ServiceNow: Automating Enterprise Workflows with a $275B Market Opportunity

Deep Dive into $NOW: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

ServiceNow: Company overview

About ServiceNow

ServiceNow is a leading enterprise software company focused on digital workflow automation. Founded in 2004 by Fred Luddy and headquartered in Santa Clara, California, the company offers a cloud-based platform that automates and streamlines business processes across IT, HR, customer service, and security. ServiceNow serves over 7,400 enterprise customers, including 85% of Fortune 500 companies.

Company Mission

ServiceNow aims to simplify work by delivering digital workflows that reduce manual processes by up to 30% and drive faster digital transformation. Its mission is centered on increasing enterprise productivity through AI-driven automation.

Sector

ServiceNow operates in the enterprise software sector with a focus on cloud-based service management and workflow automation. It is a recognized leader in ITSM, and its platform also addresses needs in customer service, HR, and security operations. The platform supports both startups and enterprises with 100,000+ employees, offering broad scalability and integration across departments.

Competitive Advantage

ServiceNow's strength lies in its scalable cloud architecture, deep integration capabilities, and high customizability. Its established presence and growing AI toolset increase switching costs and widen its competitive moat. Recent acquisitions in AI enhance its leadership in enterprise automation.

Total Addressable Market (TAM)

ServiceNow's TAM is projected to reach $275 billion by 2026, reflecting its expansion across ITSM, CSM, HR, and AI. The company’s CAGR for TAM growth is estimated at 14.26% from 2025 to 2030. The ServiceNow Business Market is expected to grow from $52.86 billion in 2025 to $103.27 billion by 2030, driven by secular trends in IT spending and the increasing demand for workflow automation.

Valuation

Looking at ServiceNow’s $NOW valuation through the Forward EV/Sales multiple, it stands at 10.97, below the company’s median of 11.7, and significantly lower than the January 2025 peak, when the Forward EV/Sales multiple reached 18.

ServiceNow $NOW is currently trading at a Forward P/E multiple of 44.4, with 21% YoY revenue growth in the last quarter. The Forward P/E valuation is close to its 2023 low.

The EPS growth forecast for 2026 is 21.2%, with a P/E of 43.9 and a PEG ratio of 2.1.

The EPS growth forecast for 2027 is 22.5%, with a P/E of 36.2 and a PEG ratio of 1.6.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast +19.8% revenue growth for $NOW in 2025 and +19.7% in 2026. Based on this forecast, the valuation, according to the P/S multiple, appears fairly valued compared to other CRM companies.

Analysts expect solid revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

ServiceNow benefits from strong economies of scale due to its global infrastructure, including 150+ data centers across six continents. Its ability to deploy AI and automation solutions at scale reduces incremental costs for serving additional clients. This scale advantage enables significant R&D investments, such as the $1.2 billion spent in 2023, ensuring continuous innovation while maintaining healthy margins. The economies of scale moat is strong, particularly in regulated industries where localized compliance is critical.

Network Effect

ServiceNow’s platform exhibits moderate network effects, as its value increases with the number of organizations using it. Integration with major partners like Microsoft, SAP, and AWS further strengthens this effect by creating seamless workflows across IT, HR, and security functions. However, direct user-to-user network effects are limited compared to social platforms. The network effect moat is moderate, driven mainly by ecosystem lock-in and partner endorsements rather than direct user interactions.

Brand

ServiceNow has established a strong brand identity as a leader in IT Service Management (ITSM), holding a 33.4% market share in the space. Recognition by industry analysts like Gartner and partnerships with consulting giants such as Deloitte and Accenture reinforce its reputation as a trusted enterprise solution provider. The brand moat is strong, supported by high customer retention rates (over 98%) and its position as the "gold standard" in enterprise workflow automation.

Intellectual Property

ServiceNow’s intellectual property moat is moderate, backed by 357 active AI-related patents and proprietary technologies that differentiate its platform from competitors. While these patents protect its innovations, the competitive cloud service market limits exclusivity. Investments in AI partnerships, such as the collaboration with NVIDIA, further enhance its technological edge but do not create insurmountable barriers for rivals.

