Salesforce Q1 2025 Earnings Analysis

Dive into $CRM Salesforce’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$9,829.0M rev (+7.6% YoY, -1.6% QoQ) beat est by 0.9%

↗️GM (77.0%, +0.6 PPs YoY)

↗️Operating Margin (20.1%, +1.3 PPs YoY)

↘️FCF Margin (64.1%, -2.6 PPs YoY)🟡

↘️Net Margin (15.7%, -1.1 PPs YoY)🟡

↗️EPS* $2.58 beat est by 1.6%

*non-GAAP

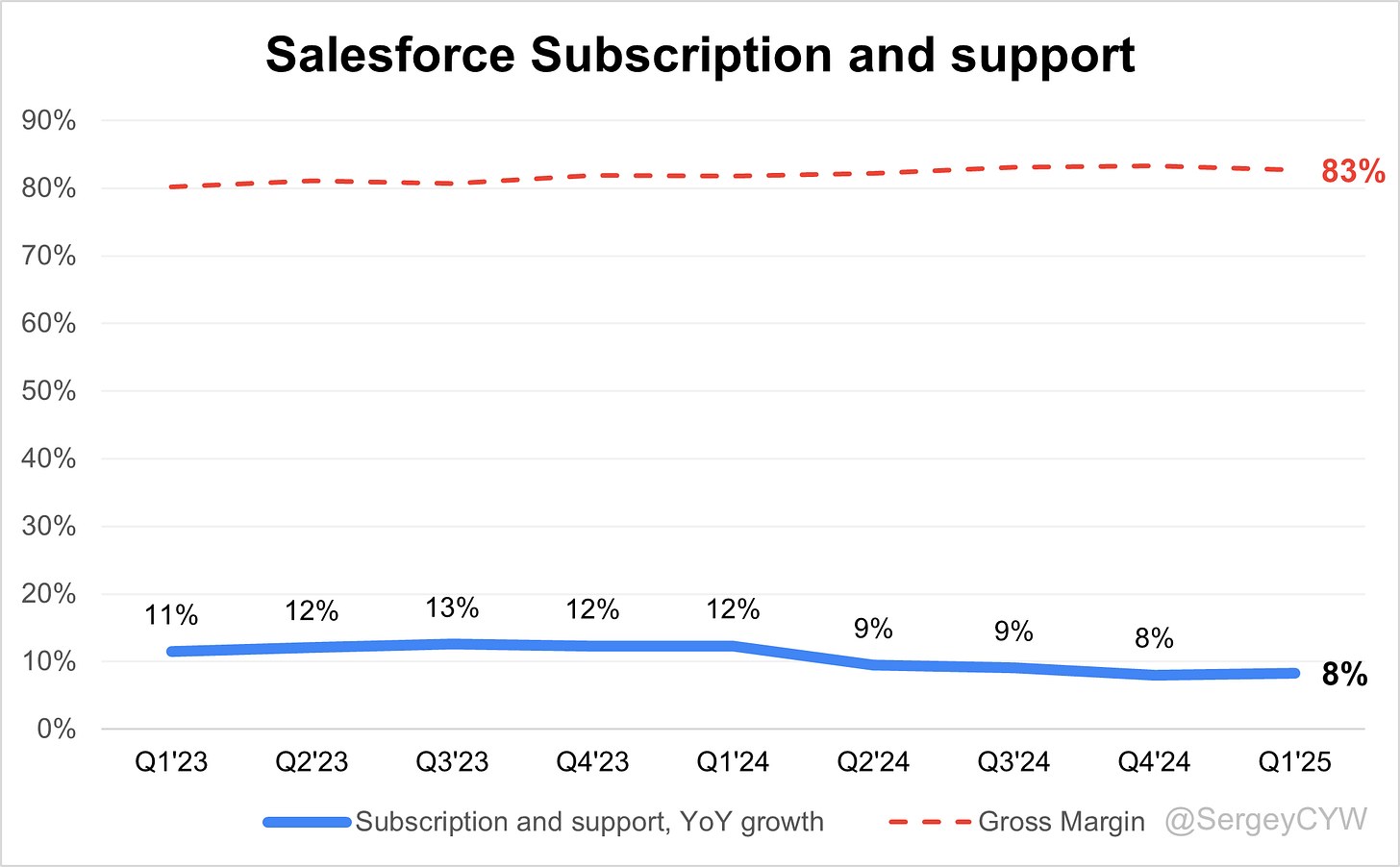

Segment Revenue

↗️Subscription and support $9,297M rev (+8.3% YoY, 82.7% Gross Margin)🟢

↘️Professional services $532M rev (-2.9% YoY, -22.9% Gross Margin)🟡

Key Metrics

↗️RPO $60.90B (+13.0% YoY)🟢

↗️cRPO $29.60B (+12.1% YoY)🟢

Subscription Revenue by Type

➡️Sales $2,131M rev (+6.7% YoY)🟡

➡️Service $2,334M rev (+7.0% YoY)🟡

↗️Platform and Other $1,963M rev (+14.3% YoY)🟢

➡️Marketing and Commerce $1,325M rev (+3.4% YoY)🟡

↗️Integration and Analytics $1,544M rev (+9.9% YoY)🟢

Revenue by Region

➡️Americas $6,469M rev (+6.7% YoY, 65.8% of Rev)🟡

↗️Europe $2,337M rev (+9.0% YoY, 23.8% of Rev)🟢

↗️Asia Pacific $1,023M rev (+10.5% YoY, 10.4% of Rev)🟢

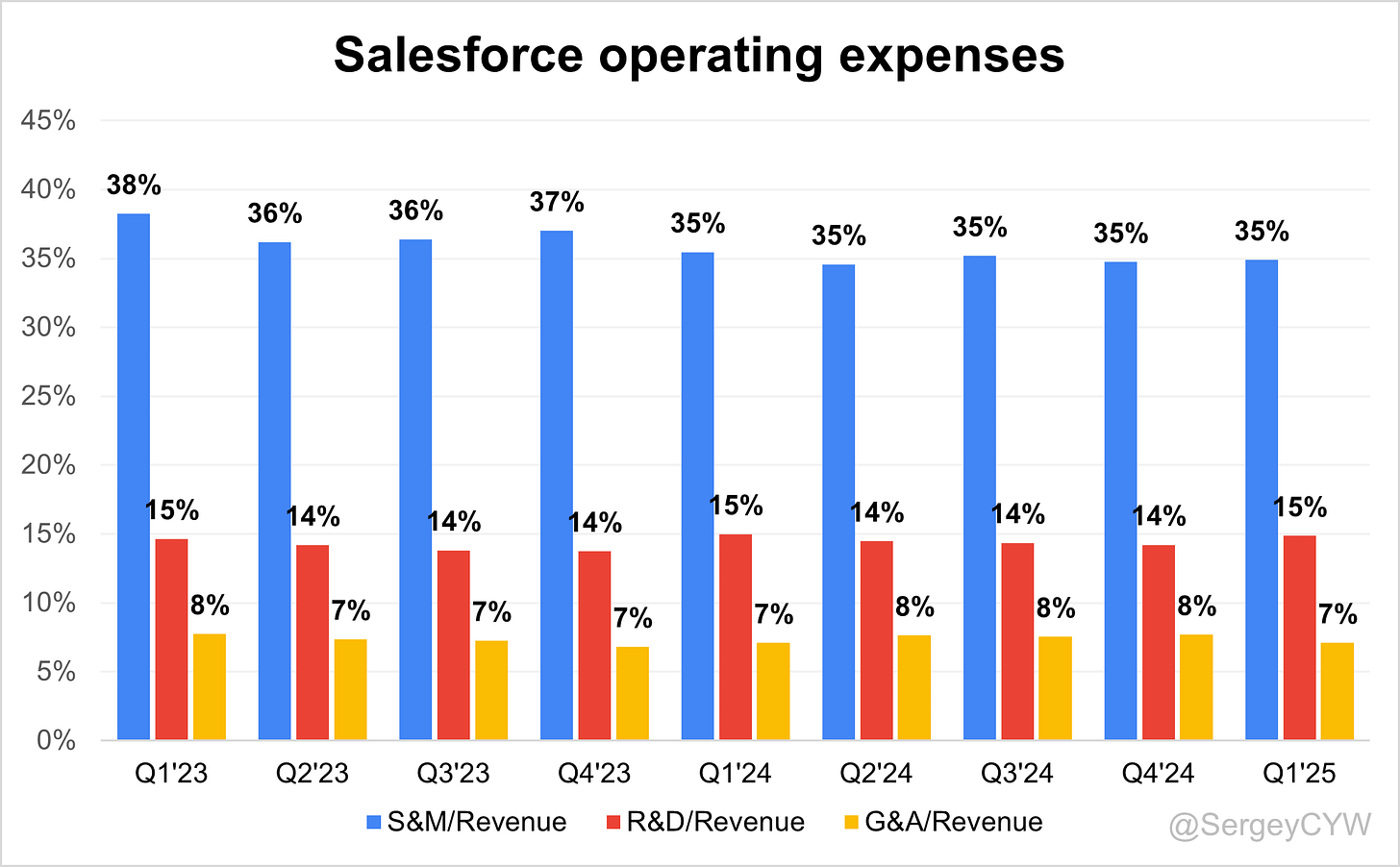

Operating expenses

↘️S&M/Revenue 34.9% (-0.6 PPs YoY)

