Shopify: Scaling E-Commerce with Innovation, Moat, and Massive TAM

Deep Dive into $SHOP: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Shopify: Company overview

About Shopify

Shopify is a leading e-commerce platform founded in 2006 by Tobias Lütke and Scott Lake. Headquartered in Ottawa, Canada, the company enables businesses to build and manage online stores, process payments, and handle shipping. As of today, Shopify powers over 4.6 million active websites worldwide. Since going public in 2015, it has expanded into point-of-sale systems, fulfillment services, and merchant financing.

Company Mission

Shopify’s mission is “To make commerce better for everyone.” The company focuses on helping businesses of all sizes succeed online by offering intuitive tools that reduce technical complexity and enhance merchant focus on product and customer experience.

Sector

Shopify operates in the e-commerce technology sector. As of 2025, it holds a 10.32% share of the global e-commerce software market and a commanding 29% share in the U.S. e-commerce platform market. Its platform supports multiple industries, with retail making up 11% of its customer base.

Competitive Advantage

Shopify’s edge lies in its scalable solutions, extensive partner ecosystem, and focus on small to mid-sized businesses. Its integrated services, such as Shopify Payments, simplify operations for merchants. The company continually improves the platform through regular feature updates and empowers brands to go direct-to-consumer, bypassing traditional retail channels.

Total Addressable Market (TAM)

Shopify’s current Total Addressable Market (TAM) stands at $849 billion, covering subscription solutions, online and offline payments, and other merchant services. The company maintains only 2% penetration in its core $404 billion SAM, leaving ample room for expansion.

The TAM is segmented into four primary revenue streams:

Offline payments: $459 billion (54%)

Online payments: $157 billion (18%)

Other merchant services: $152 billion (18%)

Subscription solutions: $81 billion (10%)

Global e-commerce is expected to reach $76.4 trillion by 2030, growing at a CAGR of 18%, providing long-term demand tailwinds for Shopify's product suite.

TAM expansion is driven by product innovation such as Shopify Payments, B2B tools, and cross-border commerce infrastructure. The company operates in 175+ countries and is scaling localized payments and compliance solutions. Shopify is also broadening its customer base from SMBs to enterprises via Shopify Plus, while pushing further into offline retail and omnichannel commerce.

Scenario-based forecasts show substantial TAM growth by 2030:

Conservative (15% CAGR): $1.96 trillion — 2.3x growth

Moderate (18% CAGR): $2.30 trillion — 2.7x growth

Aggressive (22% CAGR): $2.80 trillion — 3.3x growth

Core growth catalysts include:

Global e-commerce penetration at just 11% of total retail, suggesting early innings.

U.S. entrepreneurship remains strong with ~5 million new business formations annually.

B2B e-commerce projected to hit $36 trillion by 2026, expanding Shopify’s enterprise footprint.

Omnichannel demand continues to grow as consumers expect unified online and offline experiences.

Cross-border commerce is accelerating, benefiting from Shopify’s investment in localization and managed markets.

With product innovation, channel expansion, and a global shift to digital commerce, Shopify's TAM is set to scale significantly through 2030. The current 2% penetration in its SAM underscores how much white space remains.

Valuation

$SHOP Shopify is trading at a Forward EV/Sales multiple of 12.36, which is slightly above the median of 11.27 and close to valuation levels based on multiples from 2018-2019.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$SHOP Shopify is trading at a Forward P/E multiple of 76.7, with revenue growth of +26.8% YoY in the most recent quarter.

The EPS growth forecast for 2026 is 27%, with a P/E of 78, resulting in a 2026 PEG ratio of 2.8.

For 2027, EPS growth is projected at 31%, with a P/E of 61 and a 2027 PEG ratio of 1.9.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $SHOP revenue growth of +25.0% in 2025 and +19.8% in 2026. Based on this outlook, the valuation using the P/S multiple appears to be trading at a premium compared to other companies in the e-commerce sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Shopify has established itself as a dominant force in the e-commerce platform space, with Morningstar analysts recognizing the company as having a wide economic moat. This comprehensive analysis examines the five key components of Shopify's competitive advantages and their respective strengths in creating sustainable barriers to competition.

