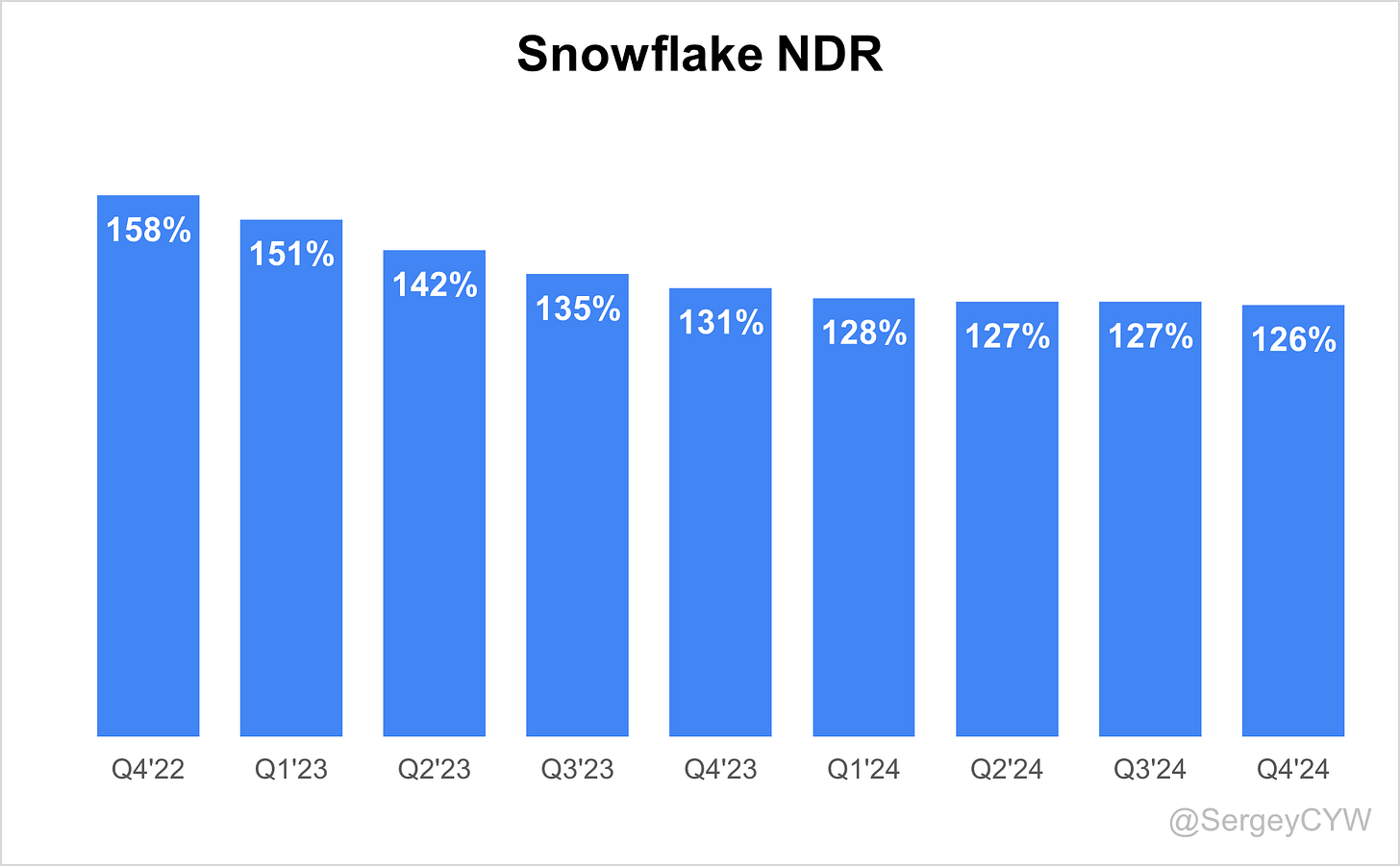

↘️NDR 126% (127% LQ)

↗️RPO $6.90B (+33.3% YoY)

↗️сRPO $3.31B (+28.0% YoY)

➡️Billings $1,595M (+16.4% YoY)🟡

↗️Data sharing 36.0% ( PPs QoQ)

➡️3,044 Marketplace Listings (+26.0% YoY, +98)

Customers

↗️11,159 customers (+18.2% YoY, +541)

↗️580 $1M+ customers (+26.6% YoY, +38)

