SentinelOne Q3 2024 Earnings Analysis

Dive into $S SentinelOne’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$211M rev (+28.3% YoY, +33.1% LQ) beat est by 0.4%

↗️GM* (79.6%, +0.3 PPs YoY)🟢

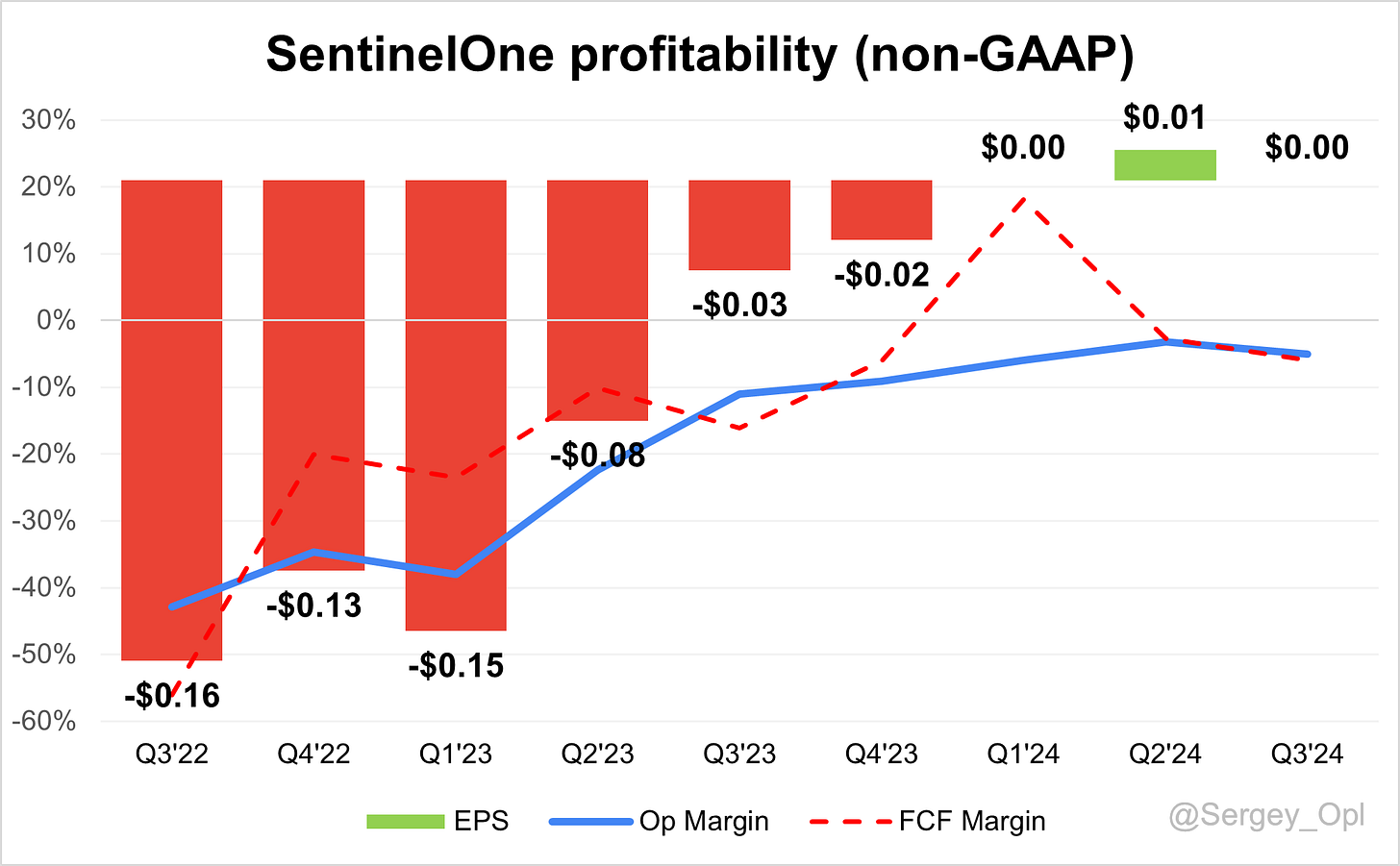

↗️Operating Margin* (-5.1%, +6.0 PPs YoY)

↗️FCF Margin (-6.0%, +10.1 PPs YoY)

