Shopify Q4 2024 Earnings Analysis

Dive into $SHOP Shopify’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$2,812.0M rev (+31.2% YoY, +26.1% LQ) beat est by 3.2%

↘️GM* (48.1%, -1.7 PPs YoY)🟡

➡️Operating Margin* (20.8%, +2.3 PPs YoY)🟢

➡️FCF Margin (21.7%, +0.9 PPs YoY)🟢

↗️Net Margin (46.0%, +15.3 PPs YoY)🟢

➡️EPS* $0.44 in line with est

*non-GAAP

Segment Revenue

➡️Subscription solutions $666M rev (+26.9% YoY, 79.9% Gross Margin)🟡

↗️Merchant solutions $2,146M rev (+32.6% YoY, 38.2% Gross Margin)🟢

Key Metrics

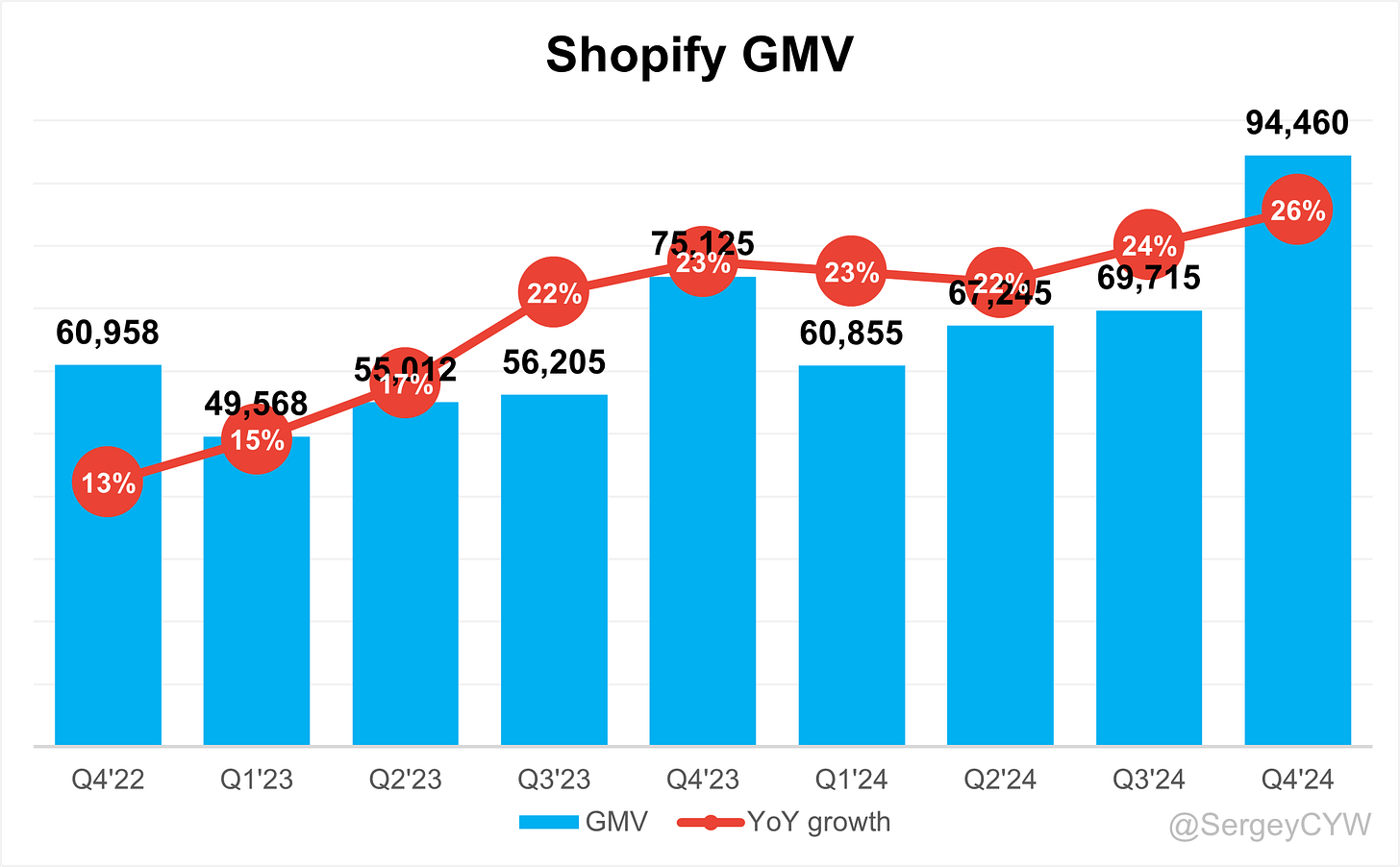

➡️GMV $94.46B (+25.7% YoY)🟡

↗️GPV $59.50B (+32.0% YoY, 63.0%% of GMV)🟢

➡️MRR 178B (+19.5% YoY)🟡

↗️Attach Rate 2.98% ( +13 BPs YoY)

Operating expenses

↘️S&M*/Revenue 11.9% (-2.2 PPs YoY)

↘️R&D*/Revenue 9.6% (-1.7 PPs YoY)

↘️G&A*/Revenue 3.1% (-0.6 PPs YoY)

Dilution

↘️SBC/rev 4%, -1.1 PPs QoQ

↘️Basic shares up 0.5% YoY, -0.0 PPs QoQ🟢

↗️Diluted shares up 0.6% YoY, +0.2 PPs QoQ🟢

Guidance

↗️Q1'25 $2,320.0 - $2,340.0M guide (+25.2% YoY) beat est by 0.8%

Key points from Shopify’s Fourth Quarter 2024 Earnings Call:

Shopify Q4 2024 Earnings & Outlook

Financial Performance

Shopify delivered $2.8B in Q4 revenue, up 31% YoY. Full-year revenue grew 26% YoY to $8.9B, driven by strong GMV growth. Gross profit reached $1.4B, up 27% YoY. Free cash flow surged to $611M, with a 22% free cash flow margin, a major milestone.

Full-year operating income surpassed $1B, marking a 4× increase from its previous peak of $269M in 2021. Shopify achieved the Rule of 50, with revenue growth and free cash flow margin exceeding 50%.

