SaaS valuation, weekly recap

A deep dive into EV/Sales, EV/Gross Profit, PSG, Rule-of-40 and shareholders Dilution — analyzing how growth, efficiency, and market expectations shape valuations across the SaaS landscape.

The sharp decline in high-growth stocks in 2022 underscored how essential it is to closely monitor valuation multiples, especially for fast-growing companies.

Each week, I’ll publish a recap breaking down the key valuation metrics across the SaaS sector, highlighting where growth, efficiency, and market expectations intersect.

Table of Contents

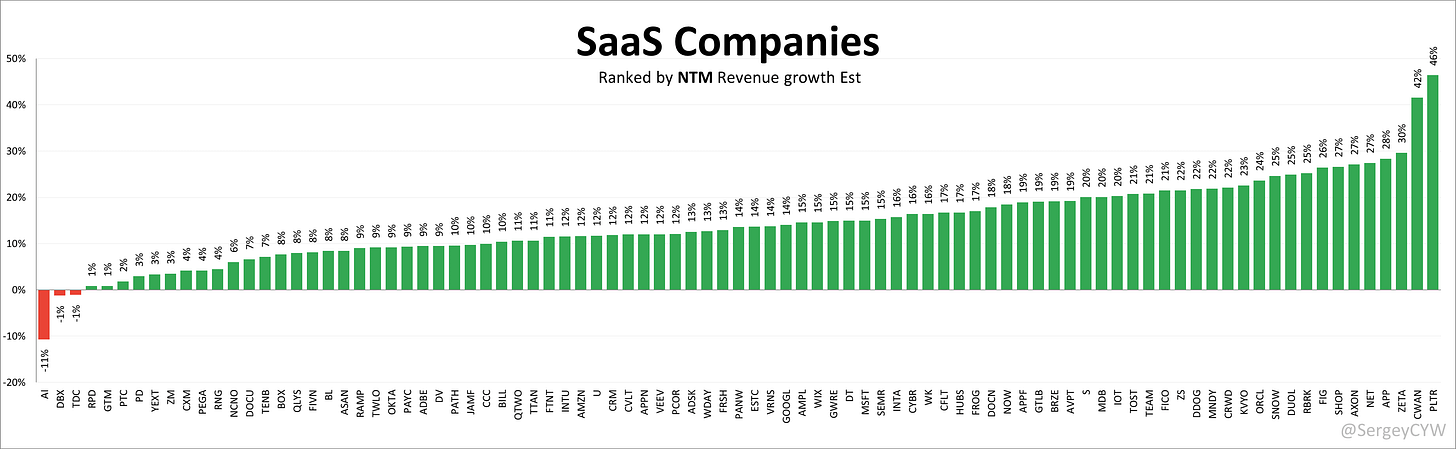

EV/Sales vs. NTM Estimated Revenue Growth (current and historical chart), including the top 10 fastest-growing SaaS companies

EV/Gross Profit vs. NTM Revenue Growth

PSG (Price/Sales/Growth) — current and historical chart

Rule of 40

Rule of 40 vs. Forward EV/S Multiple

Dilution (SBC/Revenue and Outstanding share growth)