Switching Cost

ServiceNow enjoys an exceptionally strong switching cost moat, driven by its deeply integrated workflows within large enterprises. Customization during the 12-to-18-month onboarding cycle makes migration to competitors highly complex and costly, both financially and operationally. With over 75% of customers using four or more modules, dislodging ServiceNow from critical business processes becomes nearly impossible, ensuring long-term customer loyalty.

ServiceNow’s moat is defined by strong economies of scale and exceptionally high switching costs. Its global infrastructure supports cost efficiency and sustained R&D investment. Customers face significant barriers to leaving due to deep integration into mission-critical workflows. The brand is strong, especially in ITSM, with high enterprise trust and retention. While network effects and intellectual property are moderate, the platform’s extensibility and embedded role in operations create durable competitive advantages.

Revenue growth

ServiceNow’s $NOW revenue growth slightly slowed to +21% YoY in Q4. Growth in RPO also decelerated, reaching +23.9%, still outpacing revenue growth. However, cRPO growth slowed further to +19.4% YoY, which is below the revenue growth rate.

Based on the forecast for the next quarter, if the company exceeds its guidance by 1.0%—the average beat over the last four quarters (noting a 0.4% miss in Q4)—revenue growth could reach 20.1%, signaling a continued deceleration.

The full-year 2025 guidance implies a solid +18.9% YoY growth, suggesting revenue growth may stabilize.

Segments and Main Products

ServiceNow operates through four primary segments: Technology Workflows, Customer and Industry Workflows, Employee Workflows, and Creator Workflows.

Technology Workflows

ServiceNow's Technology Workflows include key products like IT Service Management (ITSM), which consolidates IT operations on a single cloud platform, and IT Operations Management (ITOM), enabling proactive operations through AI-driven insights. Other notable products are Security Operations (SecOps) for threat management and Strategic Portfolio Management (SPM) for aligning IT investments with business goals. Technology Workflows include RaptorDB and Workflow Data Fabric. RaptorDB is a high-performance database designed to handle complex data queries and scale workflow transactions efficiently. Workflow Data Fabric unifies enterprise data, enabling real-time access and powering workflows and AI agents with actionable insights.

Customer and Industry Workflows

Customer and Industry Workflows feature products like Customer Service Management (CSM), which enhances customer experiences through automated issue resolution, and Field Service Management (FSM), which optimizes field operations with real-time tracking and mobile tools. These workflows also include tailored solutions for specific industries, such as healthcare and financial services. Customer and Industry Workflows incorporate Autonomous AI Agents. These agents automate customer service processes, integrate seamlessly across departments, and enhance productivity by managing complex workflows, such as customer onboarding and issue resolution.

Employee Workflows

Employee Workflows focus on improving employee experiences with products like HR Service Delivery (HRSD), which automates HR processes such as onboarding and case management. Other offerings include Workplace Service Delivery, providing hybrid work solutions, and the Safe Workplace Suite, ensuring safe return-to-work environments. Employee Workflows leverage Now Assist to streamline HR processes like onboarding and case management. It uses generative AI to automate repetitive tasks, improving employee experiences and operational efficiency.

Creator Workflows

Creator Workflows empower users to build custom applications with low-code tools. Key products include the App Engine, enabling rapid app development across departments, and the Automation Engine, which integrates robotic process automation (RPA) for seamless workflow automation. The Integration Hub connects ServiceNow to external systems, enhancing cross-platform functionality. Creator Workflows utilize Xanadu and Now Assist for Creator. Xanadu enhances low-code application development with AI-driven tools, while Now Assist for Creator accelerates workflow creation through generative AI, enabling developers to build automation solutions quickly.

Main Products Performance in the Last Quarter

The majority of ServiceNow's $NOW revenue comes from subscriptions, accounting for 96.9% of total revenue. The GAAP subscription revenue growth rate was +21.2% YoY, down from +22.5% in the previous quarter. The non-GAAP gross margin declined to 81.7%, compared to 82.4% in Q3 2024 and 81.9% in the same quarter last year.