Operating expenses dropped to 32% of revenue, compared to 52% in 2022. Headcount fell to 8,100, down from 8,300 in 2023, reflecting disciplined cost management.

AI & Product Innovations

AI-powered tools Sidekiq, Shopify Inbox, and Perplexity search improved merchant productivity and customer engagement. Shopify Balancer Plus introduced next-day payouts and competitive APYs.

Shopify launched tap-to-pay in multiple countries, Shopify Bundles, and expanded order management, streamlining logistics. Shopify Tax coverage expanded in the UK and EU, and Shopify Credit introduced more flexible payment options.

Subscription Solutions

Revenue rose 27% YoY, driven by merchant growth and Shopify Plus adoption. The shift to three-month trials delayed revenue recognition in Q4, impacting Q1 and Q2 2025, but improves merchant retention.

Shopify Plus remained strong, maintaining 33% of Monthly Recurring Revenue (MRR). Pricing adjustments from 2024 boosted revenue but will normalize in 2025.

Shopify faces competitive pressure but strengthens its position through AI, automation, and omnichannel capabilities.

Merchant Solutions

Revenue grew 33% YoY, led by higher Shopify Payments adoption. Gross Payments Volume (GPV) reached 64%, up from 60% in Q4 2023.

Shop Pay processed $27B in Q4 GMV, a 50% YoY increase. The Shop Pay commerce component grew 20× YoY, becoming a key entry point for large brands.

Shopify Capital and Shopify Tax expanded, increasing merchant engagement. Klarna integration and multi-currency payouts strengthened Shopify Markets.

