Samsara: Leading the Transformation of Physical Operations Through Industrial IoT

Deep Dive into $IOT: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Samsara: Company overview

About Samsara

Samsara is a pioneer in the Connected Operations Cloud, a platform that enables organizations reliant on physical operations to leverage Internet of Things (IoT) data for actionable insights and operational improvements. Founded in 2015 by Sanjit Biswas and John Bicket, the company is headquartered in San Francisco, California. Samsara serves tens of thousands of customers across industries such as construction, transportation, manufacturing, logistics, and retail, helping them digitize operations for enhanced safety, efficiency, and sustainability.

Company Mission

Samsara's mission is to revolutionize physical operations by providing innovative technology solutions that enhance safety, efficiency, and visibility. The company aims to empower organizations to make data-driven decisions while fostering sustainability in industries that represent over 40% of global GDP. Samsara’s focus on continuous improvement and customer-centric innovation drives its commitment to creating a safer and more sustainable world.

Sector

Samsara operates within the Industrial IoT (Internet of Things) sector, specializing in fleet management and physical asset monitoring. Its offerings include GPS fleet tracking, AI-powered dash cameras, environmental monitoring systems, telematics solutions, and real-time analytics. These tools are tailored for industries such as logistics, construction, food services, and public sector operations.

Competitive Advantage

Samsara stands out due to its comprehensive platform that integrates video-based safety features, advanced telematics capabilities, app workflows, and real-time monitoring. Its user-friendly interface and AI-driven analytics allow businesses to optimize operations efficiently. Strategic partnerships with companies like Continental and Revvo Technologies further enhance its product offerings. Samsara also benefits from a subscription-based revenue model with 98% recurring sales, ensuring predictable growth.

Total Addressable Market (TAM)

Samsara estimates its Total Addressable Market (TAM) at $117 billion for 2025, growing at an impressive 22% CAGR. This market spans industries such as transportation ($42 billion potential), construction ($12.5 billion), logistics ($22.6 billion), and field services ($8.3 billion). With only 11% of its revenue currently coming from international markets, Samsara has significant room for expansion overseas.

Valuation

$IOT Samsara is trading at a Forward EV/Sales multiple of 13.65, below the average of 13.25. Currently, Samsara is trading at the average Forward EV/Sales level since July 2023, down from its peak of 22 Forward EV/Sales multiple in the previous quarter.

$IOT Samsara trades at a Forward P/E of 114,8, with revenue growth of 25% YoY in the last quarter.

The EPS growth forecast for 2026 is 34.3%, with P/E of 114, 2026 PEG ratio of 3.3.

The EPS growth forecast for 2027 is 22.8%, with P/E of 85, 2027 PEG ratio of 3.7, which is high. However, Samsara only became non-GAAP profitable just in 2023 and is still in an early stage of growth.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast +22.8% revenue growth for $IOT in 2026. Based on this forecast, the valuation, according to the P/S multiple, is fairly valued compared to other SaaS companies. The non-GAAP operating margin is positive, but the GAAP operating margin remains negative.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Samsara possesses a narrow economic moat overall, with varying strengths across different moat categories. Let's examine each type of economic moat in detail.

Economies of Scale

Samsara has developed significant economies of scale as its customer base expands, allowing fixed costs to be spread across a larger revenue base. With Annual Recurring Revenue (ARR) of $1.46 billion, growing +33% year-over-year, the company has reached notable scale in the IoT sector. It now processes over 14 trillion data points (+50% YoY), tracks more than 80 billion miles traveled (+25% YoY), and handles over 120 billion API calls (+50% YoY). These metrics reflect growing efficiency and scalability as Samsara scales operations.

Network Effect

Samsara benefits from a network effect driven by user adoption and data feedback loops. As more customers join, the platform collects greater volumes of operational data, improving machine learning and predictive analytics. This in turn attracts more users. The company processes 4.2 petabytes of IoT data daily, supported by 312 dedicated data scientists, reinforcing platform intelligence. While powerful, this network effect is strongest within specific verticals rather than across industries.

