Paypal Q3 2024 Earnings Analysis

Dive into $PYPL Paypal’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results

↘️$7 847,0M rev (+5,8% YoY, +8,2% LQ) missed est by -0,4%🔴

↘️FXN Rev (+9,0% YoY, +9,0% LQ)

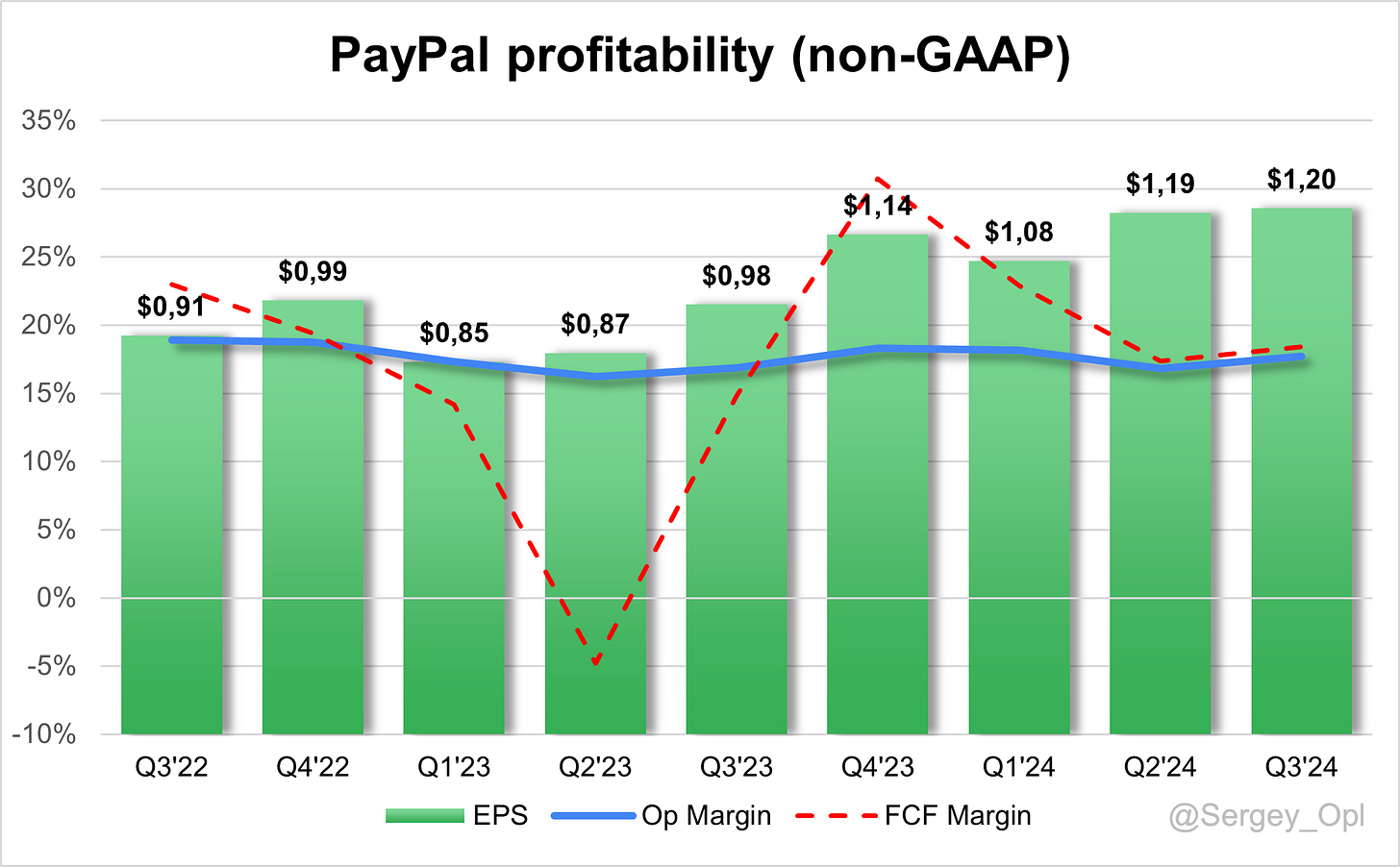

↗️Operating Margin* (17,7%, +0,8 PPs YoY)

↗️FCF Margin (18,4%, +3,6 PPs YoY)

↘️Net Margin (12,9%, -0,9 PPs YoY)🟡

↗️EPS* $1,20 beat est by 12,1%

*non-GAAP

Revenues by Type

↗️Transaction $7 067M rev (+6,2% YoY, 90,1% of Rev)

