ServiceNow Q3 2024 Earnings Analysis

Dive into $NOW ServiceNow’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results

↗️$2 797M rev (+22,2% YoY, +22,2% LQ) beat est by 2,1%

↗️GM* (82,6%, +0,6 PPs YoY)

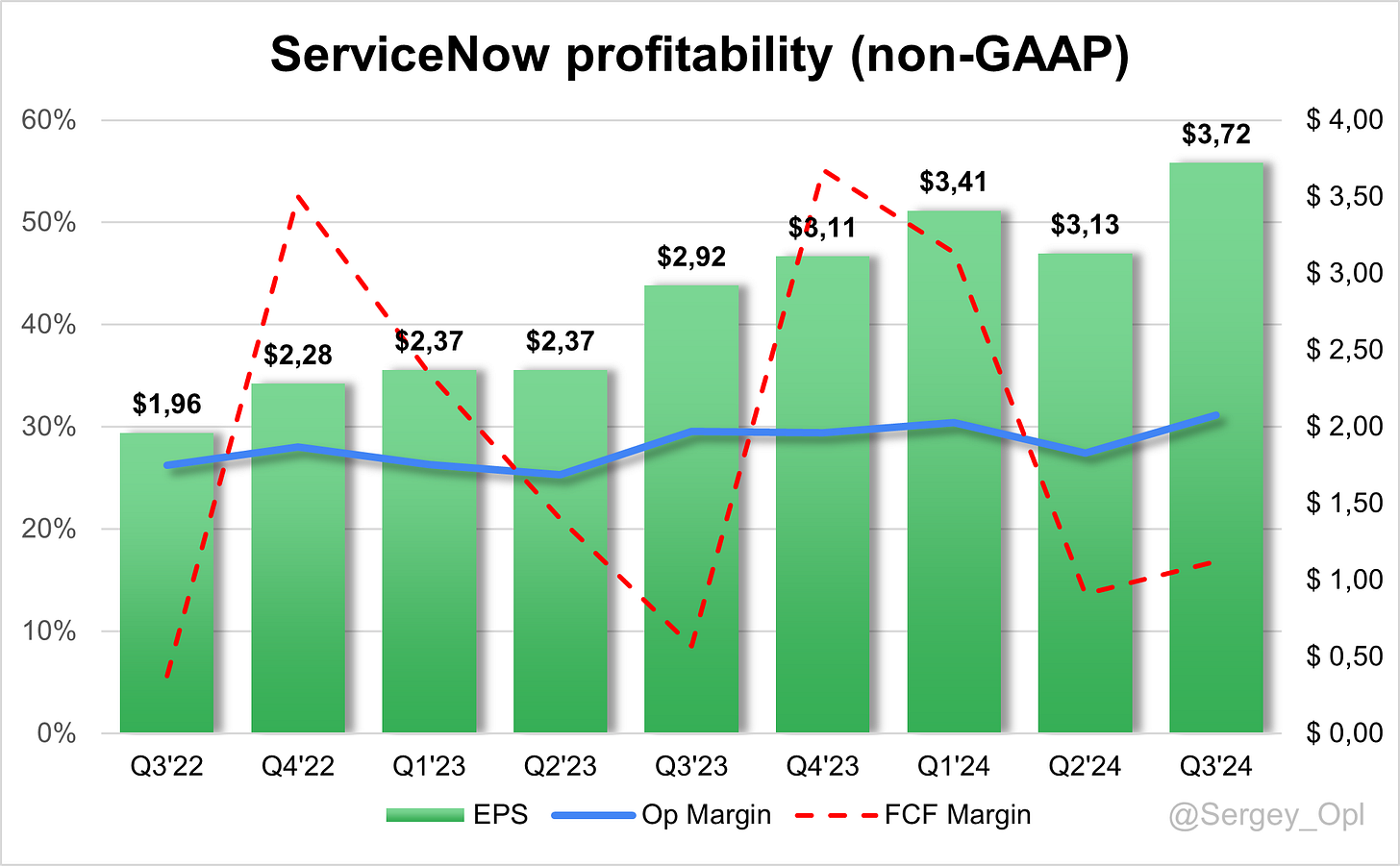

↗️Operating Margin* (31,2%, +1,6 PPs YoY)🟢

↗️FCF Margin (16,8%, +8,3 PPs YoY)

↗️EPS* $3,72 beat est by 7,5%🟢

*non-GAAP

Subscription Revenue

↗️$2 715,0M Subscription rev (+22,5% YoY)

↗️Subscription GM* (82,4%, +0,8 PPs YoY)

Key Metrics

➡️Renewal Rate 98% (98% LQ)

↗️сRPO $9,36B (+26,0% YoY)🟢

↗️RPO $19,50B (+35,4% YoY)🟢

Customers

➡️2 020 customers $1M+ ACV (+12,9% YoY, +32)🔴

Revenue by Geography

↗️North America $1 790M (+24,2% YoY, 64,0% of Rev)