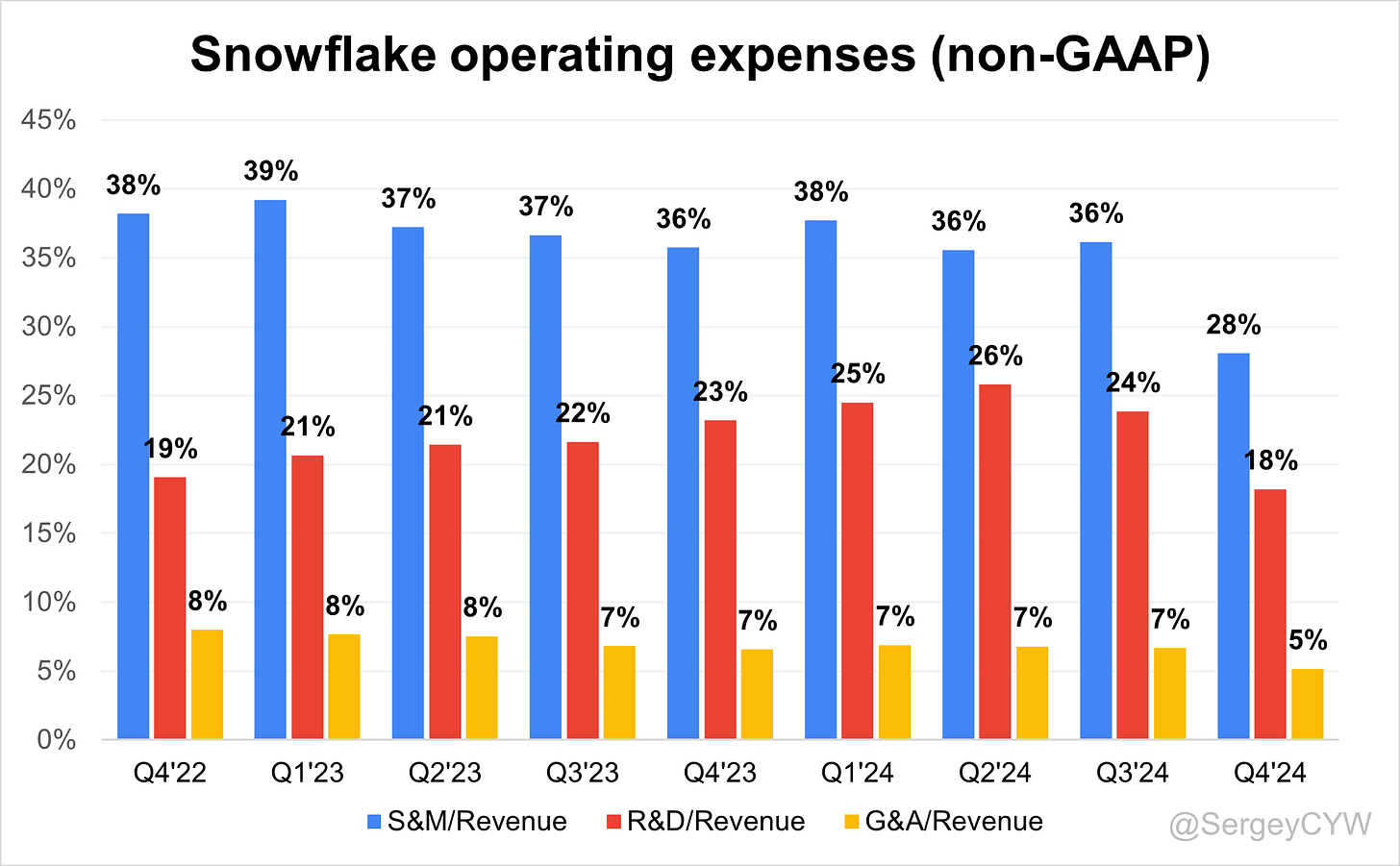

Operating expenses

↘️S&M*/Revenue 33.3% (-2.4 PPs YoY)

↗️R&D*/Revenue 23.4% (+0.2 PPs YoY)

↘️G&A*/Revenue 6.4% (-0.1 PPs YoY)