Economies of Scale

Shopify demonstrates strong economies of scale that create significant competitive advantages across multiple dimensions of its business model. The company's scale benefits manifest most prominently in its payment processing operations, where Shopify Payments has achieved 64% penetration of gross merchandise volume (GMV) as of Q4 2024. This high penetration rate allows Shopify to negotiate better rates with payment processors and reduce per-transaction costs, creating a virtuous cycle where increased volume leads to improved margins.

The platform's infrastructure investments also benefit from economies of scale, as the company can spread the costs of platform development, security, and maintenance across its growing merchant base. With over 2 million merchants globally and processing $292 billion in GMV in 2024, Shopify can amortize its technology investments across a massive user base, making it increasingly difficult for smaller competitors to match its cost structure. The company's ability to offer competitive pricing while maintaining healthy margins – with subscription solutions achieving an 81.5% gross margin in 2024 – demonstrates the power of its scale advantages.

Network Effects

Shopify exhibits moderate to strong network effects through its comprehensive ecosystem approach, though these effects are less pronounced than in traditional two-sided marketplaces. The company's App Store ecosystem has grown to over 16,000 apps, with Shopify paying out $1.0 billion to partners in the last 12 months. This creates a positive feedback loop where more merchants attract more app developers, which in turn makes the platform more valuable for new merchants.

The network effects are particularly evident in Shopify's fulfillment network and third-party integrations. As noted in industry analysis, "Just as Google and Facebook are core to anyone marketing online, Shopify is becoming the same to those who sell directly online". The platform's ability to integrate with multiple sales channels, including Instagram Stories and other social platforms, creates network value that increases with merchant adoption. However, these network effects are somewhat limited by the fact that merchants don't directly interact with each other on the platform, making this a weaker moat component compared to pure marketplace models.

Brand Strength

Shopify has developed a strong brand that has become synonymous with direct-to-consumer (DTC) commerce and entrepreneurship. The company's brand strength is evidenced by its adoption among high-profile merchants, including Kylie Cosmetics ($800 million business), Fenty Beauty ($450 million revenue in 2024), and major brands like Heinz, Red Bull, and Allbirds. This brand recognition creates a self-reinforcing cycle where successful merchants using Shopify enhance the platform's reputation, attracting more merchants.

The brand's positioning as the anti-Amazon platform has resonated strongly with merchants who want to maintain control over their customer relationships. As CEO Tobias Lütke stated, unlike Amazon, Shopify ensures that "the customers its sellers have are their customers — not Shopify's". This merchant-first philosophy has created strong brand loyalty and differentiation in the market. The company's brand strength is further reinforced by its thought leadership in e-commerce trends and its role in powering the DTC revolution, making it the go-to platform for entrepreneurs and established brands alike.

Intellectual Property

Shopify maintains a moderate intellectual property moat through its proprietary technology stack and continuous innovation in e-commerce solutions. The company's IP portfolio includes proprietary algorithms for inventory management, payment processing technology, and AI-powered features like Shopify Magic and Sidekick. These technological innovations create barriers to entry for competitors who would need to develop similar capabilities from scratch.

The platform's intellectual property extends beyond patents to include trade secrets related to its machine learning algorithms for fraud detection, inventory optimization, and customer analytics. Shopify's investment in AI technology integration across its platform represents a significant IP advantage, as these capabilities require substantial data sets and expertise to replicate. However, the software industry's rapid pace of innovation means that IP advantages can be relatively short-lived, making this a moderate rather than strong moat component.

Switching Costs

Shopify demonstrates very strong switching costs that create significant barriers for merchants considering alternative platforms. The switching costs are multifaceted and increase substantially as merchants grow their businesses on the platform. Technical switching costs include the need to rebuild websites, reconfigure integrations with third-party apps, and migrate customer data – processes that can take months and require significant technical expertise.

Financial switching costs are equally compelling, as merchants using Shopify Payments benefit from lower transaction fees compared to third-party processors. The company imposes additional fees ranging from 0.5% to 2% for merchants using alternative payment processors, creating a strong incentive to remain within the Shopify ecosystem. Operational switching costs include the time and resources required to retrain staff, rebuild marketing integrations, and potentially lose SEO rankings during migration.

The switching costs are particularly high for merchants using multiple Shopify services, as noted in recent analysis: "These integrated offerings have raised switching costs for customers, particularly in web development, as many applications are designed exclusively for Shopify". For enterprise customers using Shopify Plus, switching costs can reach hundreds of thousands of dollars when considering lost productivity, integration costs, and potential revenue disruption during transition periods.