↘️EPS* $0.00 missed est by $0.01

*non-GAAP

Key Metrics

➡️RPO $0.97B (+25.0% YoY)🟡

➡️Billings $206M (+24.5% YoY)🟡

↗️ARR $0.86B (+29.5% YoY, +54 net new ARR)🟢

Customers

↗️1,310 $100k+ customers (+23.6% YoY, +77)

Operating expenses

↘️S&M*/Revenue 48.7% (-1.2 PPs YoY)

↗️R&D*/Revenue 22.2% (+0.1 PPs YoY)

↘️G&A*/Revenue 13.8% (-4.6 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $54M (+3.9% YoY)

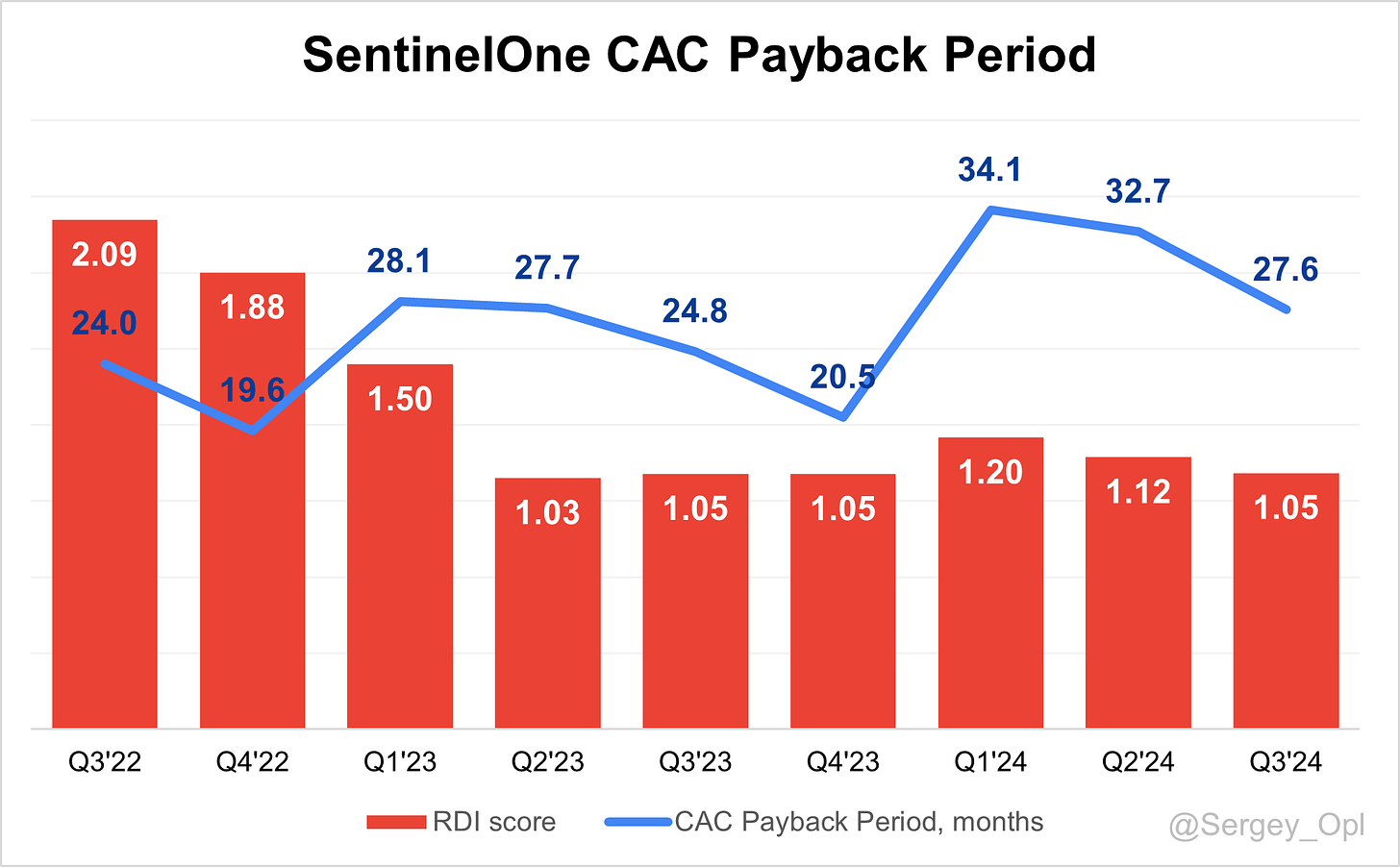

↗️CAC* Payback Period 27.6 Months (+2.7 YoY)🟡

↗️R&D* Index (RDI) 1.05 (+0.01 YoY)🟢

Dilution

↗️SBC/rev 33%, +0.8 PPs QoQ

↗️Basic shares up 6.9% YoY, +0.2 PPs QoQ🔴

↗️Diluted shares up 12.9% YoY, +1.0 PPs QoQ🔴

Guidance

↗️Q4'24 $222.0M guide (+27.4% YoY) beat est by 0.6%

↗️$818.0M FY guide (+31.7% YoY) raised by 0.4% beat est by 0.3%

Key points from SentinelOne’s Third Quarter 2024 Earnings Call:

Financial Performance

SentinelOne achieved $211 million in Q3 FY2025 revenue, reflecting 28% year-over-year growth. Annual Recurring Revenue (ARR) increased 29% to $860 million, with net new ARR of $54 million showing a 22% sequential increase and returning to 4% year-over-year growth. Gross margin remained strong at 80%, while operating margin improved by 6 percentage points year-over-year to -5%. Adjusted for one-time legal costs, the operating margin was -3%, in line with guidance.

The company reported positive net income for the second consecutive quarter and achieved positive free cash flow on a trailing 12-month basis for the first time. Full-year revenue guidance was raised to $818 million (+32% YoY growth) from $815 million (+31% growth). Gross margin for FY2025 is expected to improve by 150 basis points to 79%. SentinelOne’s financial position remains strong, with over $1 billion in cash and no debt.

Product Innovations

The Singularity Platform now integrates endpoint, cloud, identity security, and third-party solutions into a unified AI-powered system. The platform focuses on real-time autonomous security and advanced data analytics to address modern threats.

Purple AI saw attach rates double sequentially and provides automated triage, investigation, and threat-hunting capabilities, enhancing security teams' efficiency. It drives larger deal sizes and stronger adoption.

AI SIEM expands data analytics capabilities, offering real-time detection, investigation, and autonomous response for enterprises. It is positioned to disrupt legacy SIEM solutions with streaming security data processing and proactive threat management.

