Samsara Targets $200B Market—But Why Is the Stock Down -13.9% YTD?

Deep Dive into $IOT: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Samsara: Company overview

About Samsara

Samsara is a pioneer in the Connected Operations Cloud, a platform that enables organizations reliant on physical operations to leverage Internet of Things (IoT) data for actionable insights and operational improvements. Founded in 2015 by Sanjit Biswas and John Bicket, the company is headquartered in San Francisco, California. Samsara serves tens of thousands of customers across industries such as construction, transportation, manufacturing, logistics, and retail, helping them digitize operations for enhanced safety, efficiency, and sustainability.

Company Mission

Samsara's mission is to revolutionize physical operations by providing innovative technology solutions that enhance safety, efficiency, and visibility. The company aims to empower organizations to make data-driven decisions while fostering sustainability in industries that represent over 40% of global GDP. Samsara’s focus on continuous improvement and customer-centric innovation drives its commitment to creating a safer and more sustainable world.

Sector

Samsara operates within the Industrial IoT (Internet of Things) sector, specializing in fleet management and physical asset monitoring. Its offerings include GPS fleet tracking, AI-powered dash cameras, environmental monitoring systems, telematics solutions, and real-time analytics. These tools are tailored for industries such as logistics, construction, food services, and public sector operations.

Competitive Advantage

Samsara stands out due to its comprehensive platform that integrates video-based safety features, advanced telematics capabilities, app workflows, and real-time monitoring. Its user-friendly interface and AI-driven analytics allow businesses to optimize operations efficiently. Strategic partnerships with companies like Continental and Revvo Technologies further enhance its product offerings. Samsara also benefits from a subscription-based revenue model with 98% recurring sales, ensuring predictable growth.

Total Addressable Market (TAM)

Samsara's official Total Addressable Market (TAM) estimate for 2024 is $137 billion, reflecting the company's core Connected Operations opportunity. Within this, Connected Fleet Solutions account for $51 billion, expanding into broader telematics and fleet optimization.

Earlier estimates placed the 2024 TAM at $97 billion, with a 21% CAGR from 2021 to 2024. Management now expects the TAM to reach $200 billion by 2026, although no specific growth rate was provided.

Primary growth catalysts include:

· Digital Transformation across physical operations industries, which represent 40% of global GDP, is accelerating adoption of connected technologies.

· AI Integration remains central. Samsara’s platform processes over 14 trillion data points, powering advanced predictive analytics and operational insights.

· Regulatory Compliance is tightening. Mandates for electronic logging, safety monitoring, and environmental reporting continue to drive adoption.

· International Expansion represents untapped upside, with 89% of revenue currently domestic. Global rollout remains a key long-term lever.

