Shopify Q2 2024 Earnings Analysis

Dive into $SHOP Shopify’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

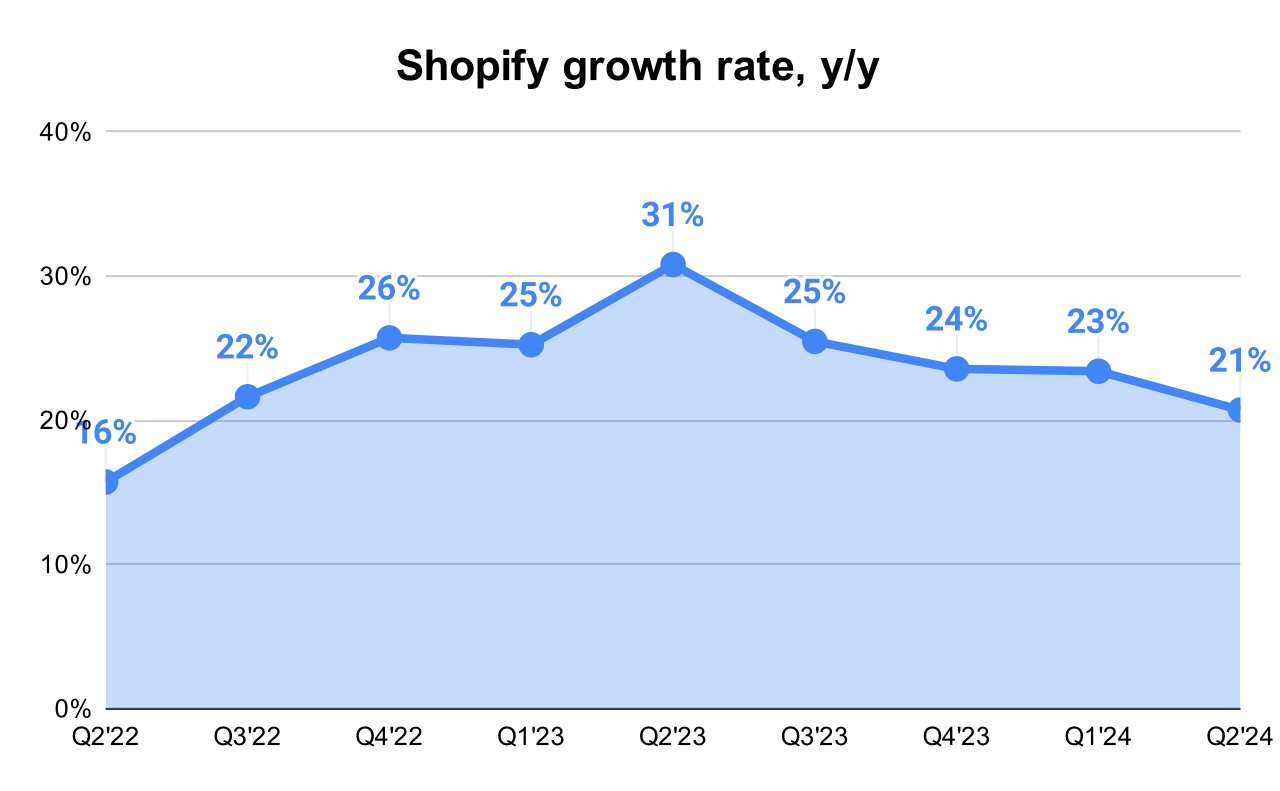

↗️$2,045.0M rev (+20.7% YoY, +23.4% LQ) beat est by 1.7%

↗️adj Rev growth (+25.0% YoY, +29.0% LQ)

↗️GM* (51.4%, +1.6 PPs YoY)

