Snowflake: Powering the Future of Data and AI

Deep Dive into $SNOW: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Snowflake: Company overview

About Snowflake

Snowflake Inc. is an American cloud-based data storage company headquartered in Bozeman, Montana. Founded in July 2012 by Benoît Dageville, Thierry Cruanes, and Marcin Żukowski, the company operates a platform enabling data analysis and simultaneous access of data sets with minimal latency. Snowflake runs across Amazon Web Services, Microsoft Azure, and Google Cloud Platform. As of November 2024, the company serves 10,618 customers, including more than 800 members of the Forbes Global 2000, and processes 4.2 billion daily queries across its platform.

Company Mission

Snowflake's mission centers on mobilizing the world's data. The company addresses a fundamental challenge: valuable data remains siloed across organizations. Their vision encompasses a world with endless insights where every organization can tackle current challenges and reveal future possibilities. Snowflake positions itself as the engine powering the AI Data Cloud, creating a global network where thousands of organizations mobilize data with near-unlimited scale, concurrency, and performance.

Sector and Services

Snowflake operates as a data cloud company providing comprehensive data platform services. The platform supports multiple workloads including data warehousing, data lakes, data engineering, artificial intelligence, machine learning, and applications. Key sectors served include advertising, media and entertainment, financial services, healthcare and life sciences, manufacturing, public sector, retail and consumer goods, technology and telecom. The company employs between 5,001-10,000 employees and maintains a public company status.

Competitive Advantage

Snowflake's competitive edge stems from four core technological features. Serverless technology allows all computing resources to be managed and provided on demand by Snowflake. Micro-partitions enable high-performance levels by storing data vertically per column with metadata for accelerated queries. The platform features separation of storage and compute, enabling independent scaling of resources. Multi-cloud functionality provides seamless operation across major cloud platforms. The company's cloud-native architecture built from scratch specifically for cloud environments differentiates it from traditional database providers.

Total addressable market (TAM)

Snowflake currently estimates its TAM at approximately $170 billion as of 2025. The company projects this market will more than double to $340 billion within three years, representing an extraordinary expansion opportunity. Another analysis suggests the TAM will reach $290 billion by 2027, indicating a compound annual growth rate (CAGR) of 15% from 2022 to 2027.

Snowflake's TAM spans multiple high-growth segments with varying expansion rates:

Cloud Data Warehouse: Growing from $28.5 billion in 2023 to $42.4 billion by 2025 (22.3% CAGR)

Data Analytics Platform: Expanding from $65.2 billion to $94.7 billion (20.5% CAGR)

Data Sharing Solutions: Accelerating from $13.8 billion to $24.3 billion (32.7% CAGR)

AI/ML Data Infrastructure: Surging from $19.6 billion to $41.2 billion (45.1% CAGR)

Valuation

After a significant drop, $SNOW is trading at a Forward EV/Sales multiple of 14.3 —below 2022-2023 low levels and below the median of 17.4.

Powered by FinChat.io — get 15% off with affiliate link for Compounding Your Wealth readers.

$SNOW trades at a Forward P/E of 177.3. In 2024, under new CEO Sridhar Ramaswamy, the company significantly increased operating expenses, particularly in R&D, returning to an earlier stage of growth.

The EPS growth forecast for 2026 is 37.8%, 2027 P/E of 180.8, with a 2026 PEG ratio of 4.8.

The EPS growth forecast for 2027 is 42.3%, 2027 P/E of 131.1, with a 2027 PEG ratio of 3.1.

