Shopify Q3 2024 Earnings Analysis

Dive into $SHOP Shopify’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

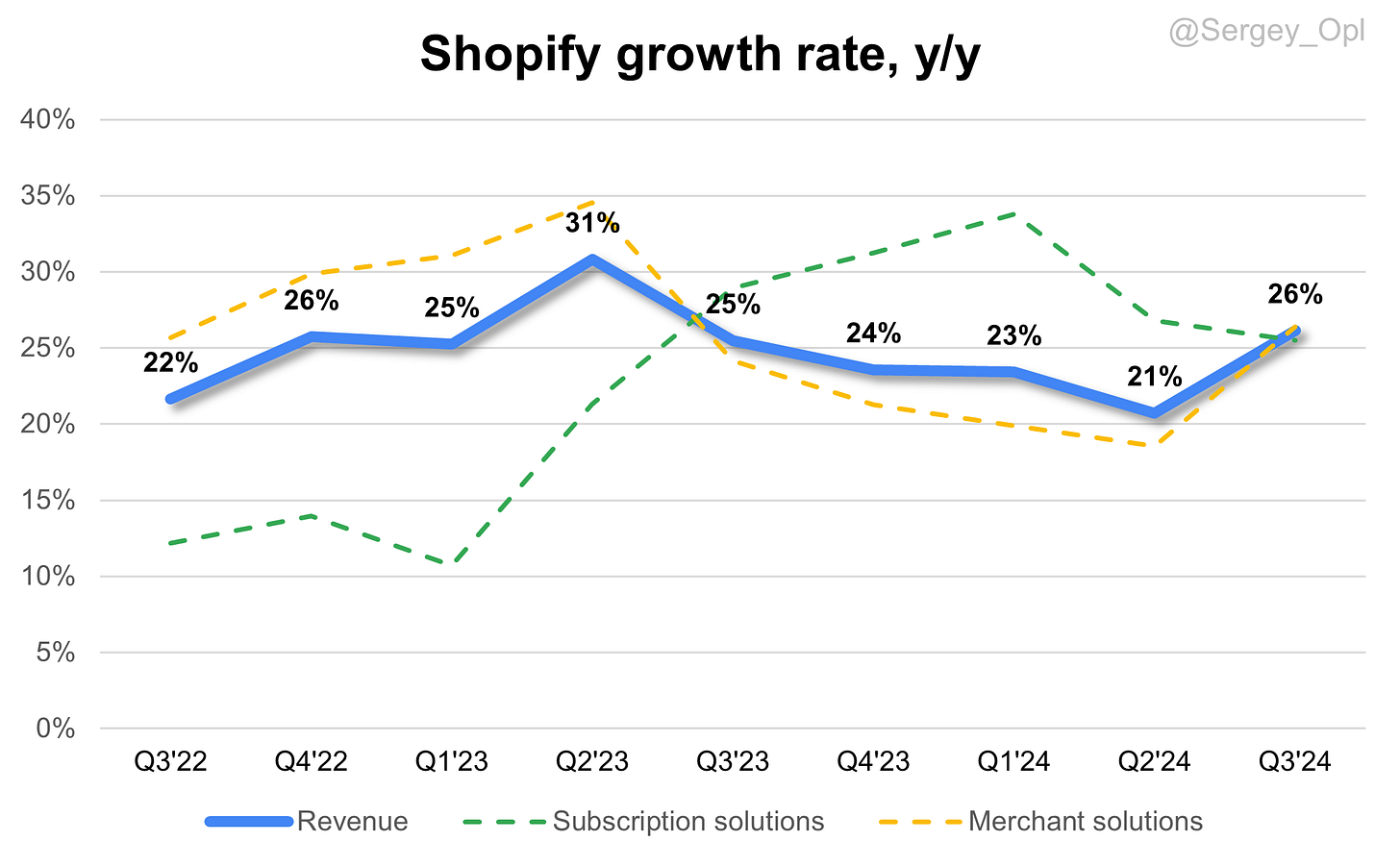

↗️$2,162.0M rev (+26.1% YoY, +20.7% LQ) beat est by 2.5%

➡️GM* (51.6%, -1.2 PPs YoY)🟡

➡️Operating Margin* (18.4%, +2.6 PPs YoY)