Quarterly Performance Highlights

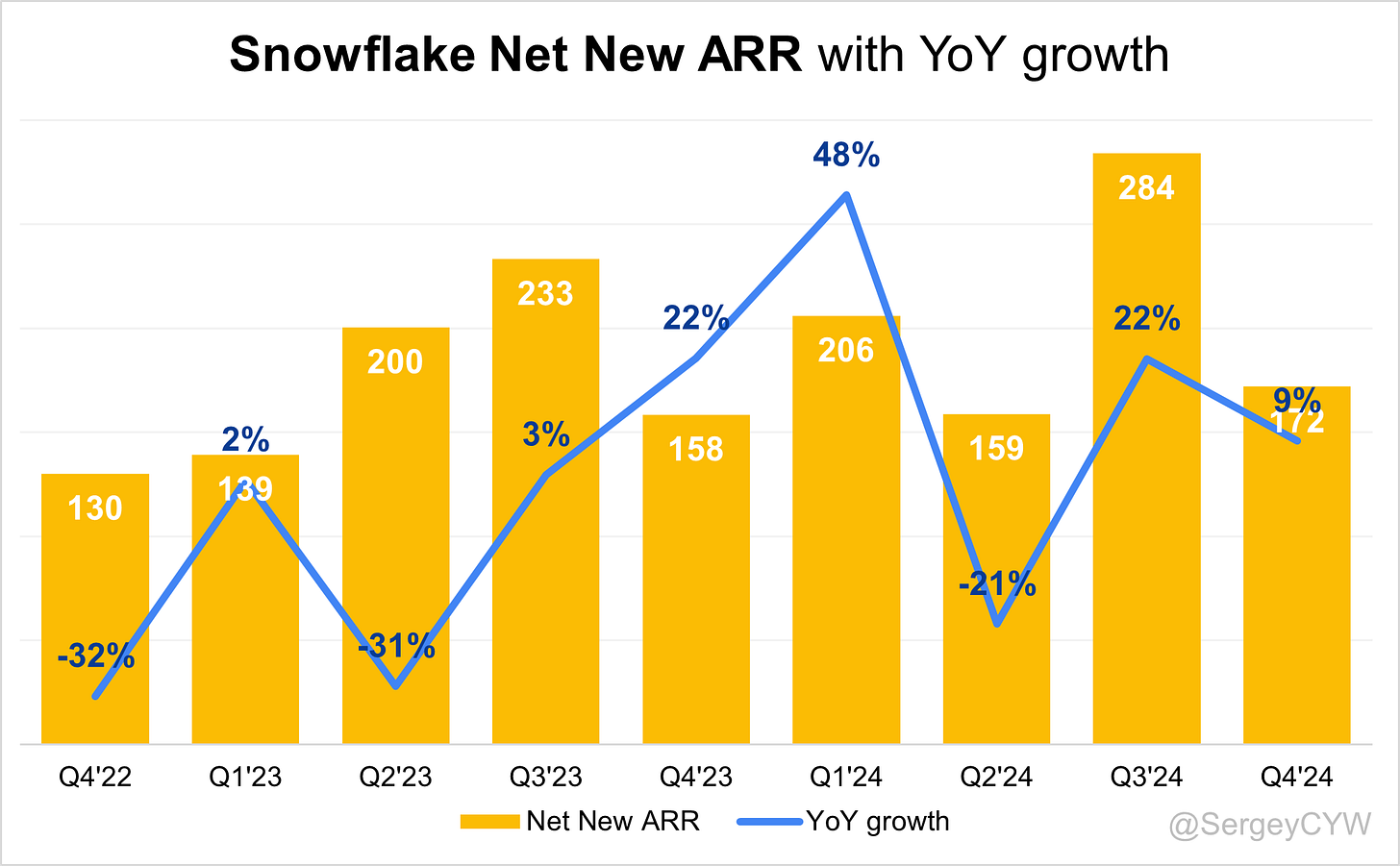

↗️Net New ARR $172M (+8.6% YoY)

↗️CAC* Payback Period 32.6 Months (+5.4 YoY)🟡

↘️R&D* Index (RDI) 1.26 (-0.52 YoY)🟡

Dilution

↗️SBC/rev 46%, +5.0 PPs QoQ

↘️Basic shares up 0.1% YoY, -0.6 PPs QoQ🟢

↗️Diluted shares up 1.9% YoY, +1.8 PPs QoQ

Headcount

➡️7,837 Total Headcount (+11.9% YoY, +14 added)🔴

Guidance

↘️Q1'25 $955.0 - $960.0M guide (+21.3% YoY) missed est by -0.3%🔴

↗️$4,280.0M FY guide (+23.6% YoY) beat est by 1.5%

Key points from Snowflake’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Snowflake reported Q4 FY 2025 product revenue of $943M, a 28% YoY increase. FY 2025 revenue reached $3.5B, up 30% YoY. Remaining performance obligations (RPO) grew 33% to $6.9B, with a 126% net revenue retention rate.

