Snowflake Q3 2024 Earnings Analysis

Dive into $SNOW Snowflake’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$942M rev (+28.3% YoY, +28.9% LQ) beat est by 5.0%

↘️GM* (72.9%, -2.0 PPs YoY)🟡

↘️Operating Margin* (6.3%, -3.5 PPs YoY)🟡

↘️FCF Margin (8.3%, -5.6 PPs YoY)🟡

↗️EPS* $0.25 beat est by 66.7%

*non-GAAP

Product

↗️Product Revenue $900M (+28.9% YoY)

↘️GM* (76.3%, -2.0 PPs YoY)

Key Metrics

➡️NDR 127% (127% LQ)

↗️RPO $5.70B (+54.1% YoY)🟢

↗️Billings $1,068M (+30.9% YoY)🟢

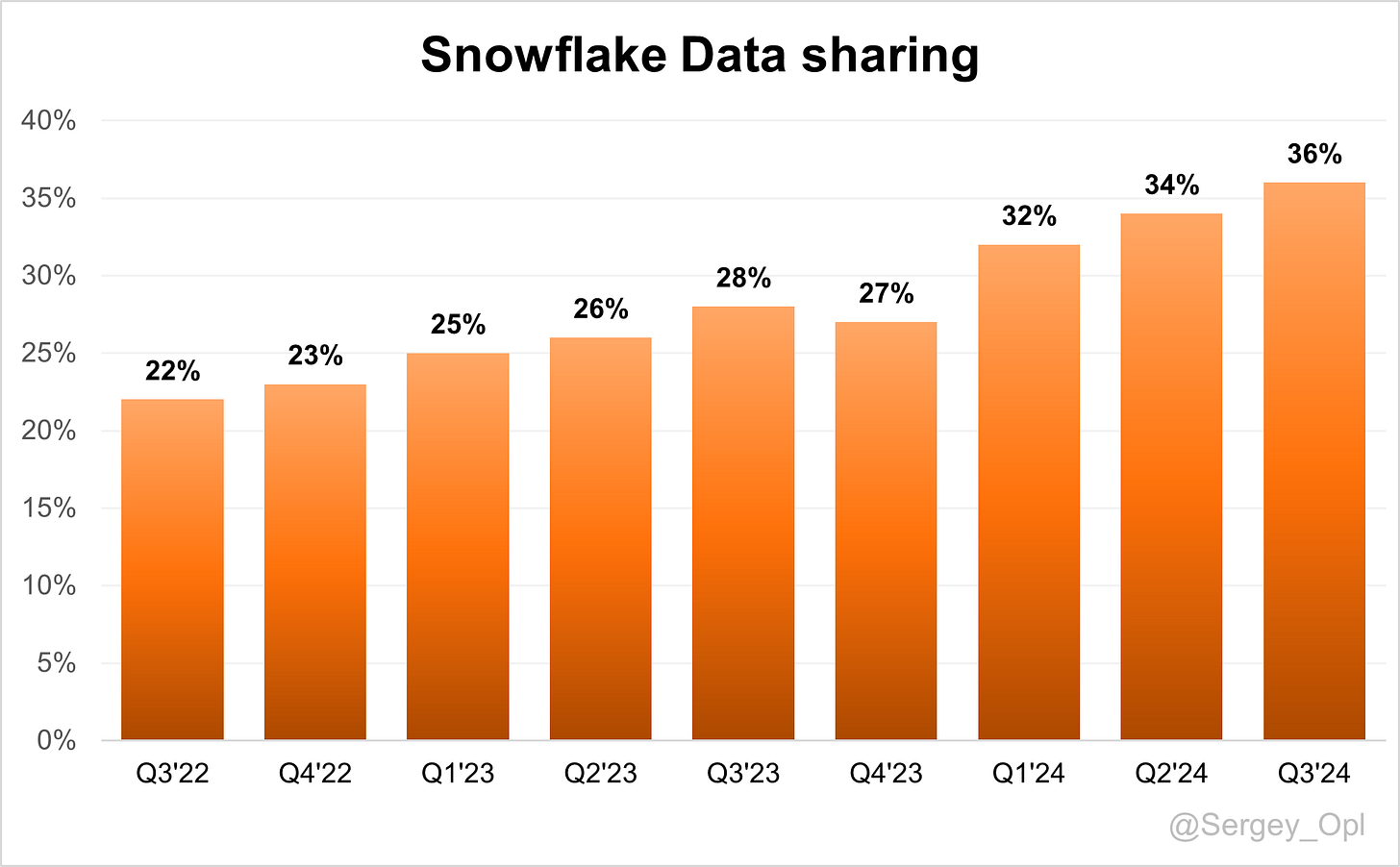

↗️Data sharing 36.0% (+2.0 PPs QoQ)

