Salesforce Q4 2024 Earnings Analysis

Dive into $CRM Salesforce’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↘️$9,993.0M rev (+7.6% YoY, +8.3% LQ) missed est by -0.3%🔴

↗️GM (77.8%, +0.9 PPs YoY)🟢

↗️Operating Margin (21.2%, +1.9 PPs YoY)🟢

↗️FCF Margin (38.2%, +3.1 PPs YoY)

↗️Net Margin (17.1%, +1.5 PPs YoY)🟢

↗️EPS* $2.78 beat est by 6.5%

*non-GAAP

Segment Revenue

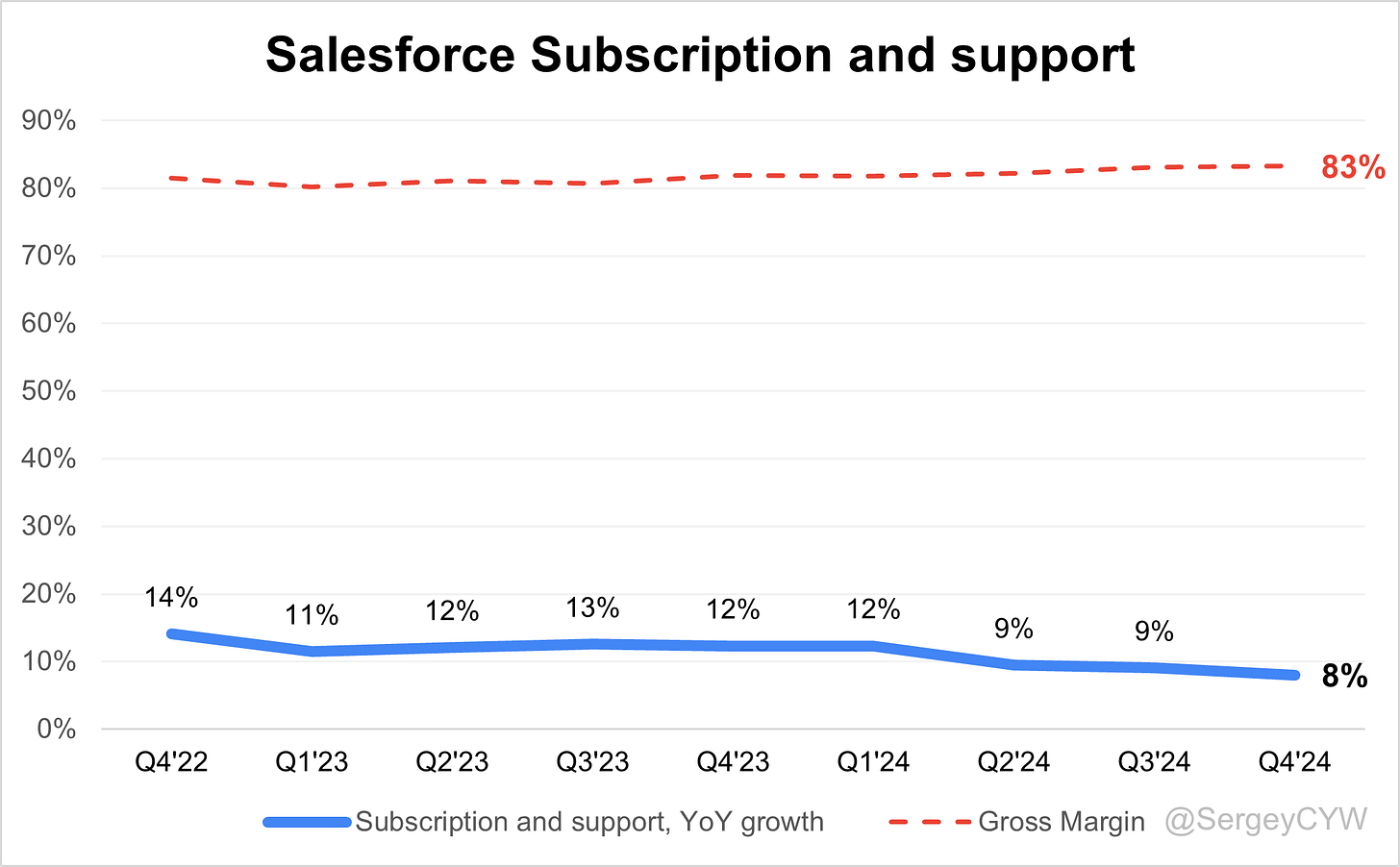

↗️Subscription and support $9,451M rev (+8.0% YoY, 83.3% Gross Margin)