Powered by FinChat.io — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

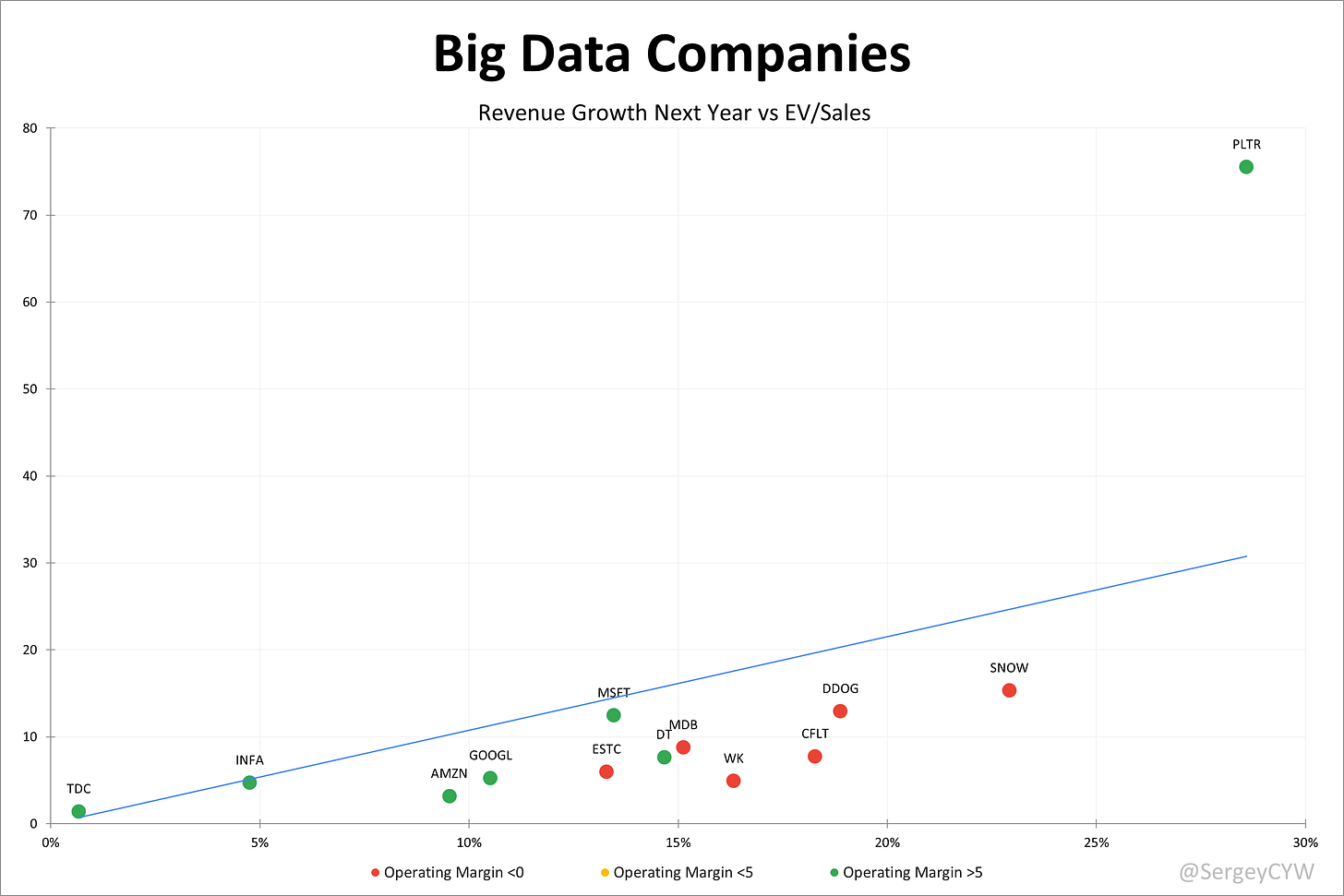

Valuation comparison

Analysts forecast $SNOW's revenue growth at +25.2% in 2025, one of the highest among the companies I am monitoring. Considering the 2025 revenue forecast, the valuation based on the P/S multiple appears undervalued compared to companies in the big data sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Snowflake has built a strong economic moat in cloud-based data warehousing and analytics, securing its competitive position and driving long-term revenue growth. Key factors reinforcing this moat include economies of scale, network effects, brand strength, intellectual property, and switching costs.

Economies of Scale

Snowflake demonstrates strong economies of scale through its cloud-native architecture serving 10,618+ customers across its platform. The company spreads fixed infrastructure and development costs across this massive customer base, reducing per-user expenses significantly. With $3.5 billion in product revenue for fiscal 2025 and the ability to process 4.2 billion daily queries, Snowflake achieves substantial cost advantages that smaller competitors cannot match. This scalability enhances margins and pricing power, creating a formidable barrier for new entrants who lack the customer density to achieve similar unit economics.

Network Effects

The platform exhibits strong network effects that create a self-reinforcing competitive advantage. Snowflake's data-sharing capabilities have expanded dramatically, with data sharing reaching 36%, significantly up from 23% over the past two years. As more organizations join the ecosystem, the data-sharing capabilities become increasingly valuable, making the platform more attractive to new enterprise clients. With 745 Forbes Global 2000 customers and 580 customers generating over $1 million in trailing 12-month product revenue, the network creates substantial value that becomes harder for competitors to replicate.

Brand Strength

Snowflake has established itself as the market leader in cloud data warehousing, known for high performance, scalability, and security. The company serves more than 800 Forbes Global 2000 companies who rely on Snowflake for mission-critical data operations, reinforcing its brand power. CEO Sridhar Ramaswamy positions the company as "the most consequential data and AI company in the world", with more than 11,000 customers betting their business on the platform. This brand recognition drives customer acquisition and retention while commanding premium pricing in enterprise deals.

Intellectual Property

Snowflake's proprietary architecture that decouples storage and compute provides significant technological differentiation and optimizes cost efficiency and performance. The platform's multi-cloud compatibility across AWS, Azure, and Google Cloud creates a unique technological advantage that traditional on-premise and single-cloud solutions cannot match. The company's serverless technology, micro-partitions, and cloud-native architecture built from scratch specifically for cloud environments represent substantial intellectual property moats that competitors struggle to replicate quickly.

Switching Costs

Snowflake creates high switching costs that lock in customers through operational complexity and risk. Transitioning to another provider requires downtime, retraining, and reconfiguration, creating significant operational risk for enterprises. The 126% net revenue retention rate demonstrates how effectively these switching costs work in practice, as customers not only stay but expand their usage. With more than 4,000 customers using Snowflake's AI and ML technology weekly and extensive data integration, the complexity of migration discourages customer defection and fosters long-term retention.

Snowflake's economic moat combines multiple defensive layers that reinforce each other. The very strong switching costs and economies of scale create the most formidable barriers, while brand strength and network effects provide additional protection against competitive threats.

