Samsara Q1 2025 Earnings Analysis

Dive into $IOT Samsara’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

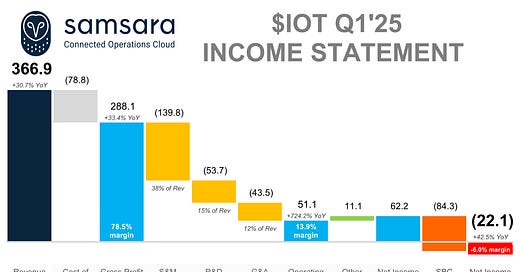

Financial Results:

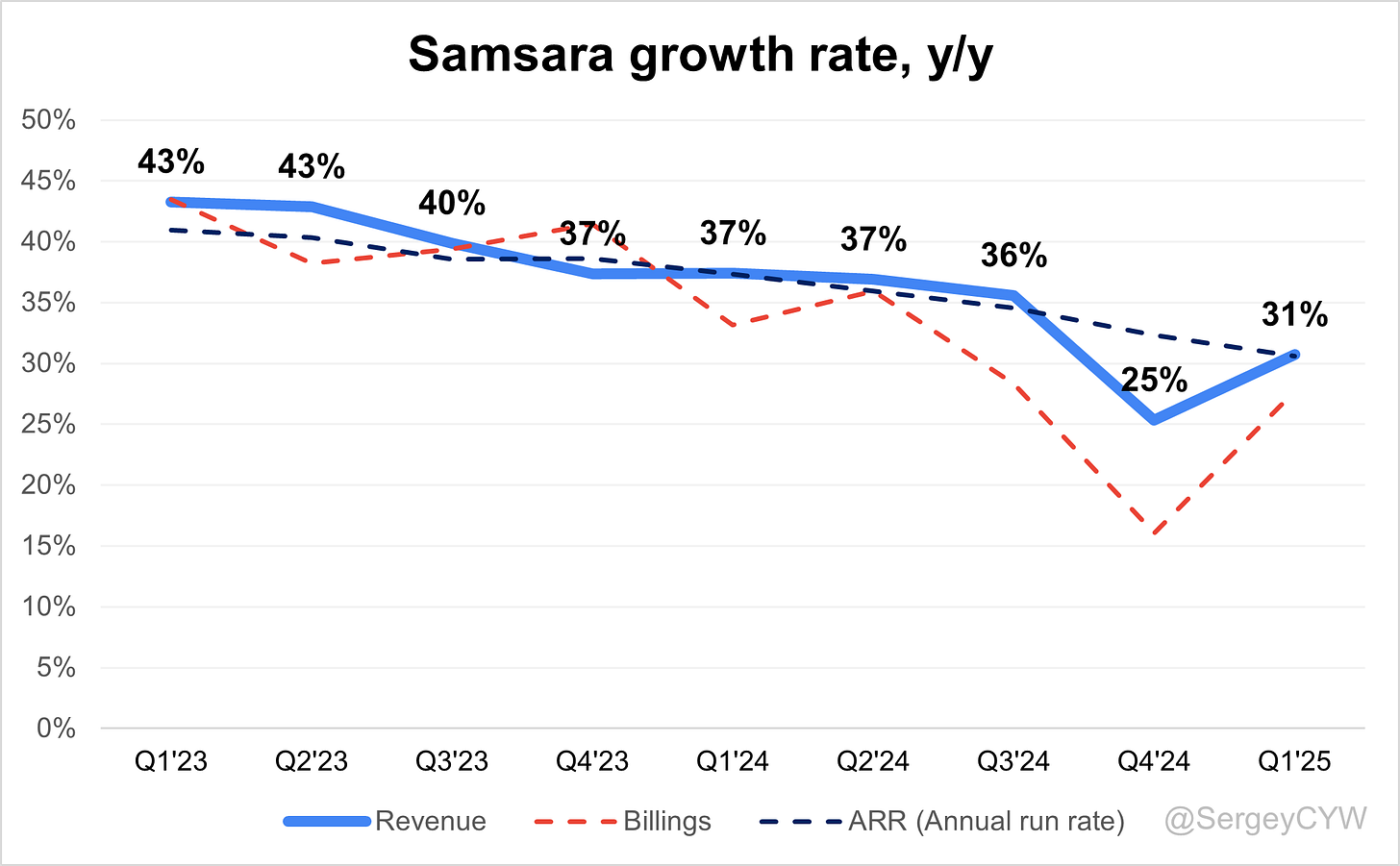

↗️$366.9M rev (+30.7% YoY, +25.3% LQ) beat est by 4.4%

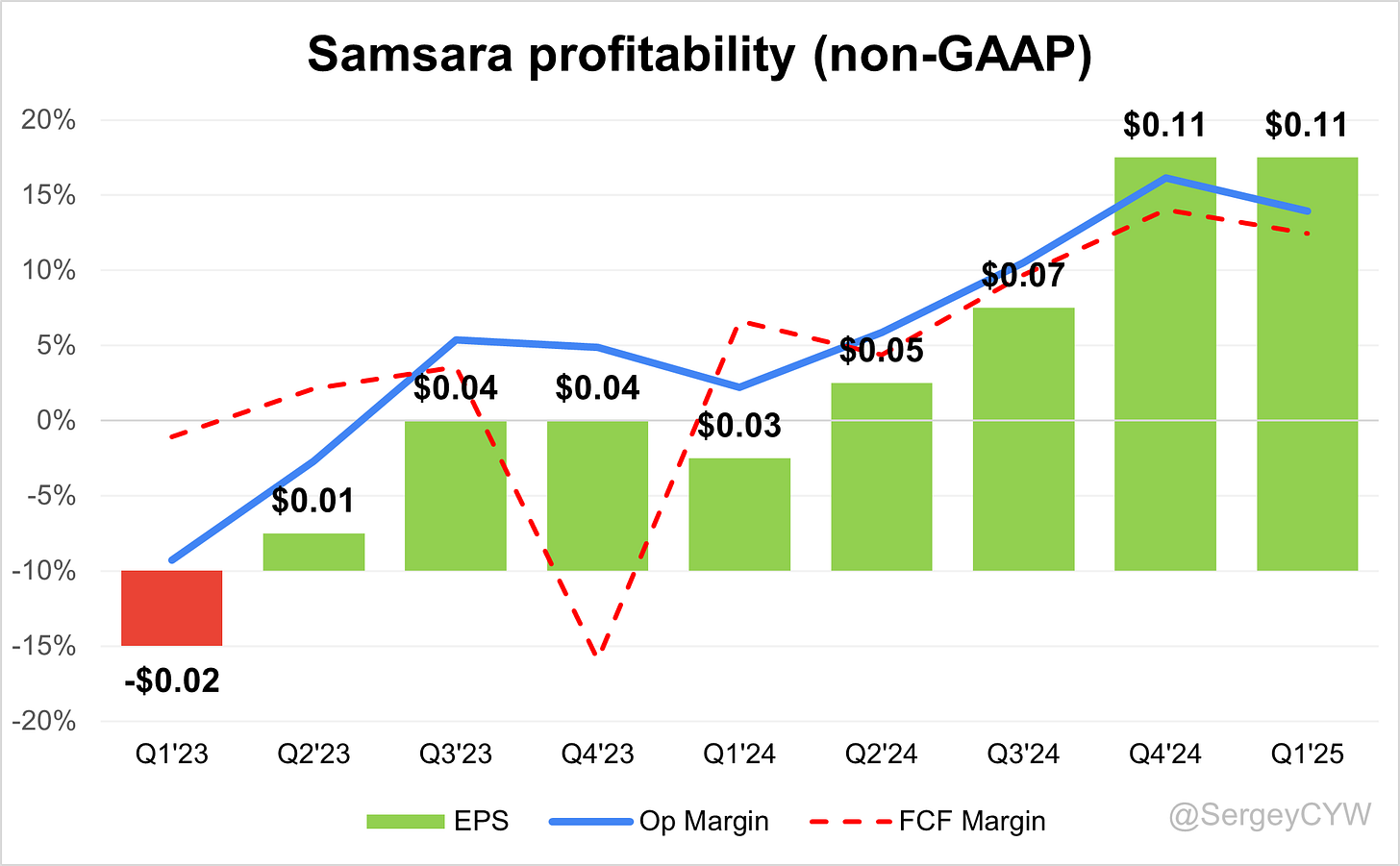

↗️GM* (78.5%, +1.6 PPs YoY)🟢

↗️Operating Margin* (13.9%, +11.7 PPs YoY)

