Financial Results:

↗️$280.7M rev (+37.4% YoY, +37.4% LQ) beat est by 3.0%

↗️GM* (76.9%, +3.6%pp YoY)🟢

↗️Operating Margin* (2.2%, +11.5%pp YoY)

↗️FCF Margin (6.6%, +7.7%pp YoY)🟢

↗️EPS* $0.03 beat est by 233.3%

*non-GAAP

Key Metrics

➡️NRR $10K+ ARR 115% (115% LQ)

➡️NRR $100K+ ARR 120% (120% LQ)

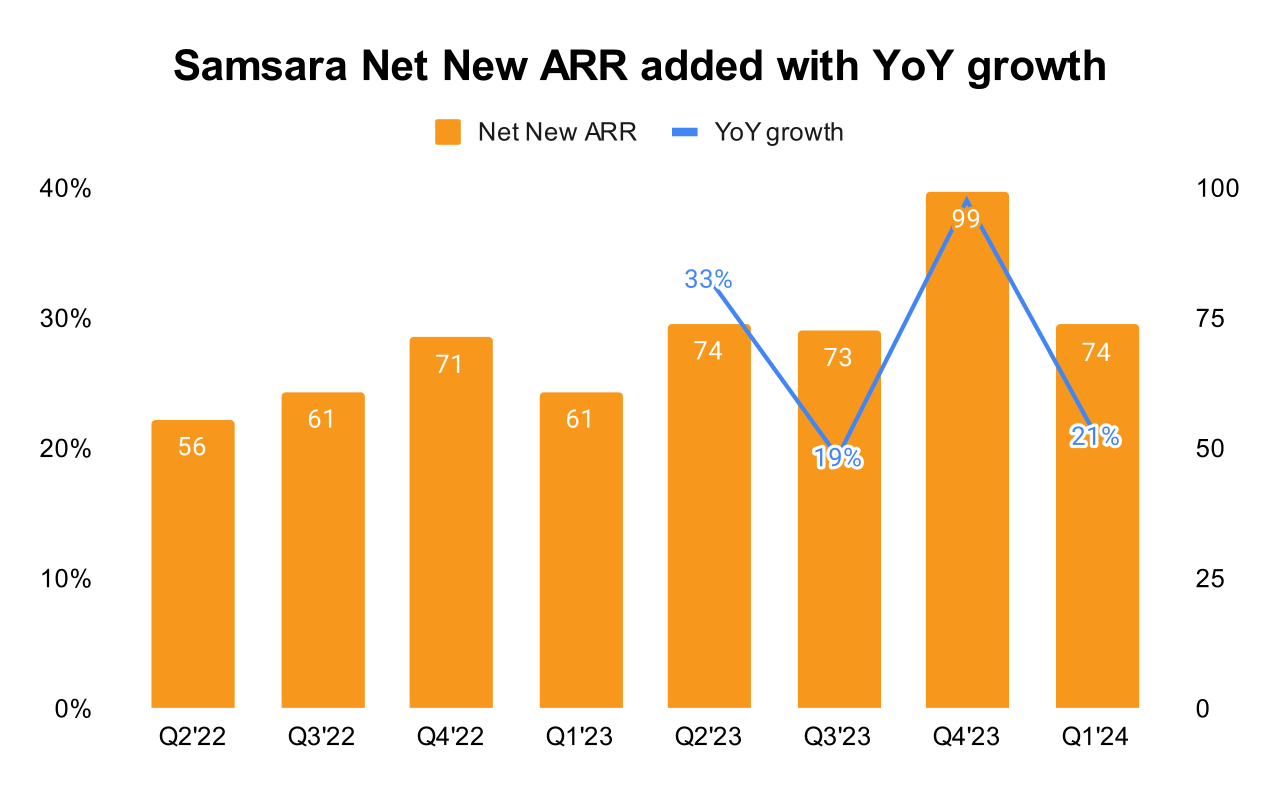

➡️ARR $1.18B (+37.3% YoY, +74 net new ARR)🟡

➡️Billings $303M (+33.0% YoY)🟡

Customers

➡️1,964 $100k+ customers (+43.0% YoY, +116)