↘️R&D/Revenue 14.9% (-0.1 PPs YoY)

↗️G&A/Revenue 7.1% (+0.0 PPs YoY)

Dilution

↗️SBC/rev 8%, +0.2 PPs QoQ

↗️Basic shares down -1.0% YoY, +0.1 PPs QoQ🟢

↘️Diluted shares down -1.5% YoY, -0.6 PPs QoQ🟢

Guidance

↗️Q2'25 $10.11 - $10.16B guide (+8.7% YoY) beat est by 1.3%

↗️$41.0 - $41.3B FY guide (+8.6% YoY) raised by 1.0% beat est by 0.9%

Key points from Salesforce’s First Quarter 2025 Earnings Call:

Financial Performance

Salesforce reported Q1 FY2026 revenue of $9.83 billion, an 8% YoY increase, with subscription and support revenue up 9% in constant currency. Operating cash flow was $6.5 billion, up 4% YoY. Remaining performance obligations (RPO) reached $60.9 billion, growing 13% YoY, while current RPO (CRPO) increased 12% nominally, and 11% in constant currency.

Non-GAAP operating margin was 32.3%, with FY26 guidance maintained at 34%. Free cash flow is projected to grow 9–10%, and total capital returns through dividends and buybacks now exceed $24 billion.

Sales Momentum

Sales Cloud contributed to 80% of top enterprise transactions, including 9 of the top 10 deals. Strong double-digit new bookings growth in small and mid-market segments led to reallocation of sales resources. AE headcount is set to rise 22% YoY by end of FY26.

Performance was especially strong in Canada, UK, France, and South Asia. Internal AI tools, such as Slack-based sales agents, drove over 21,000 interactions, saving 44,000+ hours annually. EMEA remains mixed due to macroeconomic caution.

Service and Platform Expansion

Service Cloud appeared in nearly all major customer wins and continues to drive adoption alongside Platform tools like Tableau and MuleSoft. AgentForce resolved over 750,000 internal support cases; Salesforce plans to surpass 1 million in Q2.

This enabled 500 employee redeployments to AI/data roles, generating $50 million in cost savings. Tableau was included in 70% of $1M+ deals, MuleSoft in nearly 50%, reinforcing the value of integrated analytics and API infrastructure.

Marketing and Commerce

Marketing and Commerce Cloud saw measured performance, with slower expansion due to cautious spending and a soft expiration base. Growth lagged other clouds. Salesforce is piloting AI-powered marketing agents, with promising early results.