Valuation

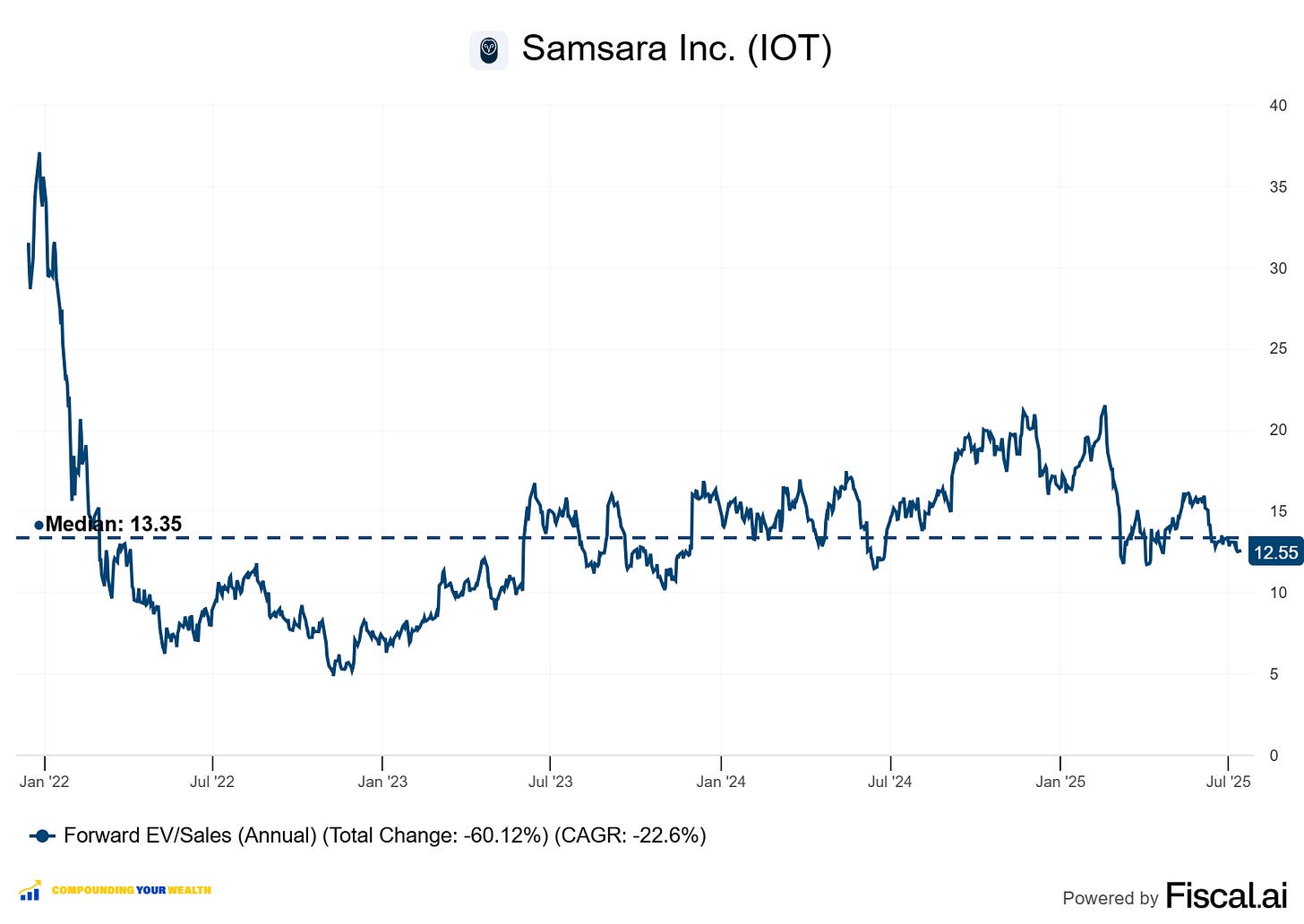

$IOT Samsara is trading at a Forward EV/Sales multiple of 12.55, which is below its average of 13.35.

Currently, Samsara is valued below its historical average Forward EV/Sales level, and has declined from a local peak of 22x back in March 2025.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$IOT Samsara trades at a Forward P/E of 90.0, with revenue growth of 30.7% YoY in the last quarter.

The EPS growth forecast for 2026 is +25.3%, with a P/E of 91.2, resulting in a 2026 PEG ratio of 3.6.

For 2027, EPS is expected to grow +26.8%, with a P/E of 72.8 and a PEG ratio of 2.7 — still on the higher side.

That said, Samsara only became non-GAAP profitable in 2023 and remains in the early stages of its growth story, which partly justifies the premium valuation.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast +21.8% revenue growth for $IOT in 2026 and +21.1% in 2027.

Based on these projections, the valuation—using the EV/Gross Profit multiple—appears slightly undervalued compared to other SaaS companies.

While the non-GAAP operating margin is positive, the GAAP operating margin remains negative.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Samsara possesses a narrow economic moat overall, with varying strengths across different moat categories. Let's examine each type of economic moat in detail.

Economies of Scale

Samsara has developed significant economies of scale as its customer base expands, demonstrating strong operational leverage across its platform. With Annual Recurring Revenue (ARR) of $1.54 billion and 31% year-over-year growth, the company has achieved substantial scale that allows fixed costs to be spread across a larger revenue base. The platform now processes over 14 trillion data points (+50% YoY), tracks more than 80 billion miles traveled (+25% YoY), and handles over 120 billion API calls (+50% YoY). This massive data processing capability creates cost efficiencies that become more pronounced as the customer base grows. The company's ability to maintain healthy unit economics while scaling rapidly demonstrates the strength of its economies of scale, particularly in data processing, infrastructure, and R&D investments. With 22% of annual revenue allocated to R&D and an R&D Index (RDI Score) of 1.45, well above the industry median of 0.7, Samsara efficiently leverages its scale to drive innovation.