Shopify's economic moat is built on a combination of strong switching costs, solid economies of scale, and a powerful brand, with moderate contributions from network effects and intellectual property. The company's wide moat designation from Morningstar reflects the cumulative strength of these competitive advantages.

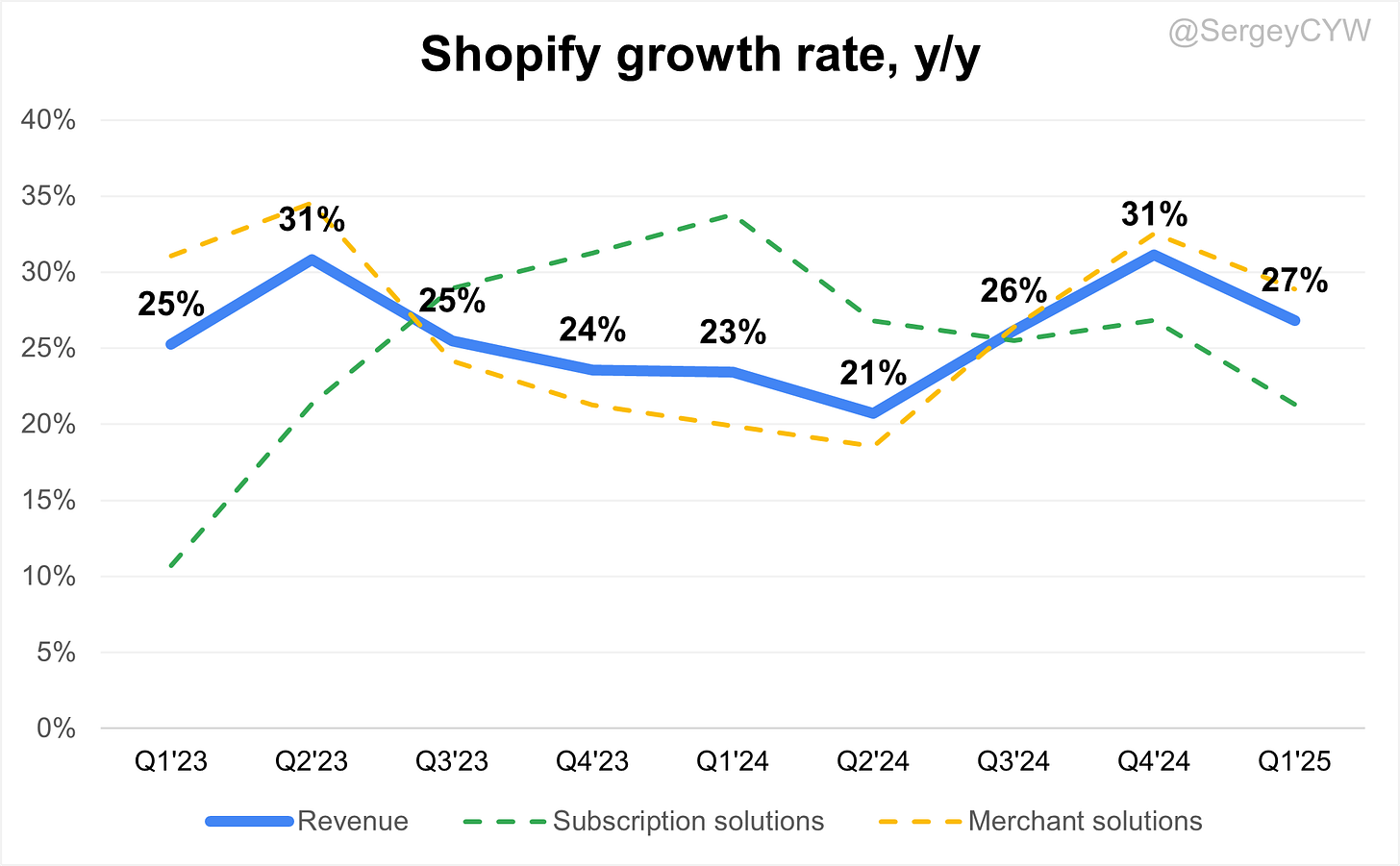

Revenue growth

Revenue growth for SHOP 0.00%↑ slowed to +26.8% YoY in Q1. Based on guidance for the next quarter, if the company beats by 1.7% again, as it did in Q1, Q2 growth would reach 27.8%, indicating a reacceleration in revenue growth.

