ServiceNow Q4 2024 Earnings Analysis

Dive into $NOW ServiceNow’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results

↘️$2,957M rev (+21.3% YoY, +22.2% LQ) missed est by -0.1%🔴

↘️GM* (81.9%, -0.4 PPs YoY)🟡

↗️Operating Margin* (29.5%, +0.1 PPs YoY)

↘️FCF Margin (47.3%, -7.8 PPs YoY)🟡

➡️EPS* $3.67 in line with est

*non-GAAP

Subscription Revenue

➡️$2,866.0M Subscription rev (+21.2% YoY)

↘️Subscription GM* (81.7%, -0.2 PPs YoY)

Key Metrics

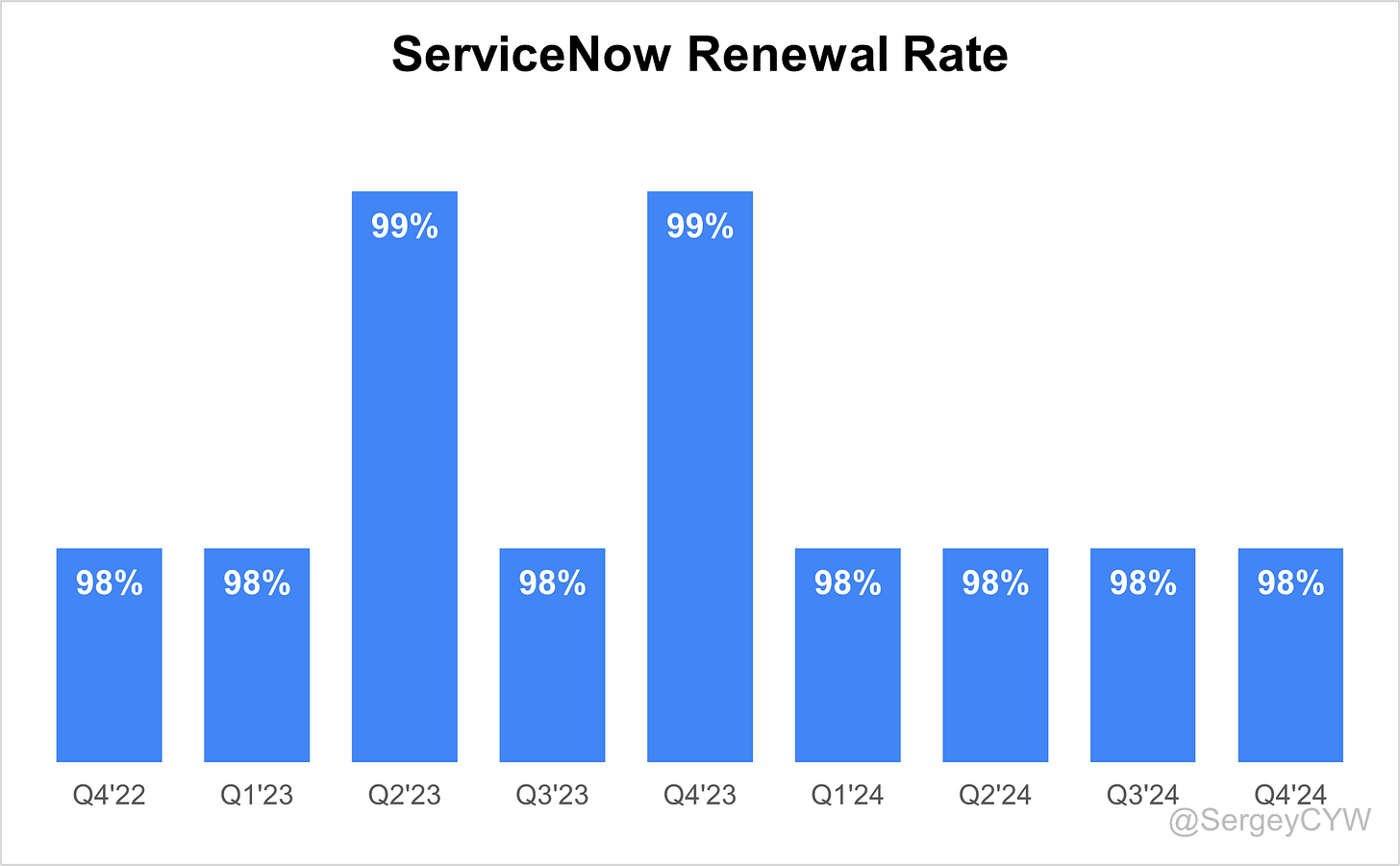

➡️Renewal Rate 98% (98% LQ)

➡️сRPO $10.27B (+19.4% YoY)🟡

↗️RPO $22.30B (+23.9% YoY)

Customers

➡️2,109customers $1M+ ACV (+11.2% YoY, +89)

Quarterly Performance Highlights

↗️Net New ARR $604M (+1.3% YoY)

