Financial Results:

⬆️$775M rev (+31.5% YoY, +31.8% LQ) beat est by 2.0%

⬆️GM* (74.4%, +3.5%pp YoY)

⬆️Operating Margin* (9.2%, +3.6%pp YoY)

⬆️FCF Margin 41.9%, +7.0%pp YoY)

⬆️EPS* $0.35 beat est by 94.4%🟢

*non-GAAP

Key Metrics

↘️NDR 131% (135% LQ)

⬆️RPO $5.20B (+42.0% YoY)🟢

➡️Billings $1,370M (+28.0% YoY)🟡

Customers

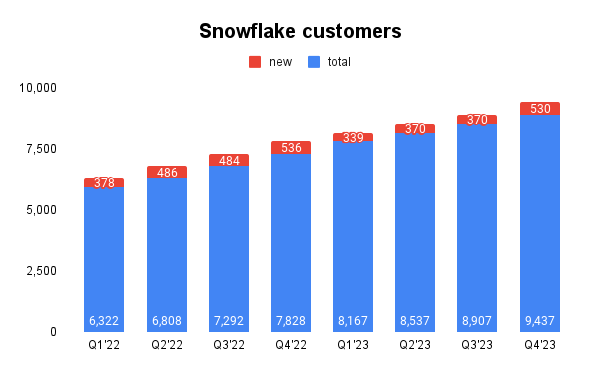

➡️9,437 customers (+21.0% YoY, +530)

➡️461 $1M+ customers (+40.0% YoY, +25)

Operating expenses

↘️S&M*/Revenue 35.7% (36.7% LQ)

⬆️R&D*/Revenue 23.2% (21.6% LQ)

↘️G&A*/Revenue 6.6% (6.8% LQ)

↘️Net New ARR $158M ($233 LQ)

⬆️CAC* Payback Period 27.2 Months (17.2 LQ)

Dilution

↘️SBC/rev 41%, -0.5%pp QoQ

↘️Dilution at 2.8% YoY, 0.0%pp QoQ

Guidance

↘️Q1'24 $750.0M guide (+27.1% YoY) missed est by -2.0%🔴

➡️$3,250M FY guide (+21.9% YoY)

Key points from Snowflake Fourth Quarter 2023 Earnings Call:

FY 2024 Performance:

Product revenue grew 38% year-over-year to reach $2.67 billion.

Non-GAAP product gross margin expanded to 77.8%.

Non-GAAP adjusted free cash flow was $810 million, representing 56% year-over-year growth.

Q4 saw strong bookings, with $5.2 billion of remaining performance obligations, a 41% year-over-year growth.

Customers:

Snowflake's customer base is diversifying, with notable growth in financial services and retail. The company is focused on engaging customers for optimization and adoption of new workloads, particularly in AI and machine learning.

CEO Transition:

Sridhar Ramaswamy is announced as the new CEO, succeeding Frank Slootman.

Frank Slootman will retire from an operating role but remain as Chairman of the Board.

Product and Market Focus:

Emphasis on mobilizing AI, with the introduction of Snowpark ML Modeling API, Cortex ML functions, and Streamlit in Snowflake.

Received FedRAMP High authorization on the AWS GovCloud, enabling Snowflake to handle classified federal data.

Snowflake highlighted several upcoming product innovations, including Snowpark Container Services, Cortex (a generative AI and search layer), Document AI for extracting structured data, and Native Applications. These innovations aim to enhance the platform's capabilities, particularly in AI, to make it simpler and more secure for customers.

Unistore, an ambitious project to combine transactional and analytical capabilities, is moving towards general availability in the second half of the year.

Snowpark:

Snowpark is expected to contribute 3% of product revenue in FY '25, translating to an implied revenue of approximately $95 million to $100 million.

The momentum around Snowpark is positive, with customer feedback highlighting better economics, performance, and simplicity due to integrated data processing.

