Salesforce Q2 2024 Earnings Analysis

Dive into $CRM Salesforce’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$9,325.0M rev (+8.4% YoY, +10.7% LQ) beat est by 1.0%

↗️GM (76.8%, +1.4 PPs YoY)

↗️Operating Margin* (33.7%, +2.1 PPs YoY)🟢

↗️FCF Margin (8.1%, +0.8 PPs YoY)

↗️Net Margin* (26.8%, +2.4 PPs YoY)🟢

↗️EPS* $2.56 beat est by 8.5%

*non-GAAP

Segment Revenue

↗️Subscription and support $8,764M rev (+9.5% YoY, 82.2% Gross Margin)

↘️Professional services $561M rev (-6.0% YoY, -7.5% Gross Margin)🟡

Key Metrics

↗️RPO $53.50B (+14.8% YoY)

↗️cRPO $26.50B (+10.0% YoY)🟢🟢

Subscription Revenue by Type

↗️Sales $2,071M rev (+9.3% YoY)

↗️Service $2,257M rev (+10.2% YoY)

↗️Platform and Other $1,786M rev (+9.0% YoY)

➡️Marketing and Commerce $1,308M rev (+5.7% YoY)🟡

↗️Integration and Analytics $1,342M rev (+13.2% YoY)

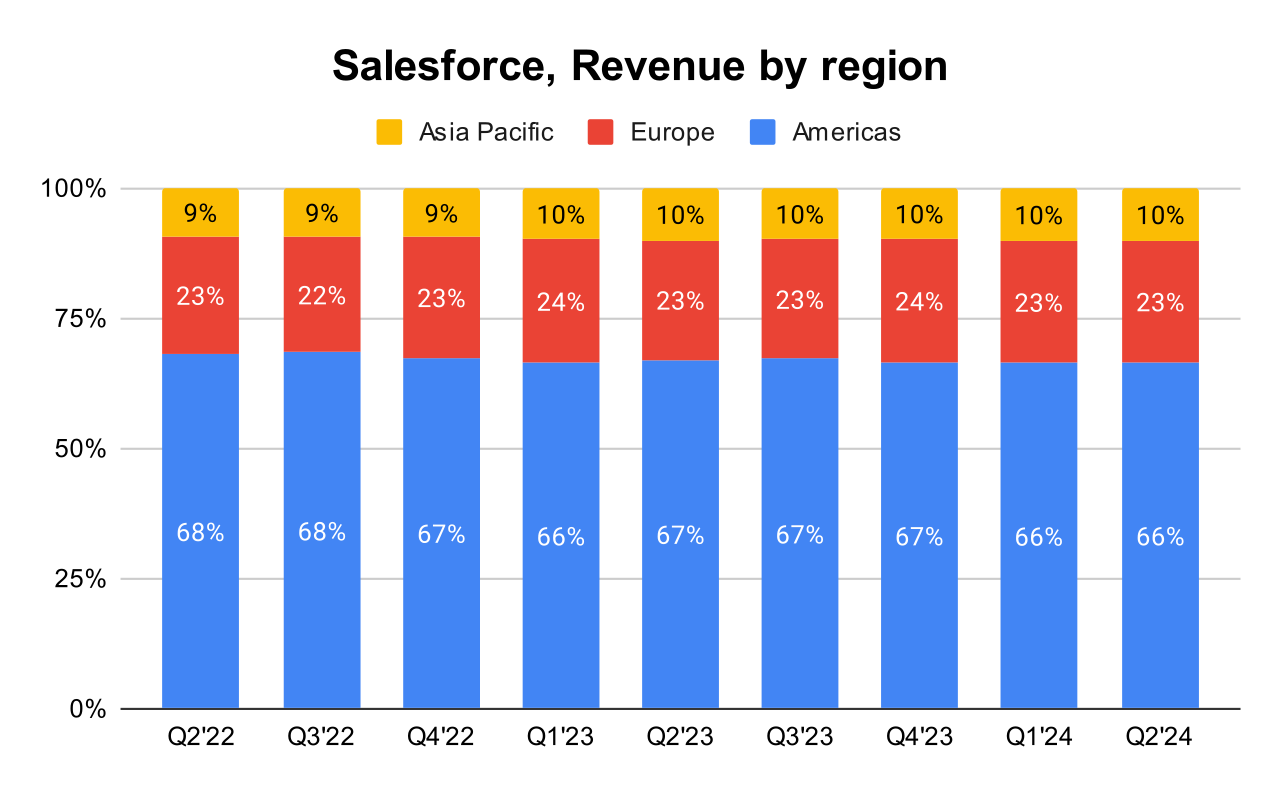

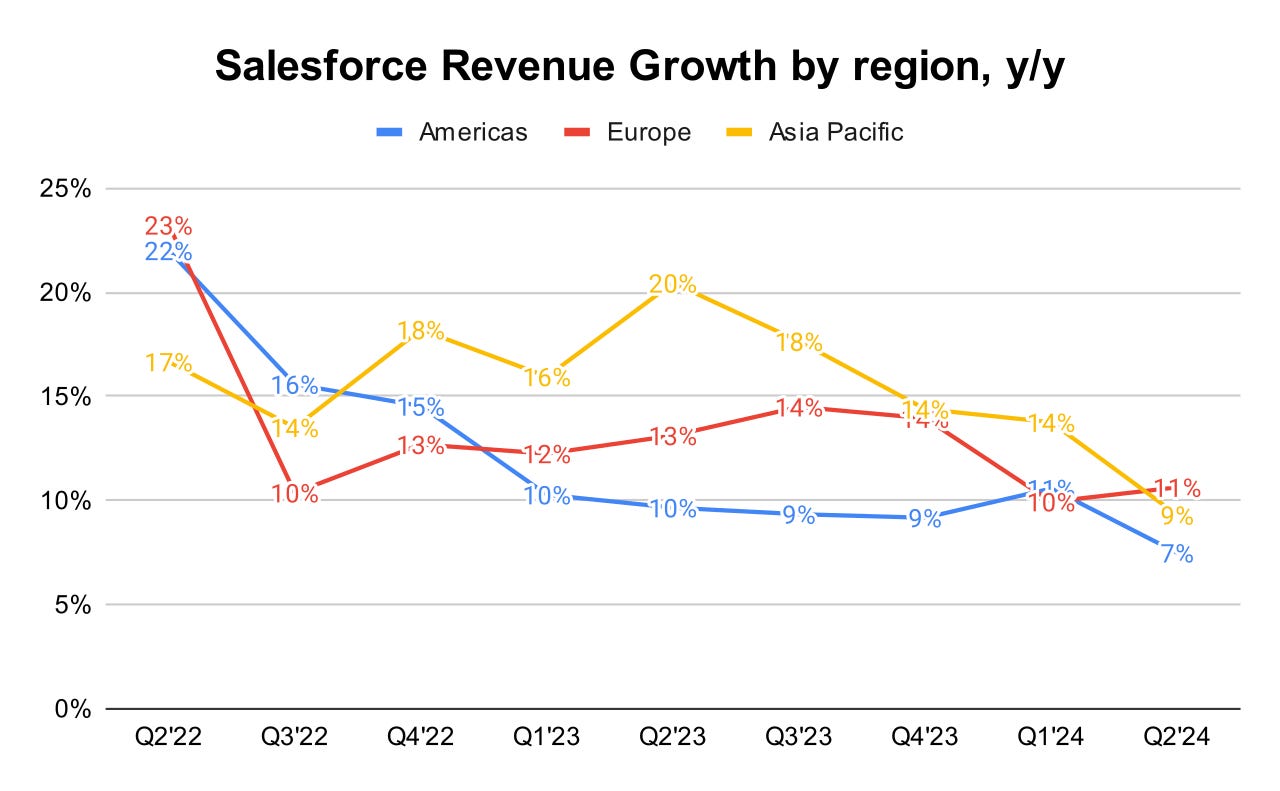

Revenue by region

➡️Americas $6,201M rev (+7.5% YoY, 66.5% of Rev)🟡

↗️Europe $2,184M rev (+10.6% YoY, 23.4% of Rev)🟢

↗️Asia Pacific $940M rev (+9.3% YoY, 10.1% of Rev)