↗️FCF Margin (12.5%, +5.8 PPs YoY)

↗️Net Margin (-6.0%, +7.7 PPs YoY)

↗️EPS* $0.11 beat est by 83.3%🟢

*non-GAAP

Key Metrics

➡️NRR $10K+ ARR 115% (115% LQ)

➡️ARR $1.54B (+30.6% YoY, +78 net new ARR)🟡

➡️Billings $387M (+27.7% YoY)🟡

Customers

➡️2,638 $100k+ customers (+35.1% YoY, +154)

Operating expenses

↘️S&M*/Revenue 38.1% (-7.1 PPs YoY)

↘️R&D*/Revenue 14.6% (-2.0 PPs YoY)

↘️G&A*/Revenue 11.9% (-1.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $78M (+5.2% YoY)

↗️CAC* Payback Period 23.9 Months (+5.6 YoY)🟡

↘️R&D* Index (RDI) 1.81 (-0.18 YoY)🟡

Dilution

↗️SBC/rev 23%, +1.9 PPs QoQ

↘️Basic shares up 3.5% YoY, -0.3 PPs QoQ

↘️Diluted shares up 1.7% YoY, -0.4 PPs QoQ

Guidance

↗️Q2'25 $371.0 - $373.0M guide (+23.9% YoY) beat est by 1.0%

↗️$1,547.0 - $1,555.0M FY guide (+24.2% YoY) raised by 1.4% beat est by 1.5%

Key points from Samsara’s First Quarter 2025 Earnings Call:

Financial Performance

Samsara ended Q1 FY26 with $1.54B in ARR, up 31% YoY in both reported and constant currency terms. Q1 revenue reached $367M, also growing 31% YoY, or 32% adjusted for constant currency.

Non-GAAP gross margin hit a record 79%, and non-GAAP operating margin increased to 14%, from 2% in Q1 FY25. Adjusted free cash flow margin rose to 12%, compared to 7% last year.

Net new ARR grew by $91M, up 8% YoY in constant currency. Q2 revenue is guided at $371M–$373M (+24% YoY), and full-year guidance stands at $1.547B–$1.555B (+24–25% YoY in constant currency).

Fleet Management

Fleet-based solutions remain core, with high traction in transportation, construction, and utilities. Transportation posted its strongest YoY growth in four years, while construction led net new ACV for the seventh straight quarter.

New customer Knife River, with 5,700+ employees and $2.8B revenue, adopted Samsara’s video-based safety, telematics, and equipment monitoring after a successful pilot reduced safety incidents.

8 of the top 10 new logos and 7 of the top 10 expansions in Q1 included 3+ product deployments, reinforcing the success of multi-product strategy.

Post-Liberation Day, some deals saw delays due to tariff-related spending shifts, but most closed in May, with pipeline generation hitting a record high.

Asset Tags

Asset tags showed four consecutive quarters of accelerating growth in net new ACV. Used to track non-powered assets like trailers and tools, they help reduce loss, improve efficiency, and optimize utilization.

Adoption is often phased, with initial pilots on subsets of equipment. Tags are gross margin accretive and are expanding Samsara’s non-vehicle ARR base, now at ~15%.

As usage grows among core and enterprise customers, asset tags are positioned for continued contribution to margin expansion and customer retention.

Safety & Telematics

The platform introduced the Intelligent Safety Inbox, AI risk pattern detection, and driver recognition tools such as streaks and kudos.