↗️CAC* Payback Period 19.2 Months (+2.9 YoY)🟡

↘️R&D* Index (RDI) 1.24 (-0.24 YoY)🟡

Dilution

↗️SBC/rev 15%, +0.1 PPs QoQ

↘️Basic shares up 0.8% YoY, -0.2 PPs QoQ🟢

↘️Diluted shares up 1.3% YoY, -0.5 PPs QoQ

Guidance

↘️Q1'25 $2,995.0 - $3,000.0M guide (+18.8% YoY) missed est by -1.0%🔴

↘️$12,635.0 - $12,675.0M FY guide (+18.9% YoY) missed est by -1.3%🔴

Key points from ServiceNow’s Fourth Quarter 2024 Earnings Call:

Financial Performance

ServiceNow exceeded expectations in Q4 2024, with subscription revenue of $2.866 billion (+21% YoY). Full-year subscription revenue hit $12.675 billion (+20% YoY).

RPO reached $22.3 billion (+26% YoY), CRPO hit $10.27 billion (+22% YoY).

Q4 operating margin was 29.5%, exceeding guidance by 50 bps. Full-year operating margin expanded 200 bps to 29.5%.

Free cash flow reached $3.5 billion, with a 31.5% margin, surpassing projections by 50 bps.

Enterprise adoption grew, with 2,109 customers generating over $1 million in ACV (+35% YoY in $20M+ ACV customers). The company closed 19 deals over $5 million, including three over $20 million.

AI Acceleration

ServiceNow’s AI adoption surged, with 150% QoQ growth in Pro Plus AI deals across ITSM, CSM, and HRSD.

Now Assist AI adoption outperformed previous product launches. More than 1,000 customers use AgenTic AI, driving automation and workflow orchestration.

AI Monetization Model

ServiceNow launched a hybrid pricing model, integrating AI agents into Pro Plus SKUs as part of the base subscription, with metered pricing for incremental usage.

Traditional per-seat pricing models limit scalability, while AI-driven automation increases system usage and monetization potential. The model is expected to accelerate revenue growth as AI usage expands.

Raptor DB

Raptor DB, a high-performance database based on PostgreSQL, has five customers with $1M+ ACV within months of launch.

The solution delivers 3.5x faster response times and 30%+ database size reductions.

Seamless integration with Snowflake, Databricks, Oracle, AWS, Azure, and Google Cloud strengthens ServiceNow’s role in AI-powered enterprise data automation.

Strategic Partnerships

ServiceNow expanded AI-driven collaborations:

AWS & Google Cloud: AI-powered workflow automation

Microsoft: AI-driven CRM innovation with Copilot

Visa: AI-enhanced dispute management

Five9: AI-powered contact center efficiency

International Growth

Manufacturing revenue surged 50% YoY, while public sector revenue grew nearly 40%, driven by U.S. federal and state contracts.

The U.S. federal sector ($125B IT spend) remains a key growth driver, with AI modernization creating new contract opportunities.

Large Enterprise Wins

Petrobras: Automated 6,000+ applications, processing 250,000+ requests monthly.

Grupo Bimbo: Optimized factory operations with real-time AI insights.

Toyota & Rolls-Royce: AI-driven workflow automation.

NTT Data: Expanded AI transformation initiatives.

Scouting America: Largest-ever nonprofit deal.

Stock Buyback

ServiceNow expanded its share repurchase program by $3 billion, building on $1.5 billion previously authorized.

With $10 billion in cash, the company aims to reduce dilution and maintain flexibility for AI and R&D investments.

Weaker Guidance

2025 subscription revenue guidance: $12.635B-$12.675B (+20% YoY).

Cautious outlook reflects uncertainty in AI monetization timing and election-driven delays in U.S. federal IT spending.

Gross Margin Pressure

2025 subscription gross margin expected at 83.5%, slightly lower due to AI and data center investments.

Despite these costs, operating margin is projected to expand to 30.5% (+100 bps YoY), with free cash flow margin rising to 32% (+50 bps YoY).

RPO Growth Slowdown

RPO grew 26% YoY to $22.3 billion, CRPO rose 22% YoY to $10.27 billion.

Growth slowed due to seasonality in large contracts and federal spending uncertainty. AI adoption could reaccelerate RPO, but timing remains uncertain.

Future Outlook

CEO Bill McDermott reaffirmed a $30B+ long-term revenue goal, with $15B+ expected by 2026.

AI automation, data integration, and workflow orchestration will drive sustained growth.

Hybrid subscription-consumption pricing positions ServiceNow for long-term AI monetization, increasing cross-sell and upsell opportunities.

Management comments on the earnings call.

Product Innovations

Bill McDermott, Chairman and Chief Executive Officer

"We are putting AI to work for people. Our innovation, growth, profitability, and brand leadership position us as a class of one in enterprise software. The market is moving with us, and our strategy is clear: drive workflow orchestration, AI automation, and enterprise transformation at scale."