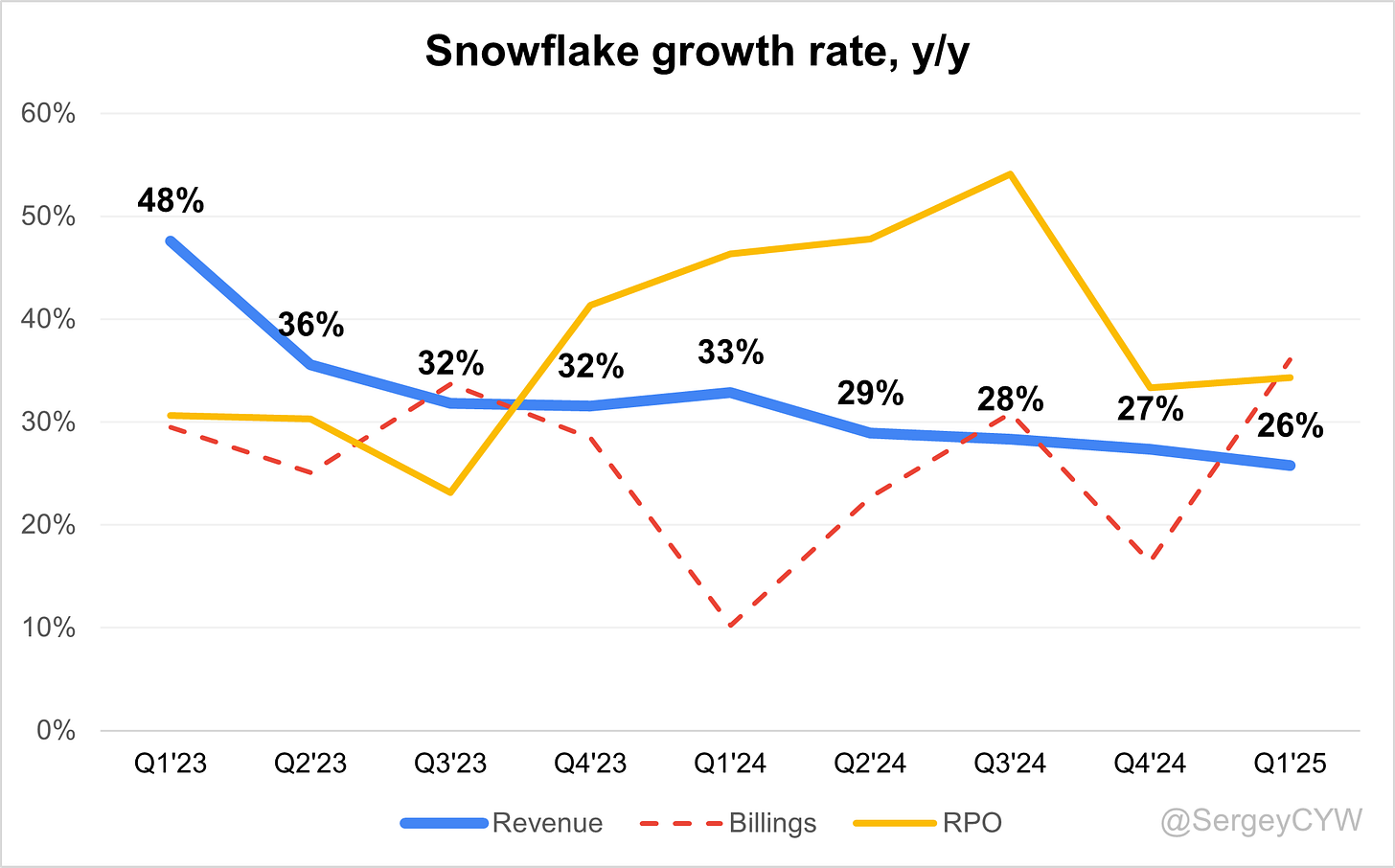

Revenue growth

However, $SNOW Snowflake's revenue growth has slowed from an exceptional >100% YoY post-IPO to +26% in Q1 2025. This slowdown is broadly seen across the software sector, yet Snowflake remains one of the fastest-growing companies.

RPO growth accelerates to +34.3% from +33.3% YoY in Q4 2024, and outpaces revenue growth.

Billings growth also accelerates to +31.7% YoY, which is now above the revenue growth rate.

Considering the forecast for the next quarter, if the company beats its own guidance by 3.8%—the same as it did this quarter—Q2 revenue growth would reach 29.9%, signaling a potential acceleration. That would be an important milestone for the company and could indicate the end of the revenue growth slowdown.

Segments and Main Products.

Snowflake's revenue primarily consists of two segments: Product and Professional Services.

Product segment generates the majority of revenue (95,6%), driven by Snowflake's core offerings like data warehousing, data lakes, data engineering, data science, and secure data sharing capabilities.

Professional Services and Other contribute a smaller portion of revenue at around 4-5%, involving consulting, training, and implementation support to help customers maximize their use of Snowflake's platform.

Key products include Snowpipe for seamless real-time data ingestion from external cloud storage like Amazon S3 or Azure Blob.

Snowflake Marketplace allows verified data sharing and collaboration among organizations, offering datasets and services that meet quality and security standards.

The company's AI initiatives are integrated into its Cortex platform, hosting leading AI models from OpenAI and Anthropic, enabling advanced analytics and AI-driven insights.

Snowflake also offers Native Apps through its Marketplace, enabling customers to deploy third-party solutions directly into their Snowflake instances for enhanced functionality.

The core platform provides integrated cloud services for data warehousing, data lakes, data engineering, analytics, and secure data sharing across scalable cloud infrastructure.

Main Products Performance in the Last Quarter

Cortex AI

Cortex AI has rapidly matured into a core pillar of Snowflake's AI strategy. Over 5,200 accounts now use Snowflake’s AI and ML capabilities on a weekly basis. The adoption curve has moved beyond experimentation into production deployments. Use cases range from chatbots trained on internal documentation to multi-step agentic workflows. Cortex Agent helps process both unstructured and structured data efficiently.

Customers like Samsung Ads use Cortex for privacy-compliant, AI-powered personalization. Kraft Heinz launched Lighthouse, its internal AI assistant, powered by Cortex. AI monetization is currently tied to overall consumption—there’s no separate SKU—signaling a land-and-expand approach rooted in platform usage. Cortex is also being used to accelerate internal operations like sales enablement and data migrations.

Apache Iceberg

Snowflake deepened support for Apache Iceberg, allowing customers to leverage core capabilities—data sharing, performance optimization, and security—on Iceberg tables. This introduces true open-table format interoperability without compromising Snowflake’s enterprise-grade performance.

Customer response has been positive, driven by a need for openness in hybrid data architectures. Iceberg’s integration supports better data flexibility, especially in environments with legacy systems and multi-cloud setups. It is enabling more fluid data access while maintaining governance standards.

Snowpark

Snowpark saw strong adoption and outperformance in Q1. It’s increasingly used for complex data engineering workloads, including structured and unstructured data pipelines. Its growth is fueled by both maturing product capabilities and focused go-to-market enablement.