Falabella scaled a WhatsApp-based AI agent from a $300K pilot to $1 million regionally. AI-driven interactivity in marketing is in early deployment and is expected to grow with further investment.

Slack as AI Interface

Slack is positioned as the enterprise AI interface. AgentForce integration enables meeting summaries, channel recaps, and customer interaction directly in Slack.

Lead routing time has dropped from 20 minutes to 19 seconds. Tableau, Sales Cloud, and Service Cloud are now accessible within Slack, enhancing workflow unification. Smartsheet adopted Slack + AgentForce for licensing automation and support.

Data Cloud Growth

Data Cloud processed over 22 trillion records, up 175% YoY, reaching $1B+ ARR. It featured in 60% of top 100 Q1 deals, with 50% of bookings from existing customers.

Major customers like PepsiCo are using it to unify data across 11 business units. Takeda Pharmaceuticals deployed it across medical and commercial operations. Continued growth is dependent on improved data harmonization, which the Informatica acquisition will support.

AgentForce Acceleration

AgentForce reached 4,000 paid customers, 8,000+ deployments, and $100M+ AOV within two quarters. It is on track to hit $1 billion ARR, with over 800 customers in production.

30% of Q1 bookings came from expansions. Each deal includes four or more additional Salesforce clouds. Templates are now available for specific industries, roles, and tasks to fast-track deployment.

Customer success includes:

Finnair: 80% of customer service automated

ENGIE: 83% AI-assisted usage

Grupo Globo: +22% retention and revenue lift

OpenTable: Expanded from internal tools to consumer agents

Falabella: Regional growth from $300K to $1M

PepsiCo: Unified architecture using AI across business lines

Innovation Framework

Salesforce is operating on the “ADAM” framework:

Agents (AgentForce)

Data (Data Cloud, Informatica)

Apps (Customer 360)

Metadata (Core unifier)

New innovations include Tableau Next and a Life Sciences mobile app. Over 750,000 AI-powered service cases were resolved in Q1 using internal deployments.

Informatica Acquisition

Salesforce will acquire Informatica for $8 billion, closing by early FY2027. The deal will be non-dilutive, financed with cash and debt, and will be accretive by FY2028 on non-GAAP EPS, margin, and FCF.

Informatica’s MDM and ETL capabilities enhance Data Cloud’s ability to unify enterprise data—a critical component of AI success.

Pricing Innovation

The company launched Flex Credits, a consumption-based pricing model tailored for AI and data services. This model has already driven upsell success, with 30% of AgentForce customers increasing usage in Q1.

AI Adoption

Enterprise AI adoption remains early-stage. Barriers include data readiness, governance, and regulatory constraints.

Salesforce is deploying forward engineering teams to support onboarding and scale consumption efficiently, ensuring enterprise customers unlock AI value faster.

Enterprise Growth

In Q1, over 50% of top 10 deals included six or more Salesforce clouds. 30+ net new deals exceeded $1M, most tied to both AI and Data Cloud.

Tableau appeared in 70%, MuleSoft in nearly 50% of large enterprise transactions. The data + agent combo is becoming the standard enterprise AI foundation.

Strategic Customers

Key wins and expansions:

Finnair, Falabella, OpenTable, PepsiCo, Grupo Globo, ENGIE, Smartsheet, Takeda, UChicago Medicine, US Air Force, Fox, Deloitte, Boeing

All demonstrate cross-cloud and AI/data-powered outcomes, confirming the value proposition of unified deployments.

Partnerships

Salesforce is now the fastest-growing ISV on AWS Marketplace, with $2 billion transacted and triple-digit growth.

Consulting partnerships with Accenture, Deloitte, and Neuroflash are enabling scaled AgentForce and Data Cloud deployments.

International Expansion

High-growth regions include:

South Asia & APAC: Strongest momentum

Japan: Localized AgentForce in development

Canada, UK, France: Consistent new business growth

Salesforce is investing in AE capacity and partner infrastructure in these geographies.