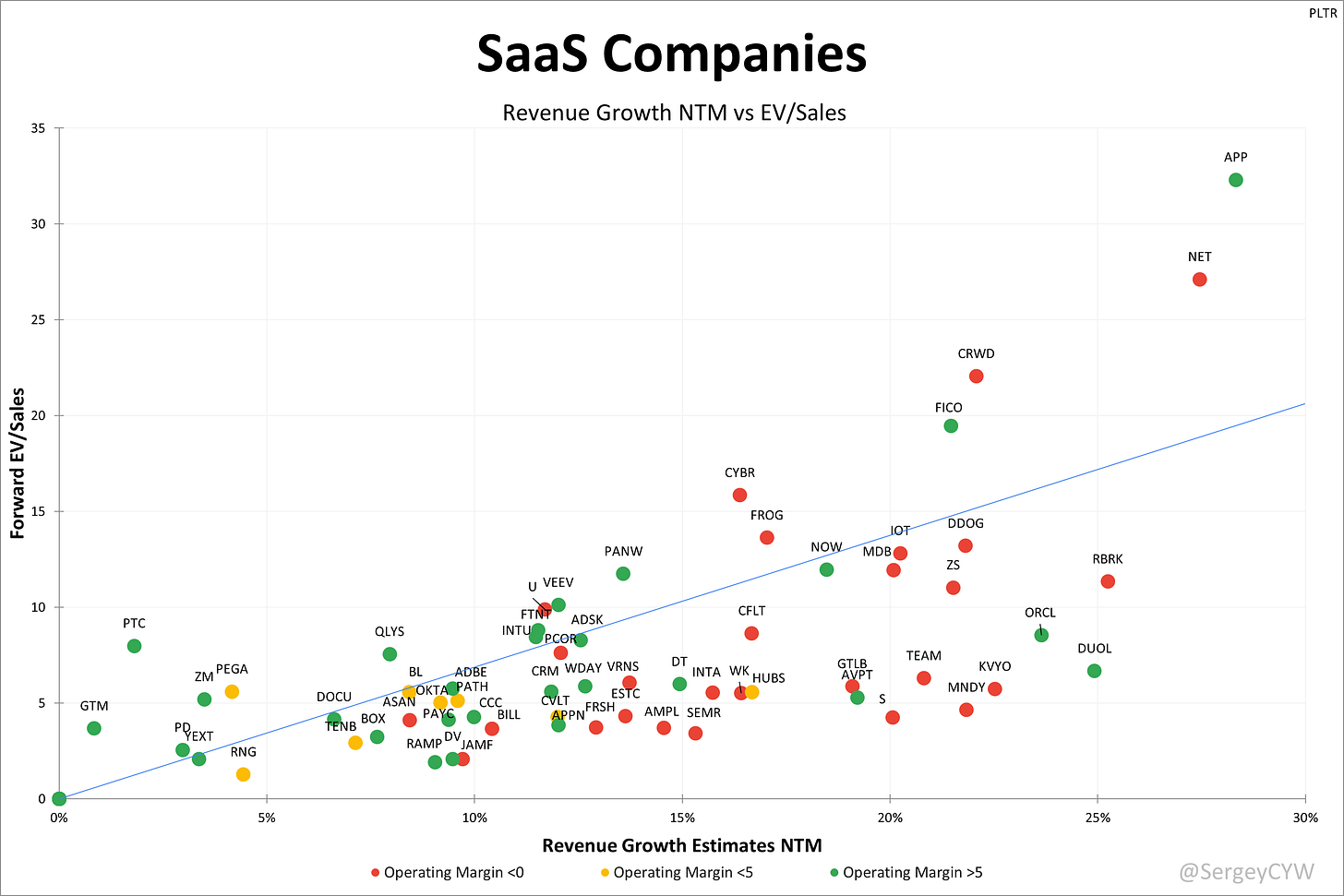

EV/Sales to NTM Revenue Growth

SaaS companies are typically valued by comparing their EV/Sales multiple to their projected NTM (next twelve months) revenue growth. Forward revenue expectations matter: they give investors a clearer view of the company’s future potential rather than its trailing performance.

Note: For readability, $PLTR was excluded, as it currently trades at an Forward EV/Sales of 75.8 and +46.4% estimated Growth Rate. The chart includes software companies with an enterprise value above $1B and gross margins over 70%.

To provide deeper valuation context, I also include Operating Margin across the EV/Sales, EV/Gross Profit, and Rule of 40 charts. Operating profitability directly influences valuation — companies with sustained positive margins deserve higher multiples than those operating at a loss.

On the charts:

Red: Negative operating margin

Yellow: Operating margin below 5%

Green: Operating margin above 5%

In this case, I used the GAAP Operating Margin from the most recent quarter. This highlights the latest trends and helps identify companies that have recently achieved operating profitability. However, for seasonal businesses, this data may be distorted.

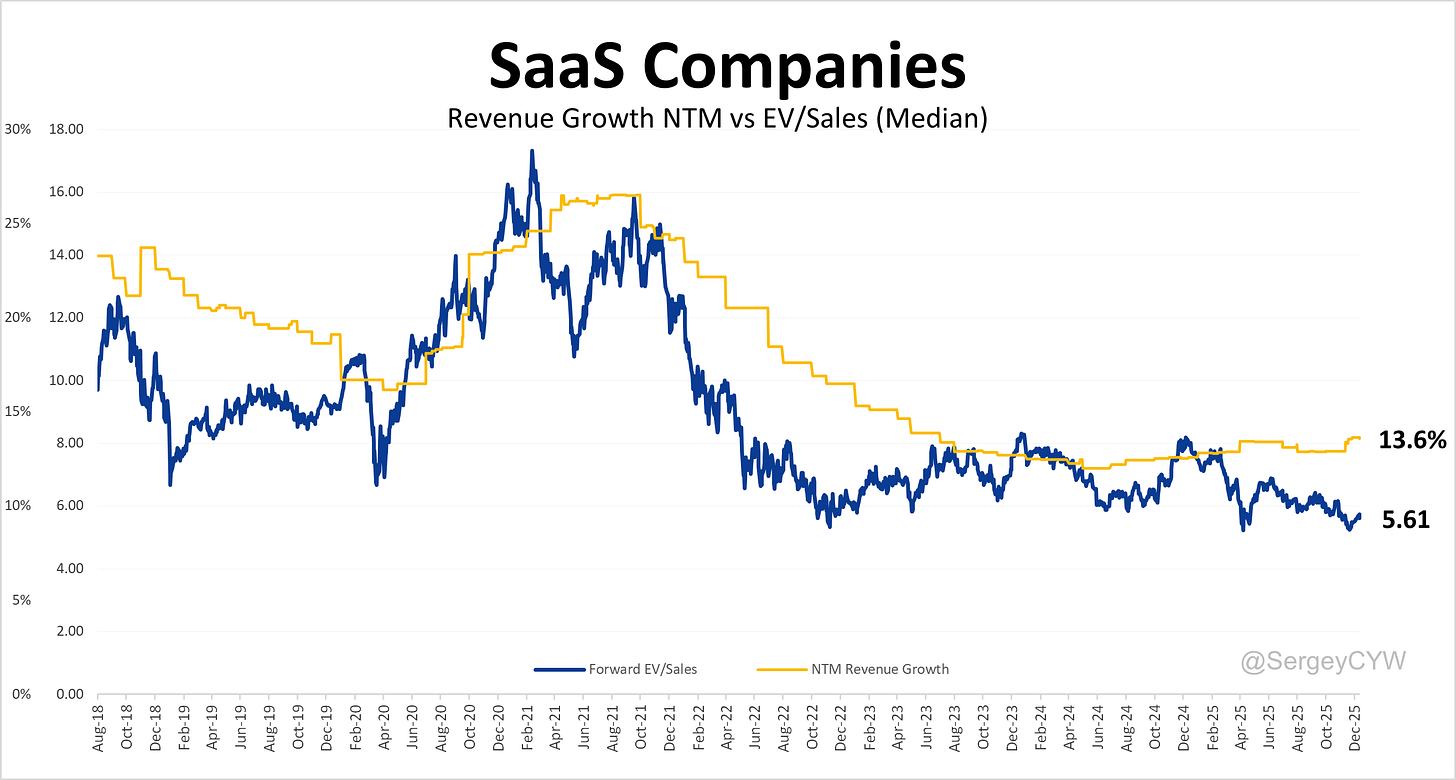

The historical median EV/Sales for SaaS companies stands at 5.61, with analyst-estimated NTM revenue growth of 13.6% YoY.