Iceberg Tables Impact on Revenue:

The adoption of Iceberg Tables is expected to impact Snowflake's revenue by reducing the growth associated with storage revenue. This is because customers moving to Iceberg Tables may choose to store new data in these open file formats outside of Snowflake's native storage, potentially leading to a decrease in storage revenue and the compute revenue associated with moving that data into Snowflake.

This reflects a theoretical headwind as Iceberg Tables have not yet reached GA, and actual customer behavior regarding data migration to Iceberg Tables has not been observed.

Financial Guidance for Fiscal Year 2025:

Product revenue is expected to be approximately $3.25 billion, a 22% year-over-year growth.

Non-GAAP operating margin is projected at 6%, with a non-GAAP adjusted free cash flow margin of 29%.

Investor Day Announcement:

Snowflake will host its Investor Day on June 4th in San Francisco, coinciding with the Data Cloud Summit.

Bookings and Revenue Recognition:

Q4 was noted as an exceptional booking quarter, signaling an improving macro environment.

The guidance provided reflects cautious optimism, with an emphasis on customer behavior similar to fiscal 2024 and acknowledging potential revenue headwinds from product efficiency gains.

Mike Scarpelli highlighted the company’s plans to adding approximately 1,000 employees in the coming year and focusing on AI initiatives.

Management comments on the earnings call.

On FY Guidance:

Mike Scarpelli, Chief Financial Officer: "We are definitely being more conservative this year given the consumption patterns we saw in '24. And as we said at our Analyst Day last year, we needed to see consumption patterns more in line with what we saw pre-'24 to get to our longer-term goal."

On Product Innovations and Snowpark:

Sridhar Ramaswamy, Chief Executive Officer: "To deliver on the opportunity ahead, we must have clear focus and move even faster to bring innovation on the Snowflake platform to our customers and partners. This will be my focus."

Christian Kleinerman, Executive Vice President, Product: "Snowpark Container Services is already in public preview in AWS, and we expect it to be generally available in that same timeframe, give or take a couple of months from Summit. It is the ultimate extensibility capability for bringing computation into Snowflake."

On Iceberg Tables:

Mike Scarpelli, Chief Financial Officer: "We do expect a number of our large customers are going to adopt Iceberg formats and move their data out of Snowflake where we lose that storage revenue and also the compute revenue associated with moving that data into Snowflake."

On Cortex ML:

Sridhar Ramaswamy, Chief Executive Officer: "Generative AI is at the forefront of my customer conversations. This drives renewed emphasis on data strategy in preparation of these new technologies. Snowflake's Cortex, Snowflake's new fully-managed service that makes AI simple and secure, is a big part of this conversation."

On Customers and Challenges:

Frank Slootman, Chairman: "Q4 was an exceptionally strong bookings quarter. We reported $5.2 billion of remaining performance obligations, representing accelerated year-on-year growth of 41%. Our international theaters outperformed the company as a whole."

Sridhar Ramaswamy, Chief Executive Officer: "The success that Snowflake has achieved is a testament to the great customers, employees, and partners who have contributed along the way. The challenge now is to navigate the new world of generative AI, requiring a hard-driving technologist at the helm."

Thoughts on Snowflake ER $SNOW:

🟢Pros:

+ Revenue rose by +31.5% YoY, and was growing 31.8% in the last quarter; revenue growth is stabilizing.

+ Net New ARR growth accelerated to +22% YoY.

+ DBNR at 131%.

+ Company increasing margins and profitability.

+ Beat Q4 revenue estimates by 2.4%.

+ RPO rose 42% YoY, faster than revenue.

+ Strong number new customers added (+530).

+ Company implements new products and increases R&D spending; Company invests in future growth.

🔴Cons:

- Weak FY guidance: +22% YoY revenue growth rate, lower than Wall Street expected (+30% YoY); management highlighted that guidance is conservative.

🟡Neutral:

+- SBC/rev at 41%, dilution at 2.8% YoY.

+- Total calculated billings growth declined and is growing slower than revenue.

+- Weak number: +25 $1M+ ARR customers added.

+- Next Quarter guidance missed by 2%.