Network Effect

Samsara benefits from a powerful network effect driven by user adoption and data feedback loops that create a self-reinforcing competitive advantage. As more customers join the platform, Samsara collects greater volumes of operational data, processing 4.2 petabytes of IoT data daily with support from 312 dedicated data scientists. This data aggregation improves the platform's machine learning and predictive analytics capabilities, which in turn attracts more users seeking superior insights. The network effect is particularly evident in Samsara's anonymized network insights like Street Sense (predictive traffic analytics) and AI Multi-Cam (behavioral safety coaching), which become more accurate and valuable as the user base expands. Real-world examples demonstrate this power: a North American logistics firm reduced safety incidents by 61% using Samsara's AI-driven coaching, while Emery Sapp & Sons achieved a 40% reduction in safety events. However, this network effect is strongest within specific verticals rather than universally across all industries, which somewhat limits its defensive strength.

Brand Strength

Samsara has established a strong brand presence in the IoT and connected operations market, particularly within transportation, logistics, and industrial sectors. The company serves 41% of Fortune 500 transportation and logistics companies, demonstrating significant market penetration among large enterprise customers. This brand strength is reinforced by measurable customer outcomes: the platform has helped prevent over 250,000 vehicle accidents, digitized 300+ million workflows, and saved 3+ billion pounds of CO₂. Frost & Sullivan recognized Samsara with the 2024 North American Company of the Year Award, citing its market-leading position and comprehensive platform capabilities. The brand's credibility is further enhanced by customer testimonials, with one enterprise stating that "Samsara is our most utilised company-wide business system and is responsible for millions in savings in our bottom line". International recognition from organizations like Great Place To Work across the United States, Mexico, and Europe reinforces the brand's global appeal. While the brand strength provides moderate competitive protection, it operates in a competitive market where technological innovation often outweighs brand loyalty.

Intellectual Property

Samsara maintains a moderate to strong intellectual property portfolio that provides meaningful competitive protection. The company holds 237 active IoT sensor patents as of the latest data, with 92% of patents remaining active. This patent portfolio covers core technologies including driver monitoring systems, impaired view detection, and battery management innovations. The company's commitment to IP development is evidenced by its substantial R&D investment of 22% of annual revenue and 63 active IoT research projects. Samsara has demonstrated its willingness to defend its IP rights aggressively, filing lawsuits against competitors like Motive Technologies for patent infringement, alleging that competitors have systematically copied Samsara's patented technologies. The lawsuit detailed that "Motive employees surreptitiously viewed Samsara's Dashboard more than 20,600 times from 2018 to 2022". However, with only 41 total patents globally, the portfolio size is relatively modest compared to larger technology companies, limiting the breadth of protection.

Switching Costs

Samsara's switching costs represent its strongest moat element, creating significant barriers for customers considering alternative solutions. The platform's deep integration into customer operations generates high switching costs that go beyond simple software replacement. Samsara reports an impressive 95% customer retention rate and 120% net revenue retention for customers with ARR over $100K, reflecting the difficulty and cost of switching platforms. The system becomes deeply embedded across multiple business functions—from fleet management to safety monitoring—making replacement highly disruptive. Customers face significant redesign costs averaging $1.2 million when considering platform changes. The switching cost advantage is reinforced by the platform's comprehensive nature, with 85% of core customers using multiple Samsara products. This multi-product adoption creates operational dependencies that make switching increasingly complex and expensive. The fact that customers describe Samsara as their "most utilised company-wide business system" demonstrates how central the platform becomes to daily operations.

Overall, Samsara possesses a narrow but strengthening economic moat with switching costs serving as the primary defensive mechanism. The combination of growing economies of scale, improving network effects, and substantial switching costs creates a competitive advantage that becomes more defensible as the company scales. While individual moat elements face competitive pressures, their combined effect provides meaningful protection in the rapidly evolving IoT and connected operations market.

Revenue growth

$IOT Samsara reported +30.7% YoY revenue growth in Q1, a slowdown from the adjusted +35% YoY in Q4 FY2024 (excluding the extra week in 2023).

Based on guidance for next quarter, if the company beats by 4.2% again, as it did in Q1, Q2 revenue growth would be ~29.5%, signaling a stabilization in growth.

RPO growth slowed to +28.4%, and cRPO growth also decelerated to +29.4% — both now growing slower than revenue.