➡️Other services $780M rev (+2,1% YoY, 9,9% of Rev)🟡

Revenues by Geography

↗️U.S. $4 518M rev (+6,1% YoY, 57,6% of Rev)

➡️International $3 329M rev (+5,3% YoY, 42,4% of Rev)🟡

Key Metrics

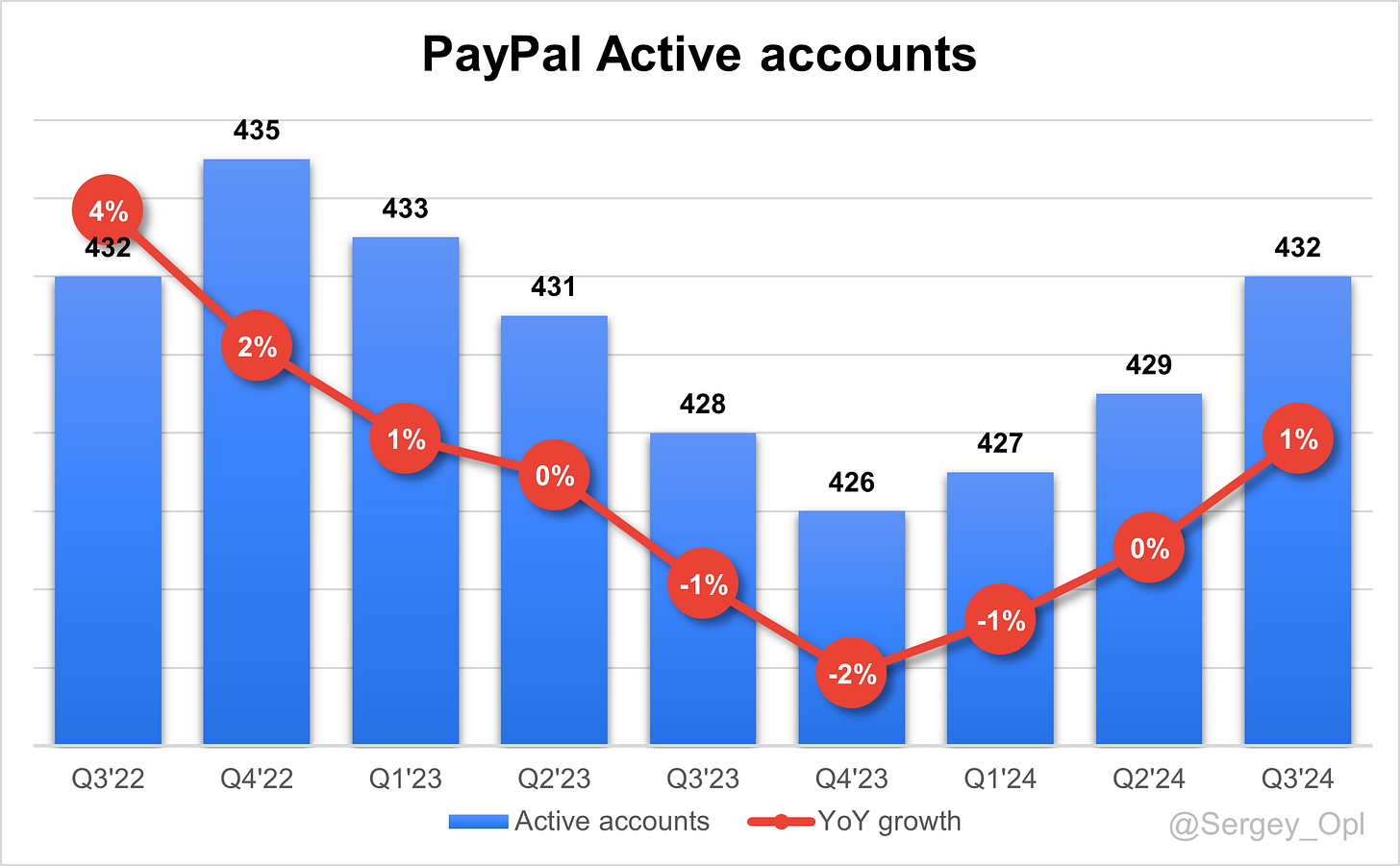

↗️432 Active accounts (+0,9% YoY, +4 YoY)

➡️6 631 Number of payment transactions (+5,7% YoY, +356 YoY)🔴

↗️Payment transactions per active account 61,40 (+8,5% YoY)