Segments and Main Products

Shopify serves a wide range of customers, including small businesses, mid-sized companies, enterprise clients, dropshippers, and service providers. The platform supports entrepreneurs building their first online store, scaling brands expanding digital operations, and large enterprises managing complex e-commerce infrastructures.

The core product is Shopify’s e-commerce platform, built on a SaaS model. Merchants can launch and manage online stores without coding, using customizable templates and drag-and-drop tools.

Merchant services form another key revenue stream. Tools like Shopify Payments handle transactions, while Shopify Shipping supports order fulfillment. Merchants manage operations from a single dashboard, increasing efficiency.

Shopify Plus targets high-volume merchants, offering greater customization, automation, and integration with social media platforms. It serves brands needing advanced e-commerce capabilities at scale.

The Shopify App Store includes over 13,000 third-party applications, enabling merchants to add features for inventory, marketing, and customer support. This ecosystem strengthens Shopify’s network effect and platform stickiness.

B2B commerce tools are a fast-growing segment. Shopify now supports wholesale experiences with custom pricing, discount structures, and flexible payment terms tailored to business buyers.

Shopify’s Point of Sale (POS) system enables merchants to operate across both online and physical stores, ensuring a unified commerce experience across all customer touchpoints.

Main Products Performance in the Last Quarter

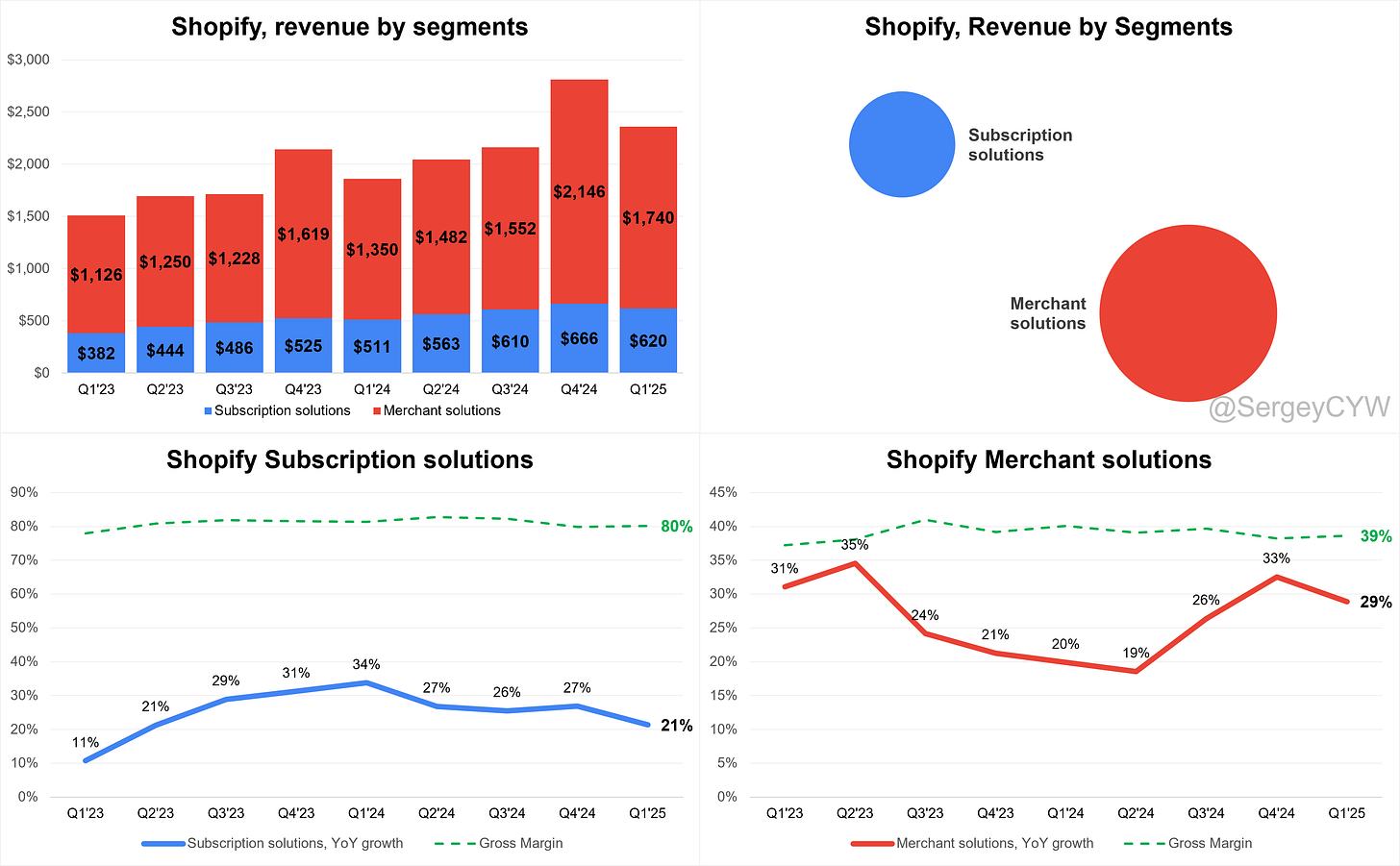

$SHOP Shopify revenue breakdown by segment: Merchant Solutions accounts for 74% of total revenue, while Subscription Solutions makes up 26%.

Merchant Solutions revenue grew by +29% YoY. The gross margin for this segment was 38.6%, slightly down from 40.1% a year earlier.

More importantly, Subscription Solutions revenue grew +21.3% YoY, a bit slower than overall revenue growth. However, this segment is highly profitable, with a gross margin of 80.2%, down from 81.4% in the same quarter last year.

Subscription Solutions

Revenue grew +27% YoY in Q4, driven by merchant growth, higher platform fees, and the impact of pricing changes. MRR rose +24%, with Plus still accounting for 33%. Growth was seen across Standard, Plus, and Offline. A headwind in Q4 was the transition from 1-month to 3-month paid trials, which reduced short-term MRR but improves merchant durability and GMV over time. Despite the slower near-term revenue from this change, Shopify expects better long-term outcomes from stronger merchant engagement.