Billings growth accelerated to +27.7%, but still lags revenue growth.

Segments and Main Products.

Samsara operates across three primary segments: fleet management, asset tracking, and industrial IoT.

The fleet management segment offers tools for real-time GPS tracking, vehicle diagnostics, driver safety, and compliance, enabling businesses to improve operational efficiency and safety. It is widely adopted in transportation and logistics.

The asset tracking segment monitors physical assets like trailers, containers, and heavy equipment. It provides real-time location data, geofencing, and environmental monitoring, ensuring better utilization and regulatory compliance for machinery-dependent industries. Samsara's Asset Tags support this segment by offering real-time visibility into high-value assets, aiding in theft prevention, inventory management, and asset recovery. These rugged tags have a four-year battery life and integrate with Samsara’s IoT network, helping field teams locate equipment quickly and reduce downtime.

The industrial IoT segment connects equipment and machinery to Samsara’s cloud-based platform, delivering data-driven insights for sectors like manufacturing, construction, and logistics. This improves efficiency and supports sustainability goals.

Connected Workflows digitize multi-step processes by integrating forms like inspections and incident reports directly into the platform. This enables real-time data capture, simplifies compliance, reduces admin overhead, and allows teams to resolve field issues faster. By centralizing information and connecting departments, operations become more agile and coordinated.

Main Products Performance in the Last Quarter

Fleet Management

Fleet Management remains Samsara’s core growth engine. $1.54B in ARR, up 31% YoY, reflects strong enterprise adoption. The company added 154 new customers with $100K+ ARR, totaling 2,638 large customers, up 35% YoY. Customers like 7-Eleven and DFW Airport contributed to large-scale wins. Use cases include vehicle tracking, fuel efficiency, and route optimization. Macro-driven spend shifts due to tariffs briefly elongated sales cycles, but several delayed deals closed in May. Transportation saw highest YoY growth in over 4 years, driven by digital transformation urgency.

Industrial IoT

Adoption of Samsara's Industrial IoT solutions is accelerating across construction, energy, and field services. Equipment monitoring experienced its 4th consecutive quarter of net new ACV acceleration. Sterling Crane saved $500K in annual labor and over $3M in maintenance costs using Samsara’s solutions. Use cases include remote diagnostics and asset visibility in harsh environments. Customers seek lifecycle extension and resilience amidst supply chain instability.

Safety & Telematics

Safety and AI-driven telematics are unlocking measurable ROI. Samsara’s safety platform addresses distracted driving, fatigue, and violations at scale. A leading propane company reduced safety incidents by 75% and mobile usage by 71% in a pilot. The driver coaching model is backed by survey data showing 95% of drivers believe coaching improves road behavior. New features like AI-driven safety inbox, streaks, kudos, and milestone recognition improve outcomes and retention.

Asset Tags

Asset Tags continue to scale with growing field services and construction demand. Asset tags drive use cases in lost asset recovery, technician efficiency, and asset utilization. Although early, adoption is expanding across customer bases. Field services segment saw its highest quarterly net new ACV mix in 5+ years. Asset tags are gross margin accretive, adding operational leverage and contributing to Samsara’s 79% non-GAAP gross margin, a quarterly record.

Connected Training

Training solutions are now integrated into Samsara’s broader safety platform. Customers leverage mobile-based, contextual training post-incident to reduce future risk. Adoption is increasing as companies focus on mitigating human risk factors amid high turnover and skills gaps. Training is embedded into AI-powered workflows, reinforcing behavioral improvement.

Connected Workflows

Workflow products like digital vehicle inspections and work order creation are widely adopted. 230M inspections per year feed Samsara’s AI, powering proactive maintenance recommendations. Customers use pre-populated forms to save technician time and drive asset uptime. Products are generalizable across verticals with expanding utility.

Samsara Intelligence

AI is at the center of Samsara’s product suite. The company’s platform ingests 80B+ asset miles annually, enabling pattern-based insights. AI supports predictive maintenance, behavior analytics, and coaching. Fault code severity analysis and vehicle lifecycle insights are now live. Enterprise customers cite AI's direct impact on safety and efficiency as a differentiator.

Product Innovation and Ecosystem Updates

Samsara is rapidly expanding its OEM strategy through integrations with Hyundai Translead, Stellantis (14M+ vehicles), and Rivian, enabling direct-to-cloud connectivity and reducing hardware dependency. The company introduced an upgrade program to simplify competitive displacement, targeting customers tied to legacy vendors and removing switching friction.

