Salesforce Q3 2024 Earnings Analysis

Dive into $CRM Salesforce’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$9,444.0M rev (+8.3% YoY, +8.4% LQ) beat est by 1.1%

↗️GM (77.7%, +2.4 PPs YoY)🟢

↗️Operating Margin (20.6%, +2.8 PPs YoY)🟢

↗️FCF Margin (20.0%, +4.4 PPs YoY)

↗️Net Margin (16.2%, +2.1 PPs YoY)

↘️EPS* $2.41 missed est by -1.2%

*non-GAAP

Segment Revenue

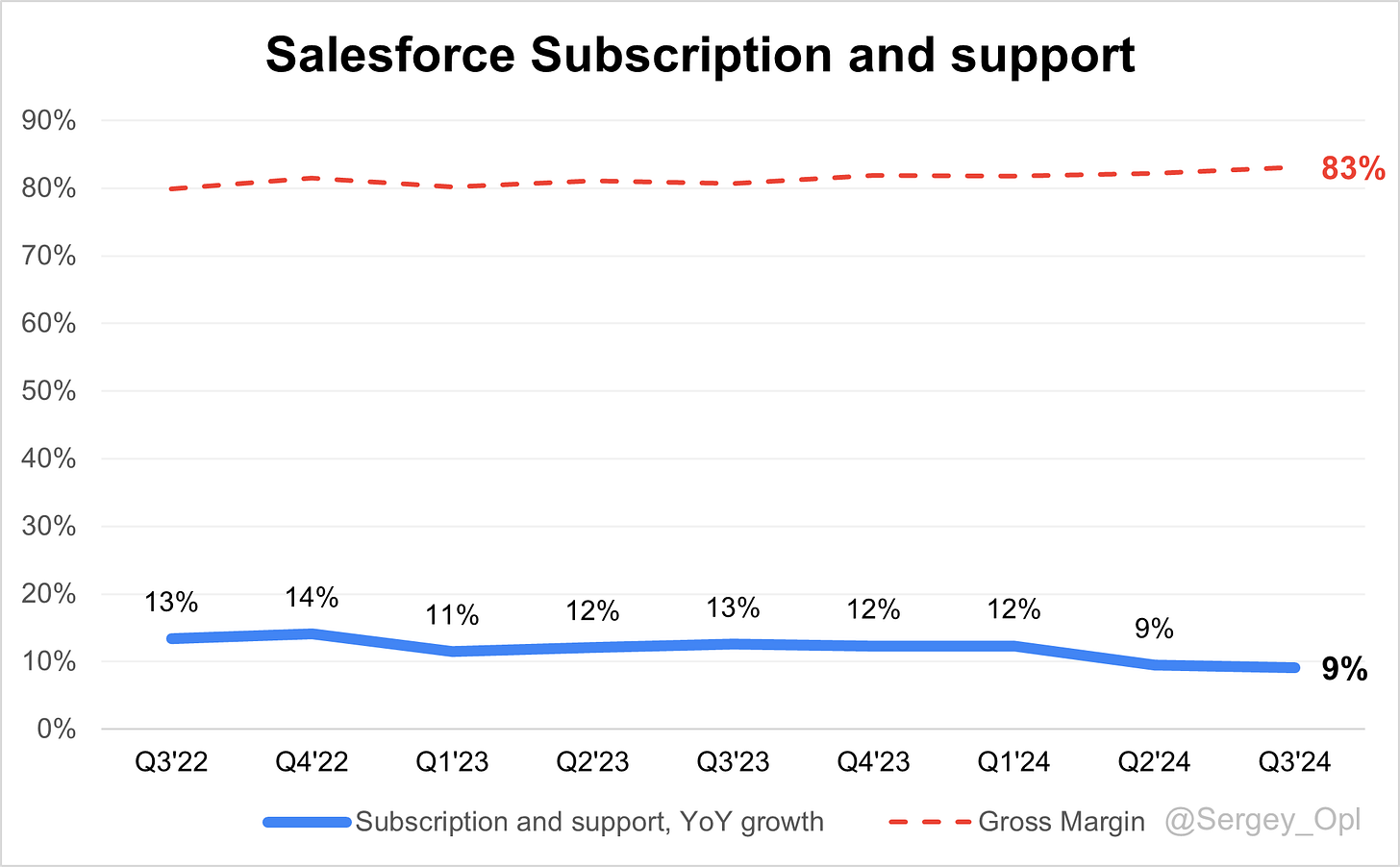

↗️Subscription and support $8,879M rev (+9.1% YoY, 83.1% Gross Margin)