➡️Professional services $542M rev (+0.6% YoY, -17.3% Gross Margin)🟡

Key Metrics

↗️RPO $63.40B (+11.4% YoY)🟢

↗️cRPO $30.20B (+9.4% YoY)

Subscription Revenue by Type

↗️Sales $2,134M rev (+8.4% YoY)

↗️Service $2,327M rev (+7.8% YoY)

↗️Platform and Other $1,918M rev (+11.5% YoY)🟢

➡️Marketing and Commerce $1,357M rev (+6.5% YoY)🟡

➡️Integration and Analytics $1,715M rev (+5.4% YoY)🟡

Revenue by Region

↗️Americas $6,660M rev (+7.8% YoY, 66.6% of Rev)🟢

➡️Europe $2,334M rev (+5.9% YoY, 23.4% of Rev)🟡

↗️Asia Pacific $999M rev (+10.3% YoY, 10.0% of Rev)

Operating expenses

↘️S&M/Revenue 34.7% (-2.3 PPs YoY)

↗️R&D/Revenue 14.2% (+0.5 PPs YoY)

↗️G&A/Revenue 7.7% (+0.9 PPs YoY)

Dilution

↘️SBC/rev 8%, -0.6 PPs QoQ

↗️Basic shares down -1.1% YoY, +0.1 PPs QoQ🟢

↘️Diluted shares down -0.9% YoY, -0.6 PPs QoQ🟢

Guidance

↘️Q1'25 $9.71 - $9.76B guide (+20.0% YoY) missed est by -1.6%🔴

↘️$40.5 - $40.9B FY guide (+7.4% YoY) missed est by -1.5%🔴

Key points from Salesforce’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Salesforce reported $10 billion in Q4 revenue, marking its first-ever $10B quarter with 8% YoY growth (9% in constant currency). Full-year FY 2025 revenue reached $37.9 billion, up 9% YoY. Operating cash flow hit $13.1 billion, up 28% YoY, the highest in company history. Non-GAAP operating margin expanded by 250 basis points YoY to 33%.

Q4 revenue missed expectations due to a $75 million FX headwind and a slowdown in professional services revenue as the company shifts implementation to partners.

FY 2026 revenue guidance is $40.5B–$40.9B, up 7–8% YoY. Subscription and support revenue is expected to grow 9% YoY. A $200 million FX headwind is included in guidance. Operating margin is set to expand to 34%, up 100 basis points YoY.

Sales Growth

Sales Cloud achieved double-digit growth, driven by demand for AI-powered sales automation. AgentForce boosted sales productivity by 7% YoY, automating lead qualification and outreach.

A $20 million ACV deal with a large telecommunications provider included $7 million for AgentForce, demonstrating AI’s growing role in sales automation. Companies like Goodyear and Lennar are using AI to accelerate deal closures and revenue visibility.

Macroeconomic challenges in EMEA slowed enterprise spending, especially in manufacturing and technology. The U.S. market is stabilizing with improving sales cycles.

Service Growth

Service Cloud posted double-digit growth as customer support automation became a key efficiency driver. AgentForce handled 380,000 service requests in Q4 on Salesforce's help portal, achieving an 84% resolution rate with only 2% requiring human escalation.

Large enterprises like Pfizer, Singapore Airlines, and OpenTable adopted AgentForce for AI-driven customer support, cutting response times and costs. OpenTable reported AgentForce resolved 73% of restaurant web queries, a 50% improvement over previous systems.