➡️FCF Margin (19.5%, +3.4 PPs YoY)

↗️EPS* $0.64 beat est by 137.0%

*non-GAAP

Segment Revenue

➡️Subscription solutions $610M rev (+25.5% YoY, 82.3% Gross Margin)🟡

↗️Merchant solutions $1,552M rev (+26.4% YoY, 39.7% Gross Margin)🟢

Key Metrics

➡️GMV $69.72B (+24.0% YoY)🟡

↗️GPV $42.90B (+30.9% YoY, 61.5%% of GMV)🟢

➡️MRR 175B (+24.1% YoY)🟡🟡

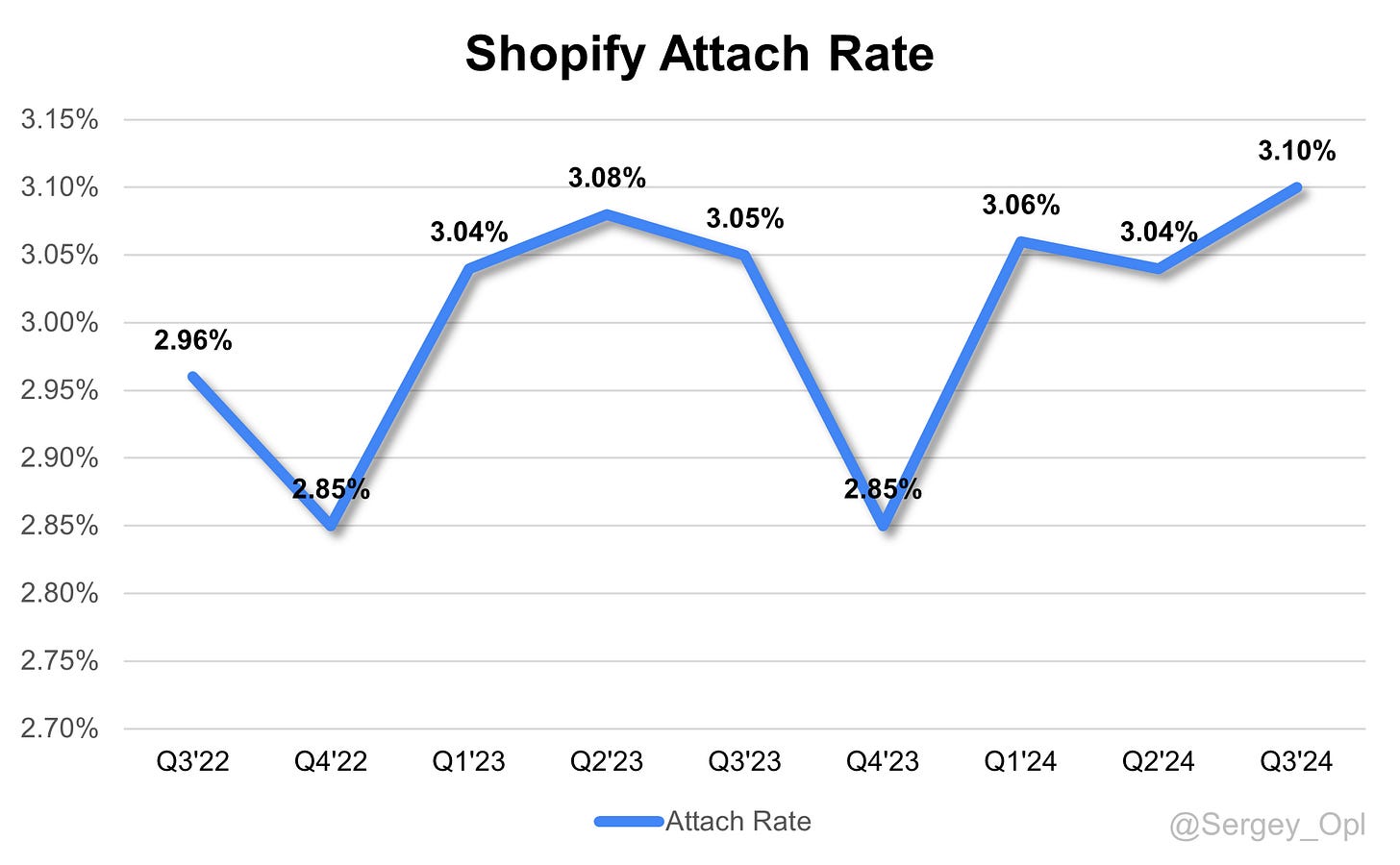

↗️Attach Rate 3.10% (+5 BPs YoY)