The dataset includes 89 public subscription-based software companies, along with historical data from several businesses that are no longer publicly traded.

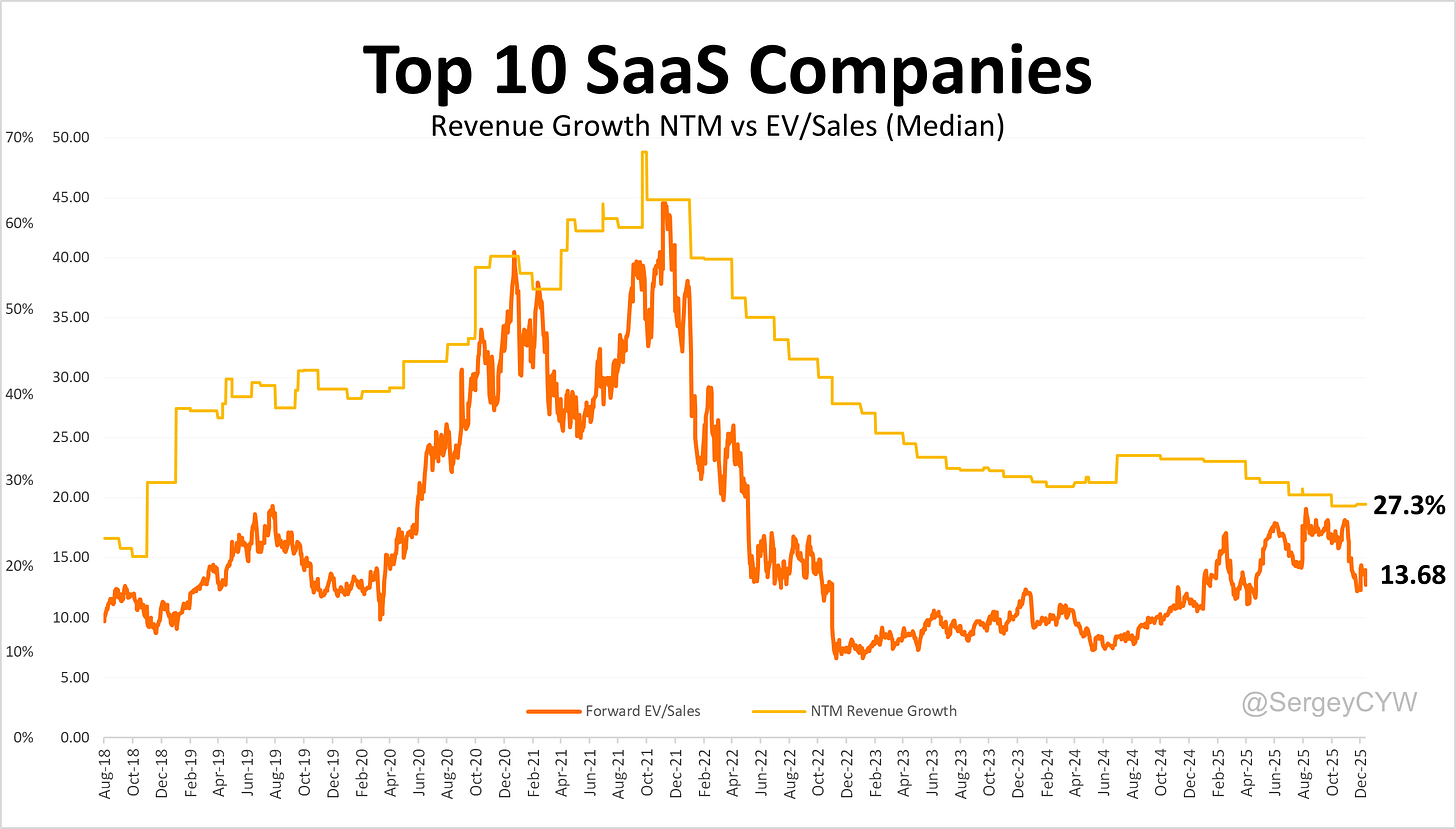

For the top 10 fastest-growing SaaS companies, the median EV/Sales multiple is 13.68, paired with 27.3% NTM revenue growth.

Evaluating growth stocks using forward projected revenue growth is crucial for investors because it provides insight into the company’s future potential, rather than just its current performance.

