Samsara Q4 2024 Earnings Analysis

Dive into $IOT Samsara’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$346.3M rev (+25.3% YoY, +35.6% LQ) beat est by 3.4%

↗️GM* (77.9%, +1.6 PPs YoY)🟢

↗️Operating Margin* (16.1%, +11.3 PPs YoY)🟢

↗️FCF Margin (14.0%, +29.9 PPs YoY)🟢

↗️Net Margin (-3.2%, +8.1 PPs YoY)🟢

↗️EPS* $0.11 beat est by 57.1%🟢

*non-GAAP

Key Metrics

➡️NRR $10K+ ARR 115% (115% LQ)

➡️NRR $100K+ ARR 120% (120% LQ)

↗️ARR $1.46B (+32.3% YoY, +109 net new ARR)🟢

➡️Billings $392M (+16.1% YoY)🟡

Customers

↗️2,506 $100k+ customers (+35.6% YoY, +203)🟢

↗️114 $1M+ customers (+39.0% YoY, +14)🟢

Operating expenses

↘️S&M*/Revenue 37.3% (-3.7 PPs YoY)

↘️R&D*/Revenue 13.9% (-3.1 PPs YoY)

↘️G&A*/Revenue 10.6% (-2.9 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $109M (+9.8% YoY)

↗️CAC* Payback Period 20.1 Months (+10.2 YoY)🟡

↘️R&D* Index (RDI) 1.45 (-0.53 YoY)🟡

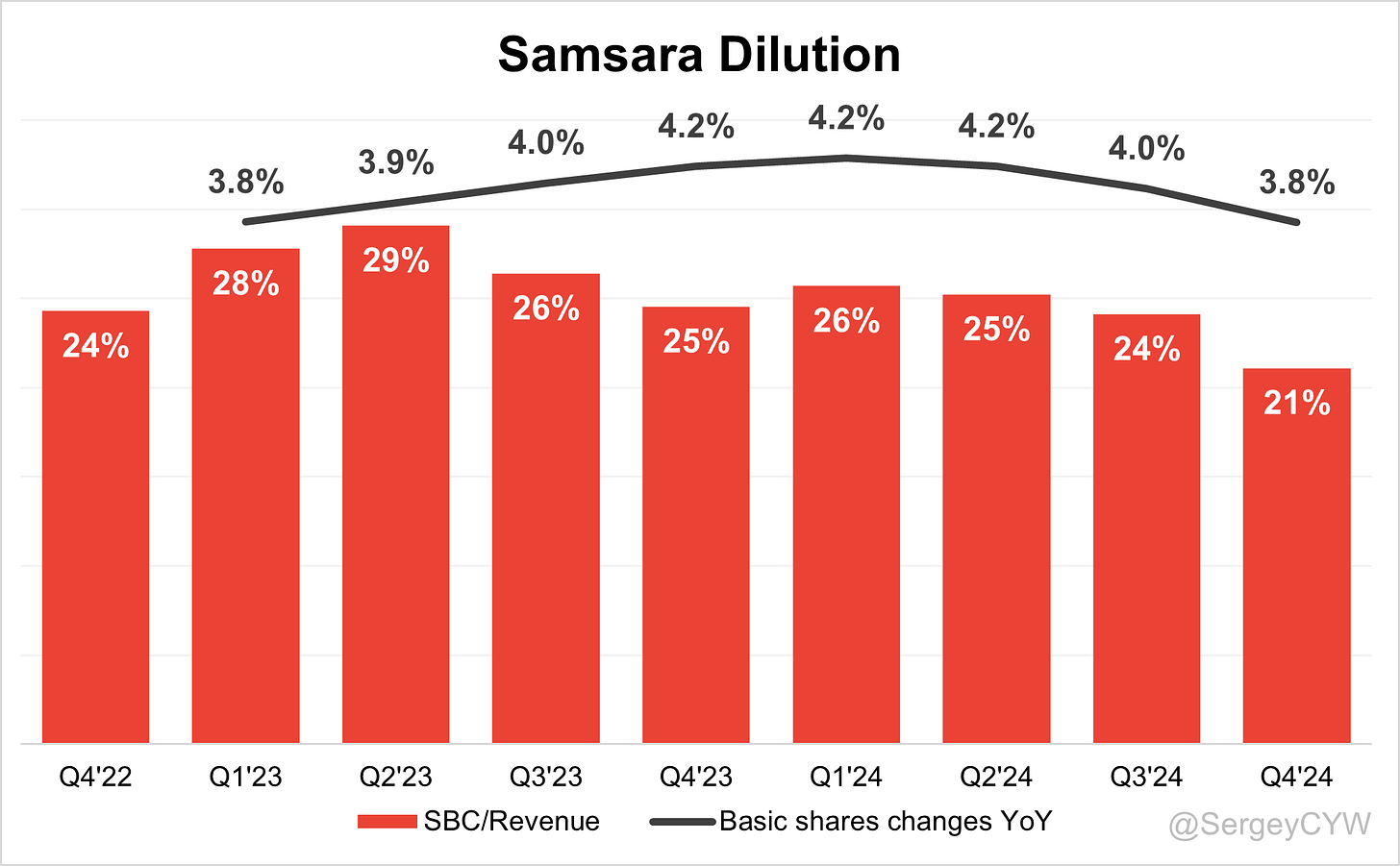

Dilution

↘️SBC/rev 21%, -3.0 PPs QoQ

↘️Basic shares up 3.8% YoY, -0.2 PPs QoQ

↘️Diluted shares up 2.1% YoY, -0.5 PPs QoQ

Guidance

➡️Q1'25$350.0 - $352.0M guide (+25.0% YoY) in line with est

➡️$1,523.0 - $1,533.0M FY guide (+22.3% YoY) in line with est

Key points from Samsara Fourth Quarter 2024 Earnings Call:

Financial Performance

Samsara closed FY 2025 with $1.46 billion in ARR, up 32% YoY (33% adjusted). Q4 revenue reached $346 million (+25% YoY, 36% adjusted), with net new ARR at $109 million (+10% YoY, 12% adjusted for currency).

Profitability hit record levels. Q4 gross margin was 78%, operating margin 16%, and free cash flow margin 14%. FY 2025 revenue totaled $1.25 billion (+33% YoY, 37% adjusted), with net new ARR at $356 million (+16% YoY, 17% adjusted).

For FY 2026, Samsara guides revenue between $1.523 billion and $1.533 billion (+22–23% YoY, 23–24% adjusted). Q1 2026 revenue expected at $350 million to $352 million (+25% YoY). Non-GAAP operating margin targeted at 11%, with EPS projected at $0.32 to $0.34.

AI Integration

Samsara processes 14 trillion data points annually (+50% YoY) and recorded 120 billion API calls (+50% YoY). AI reduces vehicle downtime, enhances driver safety, and automates employee training.

A leading field services provider deployed AI-driven Connected Training, achieving a 98% on-time training completion rate. AI is transforming operations with real-time route adjustments, predictive maintenance, and automated risk detection.