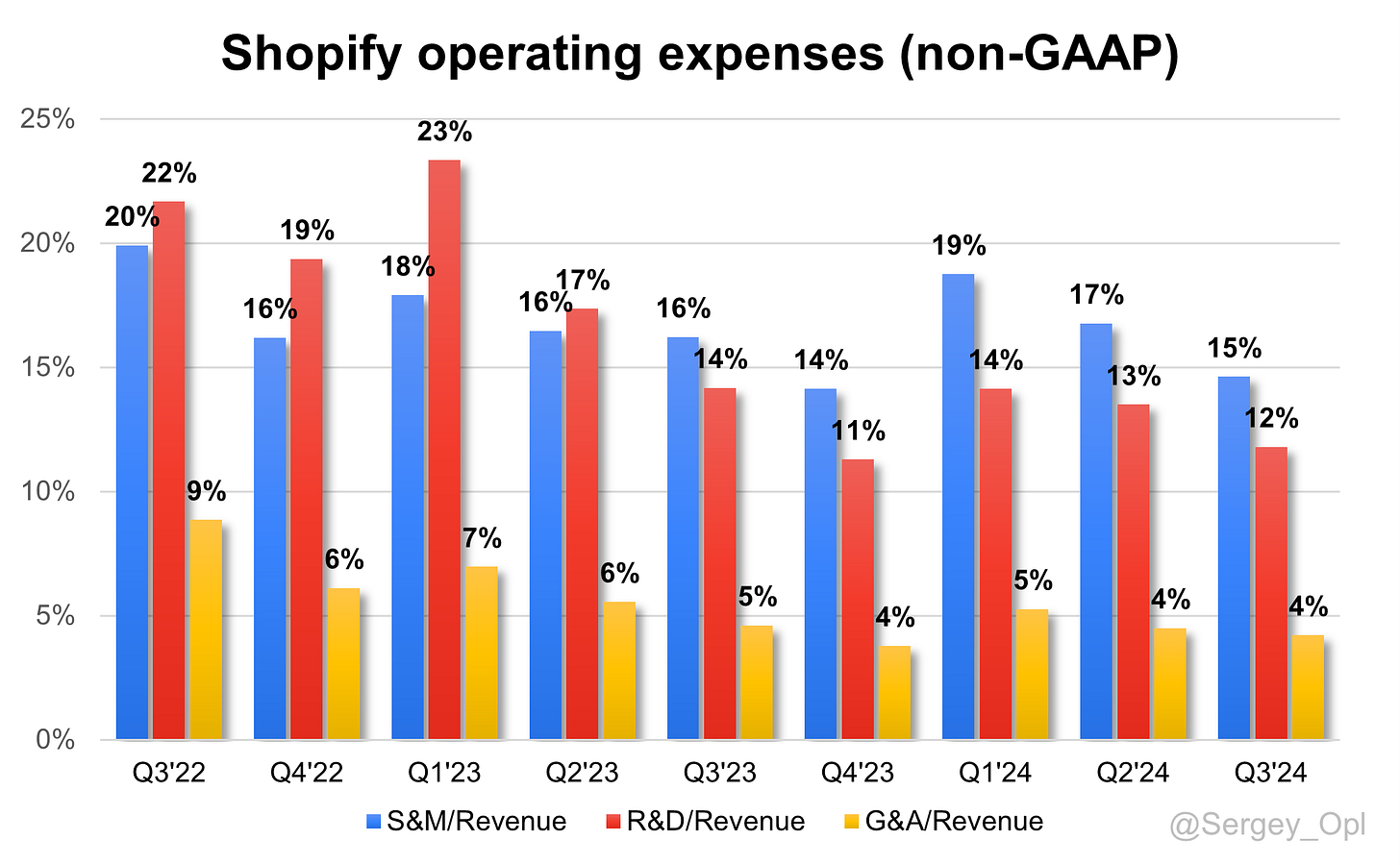

Operating expenses

↘️S&M*/Revenue 14.6% (-1.6 PPs YoY)

↘️R&D*/Revenue 11.8% (-2.4 PPs YoY)

↘️G&A*/Revenue 4.2% (-0.4 PPs YoY)

Dilution

↘️SBC/rev 5%, -0.0 PPs QoQ

↘️Basic shares up 0.6% YoY, -0.1 PPs QoQ🟢

↘️Diluted shares up 0.4% YoY, -1.1 PPs QoQ🟢

Guidance

↗️Q4'24 $2,670.0 - $2,770.0M guide (+26.9% YoY) beat est by 3.4%

Key points from Shopify’s Third Quarter 2024 Earnings Call:

Financial Performance

In Q3 2024, Shopify reported strong financial growth, with GMV (Gross Merchandise Volume) increasing 24% YoY, marking its fifth consecutive quarter of 20%+ GMV growth. Revenue climbed 26% to $2.2 billion, driven by strong performance across core markets and an increased 62% penetration of Shopify Payments. Shop Pay processed $17 billion in GMV, up 42% YoY, underscoring its role in Shopify’s ecosystem. Operating income more than doubled, while free cash flow margin expanded to 19%. Shopify projects Q4 revenue growth in the mid-to-high 20% range, with annual free cash flow margin expected in the high teens.

Product Innovations and Automation

Shopify introduced significant updates to improve merchant efficiency. Shopify Flow, a low-code workflow automation tool, added new triggers and 300+ API connectors for managing workflows and processing orders more efficiently. Shopify Inbox now employs AI for tailored customer responses, used in 50% of merchant interactions to boost response times and conversions. Shopify Tax now includes VAT compliance support for merchants in the UK and EU, easing cross-border operations with automated tax filings and compliance insights.

Subscription Solutions

