Financial Results:

↘️$9,133.0M rev (+10.7% YoY, +10.8% LQ) missed est by -0.2%🔴

↗️GM (76.3%, +2.1%pp YoY)

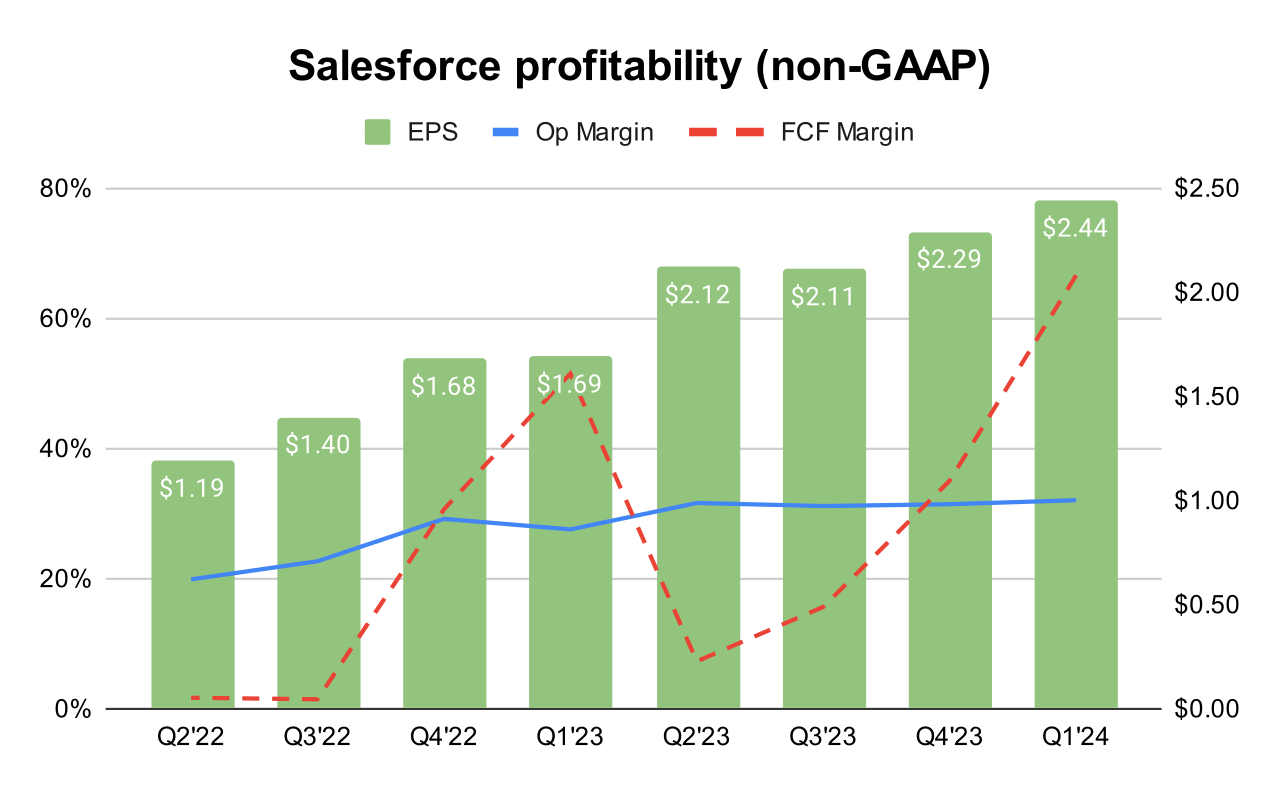

↗️Operating Margin* (32.1%, +4.5%pp YoY)🟢

↗️FCF Margin (66.6%, +15.1%pp YoY)