Technology Workflows

Technology Workflows delivered strong results with 76 deals over $1M, including one over $15M. ITSM, ITOM, ITAM, and Security & Risk appeared in at least 15 of the top 20 deals. Notably, IT Asset Management was in all top 20 deals. The platform continues expanding across enterprises, driven by its deep integration into core IT operations. No meaningful challenges mentioned—execution remains consistent.

RaptorDB

RaptorDB Pro adoption accelerated with 5 customers already exceeding $1M in ACV just months after its launch in September. A leading tech firm saw database response times improve up to 3.5x and database size reduce by over 30%, translating to notable cost savings. The product is backed by Postgres-based architecture and Swarm64’s IP. Connectors into Snowflake, Oracle, and hyperscalers extend reach. Strong early traction signals potential for significant revenue contribution.

Workflow Data Fabric

Workflow Data Fabric is expanding ServiceNow’s TAM by enabling deep AI-driven orchestration across disparate systems. Announced Oracle and Google Cloud integrations to strengthen its utility. Platform allows data to remain in place or be moved into ServiceNow, depending on customer preference. Positioned as the glue for AI orchestration across enterprise workflows. Still early, but growing awareness driven by AI use cases.

Customer and Industry Workflows

Fastest-growing business segment. Delivered 30 deals over $1M, field service management showed standout performance. Major wins across defense, healthcare, semiconductors, and transportation. ServiceNow is positioning CRM not just as sales automation but as a full lifecycle platform—sell, fulfill, service—on one unified architecture. Replacing fragmented CRM stacks. The category is being disrupted with ServiceNow’s single-data-model strategy.

Autonomous AI Agents

Over 1,000 customers are on the Agentic AI journey. AI agents included in Pro Plus offerings, driving 150% QoQ growth in Pro Plus deals. Unlike simple LLM integrations, ServiceNow offers orchestration, governance, and collaboration between agents. Consumption-based monetization tied to agent usage is expected to be multiple times higher than standard queries, allowing for long-term revenue expansion. Still in early innings but showing strong strategic uptake.

Employee Workflows

Delivered 17+ deals over $1M. Employee solutions integrated across HR, IT, and other departments, resulting in significant productivity lift. Internally, ServiceNow reduced response times from weeks to 2 days at New Zealand Parliamentary Service. AI-driven self-service cut live chat volumes by 45%, deflected 80% of cases, and saved 400,000+ labor hours internally.

Now Assist

Now Assist is the GenAI portfolio bundled into Pro Plus SKUs. Saw 150% QoQ increase in deals, >30% price uplift over Pro, and doubling of customers using 2+ GenAI capabilities. Embedded GenAI capabilities are helping companies achieve rapid productivity gains. A customer reported 45% reduction in live chat volume. Pro Plus includes AI agents without upfront charges; monetization kicks in with usage.

Creator Workflows

Saw 17+ $1M+ deals in Q4. Leveraging low-code/no-code to empower builders across enterprise functions. When paired with natural language coding via AI agents, creators can reduce build times dramatically—up to 60% faster. Expansion being driven by convergence of low-code tools with agentic AI. Internal case: 20% boost in developer productivity.

Product Innovations and Updates

ServiceNow launched RaptorDB Pro, showing 3x-5x performance gains. Workflow Data Fabric was expanded with Google Cloud and Oracle integrations. Pro Plus SKUs now include AI agents with metered consumption pricing to drive faster adoption. AI orchestration and governance positioned as core differentiators. Now Assist with Agentic AI embedded into ITSM, CSM, and HRSD. New agentic capabilities enable cross-functional workflow automation.

On the GTM side, ServiceNow is optimizing by adding regional leadership and targeting high-value and high-volume accounts, building commercial and DTC motions. AI is being used in internal sales ops to generate 16x higher prospect conversion by curating top leads.

Revenue by Region

The North America region accounts for 62% of total revenue, making it $NOW ServiceNow’s largest market, with revenue growing +19% YoY in Q4.

The EMEA region contributes 27% of total revenue and grew +26% YoY, with growth accelerating significantly in Q4.

The APAC and Other region accounts for 11%, with a +24% YoY growth rate.