Shopify's Subscription Solutions grew 26% YoY in Q3, driven by an increase in merchant adoption, revised pricing models, and subscription enhancements. Monthly Recurring Revenue (MRR) rose 28% YoY to $175 million, with Shopify Plus contributing 31% to MRR, indicating demand among enterprise clients. Product innovations, including enhancements to Shopify Flow and the integration of Shopify Tax, added value across B2B and D2C segments, helping Subscription Solutions gain traction, particularly in Europe, where MRR growth outpaced North America.

Challenges remain around balancing price adjustments with customer retention, as merchants navigate a challenging economic landscape. Shopify has managed these by maintaining transparent pricing and a focus on customer success.

Merchant Solutions

Merchant Solutions achieved 26% YoY growth, supported by GMV expansion, a higher adoption of Shopify Payments (which processed $43 billion in GMV, up 31% YoY) and Shop Pay. Shop Pay handled 40% of Gross Payment Volume (GPV) in North America. Integrating PayPal wallet transactions into Shopify’s admin enhanced transaction visibility, positioning it for further revenue recognition gains.

Innovation in Merchant Solutions remains a priority. New Shopify Flow functionalities support B2B workflows, and Tap to Pay functionality for POS expanded to Australia and key European markets, driving a 27% YoY increase in offline GMV. Shopify Finance continued to grow, providing merchants with tools like Capital, Balance, and Bill Pay for better cash flow and streamlined operations. Lower-margin payment methods such as credit cards impacted margins, but Shopify's expansion and omni-channel focus helped counterbalance these pressures.