Notebooks usage is expanding, bringing in developers and data scientists. Integration with container services now supports training larger models. Snowpark is pivotal in reducing tool sprawl by allowing more ETL and ML tasks within Snowflake. Use cases are expanding across IT, ML, and analytics teams.

Dynamic Tables

Dynamic Tables adoption also exceeded expectations. They simplify data transformation processes and help reduce ETL complexity. Strong uptake is observed in tech and retail sectors. They're critical for real-time analytics use cases and continue to evolve Snowflake’s push toward end-to-end data lifecycle management.

Improved by integration with other services like Snowflake Connectors and Snowpark, Dynamic Tables reduce time-to-insight and cost of orchestration. Their growth is driven by the need for lower-latency pipelines and simplified architecture.

Snowflake Marketplace

Snowflake is repositioning its Marketplace as a central platform for data and AI application distribution, moving beyond basic data sharing. In Q1, key upgrades included support for native apps with embedded logic, enabling developers to ship intelligent, context-aware applications.

Cortex Knowledge Extensions were introduced to bundle data, search, and models into a single deployable unit, dramatically simplifying the creation of agentic workflows.

The Marketplace also now features tight integration with governance and access control, ensuring secure enterprise-grade usage. Additionally, OpenFlow enables seamless ingestion of both structured and unstructured data, streamlining how data flows into the platform for further activation.

Product Innovations & Updates

Snowflake released 125+ new product capabilities in Q1 FY2026, a 100% increase YoY. Key launches include Cortex Analyst and Cortex Agent, enabling natural language querying and multi-step AI workflows. Users can now build AI agents that access SharePoint via Snowflake Connectors, transform data with Snowpark, index with Cortex Search, and deploy agentic flows.

Cortex now supports Meta’s Llama 4, OpenAI on Azure, and advanced embedding models. Over 5,200 enterprises including BlackRock, WHOOP, and Penske Logistics use Snowflake AI weekly. Cortex Agents use LLMs from Anthropic and OpenAI to power enterprise-grade applications.

Snowflake uses AI internally to enhance engineering, sales, and migration workflows. SnowConvert, now free for customers and partners, includes AI-powered migration testing, reducing costs and timelines in large-scale migrations.

The Gen2 compute engine delivers major performance gains by combining modern cloud hardware with software optimization. Customers see 2.1x faster analytics and significant improvements in price-performance.

Announced at Summit 2025, Snowflake Intelligence (public preview) allows business users to query structured and unstructured data using natural language. It runs inside Snowflake and inherits all security, masking, and governance policies.

Data Science Agent (private preview) automates ML workflows, improving speed and productivity. Analysts can now build and deploy ML models without engineering support.

Cortex AISQL (public preview) brings generative AI into SQL, enabling multimodal analysis of text, images, and audio with up to 60% cost savings. Companies like Hex, TS Imagine, and Sigma report 30–70% performance gains.

Cortex Knowledge Extensions (GA soon) allow enterprises to license high-quality content from USA TODAY, Stack Overflow, and others. New Agentic Native Apps support plug-and-play AI agent deployment inside Snowflake.

Semantic Models sharing (private preview) provides consistent AI outputs across organizations, reducing drift and ensuring governance.

Adaptive Compute (private preview) auto-scales resources for variable workloads, lowering operational cost and effort. Copilot for Horizon Catalog and Immutable Snapshots (public preview) further enhance governance and security.

Snowflake Openflow (GA) integrates hundreds of connectors using Apache NiFi, enabling real-time, batch, and streaming ingestion from platforms like Box, Oracle, Salesforce, and Google Drive. It supports open lakehouse formats like Apache Iceberg.

Snowflake acquired Crunchy Data to deliver enterprise-grade Postgres on the AI Data Cloud. Used by 49% of developers, Postgres enhances Snowflake’s transactional capabilities and supports FedRAMP environments, complementing Unistore.

Canva, with 230M+ users and over $3B in revenue, relies on Snowflake to scale globally, expand enterprise adoption, and personalize user experiences. Canva uses Snowflake to drive AI-powered design recommendations and accelerate data-informed product development (e.g., Canva Sheets). Snowflake supports Canva’s transition from consumer tool to enterprise design platform.

Board Appointment: Bill Scannell, President of Global Sales and Customer Operations at Dell Technologies, joined Snowflake’s Board of Directors effective May 7, 2025. Scannell brings nearly 40 years of global sales leadership across 180 countries.

Customers

$SNOW Snowflake added 419 total customers, reflecting +18% YoY growth, which is higher than in Q1 last year. The company also added 26 large customers with $1M+ ARR, matching the level from Q1 2024, and achieved +25% YoY growth in that segment.

Customer Success Stories

AstraZeneca Leverages Seamless Data Integration

Global pharmaceutical leader AstraZeneca now integrates critical business data from SAP and Workday using Snowflake connectors, enabled by the Datavolo acquisition. This facilitates streamlined access to essential datasets and supports improved enterprise-level decision-making.

Dentsu Cuts Data Costs by 30%

Global marketing agency Dentsu consolidated data infrastructure on Snowflake, resulting in a 30% cost reduction. This was achieved by simplifying data architecture and eliminating third-party dependencies. The company now uses Snowflake Data Clean Room to run secure, privacy-preserving personalized marketing campaigns for Fortune 500 clients.

Siemens Unlocks Operational Efficiency

Siemens is partnering with Snowflake to combine IT and operational technology data, including industrial equipment telemetry. This enables advanced manufacturing analytics, improved machine performance, and optimized production processes, all powered by Snowflake’s AI data cloud.

Samsung Ads Powers Privacy-Centric Innovation

Samsung Ads leverages Snowflake to unify consumer data and deliver AI- and ML-powered personalized advertising, while maintaining strict privacy standards. The platform enables faster innovation cycles and relevant ad targeting for advertisers.