Revenue growth in the EMEA, APAC, and Other regions is outpacing the company’s overall revenue growth rate.

Market Leader

Low-Code Application Platforms

ServiceNow is named a Leader in the 2024 Gartner Magic Quadrant for Enterprise Low-Code Application Platforms for the fifth consecutive year. The platform accelerates business-critical workflows and AI-powered low-code app development at scale, driving hyperautomation across enterprises.

AI in IT Service Management

ServiceNow is also a Leader in the first Gartner Magic Quadrant for AI Applications in IT Service Management. The Now Platform integrates AI and automation, enabling IT and enterprise-wide digital service delivery. This recognition highlights ServiceNow’s ability to streamline complex IT environments and enhance return on investment.

Workplace Experience Applications

ServiceNow is a Representative Vendor in the 2024 Gartner Market Guide for Workplace Experience Applications. The platform supports hybrid work through advanced capabilities, enabling digital workplace leaders to improve planning and collaboration.

Customers

$NOW ServiceNow added a solid number of customers—+89 with an ACV over $1 million. While Q4 is typically a seasonally strong quarter for the company, it's worth noting that this addition was lower than the same quarter last year (+108). The growth was +11% YoY.

ServiceNow now has 2,109 customers paying over $1 million in ACV.

Large Customer Wins

ServiceNow now counts multiple enterprise customers with ACV exceeding $100 million, a milestone absent in 2019. The rapid growth in large-scale accounts reflects deep platform penetration and broader enterprise-wide adoption. A key driver has been the Pro Plus SKU, which has fueled demand among large enterprises upgrading to unlock GenAI capabilities.

One enterprise with 200 ERP instances selected ServiceNow to consolidate fragmented IT architecture, showcasing the platform’s value in complex environments. In the public sector, a U.S. agency operating 85 HR systems for 85,000 employees deployed ServiceNow to centralize operations. This deal highlights platform consolidation as a core value proposition for large institutions.

Visa chose ServiceNow to manage its dispute resolution workflows, extending the solution to its banking partners. This B2B2C strategy targets reducing hundreds of millions in annual write-offs, marking ServiceNow's growing relevance in financial services.

CEO commentary indicated rising momentum in full-platform deployments, with many enterprises preparing for pre-consumption scaling. The company expects deal sizes to expand as product cycles compound and value delivered increases.

Customer Success Stories

ServiceNow internally generated over $400 million in realized value from GenAI and workflow automation. AI agents deflected 80% of support cases, and sales productivity rose as AI-enhanced lead conversion improved by 16x. Internal results validate the ROI potential of the Now platform and its AI offerings.

A leading CPG CEO reported that dashboards built on ServiceNow's RaptorDB produced analytics 27x faster than legacy solutions, with 3.5x faster data processing and a 30% reduction in database size. This performance positioned ServiceNow as a legitimate player in data orchestration.

In the public sector, ServiceNow helped a federal agency integrate seven decades of disparate IT systems without requiring a rip-and-replace strategy. Outcomes included operational visibility and automation layered on top of legacy infrastructure.

A top-tier Asian insurance company began transitioning to a data-first enterprise model, leveraging ServiceNow’s agentic AI to scale customer engagement and reframe itself as a tech-enabled service provider.

The employee experience offering consolidated 17 disconnected applications into a single UX, boosting productivity by 30% and reducing friction across departments.

A multinational conglomerate using Now Assist saw a 45% reduction in live chat volume from July to December 2024. The company expects to save millions by year-end 2025. Another enterprise used AI to drive a 16x improvement in prospect-to-qualified lead conversion, enhancing revenue operations.

Petrobras deployed ServiceNow across 6,000+ applications and catalog items, processing over 250,000 requests monthly, enabling better governance and decision-making.

A major U.S. Department of Defense agency adopted ServiceNow to access critical asset and operations data previously locked in outdated legacy systems, resulting in faster, data-driven decision cycles.

Grupo Bimbo deployed the platform to enable real-time factory monitoring, increasing operational efficiency and production output. ServiceNow also supported field service improvements across energy, semiconductor, and transportation verticals.

