Financial Results:

↗️$829M rev (+32.9% YoY, +31.5% LQ) beat est by 5.5%

↗️GM* (73.5%, +0.7%pp YoY)

↘️Operating Margin* (4.4%, -0.9%pp YoY)

↘️FCF Margin (40.0%, -5.4%pp YoY)

↘️EPS* $0.14 missed est by -22.2%

*non-GAAP

Product

↗️Product Revenue $790M (+33.8% YoY)🟢

↘️GM* (76.9%, 0.0%pp YoY)

Key Metrics

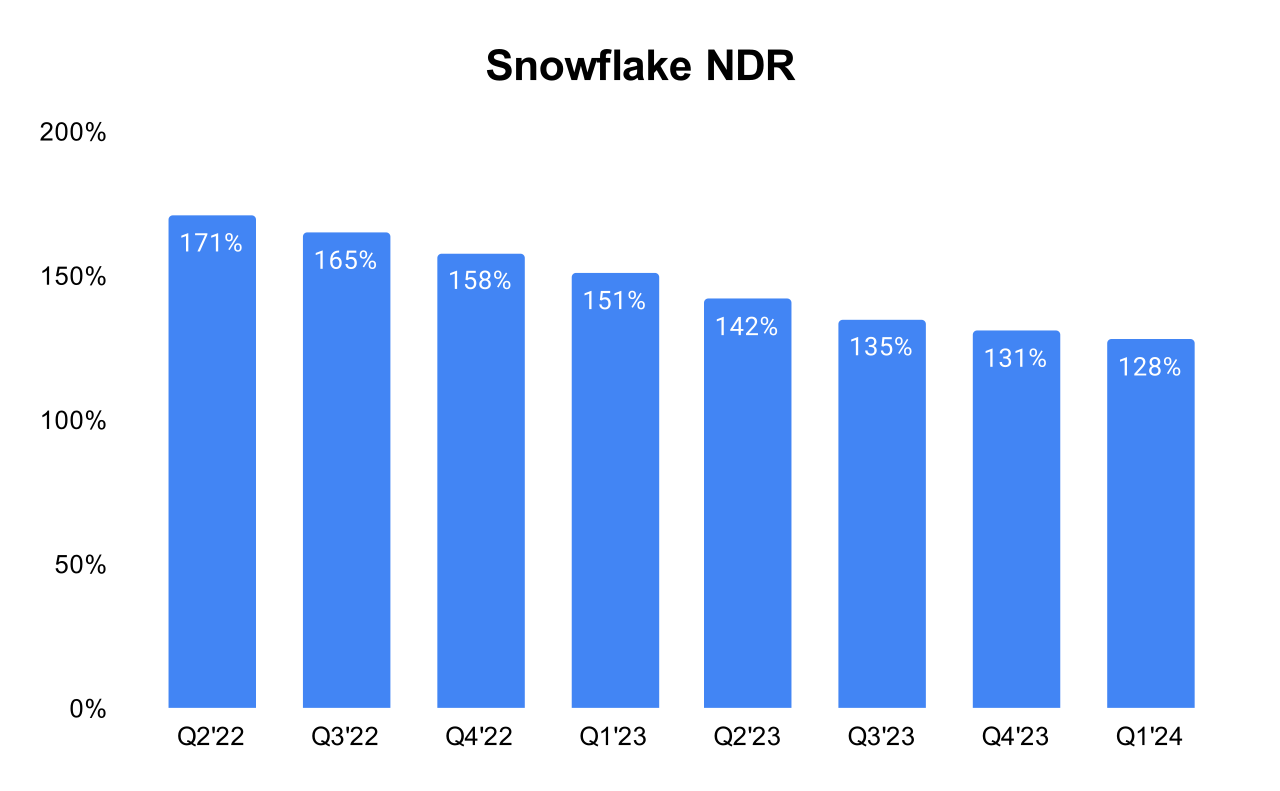

↘️NDR 128% (131% LQ)

↗️RPO $5.00B (+47.0% YoY)🟢

➡️Billings $566M (+10.0% YoY)🟡

Customers

➡️9,822 customers (+20.0% YoY, +385)

➡️485 $1M+ customers (+30.0% YoY, +25)

Operating expenses

↗️S&M*/Revenue 37.7% (35.7% LQ)

↗️R&D*/Revenue 24.5% (23.2% LQ)

↗️G&A*/Revenue 6.9% (6.6% LQ)

↗️Net New ARR $206M ($158 LQ)

↘️CAC* Payback Period 21.7 Months (27.2 LQ)

Dilution

↗️SBC/rev 43%, +2.0%pp QoQ

↗️Basic shares up 2.9% YoY, +0.1%pp QoQ

↘️Diluted shares up 0.8% YoY, -0.3%pp QoQ🟢

Headcount

➡️7,296 Total Headcount (+16.0% YoY, +292 added)

Guidance

↗️Q2'24 $805.0 - $810.0M guide (+26.1% YoY) beat est by 2.9%

↗️$3,300.0M FY guide (+23.7% YoY) raised by 1.5% beat est by 1.3%

Key points from Snowflake’s First Quarter 2024 Earnings Call:

Financial Performance

CFO Mike Scarpelli shared robust financial results, with a product revenue of $790 million, marking a 34% year-over-year increase. The company's remaining performance obligations showed a significant rise, accelerating to a 46% growth rate.