The platform now powers thousands of field services organizations with AI-driven operational intelligence, driving measurable outcomes across safety, efficiency, and response times.

Interstate Waste scaled beyond dash cams to a full digital overhaul. Sunrun cut accident rates by 32% and improved utilization by 23%. Uniti Fiber boosted dispatch efficiency by 76%. Midland Tyre saved thousands of hours through faster incident response. Roto-Rooter and Satellites Unlimited gained insurer endorsement after reducing safety risks.

AI Safety Intelligence upgrades include the AI Multicam, delivering 360° HD video coverage with real-time alerts for pedestrians and cyclists. Weather Intelligence overlays National Weather Service data to identify environmental hazards. AI Coaching Automation streamlines risk analysis and training, while the enhanced Driver App offers TikTok-style videos, end-of-day recaps, and in-app rewards. Coach USA saw a 92% reduction in preventable incidents using these tools.

The Samsara Wearable protects workers beyond vehicles, offering one-click emergency alerts, fall detection, real-time GPS/audio, and a one-year battery life. Integrated weather threat alerts add a layer of safety in high-risk or remote environments.

Advanced routing tools now integrate with ERP and CRM systems. Route Planning reduces vehicle use by up to 15% through delivery optimization. Commercial Navigation ensures compliant, real-time routing based on vehicle-specific parameters.

New AI-driven maintenance features include voice-to-text DVIR, real-time FMCSA alerts, and automated work orders triggered by AI-deciphered fault codes. Invoice Scanning digitizes vendor receipts, while Level Monitoring delivers near real-time visibility into fuel and tank levels, reducing downtime and cost.

Mohawk Industries saves $7.75M annually by optimizing route performance. Rolfson Oil manages 700+ assets via Samsara’s maintenance dashboard. Univar Solutions uses the Samsara Wearable to protect teams working with hazardous materials.

Samsara also partnered with HappyRobot to bring voice AI automation to the platform. The integration handles over 20M conversations annually, slashing call time by 50% and operational costs by 33%. This solution is available on the Samsara Marketplace.

Market Leader

$IOT Samsara has established commanding market leadership positions across numerous IoT and connected operations categories. G2's Summer 2025 Report awarded Samsara the No.1 Leader position in Fleet Management, marking another consecutive recognition based on thousands of verified user reviews. The company uniquely leads three critical categories simultaneously: Fleet Management, Fleet Tracking, and Video Surveillance—an achievement no other platform has replicated.

Customers

$IOT Samsara added 154 new $100K+ ARR customers in Q1, which is in line with the company’s two-year average and represents +35% YoY growth.

However, management did not disclose figures for larger customers exceeding $1M+ in ARR this quarter.

Customer Success Stories

Sterling Crane achieved operational transformation through Samsara’s maintenance solutions. One of the world’s largest crane rental companies, Sterling reduced unplanned maintenance from 34% to 20%, saving 10,000 technician hours, equating to $500K annually. Additionally, it reported $3M+ in equipment savings, split between $2M from on-road and $1M from off-road assets. AI-based diagnostics and asset monitoring were core to driving these outcomes across challenging terrains in Canada.

A leading retail propane distributor scaled its investment after initial telematics deployment. In Q1, the company expanded into video-based safety, citing 75% fewer safety events and 71% less mobile device usage during its pilot. Samsara’s AI-powered safety coaching was identified as the primary driver of behavioral improvements across 3,000+ vehicles and 2,300+ employees.

Knife River, a construction materials and contracting giant with over 5,700 employees and $2.8B in revenue, selected Samsara for multi-product deployment. Their solution stack included telematics, video safety, and equipment monitoring. Immediate post-pilot gains included significant reductions in distracted driving and safety incidents, validating the AI coaching framework.

A major electric utility services firm increased its investment, marking a 15x expansion since 2019. The customer added safety, telematics, and equipment solutions across a newly acquired entity. Longstanding customer success, compounded by ongoing M&A activity, positioned Samsara as a strategic operational partner.

Public sector agencies including the City of Houston, State of South Carolina, and a top U.S. county (10M+ residents) adopted Samsara to enhance safety and efficiency. Use cases spanned driver risk management, generator tracking post-storm, and fuel reduction. Governments prioritized ROI through fewer accidents and better resource allocation.