Brand Strength

Samsara has built a recognizable brand in the IoT market, especially in transportation, logistics, and industrial sectors. It serves 41% of Fortune 500 transportation and logistics companies, signaling deep industry penetration. One enterprise stated, “Samsara is our most utilised company-wide business system and is responsible for millions in savings in our bottom line.” The platform has helped prevent over 250,000 vehicle accidents, digitized 300+ million workflows, and saved 3+ billion pounds of CO₂, tying the brand to real business outcomes. Brand strength represents a moderate moat for the company.

Intellectual Property

Samsara holds 237 active IoT sensor patents as of Q4 2023 and continues to expand its portfolio with innovations like driver monitoring systems, impaired view detection, and battery management. 22% of annual revenue is allocated to R&D, with 63 active IoT research projects, indicating a strong IP strategy. The patent moat offers meaningful protection from competitors and enhances Samsara’s long-term defensibility.

Switching Costs

The platform’s integration into customer operations creates high switching costs. Samsara reports a 95% customer retention rate and 120% net revenue retention, reflecting strong customer loyalty. The system is deeply embedded across functions—from fleet management to safety monitoring—and switching involves significant disruption. Redesign costs alone average $1.2 million. Customers refer to Samsara as their most utilised company-wide business system, highlighting how central the platform becomes post-deployment. This is Samsara’s strongest moat element.

Revenue growth

$IOT Samsara's revenue growth in the latest Q4 was +25.3% YoY. However, it's important to note that the company added an extra week to Q4 2023, which complicates revenue growth calculations. Excluding the additional week, growth would have been +35% YoY and +36% YoY on an FX-neutral basis, indicating a stabilization in revenue growth.

Based on the forecast for the next quarter, if the company beats its guidance by 3.1%, as it did in Q4, Q1 growth would be 29.2%, reflecting a deceleration but still maintaining strong growth levels.

RPO is growing +32.5%, and cRPO is up +32.2%, both outpacing revenue growth. Billings growth slowed to +16.1%, which is now below the revenue growth rate.

Segments and Main Products.

Samsara operates across three primary segments: fleet management, asset tracking, and industrial IoT.

The fleet management segment offers tools for real-time GPS tracking, vehicle diagnostics, driver safety, and compliance, enabling businesses to improve operational efficiency and safety. It is widely adopted in transportation and logistics.

The asset tracking segment monitors physical assets like trailers, containers, and heavy equipment. It provides real-time location data, geofencing, and environmental monitoring, ensuring better utilization and regulatory compliance for machinery-dependent industries. Samsara's Asset Tags support this segment by offering real-time visibility into high-value assets, aiding in theft prevention, inventory management, and asset recovery. These rugged tags have a four-year battery life and integrate with Samsara’s IoT network, helping field teams locate equipment quickly and reduce downtime.

The industrial IoT segment connects equipment and machinery to Samsara’s cloud-based platform, delivering data-driven insights for sectors like manufacturing, construction, and logistics. This improves efficiency and supports sustainability goals.

Connected Workflows digitize multi-step processes by integrating forms like inspections and incident reports directly into the platform. This enables real-time data capture, simplifies compliance, reduces admin overhead, and allows teams to resolve field issues faster. By centralizing information and connecting departments, operations become more agile and coordinated.

Main Products Performance in the Last Quarter

Fleet Management

Fleet remains Samsara’s largest segment, with core vehicle applications generating over $1B in ARR. Q4 revenue reached $346M, up 25% YoY, and adjusted growth stood at 36%, same as the previous quarter but on a larger base. ARR growth ended the year at $1.46B, up 32% YoY, driven by increased enterprise traction. 203 new $100K+ ARR customers were added in Q4, a record. Fleet penetration across North America remains early; less than 50% of commercial vehicles use telematics. Samsara’s Stellantis partnership enables hardware-free telematics via VIN-based integration, covering EVs and legacy fleets across Europe. Integration includes brands such as Peugeot, Jeep, Citroën, and spans models from 2018 onward.

Industrial IoT

Non-vehicle products accounted for 15% of net new ACV, highest in the last 10 quarters. Equipment monitoring saw its third consecutive quarter of YoY growth acceleration, driven by demand for asset tags and expanded deployments in manufacturing, utilities, and heavy industries. Samsara now processes over 14 trillion data points annually and saw 120B API calls, both growing 50% YoY. International markets are adopting faster. UK and Mexico delivered strong Q4 net new ACV contributions, with the UK posting its highest mix ever.