↘️Professional services $565M rev (-2.4% YoY, -6.9% Gross Margin)🟡

Key Metrics

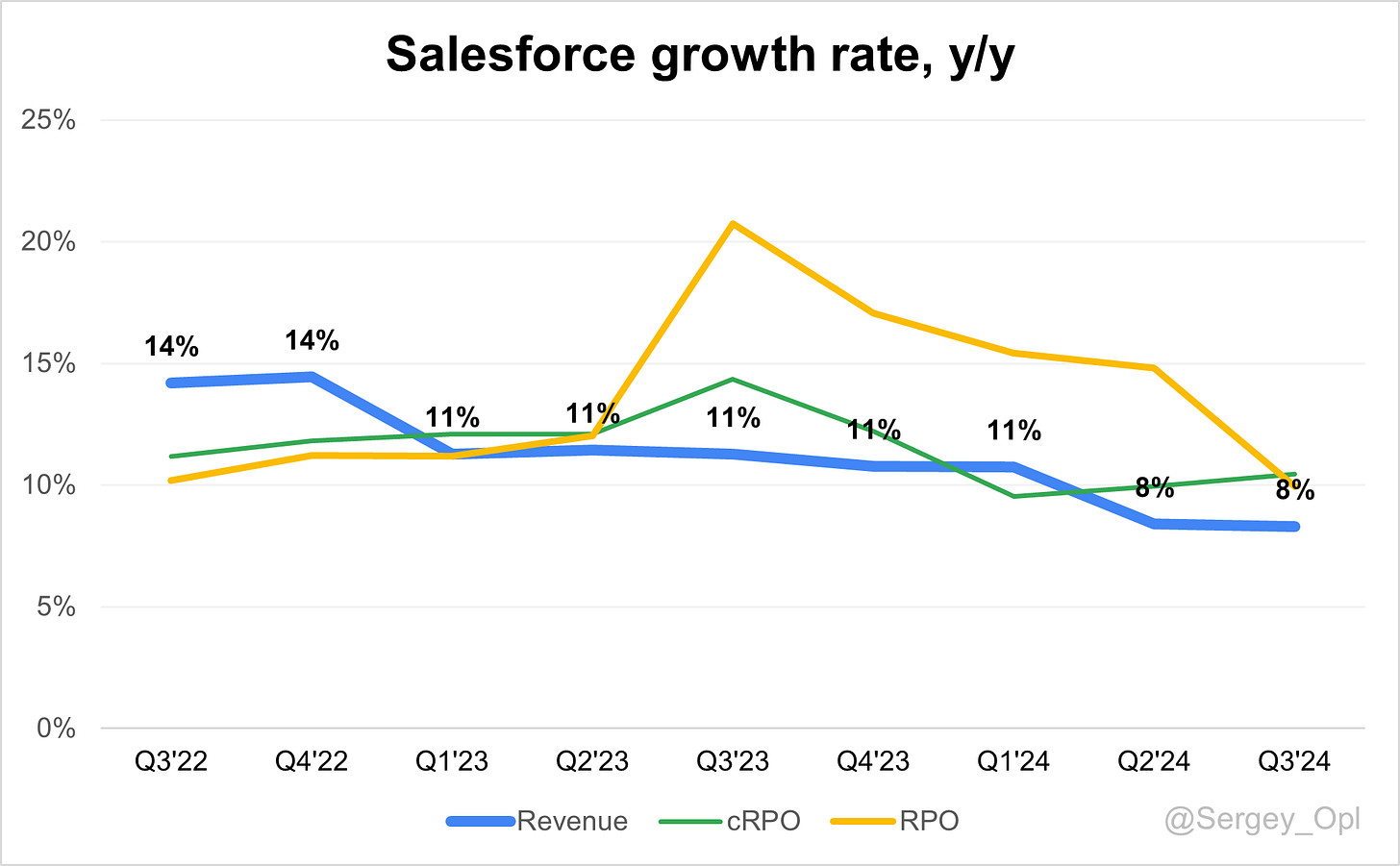

↗️RPO $53.10B (+9.9% YoY)