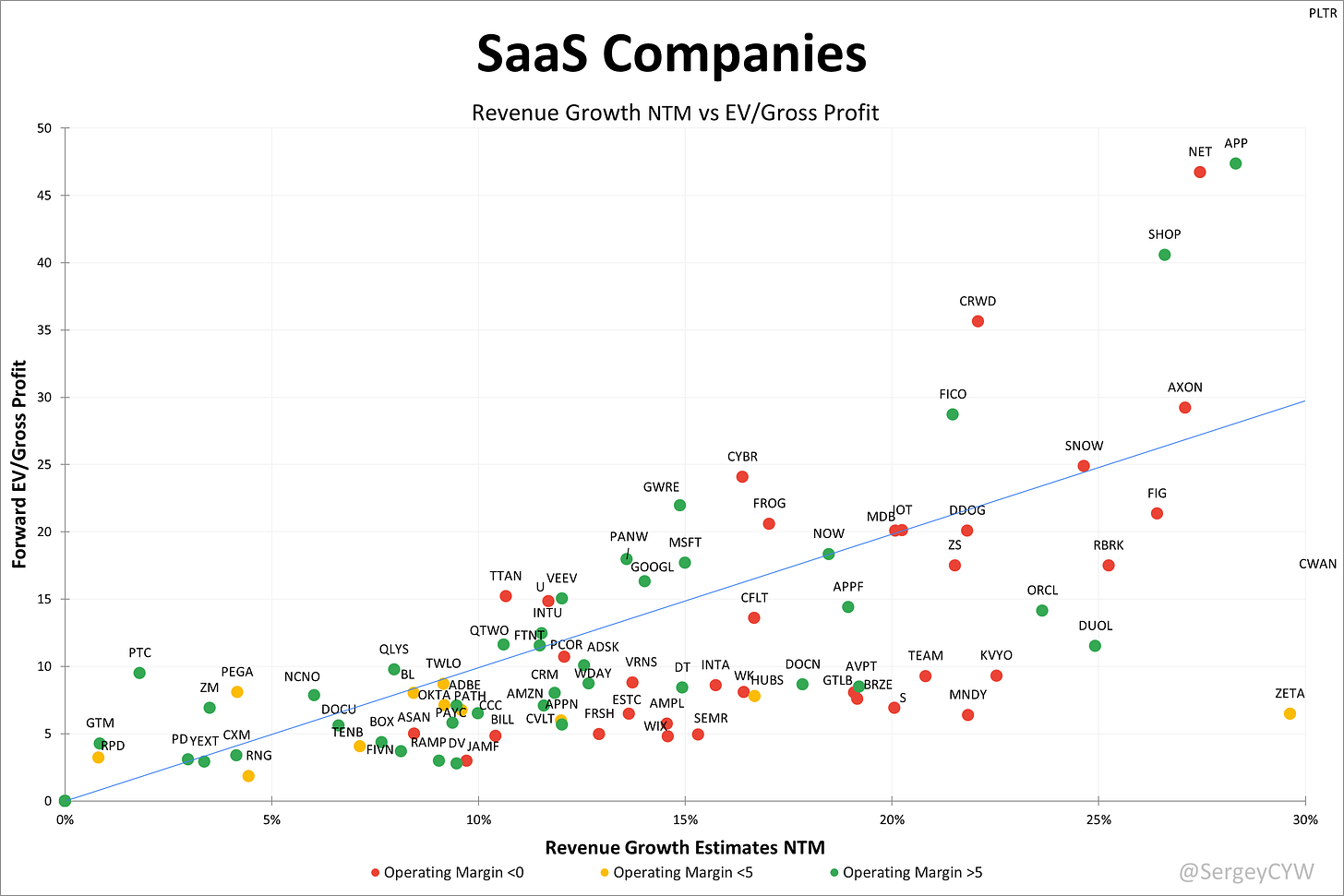

EV/Gross Profit to NTM Revenue Growth

The EV/Gross Profit (GAAP) multiple relative to projected NTM revenue growth incorporates product efficiency, reflected through gross margin. Gross margin is a critical measure for software companies — consistently high or improving margins usually indicate strong competitive positioning and long-term potential.

Note: $PLTR was removed from this chart as well, given its elevated 134.7 Forward EV/Gross Profit multiple. Only companies with EV > $1B and gross margins above 70% are included.