A major propane distributor using 3,000 vehicles saw a 75% reduction in safety events and 71% drop in mobile usage during a pilot. This led to a major expansion, with AI cited as the decisive differentiator.

A survey of 1,500 commercial drivers across 7 countries showed 95% believe coaching improves habits, validating platform efficacy.

Integrations with Stellantis (14M+ vehicles) and Hyundai Translead support hardware-free deployments, easing telematics adoption for modern fleets.

Workflows & Training

Samsara processed over 230 million inspections annually across industries. Customers increasingly deploy mobile-first forms for inspections, safety assessments, and checklists.

New visual intelligence uses AI to interpret photos submitted in workflows, streamlining issue detection and follow-up.

Training modules tied to driving behavior are now delivered via mobile, enhancing engagement and improving safety outcomes.

This workflow suite enables Samsara to expand usage across people, equipment, and job sites, deepening customer value.

Preventative Maintenance

Samsara’s AI-driven maintenance engine monitors assets traveling 80B+ miles annually and powers real-time diagnostics and automated work orders.

Sterling Crane reduced unplanned maintenance from 34% to 20%, saved 10,000 technician hours, and cut $3M in equipment costs, including $500K in labor.

Preventative maintenance tools are helping customers manage aging fleets, extend asset lifespan, and minimize operational disruptions.

Software Expansion

Samsara continues to increase its share of software-only SKUs such as asset tags and AI workflows. These are higher-margin offerings contributing to overall gross margin improvement.

Adoption is strong across both core and emerging sectors, with margin mix expected to benefit further as these products scale.

Embedded AI

AI capabilities are integrated across the platform, powering driver coaching, maintenance prediction, and visual risk detection.

Customers prioritize solutions that deliver fast, tangible ROI. AI adoption is accelerating as companies seek automation to offset labor shortages and asset constraints.

Net Retention

Dollar-based net retention held steady at ~115%, in line with targets.

95% of $100K+ ARR customers subscribed to 2+ products, and 66% subscribed to 3+ products, reflecting strong multi-product adoption.

Public Sector

Public sector saw its strongest YoY growth in three years. Notable wins include the State of South Carolina, City of Houston, and a county with 10M+ residents.

These customers use Samsara for disaster recovery, asset visibility, and fuel and insurance savings. Adoption of safety coaching and workflow digitization is increasing in municipalities.

Customer Count

Samsara ended Q1 with 2,638 customers generating over $100K in ARR, up 35% YoY. These customers contribute 58% of ARR, up from 52% two years ago.

The company updated its customer count methodology to group subsidiaries under a parent organization as a single customer, better reflecting enterprise sales strategy.

Major Customer Wins

Knife River, a leading construction firm, deployed a full suite of Samsara products post-pilot, after seeing improvements in driver behavior and site safety.

A leading U.S. propane distributor expanded from telematics into video safety, following a 75% reduction in incidents during testing.

A vegetation management and utility services firm grew its Samsara deployment 15x since 2019, integrating newly acquired units in Q1.

Public Sector Wins

Samsara added multiple high-profile public sector accounts.

A major U.S. county (10M+ residents) uses Samsara to track assets like generators during disasters. New Orleans deploys Samsara for real-time fleet visibility during storm response.

OEM Partnerships

New partnerships include:

Hyundai Translead – Enables trailer visibility and video-based safety.

Stellantis – Cloud integration with 14M+ vehicles.

Rivian – Native EV fleet management.

These integrations support cloud-to-cloud onboarding and eliminate hardware setup friction for modern vehicles.

International Markets

International ACV mix reached 18%, tying the company’s all-time high. Europe posted its highest contribution ever, with strong demand in construction, public sector, and transportation.

Localized features like bridge strike alerts and brake monitoring support market penetration in UK, France, and Germany.

Samsara is seeing growing adoption across Europe as local players remain fragmented and under-digitized.

Macro Headwinds

Sales cycles lengthened temporarily post-Liberation Day due to tariff-related spending shifts.

Management estimated the impact in the low multimillion-dollar range, not material to guidance. Most delayed deals closed in May.