↗️TPV 422 641 (+9,0% YoY)

↘️Transaction Expense Rate 0,91% (-2 BPs YoY)🟡

↘️Transaction and Credit Loss Rate 0,08% (-4 BPs YoY)🟡

↗️Transaction Margin 46,60% (+1,2 PPs YoY)

Operating expenses

↗️S&M*/Revenue 6,1% (+0,7 PPs YoY)

↘️R&D*/Revenue 8,1% (-1,7 PPs YoY)

↘️G&A*/Revenue 5,6% (-1,1 PPs YoY)

Dilution

↘️SBC/rev 4%, -0,1 PPs QoQ

↘️Basic shares down -7,2% YoY, -1,0 PPs QoQ🟢

↘️Diluted shares down -6,7% YoY, -0,7 PPs QoQ🟢

Guidance

↘️Q4'24 $8 266,8 - $8 347,0M guide (+3,5% YoY) missed est by -1,8%🔴

Key points from PayPal’s Third Quarter 2024 Earnings Call:

Financial Performance

Total Payment Volume (TPV): PayPal’s TPV reached $423 billion, a 9% year-over-year increase, indicating strong consumer engagement across platforms.

Revenue Growth: Revenue grew 6% to $7.8 billion, on a currency-neutral basis, underscoring steady revenue amid strategic adjustments.

Non-GAAP EPS: Earnings per share rose 22% year-over-year to $1.20, reflecting considerable profitability improvements.

Free Cash Flow: Free cash flow reached $1.4 billion, with PayPal holding a cash position of $16.2 billion, supporting future investments and shareholder returns through share repurchases totaling $5.4 billion over the past year.

Product Innovations

Branded Checkout Enhancements: PayPal has advanced its branded checkout experience, with a strong focus on mobile, where previous updates had lagged. The latest improvements deliver a 400-basis point increase in conversion for one-time checkouts and a 100-basis point increase for vaulted checkouts, along with a 45% reduction in latency. The mobile-specific app-switch feature, particularly on iOS, has improved success rates to over 97%. These enhancements solidify PayPal's position as a leading branded checkout solution, with substantial potential to boost conversions for both enterprise and SMB clients.

Fastlane for Unbranded Checkout: Launched in August, Fastlane targets the guest checkout segment, which accounts for 60% of online transactions. Over 1,000 merchants have already adopted Fastlane, with larger merchants expected to join after the holiday season. Strategic partnerships, like those with Fiserv, facilitate broader adoption, especially among large, multiprocessor merchants. Fastlane is engineered to convert guest users by securely vaulting payment details for future branded transactions, supporting PayPal’s ecosystem with a high-frequency, unbranded checkout experience.

PayPal Everywhere: This initiative expands PayPal’s reach from online to in-person transactions, incentivizing daily usage through cashback rewards. Early metrics reveal over 1 million new PayPal debit card users, with omni-channel spending up by 5x within the first two weeks. This initiative reinforces PayPal’s positioning as a comprehensive payment solution and builds habitual use of its services. Plans for a European rollout in 2025, including NFC capabilities, aim to further drive adoption.

Venmo Expansion: PayPal is diversifying Venmo’s role beyond peer-to-peer payments by emphasizing debit card and Pay with Venmo options. Monthly active Venmo debit card users rose by 30% in Q3, with these users delivering 4x the average revenue per account. Pay with Venmo also saw a 20% increase in monthly active users, with only a small portion of Venmo's user base currently using these services. PayPal sees significant monetization potential and cross-platform engagement growth for Venmo through these channels.

Braintree Value-Added Services: As part of a price-to-value strategy, Braintree now offers services like risk management, payouts, orchestration, and personalization. By bundling these offerings with payment processing, PayPal enhances Braintree’s appeal, focusing on profitable growth over transaction volume. This approach not only increases transaction margins but also strengthens Braintree’s position as a comprehensive merchant solution.

Advertising Platform

Merchant Value-Add: PayPal’s new advertising platform extends Braintree’s offerings, providing merchants with ad-targeting tools and payment APIs. These additions bolster Braintree’s capabilities, driving higher-margin revenue streams and strengthening merchant loyalty through cross-sell opportunities.

Global Integration

PayPal Complete Payments (PPCP): Recently expanded to markets including China and Hong Kong, PPCP captures cross-border demand, positioning PayPal as a solution for SMBs globally. Partnerships with Shopify and Amazon extend PayPal’s footprint, enhancing its value proposition with options like "Buy with Prime" for major retailers.

