Samsara Q3 2024 Earnings Analysis

Dive into $IOT Samsara’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$322.0M rev (+35.6% YoY, +36.9% LQ) beat est by 3.7%

↗️GM* (77.6%, +2.2 PPs YoY)🟢

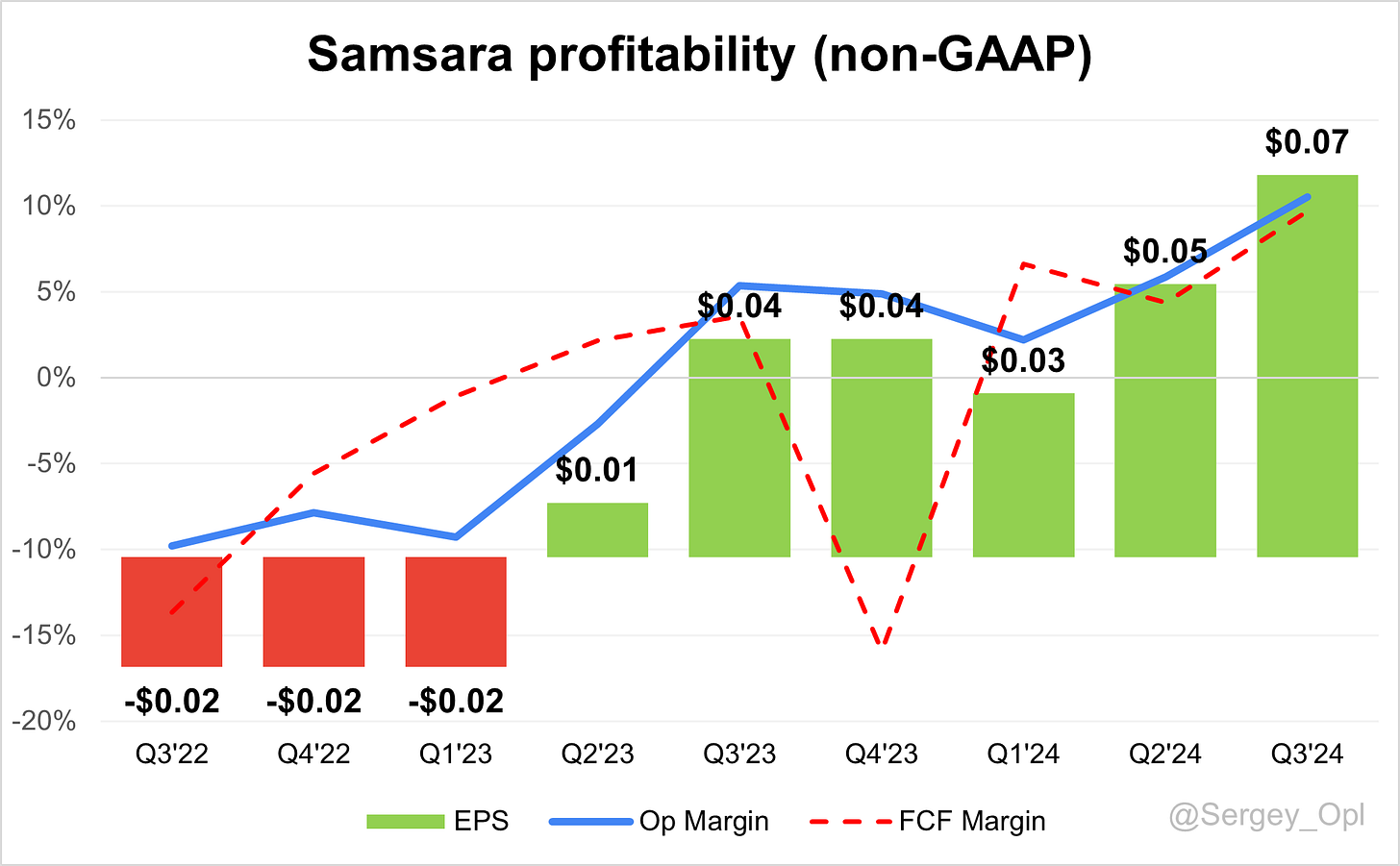

↗️Operating Margin* (10.5%, +5.2 PPs YoY)🟢

↗️FCF Margin (9.7%, +6.1 PPs YoY)🟢

↗️EPS* $0.07 beat est by 75.0%🟢

*non-GAAP

Key Metrics

➡️NRR $10K+ ARR 115% (115% LQ)

➡️NRR $100K+ ARR 120% (120% LQ)

➡️ARR $1.35B (+34.5% YoY, +85 net new ARR)🟡

➡️Billings $339M (+28.3% YoY)🟡

Customers

↗️2,303 $100k+ customers (+38.5% YoY, +170)

Operating expenses

↘️S&M*/Revenue 39.3% (-1.4 PPs YoY)

↘️R&D*/Revenue 15.0% (-1.1 PPs YoY)

↘️G&A*/Revenue 12.7% (-0.6 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $85M (+16.8% YoY)