Shopify must increase merchant adoption of financial services to sustain growth. AI-driven automation will enhance efficiency, freeing merchants to focus on revenue.

Shop Pay

Shop Pay now accounts for 41% of total GPV, up from 33% in 2023. Shopify continues expanding Shop Pay commerce components, onboarding Crocs, GameStop, and other enterprise retailers.

Cart syncing improved abandoned checkout recovery, increasing conversion rates. Shop Pay faces competition from Apple Pay and Google Pay but maintains an edge with superior checkout performance and deep Shopify integration.

Klarna & Shopify Markets

Klarna expanded across European markets, offering more flexible payments. Shopify Markets scaled, improving global buyer experiences with UPS shipping options, multi-currency payouts, and localized Shopify Plans in Japanese Yen.

Shop App & Buyer Growth

Shop App GMV grew 84% YoY, with more active users and in-app transactions. Personalized shopping feeds, curated events, and cart syncing improved engagement.

More than 875M consumers purchased from a Shopify merchant in 2024, 1 in 6 internet users globally.

Offline & B2B Growth

Offline commerce grew 26% YoY, driven by point-of-sale adoption. Shopify surpassed $100B in cumulative offline GMV and launched POS in eight new countries.

B2B GMV increased 40% YoY, marking six consecutive quarters of 100%+ growth. Shopify enhanced wholesale purchasing tools, making it a top enterprise B2B solution.

Enterprise & Large Customers

Shopify secured Reebok, Champion, BarkBox, Hunter Douglas, Westwing, and Karl Lagerfeld. FC Barcelona expanded its Shopify partnership, adding unified commerce and POS solutions.

Aldo, Sperry, and Call It Spring transitioned from Shop Pay commerce components to full Shopify adoption. Everlane expanded its Shopify partnership after starting with Shop Pay.

Real Madrid, Newcastle United, LA Lakers, Miami Heat, Dallas Mavericks, and Toronto Maple Leafs joined Shopify. Warner Music Group and global esports teams also migrated.

Shopify’s modular approach accelerates enterprise adoption. Companies start with one solution and scale into full-platform use, significantly reducing time to launch from 12-18 months to just a few months.

International Growth

International GMV grew 33% YoY, outpacing North America. Europe (+37% YoY) led growth, with strong UK, Germany, France, and Netherlands performance.

Shopify holds 12% of the U.S. eCommerce market but less than 1% of global retail, signaling huge expansion potential. The company is investing aggressively in Europe and Japan.

Economic & Regulatory Environment

Shopify gained market share despite macroeconomic headwinds, outperforming global eCommerce growth rates. The company’s 18% free cash flow margin provides flexibility for strategic investments.

Trade policies, including de minimis exemptions, could impact cross-border merchants, but Shopify integrated duty collection tools to reduce risks.

Future Outlook

Revenue growth guidance for Q1 2025 is in the mid-20s%, slightly below Q4’s 31% YoY growth. MRR will be temporarily impacted by the three-month trial transition but improves long-term GMV retention.

Gross profit growth is expected in the low 20s%, driven by Merchant Solutions outpacing Subscription Solutions. No major pricing changes planned in 2025.

Shopify maintains strong free cash flow margins (~18%) but prioritizes AI, enterprise expansion, international growth, B2B, and POS investments over further margin expansion.

The company holds ~$1B in cash ahead of convertible note maturity in 2025 and continues small AI-focused acquisitions with no plans for major M&A.

Management comments on the earnings call.

Product Innovations

Harley Finkelstein, President

"In 2024, we focused a ton on optimizing and fortifying the incredible platform we have built. We fine-tuned the edges, improved performance, and made sure everything works seamlessly together. This year was one of the strongest and most balanced years across all aspects of our business in our twenty-year history."

Harley Finkelstein, President

"Everything we build and do should make our platform even more user-friendly for our merchants. This means stripping away unnecessary processes and focusing on what truly adds value—helping our merchants grow revenue while simplifying complexity for their businesses."