Non-GAAP operating margin improved to 9% in Q4, compared to 6% for the full year. Free cash flow margin reached 43% in Q4 and 26% for FY 2025. The company ended the year with $5.3B in cash, cash equivalents, and investments.

Stock buybacks totaled $1.9B, repurchasing 14.8M shares at $130.87 per share. No repurchases occurred in Q4, leaving $2B under authorization through March 2027.

FY 2026 product revenue is expected to reach $4.28B, a 24% YoY increase. Q1 guidance is set at $955M–$960M, up 21–22% YoY. Non-GAAP operating margin is expected to reach 8%, with free cash flow margin at 25%.

Cortex AI

More than 4,000 customers use Cortex AI weekly. Snowflake integrated Anthropic and OpenAI models into its platform, becoming the only data cloud hosting both within a secure perimeter.

Cortex AI features Cortex Agents, which automate structured and unstructured data workflows. Adoption is expected to drive stronger revenue in H2 FY 2026.

AI workloads initially carry lower gross margins due to infrastructure costs. Margins should improve as GPU availability increases and AI adoption scales.

Apache Iceberg

Support for Apache Iceberg has transitioned from a perceived risk to a competitive advantage. Snowflake expanded data access without requiring movement, positioning itself as a leading platform for open data analytics.

Some customers moved data to Iceberg, but storage revenue remained stable at 11% of total revenue. New analytics and data engineering workloads are now driving additional revenue.

Large enterprises use Iceberg for petabyte-scale data queries while keeping Snowflake’s AI and data-sharing capabilities. Snowflake strengthened integrations with SAP and ServiceNow, ensuring Iceberg-powered workloads remain within its cloud ecosystem.

Snowpark

Snowpark contributed 3% of FY 2025 product revenue and is seeing increased adoption in data engineering. Enterprises use Snowpark for pipeline automation, AI-driven analytics, and large-scale data transformation.

Customers in financial services, healthcare, and supply chain sectors, including State Street and Blue Yonder, run AI-driven pipelines to optimize investment analysis and forecasting.

Snowflake is addressing challenges in enterprise education and legacy data engineering transitions by investing in developer training, AI-driven data processing, and deeper software integrations.

Product Expansion

Snowflake launched 400+ new product features in FY 2025, doubling the prior year. Key innovations include:

Dynamic Tables – Simplify large-scale data pipelines.

Expanded Data Connectors – Integrate with SharePoint, Google Drive, Workday, and Slack.

SnowConvert Free Offering – Accelerate migrations from Oracle, Teradata, and legacy systems.

AI-Powered Data Agents – Automate enterprise workflows and insights generation.

Industry Adoption

Customers from multiple industries are expanding Snowflake usage:

Financial Services: State Street (10% of global assets) uses Snowflake AI for market insights.

Healthcare: Sanofi leverages AI to accelerate drug discovery, targeting 20 new medicines by 2030.

Retail & Supply Chain: Blue Yonder processes 20B+ AI-driven predictions daily for inventory and logistics optimization.

Payments & Fintech: Fiserv built a real-time analytics platform, enabling businesses to monetize transaction data.

Margin Trends

Non-GAAP product gross margin guidance declined to 75% for FY 2026, down from 76% in FY 2025. Snowflake attributed this to:

Higher GPU infrastructure costs for AI workloads.

Increased multi-cloud investments.

Scaling AI adoption, initially carrying lower margins.

Margins are expected to improve as AI infrastructure costs decline and adoption scales.

RPO Growth Trends

RPO growth slowed to 33% YoY, attributed to large customers consuming capacity faster than expected and shifting to on-demand purchases rather than early renewals.

Despite this, management expects these customers to sign larger contracts within six months.

Large Enterprise Growth

Snowflake expanded its $1M+, $5M+, and $10M+ customer base, with major wins across industries.

ExxonMobil, Honeywell, and London Stock Exchange expanded real-time analytics and AI workloads.

Fiserv built an AI-powered analytics platform for financial decision-making.

Blue Yonder processes 20B AI-driven predictions daily for supply chain optimization.

Data-Sharing Growth

Stripe, NTT, and Braze use Snowflake for data sharing with 160+ partners, unlocking new revenue streams and operational efficiencies.

Partnerships

Snowflake deepened strategic partnerships:

Microsoft – Integrated Cortex AI into Microsoft 365 Copilot and Teams.

SAP – Strengthened bidirectional data sharing with Business Data Cloud.