↗️CAC* Payback Period 23.0 Months (+1.2 YoY)🟡

↘️R&D* Index (RDI) 1.97 (-0.16 YoY)🟡

Dilution

↘️SBC/rev 24%, -1.1 PPs QoQ

↘️Basic shares up 4.0% YoY, -0.2 PPs QoQ🟡

↗️Diluted shares up 2.6% YoY, +0.3 PPs QoQ

Guidance

➡️Q4'24 $334.0 - $336.0M guide (+21.2% YoY) in line with est

↗️$1,237.0 - $1,239.0M FY guide (+32.1% YoY) raised by 0.9% beat est by 0.7%

Key points from Samsara’s Third Quarter 2024 Earnings Call:

Financial Performance

Samsara reported strong Q3 FY2025 financial results, reflecting durable growth and increasing profitability. The company achieved $1.35 billion in Annual Recurring Revenue (ARR), a 35% year-over-year increase. Quarterly revenue reached $322 million, growing 36% from the prior year. Key profitability metrics reached record levels, including a 78% gross margin, an 11% operating margin, and a 10% adjusted free cash flow margin.

Large enterprise customers accounted for 54% of total ARR, up from 51% last year and 47% two years ago. Net retention rates were 115% for core customers and 120% for large customers, showcasing effective account expansion. Samsara added 170 customers with ARR exceeding $100,000, increasing its large customer base by 38% year-over-year. The average ARR per large customer rose to $318,000, compared to $307,000 a year ago.

Guidance for FY2025 was raised. Revenue is projected between $1.237 billion and $1.239 billion, representing 35% annual growth. Non-GAAP operating margin is expected at 7%, with EPS guidance between $0.22 and $0.23.

Product Innovations

Samsara accelerated its product innovation, launching Samsara Intelligence, an AI-powered suite aimed at enhancing safety, compliance, and operational efficiency. The suite includes Samsara Assistant, a generative AI tool, and Intelligent Experiences, which delivers actionable insights to frontline workers.

New international features included Low Bridge Strikes in Europe to reduce vehicle collisions with low bridges, Electronic Brake Performance Monitoring System (EBPMS) in the UK for regulatory compliance, and Engine Immobilizer 2.0 in Mexico for enhanced vehicle security and monitoring.

AI-Driven Enhancements

AI remains central to Samsara's strategy. The platform processes over 10 trillion data points and 70 billion miles annually, enabling significant operational improvements. Samsara Assistant identifies vehicle fault codes and offers step-by-step solutions. Intelligent Experiences embeds AI recommendations into workflows, improving safety and compliance.

Beta tests show strong customer impact, with broader adoption expected as feedback is incorporated.

Asset Tags

Asset Tags, a rapidly growing product line, saw 100% quarter-over-quarter growth in net new ACV. These tags track high-value assets, helping organizations locate lost equipment, optimize asset utilization, and save time. Industries such as construction, field services, and transportation have widely adopted the product.

In construction, Asset Tags enable firms to monitor equipment like scissor lifts and welding tools, reducing theft and idle time while driving ROI. Challenges include scaling adoption among smaller businesses that may not yet understand the benefits. Simplifying deployment and educating potential customers could unlock more market opportunities.

Connected Workflows and Training

Samsara’s Connected Workflows and Training tools help digitize traditional processes, particularly in industries reliant on manual workflows. Recent innovations include Visual Intelligence, an AI tool that analyzes job site photos to identify safety risks or extract actionable data. Policy documents can be uploaded to auto-generate compliance workflows or training modules, reducing administrative efforts and improving safety.

Challenges include integrating these tools into industries with legacy systems. Building seamless integrations and demonstrating ROI will be critical for scaling adoption.

Construction Industry

The construction sector led Samsara's net new ACV growth for the fifth consecutive quarter, driven by demand for safety, asset utilization, and equipment monitoring solutions. Products like Asset Tags have been particularly impactful, allowing companies to track and optimize the use of heavy machinery and tools.

Significant ROI has been delivered through reductions in theft and idle time. To scale further, Samsara must address the needs of mid-market and small construction firms, which often face resource constraints.

Public Sector

The public sector delivered its highest net new ACV contribution in four years, with 16 deals exceeding $100,000 in ARR. Key wins include contracts with the City of Omaha, Fresno County, and the Florida Department of Fish & Wildlife. Organizations are adopting Samsara’s platform to modernize operations, enhance safety, and improve compliance.

Navigating long sales cycles and budgetary constraints remain challenges. However, Samsara’s growing certifications and integrations position it well to continue gaining market share.

Customers and Success Stories

Samsara added 170 customers with ARR over $100,000, bringing the total to 2,303 large customers. Notable customer expansions include:

Comfort Systems USA: Achieved 85% reduction in safety events and 72% reduction in speeding incidents. This Fortune 1000 company has undergone nine expansions since 2022 and now tracks tools like scissor lifts and welders using Asset Tags.