➡️2,946 Marketplace Listings (+26.3% YoY, +143)

Customers

➡️10,618 customers (+19.2% YoY, +369)

➡️542 $1M+ customers (+25.2% YoY, +32)

Operating expenses

↘️S&M*/Revenue 36.2% (-0.5 PPs YoY)

↗️R&D*/Revenue 23.9% (+2.2 PPs YoY)

↘️G&A*/Revenue 6.7% (-0.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $284M (+21.8% YoY)

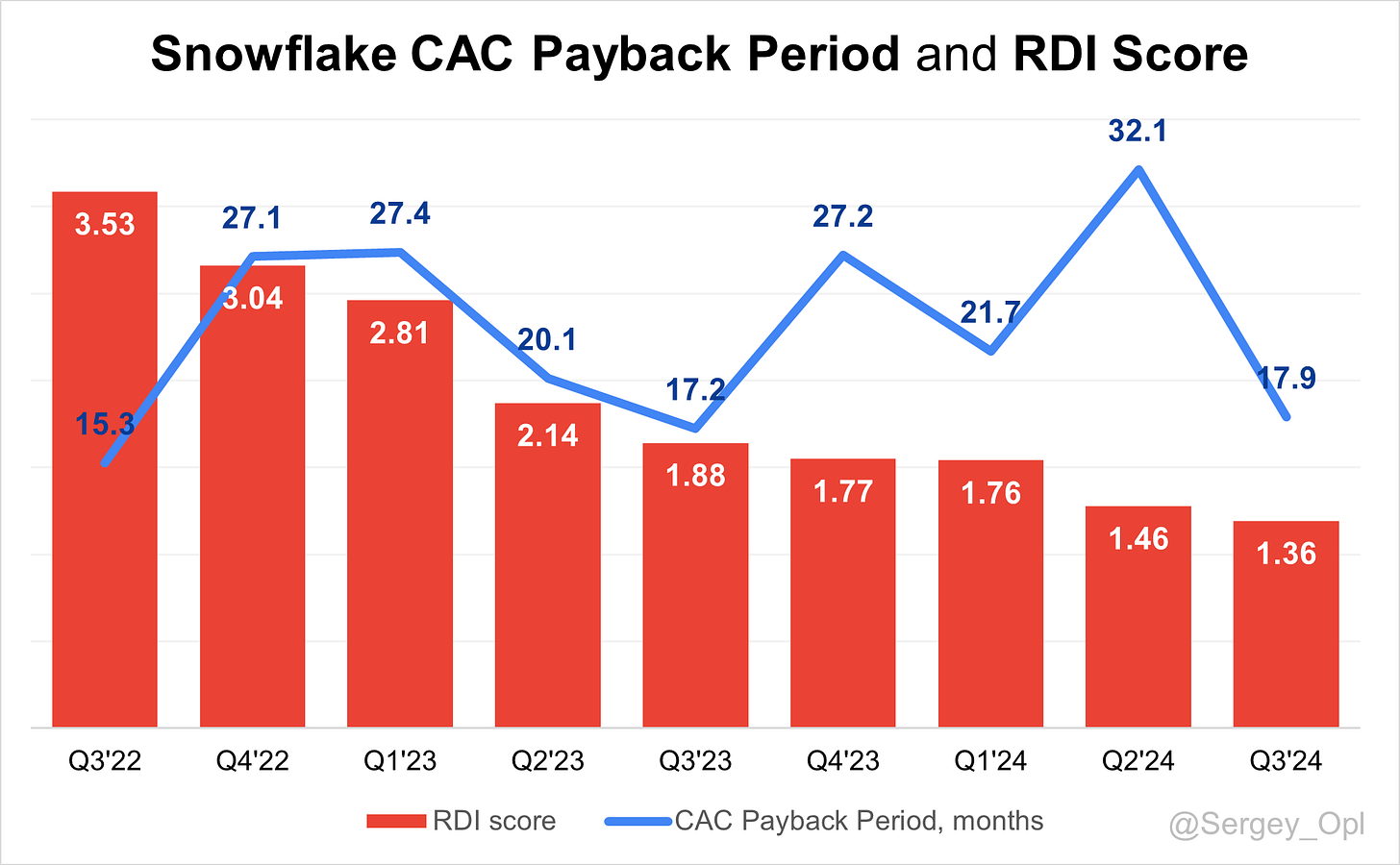

↗️CAC* Payback Period 17.9 Months (+0.7 YoY)🟡

↘️R&D* Index (RDI) 1.36 (-0.51 YoY)🟡

Dilution

↘️SBC/rev 40%, -2.5 PPs QoQ

↘️Basic shares up 0.7% YoY, -1.3 PPs QoQ🟢

↗️Diluted shares up 0.1% YoY, +1.2 PPs QoQ🟢

Headcount

➡️7,823 Total Headcount (+15.3% YoY, +193 added)