Kraft Heinz Deploys AI Assistant Across Workforce

Kraft Heinz built its internal AI assistant, “Lighthouse”, using Snowflake Cortex, enabling company-wide AI adoption. The assistant enhances workflow automation and sets the foundation for agentic AI across the organization.

Luminate Data Scales AI Application Infrastructure

Luminate Data uses Cortex Agent to power complex data workflows by processing structured and unstructured data. This lays the groundwork for scalable AI agent development in the entertainment analytics space.

Canva, JPMorgan Chase, CloudZero Among Trusted Enterprise Users

Enterprises such as Canva, JPMorgan Chase, and CloudZero rely on Snowflake for scalable, secure, and easy-to-use data infrastructure. CloudZero alone maintains hundreds of active data-sharing connections, showcasing the ecosystem reach of Snowflake.

Large Customer Wins

Two $100M+ Contracts Signed in Q1

Snowflake secured two contracts exceeding $100 million in Q1 FY26, both in the financial services sector. These deals had been delayed from Q4 due to prior capacity exhaustion. Their completion reflects strong enterprise confidence and contractual commitment to the platform.

Expansion into Federal Market via Snowflake Public Sector Inc.

The launch of Snowflake Public Sector Inc. and attainment of DoD Impact Level authorization now positions Snowflake to serve the U.S. Department of Defense, its military branches, and affiliated contractors. This represents a strategic expansion into mission-critical government workloads.

Adoption in Automotive Sector Through Vertical Solutions

Snowflake introduced automotive-specific AI data cloud solutions, adopted by CarMax and Nissan. These solutions help drive innovation and internal efficiency, expanding Snowflake’s relevance in industry-focused applications.

Retention

$SNOW Snowflake’s retention rate remains one of the highest in its class at 124% in Q1 2025, decreasing by 2 PP QoQ. The company calculates this metric based on data from the past two years, making it a lagging indicator for Snowflake.

Net new ARR

$SNOW Snowflake added $214 million in net new ARR, reflecting a +4% increase YoY.

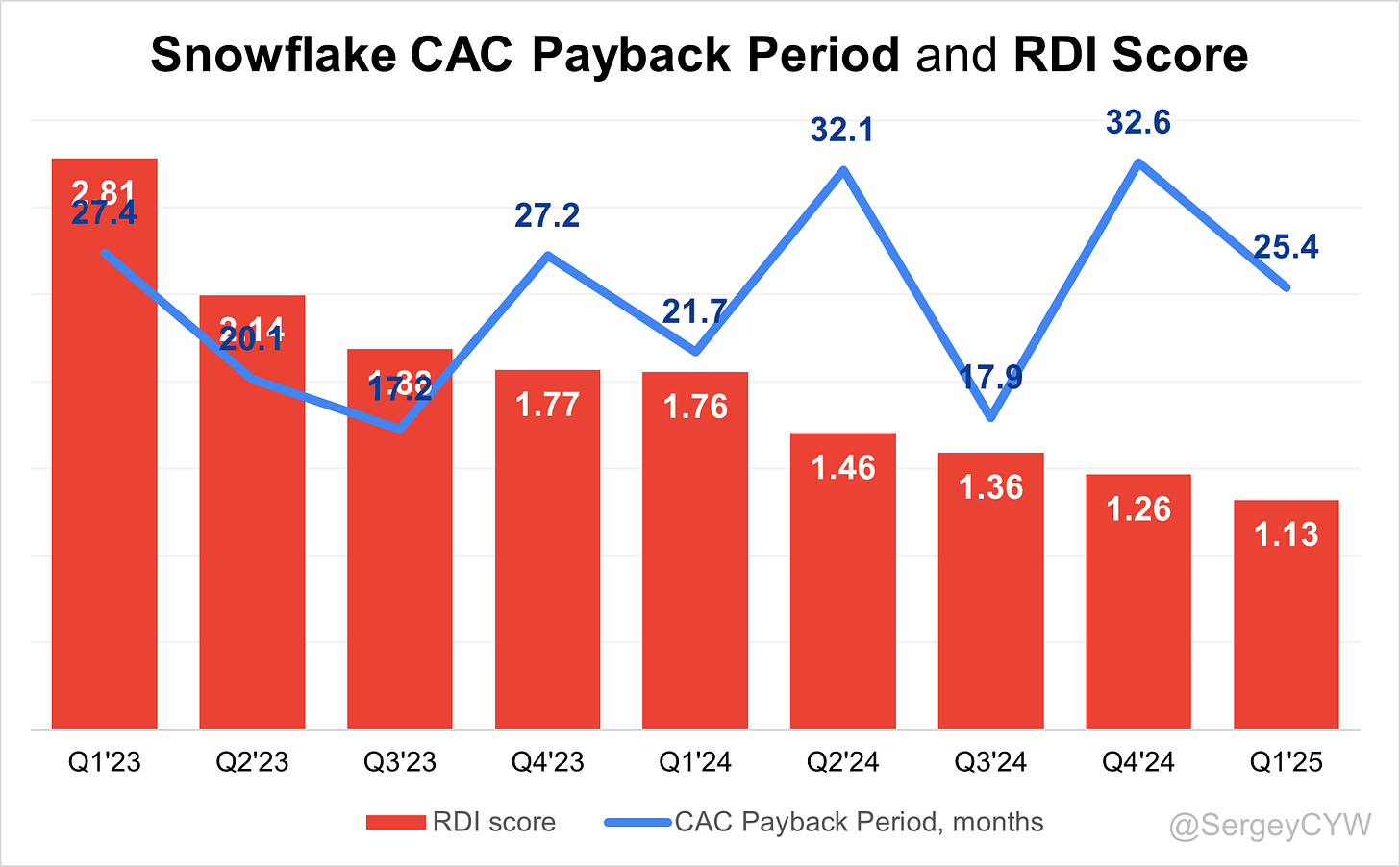

CAC Payback Period and RDI Score

$SNOW Snowflake’s return on S&M spending is 25.4, an improvement compared to the previous quarter.