The New Zealand Parliamentary Service reduced employee service response times from weeks to two days using ServiceNow. Scouting America, the company’s largest nonprofit deal, adopted ServiceNow to modernize HR and customer service using GenAI.

Internally, ServiceNow achieved 37% automation of customer case workflows, deflected 80% of support tickets, and increased developer productivity by 20%+, all while operating entirely on its own platform. The scale and results of internal deployment further confirm the performance and value of the GenAI-enabled architecture.

Retention

$NOW ServiceNow's renewal rate remains strong at 98%, reflecting a high percentage of customers consistently renewing their subscriptions.

Net new ARR

$NOW ServiceNow added $604 million in net new ARR (+1% YoY). This is a strong net new ARR addition, higher than in Q4 2023 and Q4 2022.

CAC Payback Period and RDI Score

$NOW ServiceNow's return on S&M spending, with a CAC Payback Period of 19.2 months, is at a healthy level and better than the median for SaaS companies (the median for the SaaS companies I track is 20.8).

The R&D Index (RDI Score) for Q4 stands at 1.24, which better the median of 1.2 for the SaaS companies I monitor and is significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered indicative of best-in-class performance. The industry median of 0.7 emphasizes the importance of efficient R&D investment.

Profitability

Over the past year, $NOW ServiceNow has seen changes in its margins and profitability:

• Gross margin slightly decreased from 82.3% to 81.9%.

• Operating margin slightly increased from 29.4% to 29.5%.

• Free cash flow (FCF) margin decreased from 55.1% to 47.3%.