Guidance

↗️Q4'24 $906.0 - $911.0M guide (+23.1% YoY) beat est by 2.1%

↗️$3,430.0M FY guide (+28.6% YoY) raised by 2.2% beat est by 1.7%

Key points from Snowflake’s Third Quarter 2024 Earnings Call:

Financial Performance

Snowflake delivered a strong Q3 Fiscal 2025, with product revenue reaching $900 million, reflecting a 29% year-over-year (YoY) growth. Remaining Performance Obligations (RPO) climbed to $5.7 billion, growing 55% YoY. The Net Revenue Retention Rate (NRR) stabilized at 127%, showing strong customer expansion and retention.

Profitability improved significantly with a Non-GAAP Operating Margin of 6%, exceeding guidance. The Non-GAAP Product Gross Margin remained steady at 76%, and the Adjusted Free Cash Flow Margin reached 9%. Full-year product revenue guidance was raised to $3.43 billion, representing a 29% YoY increase, while Q4 product revenue is projected to range between $906 million and $911 million.

Product Innovations

Snowflake accelerated its product development, releasing as many Tier 1 features in Q3 as in all of FY 2024. Key launches included Unistore, the Snowflake Open Catalog, and Snowflake Intelligence for multimodal AI applications. The company introduced Snowflake Notebooks, enhancing the data science persona experience and integrating machine learning, AI, and analytics into workflows.

Cortex AI

Cortex AI adoption exceeded expectations with over 1,000 deployed use cases and 3,200 accounts using its AI and machine learning features. Cortex enables advanced analytics, including sentiment detection and summarization, through SQL, simplifying traditionally complex workflows.

The partnership with Anthropic integrates advanced AI models into Snowflake, offering customers a secure and governed platform for cutting-edge AI applications. Enterprises such as Siemens, Bayer, and Zoom reported significant value, making Cortex a key driver of incremental consumption. Challenges remain in differentiating Cortex from competitors and ensuring seamless integration into customer workflows.

Iceberg

The adoption of Apache Iceberg expanded Snowflake’s reach into unstructured data workloads. Customers are using Iceberg to analyze vast amounts of historical data stored in cloud storage, unlocking workloads previously inaccessible. Snowflake reported customers often hold 100 to 1,000 times more data outside its platform, which Iceberg helps bridge.

The Snowflake Open Catalog, based on Iceberg, has gained adoption across industries, enhancing data interoperability. Iceberg workloads, often originating from large datasets outside Snowflake, present significant revenue opportunities. Concerns about potential revenue cannibalization were offset by incremental growth in data engineering workloads.

Snowpark

Snowpark is forecasted to represent 3% of product revenue for FY 2025, highlighting its importance in Snowflake’s portfolio. It supports data engineering use cases such as dynamic tables and real-time streaming pipelines, driving broader adoption and a growing revenue stream.

Enterprises reported significant cost savings, with some achieving 50% or more in operational efficiencies using Snowpark. The platform’s scalability and innovation have positioned it as a key revenue driver, though maintaining competitiveness remains a focus.

Partnership with Anthropic

Snowflake’s collaboration with Anthropic has enhanced Cortex AI by bringing advanced AI models directly to its platform. This partnership enables flexible model selection while ensuring robust security and governance, positioning Snowflake as a leader in enterprise AI-enabled data management.

Acquisitions

The acquisition of DataVolo expanded Snowflake’s data connectivity capabilities, adding 100+ connectors and strengthening its ability to handle structured and unstructured data. The purchase of Night Shift bolstered Snowflake’s position in the federal sector, supporting long-term growth in government markets.

International Expansion

International growth was strong, particularly in Europe and Asia-Pacific (APAC). Markets such as Japan, India, and Australia demonstrated momentum, while Snowflake expanded into mid-market segments in Europe. It also became a key data platform provider for New Zealand's government agencies.

Gross Margin

Non-GAAP Product Gross Margin was 76%, consistent with prior quarters and guidance. Snowflake raised its full-year FY 2025 gross margin guidance to 76%, reflecting efficient cost management alongside investments in innovation.

Operating Margin

Operating Margin improved to 6% in Q3, exceeding guidance due to strong revenue and cost management. Efforts such as centralizing operations, removing redundant management layers, and using AI-driven tools contributed to efficiency. Snowflake raised its FY 2025 Non-GAAP Operating Margin guidance to 5%, reflecting confidence in balancing profitability with aggressive investments.

Share Buyback

Snowflake repurchased $1.9 billion worth of shares year-to-date, totaling 14.8 million shares at an average price of $130.87. $2 billion remains under its authorization, valid through March 2027. Proceeds from convertible senior notes issued in Q3 were allocated for stock repurchases.

