Snowflake Q2 2024 Earnings Analysis

Dive into $SNOW Snowflake’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$869M rev (+28.9% YoY, +32.9% LQ) beat est by 2.2%

↘️GM* (73.2%, -1.0 PPs YoY)🟡

↘️Operating Margin* (5.0%, -3.0 PPs YoY)🟡

↘️FCF Margin (6.8%, -3.5 PPs YoY)🟡

↗️EPS* $0.18 beat est by 12.5%

*non-GAAP

Product

↗️Product Revenue $829M (+29.5% YoY)

↘️GM* (76.4%, -1.5% PPs YoY)

Key Metrics

↘️NDR 127% (128% LQ)

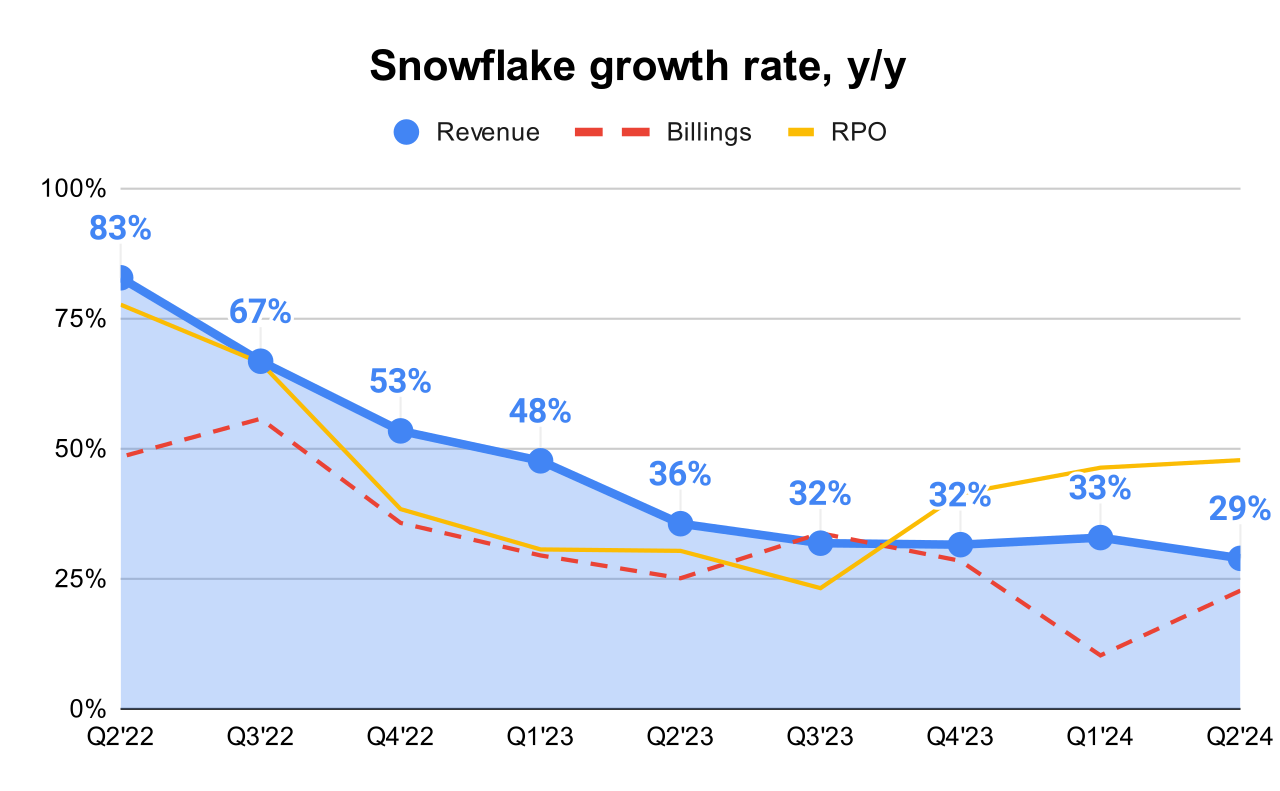

↗️RPO $5.23B (+48.0% YoY)🟢

➡️Billings $779M (+23.0% YoY)🟡

↗️Data sharing 34.0% (+2 PPs QoQ)