AI Security Posture Management (AI SPM) enables enterprises to secure generative AI applications, providing visibility into AI services, detecting vulnerabilities, and safeguarding pipelines. It is compatible with platforms like AWS SageMaker, Azure OpenAI, and Google Vertex AI.

Singularity Platform

The platform evolved into a comprehensive security solution integrating endpoint, cloud, and identity security. It delivers scalability, efficiency, and cost savings while enhancing enterprise-wide security.

Singularity attracted a record number of $100,000+ ARR customers, growing 24% year-over-year, and drove higher ARR per customer, which reached a new high. Key wins include major financial institutions and global enterprises migrating from legacy solutions due to Singularity’s superior performance and scalability.

Challenges include longer enterprise sales cycles and aggressive competitor discounting. Despite this, 80% gross margin underscores its pricing resilience and strong value.

Purple AI

Purple AI is the company’s fastest-growing product, with sequential attach rates doubling in Q3. It automates triage, threat hunting, and investigation, enabling analysts to process thousands of alerts in minutes and improve efficiency.

It played a significant role in new accounts and larger deals, including integrations at Fortune 50 companies and government entities. Its productivity enhancements and cost-saving potential drive customer demand.

Scaling adoption across the customer base and educating users on its full capabilities remain areas of focus. Investments in marketing and enablement will enhance penetration into existing and new markets.

AI SIEM

AI SIEM is a next-generation solution providing real-time detection and autonomous responses. It replaces legacy systems by offering full visibility and streamlined threat management.

Federal agencies and enterprises adopted AI SIEM in Q3 for unified threat visibility and cost-effective security operations. Its ability to deliver both cost savings and enhanced security positions it as a critical solution.

Educating customers about its ROI and tangible benefits is key to overcoming hesitancy tied to replacing entrenched legacy systems.

AI Security Posture Management (AI SPM)

AI SPM addresses security for generative AI adoption. It provides visibility into AI services, identifies vulnerabilities, and protects AI pipelines on platforms like AWS and Azure.