Despite macro pressure, pipeline generation in Q1 was a record, reflecting sustained demand.

Outlook

Full-year revenue guidance remains at $1.547B–$1.555B, representing 24–25% YoY growth.

Samsara will continue to invest in AI, enterprise expansion, and margin optimization.

Upcoming Investor Day on June 24 in San Diego will highlight product roadmap and long-term growth drivers, including “same-store” trajectory.

Management comments on the earnings call.

Product Innovations

Sanjit Biswas, Chief Executive Officer and Co-Founder

“We’re doubling down on safety and recently launched new positive recognition tools within the platform. This includes streaks and milestones, personalized kudos, and shared visibility.”

“We’re just getting started on the maintenance journey with our customers and are excited for the opportunities ahead.”

Dominic Phillips, Chief Financial Officer

“We’re rolling out a number of software-only SKUs and products, even things like asset tags. All of those are gross margin accretive, and as those products scale, that can open up more opportunities for gross margin benefits in the future.”

Fleet Management

Sanjit Biswas, Chief Executive Officer and Co-Founder

“These are industries where they have a lot of operational complexity, and they’re looking for what can I really do with this AI. We’ve shown that with safety and we’re able to really show that now on the efficiency side.”

Dominic Phillips, Chief Financial Officer

“ARR per $100K+ customer increased to $338,000, and the combination of adding more large customers and a higher average ARR resulted in ARR mix from $100K+ customers of 58%, up from 56% one year ago and 52% two years ago.”

Asset Tags

Dominic Phillips, Chief Financial Officer

“In some cases, asset tags can be the leading product for a customer use case. In others, they’re an add-on. What’s consistent is the value they’re delivering—whether it’s locating missing equipment, improving worker efficiency, or helping assess utilization.”

“We’ve been selling asset tags now for about a year, and it’s been a good point of strength for equipment monitoring. They’re also gross margin accretive.”

Safety & Telematics

Sanjit Biswas, Chief Executive Officer and Co-Founder

“Our platform provides comprehensive AI alerts covering a wide range of safety concerns. This includes collision risk, traffic violations, policy violations, driver fatigue, speeding, and distracted driving events like mobile phone use and eating.”

Dominic Phillips, Chief Financial Officer

“One of our largest expansions in the quarter was with a provider of vegetation management. They’ve expanded with us 15x since 2019, and in Q1 they added more video-based safety, telematics, and equipment monitoring licenses.”

Connected Workflows & Training

Sanjit Biswas, Chief Executive Officer and Co-Founder

“There's increasing awareness among frontline workers that digital is better. They can attach photos from their smartphone and do inspections more efficiently.”

“We’ve also added AI features like visual intelligence, where we can interpret a photo and extract meaning automatically. This is helping managers act faster and with more accuracy.”

Samsara Intelligence

Sanjit Biswas, Chief Executive Officer and Co-Founder

“We have millions of assets on our platform that collectively travel more than 80 billion miles each year. This provides us real-world data on how assets run and how they break.”

Dominic Phillips, Chief Financial Officer

“One standout use case was Sterling Crane. With Samsara, they reduced their unplanned maintenance from 34% to 20%, saving 10,000 hours of technician time and $3 million in equipment savings.”

AI Integration

Sanjit Biswas, Chief Executive Officer and Co-Founder

“Our customers recognize that safety is largely a data problem, and they’re using AI and automation to improve outcomes at scale.”

“Everyone I’ve spoken with has interest in AI and sees it as a transformational technology. What they’re really focused on is fast, tangible ROI that addresses real operational needs.”

Competitors

Sanjit Biswas, Chief Executive Officer and Co-Founder

“Our customers are looking for a single pane of glass—not just trucks, but construction equipment, refrigeration units, and more. That breadth and integration is unique compared to regionally focused competitors.”

Dominic Phillips, Chief Financial Officer

“We’re often the first digital solution deployed across a customer’s operations. Most are not replacing something—they’re digitizing for the first time, and we’re delivering a comprehensive solution.”