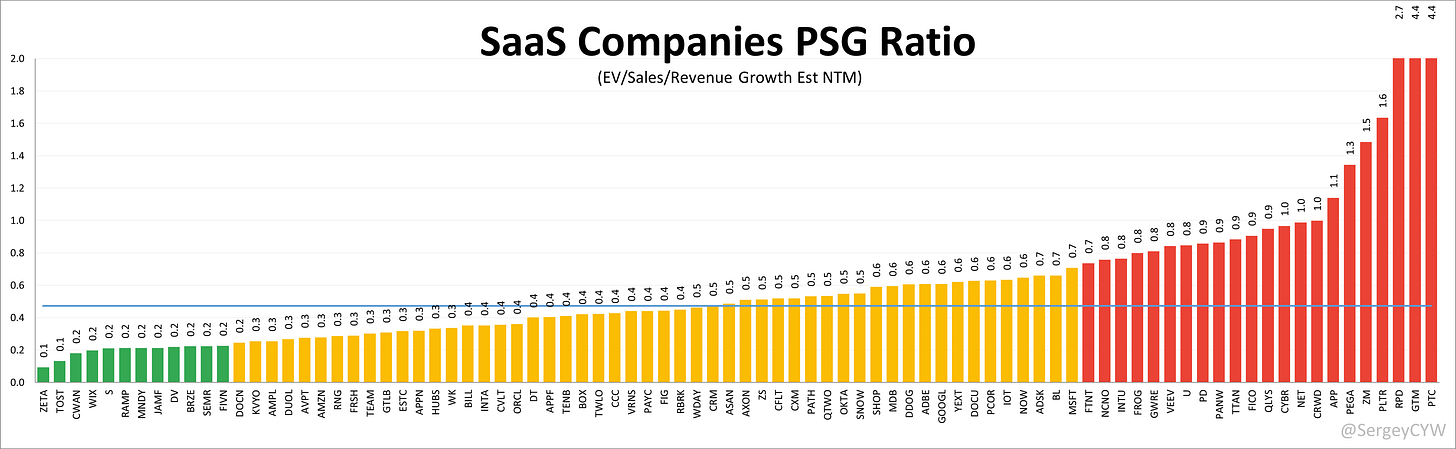

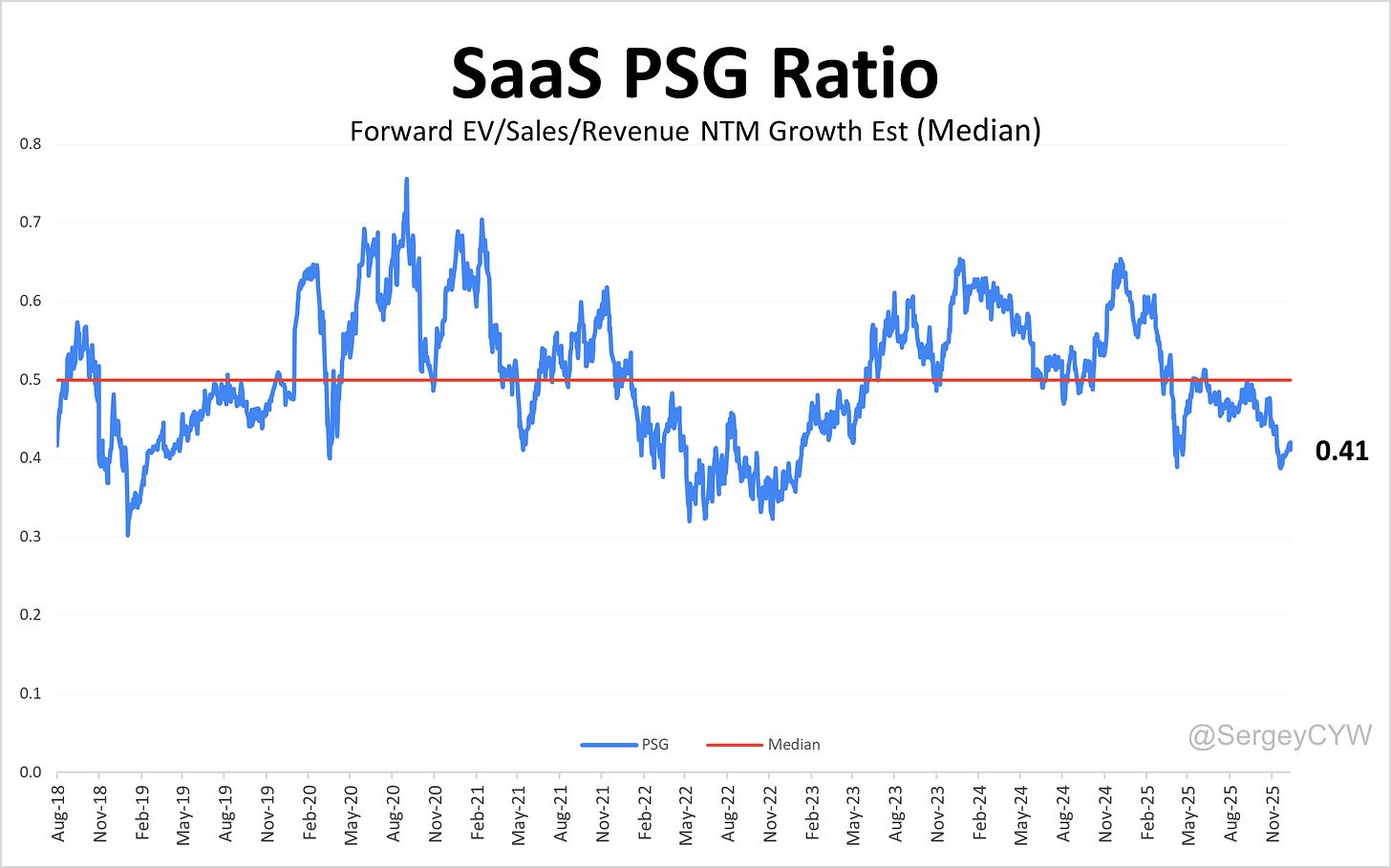

PSG (Price/Sales/Growth)

The Price/Sales/Growth (PSG) ratio adds growth discipline to the traditional P/S ratio, helping investors evaluate whether a premium valuation is backed by actual revenue expansion. This is especially relevant in software, where high P/S ratios often reflect expectations of scalable growth.

For calculations, I use: EV / NTM Estimated Sales / NTM Revenue Growth

The historical chart for the median PSG multiple among SaaS companies shows a median of 0.41, compared with a long-term historical median of 0.5.