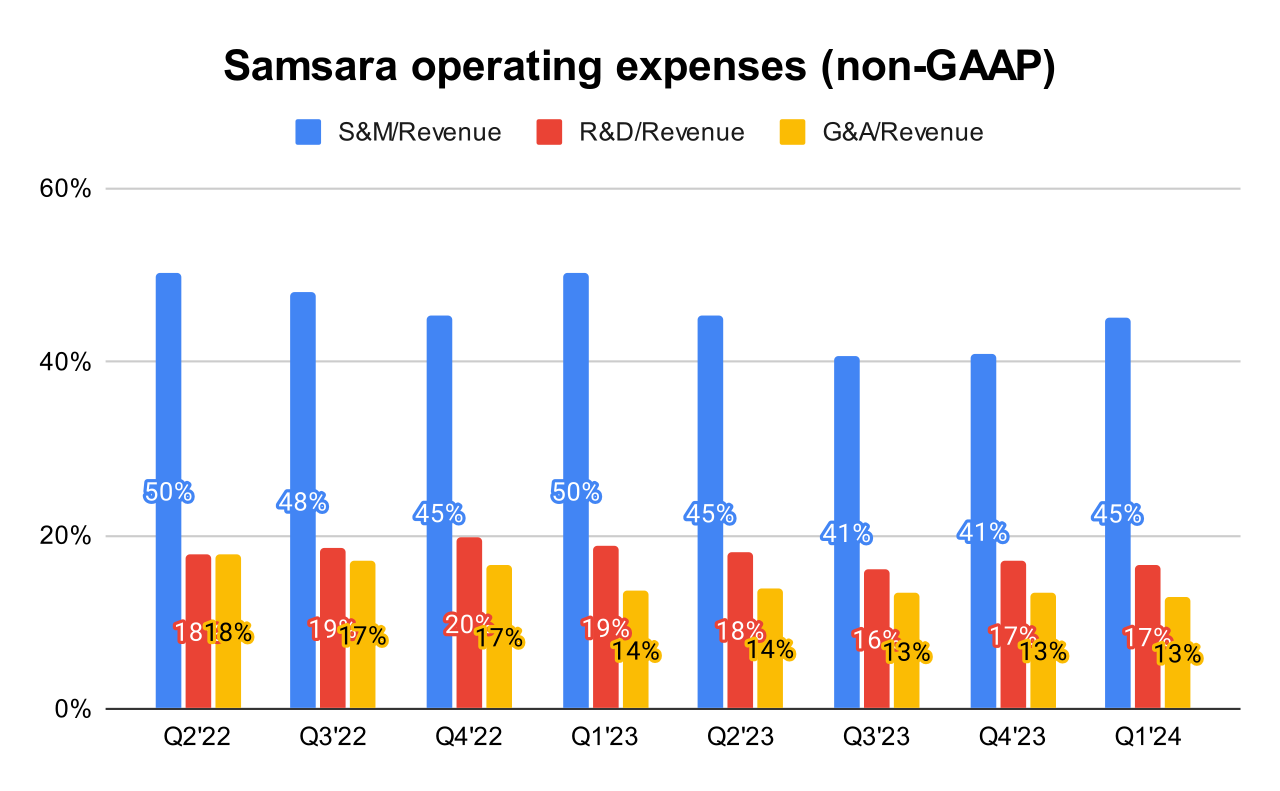

Operating expenses

↗️S&M*/Revenue 45.2% (40.9% LQ)

↘️R&D*/Revenue 16.6% (17.0% LQ)

↘️G&A*/Revenue 12.9% (13.4% LQ)

↘️Net New ARR $74M ($99 LQ)

↗️CAC* Payback Period 100.3 Months (9.9 LQ)