AgentForce for Field Service is reducing repair times for Goodyear, assisting technicians with diagnostics and scheduling. AI-powered automation scales operations without increasing headcount.

Marketing & Commerce

Marketing and Commerce Cloud faced weaker demand, impacting overall revenue. Enterprise marketing budgets remained constrained, especially in EMEA.

AI-driven personalization is gaining traction. Pandora is automating 30–60% of service cases with AgentForce. AI-powered lead conversion and campaign optimization are embedding into Data Cloud and Customer 360.

Salesforce expects limited AI revenue contribution in FY 2026 but sees AI adoption driving stronger revenue impact in FY 2027. Many enterprise customers require significant investment in AI integration before full-scale deployment.

Slack Expansion

Slack was featured in over one-third of $1M+ deals, with double-digit YoY growth in contribution to deal size. Nearly 5 billion messages are sent weekly.

Companies like ZoomInfo, reMarkable, and MyMedHealth are integrating AgentForce-powered automation into Slack to streamline workflows.

Salesforce is monetizing AI features within Slack to increase revenue per user and drive enterprise adoption of AI-native collaboration tools.

AgentForce Growth

AgentForce recorded 3,000+ paying customers within three months. Data Cloud & AI ARR exceeded $900 million, growing 120% YoY.

Companies like Pfizer, Lennar, and Singapore Airlines are using AI-powered agents to reduce costs and increase productivity.

Salesforce expects modest AI revenue in FY 2026 but significant acceleration in FY 2027 as enterprises complete deployment. 50% of AgentForce wins and 70% of activations were partner-driven in Q4.

The pricing model is shifting from per-seat to consumption-based AI pricing. The $20M telco deal included $7M for AgentForce, indicating AI-driven upsell potential.

Product Innovations

Tableau Next, a fully AI-powered version, integrates deeply with Data Cloud and AgentForce. It enables conversational analytics, automated insights, and AI-assisted data management.

Other AI-driven updates include Slack AI, Sales Cloud, Service Cloud, Marketing Cloud, and a new ITSM product.

Pricing Evolution

Salesforce combines per-seat licensing with AI consumption-based pricing.

A major telco deal included $20M ACV, with $7M allocated to AgentForce. AI-driven automation increases contract values as enterprises expand AI adoption.

Enterprise Adoption

Salesforce closed 400+ deals over $1M in Q4, with all top 10 deals including Data Cloud and AI.

Key AI adopters include Pfizer, Singapore Airlines, Lennar, Pandora, OpenTable, and Goodyear.

Customer Success

Lennar deployed AI-powered 24/7 customer service, automated sales leads, and expanded into AI-assisted mortgages and insurance.

Pfizer integrated AI into Life Sciences Cloud, optimizing clinical trials, sales, and customer service for 20,000+ employees.

Singapore Airlines automated flight inquiries and customer service using Sales Cloud, Service Cloud, and Marketing Cloud.

Pandora adopted AI-powered retail automation, targeting 30–60% service case automation.

OpenTable automated 73% of restaurant web queries, improving efficiency by 50%.

Goodyear integrated AgentForce for sales and field service, cutting repair times and improving productivity.

Strategic Partnerships

Salesforce expanded Google Cloud integration, allowing customers to deploy Salesforce AI on Google’s Gemini models.

AWS remains a key growth driver, closing 25+ $1M+ deals, including three over $10M.

127,000+ system integrator employees trained on AgentForce. 1,000+ ISVs and technology partners building AI-powered solutions.

Global Expansion

Revenue grew 8% in the Americas, 7% in EMEA (constant currency), and 14% in APAC.

LATAM, Japan, and Canada saw strong new business growth.

Nearly half of top 100 Q4 deals were international, with One New Zealand, LG Electronics, and Versace expanding AI adoption.

Leadership Changes

Amy Weaver (CFO) and Brian Millham (COO) are stepping down.

Robin Washington is appointed COFO, combining finance and operations.

Miguel Milano will report directly to Marc Benioff as Chief Revenue Officer.