Large Customer Wins

7-Eleven, the world’s largest convenience store chain, selected Samsara to streamline and digitize its physical operations. The Dallas–Fort Worth Airport, the second-largest U.S. airport, and a major 10M-resident U.S. county also became new customers, emphasizing scale, safety, and asset utilization as primary motivators.

OEM integrations with Hyundai Translead, Stellantis, and Rivian contributed to channel wins by enabling direct-to-cloud deployment across 14M+ vehicles. This connectivity removed hardware dependencies and unlocked new enterprise channels.

European expansion delivered the highest net new ACV contribution to date from the region. Companies like VINCI, a major global construction player, were highlighted as key lighthouse wins, validating product fit and driving geographic diversification.

International growth, especially in transportation, public sector, and field services, underpinned broad market traction. Samsara’s ability to demonstrate fast ROI and digitally transform multi-billion-dollar operations was core to customer acquisition at scale.

Retention

$IOT Samsara reported a Net Revenue Retention (NRR) of 115% for customers with ARR over $10K. For customers with ARR over $100K, NRR stood at 120% in Q4 FY2024.

In Q1 FY2025, management did not provide updated NRR data for large customers.

For context, the median NRR among SaaS companies I track is around 119%, so Samsara remains competitive on retention metrics.

ARR Growth

$IOT Samsara is seeing a slowdown in Annual Recurring Revenue (ARR) growth, which came in at +30.6% YoY in Q1 — roughly in line with the company’s revenue growth.

Net new ARR

$IOT Samsara added $78 million in net new ARR for Q1 2025, which is 5% higher than the previous year.

CAC Payback Period and RDI Score

$IOT Samsara's return on S&M spending is 23.9, the CAC Payback Period, better than the median for SaaS companies, is at a healthy level (the median for the SaaS companies I track is 26.9).

The R&D Index (RDI Score) for Q1 stands at 1.81, above the median of 1.1 for the SaaS companies I monitor and significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered indicative of best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