Operating expenses

↘️S&M/Revenue 34.6% (-1.6 PPs YoY)

↗️R&D/Revenue 14.5% (+0.3 PPs YoY)

↗️G&A/Revenue 7.6% (+0.3 PPs YoY)

Dilution

↗️SBC/rev 9%, +0.5 PPs QoQ

↘️Basic shares down -1.1% YoY, -0.1 PPs QoQ🟢

↘️Diluted shares down -1.3% YoY, -1.0 PPs QoQ🟢

Guidance

↘️Q3'24 $9.31 - $9.36B guide (+20.0% YoY) missed est by -0.8%🔴

➡️$37.7 - $38.0B FY guide (+8.6% YoY) in line with est

Key points from Salesforce’s Second Quarter 2024 Earnings Call:

Agentforce Platform

AI-Driven Platform:

Agentforce is designed as a new, AI-driven platform intended to enhance customer interaction through autonomous agents. This represents a shift from traditional customer relationship management to more dynamic, AI-enabled interactions, potentially transforming how businesses engage with their customer base.

Integration with Salesforce Ecosystem:

Agentforce is deeply integrated within the Salesforce ecosystem, leveraging the company's extensive data and application network. This integration ensures that Agentforce can seamlessly work with existing Salesforce applications, enhancing its functionality and appeal to current Salesforce customers.

Strategic Importance for Salesforce:

The launch of Agentforce is strategically important for Salesforce as it marks the company's deeper foray into AI and machine learning, areas that are becoming increasingly critical in the tech industry.

Integration of AI Across Products:

Salesforce is embedding AI across all its products, enhancing the capabilities of its existing CRM solutions and extending these capabilities to new applications. This widespread integration signifies Salesforce’s commitment to leading in AI application within enterprise software solutions.

Leadership Changes

Amy Weaver, President and Chief Financial Officer, announced her decision to step down at the end of the fiscal year. Weaver has been instrumental in spearheading Salesforce’s financial transformation, focusing on increasing operational efficiency and expanding margins.

Market Expansion:

Salesforce continues to secure substantial multi-cloud deals, which account for a significant portion of their new business.

Strong momentum in Salesforce’s international business, with substantial growth in regions like Japan, India, and Canada. Salesforce is pushing forward with industry-specific solutions, particularly leveraging their AI technology to cater to unique industry needs.

Customers

OpenTable: OpenTable has deployed Agentforce to manage customer service operations for its network of 60,000 restaurants and 160 million diners.

Wiley: Wiley uses Agentforce to handle the increased customer service demands during the back-to-school season, traditionally a period of high activity due to textbook purchases. Wiley reported a double-digit percentage increase in customer satisfaction.

Royal Bank of Canada (RBC): RBC is implementing customized agents through Agentforce to improve customer service operations.

A Large Healthcare Organization: This unnamed healthcare provider is using Agentforce to manage over 90% of patient inquiries autonomously, significantly reducing the burden on human staff.

Future Outlook

The future outlook for Salesforce is heavily geared towards expanding its AI capabilities. The continued growth of Salesforce's Data Cloud and new AI initiatives are expected to play critical roles in the company's strategy, driving both innovation and revenue growth.

Management comments on the earnings call.

Product Innovations:

Marc Benioff: "We're going to show our new Agentforce agents and how we've reimagined enterprise software for this new world of autonomous AI... a different kind of architecture and a product that we didn't even talk about on the last earnings call, that is going to be fundamental to our future and a manifestation of our decade of AI leadership."

Customers:

Marc Benioff: "Every customer, I'm going to try to get every customer who comes to Dreamforce to turn agents on while they're there. Many of the customers, of course, are already using our applications... and we're automating all our customer touch points."

Market Expansion:

Brian Millham: "We had strong momentum in our industries business as well, and we continue to help our customers save time and money with industry-specific solutions. More than half of our top 100 deals included one of our industry cloud in the quarter."

Future Outlook:

Marc Benioff: "This is not Copilot's -- so many customers are so disappointed in what they bought from Microsoft Copilot because they're not getting the accuracy and the response that they want. Microsoft has disappointed so many customers with AI... With our new Agentforce platform, we're going to make a quantum leap forward in AI."