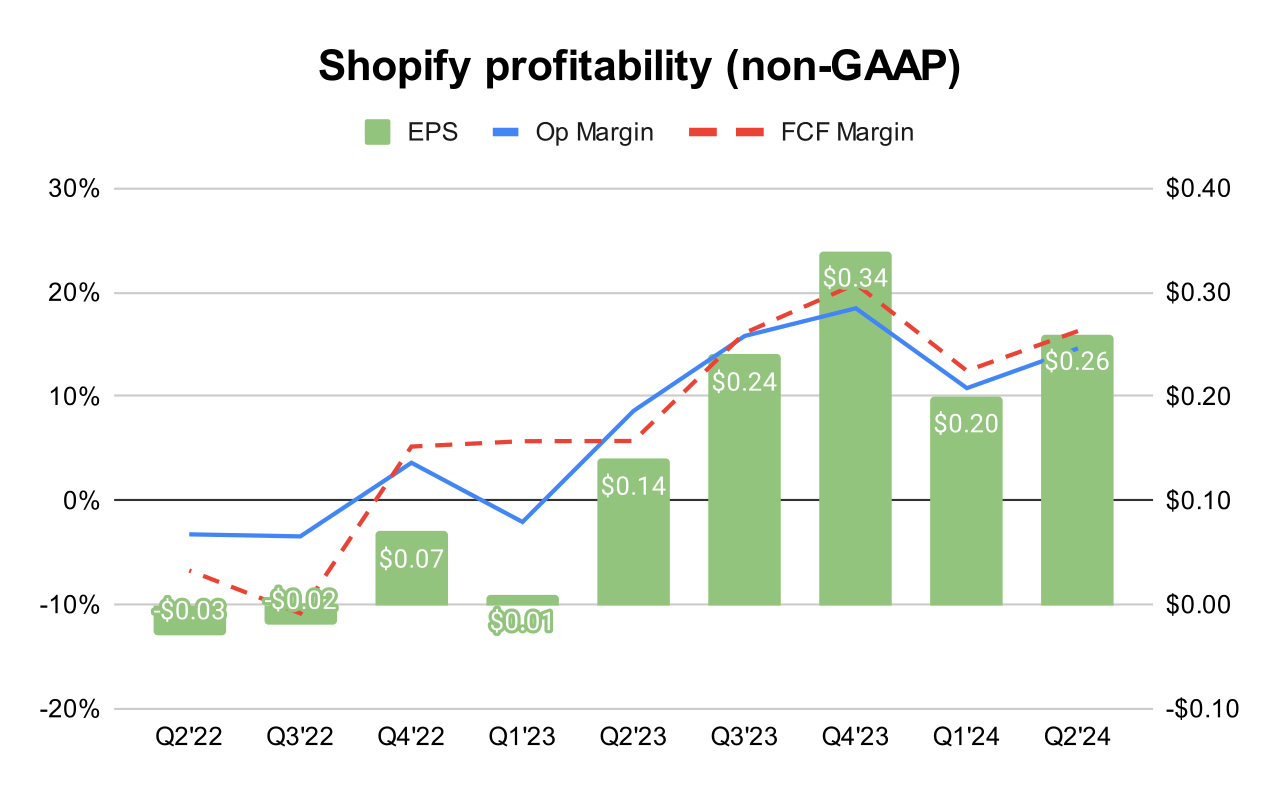

↗️Operating Margin* (14.6%, +6.0 PPs YoY)

↗️Net Margin* (16.9%, +6.4 PPs YoY)