Customer Base and Retention Metrics

Net Revenue Retention Rate (NRR) held steady at 127%, supported by strong customer satisfaction and expanding use cases. Approximately 80% of customers pay annually in advance, ensuring a reliable revenue stream.

Large Customer Wins

Snowflake added 18 Global 2000 customers in Q3. Notable wins include:

Global Telecom Provider: Adopted Snowflake for mobile network performance analytics, improving reliability for millions of users.

Warner Bros. Discovery: Unified data across streaming, gaming, and studio divisions, enabling personalized entertainment recommendations.

Hyatt Hotels: Leveraged Snowflake to personalize guest experiences across properties.

Adoption is strong in industries like technology, financial services, and healthcare. Customers such as Siemens, Bayer, Toyota, and Sanofi utilize Snowflake’s scalability and governance features to enhance their operations.

Future Outlook

Product revenue is projected to grow 29% YoY in FY 2025. Contributions from AI-driven features, Snowpark, and Iceberg are expected to drive incremental growth. Adjusted Free Cash Flow Margin is forecasted at 26% for FY 2025, supported by operational rigor and sales efficiency.

A strong backlog of workloads and expanding international footprint position Snowflake for sustained growth into FY 2026 and beyond.

Management comments on the earnings call.

Product Innovations

Sreedhar Ramaswamy, Chief Executive Officer

"Our product development engine continues to accelerate as we launched the same number of Tier 1 features to general availability in Q3 as we did in all of fiscal 2024. This operational pace is fueling alignment with our customers’ needs and expanding our product footprint."

Cortex AI

Sreedhar Ramaswamy, Chief Executive Officer

"Our AI investments are easy, efficient, and trusted. Cortex AI now enables customers to achieve advanced analytics like sentiment detection or summarization through a single SQL query, transforming previously complex processes into accessible business solutions."

Iceberg

Mike Scarpelli, Chief Financial Officer

"Customers typically have 100 to 1,000 times more data sitting in cloud storage than within Snowflake. Iceberg has unlocked these new data estates for us, creating incremental opportunities that were not feasible before."

Customers

Sreedhar Ramaswamy, Chief Executive Officer

"Our obsessive drive to deliver product cohesion and ease of use continues to win new customers. This quarter, we helped a global telecom giant optimize network performance data, delivering superior reliability to millions of users worldwide."

Strategic Partnerships

Sreedhar Ramaswamy, Chief Executive Officer

"Our collaboration with Anthropic brings cutting-edge AI models to our platform. This partnership provides enterprises with flexibility in AI adoption while ensuring built-in governance and security."

International Growth

Mike Scarpelli, Chief Financial Officer

"We are seeing strong international growth, particularly in Japan, India, and Australia. In smaller but forward-thinking markets like New Zealand, we have become the data platform of choice for government agencies."

Challenges

Sreedhar Ramaswamy, Chief Executive Officer

"While the data platform industry is poised for massive expansion, the challenge is ensuring every team aligns effectively to collaborate across multi-thousand-person organizations, which we’re addressing through tighter operational rigor."

Future Outlook

Sreedhar Ramaswamy, Chief Executive Officer

"Our long-term vision is to power the end-to-end data lifecycle for customers. With unmatched governance, cross-cloud consistency, and a focus on ease of use, we are well-positioned to be the data platform of choice for the next decade."

Thoughts on Snowflake ER $SNOW:

🟢 Pros:

Revenue increased by +28.3% YoY. If the company exceeds its Q4 forecast by the same 5.3% as it did in Q3, revenue growth for Q4 could reach 29.6%, signaling a potential reversal of the slowing growth trend.

Strong DBNR (Dollar-Based Net Retention) stabilized at 127%.

Q3 revenue beat estimates by 5.3%.

FY guidance increased by 2.2%.

RPO growth accelerated to 54.1% YoY, outpacing revenue growth.

Total calculated billings growth increased to +30.9%, also exceeding revenue growth.

Record Net New ARR added: $284M, representing a +22% YoY growth.

Strong enterprise traction: +32 customers with $1M+ ARR were added.

R&D expenses now account for 23.8% of revenue, reflecting significant investment in future growth.

Record Marketplace Listings increased by +143, representing +26% YoY growth.

Data sharing adoption rose to 36%, an increase of 2 percentage points sequentially.

🟡 Neutral:

SBC (Stock-Based Compensation)/Revenue stands at 40%, with basic shares up 0.7% YoY.

A solid number of new customers were added (+369), roughly the same as last year (+370).

Product Gross Margin declined by 2 percentage points YoY but remained consistent with the previous quarter. The decline was attributed to GPU-related costs associated with enhancing the company’s AI functionalities.

Margins and profitability were impacted by higher operating expenses. Operating margin decreased from 9.8% to 6.25%.