Merchant Solutions

Q4 revenue increased +33% YoY, supported by +26% GMV growth and expanding payments adoption. Gross payments volume (GPV) hit $61 billion, up 35% YoY, with Shopify Payments penetration reaching 64%. Strength came from the adoption of value-added services like Capital, Tax, and Markets. International growth was also a key factor, especially in EMEA (+37%). Merchant Solutions take rate outperformance was supported by scale in enterprise and increased GPV from Shop Pay. Gross margin was impacted slightly by lower non-cash revenue from partnerships and expanded PayPal integration.

Shop Pay

GMV processed through Shop Pay reached $27 billion in Q4, up +50% YoY, and now makes up 41% of GPV. It processed 2x more GMV than the next leading accelerated checkout. Growth was fueled by adoption from major brands like Crocs and GameStop. The Shop Pay Commerce Component saw 20x YoY GMV growth, acting as a strong entry point for enterprise brands. Conversion improvements and widespread buyer trust are reinforcing Shop Pay as a competitive moat.

Shopify App Store

The App Store grew significantly, adding over 3,000 new apps in 2024, with more than 16,000 apps total by year-end. 675+ apps were part of the Built for Shopify program. Shopify paid $1 billion to partners in 2024, emphasizing the ecosystem's scale. The integration of partners like Roblox, Oracle, YouTube, and PayPal further deepened the App Store’s reach. The store continues to be a critical growth and retention lever, particularly for scaling mid-market and enterprise merchants.

Product Innovation and New Features

In 2024, Shopify introduced major updates across all merchant segments. Variant limits were raised to 2,000 for complex catalogs. Shopify Balance for Plus brought next-day payouts and improved credit products. Shopify Tax expanded to the U.K. and EU. Tap to Pay and enhanced order management features were introduced in Offline. Shop App added cart syncing and personalized feeds, driving +84% native GMV YoY.

AI played a growing role. Sidekick, Shopify’s AI assistant, along with semantic search and AI-enhanced support tools, improved merchant productivity. Internally, AI enabled more efficient customer support and development.