Snowflake isn’t a pure SaaS company—it runs on a consumption-based model, which makes metrics like CAC Payback Period and net new ARR more volatile than those of traditional SaaS businesses.

The R&D Index (RDI Score) for Q1 came in at 1.13, slightly below the median of 1.2 for the SaaS companies I track, but still solid and well above the industry median of 0.7. Snowflake has increased its R&D spending, which has temporarily lowered the RDI Score—though this is expected, as the impact of those investments should be reflected in future revenue growth.

An RDI Score above 1.4 is considered best-in-class, while the industry median of 0.7 highlights the importance of efficient R&D investment.

Key Metrics

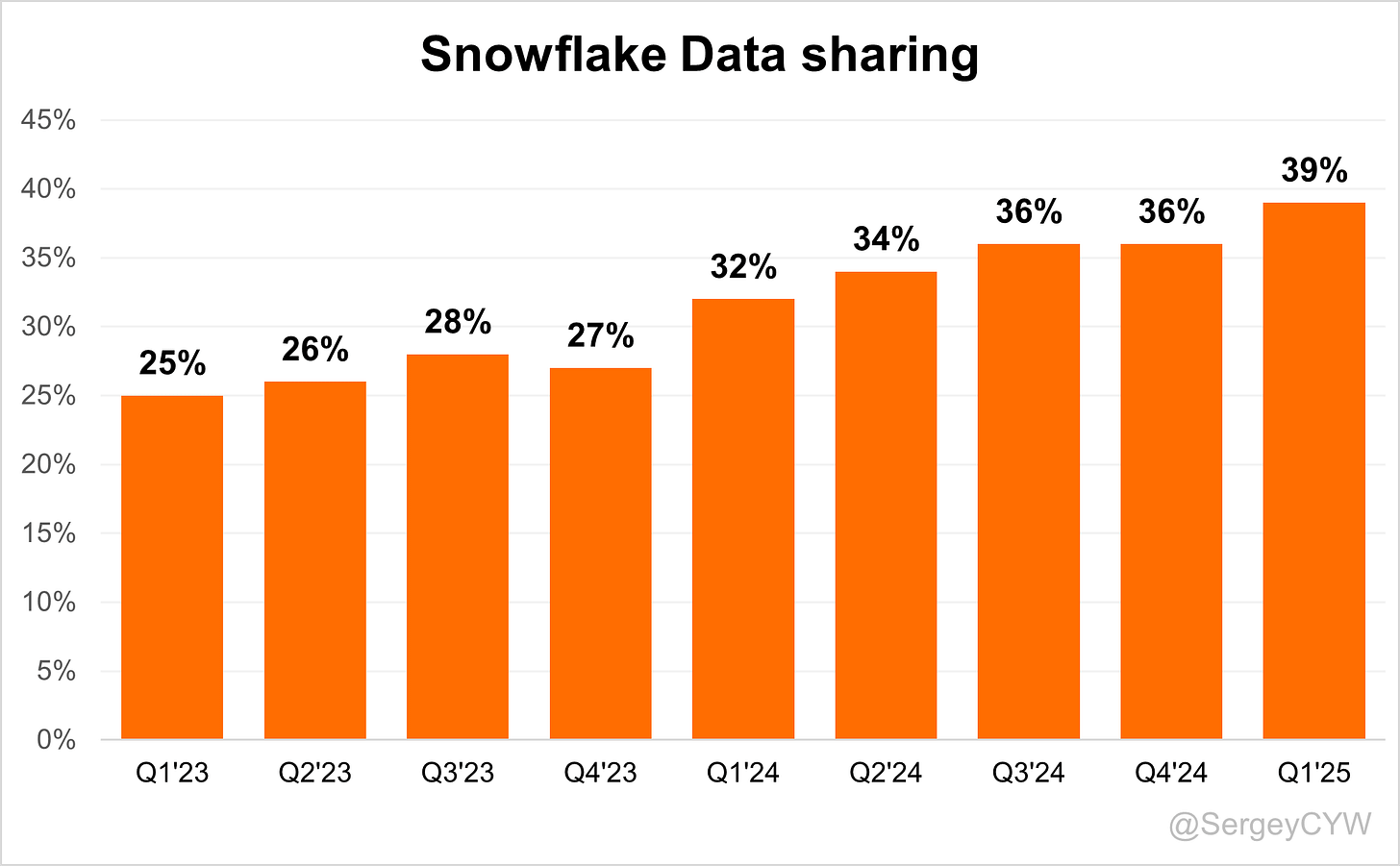

Two key components of $SNOW Snowflake’s economic moat are high switching costs and strong network effects.

Data sharing has steadily grown from 25% two years ago to 39% in Q1 2025, reflecting sustained engagement.

This metric is crucial in highlighting Snowflake’s network effect, as higher data sharing enhances platform utility, attracting more customers and reinforcing Snowflake’s competitive edge.

Data sharing remains Snowflake’s structural moat. Dentsu and CloudZero use live data connections to collaborate across networks and eliminate third-party tools.

Snowflake’s Data Clean Room supports secure, privacy-preserving sharing—critical for industries like advertising and finance.

$SNOW Snowflake added 54 new listings to its Marketplace in Q1 2025, reflecting a 21% YoY increase, though this was the smallest addition in the past two years.

The slowdown is linked to evolving enterprise data strategies and more selective partnership evaluations. Customers are now prioritizing high-value datasets and AI-powered insights over general-purpose listings.