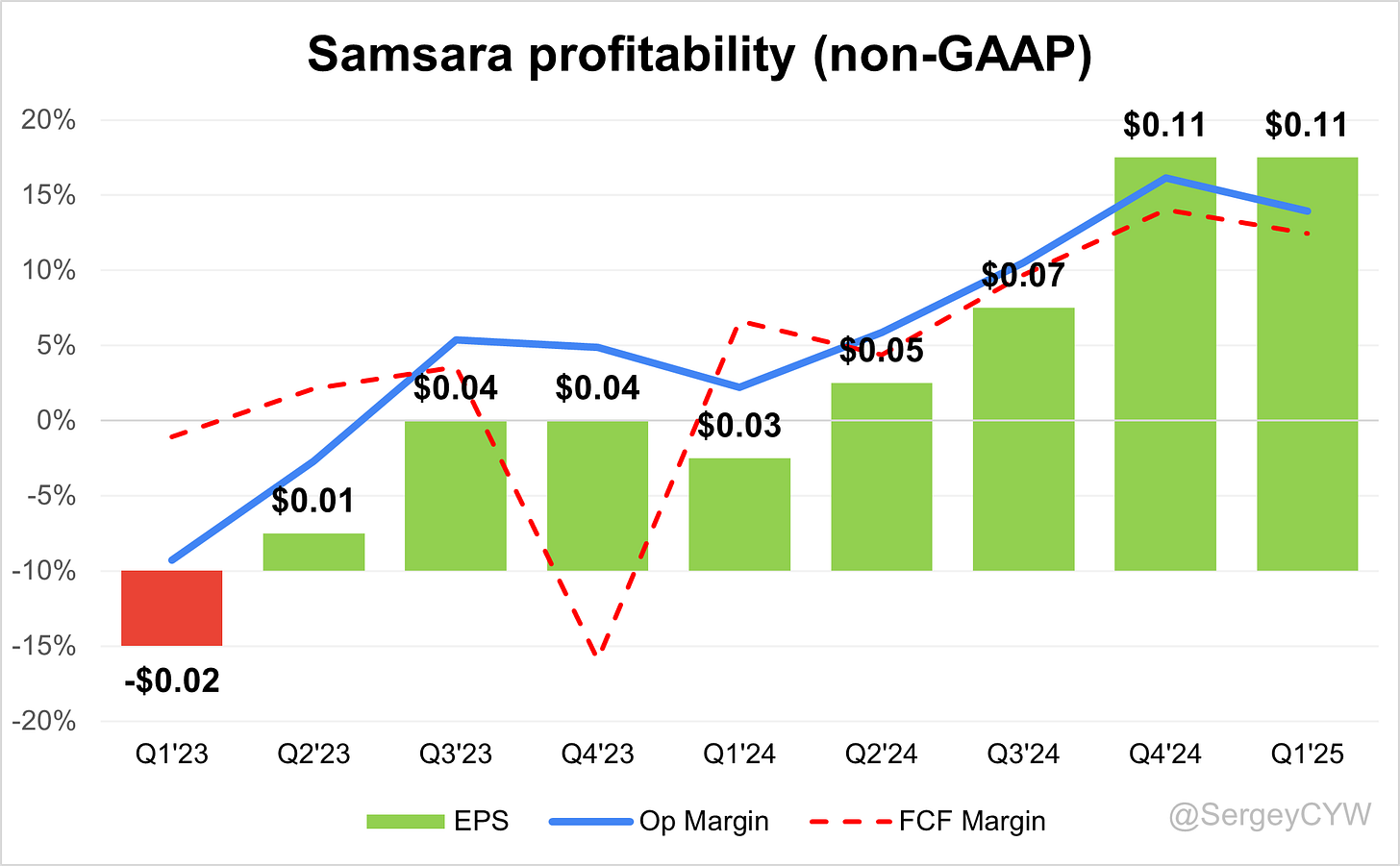

Over the past year, $IOT Samsara has significantly improved its margins:

Gross Margin rose from 76.9% to 78.5%.

Operating Margin increased from 2.2% to 13.9%.

FCF margin increased from 6.6% to 12.4%.

Operating expenses

$IOT Samsara has seen a gradual decline in non-GAAP operating expenses, primarily driven by a reduction in Sales & Marketing (S&M) spend.

S&M expenses dropped from 50% to 38% over the past two years, showing improved efficiency.

R&D remains elevated at 15%, though down from 19%, reflecting Samsara’s continued investment in innovation and long-term product development.

General & Administrative (G&A) expenses also declined to 12%, down from 14%, contributing to overall margin improvement.