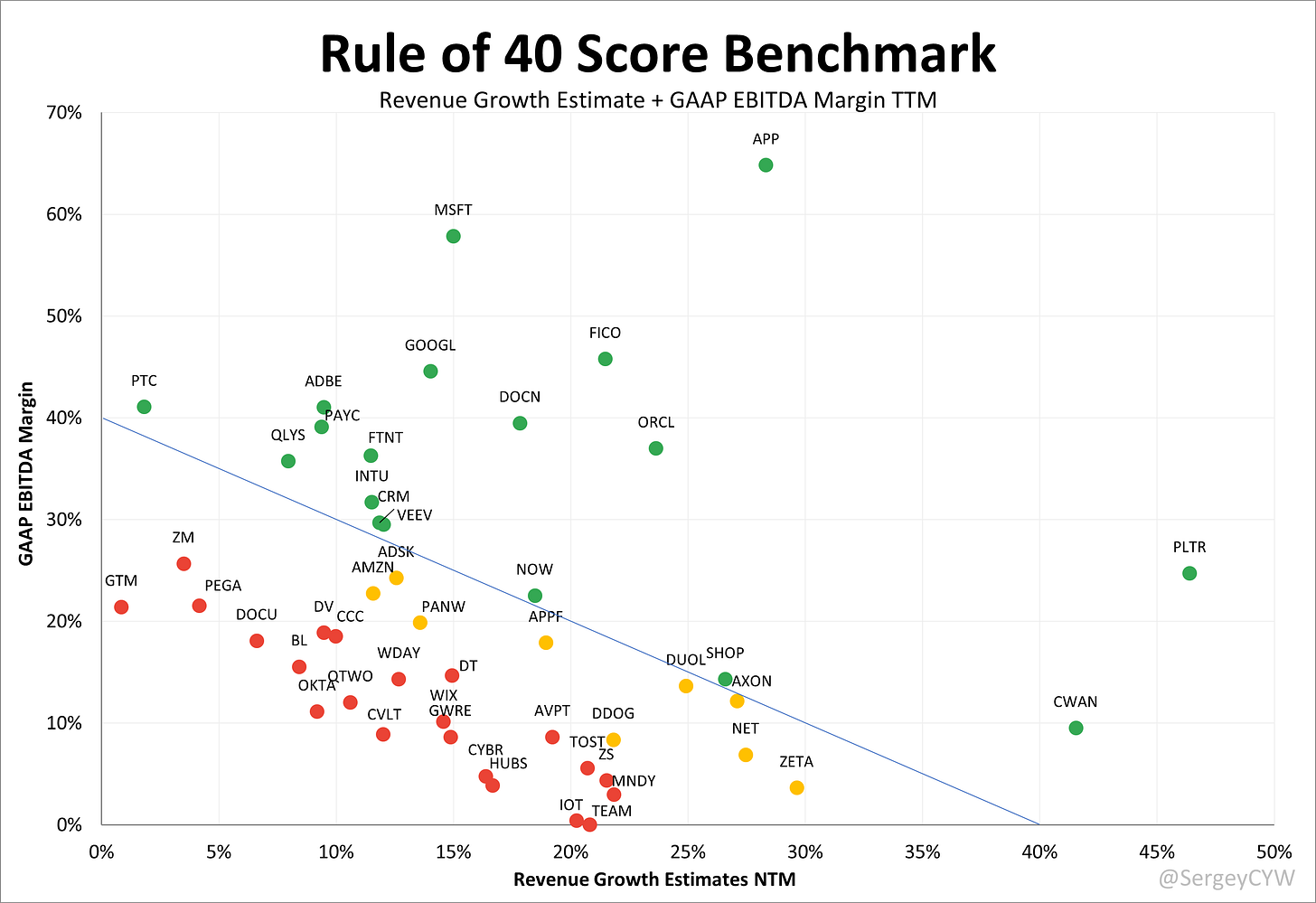

Rule of 40

The Rule of 40 remains one of the most practical metrics for assessing the balance between growth and profitability in SaaS. A score above 40% generally signals strong operational performance and makes a business more compelling from a capital-efficiency standpoint.

For this chart, I combined GAAP EBITDA Margin (TTM) with revenue growth estimates (NTM), creating a clear view of efficiency relative to future growth.

The Rule of 40 also allows useful comparisons across companies at different maturity levels.