Gross Margin

Non-GAAP product gross margin was reported at 76.9%, slightly down year-over-year. The decline was attributed to GPU-related costs which are necessary for supporting the company’s growing AI functionalities.

While acknowledging the short-term impact on margins due to AI investments, Snowflake's management believes these investments are crucial for unlocking future revenue opportunities.

Impact of Storage Tier Pricing

The implementation of tiered storage pricing impacted the gross margin by approximately $6 million to $8 million for the quarter. This new pricing strategy is part of Snowflake's effort to provide value to customers and manage revenue streams effectively.

Customer Expansion and Engagement

The introduction of AI and machine learning tools is enabling Snowflake to reach a wider audience, including those who may not be traditional data scientists. By democratizing access to complex data operations through simpler interfaces, Snowflake is opening up its platform to a broader user base.

Product Innovations

Cortex AI:

Recently made generally available, Cortex AI is designed to turbocharge Snowflake's capabilities across data management layers. It simplifies complex AI functionalities, enabling users, especially analysts, to perform advanced data tasks through simpler interfaces like SQL queries.

Arctic Language Model:

Developed in less than three months with significantly reduced costs compared to peer models, Arctic outperformed leading models in various benchmarks. This model enhances Snowflake’s ability to process and analyze large volumes of data efficiently.

Snowpark and Container Services:

Snowflake has made significant progress with Snowpark, which is a suite of developer tools for building more complex data pipelines and machine learning models directly on the platform. Snowpark Container Services, set to be generally available later in the year, will allow users to execute containerized jobs, greatly expanding the type of workloads Snowflake can handle.

Hybrid Tables and Iceberg:

Hybrid Tables: Announced to be generally available later in the year, these are designed to handle transactional and operational workloads directly within Snowflake, thus extending its capabilities beyond traditional data warehousing tasks.

Iceberg: Also moving towards general availability, Iceberg is a new table format that enables more extensive data workload management. It promises to unlock greater data processing capabilities and facilitate the management of large data volumes more effectively.

Unstructured Data Handling and Document AI:

Snowflake continues to enhance its capabilities to handle unstructured data, with approximately 40% of its customers now processing such data on the platform. The addition of Document AI tools allows for the automatic extraction of features from large volumes of documents, enabling users to analyze and utilize this data more effectively.

Data Collaboration Enhancements:

The platform has improved its data collaboration capabilities, with nearly a third of customers now sharing data products. This functionality is crucial for new customer acquisition and enables secure direct access to financial data and insights, particularly highlighted through strategic collaborations like the one with Fiserv.

Strategic Acquisitions:

The acquisition of TruEra, an AI observability platform, signifies a deeper move into enhancing AI functionalities. TruEra provides tools to evaluate and monitor AI applications and machine learning models, which will complement Snowflake's AI offerings.

Future Outlook

Snowflake increased its product revenue outlook for the year based on the strong Q1 performance.

The company plans to continue investing in AI, viewing these investments as crucial for unlocking future revenue opportunities.

Management comments on the earnings call.

Product Innovations

Sridhar Ramaswamy, CEO:

"Earlier this month, we announced that Cortex, our AI layer, is generally available. Iceberg, Snowpark Container Services, and Hybrid Tables will all be generally available later this year. We're investing in AI and machine learning, and our pace of progress in a short amount of time has been fantastic."

Christian Kleinerman, EVP of Product: "We're investing in AI and machine learning, and our pace of progress in a short amount of time has been fantastic. What is resonating most with our customers is that we are bringing differentiation to the market. Snowflake delivers enterprise AI that is easy, efficient, and trusted."

Customers

Sridhar Ramaswamy, CEO:

"I've had conversations with over 100 customers for the past several months, and I'm very optimistic. Snowflake is a beloved platform, and the value we bring comes through in every customer conversation I have."

Future Outlook

Sridhar Ramaswamy, CEO:

"Given the strong quarter, we are increasing our product revenue outlook for the year. Working through the second quarter and beyond, our priorities remain the same."

Mike Scarpelli, CFO:

"As mentioned on our prior call, we have headwinds associated with GPU-related costs as we invest in new AI initiatives. Our non-GAAP operating margin of 4% and benefited from revenue outperformance."

Thoughts on Snowflake ER $SNOW:

🟢Pros:

+ Revenue rose by +32.9% YoY, accelerated from 31.5% in the last quarter.

+ Net New ARR growth accelerated to +48% YoY.

+ Strong DBNR at 128%.

+ Beat Q4 revenue estimates by 5.3%; Snowflake confirmed that guidance was conservative.

+ FY guidance increased by 1.5%.

+ RPO growth increased to 47% YoY, growing faster than revenue.

+ For Q1, it was strong number new customers added (+385).

+ The company is implementing new products and increasing R&D spending; R&D expenses increased by +58% YoY as the company invests in future growth.

🟡Neutral:

+- SBC/rev at 43%, basic shares up 2.9% YoY.

+- Product Gross Margin down 1pp sequentially; the decline was attributed to GPU-related costs which improve the company’s AI functionalities.

+- Margins and profitability declined due to increases operating expenses.

+- Total calculated billings growth declined and is growing slower than revenue.

+- Weak number: +25 $1M+ ARR customers added.