ServiceNow & Salesforce – Expanded integrations and data-sharing capabilities.

ISVs (Relational AI, Qumu, Blue Yonder) – Strengthened third-party partnerships.

International Growth

EMEA outpaced overall company growth, while APAC showed increasing traction. North America remains Snowflake’s largest market.

Marketplace Listings

Marketplace listing growth slowed, despite strong customer adoption of third-party datasets.

The slowdown is linked to evolving enterprise data strategies and stricter partnership evaluations. Customers prioritize high-value datasets and AI-powered insights over general-purpose listings.

To counter this, Snowflake is expanding AI-driven capabilities, improving data discoverability, and refining revenue-sharing models. Marketplace activity is expected to reaccelerate in H2 FY 2026 as AI applications scale.

Headcount and Efficiency

Hiring is focused on revenue-generating teams:

Engineering and sales remain hiring priorities.

AI-powered automation is increasing sales productivity.

Stock-based compensation (SBC) is set to decline to 37% of revenue, down from 41% in FY 2025.

Future Growth

Snowflake expects stronger revenue growth in H2 FY 2026, driven by:

Cortex AI, Iceberg, and Snowpark adoption.

Increased enterprise demand in financial services, healthcare, and supply chain.

Growing data-sharing ecosystem.

New workloads in advertising, cybersecurity, and real-time analytics.

CEO Sridhar Ramaswamy emphasized Snowflake’s scalable AI-driven growth and expects strong free cash flow and operational leverage in FY 2026.

Management comments on the earnings call.

Product Innovations

Sridhar Ramaswamy, Chief Executive Officer

"We are continuing to win in the market because our platform is easy to use, helps customers break down silos to collaborate, and is trusted by companies of all sizes and industries. Our innovation engine is in overdrive, with over 400 product capabilities launched this year, more than double what we introduced in the previous year."

Christian Kleinerman, Executive Vice President of Product

"The ability to collaborate and share data is one of our core differentiators. Customers increasingly see Snowflake as the circulatory system of the enterprise world, and our rapid product development is reinforcing that position."

Cortex AI

Sridhar Ramaswamy, Chief Executive Officer

"Right now, we are the most consequential data and AI company on the planet. We have built rock-solid primitives for AI, including search, retrieval-augmented generation, and automated data agents. Our deepened partnership with Microsoft ensures that OpenAI’s models are available within our security perimeter, making us the only data platform to seamlessly host both Anthropic and OpenAI models."

Christian Kleinerman, Executive Vice President of Product

"Cortex AI is unlocking new AI-driven workloads across structured and unstructured data. We are seeing more than 4,000 customers use our AI and ML technology on a weekly basis, and adoption is scaling quickly as organizations realize the power of integrating AI directly into their data."

Apache Iceberg

Sridhar Ramaswamy, Chief Executive Officer

"Our investments in Apache Iceberg have transformed it from a perceived headwind into a strong tailwind for the business. While some customers have moved data to Iceberg, we are now accessing workloads that were previously outside our reach. We have made the right investments, and this is our story to write."

Mike Scarpelli, Chief Financial Officer

"We have yet to see massive amounts of data move out of Snowflake. Storage remains steady at 11% of revenue, and Iceberg is opening up new analytics and data engineering workloads for us. We view this as an opportunity rather than a risk."

Snowpark

Sridhar Ramaswamy, Chief Executive Officer

"Snowpark is now driving meaningful contributions to our business, especially in data engineering. Dynamic Tables, in particular, have been a game-changer, making it as easy as writing a SQL query to set up complex data pipelines."

Christian Kleinerman, Executive Vice President of Product

"Enterprises are increasingly using Snowpark to power AI-driven analytics, real-time processing, and large-scale data transformation. This is an area of rapid growth, and we expect its contribution to revenue to increase over time."

Competition

Sridhar Ramaswamy, Chief Executive Officer

"The AI revolution is changing how data platforms operate, and we are positioned at the center of it. While competitors require extensive engineering resources to scale, we make AI and data collaboration seamless and cost-effective. Customers who switch to Snowflake often see more than 50% cost savings compared to alternative providers."

Customers

Sridhar Ramaswamy, Chief Executive Officer

"Our customers continue to see significant value from our platform. Companies like ExxonMobil, Honeywell, and London Stock Exchange Group are betting their business on us. Fiserv is building an AI-powered analytics platform, and Blue Yonder is processing over 20 billion AI-driven predictions daily to optimize supply chain operations."