↗️cRPO $26.40B (+10.5% YoY)🟢

Subscription Revenue by Type

↗️Sales $2,119M rev (+11.2% YoY)🟢

↗️Service $2,288M rev (+10.3% YoY)🟢

➡️Platform and Other $1,825M rev (+8.2% YoY)🟡

↗️Marketing and Commerce $1,334M rev (+8.5% YoY)🟢

➡️Integration and Analytics $1,313M rev (+5.5% YoY)🟡

Revenue by region

➡️Americas $6,220M rev (+6.1% YoY, 65.9% of Rev)🟡

↗️Europe $2,228M rev (+11.5% YoY, 23.6% of Rev)🟢

↗️Asia Pacific $996M rev (+15.8% YoY, 10.5% of Rev)🟢

Operating expenses

↘️S&M/Revenue 35.2% (-1.2 PPs YoY)

↗️R&D/Revenue 14.4% (+0.6 PPs YoY)

↗️G&A/Revenue 7.5% (+0.3 PPs YoY)

Dilution

↗️SBC/rev 9%, +0.0 PPs QoQ

↘️Basic shares down -1.2% YoY, -0.1 PPs QoQ🟢

↗️Diluted shares down -0.3% YoY, +1.0 PPs QoQ🟢

Guidance

➡️Q4'24 $9.90 - $10.10B guide (+19.0% YoY) in line with est

➡️$37.8 - $38.0B FY guide (+8.7% YoY) in line with est

Key points from Salesforce’s Third Quarter 2024 Earnings Call:

Financial Performance

Salesforce reported strong Q3 FY2025 results, achieving $9.44 billion in revenue, an 8% YoY increase in both nominal and constant currency. Subscription and support revenue grew 9% YoY, driven by higher ARPU in Sales Cloud and Service Cloud. Profitability reached a milestone, with a 20% GAAP operating margin, the highest in the company’s history, and a 33.1% non-GAAP operating margin, a 190-basis-point YoY increase.

Operating cash flow increased 29% YoY to $2 billion, and free cash flow rose 30% YoY to $1.8 billion. RPO grew 10% YoY to $53.1 billion, while CRPO reached $26.4 billion, up slightly over 10% YoY. Salesforce raised FY2025 non-GAAP operating margin guidance to 32.9%, with free cash flow growth projected at 26-28% and revenue expected between $37.8 billion and $38 billion, reflecting 8-9% growth.

Product Innovations

Salesforce launched Agent Force, a platform of autonomous AI agents designed to transform digital labor. Agent Force integrates across core products, automating customer interactions, resolving issues, and enhancing operational efficiency. This marks a shift from data management to labor augmentation through AI.

The More Core Initiative unified Sales, Service, Marketing, Commerce, Analytics, Data Cloud, and Slack under a single codebase, ensuring seamless AI-driven workflows. Foundations, a multi-cloud package, accelerates adoption by offering a comprehensive introduction to Salesforce’s ecosystem.

Sales

Sales Cloud maintained market leadership, achieving robust growth. As the first agent-first Sales Cloud, it integrates Agent Force to enhance productivity in sales qualification and pipeline management. Multi-cloud transactions were a highlight, with the top 25 deals averaging five integrated clouds.

Strong new business growth in Latin America and Canada offset macroeconomic pressures in the U.S. However, slower cross-sell rates to Service Cloud customers present opportunities for improvement.

Service

Service Cloud, Salesforce’s largest offering, benefits from Agent Force integration. Early adopters like Wiley reduced case resolution times by 40%, and Heathrow Airport scaled operations to handle traveler inquiries.

Industries such as healthcare leveraged Service Cloud to address labor shortages. For instance, UCSF aims to offload administrative tasks to enable staff to focus on strategic care. Despite high adoption rates among new customers, cross-sell opportunities with Sales Cloud remain underutilized.

Marketing

Marketing Cloud enabled data-driven and personalized campaigns with Agent Force. The platform integrated Data Cloud for real-time actionable insights. Shark Ninja deployed Marketing Cloud with Commerce Cloud to unify operations across 28 markets, and a major healthcare client chose Salesforce over competitors due to its seamless integration capabilities.

Adoption faced competition from point solutions like Adobe. Salesforce emphasized its unified platform as a key differentiator, which combines Marketing Cloud with other Salesforce products.

Commerce

Commerce Cloud powered nearly 50 million orders during Cyber Week with 100% uptime, demonstrating scalability and reliability. It also supported 56 billion marketing messages and 60 billion product recommendations using Salesforce AI.