In response, Snowflake is focusing on enhancing its AI-driven capabilities, improving data discoverability, and updating revenue-sharing models. Marketplace activity is expected to reaccelerate in H2 FY2026 as AI adoption scales.

This metric still reflects the strength of Snowflake’s expanding ecosystem and the growing traction of its data-sharing platform.

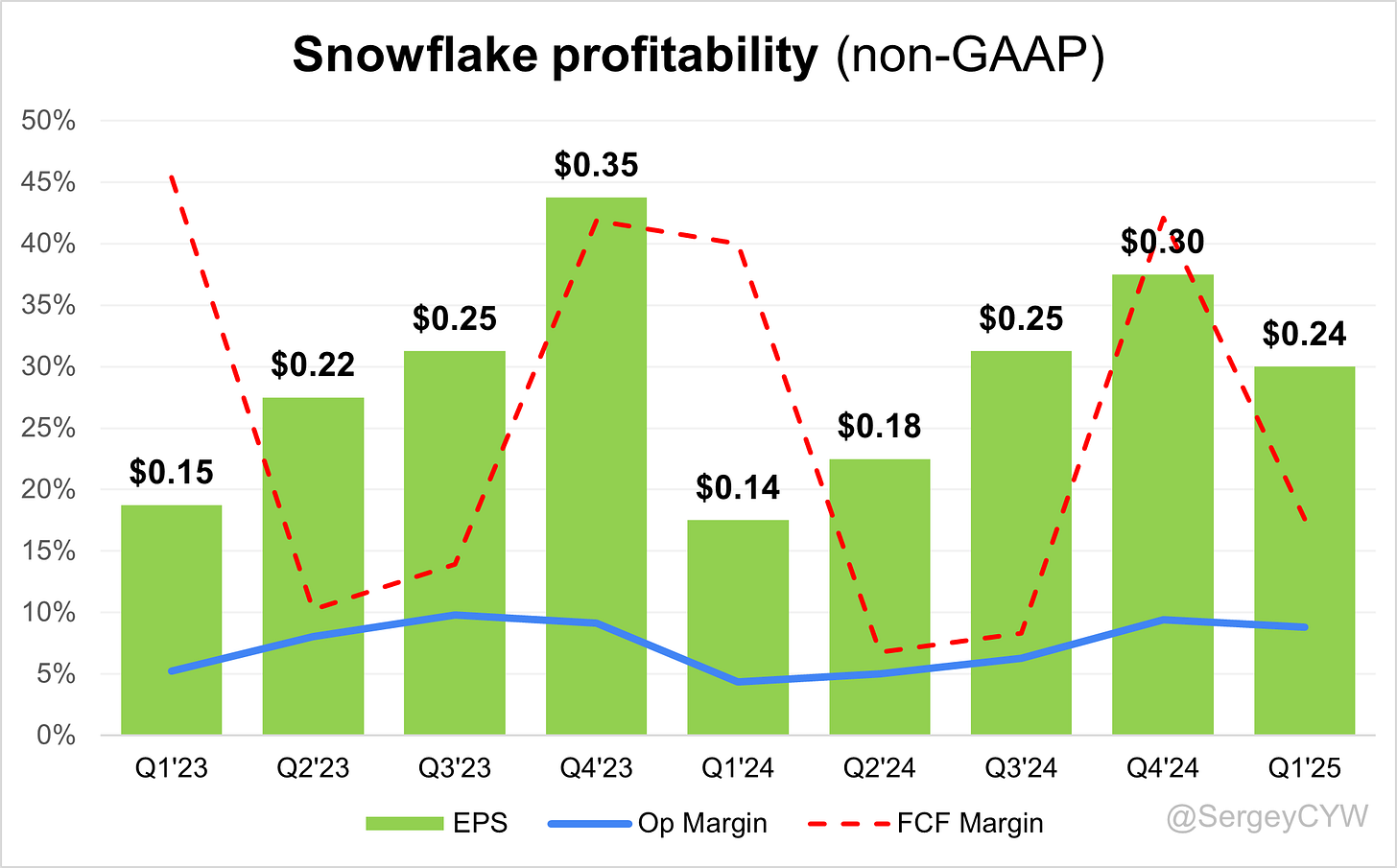

Profitability

Over the past year, $SNOW Snowflake’s margins have changed:

• Gross Margin slightly declined from 73.5% to 72.2%.

• Operating Margin increased from 4.4% to 8.8%.

• FCF Margin declined from 40.0% to 17.6%.