Dilution

↗️SBC/rev 26%, +1.0%pp QoQ

↗️Basic shares up 4.2% YoY, +0.1%pp QoQ🟡

↘️Diluted shares up 8.9% YoY, -0.6%pp QoQ🔴

Guidance

↗️Q2'24 $288.0 - $290.0M guide (+31.8% YoY) beat est by 0.6%

↗️$1,205.0 - $1,213.0M FY guide (+29.0% YoY) raised by 1.4% beat est by 0.8%

Key points from Samsara’s First Quarter 2024 Earnings Call:

Financial Results and Growth:

Samsara reported a strong start to fiscal 2025, with $1.18 billion in Annual Recurring Revenue (ARR), representing a 37% year-over-year growth.

Connected Forms Application:

Samsara released its Connected Forms application to general availability. This innovation allows customers to transform traditional paper-based processes into digital workflows, enhancing efficiency and accuracy.

Connected Forms is part of Samsara’s broader strategy to offer a unified platform where multiple applications are used together to leverage greater operational value. The product is designed to integrate seamlessly with other Samsara applications, providing a cohesive experience that enhances data usability and workflow efficiency.

Customers:

Samsara secured contracts with the Department of Transportation in Iowa and Kansas, and Vinci, a Fortune Global 500 construction company.

Customers are achieving substantial benefits from Samsara's products. Examples include Nutrien Ag Solutions, which reported a 40% reduction in unsafe driving practices through the use of Samsara's video-based safety application, and Frontier Communications, which realized significant fuel savings.

The introduction of Connected Forms has been successful, with notable adoption by large companies like the UK-based utility service provider which implemented over 30 use cases.

An IDC survey of 130 customers indicated strong ROI from Samsara’s solutions, averaging more than 8x ROI, which underscores the value delivered to customers and their readiness to invest in further technology integration for safety, efficiency, and sustainability.

Many of Samsara's customers previously relied on legacy point solutions that kept data trapped in silos. This fragmentation presented challenges in data integration and efficiency, which Samsara addresses with its unified platform approach.

Common issues across customer industries include fuel savings, workplace accidents, maintenance, and insurance costs. Samsara’s products help address these pervasive challenges.

Future Outlook:

Following a strong performance in Q1, Samsara has raised its financial outlook for FY2025. It now expects Q2 revenue to be between $288 million and $290 million and full-year revenue to be between $1.205 billion and $1.213 billion.

Samsara plans to continue investing in emerging products, refining its corporate culture, and expanding customer support as it scales.

Samsara emphasized the substantial market potential in digitizing physical operations, a sector that remains largely underserved by modern technology solutions.

Management comments on the earnings call.

Product Innovations

Sanjit Biswas, CEO: "Connected Forms is a workflow solution that allows our customers' frontline workers to streamline their operations through digital forms. Our customers are already finding value... A good example of this is with [a UK utility company], the largest privately owned drainage and wastewater utility specialists in the UK."

Customers

Sanjit Biswas, CEO: "The IDC research shows customers partner with us to be their system of record because we deliver clear and fast ROI. At the same time, we are helping customers achieve their safety, efficiency, and sustainability goals."

"Samsara customers achieved these savings [using Samsara's product] from reducing costs related to vehicle related crashes and insurance, spending less on fuel, lowering maintenance costs and extending vehicle lifespans, minimizing lost revenue associated with vehicle availability, and increasing driver productivity."

International Expansion

Dominic Phillips, CFO: "A quarterly record 18% of net new ACV came from international geographies in Q1, driven by strength in Mexico and Europe, which contributed its highest ever quarterly net new ACV mix."

Future Outlook

Dominic Phillips, CFO: "Because of our strong Q1 performance and outlook for the rest of FY 'twenty five, we're raising our guidance across all key metrics. We've also analyzed various scenarios and believe that this guidance is adequately derisked to account for the potential impact of worsening macroeconomic factors on our business."