Operational Challenges

Key headwinds:

Slower expansion in Marketing and Commerce

Caution in EMEA and Public Sector

Data governance limiting full AI adoption

Salesforce is addressing these through consumption-focused models, partner ecosystems, and internal engineering support.

Outlook

FY26 guidance was raised to $41.3 billion, up $400 million. CRPO is expected to grow 9% in constant currency in Q2.

Salesforce is entering a growth transformation phase: reinvesting in sales, preserving margin discipline, and doubling down on AI + data leadership. The company is positioned to lead the enterprise digital labor revolution.

Management comments on the earnings call.

Product Innovations

Marc Benioff, Chair and Chief Executive Officer

“We've rewritten all of our apps, all of our data cloud, and created an agentic layer and Hyperforce and brought it all together as one unified platform.”

Srini Talabergata, President, Chief Engineering and Customer Success Officer

“We are releasing product features almost every day. This is a learning journey, and we are learning at the biggest scale of any vendor right now across every industry, across every geography, across every segment.”

Slack Expansion

Marc Benioff, Chair and Chief Executive Officer

“With AgentForce in Slack, every employee has a digital teammate that can make notes for your meeting, summarize your Slack channels, and you really see AI taking place on Slack.”

Robin Washington, Chief Operating and Finance Officer

“Our sales agent in Slack is transforming how our teams sell. Our AEs have already logged over twenty-one thousand interactions, simplifying everyday sales activity and saving our teams over forty-four thousand hours annually.”

Data Cloud

Marc Benioff, Chair and Chief Executive Officer

“Data readiness, as I mentioned, with Informatica is critical for every company. In this quarter, our Data Cloud surpassed twenty-two trillion records, up 175% year over year.”

Robin Washington, Chief Operating and Finance Officer

“Nearly 60% of our top 100 deals included investments in both Data Cloud and AI. Fifty percent of Data Cloud's Q1 new bookings came from existing customers.”

Srini Talabergata, President, Chief Engineering and Customer Success Officer

“This enterprise-grade data platform with MuleSoft, Data Cloud, Tableau, and in the future with Informatica gives enterprises a trusted data platform which is what is required to make the promise of agents true.”

AgentForce Growth

Marc Benioff, Chair and Chief Executive Officer

“We now have more than four thousand paid deals, more than eight thousand in total across every industry. AgentForce reached more than a hundred million in AOV much faster than any product in our history.”

Robin Washington, Chief Operating and Finance Officer

“Thirty percent of Q1 AgentForce new bookings came through expansion deals from existing AgentForce customers.”

Miguel Milano, President and Chief Revenue Officer

“On average, AgentForce deals included four other Salesforce clouds. On the top six deals, five included both Data Cloud and AgentForce. It’s kind of magic.”

AI

Marc Benioff, Chair and Chief Executive Officer

“This is a moment where Informatica is more important to our customers than ever before because of what's happened with AI. Every AI transformation is a data transformation.”

Robin Washington, Chief Operating and Finance Officer

“As customers adopt more agents, upgrade to premium editions, and leverage our industry solutions, we see greater expansion and stronger customer retention. With data and AI, that value is accelerating.”

Acquisition Informatica

Marc Benioff, Chair and Chief Executive Officer

“I couldn't be more excited about this acquisition. We've probably spent the last twenty years discussing how to bring the companies together.”

Robin Washington, Chief Operating and Finance Officer

“This is a key enabler for our next phase of AI-driven growth. We expect to achieve accretion on non-GAAP operating margin, non-GAAP EPS, and free cash flow by year two post-close.”

Pricing Strategy Shift

Marc Benioff, Chair and Chief Executive Officer

“Earlier this month, we introduced our Flex Credits. It’s a new consumption-based pricing model tuned after a huge amount of customer feedback.”

Robin Washington, Chief Operating and Finance Officer

“Our guidance reflects a consistent demand environment. Pricing and packaging continued to be a key lever for us, most notably in sales and service.”