↗️Net Margin* (26.4%, +6.1%pp YoY)🟢

↗️EPS* $2.44 beat est by 2.5%🟢

*non-GAAP

Segment Revenue

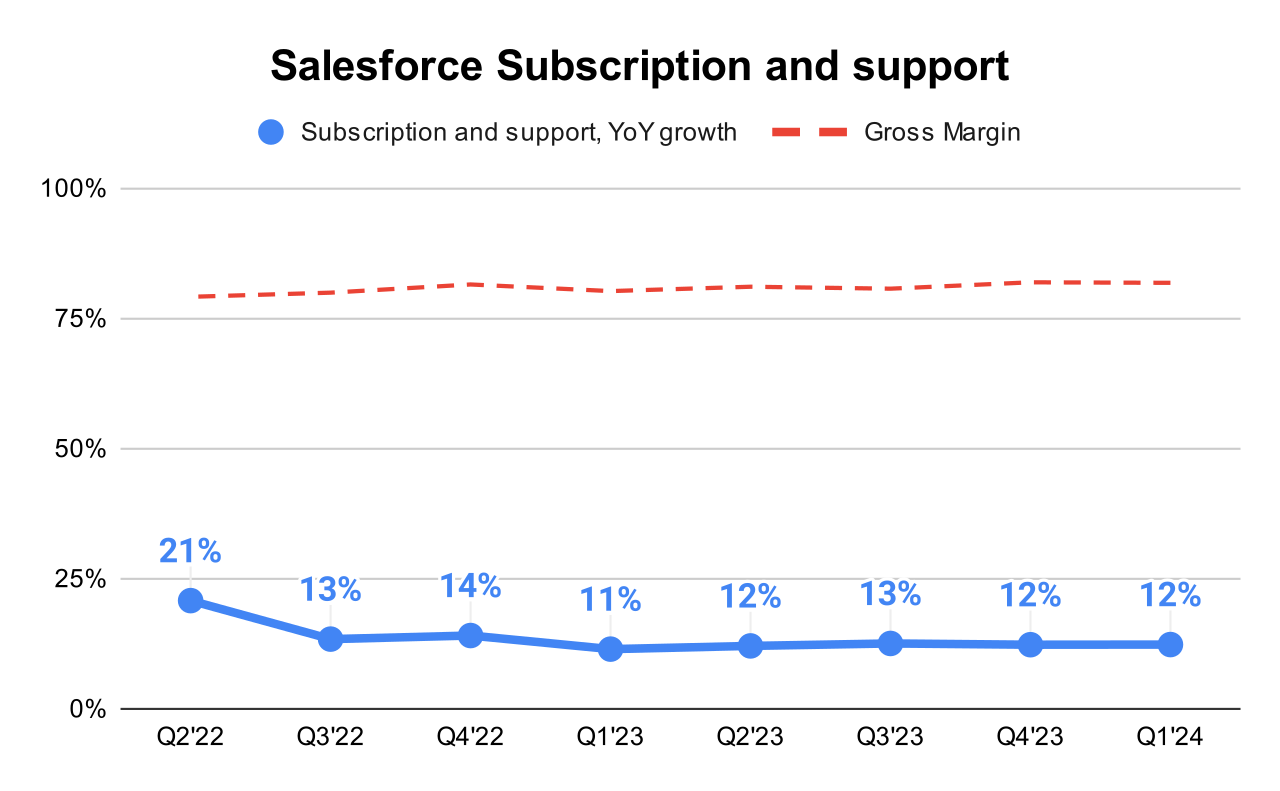

↗️Subscription and support $8,585M rev (+12.3% YoY, 81.8% Gross Margin)

↘️Professional services $548M rev (-9.4% YoY, -9.9% Gross Margin)🟡

Key Metrics

↗️RPO $53.90B (+15.4% YoY)

➡️cRPO $26.40B (+9.5% YoY)🟡🟡

Subscription Revenue by Type

➡️Sales $1,998M rev (+10.4% YoY)🟡

↗️Service $2,182M rev (+11.1% YoY)

➡️Platform and Other $1,718M rev (+9.6% YoY)🟡

➡️Marketing and Commerce $1,282M rev (+9.6% YoY)🟡

↗️Integration and Analytics $1,405M rev (+24.2% YoY)🟢

Revenue by region

➡️Americas $6,062M rev (+10.6% YoY, 66.4% of Rev)🟡

➡️Europe $2,145M rev (+9.9% YoY, 23.5% of Rev)🟡

↗️Asia Pacific $926M rev (+13.8% YoY, 10.1% of Rev)

Operating expenses

↘️S&M/Revenue 35.5% (37.0% LQ)

↗️R&D/Revenue 15.0% (13.7% LQ)

↗️G&A/Revenue 7.1% (6.8% LQ)

Dilution

↗️SBC/rev 8%, +1.0%pp QoQ

↗️Basic shares down -1.0% YoY, +0.4%pp QoQ🟢

↘️Diluted shares down -0.3% YoY, -0.2%pp QoQ🟢

Guidance

↘️Q2'24 $9.20 - $9.25B guide (+7.2% YoY) missed est by -1.2%🔴

➡️$37.7 - $38.0B FY guide (+8.6% YoY) in line with est

Key points from Salesforce's First Quarter 2024 Earnings Call:

Financial Performance Overview:

Salesforce reported Q1 revenue of $9.13 billion, marking an 11% year-over-year increase.

Subscription and support revenue grew by 12% year-over-year.

The company maintained its revenue guidance for Fiscal Year 2025 at $37.7 billion to $38 billion, representing an 8% to 9% growth year-over-year.