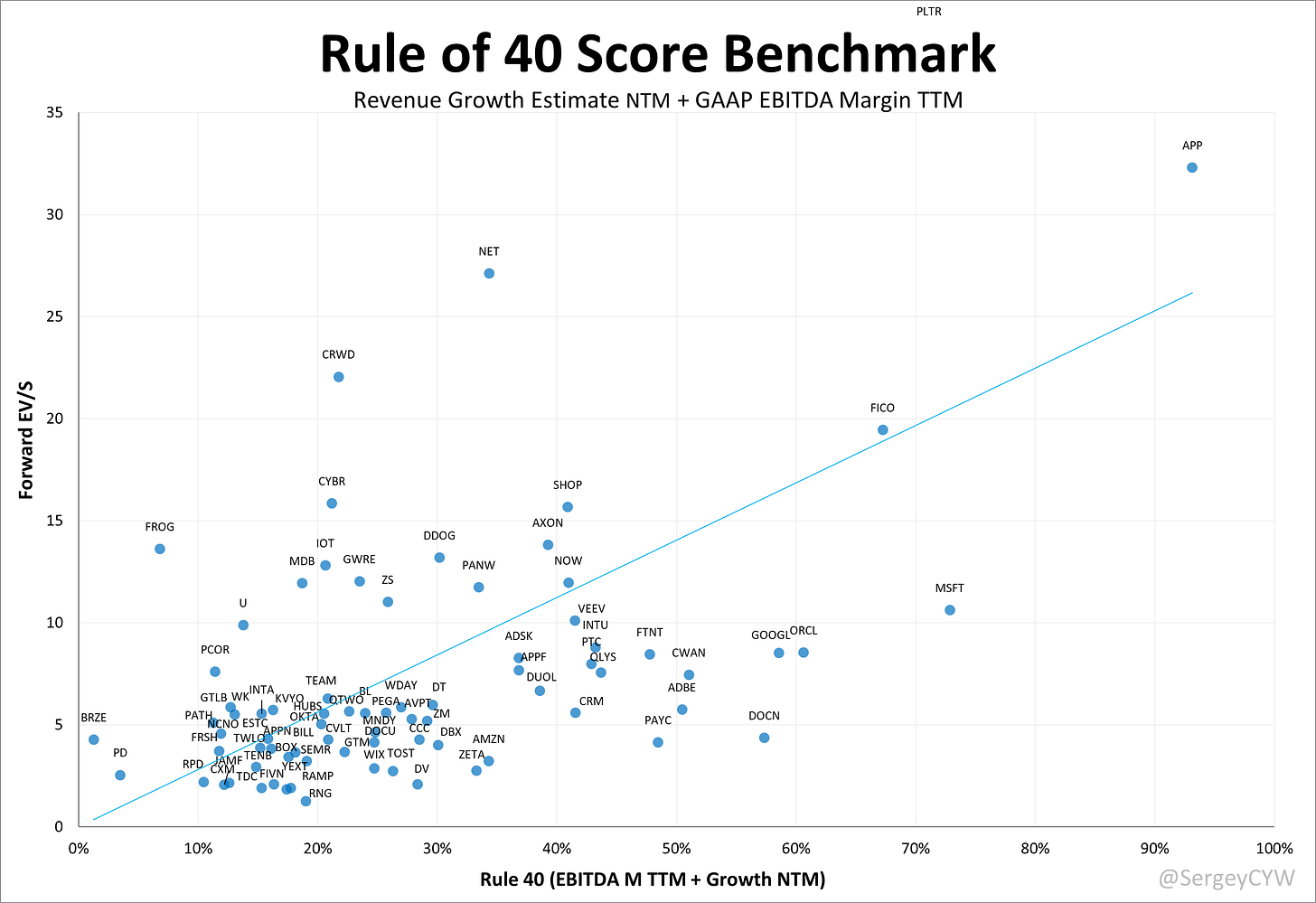

Rule of 40 vs Forward EV/S Multiple

Comparing the Rule of 40 to Forward EV/S multiples highlights how the market prices efficiency versus pure top-line growth.

The Rule of 40 captures operational discipline.

EV/S reflects revenue expectations alone.

Using both provides a more complete framework for evaluating whether investors are paying a reasonable price for sustainable growth.

A company above the 40% threshold tends to attract more interest from investors who prioritize both profitability and forward momentum.

Note: For visibility, $PLTR was excluded again due to its 75.8 Forward EV/Sales multiple. This chart also uses GAAP EBITDA Margin (TTM) and next year’s revenue growth estimates.