↗️EPS* $0.26 beat est by 30.0%

*non-GAAP

Segment Revenue

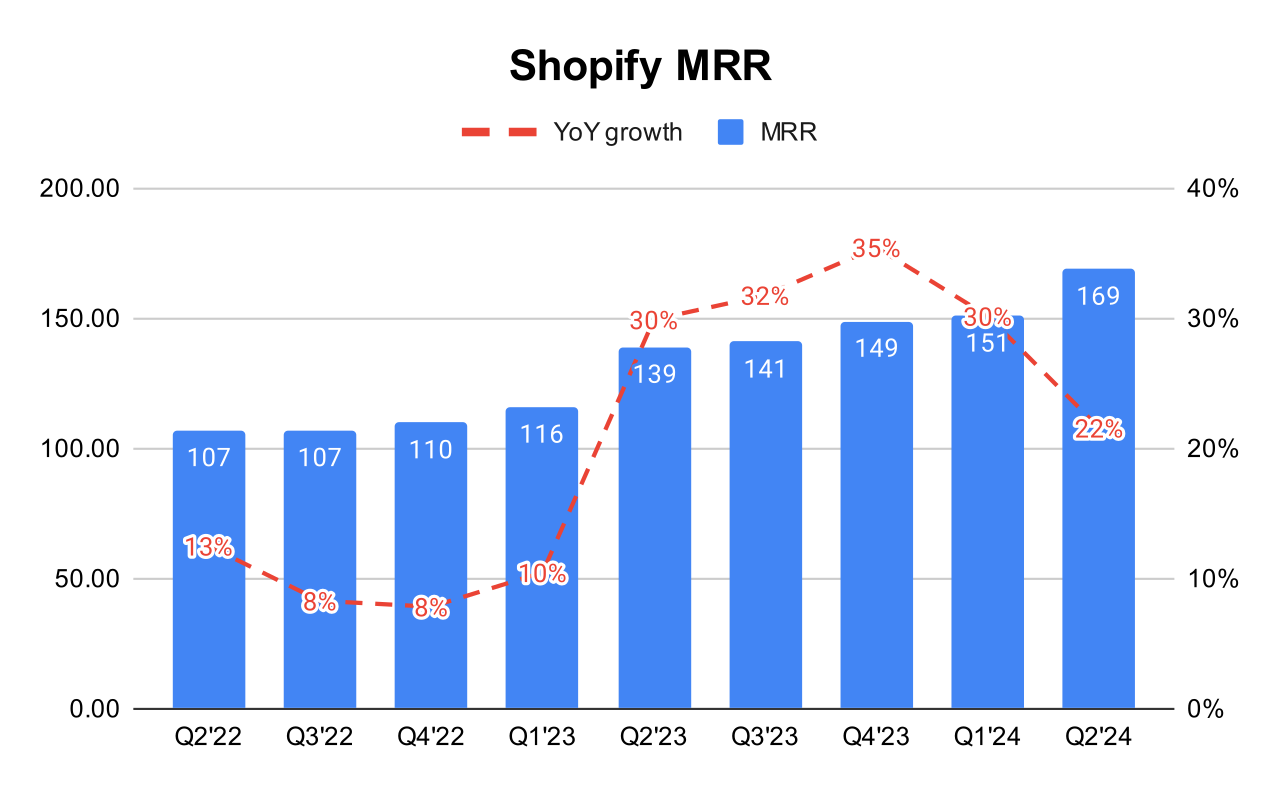

↗️Subscription solutions $563M rev (+26.8% YoY, 82.8% Gross Margin)

➡️Merchant solutions $1,482M rev (+18.6% YoY, 39.1% Gross Margin)🟡

Key Metrics

↗️GMV $67.25B (+22.2% YoY)

↗️GPV $41.10B (+29.7% YoY, 61.1%% of GMV)

↗️MRR 169B (+21.6% YoY)

↘️Attach Rate 3.04% ( -4 BPs YoY)🟡

Operating expenses

↗️S&M*/Revenue 16.8% (+0.3 PPs YoY)

↘️R&D*/Revenue 13.5% (-3.9 PPs YoY)

↘️G&A*/Revenue 4.5% (-1.1 PPs YoY)

Dilution

↘️SBC/rev 5%, -0.6 PPs QoQ

↘️Basic shares up 0.7% YoY, -0.2 PPs QoQ🟢

↗️Diluted shares up 1.5% YoY, +1.9 PPs QoQ

Guidance

↗️Q3'24 $2,099.7M guide (+22.5% YoY) beat est by 1.4%

Key points from Shopify’s Second Quarter 2024 Earnings Call:

Revenue Growth:

Shopify reported a 25% year-over-year revenue growth, excluding logistics, and a gross merchandise volume (GMV) of $67.2 billion, up 22% from the previous year. This growth is attributed to strong sales performance from existing merchants, particularly those on Shopify Plus, and robust new merchant acquisition across Europe.

Unified Commerce Capabilities:

Shopify has evolved from an online store provider to a comprehensive unified operating system for commerce. This integration simplifies operations for merchants, allowing them to manage both online and offline sales through a single platform. The system facilitates seamless interactions across different sales channels, reducing complexity for businesses as they scale up.

Shopify Markets:

The introduction of Shopify Markets streamlines international commerce by consolidating previous offerings into two main products: cross-border products and managed markets. This simplifies the process for merchants to enter new markets by setting up and customizing their international operations directly from their Shopify dashboard, eliminating the need to manage multiple stores.