Challenges

Salesforce faces macroeconomic uncertainty in EMEA and FX headwinds of $200M in FY 2026.

Professional services revenue is declining as Salesforce shifts implementation to partners.

Marketing and Commerce Cloud weakness continues to impact total revenue growth.

Future Outlook

FY 2026 revenue projected at $40.5B–$40.9B, with 9% YoY subscription revenue growth.

Operating margin expected to reach 34%, reflecting disciplined cost control and AI-driven efficiency.

AgentForce adoption will scale significantly in FY 2027, positioning Salesforce as the leader in AI-driven enterprise automation.

"Fiscal 2026 will be the year of digital labor," Marc Benioff stated, reinforcing Salesforce’s commitment to AI-driven workforce transformation.

Management comments on the earnings call.

Product Innovations

Mark Benioff, Chair and Chief Executive Officer

"Tableau Next is about to deploy to customers at scale, and I think people are going to be absolutely blown away. It’s a completely AI-powered version of Tableau built with AgentForce on Data Cloud, deeply integrated into our product line. When you see what we have built, it is going to transform how customers unlock insights and take action on their data."

Brian Millham, President and Chief Operating Officer

"Customers are seeing immediate and substantial value with AgentForce. With its integration across our Customer 360 apps, Data Cloud, and AI, we are setting new standards in the industry for automation, intelligence, and efficiency."

Slack

Brian Millham, President and Chief Operating Officer

"Once again, Slack was included in over a third of our deals over $1 million, and its contribution to overall deal size increased double digits year over year. Slack is central to how people work, and as AI adoption accelerates, it will become the place where every company brings digital labor to all of their employees."

AgentForce

Mark Benioff, Chair and Chief Executive Officer

"This was the quarter of AgentForce. Just ninety days after it went live, we already have 3,000 paying customers who are experiencing unprecedented levels of productivity, efficiency, and cost savings. No one else is delivering at this level of capability."

Brian Millham, President and Chief Operating Officer

"AgentForce is revolutionizing how our customers work by bringing AI-powered insights and actions directly into workflows. Customers of every size, across every industry, are seeing immediate returns, achieving ROI five times faster than DIY solutions while lowering costs by 20%."

AI Leadership & Competitive Advantage

Mark Benioff, Chair and Chief Executive Officer

"We are leading the digital labor revolution. While other vendors talk about AI and agent capabilities, we are delivering it at scale. AgentForce is already being used by thousands of companies worldwide, and we are years ahead of competitors in terms of execution."

Brian Millham, President and Chief Operating Officer

"Customers are telling us that we are light-years ahead of other providers in delivering AI-powered automation. The reality is, while some companies use the word ‘agent,’ very few are actually deploying agents at scale. We are seeing significant differentiation with our deeply unified AI platform."

Customer Adoption & Success

Mark Benioff, Chair and Chief Executive Officer

"Customers like Lennar, Pfizer, Pandora, OpenTable, and Singapore Airlines are going all-in on AI-driven digital labor. The success stories we are seeing, from homebuilding to financial services, are evidence of the massive market shift towards automation and AI-driven efficiency."

Brian Millham, President and Chief Operating Officer

"We are seeing tremendous momentum. OpenTable has already automated 73% of all restaurant web queries with AgentForce, achieving a 50% improvement over their previous solution. Companies are realizing real-world efficiency gains, and this is just the beginning."

Strategic Partnerships

Brian Millham, President and Chief Operating Officer

"Our partnerships with AWS and Google Cloud continue to accelerate enterprise AI adoption. We closed 25 transactions over $1 million with AWS, including three deals above $10 million. Google’s Gemini AI models are now integrated with our AI platform, expanding our ability to deliver intelligent automation."

Mark Benioff, Chair and Chief Executive Officer

"AWS, Google, and Alibaba are making massive investments in AI infrastructure, and we are leveraging these investments to deliver AI-powered digital labor at scale. We are getting great pricing, and our ability to deploy at a low cost is benefiting our customers tremendously."