↗️2,803 Marketplace Listings (+30.0% YoY, +237)🟢

Customers

↗️10,249 customers (+20.0% YoY, +427)

➡️510 $1M+ customers (+28.0% YoY, +26)

Operating expenses

↘️S&M*/Revenue 35.6% (-1.6 PPs YoY)

↗️R&D*/Revenue 25.8% (+4.4 PPs YoY)

↘️G&A*/Revenue 6.8% (-0.7 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $159M (-20.8% YoY)

↗️CAC* Payback Period 32.1 Months (21.7 LQ)

Dilution

↘️SBC/rev 43%, -0.5 PPs QoQ

↘️Basic shares up 2.1% YoY, -0.9 PPs QoQ

↘️Diluted shares down -1.0% YoY, -1.9 PPs QoQ🟢

Headcount

➡️7,630 Total Headcount (+15.0% YoY, +334 added)

Guidance

↗️Q3'24 $850.0 - $855.0M guide (+22.0% YoY) beat est by 1.0%

↗️$3,356.0M FY guide (+25.8% YoY) raised by 1.7% beat est by 1.0%

Key points from Snowflake’s Second Quarter 2024 Earnings Call:

Financial Performance:

Q2 product revenue reached $829 million, a 30% increase year-over-year.

Non-GAAP operating margin came in at 5%, and the adjusted free cash flow margin was reported at 7%.

Product Innovation:

Snowflake has accelerated its product innovation pipeline, delivering as many products in the first half of the year as in the entire previous year.

A focus on both launching new products and reaching general availability for over 15 product capabilities during Q2.

Continued emphasis on integrating AI and machine learning into their products to deliver enterprise AI solutions that are easy, efficient, and trusted.

Cortex AI:

Cortex AI was highlighted as a significant innovation, enhancing Snowflake's capabilities in AI and data analytics.

The platform is used for diverse applications such as analyzing unstructured text data, running sentiment analysis, and integrating with customer service operations.

Iceberg:

Iceberg has been made generally available, providing a more flexible and interoperable data management solution.

This product enables customers to manage large data sets more efficiently and is being used by companies in sectors like consumer services and hospitality to accelerate cloud migration.

Over 400 accounts were reported to be using Iceberg by the end of Q2.

Snowpark:

Snowpark's contributions to Snowflake’s product revenue for the fiscal year were projected to be significant. The product is designed to facilitate easier and more efficient data engineering and analytics workflows.

Strong Adoption Across Major Clients:

Notable companies like Capital One, NBCUniversal, Petco, Pfizer, Snapchat, and Western Union are leveraging Snowflake to enhance their business operations.

Use Case Examples:

Penske Logistics: Utilizing Cortex AI for analyzing various performance metrics related to their transportation business, aiming to improve operational efficiency and truck driver retention.

Large Financial Services Company: Using Cortex AI for sentiment analysis on call center transcripts to enhance customer support experiences.

Hospitality Company: Leveraging Iceberg to provide a more flexible and interoperable deployment model, enabling accelerated migration to cloud-based data management.

Snowflake Summit Impact:

The Snowflake Summit showcased strong customer engagement, with 15,000 on-site attendees representing a 28% year-over-year growth, demonstrating expanding interest and commitment from the customer base.

Snowflake’s first-ever Developers Day attracted over 3,000 attendees, reflecting strong community and developer interest in Snowflake’s platforms and tools.

Gross Margin:

Q2 non-GAAP product gross margin was reported at 76%, which is slightly down year-over-year.

Despite the slight decline, the guidance for the year remains consistent, with expectations of maintaining around a 75% non-GAAP product gross margin.

Share Buyback:

Snowflake announced a substantial share buyback program during the earnings call.