➡️EMEA $699M (+17,5% YoY, 25,0% of Rev)

➡️APAC & Other $308M (+22,2% YoY, 11,0% of Rev)

Operating expenses

↘️S&M*/Revenue 28,6% (-0,6 PPs YoY)

↘️R&D*/Revenue 17,0% (-0,4 PPs YoY)

↘️G&A*/Revenue 6,0% (-0,3 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $692M (+22,7% YoY)

↘️CAC* Payback Period 17,2 Months (149,2 LQ)

Dilution

↘️SBC/rev 15%, -1,7 PPs QoQ

↗️Basic shares up 1,0% YoY, +0,2 PPs QoQ🟢

↗️Diluted shares up 1,8% YoY, +0,6 PPs QoQ

Guidance

↗️Q4'24 $2 875,0 - $2 880,0M guide (+21,7% YoY) beat est by 0,8%

↗️$10 655,0 - $10 660,0M FY guide (+22,8% YoY) raised by 0,7% beat est by 0,6%

Key points from ServiceNow’s Third Quarter 2024 Earnings Call:

Financial Performance:

ServiceNow reported a robust Q3 2024, with subscription revenues increasing by 22.5% year-over-year in constant currency, reaching $2.715 billion. This performance exceeded the upper end of the company’s guidance by 200 basis points. Remaining performance obligations (RPO) rose to $19.5 billion, up 33% year-over-year, signaling strong future revenue visibility.

Product Innovations:

ServiceNow's Q3 2024 showcased substantial product advancements, particularly in AI and enterprise automation. The company launched the "Xanadu" release, introducing over 350 new innovations and its fastest-growing product, Now Assist, a generative AI solution. Now Assist has gained traction, with 44 customers spending more than $1 million in ACV, including several deals over $5 million and $10 million. The product is key to ServiceNow's strategy of embedding AI across workflows to enhance business outcomes.

Raptor DB, a next-generation database for AI-first enterprises, is another innovation, delivering 12x faster transaction processing and 27x faster analytics. Early adopters, such as Amadeus, are already leveraging Raptor DB to boost global processing speeds.

ServiceNow also introduced its workflow data fabric, enabling seamless integration of structured and unstructured data from any source. This innovation, along with zero-copy data integration partnerships with Databricks and Snowflake, enhances customers' ability to turn data into real-time insights.

New product offerings, such as Now Assist for Security, Procurement, and Software Development, further expand AI applications across enterprise functions, reinforcing ServiceNow’s leadership in AI-driven business transformation.

Strategic Partnerships:

ServiceNow strengthened its AI capabilities through strategic collaborations with NVIDIA, Databricks, and Snowflake. The partnership with NVIDIA aims to develop AI agent use cases on the Now Platform, providing pre-built solutions that accelerate enterprise AI adoption. Integrations with Databricks and Snowflake via ServiceNow’s workflow data fabric help customers unify and operationalize their data, driving greater workflow efficiency.

Additionally, partnerships with Zoom and Siemens target the integration of AI-powered solutions in cybersecurity and industrial operations, further deepening ServiceNow's footprint in these critical sectors.

Customers and Large Customer Wins:

ServiceNow continued its impressive growth in Q3 2024, closing 96 deals with more than $1 million in net new ACV. Among these, 15 deals were over $5 million, and 6 exceeded $10 million, underscoring the company’s increasing relevance to large enterprises. ServiceNow also secured its second-largest new logo deal ever, showcasing its ability to attract major new customers.

The number of customers contributing over $1 million in ACV grew to 2,020, and the number paying over $20 million increased nearly 40% year-over-year. Industry verticals such as technology, media, telecom saw 100% YoY growth in net new ACV, with retail and hospitality growing 80% YoY. Public sector and healthcare also delivered strong performances, contributing to ServiceNow’s expanding market presence.

Prominent customer wins include Mercedes-Benz, Lloyd’s Banking Group, and the U.S. Department of Veterans Affairs, all leveraging ServiceNow's platform for digital transformation. The growing adoption of Now Assist and other AI capabilities drove these large customer wins, further strengthening ServiceNow’s position in the enterprise software market.

International Growth:

ServiceNow’s international expansion remains robust, driven by strong performance across various sectors. The U.S. Federal business continued to perform exceptionally well, securing five deals over $5 million. Globally, sectors such as technology, media, and telecom achieved 100% YoY growth, while retail and hospitality increased by 80% YoY. Wins in financial services and public sector agencies across multiple regions also contributed to this global momentum.

The strategic partnership with CoreWeave to build AI data centers in the U.K. reinforces ServiceNow's commitment to expanding its AI infrastructure in Europe, signaling continued international investment.

Future Outlook:

ServiceNow raised its full-year 2024 subscription revenue guidance to a range of $10.655 billion to $10.660 billion, representing 23% YoY growth. The company forecasts Q4 subscription revenues between $2.875 billion and $2.880 billion, reflecting strong momentum across product lines and regions.