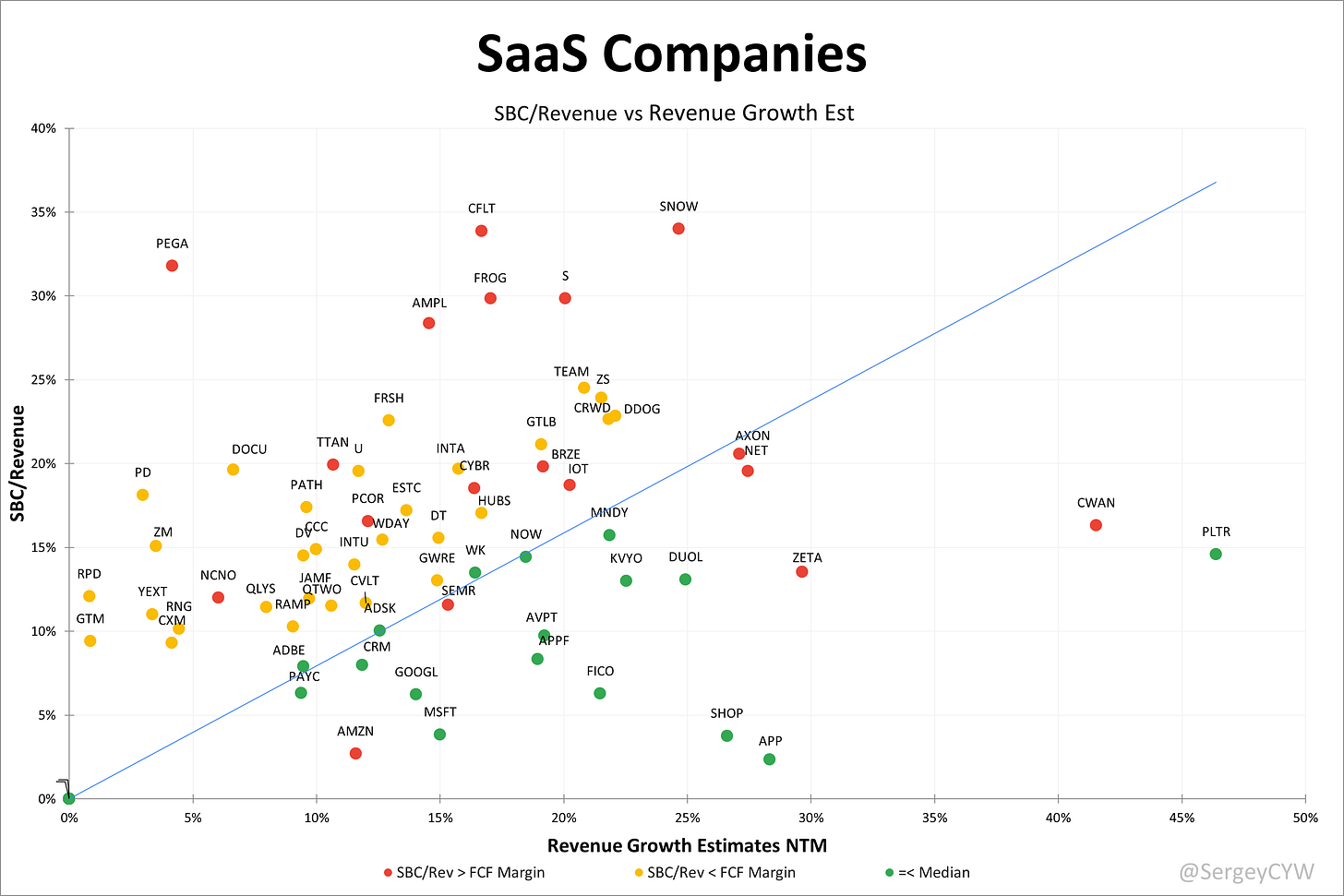

Dilution

Stock-Based Compensation (SBC) relative to estimated revenue growth is a key metric for assessing SaaS company efficiency and shareholder dilution.

SBC plays a vital role in attracting and retaining top talent while tying employee incentives to long-term performance.

However, it must be managed with discipline — excessive SBC can dilute shareholders and depress earnings per share, both of which weigh heavily on investor perception of financial health and sustainable value creation.

On the chart:

Red: SBC/Revenue > Free Cash Flow (FCF) margin

Yellow: SBC/Revenue < FCF margin

Green: SBC/Revenue =< Median

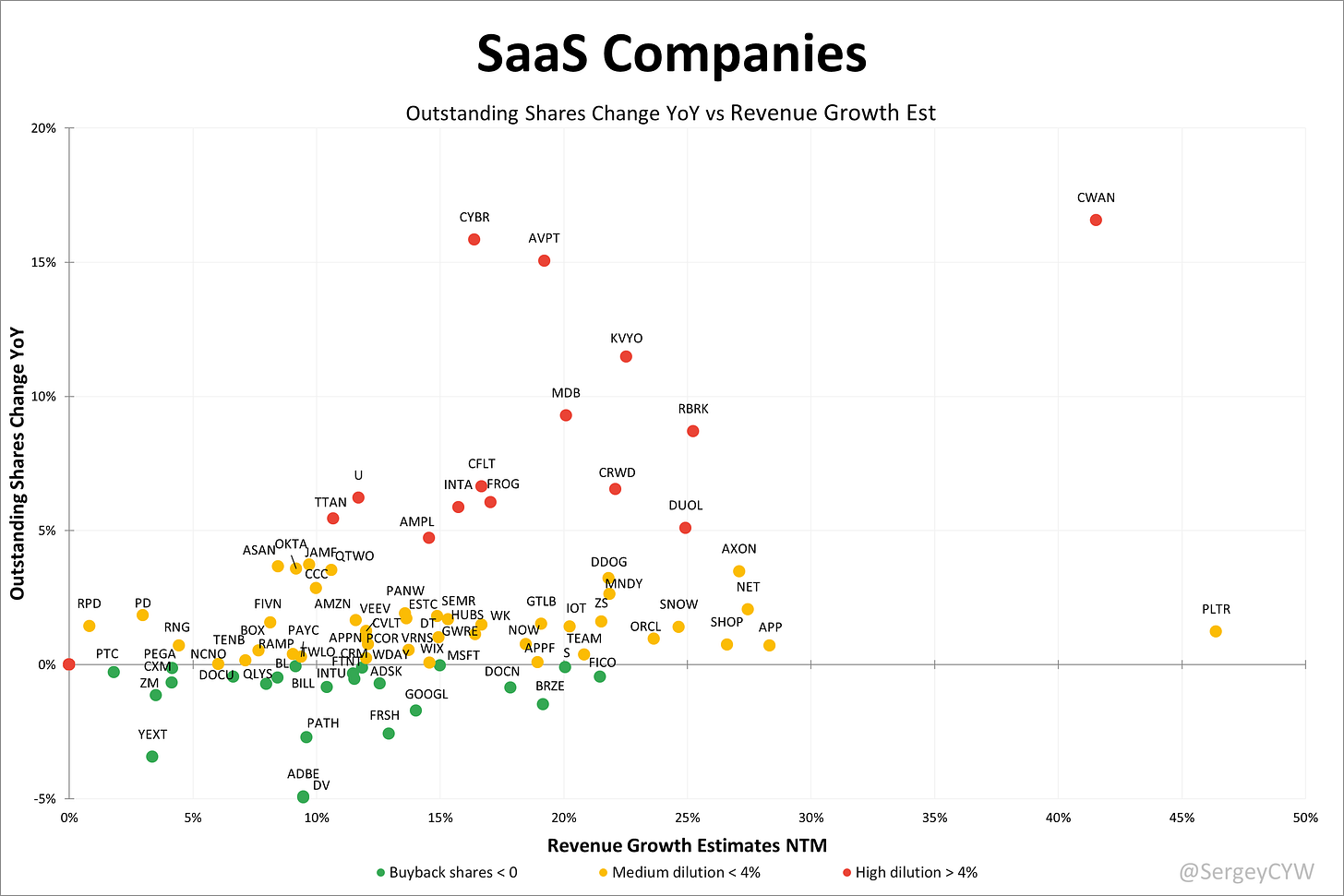

Outstanding share growth matters more than the absolute SBC expense because it directly reflects the erosion of shareholder ownership.

By comparing outstanding share count growth directly against estimated revenue growth, we can clearly see what portion of expected revenue expansion will be absorbed by dilution.

On the chart:

• Companies that buy back shares are marked in green

• Moderate dilution under 4% YoY is marked in yellow

• High dilution above 4% YoY is marked in red

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.