The company used $400 million to repurchase three million shares under the original two billion dollar repurchase plan, with $492 million remaining through March 2025.

Additionally, Snowflake's Board of Directors authorized the repurchase of an additional $2.5 billion under its stock repurchase program through March 2027.

Security and Reliability:

The company emphasized that after multiple investigations by internal and external cybersecurity experts, there was no evidence of a breach or compromise on Snowflake's platform.

Snowflake strongly advocated for the adoption of robust security measures like multi-factor authentication (MFA) and strict network policies, which have been supported by Snowflake since 2016, to enhance overall security and reliability.

Future Outlook:

The company provided guidance for the third quarter and revised its full-year revenue expectations upwards based on strong Q2 performance.

Snowflake continues to invest heavily in innovation and product development, particularly in areas such as AI and machine learning.

The company emphasized the integration of AI into its platform, aiming to make Snowflake the best cloud for computation, collaboration, and application on all data.

Management comments on the earnings call.

Product Innovations

Sridhar Ramaswamy, CEO:

On Cortex AI: "We are making Snowflake the best cloud for computation, collaboration, and application on all data. And we are leveraging the power of AI to make all of these easier to create, maintain and use."

On Iceberg: "Iceberg is providing one of the largest consumer services and hospitality companies with a more flexible and interoperable deployment model, enabling them to accelerate their migration to the cloud."

Customers

Sridhar Ramaswamy, CEO:

"Companies like Capital One, NBCU, Petco, Pfizer, Snapchat, and Western Union are all relying on Snowflake to help them fuel their businesses."

"The affinity for our product is incredible. And the consistent theme I hear from the C-suite across industries and geographies is that Snowflake is delivering ease, efficiency, and reliability to their business."

RPO (Remaining Performance Obligations)

Sridhar Ramaswamy, CEO:

"I'll actually answer that first just while it's on my mind, as we said before, we have customers that sign long-term contracts. If they have consumed everything under their contract, they have the ability to buy monthly. We have two of our top-10 customers right now that can continue to buy through the end of the year and we're seeing that. So they're in their top-10 customers and think top-10 customers are roughly in the $50 million to $40 million range. Those aren't reflected in current RPO very much because they're just buying as they go."

Future Outlook

Mike Scarpelli, CFO:

"We are increasing our FY '25 product revenue guidance. We now expect full-year product revenue of approximately $3.356 billion, representing 26% year-over-year growth."

"Our new customer acquisition motion is ramping. We expect it to have a more material impact in FY 2026."

Thoughts on Snowflake ER $SNOW:

🟢Pros:

+ Revenue rose by +28.9% YoY.

+ Strong DBNR at 127%, with a minor decline of -1PP sequentially.

+ FY guidance increased by 1.7%.

+ RPO growth increased to 48% YoY, growing faster than revenue. cRPO is growing at 29.6%. Some major clients pay monthly, which suggests that the actual cRPO growth could be higher.

+ Strong number of new customers added (+427), more than last year (+370).

+ The company is implementing new products and increasing R&D spending; R&D expenses now account for 25.8% of revenue as the company invests in future growth.

+ Record number of Marketplace Listings added +237.

+ Data sharing 34%, up 2 PPs sequentially.

🔴Cons:

- Net New ARR growth declined by -21% YoY.

- If the company beats its forecast for the next quarter by a similar 2.4%, revenue growth will continue to slow down to +25% YoY.

🟡Neutral:

+- SBC/rev at 43%, basic shares up 2.1% YoY.

+- Beat Q2 revenue estimates by 2.4%; significantly less than the 5.3% beat in the previous quarter.

+- The company announced an additional $2.5 billion share buyback.

+- Product Gross Margin down 1.5PPs YoY, but consistent with the previous quarter; the decline was attributed to GPU-related costs which improve the company’s AI functionalities.

+- Margins and profitability declined due to increases in operating expenses.

+- Total calculated billings growth accelerated to +22.7% but is still growing slower than revenue.

+- Weak number: +26 $1M+ ARR customers added.