Fortune 500 Water Solutions Provider: Reduced harsh driving by 37%, severe speeding by 48%, and Forward Collision Warnings by 50%. This customer has expanded 11 times since 2021.

Global Logistics Leader: Signed a $1 million-plus deal across multiple products, including Video-Based Safety, Vehicle Telematics, and Equipment Monitoring.

Large Customer Wins

Of the 170 new $100,000+ ARR customers, 78 were new logos, with 9 of the top 10 new customers adopting multiple products. Major wins included:

Papa John’s International, the world’s third-largest pizza delivery company.

A Fortune 500 confectionery company and a Fortune 1000 medical equipment provider.

Expansions also remained strong, with 16 of the top 25 customers increasing their investments in Q3. 21 of the top 25 accounts expanded over the past two quarters.

International Expansion

International markets contributed 17% of net new ACV, the second-highest quarterly contribution. Mexico achieved its highest-ever quarterly ACV contribution, and Europe saw accelerating ARR growth for the fourth consecutive quarter. Despite the gains, market penetration remains low, signaling significant untapped potential.

Future Outlook

Samsara aims to sustain high growth while increasing operational efficiency. Investments will continue in R&D and go-to-market strategies, particularly in international regions. Emerging products and AI-driven solutions are expected to drive ARR growth.

Leadership highlighted strong demand across industries and the company’s ability to scale profitably while delivering measurable ROI. Samsara reaffirmed its focus on innovation and long-term partnerships with enterprise customers.

Management comments on the earnings call.

Product Innovations

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Our focus on innovation is unwavering. With Samsara Intelligence, we’re leveraging AI to deliver actionable insights that improve safety, compliance, and operational efficiency, enabling our customers to achieve measurable results."

Asset Tags

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Asset Tags are rapidly transforming asset-heavy industries by helping organizations track high-value equipment, reduce theft, and optimize utilization. The product’s growth reflects its critical role in driving ROI for our customers."

Connected Workflows

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Connected Workflows and Training are modernizing outdated processes. By using AI tools like Visual Intelligence, customers are improving safety and compliance while significantly reducing administrative overhead."

Construction Industry

Dominic Phillips, Chief Financial Officer

"The construction sector continues to lead our growth. Companies are rapidly adopting our solutions to address key challenges like safety and asset management, delivering measurable improvements in operations."

Public Sector

Sanjit Biswas, Chief Executive Officer and Co-Founder

"The public sector’s adoption of our platform highlights its commitment to modernizing legacy systems. We’re proud to help these organizations improve safety, compliance, and operational efficiency at scale."

Customers

Dominic Phillips, Chief Financial Officer

"Our ability to expand relationships is evident, with large customers like Comfort Systems and a Fortune 500 water solutions provider achieving significant operational improvements through multiple expansions."

Strategic Partnerships

Sanjit Biswas, Chief Executive Officer and Co-Founder

"By delivering clear ROI and building long-term relationships, we’re not just a vendor but a strategic partner for our customers. This alignment drives trust and ensures continued collaboration."

International Expansion

Sanjit Biswas, Chief Executive Officer and Co-Founder

"International markets represent an exciting growth frontier. Our investments in localized features and go-to-market strategies are driving adoption and accelerating our global expansion."

Challenges

Dominic Phillips, Chief Financial Officer

"Scaling solutions for smaller businesses and navigating the complexities of lengthy sales cycles remain challenges, but our focus on educating customers and simplifying deployments will unlock further opportunities."

Future Outlook

Sanjit Biswas, Chief Executive Officer and Co-Founder

"Looking ahead, we are committed to innovation and operational efficiency. By continuing to invest in emerging technologies and markets, we see significant potential to scale profitably while delivering value to our customers."

Thoughts on Samsara ER $IOT:

🟢 Pros:

Revenue growth at +35.6% YoY. If the company similarly beats its forecast by 3.5%, as in Q3, next quarter's revenue growth will be 25.9% in Q4, representing a deceleration. However, it is important to note the additional week in Q4 2023, which complicates direct comparisons. Without the impact of the additional week in Q4 2023, revenue growth for Q4 would be approximately 33% YoY.

Dollar-Based Net Retention (DBNR) for $10k+ customers remains stable at 115%, and for $100k+ customers at 120%.

Strong addition of $100k+ customers with +170, higher than Q3 of last year and nearly at a record level. The number of $1M+ ARR customers now exceeds 100.

Net New ARR added +84, representing a +17% YoY increase.

The company significantly improved margins and profitability.

Non-GAAP gross margin reached a record 77.6%.

Beat Q3 revenue guidance by 3.5%.

FY 2024 guidance increased by 0.9%.

Introduced Samsara Intelligence, an AI-powered suite aimed at enhancing safety, compliance, and operational efficiency.

Asset Tags are experiencing rapid growth with +100% quarter-over-quarter growth in net new ACV.

🟡 Neutral:

Stock-Based Compensation (SBC) to revenue ratio at 24%, a 2 percentage point decrease YoY.

Diluted shares outstanding increased by 2.6% YoY.