Customers

Marc Benioff, Chair and Chief Executive Officer

“Falabella was a low six-figure deal in December. It turned into a million-dollar deal overnight. This is a great example of why AgentForce is winning.”

Miguel Milano, President and Chief Revenue Officer

“We had three times more Data Cloud deals in Q1 than a year before. Thirty customers came back and refilled the tank with AgentForce.”

Srini Talabergata, President, Chief Engineering and Customer Success Officer

“We see three types of AgentForce customers: those in expansion, those in pilot, and those building enterprise readiness. Each phase drives specific product features and maturity.”

Strategic Partnerships

Miguel Milano, President and Chief Revenue Officer

“Today, Salesforce is the fastest-growing ISV on AWS Marketplace. We transacted two billion dollars of business through them, hundreds of transactions, and it’s tripling year on year.”

International Growth

Marc Benioff, Chair and Chief Executive Officer

“I was in Japan last week. They can’t wait to get AgentForce running in Japanese, which we're about to deliver to them.”

Miguel Milano, President and Chief Revenue Officer

“We saw strong momentum in Canada, the whole of South Asia is on fire. Even Europe had bright spots—France and the UK out-delivered in the quarter.”

Challenges

Robin Washington, Chief Operating and Finance Officer

“Marketing and Commerce remain more measured. Retail, consumer goods, and the public sector are more cautious compared to other industries.”

Marc Benioff, Chair and Chief Executive Officer

“Enterprise adoption is not as simple as in the consumer world. AI doesn’t work unless your enterprise data is structured, governed, and harmonized.”

Future Outlook

Marc Benioff, Chair and Chief Executive Officer

“We are now entering our growth transformation. We’re going to grow our margin, grow our cash flow, and grow our revenue by investing in the right geographies, segments, and products.”

Robin Washington, Chief Operating and Finance Officer

“We raised fiscal year 2026 revenue guidance to $41.3 billion. We are reiterating our margin targets and expect strong demand in the second half as new AE capacity ramps.”

Thoughts on Salesforce Earnings Report $CRM:

🟢 Positive

Revenue of $9.83B, up +7.6% YoY, beat estimates by 0.9%

Non-GAAP EPS of $2.58, beat estimates by 1.6%

Data Cloud processed 22T+ records, up +175% YoY, reached $1B+ ARR

AgentForce hit 4,000 paid customers, $100M+ AOV in two quarters

RPO at $60.9B (+13% YoY), cRPO at $29.6B (+12.1% YoY)

Platform & Other revenue grew +14.3% YoY, Integration & Analytics +9.9% YoY

Operating margin at 20.1%, up +1.3 pp YoY

Europe revenue up +9.0%, Asia Pacific +10.5% YoY

Q2 guidance $10.11B–$10.16B, beat by 1.3%

FY26 guidance raised to $41.3B, up $400M

Sales Cloud new bookings posted double-digit growth in SMB segment

Slack integrations improved lead routing to 19 seconds

$2B transacted via AWS, fastest-growing ISV in Marketplace

750,000+ AI cases resolved internally, saving $50M

🟡 Neutral

Subscription and Support revenue rose +8.3% YoY, GM at 82.7%

Sales revenue grew +6.7% YoY, Service revenue +7.0% YoY

Marketing & Commerce revenue grew +3.4% YoY, underperforming other segments

Americas revenue up +6.7% YoY, slower than international growth

Basic shares -1.0% YoY, Diluted shares -1.5% YoY

S&M expense ratio decreased to 34.9%, R&D remained steady at 14.9%

SBC/Revenue rose to 8%, up +0.2 pp QoQ

🔴 Negative

Free Cash Flow margin at 64.1%, down -2.6 pp YoY

Net margin at 15.7%, down -1.1 pp YoY

Professional Services revenue fell -2.9% YoY, GM at -22.9%

Slower growth in Marketing & Commerce due to budget caution

Macro pressure in EMEA and Public Sector

AI adoption limited by data governance and enterprise readiness

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.