AI Advancements

Harley Finkelstein, President

"We are already transforming our platform into an AI-driven commerce solution where users and machines work seamlessly together. AI is not just part of the future—it is redefining it. We are deepening our investment in AI capabilities to help both new merchants launch and larger merchants scale faster."

Harley Finkelstein, President

"Internally, AI is making our developers more effective and enhancing support teams by automating routine queries, allowing them to focus on higher-value interactions. We are uniquely positioned to harness AI, unlocking unprecedented capabilities for both our merchants and our operations."

Subscription Solutions

Jeff Hoffmeister, Chief Financial Officer

"The transition to three-month paid trials in certain markets is a strategic move aimed at improving long-term merchant success. While it has a short-term impact on revenue recognition, our data suggests that merchants with more time to experiment with our platform achieve stronger GMV milestones and higher retention."

Harley Finkelstein, President

"Merchants continue to believe that we offer the best value in the market. Whether it’s startups, growing brands, or enterprise retailers, our platform remains the most compelling solution for businesses looking to scale quickly, reliably, and at a cost-effective rate."

Shop Pay Growth

Harley Finkelstein, President

"The Shop Pay button has become one of the most valuable pieces of real estate in commerce. Buyers are actively seeking it out during checkout, and if it’s not available, they are more likely to abandon their cart. This demonstrates the immense power of our payment ecosystem."

Jeff Hoffmeister, Chief Financial Officer

"Shop Pay processed $27 billion in GMV this quarter, a 50% year-over-year increase. The commerce component alone surged nearly 20 times year-over-year, proving that enterprise retailers are recognizing the value of our checkout infrastructure and integrating it into their own platforms."

Customer and Merchant Success

Harley Finkelstein, President

"We grow by helping our merchants grow. Their success fuels our own, and that remains the flywheel behind everything we do. From local startups landing their first sale to global brands processing billions in GMV, businesses everywhere are choosing our platform to power their commerce."

Harley Finkelstein, President

"This year, we saw more large brands, sports franchises, and luxury retailers migrate to our platform than ever before. The fact that global brands like Reebok, FC Barcelona, and Karl Lagerfeld are choosing us demonstrates the strength of our offering in both online and offline commerce."

B2B Commerce Expansion

Harley Finkelstein, President

"B2B commerce is growing at an incredible pace. We have now delivered six straight quarters of over 100% year-over-year GMV growth in this category. Our aim is to make our platform the premier self-serve wholesale purchasing platform, providing a unified solution for online and offline transactions."

Jeff Hoffmeister, Chief Financial Officer

"B2B still represents a small portion of our GMV, but the strong growth rates we are experiencing highlight the vast opportunity ahead. We secured a top spot in Forrester’s rankings, which reinforces our leadership in the space and further validates our value proposition for enterprise customers."

Strategic Partnerships Driving Growth

Harley Finkelstein, President

"We are widely recognized as one of the best companies at fostering long-term, mutually beneficial partnerships. Whether it’s our commerce integration with Roblox, our AI-powered search collaboration with Perplexity, or our expanding payments offerings with PayPal and Klarna, we continue to strengthen our ecosystem to drive more value for merchants."

Harley Finkelstein, President

"We have paid out over $1 billion to our partners for apps that benefit our merchants. Our App Store now boasts over 16,000 apps, including more than 675 that are part of our Built for Shopify program, ensuring our merchants have access to best-in-class tools tailored to their needs."

International Growth and Expansion

Harley Finkelstein, President

"Our international GMV grew 33% year-over-year, outpacing North America. We are seeing strong momentum in key regions like the UK, Germany, France, and the Netherlands. Our global reach continues to expand, and we now process more transactions internationally than ever before."

Jeff Hoffmeister, Chief Financial Officer

"We have made tremendous progress in international markets, expanding payment methods, localizing our platform, and growing merchant adoption. Today, 50% of our merchant base is outside of North America, and we see this percentage continuing to rise as we further scale internationally."