Balance Sheet

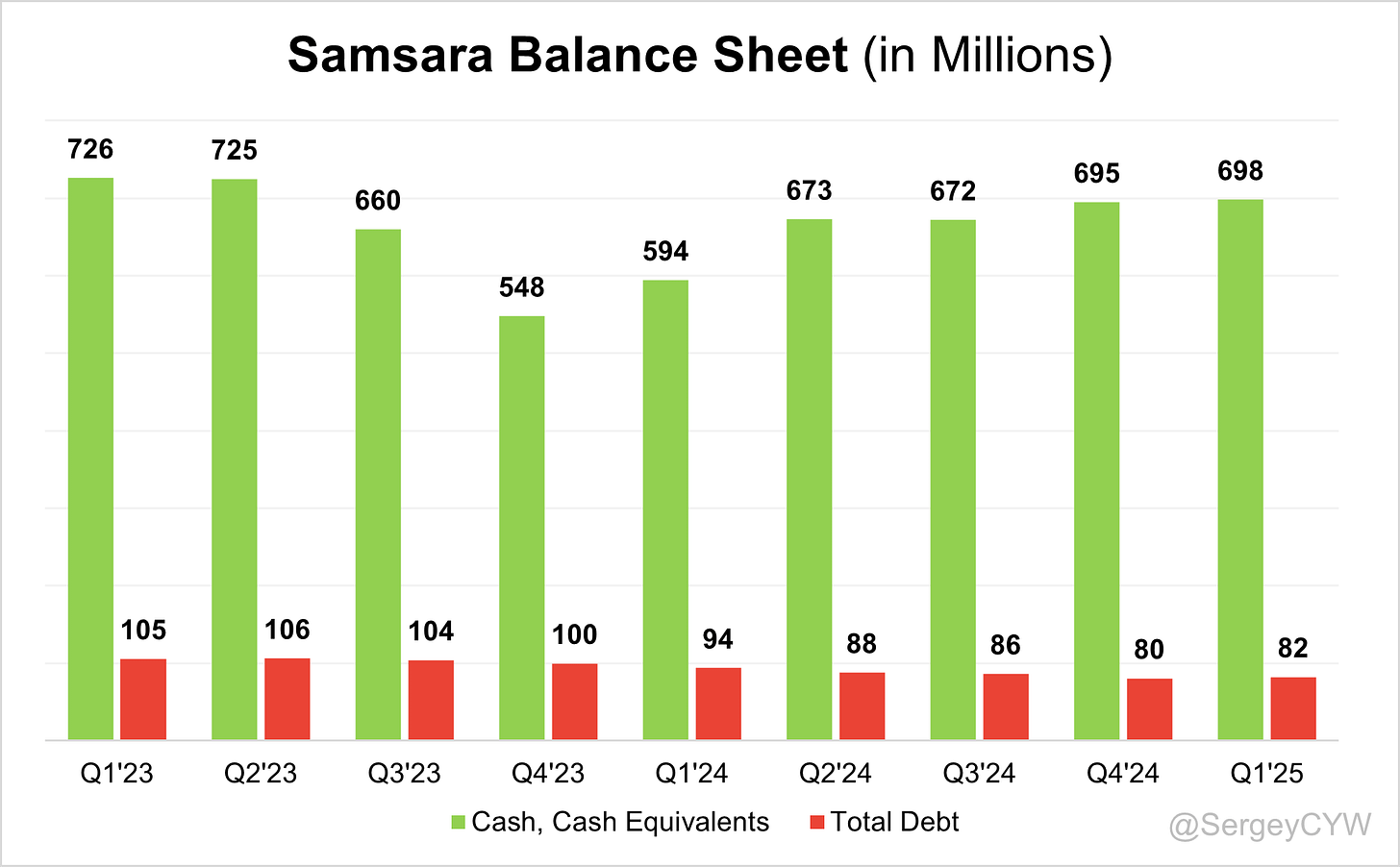

$IOT Balance Sheet: Total debt stands at $82M, while Samsara holds $698M in cash and cash equivalents, exceeding its total debt and ensuring a healthy balance sheet reflects a virtually debt-free balance sheet.

Dilution

$IOT Samsara — Shareholder Dilution: Stock-based compensation (SBC) expenses have been gradually declining over the past two years, but in Q1 ticked up slightly to 23% of revenue, which is still a relatively high level compared to typical SaaS benchmarks.

Shareholder dilution remains elevated, but still within acceptable limits, with a modest improvement in Q1. The weighted-average basic shares outstanding increased by 3.5% YoY.

Conclusion

$IOT Samsara saw a slowdown in revenue growth in Q1 FY2025, but it remains at a strong level overall.

Management now expects to expand its TAM to $200 billion by 2026, signaling long-term opportunity.

Leading Indicators

RPO growth of +28.4%, which is below revenue growth

Billings growth of +27.7%, also below revenue growth

ARR growth at +30.6% YoY, roughly in line with revenue

Net new ARR additions up +5% YoY

Customer growth was average, in line with the company’s two-year trend

Key Metrics

Net Dollar Retention (NDR) held steady at 115%

CAC Payback Period worsened slightly to 23.9 months, but remains slightly better than the SaaS average

RDI Score increased to 1.81, which is above the median of the SaaS companies I track

The forecast suggests a potential stabilization in revenue growth, but leading indicators were mixed.

Customer additions were mediocre, and RPO and Billings growth came in below revenue — a cautionary signal.

That said, Samsara is strengthening its competitive position through key product innovations like Asset Tags, Samsara Intelligence, and notable customer wins in Q1 such as 7-Eleven and Dallas–Fort Worth Airport.

Margins have improved significantly over the past year, and the company continues to deliver strong top-line growth.

Valuation has compressed below median levels, making Samsara appear slightly undervalued relative to its expected revenue growth among SaaS peers.

After the recent valuation reset, I slightly increased my position in June 2025.

While the slowing revenue growth and weaker leading indicators raise some concerns, I’ll be closely watching Q2 results — particularly RPO, Billings, and new customer additions.

Despite its strong growth profile and expanding TAM, Samsara remains a small position in my portfolio at 4.1%.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

excellent article, like always ! It is still on my watchlist, and still a bit expensive ... next dip , i am in ;-)