Financial Results:

↗️$186M rev (+39.7% YoY, +38.1% LQ) beat est by 2.9%

↗️GM* (78.9%, +3.8%pp YoY)

↗️Operating Margin* (-5.9%, +32.1%pp YoY)🟢

↗️FCF Margin (18.1%, +41.7%pp YoY)🟢

↗️EPS* $0.00 beat est 🟢

*non-GAAP

Key Metrics

↘️DBNR 110% (115% LQ)

➡️Billings $165M (+22.0% YoY)🟡

➡️ARR $0.76B (+35.0% YoY, +65 net new ARR)🟡

Customers

➡️1,193 $100k+ customers (+30.0% YoY, +60)

Operating expenses

↗️S&M*/Revenue 50.7% (47.9% LQ)

↘️R&D*/Revenue 21.3% (23.2% LQ)

↘️G&A*/Revenue 12.8% (16.0% LQ)

↗️Net New ARR $65M ($61 LQ)

↗️CAC* Payback Period 34.1 Months (20.5 LQ)

Dilution

↗️SBC/rev 31%, +1.0%pp QoQ

↗️Share count up 7.4% YoY, +1.1%pp QoQ🔴

Guidance

↘️Q2'24 $197.0M guide (+31.9% YoY) missed est by -0.4%🔴

↘️$808.0 - $815.0M FY guide (+30.6% YoY) lowered by -0.4% missed est by -0.7%🔴

Key points from SentinelOne’s First Quarter 2024 Earnings Call:

Performance Highlights:

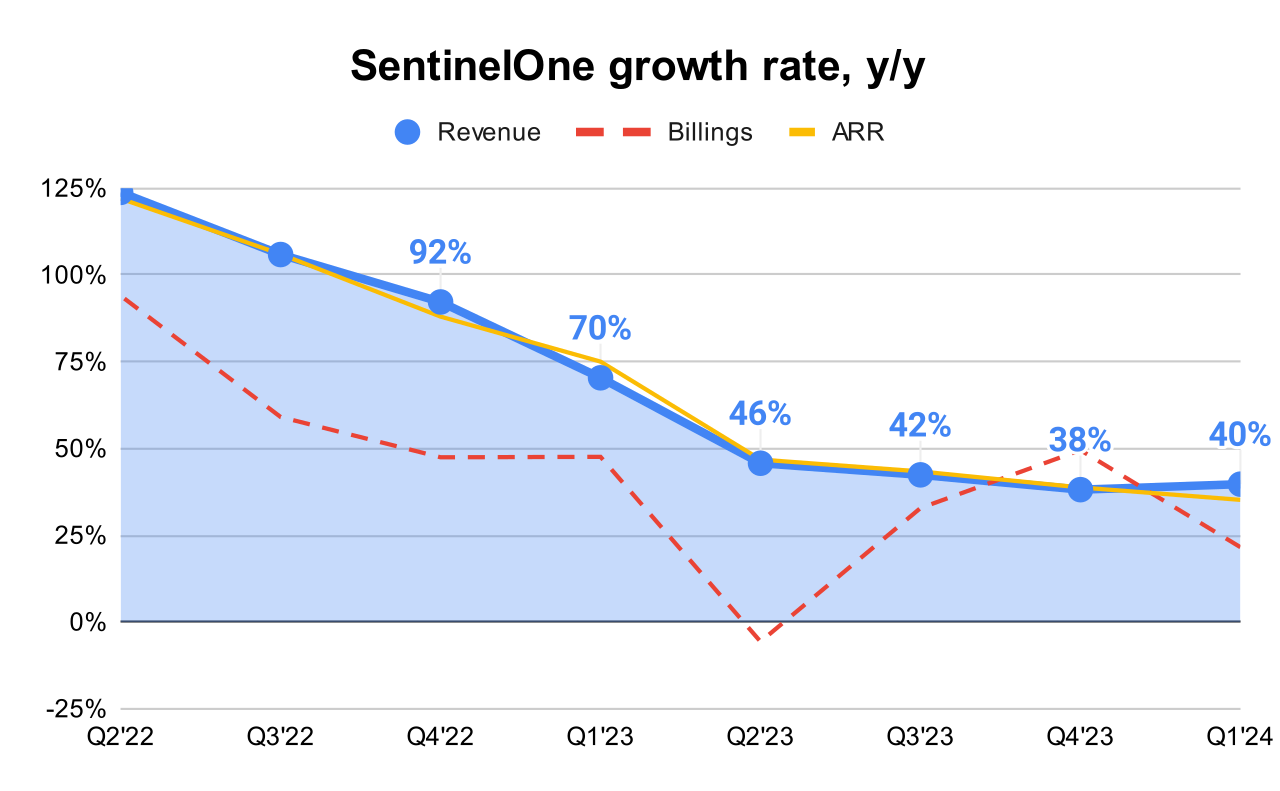

SentinelOne reported a 40% year-over-year revenue growth, which positions it among the fastest-growing companies in the public markets.