Safety & Telematics

Penetration remains low across the market. Only ~10% of commercial vehicles use video-based safety. Customers adopting safety products report significant ROI. One operator cut safety incidents by 61%, distracted driving by 82%, and harsh driving by 47%. Samsara added over 1,000 core customers in Q4 for the sixth straight quarter. Safety modules are expanding through integration with connected training and AI-driven risk detection. Momentum continues across sectors including food and beverage, public sector, and logistics.

Asset Tags

Adoption is expanding rapidly. One storage and logistics customer added 10,000+ asset tags in Q4 after abandoning RFID and QR code trials. The product is now helping reduce asset loss and improve utilization in construction, logistics, and field services. Another customer recovered $500K annually in lost tools. Asset tag growth is driving equipment monitoring, which saw continued acceleration in net new ACV. While revenue impact is still early, customer feedback and expansion potential are strong.

Connected Training

Q4 marked early success. A major services provider launched 20+ AI-generated training modules and achieved 98% course completion. Customers using connected training see it as a complement to safety and compliance modules. With Samsara’s AI Course Builder, large deployments are scaling quickly. Use cases include onboarding, compliance certification, and behavior-based coaching. The product is gaining traction in high-turnover industries and field operations.

Connected Workflows

Customers digitized 300M workflows in FY’25. The segment supports automation and operational visibility across frontline work. It plays a key role in enabling safety, maintenance, and asset utilization use cases. Integrates tightly with Samsara’s IoT and fleet products. A top new customer adopted connected workflows alongside four other Samsara products in Q4, driving a projected 7x ROI. Growth is tied closely to workflow automation and frontline digitization, especially in construction and public utilities.

Samsara Intelligence

Still in beta, but gaining traction. Customers are actively using AI for maintenance prediction, driver behavior analysis, and training automation. Connected Training’s AI Course Builder is the first monetizable use case. Internally, Samsara uses AI across support, sales, and development to improve speed and efficiency. With 1B+ fault codes processed annually, predictive maintenance and risk scoring models are being refined. Monetization is expected post-beta following customer feedback loops and pricing model development.

Innovation and Product Updates

Samsara is advancing toward a fully integrated Connected Operations Cloud. AI is being embedded across the platform, including safety detection, maintenance analytics, and autonomous training generation. The partnership with Stellantis introduces VIN-based telematics onboarding, removing hardware friction and opening access to 17% of Europe’s automotive market. Internally, AI enhances engineering, support, and GTM productivity. Product attach continues to rise: 62% of large customers now use 3 or more products, up from 58% a year ago

Customers

$IOT Samsara added 203 new $100K+ ARR customers in Q4, record addition for the Company, bringing the total to 2,506, up 36% YoY. The company ended the quarter with 118 customers exceeding $1M+ in ARR, growing 44% YoY, with 14 additions, tied for the highest in a single quarter.

Large Customer Wins

Key enterprise wins included one of the top three global telecom firms, one of the top three U.S. LTL carriers, and Bimbo Bakeries USA, operating 20,000+ workers, 5,500 vehicles, and 11,000 routes. Each of these customers is expected to scale toward $10M+ in ARR through multi-product expansion.

In the public sector, Miami-Dade County signed a $1M+ deal, spanning the Departments of Transportation and Solid Waste. International momentum also accelerated, with the UK contributing its highest net new ACV mix ever, and Mexico posting its second highest.

The construction vertical led net new ACV for the sixth consecutive quarter. Of the 203 $100K+ ARR additions, 90 were net-new logos. Among the top ten new customers, nine adopted multiple Samsara products at launch.

A major strategic expansion came through the partnership with Stellantis. Samsara joined forces with Mobilisights, Stellantis’ Data-as-a-Service unit, to provide hardware-free telematics integration across Europe. This includes vehicles from Alfa Romeo, Citroën, Jeep, and Peugeot, spanning models built from 2018 to 2024.

Fleet operators can now connect vehicles to Samsara using only a VIN, enabling tamper-proof GPS, mileage, and fuel data. The integration supports EVs and commercial fleets, and eliminates installation delays. Stellantis, holding 17% market share in Europe, amplifies Samsara’s reach in OEM integrations and enhances its competitive position in connected operations.