With a strong pipeline of AI-driven solutions like Now Assist and Raptor DB, ServiceNow is well-positioned to capitalize on the ongoing AI transformation in enterprise software. Management remains confident about continued margin expansion and growth in large-scale deals, setting the company on a path to reach $30 billion in revenue over the long term. Key growth drivers include AI-powered workflow automation, customer workflows, and deeper penetration into front-office operations.

Management comments on the earnings call.

Product Innovations:

Bill McDermott, Chairman and Chief Executive Officer

"Now Assist is quickly becoming our fastest-growing product ever, with 44 customers spending over $1 million in ACV. This AI-driven innovation is central to our strategy of embedding AI across workflows to improve business outcomes. The launch of Raptor DB, which enhances transaction speeds by 12x and analytics by 27x, is a significant upsell opportunity across our installed base. These innovations, coupled with our workflow data fabric and zero-copy partnerships, enable enterprises to unify data sources and turn them into actionable insights in real-time, driving productivity and efficiency across the board."

Competitors:

Bill McDermott, Chairman and Chief Executive Officer

"In the AI race, the market is now selecting the platforms that truly matter. Customers are looking for real, impactful AI solutions, and we are proving with every quarter that ServiceNow has the innovation, execution, and platform to win. Our differentiated architecture allows us to integrate seamlessly with legacy systems while offering the AI tools and automation capabilities that are becoming essential for enterprises to remain competitive. This positions us as the trusted partner for companies navigating the complexity of digital transformation."

Customers:

Bill McDermott, Chairman and Chief Executive Officer

"Our ability to secure large deals underscores the strategic importance of our platform. We closed 96 deals with more than $1 million in net new ACV, including 15 deals over $5 million and 6 exceeding $10 million. The number of customers paying over $20 million in ACV grew nearly 40% year-over-year, showing that we’re not just winning new customers but scaling significantly within our existing base. Major companies like Mercedes-Benz, Lloyd’s Banking Group, and the U.S. Department of Veteran Affairs are adopting ServiceNow to drive digital transformation across their operations."

Strategic Partnerships:

Bill McDermott, Chairman and Chief Executive Officer

"Our partnership with NVIDIA has been a game changer, as we co-develop out-of-the-box use cases for AI agents on the Now Platform. These partnerships, including those with Databricks, Snowflake, and Siemens, enable us to extend the capabilities of our platform into new verticals and industries. These collaborations are integral to our strategy of becoming the AI platform for business transformation, allowing us to deliver faster, more integrated solutions to our customers while expanding our total addressable market."

International Growth:

Gina Mastantuono, Chief Financial Officer

"Our international growth has been robust, with significant contributions from key sectors and regions. In the U.S. Federal market, we saw outstanding performance, landing five deals over $5 million. Globally, sectors like technology, media, and telecom achieved 100% year-over-year growth in net new ACV, with retail and hospitality growing 80%. Additionally, our partnership with CoreWeave to build AI data centers in the U.K. reflects our commitment to expanding our AI infrastructure in Europe, further enhancing our international footprint."

Challenges:

Bill McDermott, Chairman and Chief Executive Officer

"Navigating the current macroeconomic environment remains challenging, but ServiceNow continues to outperform by focusing on value-driven outcomes for our customers. The need for businesses to modernize and optimize has never been greater, and while other companies may struggle, we are leveraging our platform to help enterprises integrate AI and automation into their workflows, solving real business problems. Our ability to maintain elite-level execution in such a complex market is a testament to our team’s discipline and customer-centric approach."

Future Outlook:

Gina Mastantuono, Chief Financial Officer

"Given our Q3 outperformance, we are raising our full-year 2024 guidance, with subscription revenues expected to reach $10.655 billion to $10.660 billion, representing 23% year-over-year growth. As we look to the future, AI will continue to be a major driver of growth, with products like Now Assist and Raptor DB leading the way. Our focus remains on delivering durable top-line growth and expanding margins, positioning us to achieve $30 billion in revenue over the long term, driven by AI-powered workflow automation, customer workflows, and deeper penetration into front-office operations."

Thoughts on ServiceNow ER $NOW:

🟢Pros:

+ Revenue growth stabilized at 22.2% YoY.

+ RPO growth accelerated to +35.4% YoY, faster than revenue; cRPO growth accelerated to +26% YoY, also faster than revenue.

+ The company is improving margins and profitabilit.

+ Subscription Gross margin is at a record level.

+ Renewal rate remains strong at 98%.

+ CAC payback period decreased to 17 months, which is better than the average for SaaS companies.

+ Beat revenue guidance by 5.0%.

+ FY revenue growth guidance increased by 0.7%.

🔴Cons:

- Weak addition of new $1M+ ACV customers, only +32, the lowest addition of new customers in the last 2 years.

🟡Neutral:

+- Diluted shares count rose by 1.8% YoY.

+- SBC/rev 15%.