Shopify Markets and International Expansion

The Shopify Markets initiative is central to Shopify’s international growth, simplifying cross-border sales with tools like Shopify Tax, which now includes VAT compliance for UK and EU merchants. Shopify’s Managed Markets has enabled 83% of users to expand to new countries, achieving over 40% growth in international sales. Shopify’s international GMV grew 30%+ YoY in Q3, outpacing North America, with notable traction in Germany and France.

AI-Driven Enhancements

Under CTO Mikhail Parakhin, Shopify accelerated AI-driven product improvements. Shopify Inbox now uses AI to improve customer support efficiency with auto-suggested replies, while the Shop App’s machine learning models enhance user experience by offering personalized brand recommendations. These improvements led to an 18% increase in sessions where users engaged with brand recommendations, benefiting both merchant discovery and engagement.

Shopify Flow

Shopify Flow added new automation triggers and 304 API connectors, allowing merchants to streamline product updates, form submissions, and order management. By automating these tasks, Shopify Flow enables merchants to reduce costs and focus on growth activities. The tool also now supports B2B workflows, which optimize efficiency and improve customer service for enterprise clients.

Shop App Enhancements

Updates to the Shop App enhanced brand discovery and personalization with AI. A new home feed showcases brands based on user preferences, leading to an 18% engagement increase in sessions involving brand recommendations. High-profile brands like Drake and Mr. Beast have used the app for exclusive launches, establishing the Shop App as a growing e-commerce platform for consumers and helping merchants build brand loyalty.

Shop Pay Growth

Shop Pay processed $17 billion in GMV, a 42% YoY increase, with a 62% penetration rate among Shopify merchants. Integration with PayPal wallet transactions into Shopify’s admin allows merchants to manage payments more seamlessly, positively impacting revenue recognition and gross profit. Shop Pay is an integral part of Shopify’s ecosystem, supporting seamless payments, enhancing customer trust, and increasing conversion rates.

Offline Retail Expansion

Shopify expanded its offline retail capabilities by extending Tap to Pay within its POS system to Australia, Germany, the Netherlands, and the UK, as well as Android devices, allowing contactless payments. Offline GMV rose 27% YoY, with brands like Laura and Fit2Run adopting Shopify’s POS solutions for omni-channel sales. Enhancements such as offline payment support and customer personalization features make Shopify’s POS system attractive to multi-location merchants, supporting omni-channel growth.

B2B Commerce Enhancements

Shopify’s B2B GMV grew 145% YoY as new features, including product bundles, enhanced conversion tracking, and Shopify Flow’s automation templates, streamlined B2B workflows and boosted operational efficiency. The platform attracted new B2B sectors such as industrial goods and automotive parts, which contributed significantly to GMV growth.

Customer Base and Merchant Success

Shopify continues to prioritize merchant success by simplifying commerce, compliance, and cross-border operations with tools like Shopify Flow and Shopify Tax. These tools help merchants focus on product innovation and customer engagement. Shopify’s 62% penetration of Shopify Payments and Shop Pay further strengthens the user experience and supports merchant growth.

Internationally, Managed Markets has enabled merchants to expand into new territories, aligning Shopify’s growth with merchant success. Merchants using Managed Markets increased their reach, with an average 40% growth in international sales. Shopify’s symbiotic growth model ensures both merchant and company success.

Customer Success Stories

Shopify’s Managed Markets feature enabled 83% of merchants in a sample group to expand internationally, with over 40% sales growth in new countries. Canadian retailer Laura transitioned 130+ stores to Shopify’s POS system, underlining the platform's omni-channel appeal for established retailers. The Shop App has become a significant engagement tool, with brands like Drake and Mr. Beast using it for exclusive product launches. Consumer metrics show an 18% increase in engagement sessions, highlighting the app’s role in brand discovery.

Large Customer Wins

Shopify’s expansion into the enterprise sector gained momentum with Q3 onboarding of brands like Reebok, Off-White, FASHIONPHILE, Beautycounter, and Lions Gate Entertainment. Shopify’s Commerce Components solution was a key driver, allowing large brands to customize features like checkout. The flexible architecture led On Running to adopt Shopify’s checkout component, demonstrating its scalability.