Artificial Intelligence (AI) Enhancements:

Marc Benioff emphasized Salesforce's significant focus on AI, particularly highlighting how their management of over 250 petabytes of customer data is crucial for powering AI applications. This vast data management capability is fundamental as companies globally are expected to embrace AI transformation across various industries.

Data Cloud Expansion:

The Salesforce Data Cloud has shown rapid growth and is becoming increasingly central to Salesforce's strategy. It was included in 25% of Salesforce's $1 million+ deals during the quarter. The Data Cloud facilitates a unified data environment that enhances the ability to generate actionable AI insights across Salesforce’s comprehensive Customer 360 platform.

Einstein AI Capabilities:

Salesforce continues to expand its Einstein AI platform, which is now delivering hundreds of billions of predictions daily. The introduction of Einstein Copilot, Prompt Builder, and Einstein Studio represents Salesforce’s push into generative AI, providing users with advanced AI tools to enhance decision-making and customer interactions.

Product Integration and Multi-Cloud Strategy:

Salesforce highlighted the integration of its various cloud services as nearly half of their top 50 wins included six or more of their cloud products. This integration underscores Salesforce's strategy to provide comprehensive solutions that cater to all aspects of their clients' business needs.

New Product Offerings and Upgrades:

New offerings like the UE+ hybrid pricing model combine per-user and consumption-based pricing, which aligns with the company’s AI and data analytics capabilities. This model is designed to provide flexibility and scalability to customers, adapting to the varied demands of enterprise users.

Customers and Market Expansion:

Salesforce's AI and Data Cloud capabilities are being increasingly adopted by large-scale customers such as Saks, FedEx, and CrowdStrike. These customers are leveraging Salesforce's platforms for enhancing customer experiences and operational efficiency.

Notable customer engagement includes Saks utilizing AI for personalized shopping experiences and FedEx integrating Salesforce for operational improvements and cost savings.

Challenges and Macroenvironment:

Salesforce continues to navigate a "measured buying environment," characterized by prolonged decision cycles, deal compression, and heightened budget scrutiny. This environment has persisted for the past two years and affects sales performance and deal closures and characterized by elongated deal cycles, deal compression, and high levels of budget scrutiny from clients, which contributed to the lower-than-expected billings.

The company saw weaker performance in some regions, notably EMEA, while other areas like Japan and Canada showed stronger growth.

cRPO Growth Below Expectations:

The quarter witnessed CRPO growth that was below Salesforce's initial expectations.

Management is focusing on maintaining higher pipeline multiples at the start of each quarter and increasing enablement efforts to ensure sales teams are equipped to navigate the tougher selling environment. These strategies are aimed at mitigating the impact of the current economic climate on billings and bookings.

Future Outlook and Strategic Focus:

Despite challenges, Salesforce maintains its revenue guidance for Fiscal Year 2025, anticipating growth of 8% to 9%.

The company is heavily invested in expanding its AI capabilities, expecting this technology to drive future growth.

Management comments on the earnings call.

Product Innovations:

Marc Benioff: "Every company in the world across every industry is being transformed by AI in the next few years. And when you look at the power of AI, you realize the models and the UI are not the critical success factors, it's not critical where the enterprise will transform."

Data Cloud:

Marc Benioff: "Data Cloud was included in 25% of our $1 million plus deals in the quarter. We added more than 1,000 data cloud customers for the second quarter in a row. 8 trillion records were ingested in the Data Cloud in the quarter, up 42% year-over-year and we processed 2 quadrillion records, that's a 217% increase compared to last year."

Competitors:

Marc Benioff: "And you may see great new UIs like agents and you may see great new UIs like you see what we've deployed with Slack. Brian was talking about how he's changed how we use Slack with our new Slack AI or what we've done with SFA this quarter or service this quarter with the incredible new generative capabilities."

Customers:

Marc Benioff: "Saks, a leader in the luxury fashion market, part of Hudson Bay, went all in on Salesforce in the quarter. CEO, Marc Metrick, is using AI to create more personal experiences for every customer touchpoint across their company."

cRPO Growth:

Amy Weaver: "Current remaining performance obligation, or CRPO, ended at $26.4 billion, up 10% year-over-year in nominal. Now this includes a $200 million FX headwind, which results in more than 10% year-over-year growth in constant currency."

Challenges:

Brian Millham: "We continue to see the measured buying behavior similar to what we experienced over the past two years and with the exception of Q4 where we saw stronger bookings. The momentum we saw in Q4 moderated in Q1 and we saw elongated deal cycles, deal compression and high levels of budget scrutiny."

Macroenvironment:

Marc Benioff: "As we entered the post pandemic reality, we saw companies who had acquired so much software in that time look to actually rationalize it, ingest it, integrate it, install it, update it. I mean, it's just a massive amount of software that was put in, and so for every enterprise software company kind of has adjusted during end of this post pandemic environment."