Offline POS expanded to 8 new countries and Shopify Payments integrated Klarna in Europe. POS now supports up to 1,000 retail locations, a milestone for enterprise.

Market Leader

Shopify achieved Leader status in the 2024 Gartner Magic Quadrant for Digital Commerce for the second consecutive year, recognized for both completeness of vision and ability to execute. This positioning places Shopify among the top-tier vendors capable of serving enterprise-level requirements while driving innovation in the digital commerce space.

The Gartner evaluation assessed vendors across strategic vision, execution capacity, and innovation capabilities. Shopify's leadership position reflects its evolution from a simple e-commerce platform to a comprehensive commerce operating system serving merchants across multiple channels and geographies.

In 2024, Shopify debuted as a Leader in the Forrester Wave: Commerce Solutions for B2B, marking its first appearance on this prestigious evaluation. This recognition validates Shopify's expansion beyond direct-to-consumer commerce into the complex B2B marketplace, where the platform seamlessly integrates DTC expertise with robust wholesale buyer experiences.

The Forrester analysis highlighted Shopify's ability to deliver personalized and intuitive experiences for both consumers and wholesale buyers through its unified platform approach. This dual-capability positioning differentiates Shopify from competitors who typically specialize in either B2C or B2B commerce.

The IDC MarketScape 2024 named Shopify a Leader in B2C Digital Commerce Platforms for the midmarket segment, defined as companies with revenues between $100 million and $500 million. This recognition emphasizes Shopify's ability to meet specific enterprise business needs while providing the flexibility and scalability required for rapid growth and market adaptation.

Customers

Customer Success Stories

Allo Yoga implemented same-day delivery via Shopify’s integration with Uber and DoorDash. The initiative was executed in weeks, demonstrating Shopify’s infrastructure agility and its ability to convert merchant ideas into operational advantages at speed. Same-day fulfillment is now a competitive differentiator for Allo in retail-heavy markets.

Tapestry Brands (Coach, Kate Spade, Coach Outlet) expanded Shop Pay usage across their digital storefronts following early success. Starting with Coach Outlet, conversion performance led to broader rollout, confirming the stickiness and ROI of Shopify’s payments stack in enterprise environments.

Purple, Johnny Was, Lily Pulitzer, and Birkenstock saw positive results using Shop Pay and other Shopify tools to streamline customer journeys and drive upmarket engagement. These brands are using the platform not only for direct-to-consumer growth but also to optimize checkout and backend operations.

FAO Schwartz, Just Cozy, Grand Seiko integrated Shopify POS into multi-location retail footprints. The unified commerce experience across online and offline has improved operational efficiency and customer experience, showcasing the value of Shopify’s omnichannel infrastructure for brand-driven retailers.

All merchants adopting the AI-powered Sidekick assistant have seen measurable productivity gains. The tool’s user base more than doubled since the start of 2025, with merchants leveraging Sidekick for content creation, data queries, and customer engagement automation. Reflexive AI adoption is becoming a competitive advantage among Shopify users.

Large Customer Wins

VF Corp, one of the world’s largest apparel and footwear conglomerates, signed a multi-brand agreement. Eight brands are moving to Shopify, including Dickies, Ultra Running, Kipling, and Icebreaker. JanSport and Eastpak have already launched. The deal expands Shopify’s penetration into global consumer verticals with high-volume, omni-channel requirements.

Follett Higher Education Group, managing over 1,000 college bookstores in North America, is deploying Shopify across campus retail operations. The move consolidates B2B, B2C, and POS into a single commerce stack, enhancing inventory control and checkout consistency at scale.

Caring Beauty, representing luxury fragrance and beauty brands under the umbrella of Alexander McQueen, Creed, Balenciaga, is now on Shopify. The group is consolidating its digital infrastructure using Shopify’s B2B, B2C, and POS offerings to unify customer experience across Europe.

Recent high-profile launches include JW Anderson (LVMH), Therabody, Paper Source (Barnes & Noble), Away, Kent Automotive, and Life is Good. These brands span categories from luxury fashion to consumer electronics and automotive, reinforcing Shopify’s horizontal scale and infrastructure readiness across verticals.

The enterprise pipeline remains robust. Shopify continues converting large legacy and custom-built platforms by emphasizing total cost of ownership, execution speed, and unified commerce. Merchant wins are accelerating post-tariff uncertainty, showing confidence in Shopify’s adaptability and scalability.