Mike Scarpelli, Chief Financial Officer

"We are seeing continued momentum with our largest customers. The number of $1 million+, $5 million+, and $10 million+ customers continues to grow, and these accounts remain the primary drivers of our revenue expansion."

Strategic Partnerships

Sridhar Ramaswamy, Chief Executive Officer

"We have expanded our partnership with Microsoft to bring Cortex AI directly into Microsoft 365 Copilot and Teams, ensuring that our customers have seamless access to AI-driven insights. Our bidirectional integrations with Salesforce, ServiceNow, and SAP continue to create value for enterprises looking to unify their data."

International Growth

Mike Scarpelli, Chief Financial Officer

"EMEA was a strong source of growth for us this quarter, outpacing overall company expansion. As we deepen our presence in international markets, we expect continued growth from global enterprises adopting our platform."

Challenges

Mike Scarpelli, Chief Financial Officer

"A few large customers exhausted their contracted capacity earlier than expected. Instead of signing early renewals, they are now purchasing on-demand. This is a normal pattern for large enterprises, and we fully expect them to sign new multi-year agreements in the coming months."

Sridhar Ramaswamy, Chief Executive Officer

"While AI workloads are a major growth driver, they initially carry lower gross margins due to infrastructure costs. We expect this to improve over time as AI adoption scales and GPU availability increases."

Future Outlook

Sridhar Ramaswamy, Chief Executive Officer

"We are positioned for long-term success at the intersection of AI, data engineering, and enterprise cloud adoption. With 30% revenue growth in fiscal 2025 and strong early momentum in fiscal 2026, we are demonstrating our ability to execute at scale while expanding our efficiency and profitability."

Mike Scarpelli, Chief Financial Officer

"Our guidance reflects confidence in our core business, our AI and data engineering expansion, and our ability to drive meaningful efficiency gains. We see strong potential for new workloads, particularly in the second half of the year, as customers scale their AI and data analytics investments."

Thoughts on Snowflake Earnings Report $SNOW:

🟢 Positive

Revenue beat expectations with $987M (+27.4% YoY, +28.3% QoQ), exceeding estimates by 3.6%.

Product revenue reached $943M (+27.8% YoY), maintaining strong growth.

Operating margin improved to 9.4% (+0.2 PPs YoY), reflecting operational efficiency.

Free cash flow margin increased to 42.1% (+0.2 PPs YoY), ensuring strong liquidity.

EPS of $0.30 beat estimates by 76.5%, showing profitability improvement.

Enterprise customers expanded to 11,159 (+18.2% YoY, +541 added), reinforcing growth momentum.

Large contracts ($1M+ customers) grew to 580 (+26.6% YoY, +38 added), marking the highest addition in the last two years and showcasing strong customer retention and expansion.

S&M expense declined to 33.3% of revenue (-2.4 PPs YoY), improving cost efficiency.

🟡 Neutral

Net revenue retention rate (NDR) declined to 126% (-1 PPs QoQ), still solid but showing slight deceleration.

Billings reached $1.59B (+16.4% YoY), significantly lagging revenue growth.

RPO grew to $6.90B (+33.3% YoY) but growth has slowed considerably. Since Snowflake operates on a consumption-based model, management attributes this to large customers consuming capacity faster than expected and opting for on-demand purchases instead of early renewals.

Marketplace listings grew to 3,044 (+26.0% YoY, +98 added QoQ), though momentum slowed.

Headcount growth slowed to just +14 employees QoQ, optimizing workforce expansion.

cRPO at $3.31B (+28.0% YoY), reflecting a healthy backlog but slightly lower than total RPO growth.

Stock-based compensation (SBC) as a % of revenue increased to 46% (+5 PPs QoQ), impacting share dilution.

Guidance missed estimates: Q1’25 revenue guidance of $955M–$960M (+21.3% YoY) was 0.3% below expectations, but FY guidance was strong.

🔴 Negative

Gross margin dropped to 72.6% (-1.8 PPs YoY), with product gross margin at 75.8% (-2.2 PPs YoY), pressured by AI infrastructure costs.

Net margin declined sharply to -33.0% (-11.1 PPs YoY), reflecting increased expenses.

Diluted shares outstanding rose 1.9% YoY (+1.8 PPs QoQ), causing further dilution.

Customer acquisition cost (CAC) payback period increased to 32.6 months (+5.4 YoY), making customer profitability take longer.

R&D Index (RDI) fell to 1.26 (-0.52 YoY), suggesting reduced efficiency in innovation spending.