Asset Tags

A DIY moving and storage company added 10,000+ asset tags to monitor 200,000 trucks, 140,000 trailers, and 250,000 storage boxes, cutting costs by $1 million in safety, idling, and maintenance.

Asset Tags replace RFIDs and QR codes, improving asset tracking, utilization, and security. Adoption is growing, contributing 15% of net new ACV in Q4, the highest in 10 quarters. Expansion is expected in construction, logistics, and industrial sectors.

Safety & Telematics

Adoption remains underpenetrated, with 90% of North American commercial vehicles lacking AI safety technology.

Bimbo Bakeries expanded Samsara's safety platform, cutting collision risk by 70%, harsh driving by 64%, and policy violations by 49%. A top 3 U.S. LTL carrier optimized fleet operations with Samsara’s AI-powered telematics and routing.

Scaling remains complex, requiring multi-year sales cycles, fleet integration, and workforce change management. ARR per $100K+ customer rose to $323,000 (from $313,000 YoY).

Connected Workflows & Training

A leading gas and water distribution company adopted telematics, safety, equipment monitoring, and AI-powered training. It created 20+ custom courses, achieving a 98% on-time completion rate, reducing $500K in annual asset losses.

AI-driven workflows streamline compliance and improve workforce accountability. Cross-selling boosts retention, with 115–120% net revenue retention for large customers.

Public Sector

Miami-Dade County signed a $1M+ contract, implementing Samsara’s platform in transportation and waste management.

Public sector customers require long sales cycles but provide high retention. Investments in compliance-driven enhancements strengthen Samsara’s market position.

Customers

Samsara ended FY 2025 with 2,506 customers generating $100K+ ARR (+36% YoY), adding 203 new customers in Q4 (quarterly record). The $1M+ ARR customer base grew to 118 (+44% YoY), adding 14 in Q4.

55% of ARR now comes from $100K+ customers (up from 52% YoY, 48% two years ago). 62% of large customers use 3+ Samsara products (up from 58% YoY), driving higher multi-product adoption.

Large Customer Wins

New enterprise wins include:

A top 3 global telecom company adopting Samsara’s platform.