Integration with Agent Force allowed businesses like Shark Ninja to streamline global e-commerce operations and customer support. Slower adoption in certain regions and industries reflected economic pressures, but integrating Commerce Cloud with Data Cloud positions Salesforce to capture future demand.

AI Leadership and Agent Force

Agent Force adoption has been rapid, closing 200 deals in its first week and building a pipeline of over 1,000 potential transactions. Leveraging Data Cloud, Agent Force processes vast data sets to deliver actionable insights.

Einstein AI continues as a cornerstone, with 2 trillion transactions processed weekly. Agent Force’s consumption-based pricing of $2 per conversation offers cost-effective alternatives to traditional labor. Customers like Vivint and Wiley achieved operational efficiencies, and Indeed aims to halve time-to-hire using the platform.

Product Integration and Market Expansion

Salesforce's unified platform allows seamless interaction across Sales, Service, Marketing, Commerce, Slack, and Data Cloud. The integration supports AI-driven workflows and enhances scalability.

International markets, including EMEA (+9% YoY) and APAC (+14% YoY), showed strong growth. Multi-cloud strategies drove higher customer spending, with top 25 deals averaging five cloud products.

Customer Success Stories

Vivint automated customer support and optimized operations using Agent Force.

Adecco Group processed over 300 million applications, improving recruiter efficiency through Agent Force and Data Cloud.

Wiley achieved 40% faster case resolutions with Agent Force.

College Possible implemented virtual counselors to support students, reducing advisor shortages.

Heathrow Airport managed thousands of inquiries simultaneously with Agent Force.

Indeed matched 580 million profiles with employers, aiming to halve time-to-hire.

Large Customer Wins

FedEx adopted Agent Force to enhance operational efficiency.

IBM used Data Cloud to unify client interactions globally.

Shark Ninja deployed Agent Force and Commerce Cloud across 28 markets.

Accenture integrated Agent Force to enhance global sales operations for 52,000 sellers.

Capital One, Snap, and Rivian adopted Slack, with Slack AI spend up 50% QoQ.

Challenges and Considerations

Adopting AI solutions like Agent Force requires harmonized data architecture. Customers with well-structured data can integrate the platform in weeks, while fragmented systems may delay implementation by up to six months. Attrition remained slightly above 8%, consistent with prior quarters. Economic constraints in the U.S. and parts of EMEA posed challenges, though diversification helped mitigate impacts.

Future Outlook

The launch of Agent Force 2.0 on December 17 promises enhanced accuracy and functionality. Salesforce plans to hire 1,400 account executives in Q4 to meet growing demand.

With a focus on AI, data cloud capabilities, and platform integration, Salesforce aims to lead the enterprise AI market. Investments in product development, customer success, and global expansion position the company for sustained growth, unlocking new productivity opportunities for businesses worldwide.

Management comments on the earnings call.

Product Innovations

Mark Benioff, Chair and CEO

"Agent Force is not just a tool—it’s a platform where AI agents work alongside humans, fundamentally reshaping how businesses operate and unlocking a new era of digital labor."

Competitors

Mark Benioff, Chair and CEO

"Salesforce is the only platform where AI, data, and workflows integrate seamlessly across sales, service, marketing, analytics, and more. Unlike others, we deliver this as one unified system, ensuring unmatched efficiency and functionality for our customers."

Customers

Brian Millham, President and Chief Operating Officer

"Our customers understand the cost of labor, and Agent Force provides them with a limitless digital workforce that saves millions of dollars while driving stronger customer relationships."

Strategic Partnerships

Brian Millham, President and Chief Operating Officer

"We’re seeing incredible momentum with our partners, who were involved in 75% of our Agent Force deals last quarter. Accenture, for example, is using Agent Force internally to enhance bid management and improve global sales operations."

Market Expansion

Amy Weaver, President and Chief Financial Officer

"Our growth in EMEA and APAC, along with strong performance in Latin America and Canada, demonstrates the scalability of our multi-cloud strategy and the increasing demand for our AI-driven solutions worldwide."

Challenges

Amy Weaver, President and Chief Financial Officer

"Adopting solutions like Agent Force requires harmonized data architecture. While some customers integrate quickly, those with fragmented systems face delays, highlighting the critical role of Data Cloud in unlocking AI’s full potential."

Future Outlook

Mark Benioff, Chair and CEO

"Agent Force 2.0 represents the next evolution of digital labor, enabling businesses to scale productivity without workforce growth. This isn’t just a technological transformation; it’s a fundamental shift in how the world will work."