Amit Zavery, President and Chief Operating Officer

"With Raptor DB, AI agents, and a deeply integrated workflow fabric, we are delivering the most advanced automation solutions. Our customers are seeing significant improvements in speed, efficiency, and operational intelligence—all powered by our AI-driven platform."

AI Monetization Model

Bill McDermott, Chairman and Chief Executive Officer

"We have structured our AI monetization strategy to be both predictable and scalable. Customers start with a base subscription, but as they unlock AI-driven efficiencies, the consumption model kicks in—driving value for them and high-margin revenue growth for us. This is a game-changer."

Amit Zavery, President and Chief Operating Officer

"The shift to AI-powered automation is happening rapidly, and we’ve designed our business model to reflect that reality. With Pro Plus, customers gain access to AI agents that scale dynamically with their needs, creating a powerful flywheel effect in AI adoption."

Strategic Partnerships

Bill McDermott, Chairman and Chief Executive Officer

"The industry is moving fast, and we are positioned at the center of it. Whether it’s AWS, Google Cloud, Microsoft, Visa, or Five9—our partnerships amplify our reach, embedding our AI-powered workflows into the most critical enterprise systems worldwide."

Gina Mastantuono, President and Chief Financial Officer

"By integrating with hyperscalers, financial institutions, and enterprise software leaders, we are not only expanding our market reach but also making it easier for customers to deploy and scale our platform within their existing ecosystems."

International Growth

Bill McDermott, Chairman and Chief Executive Officer

"Every CEO I meet, regardless of region or industry, wants to simplify their business and unlock the potential of AI-driven workflows. From Asia to Europe to Latin America, our global customers are embracing AI-powered automation to redefine how they operate."

Customers and Large Enterprise Adoption

Bill McDermott, Chairman and Chief Executive Officer

"We have 1,000 customers actively using our AI-driven platform today. These companies aren’t just experimenting; they’re transforming their businesses with automation, AI agents, and data orchestration at scale."

Gina Mastantuono, President and Chief Financial Officer

"Customer success is at the heart of what we do. With a 98% renewal rate and continued growth in our largest deals, it’s clear that organizations are deepening their investments in our platform to drive long-term value."

Weak Guidance and Market Caution

Gina Mastantuono, President and Chief Financial Officer

"We are guiding prudently for 2025, reflecting AI monetization dynamics and federal spending cycles. While we expect strong growth, we are factoring in near-term considerations such as election-related federal procurement shifts and a more pronounced backloaded revenue pattern."

Challenges in Scaling AI Consumption

Bill McDermott, Chairman and Chief Executive Officer

"The AI revolution is happening faster than many anticipated, but the challenge is in scaling adoption efficiently. Enterprises are eager to implement AI-driven workflows, but they also need time to transition from traditional models. We’re making that transition seamless with our hybrid subscription and consumption-based approach."

Gina Mastantuono, President and Chief Financial Officer

"AI-driven consumption will take time to reach its full revenue impact. We are confident in the long-term trajectory, but in the short term, we are being prudent in forecasting how customers scale their AI utilization."

Future Outlook and Long-Term Vision

Bill McDermott, Chairman and Chief Executive Officer

"Our $15 billion-plus target by 2026 is just one chapter in our journey. The real vision is a $30 billion-plus enterprise, defining the future of AI-powered business transformation. With our platform’s capabilities, the only limit is imagination."

Gina Mastantuono, President and Chief Financial Officer

"We are continuing to execute with discipline—expanding margins, scaling AI adoption, and positioning ourselves for long-term market leadership. While the near-term environment may have uncertainties, our strategy is built for sustained, high-quality growth."

Thoughts on ServiceNow Earnings Report $NOW:

Thoughts on ServiceNow Earnings Report $NOW:

🟢 Pros:

Revenue growth stabilized at 21.3% YoY.

Renewal rate remains strong at 98%.

CAC payback period is healthy at 19 months, in line with the SaaS industry average.

AI growth: Pro Plus AI deals up +150% QoQ; over 1,000 customers using AgenTic AI.

Raptor DB adoption: Five customers with $1M+ ACV within months; 3.5x faster response times.

Stock buyback expanded by $3B, totaling $4.5B in authorized repurchases.

Expanded partnerships with AWS, Google Cloud, Microsoft, Visa, and Five9.

🔴 Cons:

Management provided weak guidance for the next quarter and full year, missing analysts' expectations. Q4 guidance projects 18.4% YoY revenue growth, a decline justified by Federal IT spending delays due to the U.S. election cycle.

Missed its own Q4 forecast by 0.4%.

🟡 Neutral:

RPO growth slowed to +23.9% YoY, but remains faster than revenue; cRPO growth dropped to +19.4% YoY, now lower than revenue growth.

Gross margin declined to 81.94%.

2025 subscription gross margin expected at 83.5%, slightly lower due to AI and data center investments.

The addition of new $1M+ ACV customers was lower than last year: +89 vs. +108 in the previous year.

Diluted shares count rose by 1.3% YoY.

SBC/rev at 15%.