Luxury and high-GMV brands such as Brilliant Earth and Vera Bradley also chose Shopify, attracted by the rapid deployment capabilities. An outdoor gear company integrated Shopify’s Shop Pay in under three weeks, reinforcing Shopify’s strength in rapid enterprise adoption. This momentum in the enterprise segment, coupled with system integrations, positions Shopify as a leader in omni-channel commerce for large-scale brands.

Macroenvironment

Shopify displayed resilience in Q3 2024 despite a challenging macroeconomic environment, supported by steady GMV growth from increased online and offline consumer spending. Shopify’s disciplined cost management and operational efficiency have ensured revenue growth and robust free cash flow margins. The company benefits from trends like digital transformation in commerce, consumer preference for online shopping, and increasing omni-channel adoption. International growth, especially in Europe, has also diversified Shopify’s revenue base, mitigating pressures in North America.

Future Outlook

For Q4 and beyond, Shopify anticipates revenue growth in the mid-to-high 20% range, driven by holiday sales and strong online and offline channels. Management projects a stable free cash flow margin in the high teens, maintaining a balance between profitability and reinvestment in AI, enterprise expansion, international growth, and B2B solutions. Shopify remains committed to advancing merchant productivity, customer experience, and strategic investments to sustain growth and profitability in the quarters ahead.

Management comments on the earnings call.

Product Innovations

Harley Finkelstein, President

"Our focus on continuous product innovation drives value for merchants by automating complex workflows and reducing operational bottlenecks. Enhancements in tools like Shopify Flow and Shopify Inbox enable merchants to operate more efficiently and deliver better customer experiences."

Competitors

Harley Finkelstein, President

"As larger brands and enterprises seek unified, omni-channel solutions, we’re seeing our flexibility and rapid implementation capabilities set us apart. Our platform provides the transparency, speed, and robust ecosystem that modern businesses need, allowing us to gain ground against legacy competitors."

Customers

Harley Finkelstein, President

"Our platform is built around merchant success. Every update and feature we roll out is geared towards making it easier for them to focus on what they do best: building and growing their businesses. The demand from enterprises and high-GMV brands reflects the trust and value merchants place in our platform."

International Growth

Jeff Hoffmeister, CFO

"Our international growth strategy is yielding solid results, particularly in Europe, where we’re seeing increased adoption in markets like Germany, France, and the Netherlands. Expanding our global footprint allows us to provide local solutions that help merchants expand cross-border with ease and compliance."

Challenges

Jeff Hoffmeister, CFO

"Managing cost pressures and maintaining balance between investment and profitability is critical in this macroeconomic climate. By staying disciplined in our approach, especially around headcount and efficient operations, we are well-positioned to sustain growth and margin strength."

Future Outlook

Jeff Hoffmeister, CFO

"Looking ahead, our priority is to maintain steady revenue growth in the high 20% range, with a free cash flow margin that balances profitability with reinvestment in high-potential areas like AI, international expansion, and enterprise solutions. We’re building for long-term growth, while meeting the needs of our merchants today."

Thoughts on Shopify ER SHOP:

🟢 Pros:

+ Revenue growth rate at 26.1% YoY. If the company beats the forecast similarly to this quarter by 3.0%, growth could accelerate to 28.2% next quarter.

+ The company is increasing margins and profitability on YoY basics and sequentially.

+ Beat Q3 revenue guidance by 3.0%.

+ Gross Merchandise Volume (GMV) growing at 24% YoY, and Gross Payment Volume (GPV) is growing 31% YoY, accelerating compared to last quarter. GPV is growing faster than revenue.

+ Merchant solutions revenue growing at 26.4%, a significant acceleration from the 18.6% growth last quarter, with a solid gross margin of 40%.

🟡 Neutral:

+- Subscription solutions revenue has slightly decelerated to 25.5%, with a gross margin close to a record level of 82.3%.

+- SBC/rev is 5%.

+- Diluted shares are up 0.4% YoY.