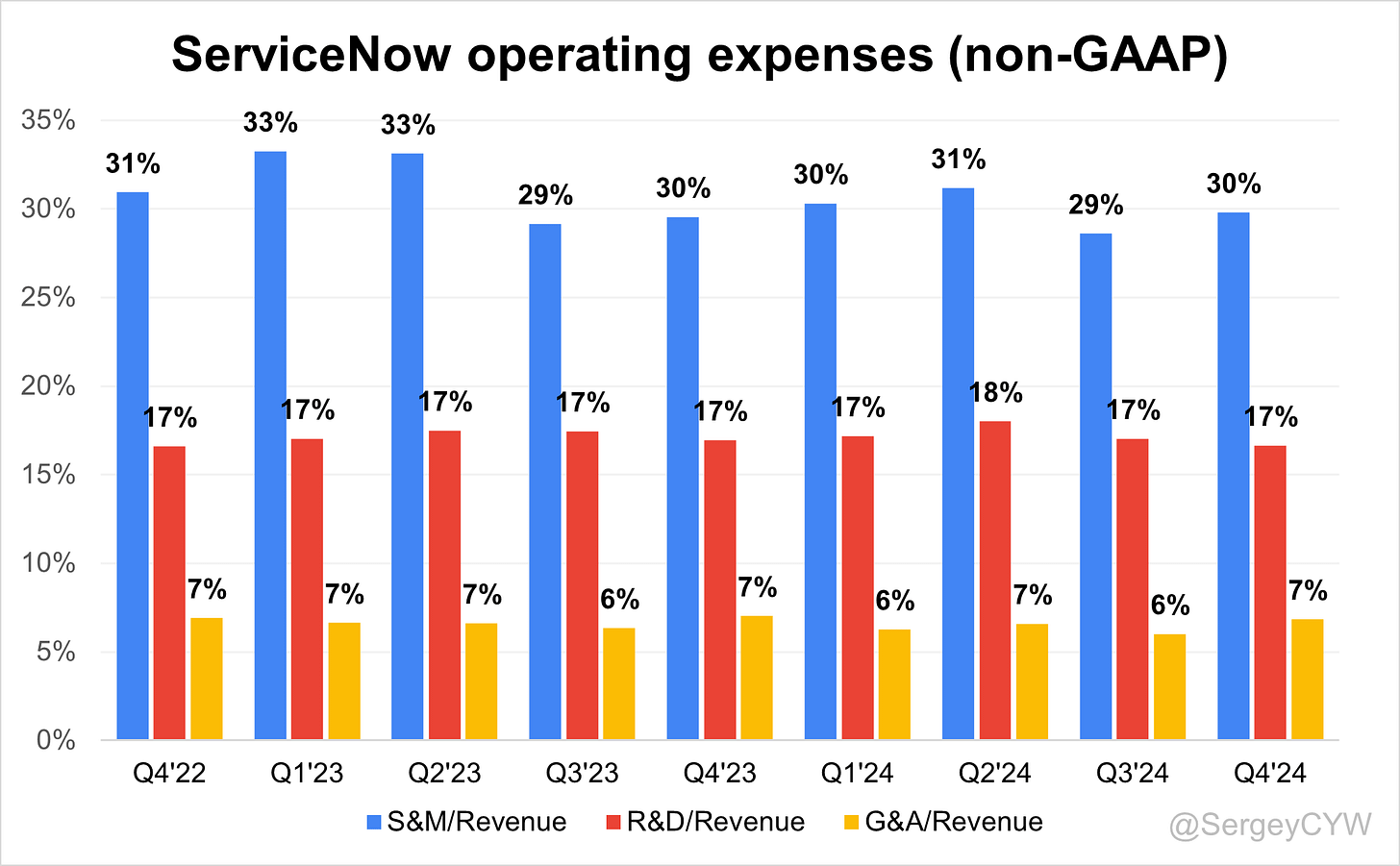

Operating expenses

$NOW ServiceNow's non-GAAP operating expenses have remained nearly unchanged over the past two years. S&M expenses slightly decreased from 31% to 30%. R&D spending remains high at 17%, as the company continues to invest in future growth through enhancements and updates to its core platform. G&A expenses have remained stable at 7%.

Balance Sheet

$NOW Balance Sheet: Total debt stands at $2,278M, while ServiceNow holds $5,762M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$NOW Shareholder Dilution: ServiceNow’s stock-based compensation (SBC) expenses declined in the last quarter, reaching 15% of revenue, which is below the average for SaaS companies.

Shareholder dilution remains at an acceptable level, slightly decreasing in Q4, with the weighted-average number of basic common shares outstanding increasing by just 0.8% YoY.

ServiceNow also expanded its share repurchase program by $3 billion, in addition to the previously authorized $1.5 billion.

Conclusion

$NOW ServiceNow has demonstrated strong innovation through consistent investment in R&D, regularly launching new products and expanding strategic partnerships with key industry players.

Leading Indicators

RPO growth slowed to +21.3% YoY but still outpaced revenue growth.

cRPO growth decelerated to +19.4% YoY, slightly below revenue growth.

Net new ARR additions increased +1% YoY.

New customer additions totaled +89 with an ACV over $1 million—strong, though slightly below the number added in Q4 last year.

RPO and cRPO growth slowed due to seasonality in large contracts and uncertainty around U.S. federal spending. AI adoption could reaccelerate RPO growth, but the timing remains uncertain.

Key Indicators

Renewal rate remains strong at 98%.

CAC Payback Period is 19.2 months, slightly better than the SaaS average.

RDI Score slightly declined to 1.24, but remains above the median for SaaS companies I track.

Management issued a weaker outlook for the next quarter, citing uncertainty around AI monetization and election-related delays in U.S. federal IT budgets. However, CEO Bill McDermott reaffirmed a long-term revenue target of $30B+, with $15B+ expected by 2026, signaling management’s confidence in the company’s long-term trajectory.

Gross margin declined compared to both the previous quarter and the prior year, which management attributed to increased AI and data center investments. Despite these higher costs, the operating margin is expected to expand to 30.5% (+100 bps YoY), with free cash flow margin projected at 32% (+50 bps YoY).

ServiceNow’s valuation multiples have compressed and now appear fairly valued relative to other CRM companies. The company maintains a diversified product portfolio and has been recognized as a leader in several Gartner Magic Quadrant reports.

Q4 results were weaker than expected by both analysts and management. The company missed its own revenue forecast by 0.4%, but new customer additions were solid, and key metrics remain strong.

I decided to keep my position unchanged following the post-earnings drop. I’ll be closely monitoring the results for Q1 2025. Currently, $NOW represents 4.9% of my portfolio.