Customers

Sanjit Biswas, Chief Executive Officer and Co-Founder

“We partnered with one of the largest retail propane companies in the U.S. After a successful pilot, they signed one of our largest expansions this quarter because of the measurable impact AI had on their driver safety.”

“Large customers like Knife River are deploying multiple Samsara products out of the gate. This reflects growing confidence in our platform’s value across different functions.”

Dominic Phillips, Chief Financial Officer

“95% of our $100K+ ARR customers and 85% of core customers subscribe to two or more Samsara products. 66% of $100K+ customers subscribe to three or more.”

Strategic Partnerships

Sanjit Biswas, Chief Executive Officer and Co-Founder

“To create a seamless customer experience, we’re integrating directly with OEMs so customers can deploy Samsara without installing any hardware.”

“This quarter, we announced partnerships with Hyundai Translead, Stellantis, and Rivian—each expanding our reach into connected assets and enabling cloud-to-cloud integrations.”

International Growth

Sanjit Biswas, Chief Executive Officer and Co-Founder

“We’ve achieved product-market fit in the UK and are now gaining traction in France and Germany. There’s increasing interest in digital transformation across Europe, even if it's early.”

Dominic Phillips, Chief Financial Officer

“18% of net new ACV came from international geographies, tied for our highest quarterly contribution ever. Europe delivered its highest net new ACV mix to date.”

Challenges and Macro

Dominic Phillips, Chief Financial Officer

“After a strong start to the quarter, we experienced some elongated sales cycles post-Liberation Day, as customers prioritized spending on tariff-impacted goods like vehicles and equipment.”

“It was a multi-million-dollar impact, but not in the tens of millions. Many of those deals closed in May, and we had record pipeline generation in Q1.”

Sanjit Biswas, Chief Executive Officer and Co-Founder

“Customers are still committed to digitizing their operations, but during periods of uncertainty, their immediate focus can shift toward assets that drive near-term revenue.”

Future Outlook

Dominic Phillips, Chief Financial Officer

“Looking forward, we believe we’re well-positioned to continue delivering durable and efficient growth. If downside scenarios don’t materialize, we expect to outperform our current guidance.”

Sanjit Biswas, Chief Executive Officer and Co-Founder

“We’re grateful to our customers, partners, and team members around the world. This year, we’ll continue investing in safety, efficiency, and sustainability—and we look forward to sharing more at our upcoming Investor Day and Beyond conference.”

Thoughts on Samsara Earnings Report $IOT:

🟢 Positive

Revenue reached $366.9M, up +30.7% YoY, beating estimates by 4.4%

Non-GAAP Gross Margin improved to 78.5%, up +1.6 percentage points (PPs) YoY

Non-GAAP Operating Margin rose to 13.9%, up +11.7 PPs YoY

Free Cash Flow Margin increased to 12.5%, up +5.8 PPs YoY

EPS (non-GAAP) of $0.11, beat estimates by 83.3%

Net Retention Rate (NRR) at 115% for $10K+ ARR customers

ARR ended at $1.54B, up +30.6% YoY

$100K+ customer count rose to 2,638, up +35.1% YoY

Billings reached $387M, up +27.7% YoY

Major wins: Knife River, propane distributor, vegetation management firm

International ACV mix tied record high at 18%, with Europe at highest ever contribution

Full-year revenue guidance raised to $1.547B–$1.555B, up +24.2% YoY

🟡 Neutral

Net new ARR added $78M, up +5.2% YoY

CAC Payback Period increased to 23.9 months, up +5.6 YoY

R&D Index declined to 1.81, down 0.18 YoY

Customer methodology updated to consolidate related entities; minimal metric impact

Software-only SKUs and asset tags gaining traction, still early in full deployment

SBC as % of revenue rose to 23%, up +1.9 PPs QoQ

🔴 Negative

Net Margin remained negative at -6.0%, despite improving +7.7 PPs YoY

Basic shares up +3.5% YoY; Diluted shares up +1.7% YoY, dilutive pressure persists

Sales cycles extended post-Liberation Day due to tariff-related purchasing delays

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.