A top 3 U.S. LTL carrier implementing Samsara’s telematics and safety.

Bimbo Bakeries optimizing fleet safety and reducing collisions.

Miami-Dade County integrating Samsara for government fleet management.

Customer Success

Bimbo Bakeries (20,000+ workers, 5,500 vehicles, 11,000 routes) reduced collision risk by 70%, harsh driving by 64%, policy violations by 49%.

A DIY moving company (200,000+ trucks) cut $1M+ in costs using Samsara’s asset tracking and real-time visibility tools.

A gas and water distribution company saw a 98% on-time training completion rate and eliminated $500K in annual asset losses with AI-powered tracking.

International Growth

International markets contributed 17% of net new ACV in Q4, the second-highest quarterly mix ever.

The UK posted its highest net new ACV mix, while Mexico recorded its second-highest. Expansion investments target Europe and Latin America.

Leadership Changes

Lara Kami, President of Worldwide Field Operations, is stepping down.

Chief Revenue Officer Amit Vias and COO Robert Stobah assume leadership, ensuring a smooth transition.

Challenges

Macroeconomic uncertainty, slowing GDP growth, and geopolitical risks pose headwinds.

Large enterprise deals require multi-year evaluations, integration, and change management. 50% of North American vehicles still lack telematics, and 90% lack AI-based safety solutions, presenting growth opportunities but requiring customer education.

Future Outlook

Samsara expects durable long-term growth in digitizing physical operations. ARR is approaching $1.5 billion, with expanding operating margins.

Investor Day in June 2025 will outline AI monetization, new product strategies, and expansion plans.

Management comments on the earnings call.

Product Innovations

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Since founding, we've successfully built and scaled more than eight products. Our customers use our platform as a single system of record, integrating safety, telematics, equipment monitoring, and AI-powered insights to transform their operations. As we expand our platform to serve our customers better, we create future expansion opportunities to drive growth.”

"We are continuously innovating to solve the toughest challenges in operations. Today, 62% of our large customers use three or more products, up from 58% a year ago. This steady growth in multi-product adoption reflects the increasing value of our platform.”

Artificial Intelligence (AI) Transformation

Sanjit Biswas, Chief Executive Officer and Co-Founder

"AI has become 100 times less expensive over the last two years, making it more accessible than ever before. Our customers are already using AI for proactive maintenance, detecting risky behaviors like drowsiness, and automating training. We believe AI will completely transform how physical operations are managed in the future.”

"By leveraging our massive data asset—processing over 14 trillion data points annually and more than 120 billion API calls last year—we are in a unique position to integrate AI at scale. AI will allow our customers to dynamically monitor operations, adjust delivery routes based on real-time conditions, and anticipate customer demands with unprecedented accuracy.”

Asset Tags: Expanding Use Cases

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Asset Tags have rapidly become a powerful tool for tracking high-value equipment across industries. Customers previously relied on manual tracking methods like RFIDs and QR codes, but with our technology, they now have a seamless and scalable way to manage assets in real time. In industries like construction and logistics, we’re seeing strong demand as companies look for better asset visibility and loss prevention solutions.”

"One of North America’s largest DIY moving and storage operators recently deployed over 10,000 asset tags across their fleet. The result? Over $1 million in cost savings across safety, idling, and maintenance expenses—proving the strong return on investment.”

Safety & Telematics Products

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Our customers choose us because we help them operate smarter with our connected operations platform. From AI camera alerts for safety to real-time tracking and fuel optimization, we are enabling businesses to make data-driven decisions that enhance efficiency and reduce operational costs.”

"Bimbo Bakeries, the largest commercial bakery in the U.S., saw a 70% reduction in collision risk, a 64% decrease in harsh driving events, and a 49% drop in policy violations after implementing our AI-powered safety and telematics solutions. These results showcase the tangible impact of our technology on real-world operations.”

Connected Workflows and Training

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Our Connected Workflows and Training platform is transforming how businesses manage their frontline workforce. A major gas and water distribution company used our AI course builder to create over 20 custom training courses and achieved a 98% on-time completion rate. This demonstrates how AI can streamline compliance and enhance workforce efficiency.”

"Companies operating at scale need digital solutions to reduce inefficiencies and prevent unnecessary costs. One customer was losing $500,000 annually due to misplaced assets—after deploying our asset tracking and workflow solutions, they dramatically improved accountability and operational efficiency.”

Customers

Dominic Phillips, Chief Financial Officer

"We are successfully proving that we have an enterprise-grade platform capable of serving the largest and most strategic accounts. In Q4 alone, we landed a top three global telecom provider, a top three U.S. LTL carrier, and Bimbo Bakeries—all of which represent massive opportunities for long-term expansion.”