Customer Success Stories

A top U.S. moving and storage operator—managing 200,000 trucks, 140,000 trailers, and 250,000 storage units—deployed 10,000+ asset tags in Q4. The company transitioned from QR and RFID solutions after inconsistent results. In a pilot, Samsara helped them save $1M, reduce safety events by 61%, cut distracted driving by 82%, and lower harsh driving events by 47%.

A leading safety and maintenance services provider with 1,000 field technicians, 2,000 assets, and 700 vehicles adopted five Samsara products: telematics, video safety, equipment monitoring, connected workflows, and connected training. Using AI Course Builder, they created 20+ training modules, achieving a 98% on-time course completion rate. Asset tracking reduced tool loss, recovering $500K annually. Projected ROI exceeded 7x.

Bimbo Bakeries saw a 70% reduction in collision risk, 64% drop in harsh events, and 49% decline in policy violations after expanding its deployment. Results confirmed Samsara’s role in enhancing safety, compliance, and fleet performance.

Major transportation players, including Werner Enterprises, XPO, and UniGroup, rely on Samsara for real-time safety and operational visibility. Jaime Hamm, SVP at Werner, cited Samsara’s innovation and customer-centric execution as key drivers of their partnership.

Retention

$IOT Samsara's Retention Rate (NRR) is at 115% for customers with ARR over $10k. For customers with ARR over $100k, it stands at 120%, remaining at a high level, above the average for SaaS companies (the median of 117% for SaaS companies that I monitor).

ARR Growth

$IOT Samsara's Annual Recurring Revenue (ARR) growth is slowing, reaching +32.3% YoY in Q4 (+33% YoY adjusted), which is above the company’s revenue growth.

Net new ARR

$IOT Samsara added $109 million in net new ARR for Q4 2024, which is 10% higher than the previous year. The addition of net new ARR is at a record level for the company.

CAC Payback Period and RDI Score

$IOT Samsara's return on S&M spending is 20.1, the CAC Payback Period, while slightly better than the median for SaaS companies, is at a healthy level (the median for the SaaS companies I track is 20.8).

The R&D Index (RDI Score) for Q4 stands at 1.45, above the median of 1.2 for the SaaS companies I monitor and significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered indicative of best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

Over the past year, $IOT Samsara has significantly improved its margins:

Gross Margin rose from 76.2% to 77.9%.

Operating Margin increased from 4.8% to 16.1%.

FCF margin increased from -15.9% to 14.0%.