Gross margin reached a record high of 79%.

Operating margin expanded for the 11th consecutive quarter, and for the first time, the company achieved a positive free cash flow margin.

Full CNAPP Integration:

SentinelOne has enhanced its cloud security offerings by fully integrating Cloud Native Application Protection Platform (CNAPP) capabilities. This improvement is part of their strategy to strengthen their position in cloud security and provide comprehensive protection across cloud applications and infrastructure.

Purple AI Introduction:

The company introduced Purple AI, a first-of-its-kind AI-driven security system. Purple AI simplifies complex tasks like threat hunting and investigations, enabling security teams to detect threats earlier, respond faster, and stay ahead of attacks.

Singularity Operations Center:

SentinelOne launched the new Singularity Operations Center, which dramatically enhances the security experience by providing a centralized view of all security workflows across the enterprise. This operations center allows security teams to manage all SentinelOne and non-SentinelOne security alerts in one place, offering comprehensive investigations that clarify the origin and context of alerts.

Singularity Cloud Native Security:

Shortly after acquiring PingSafe, SentinelOne integrated it into its unified Singularity Platform, rapidly bringing a new agentless cloud security solution to market. This new offering prioritizes threats and prevents attacks using a unique offensive security engine that simulates attack paths actively, distinguishing it from other solutions in the market. The early customer response has been very positive, highlighting its ease of use and effectiveness compared to both public and private competitors.

Customers and Market Dynamics:

SentinelOne reported a 30% year-over-year growth in customers with annual recurring revenue (ARR) over $100,000 and set a new record for customers with more than $1 million in ARR.

Full-Year Guidance Cut:

SentinelOne slightly revised its full-year revenue outlook, primarily due to challenges related to macroeconomic uncertainty and transitions in its go-to-market strategies.

The macroeconomic environment, characterized by high interest rates and inflation, continues to pressure enterprise spending, impacting customer buying behavior.

Future Outlook:

Despite the near-term challenges, SentinelOne is optimistic about its growth trajectory and remains committed to investing in key areas like AI, cloud security, and data.

Leadership expressed confidence in improved performance in the latter half of the fiscal year, supported by a strong product pipeline, go-to-market enhancements, and early successes from new product introductions.

Management comments on the earnings call.

Product Innovations:

Tomer Weingarten, CEO: "In Q1 alone, we amplified our cloud security offering with full CNAPP integration, introduced the first-of-its-kind AI security system through Purple AI, and dramatically enhanced the security experience by launching the new Singularity Operations Center."

Customers:

Tomer Weingarten, CEO: "The total cost of breaches and operational disruptions are reaching new highs. More and more enterprises are turning to SentinelOne for best-in-class security, simplification, and savings."

Competitors:

Tomer Weingarten, CEO: "Our technology comes out on top across every capability, be it endpoint, cloud, data or AI. Singularity outperforms both point products and disjointed platforms alike. For years running, SentinelOne has led objective evaluations like MITRE as well as industry reviews from Gartner and others."

Full Year Guidance Cut:

Dave Bernhardt, CFO: "We are modestly revising our revenue outlook range to reflect the impact of persistent macro uncertainty and our go-to-market transition."

Dave Bernhardt, CFO: "As we enter the new year, the macroeconomic uncertainty and tighter financial conditions have continued to pressure enterprise spending. We are still operating in a high interest rate and a high inflation environment, which continues to impact new budgets and expansionary spending."

Challenges:

Tomer Weingarten, CEO: "As you know, Michael Cremen recently joined SentinelOne as Chief Revenue Officer to drive our go-to-market strategy for growth at scale. We've pinpointed several opportunities to enhance our performance and are already making progress."

Tomer Weingarten, CEO: "Macroeconomic uncertainty and tighter financial conditions continue to impact customer buying behavior. With better execution, we believe we can mitigate these factors and deliver higher growth."

Future Outlook:

Tomer Weingarten, CEO: "Our confidence stems from strong pipeline, ramping newer products and leading indicators from our go-to-market improvements. We're expecting over 30% revenue growth this year, one of the fastest growth rates in public markets once again, combined with a charge towards profitability."

Awesome write up! I'm super bullish and definitely picked up shares today.

What I think went under the radar though is that they didn't report NRR and only disclosed when asked by an analyst. 110%+ still isn't bad in this environment, but certainly wish they weren't cagey about it.