It aligns with SentinelOne’s mission to enable secure adoption of transformative technologies. As AI adoption accelerates, AI SPM has the potential to drive significant ARR growth.

The challenge lies in establishing its necessity in an evolving market. Investments in partnerships and product enhancements will help capture this opportunity.

Customers and Success Stories

SentinelOne added a record number of $100,000+ ARR customers in Q3, growing 24% YoY. Customers with $1 million+ ARR grew faster, driven by platform expansions and upsell opportunities.

A Fortune 50 company switched to SentinelOne after suffering breaches with legacy systems, migrating its entire endpoint footprint. A global retailer adopted multiple solutions, doubling its ARR with SentinelOne. A leading technology firm secured a multi-million-dollar deal citing Purple AI as critical to their security operations. A federal agency chose SentinelOne for unified visibility and proactive threat hunting.

Competitors

The July 19 outage of a competitor amplified SentinelOne’s momentum, leading to increased migrations. Record wins against competitors underscore SentinelOne’s superior platform architecture and advanced AI capabilities. Despite aggressive discounting in the market, the company maintains pricing power with a consistent 80% gross margin.

Strategic Partnerships

SentinelOne partnered with Lenovo, bundling the Singularity Platform and Purple AI on enterprise PC shipments to expand global reach. Collaboration with AWS enabled Purple AI deployment on Amazon Bedrock. These alliances strengthen SentinelOne’s growth opportunities.

Market Expansion

International revenue grew 28%, representing 37% of total revenue. The company achieved FedRAMP High certification for endpoint security and AI SIEM, positioning it for growth in federal markets. SentinelOne sees significant opportunities in both enterprise and SMB segments.

Challenges

Macroeconomic conditions emphasize cost scrutiny and efficiency, with IT budgets under pressure. Competitor discounting adds pricing pressures. Despite this, cybersecurity demand remains strong, driven by evolving threats and enterprise needs for advanced solutions.

Future Outlook

SentinelOne expects continued momentum in net new ARR and a stronger second half for FY2025. The focus is on sustainable growth, with long-term goals of achieving a 20% operating margin and scaling the business into a multibillion-dollar enterprise.

Management comments on the earnings call.

Product Innovations

Tomer Weingarten, Chief Executive Officer

“Our Singularity Platform continues to evolve into a comprehensive enterprise security solution. By integrating endpoint, cloud, and identity security with AI-powered automation, we deliver unmatched scalability and real-time capabilities to address modern cybersecurity challenges.”

Purple AI

Tomer Weingarten, Chief Executive Officer

“Purple AI has quickly become one of our fastest-growing solutions. Its ability to automate alert triage and enhance productivity allows security teams to handle thousands of alerts in minutes, driving significant efficiency gains and positioning us as a market leader in AI-driven security.”

FedRAMP Certification

Tomer Weingarten, Chief Executive Officer

“Achieving FedRAMP High certification for both endpoint security and AI SIEM reflects our commitment to meeting the highest security standards. This milestone positions us to expand further into the federal market with solutions that meet rigorous compliance requirements.”

Competitors

Tomer Weingarten, Chief Executive Officer

“The shortcomings of incumbent solutions are becoming more apparent, especially following events like the July 19 outage. Customers are increasingly looking to SentinelOne for superior technology and reliability, resulting in record displacements and growing opportunities.”

Customers

Tomer Weingarten, Chief Executive Officer

“Our platform has enabled Fortune 50 enterprises, global retailers, and federal agencies to strengthen their security posture. These large-scale deployments highlight our ability to address the needs of diverse industries with solutions that deliver real value.”

Strategic Partnerships

Barbara Larson, Chief Financial Officer

“Our partnership with Lenovo represents a strategic move to expand our global reach by integrating the Singularity Platform and Purple AI into millions of enterprise PCs. Collaborations like these are pivotal in scaling our market presence.”

Challenges

Tomer Weingarten, Chief Executive Officer

“While macroeconomic conditions remain challenging, our focus on cost efficiency and automation aligns with customer priorities. Despite competitive discounting, we maintain strong pricing power, supported by an industry-leading gross margin of 80%.”

Future Outlook

Barbara Larson, Chief Financial Officer

“As we near $1 billion in ARR, we remain focused on achieving sustainable growth and expanding our market presence. With a disciplined approach to investments, we aim to position the company for long-term profitability and durable growth opportunities.”