Key Metrics

$SHOP Shopify Company Metrics Explained: GMV, GPV, MRR, and Attach Rate. Starting with GMV—Gross Merchandise Volume is a key metric for Shopify, representing the total dollar value of merchandise sold through its platform over a given period. GMV growth indicates rising adoption of Shopify by merchants and overall expansion in e-commerce activity across its user base.

GMV growth accelerated from +10% YoY in Q3 2022 to +26% in Q4 2024, and then slightly slowed to +23% in Q1 2025.

Next, let's look at GPV for $SHOP Shopify. Gross Payments Volume (GPV) measures the total dollar value of transactions processed through Shopify Payments. This service enables merchants to accept credit cards and other payment methods directly on their Shopify stores.

GPV is a key indicator of the adoption and effectiveness of Shopify’s integrated payment solutions, as it reflects the volume of commerce processed on the platform that generates transaction-based revenue.

GPV growth accelerated from +30% YoY in Q2 2024 to +32% in Q1 2025.

Now, let's look at MRR for $SHOP Shopify. Monthly Recurring Revenue (MRR) is a key metric for Shopify’s Subscription Solutions, reflecting the total recurring revenue generated from subscription plans on a monthly basis. MRR is important for assessing the stability and predictability of Shopify’s revenue from its tiered subscription offerings.

MRR growth signals an increasing number of merchants subscribing and maintaining their plans, contributing to a consistent revenue stream.

MRR growth accelerated from +10% YoY in Q1 2023 to +35% in Q4 2023, but slowed to +21% YoY in Q1 2025.

Lastly, let's consider the attach rate for $SHOP Shopify. The attach rate refers to the percentage of Shopify merchants who adopt additional services beyond the basic subscription. This includes Shopify Payments, Shopify Shipping, Shopify Capital, and advanced apps.

It’s a key indicator of product adoption and monetization depth. The attach rate is currently at a record level of 3.20%, up from 3.06% in Q1 2024.

Profitability

Over the past year, $SHOP Shopify's margins have shifted:

Gross Margin decreased from 51.7% to 49.5%.

Operating Margin increased from 10.8% to 13.9%.

Free Cash Flow (FCF) Margin improved from 12.5% to 15.4%.

The company also achieved GAAP profitability in Q2 2024, although in Q1 2025, GAAP Net Income turned negative again.

Operating expenses

$SHOP non-GAAP operating expenses have gradually decreased, driven by reductions in S&M, R&D, and G&A spending.

Sales & Marketing (S&M) expenses declined from 18% two years ago to 17%.

R&D expenses also dropped from 23% to 12% over the same period, but remain at a relatively high level, enabling continuous product innovation.

General & Administrative (G&A) expenses have decreased to 4%.