Pricing Model Evolution

Mark Benioff, Chair and Chief Executive Officer

"Historically, we priced per human, but now we are introducing a hybrid model. AI agents are consumption-based, while core CRM remains per-seat. In a recent deal with a telecommunications company, $7 million of a $20 million transaction was for AgentForce—demonstrating the revenue expansion opportunity AI brings."

Brian Millham, President and Chief Operating Officer

"Customers understand the ROI of AI. We expect to transition many of our initial AgentForce deals into Universal Credit models, giving customers more flexibility while driving significant revenue upside for us."

International Growth & Expansion

Amy Weaver, President and Chief Financial Officer

"Nearly half of our top 100 deals were international, with significant expansion in Latin America, Japan, and Canada. While parts of EMEA remain constrained, we are seeing strong AI adoption in financial services, healthcare, and telecommunications across multiple regions."

Challenges in Market Conditions

Amy Weaver, President and Chief Financial Officer

"Foreign exchange headwinds impacted revenue by $75 million in Q4 and will create a $200 million headwind in fiscal year 2026. While we are seeing stabilization in the U.S. market, professional services revenue remains a challenge as we continue shifting implementation to our partner ecosystem."

Future Outlook

Mark Benioff, Chair and Chief Executive Officer

"Fiscal 2026 is the year of digital labor. We are entering an era where every CEO will manage both humans and AI-powered agents. The global workforce is not growing, but productivity must—AI is the only way to achieve that, and we are leading the charge."

Amy Weaver, President and Chief Financial Officer

"We remain committed to profitable growth, with operating margins set to expand another 100 basis points in fiscal 2026. AI adoption will continue accelerating, and while we expect a modest revenue contribution from AgentForce in fiscal 2026, we anticipate significant scaling in fiscal 2027."

Thoughts on Salesforce Earnings Report $CRM:

🟢 Positive

Revenue: Reached $9.99B (+7.6% YoY, +8.3% QoQ)

Profitability: Net margin 17.1% (+1.5 PPs YoY), Operating margin 21.2% (+1.9 PPs YoY), FCF margin 38.2% (+3.1 PPs YoY)

Subscription & Support Revenue: $9.45B (+8.0% YoY), Gross Margin 83.3%

AI & Platform Growth: Platform & Other revenue up 11.5% YoY, Data Cloud & AI ARR reached $900M (+120% YoY)

AgentForce Adoption: 3,000+ paying customers in 3 months, driving higher contract values

Regional Growth: Asia Pacific revenue +10.3% YoY, Americas revenue +7.8% YoY

Stock-Based Compensation: 8% of revenue (-0.6 PPs QoQ), diluted shares down -0.9% YoY

Strategic Partnerships: Expanded Google Cloud integration, AWS closed 25+ $1M+ deals

Leadership & Efficiency: S&M expense down to 34.7% of revenue (-2.3 PPs YoY), diluted shares down -0.9% YoY

🟡 Neutral

Professional Services Revenue: $542M (+0.6% YoY), -17.3% Gross Margin

Marketing & Commerce Cloud Revenue: $1.36B (+6.5% YoY), lower than other segments

Integration & Analytics Growth: $1.71B (+5.4% YoY)

Europe Revenue: $2.33B (+5.9% YoY), 23.4% of total revenue

R&D Expense: 14.2% of revenue (+0.5 PPs YoY) as AI investment scales

🔴 Negative

Revenue Miss: $9.99B revenue missed estimates by -0.3%

Guidance Below Expectations: Q1’25 revenue guide ($9.71B–$9.76B) missed estimates by -1.6%

FY 2026 Guidance Lower: $40.5B–$40.9B guide (+7.4% YoY) missed estimates by -1.5%

FX Headwinds: $75M impact in Q4, expected $200M impact in FY 2026

Professional Services Slowdown: Company shifting implementation to partners, reducing growth potential

Marketing & Commerce Cloud Weakness: Slowest-growing segment in subscription revenue

Macroeconomic Challenges: Slower enterprise spending in EMEA due to economic conditions