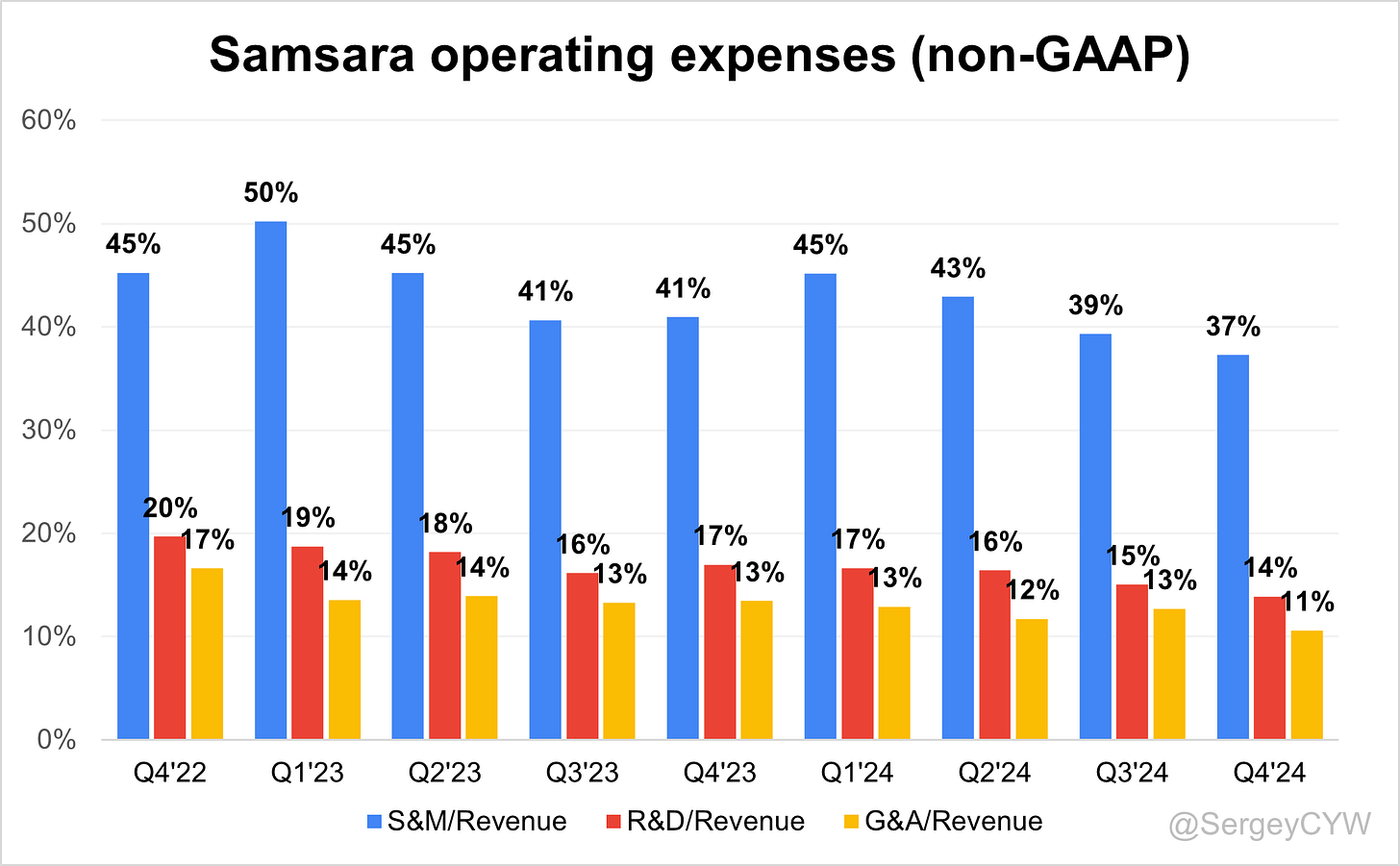

Operating expenses

$IOT Samsara's non-GAAP operating expenses have gradually decreased, driven by reduced Sales & Marketing (S&M) spending. S&M expenses declined from 45% two years ago to 37%. The R&D share remains high at 14%, reflecting the company's continued investment in future growth through product enhancements and updates.

General & Administrative (G&A) expenses also decreased to 11%, down from 17% two years ago.

Balance Sheet

$IOT Balance Sheet: Total debt stands at $80M, while Samsara holds $695M in cash and cash equivalents, exceeding its total debt and ensuring a healthy balance sheet reflects a virtually debt-free balance sheet.

Dilution

$IOT Shareholder Dilution: Samsara’s stock-based compensation (SBC) expenses are gradually declining, reaching 21% of revenue in the most recent quarter—still relatively high compared to typical SaaS benchmarks. Shareholder dilution remains elevated but within acceptable levels, with a slight improvement in Q4. The weighted-average number of basic common shares outstanding increased by 3.8% YoY.

Conclusion

$IOT Samsara Revenue growth has stabilized at a high level over the past few quarters.

Leading Indicators

• RPO growth of +32.5% exceeded revenue growth

• Billings growth of +16.1% came in below revenue growth

• ARR growth reached +32.3% (+33% adjusted), ahead of revenue growth

• Record net new ARR additions, up +10% YoY

• Record number of new customers added

Key Indicators

• Net Dollar Retention (NDR) for large customers remained steady at 120%

• CAC Payback Period improved to 20.1 months, slightly better than the SaaS average

• RDI Score slightly declined to 1.45, but remains above the median of the SaaS companies I track

The forecast points to a potential deceleration in revenue growth, but there are signs of continued stabilization, supported by strong net new ARR and new customer additions. Samsara is strengthening its competitive position through key product innovations like Asset Tags, Samsara Intelligence, and several major customer wins in Q4.

Margins have improved significantly over the past year while the company continues to post strong top-line growth.

Valuation has normalized, and the company now appears fairly valued relative to its expected high revenue growth.

After $IOT shares dropped 9% following the Q3 2024 earnings report, the valuation based on multiples became more attractive, and I increased my position. My current position is 3.9%. While the weak forecast for the next quarter raises some concerns, if Samsara meaningfully beats its Q1 guidance and revenue growth stabilizes, I plan to increase my position further.