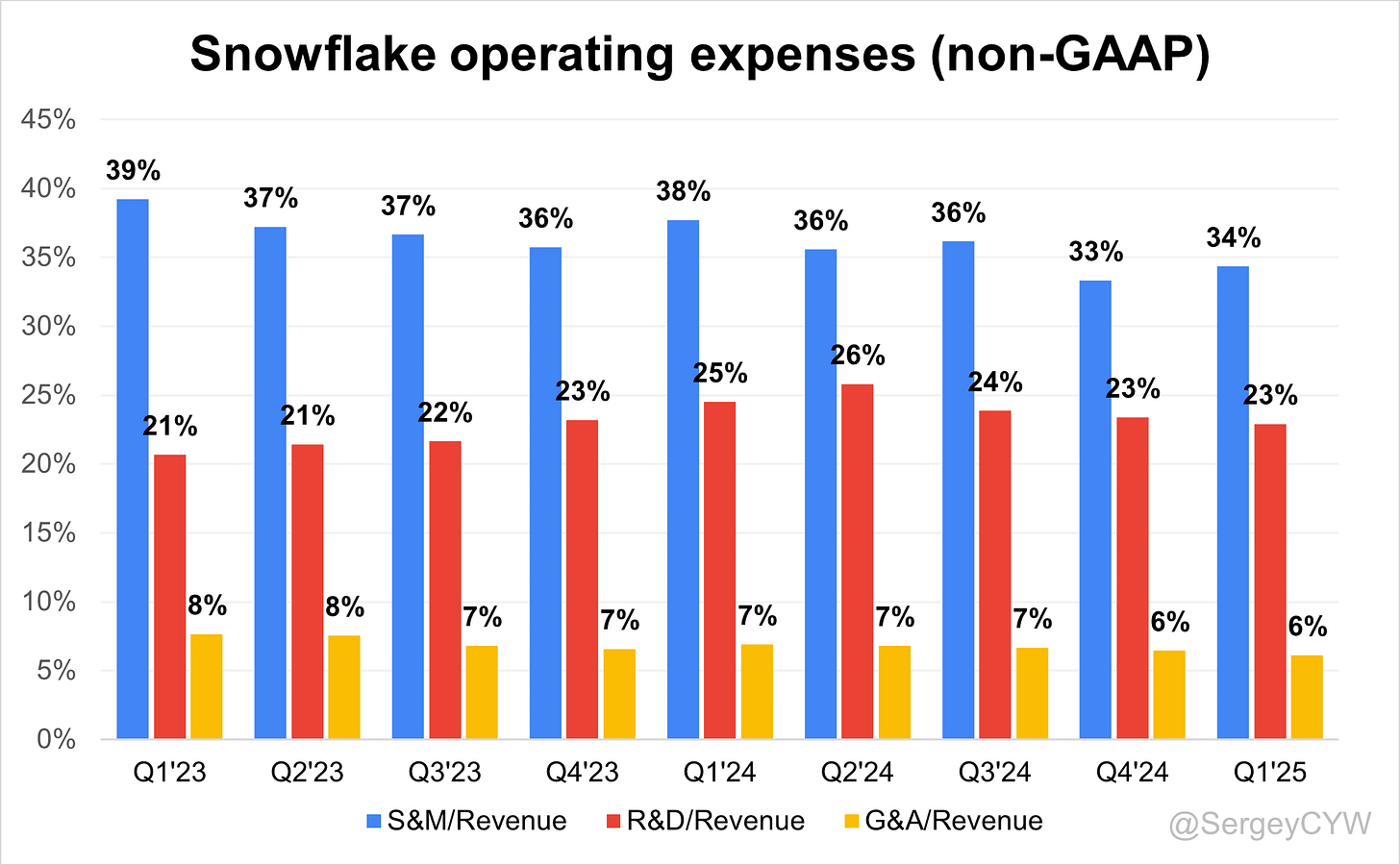

Operating expenses

Over the past two years, $SNOW Snowflake has reduced operating expenses, with a significant decline in the last quarter. S&M expenses dropped from 39% in Q1 2023 to 34%, while G&A decreased from 8% to 6%. Meanwhile, R&D spending increased and remained high at 23% of revenue, reflecting the company’s commitment to reinvesting in product development.

Balance Sheet

$SNOW Balance Sheet: Total debt stands at $2,688M. The company's debt increased in Q3 2024 due to the issuance of $2.3 billion in 0% convertible senior notes, split into $1.15 billion due in 2027 and $1.15 billion due in 2029. However, Snowflake holds $3,911M in cash and cash equivalents, keeping the balance sheet stable.

Dilution

$SNOW Shareholder Dilution: Snowflake's stock-based compensation (SBC) expenses were previously at very high levels but declined in the last quarter to 39% of revenue, which is still relatively high.

The company is actively repurchasing shares to offset dilution. During the first quarter of fiscal year 2026, Snowflake allocated $491 million to repurchase 3.2 million shares at an average price of $152.63 per share. As a result, the weighted-average number of common shares outstanding decreased by 0.3% YoY.

Conclusion

$SNOW Snowflake is strengthening its competitive position through a significant number of new products and innovations, along with expanded collaboration with major cloud providers.

Innovation has accelerated notably under CEO Sridhar Ramaswamy, as reflected in a substantial increase in R&D spending—which, in my view, is the right move.

Considering the projected revenue growth for 2025, the forward P/S ratio appears undervalued compared to other companies in the big data sector. Analysts expect strong revenue expansion. In Q4 2024, management anticipated an acceleration in H2 2025, and the current Q2 guidance supports that outlook, confirming earlier expectations.

Revenue growth is being driven by the adoption of Cortex AI, Iceberg, and Snowpark, rising enterprise demand across financial services, healthcare, and supply chain, and new workloads in advertising, cybersecurity, and real-time analytics.

Leading Indicators

• RPO growth of +34.3%, outpacing revenue growth

• Strong net new ARR in Q1, up +4% YoY

• Solid customer growth, especially among large enterprise accounts

Key Indicators

• Net Dollar Retention (NDR) remains high for a SaaS company, though it dipped slightly last quarter

• CAC Payback Period improved slightly vs. Q4 2024

• RDI Score is gradually declining but remains well above SaaS peers

Snowflake’s economic moat—especially its high switching costs and strong network effect—continues to strengthen. Data sharing now accounts for 39% of platform usage, up from 25% two years ago.

The company has reduced S&M and G&A expenses while reinvesting heavily in R&D, reinforcing its long-term advantage. It appears that CEO Sridhar Ramaswamy’s strategy is already starting to show results, with growth expected to accelerate next quarter and the pace of product releases increasing.

FCF margin has declined significantly YoY. This softness is attributed to customer purchasing patterns that carried over from Q4 FY25, where several large customers opted for a “consume-as-you-go” model. This delayed revenue recognition and shifted cash flow toward the back half of the fiscal year.

Management reaffirmed expectations for stronger free cash flow in H2, noting that FY2026 will likely be back-end loaded.

While SBC as a percentage of revenue is still relatively high, it has declined significantly, and it’s clear that management is actively keeping it under control.

$SNOW is one of the largest positions in my portfolio and now represents 9.3% of total holdings.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.