Point of Sale Enhancements:

Shopify's point of sale (POS) solution continues to evolve, integrating online and offline commerce more effectively. Recent updates include a remote smart grid layout editor, omnichannel return rules, and the ability to stack multiple discounts at checkout. These features help merchants enhance operational efficiency and tailor promotional strategies to specific needs, thereby supporting larger, global merchants with multiple store locations.

B2B Commerce Enhancements:

Shopify has significantly improved its B2B commerce capabilities, introducing features like deposits at checkout and manual payment methods. These additions make the B2B purchasing process smoother and more competitive, helping merchants manage and track their business seamlessly across channels.

Shop Pay and Shopify Payments:

The Shop Pay feature, recognized for its high conversion rates, continues to be a major draw for enterprise brands considering Shopify. It not only acts as a digital wallet but also provides comprehensive order tracking via the Shop app and allows buyers to earn ShopCash, which can be redeemed for purchases within the app. This builds greater customer engagement and drives additional sales.

International Expansion:

International GMV growth outpaced North American growth, with significant expansion in Europe where GMV grew by 32%. This is attributed to both new merchant acquisition and strong same-store sales growth.

Shopify has localized its offerings in key international markets, rolling out POS terminals in eight additional countries and launching Shopify plans in local currencies like Japanese yen, enhancing the user experience and customer engagement in these regions.

Customers:

Shopify has seen robust growth in its merchant base, which is diversified across various industries and geographies. This growth is supported by new product launches and enhanced platform capabilities, particularly in areas like B2B commerce, where there's been a significant increase in both the number of orders and the number of merchants engaging in B2B transactions.

Notable enterprises and high-profile brands have adopted Shopify, driven by its comprehensive commerce solutions and high conversion rates offered by features like Shop Pay. Brands like Toys R Us, Barnes and Noble, and new celebrity ventures are now using Shopify, underscoring its appeal to large-scale businesses.

Macroenvironment:

Despite broader market concerns about softening consumer spending, Shopify did not observe significant deterioration or improvement in consumer behavior during the quarter. The platform's broad merchant base and diversity in product offerings have helped stabilize its performance against macroeconomic fluctuations.

Future Outlook:

Looking forward, Shopify remains focused on driving growth through strategic marketing, international expansion, and enhancing enterprise features. They anticipate continued revenue growth and margin improvements as they optimize operations and invest in long-term opportunities.

Management comments on the earnings call.

Merchants

Harley Finkelstein, President: "What makes Shopify so powerful is how seamlessly all parts of the product work together, reducing complexity at every stage of our merchants' journey. We understand that starting a business is hard, and expanding into new markets adds even more complexity. As our merchants grow, Shopify tackles these challenges so they don't have to."

Harley Finkelstein, President: "One of the biggest challenges that merchants face when selling internationally is after they make the sale. Now they've got to actually get the purchase to the buyer. So we've added support for UPS and managed markets in Q2, which makes it even easier for merchants to get great expedited shipping rates to their international buyers."

International Expansion

Harley Finkelstein, President: "Our international GMV growth continues to outpace North America, up 27% from last year, driven by two main goals, expanding our presence and introducing more products in more markets."

Macroenvironment

Jeff Hofmeister, CFO: "From our vantage point, the quarter was pretty consistent in terms of what we've seen. I do know that there are a lot of people out there talking about softening consumer spend and we hear that too. I think from us, the key point is we are working with our merchants to help them be very successful in this environment. We didn't see any significant deterioration or improvement throughout the quarter."

Future Outlook

Harley Finkelstein, President: "We are investing in sustainable growth and driving profitability for the long term. This very unique ability that we have to serve the largest brands while also inspiring new entrepreneurs to launch and scale businesses make Shopify an incredibly durable company. We are so well positioned to power more commerce globally for the years to come."

Thoughts on Shopify ER $SHOP :

🟢 Pros:

+ Revenue growth rate at 20.7% YoY. If the company beats the forecast similarly to this quarter by 1.4%, growth could accelerate to 24.3% next quarter.

+ The company is increasing margins and profitability on YoY basics.

+ Beat Q2 revenue guidance by 1.4%.

+ GMV growing at 22% YoY and GPV is growing 30% YoY, faster than revenue.

+ Subscription solutions revenue growing at 27%, with a record gross margin of 83%.

🟡 Neutral:

+- SBC/rev is 5%.

+- Diluted shares are up 1.5% YoY.