Challenges and Competitive Landscape

Harley Finkelstein, President

"Enterprise brands have historically been locked into custom-built or legacy platforms that were costly and difficult to maintain. Now, we are seeing these companies actively seeking modern, cost-effective, and future-proof solutions, which is why they are migrating to our platform in record numbers."

Jeff Hoffmeister, Chief Financial Officer

"One challenge remains merchant adoption of additional financial solutions. While our payments penetration is increasing, we continue to focus on driving greater adoption of products like Shopify Capital and Shopify Tax to ensure merchants are taking full advantage of our ecosystem."

Future Outlook and Strategic Vision

Harley Finkelstein, President

"Our vision goes way beyond the next quarter. We are committed to building a durable, 100-year company that doesn’t just meet the needs of our merchants today but anticipates what they will need in the next five, ten, or twenty years. AI, automation, and enterprise expansion will play a key role in shaping the future of commerce."

Jeff Hoffmeister, Chief Financial Officer

"We have significantly expanded our free cash flow margins over the past two years, but we believe the balance we have achieved in 2024 is the right level. Instead of optimizing for higher margins, we will prioritize investing in AI, international expansion, enterprise growth, and offline commerce—areas where we see immense opportunities ahead."

Harley Finkelstein, President

"This is the best version of our company I’ve seen in my 15 years here. We have the strongest team, the best product, and the most compelling vision for the future. The best part? We’re just getting started."

Thoughts on Shopify Earnings Report $SHOP:

🟢 Positive

Revenue: $2.8B in Q4, +31% YoY, exceeding estimates by 3.2%

Operating Income: Surpassed $1B, a 4× increase from its previous peak

Net Margin: 46.0%, up 15.3 PPs YoY

Free Cash Flow Margin: 21.7%, up 0.9 PPs YoY

Shop Pay GMV: $27B, up 50% YoY, now 41% of total GPV

B2B GMV Growth: +40% YoY, marking six straight quarters of 100%+ growth

International GMV: Grew 33% YoY, outpacing North America, led by Europe (+37% YoY)

Enterprise Adoption: Signed Reebok, Champion, Hunter Douglas, Westwing, Karl Lagerfeld, FC Barcelona, Real Madrid, and LA Lakers

Gross Payments Volume (GPV): $59.5B, up 32% YoY, representing 63% of GMV

Operating Margin: 20.8%, up 2.3 PPs YoY

Shop App GMV Growth: +84% YoY, reinforcing its role in mobile commerce

🟡 Neutral

Gross Margin Decline: 48.1%, down 1.7 PPs YoY, impacted by higher payments penetration

Subscription Solutions Revenue: $666M, +26.9% YoY, maintaining a strong 79.9% Gross Margin, but expected to normalize in 2025

Merchant Solutions Gross Margin: 38.2%, reflecting an ongoing mix shift

Q1 2025 Guidance: $2.32B–$2.34B, +25.2% YoY, slightly beating estimates (+0.8%)

R&D, S&M, and G&A Expenses Lower: Operating efficiency improved, but investments in AI and international expansion will continue

Attach Rate: 2.98%, up 13 BPs YoY, but needs further merchant adoption for sustained growth

FC Barcelona and other major brands adopted Shopify POS, but offline retail still in early scaling phase

EPS: $0.44, in line with estimates, showing no significant earnings outperformance

Higher Diluted Share Count: Up 0.6% YoY, reflecting stock-based compensation (SBC) impact

🔴 Negative

MRR Growth Slowing: $178B, up +19.5% YoY, impacted by transition to three-month trials, which will delay short-term revenue recognition into Q1 & Q2 2025

Competition in Payments: While Shop Pay continues to grow, competitors Apple Pay & Google Pay remain threats

Regulatory & Trade Risks: De minimis exemptions and tariffs could impact cross-border merchants, but Shopify is addressing this through duty collection integrations

No Major Pricing Adjustments in 2025, limiting subscription revenue acceleration after last year’s price increases