Fastlane and PayPal Everywhere: The Fastlane and PayPal Everywhere offerings integrate online and offline experiences, with Fastlane targeting high-growth unbranded checkout markets. With over 1,000 merchants on board, PayPal aims to expand Fastlane further with partners like Fiserv.

Competition

Competitive Positioning: PayPal’s branded checkout is regarded as one of the market’s best-converting solutions, especially for large enterprises and SMBs. Fastlane, meanwhile, is positioned as a premier guest checkout solution, enhancing PayPal’s competitiveness against alternative guest checkout products. Venmo continues to differentiate PayPal’s offerings, boasting average revenue per active account that is four times higher than standard Venmo users, catering to a younger, affluent demographic.

Future Outlook

Q4 and 2025 Expectations: For Q4, PayPal expects lower TPV growth and interest income from Braintree as it continues to prioritize profitability. Looking ahead to 2025, branded checkout innovations and Venmo monetization are projected to drive sustained transaction margin growth. However, potential interest rate cuts could pose a headwind to earnings.

Management comments on the earnings call.

Product Innovations

Alex Kris, Chief Executive Officer

“Our commitment to product innovation is central to our strategy of delivering value for both consumers and merchants. With our branded checkout enhancements, we're addressing prior gaps, particularly in mobile, where our updated experiences are delivering a 400-basis point lift for one-time checkouts and 100 basis points for vaulted. By significantly reducing latency and optimizing features like app-switching, we’re reinforcing our position as the highest-converting branded checkout solution. Our focus now is on rolling these benefits out widely, to enterprise and SMB clients alike, to drive meaningful conversion gains and strengthen our overall platform value.”

Competitors

Jamie Miller, Chief Financial Officer

“We operate in an increasingly competitive landscape, particularly in branded and unbranded checkouts where players are vying for market share. Fastlane, our new high-frequency guest checkout solution, was designed precisely to capture those consumers bypassing branded checkout and bolster our market presence in this unbranded segment. By partnering with top-tier processors and offering unparalleled conversion rates, we’re positioning Fastlane as a standout solution. Combined with Venmo’s powerful appeal to younger demographics, our comprehensive approach leverages multiple consumer touchpoints and deepens our competitive moat.”

Strategic Partnerships

Alex Kris, Chief Executive Officer

“Our strategic partnerships are designed to amplify the value we bring to both merchants and consumers on a global scale. This year alone, we've formed new alliances with major commerce players like Shopify and Amazon, integrating services that align with our core growth strategy. For example, our integration with Shopify Payments in the U.S. allows for seamless PayPal-branded checkouts within their platform. These partnerships not only expand our reach but also strengthen our role as a trusted commerce partner for large enterprises and SMBs alike, creating a multiplier effect on our platform’s value.”

International Growth

Jamie Miller, Chief Financial Officer

“International expansion remains a key pillar of our growth strategy, especially with products like PayPal Complete Payments (PPCP), which are now live in regions such as China and Hong Kong. Our ability to serve cross-border demands with solutions tailored for local SMBs positions us strongly in these new markets. Additionally, our partnerships with giants like Amazon and Shopify further enhance our global footprint, allowing us to offer advanced solutions like 'Buy with Prime,' which brings new value to our international retailers. We’re not just entering markets—we’re entering with purpose-built, high-impact solutions that support meaningful growth.”

Challenges

Jamie Miller, Chief Financial Officer

“As we advance our product and partnership strategies, we’re conscious of challenges that lie ahead, particularly around interest rate volatility and its impact on transaction margin dollar growth. While this year we saw a significant benefit from interest income, we anticipate a lower contribution from this tailwind moving forward. Additionally, new product launches bring inherent risks, including the potential for higher transaction losses as we scale. These factors require us to be prudent and balanced, leveraging efficiency improvements while also making strategic reinvestments to drive long-term value for our stakeholders.”

Future Outlook

Alex Kris, Chief Executive Officer

“Our outlook for the future remains highly optimistic. We have assembled a world-class leadership team that’s laser-focused on building durable, profitable growth. Key innovations, like branded checkout, Fastlane, and PayPal Everywhere, are enhancing user experiences and driving consumer habituation across digital and in-person settings. Going into 2025, we are well-positioned to expand on these gains. With our February Investor Day approaching, we’ll share our long-term vision, new financial targets, and specific strategies that underscore our commitment to building a high-margin, high-growth platform that meets the evolving needs of our global user base.”