"Our strategy is working—55% of our ARR now comes from $100K+ customers, up from 52% last year and 48% two years ago. At the same time, our average ARR per $100K+ customer has increased to $323,000. We are landing larger customers at a faster rate and seeing significant expansion opportunities within those accounts.”

International Growth

Dominic Phillips, Chief Financial Officer

"International expansion remains a critical growth driver. In Q4, 17% of net new Annual Contract Value came from international markets, tied for our second-highest quarterly contribution ever. Mexico and the UK were particularly strong, both accelerating net new ACV growth sequentially.”

"With more physical operations assets and frontline workers outside of North America than within it, we see an enormous global market opportunity. As we continue to invest in international go-to-market expansion, we expect further growth in these regions.”

Leadership Changes

Sanjit Biswas, Chief Executive Officer and Co-Founder

"We want to thank Lara Kami for her leadership as President of Worldwide Field Operations. Following her departure, we are confident in the transition, with Chief Revenue Officer Amit Vias and Chief Operating Officer Robert Stobah stepping up to lead our go-to-market efforts. Both leaders have been with the company for over six years and have deep expertise in scaling revenue operations.”

Challenges

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Many of our largest enterprise customers require multi-year sales cycles before adopting our platform at scale. While these sales cycles are longer and less predictable, they also represent some of our highest-value opportunities. Our enterprise focus ensures strong retention, high expansion potential, and significant long-term revenue growth.”

Dominic Phillips, Chief Financial Officer

"The macroeconomic environment remains uncertain, and while we do not see immediate headwinds, we remain vigilant. Our customers are focused on driving efficiency, and our solutions directly address their need to reduce costs and optimize operations. This gives us confidence in the durability of our growth, even in a changing economic climate.”

Future Outlook

Sanjit Biswas, Chief Executive Officer and Co-Founder

"We are just getting started. The digital transformation of physical operations is in its early stages, and we see a clear path to multi-billion-dollar revenue growth. AI will be at the center of this transformation, enabling businesses to operate smarter, safer, and more efficiently than ever before.”

"With ARR approaching $1.5 billion and operating margins expanding, we are in a rare position of scale, growth, and profitability. As we enter the next decade, we are focused on deepening enterprise penetration, expanding internationally, and leveraging AI to drive long-term value for our customers.”

Dominic Phillips, Chief Financial Officer

"Our financial outlook for FY 2026 remains strong. We expect revenue between $1.523 billion and $1.533 billion, reflecting 22–23% YoY growth, with non-GAAP operating margin expanding to approximately 11%. Our Investor Day in June will provide further details on our long-term strategy, including AI monetization, new product innovation, and international expansion.”

Thoughts on Samsara Earnings Report $IOT:

🟢 Positive

Revenue reached $346.3M (+25.3% YoY, adj +36% YoY), beating estimates by 3.4%.

ARR grew to $1.46B (+32.3% YoY adj +33% YoY, +$109M net new ARR).

Operating margin expanded to 16.1% (+11.3 PPs YoY).

Gross margin reached 77.9% (+1.6 PPs YoY).

Free cash flow margin improved to 14.0% (+29.9 PPs YoY).

EPS of $0.11 beat estimates by 57.1%.

$100K+ customers grew to 2,506 (+35.6% YoY, +203 net new). Record-level additions.

114 $1M+ customers (+39.0% YoY, +14 net new). Additions at a record level.

AI-powered safety and telematics led to a 70% collision risk reduction for Bimbo Bakeries.

Miami-Dade County signed a $1M+ contract, strengthening Samsara’s public sector presence.

NRR for $10K+ ARR customers at 115%, and $100K+ ARR customers at 120%, unchanged QoQ.

🟡 Neutral

Billings increased to $392M (+16.1% YoY), trailing ARR growth.

Q1 2026 revenue guidance of $350M–$352M (+25% YoY) in line with estimates.

FY 2026 revenue guide at $1.523B–$1.533B (+22.3% YoY), also in line with expectations.

International net new ACV contribution at 17%, tied for second-highest quarterly mix.

RDI Index dropped to 1.45 (-0.53 YoY).

🔴 Negative

CAC payback period extended to 20.1 months (+10.2 YoY).

Stock-based compensation (SBC) at 21% of revenue, though improving (-3.0 PPs QoQ).

Macroeconomic uncertainty and long enterprise sales cycles pose challenges.

50% of North American vehicles still lack telematics, and 90% lack AI-based safety solutions, requiring more market penetration.