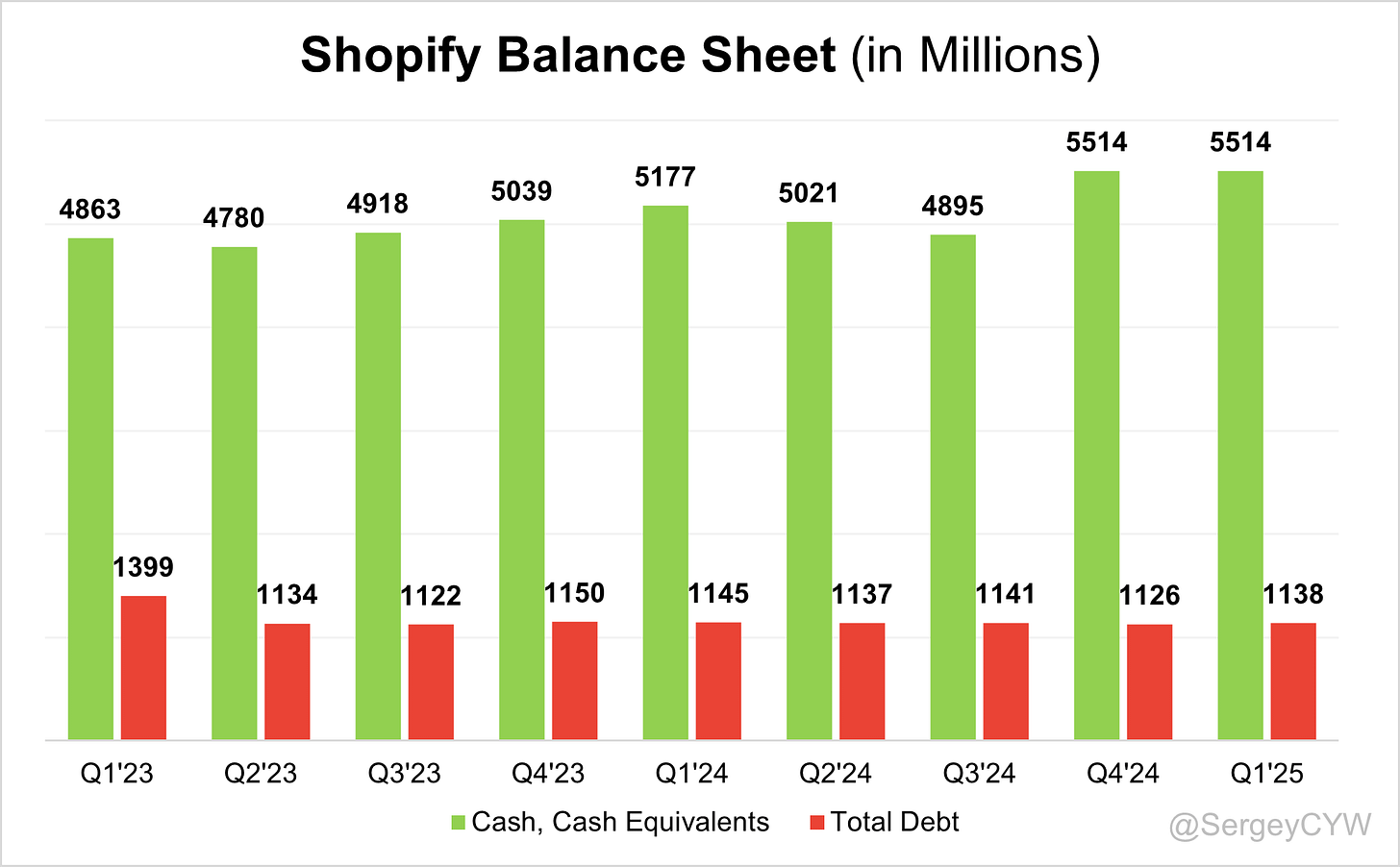

Balance Sheet

$SHOP Balance Sheet: Total debt stands at $1,138 million, while Shopify holds $5,514 million in cash and cash equivalents, far exceeding its liabilities and reflecting a healthy balance sheet.

Dilution

$SHOP Shareholder Dilution: Shopify’s stock-based compensation (SBC) expenses have declined, but in the most recent quarter slightly increased to 5% of revenue, which is still low compared to typical SaaS companies.

However, shareholder dilution remains well-controlled, with the weighted-average number of basic common shares outstanding increasing by just 0.6% YoY.

Conclusion

$SHOP has been highly innovative and is strengthening its position through a high level of investment in R&D. Shopify’s wide economic moat is supported by strong switching costs, economies of scale, and a powerful brand, with moderate contributions from network effects and intellectual property.

The company operates in a massive Total Addressable Market (TAM) of $849 billion. Yet, it holds just 2% penetration in its $404 billion core SAM, highlighting significant growth potential.

Global e-commerce is projected to reach $76.4 trillion by 2030, growing at a CAGR of 18%, providing long-term tailwinds for Shopify.

Margins—operating, free cash flow, and net—are improving compared to last year.

Key performance indicators (KPIs) show positive momentum:

GMV and GPV continue to grow at strong, stable rates

MRR growth accelerated to +21% YoY in Q1 2025

Attach Rate is at a record high, signaling Shopify’s growing competitive edge

The revenue growth forecast for next quarter is strong, suggesting an acceleration to +27.8% YoY.

Shopify trades at premium valuation multiples, but its competitive advantage and strong execution justify the pricing.

The company has exited low-margin logistics operations and is now focused on high-margin subscription solutions, where gross margin rose to 80.2%, remaining at a high level.

In January 2025, after valuation multiples normalized, I slightly increased my position. $SHOP now represents 7.0% of my portfolio.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.